0000014693false2025Q304/30http://xbrl.sec.gov/country/2024#UShttp://xbrl.sec.gov/country/2024#UShttp://xbrl.sec.gov/country/2024#UShttp://xbrl.sec.gov/country/2024#UShttp://xbrl.sec.gov/country/2024#UShttp://xbrl.sec.gov/country/2024#UShttp://xbrl.sec.gov/country/2024#UShttp://xbrl.sec.gov/country/2024#USxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureiso4217:EURiso4217:GBP00000146932024-05-012025-01-310000014693us-gaap:CommonClassAMember2024-05-012025-01-310000014693us-gaap:NonvotingCommonStockMember2024-05-012025-01-310000014693bfb:OnePointTwoPercentNotesDueinFiscalTwoThousandTwentySevenMember2024-05-012025-01-310000014693bfb:TwoPointSixPercentNotesDueinFiscalTwoThousandTwentyNineMember2024-05-012025-01-310000014693us-gaap:CommonClassAMember2025-02-280000014693us-gaap:NonvotingCommonStockMember2025-02-2800000146932023-11-012024-01-3100000146932024-11-012025-01-3100000146932023-05-012024-01-3100000146932024-04-3000000146932025-01-310000014693us-gaap:CommonClassAMember2024-04-300000014693us-gaap:CommonClassAMember2025-01-310000014693us-gaap:NonvotingCommonStockMember2024-04-300000014693us-gaap:NonvotingCommonStockMember2025-01-3100000146932023-04-3000000146932024-01-310000014693bfb:DuckhornMember2024-04-3000000146932025-01-130000014693srt:MinimumMember2025-01-130000014693srt:MaximumMember2025-01-130000014693us-gaap:EmployeeSeveranceMembersrt:MinimumMember2025-01-130000014693us-gaap:EmployeeSeveranceMembersrt:MaximumMember2025-01-130000014693us-gaap:OtherRestructuringMembersrt:MinimumMember2025-01-130000014693us-gaap:OtherRestructuringMembersrt:MaximumMember2025-01-130000014693bfb:OtherChargesMember2025-01-310000014693bfb:SpecialTerminationBenefitsExpenseMember2025-01-310000014693us-gaap:EmployeeSeveranceMember2023-11-012024-01-310000014693us-gaap:EmployeeSeveranceMember2024-11-012025-01-310000014693us-gaap:EmployeeSeveranceMember2023-05-012024-01-310000014693us-gaap:EmployeeSeveranceMember2024-05-012025-01-310000014693us-gaap:OtherRestructuringMember2023-11-012024-01-310000014693us-gaap:OtherRestructuringMember2024-11-012025-01-310000014693us-gaap:OtherRestructuringMember2023-05-012024-01-310000014693us-gaap:OtherRestructuringMember2024-05-012025-01-310000014693us-gaap:EmployeeSeveranceMember2024-04-300000014693us-gaap:OtherRestructuringMember2024-04-300000014693us-gaap:EmployeeSeveranceMember2025-01-310000014693us-gaap:OtherRestructuringMember2025-01-310000014693bfb:ThreePointFivePercentNotesDueinFiscalTwoThousandTwentyFiveMember2025-01-310000014693bfb:ThreePointFivePercentNotesDueinFiscalTwoThousandTwentyFiveMember2024-04-300000014693bfb:ThreePointFivePercentNotesDueinFiscalTwoThousandTwentyFiveMember2024-05-012025-01-310000014693bfb:OnePointTwoPercentNotesDueinFiscalTwoThousandTwentySevenMember2024-04-300000014693bfb:OnePointTwoPercentNotesDueinFiscalTwoThousandTwentySevenMember2025-01-310000014693bfb:TwoPointSixPercentNotesDueinFiscalTwoThousandTwentyNineMember2025-01-310000014693bfb:TwoPointSixPercentNotesDueinFiscalTwoThousandTwentyNineMember2024-04-300000014693bfb:FourPointSevenFivePercentNotesDueInFiscalTwoThousandThirtyThreeMember2024-04-300000014693bfb:FourPointSevenFivePercentNotesDueInFiscalTwoThousandThirtyThreeMember2025-01-310000014693bfb:FourPointSevenFivePercentNotesDueInFiscalTwoThousandThirtyThreeMember2024-05-012025-01-310000014693bfb:FourPointZeroPercentNotesDueinFiscalTwoThousandEightMember2025-01-310000014693bfb:FourPointZeroPercentNotesDueinFiscalTwoThousandEightMember2024-04-300000014693bfb:FourPointZeroPercentNotesDueinFiscalTwoThousandEightMember2024-05-012025-01-310000014693bfb:ThreePointSevenFivePercentNotesDueInFiscalTwoThousandFortyThreeMember2024-04-300000014693bfb:ThreePointSevenFivePercentNotesDueInFiscalTwoThousandFortyThreeMember2025-01-310000014693bfb:ThreePointSevenFivePercentNotesDueInFiscalTwoThousandFortyThreeMember2024-05-012025-01-310000014693bfb:FourPointFivePercentNotesDueinFiscalTwoThousandFortySixMember2025-01-310000014693bfb:FourPointFivePercentNotesDueinFiscalTwoThousandFortySixMember2024-04-300000014693bfb:FourPointFivePercentNotesDueinFiscalTwoThousandFortySixMember2024-05-012025-01-310000014693us-gaap:CommercialPaperMember2024-04-300000014693us-gaap:CommercialPaperMember2025-01-310000014693us-gaap:CommercialPaperMember2024-05-012024-07-310000014693us-gaap:CommercialPaperMember2024-05-012025-01-310000014693us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-04-300000014693us-gaap:CommonStockMemberus-gaap:NonvotingCommonStockMember2023-04-300000014693us-gaap:AdditionalPaidInCapitalMember2023-04-300000014693us-gaap:RetainedEarningsMember2023-04-300000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-300000014693us-gaap:TreasuryStockCommonMember2023-04-300000014693us-gaap:RetainedEarningsMember2023-05-012023-07-3100000146932023-05-012023-07-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-05-012023-07-310000014693us-gaap:AdditionalPaidInCapitalMember2023-05-012023-07-310000014693us-gaap:TreasuryStockCommonMember2023-05-012023-07-310000014693us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-07-310000014693us-gaap:CommonStockMemberus-gaap:NonvotingCommonStockMember2023-07-310000014693us-gaap:AdditionalPaidInCapitalMember2023-07-310000014693us-gaap:RetainedEarningsMember2023-07-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-310000014693us-gaap:TreasuryStockCommonMember2023-07-3100000146932023-07-310000014693us-gaap:RetainedEarningsMember2023-08-012023-10-3100000146932023-08-012023-10-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-08-012023-10-310000014693us-gaap:TreasuryStockCommonMember2023-08-012023-10-310000014693us-gaap:AdditionalPaidInCapitalMember2023-08-012023-10-310000014693us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-10-310000014693us-gaap:CommonStockMemberus-gaap:NonvotingCommonStockMember2023-10-310000014693us-gaap:AdditionalPaidInCapitalMember2023-10-310000014693us-gaap:RetainedEarningsMember2023-10-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-310000014693us-gaap:TreasuryStockCommonMember2023-10-3100000146932023-10-310000014693us-gaap:RetainedEarningsMember2023-11-012024-01-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-11-012024-01-310000014693us-gaap:TreasuryStockCommonMember2023-11-012024-01-310000014693us-gaap:AdditionalPaidInCapitalMember2023-11-012024-01-310000014693us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-310000014693us-gaap:CommonStockMemberus-gaap:NonvotingCommonStockMember2024-01-310000014693us-gaap:AdditionalPaidInCapitalMember2024-01-310000014693us-gaap:RetainedEarningsMember2024-01-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-310000014693us-gaap:TreasuryStockCommonMember2024-01-310000014693us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-04-300000014693us-gaap:CommonStockMemberus-gaap:NonvotingCommonStockMember2024-04-300000014693us-gaap:AdditionalPaidInCapitalMember2024-04-300000014693us-gaap:RetainedEarningsMember2024-04-300000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-300000014693us-gaap:TreasuryStockCommonMember2024-04-300000014693us-gaap:RetainedEarningsMember2024-05-012024-07-3100000146932024-05-012024-07-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-05-012024-07-310000014693us-gaap:AdditionalPaidInCapitalMember2024-05-012024-07-310000014693us-gaap:TreasuryStockCommonMember2024-05-012024-07-310000014693us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-07-310000014693us-gaap:CommonStockMemberus-gaap:NonvotingCommonStockMember2024-07-310000014693us-gaap:AdditionalPaidInCapitalMember2024-07-310000014693us-gaap:RetainedEarningsMember2024-07-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-310000014693us-gaap:TreasuryStockCommonMember2024-07-3100000146932024-07-310000014693us-gaap:RetainedEarningsMember2024-08-012024-10-3100000146932024-08-012024-10-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-08-012024-10-310000014693us-gaap:AdditionalPaidInCapitalMember2024-08-012024-10-310000014693us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-10-310000014693us-gaap:CommonStockMemberus-gaap:NonvotingCommonStockMember2024-10-310000014693us-gaap:AdditionalPaidInCapitalMember2024-10-310000014693us-gaap:RetainedEarningsMember2024-10-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-10-310000014693us-gaap:TreasuryStockCommonMember2024-10-3100000146932024-10-310000014693us-gaap:RetainedEarningsMember2024-11-012025-01-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-11-012025-01-310000014693us-gaap:AdditionalPaidInCapitalMember2024-11-012025-01-310000014693us-gaap:CommonStockMemberus-gaap:CommonClassAMember2025-01-310000014693us-gaap:CommonStockMemberus-gaap:NonvotingCommonStockMember2025-01-310000014693us-gaap:AdditionalPaidInCapitalMember2025-01-310000014693us-gaap:RetainedEarningsMember2025-01-310000014693us-gaap:AccumulatedOtherComprehensiveIncomeMember2025-01-310000014693us-gaap:TreasuryStockCommonMember2025-01-310000014693us-gaap:AccumulatedTranslationAdjustmentMember2024-04-300000014693us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-04-300000014693us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-04-300000014693us-gaap:AccumulatedTranslationAdjustmentMember2025-01-310000014693us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2025-01-310000014693us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2025-01-310000014693bfb:O2025Q1DividendsMember2024-05-012025-01-310000014693bfb:O2025Q2DividendsMember2024-05-012025-01-310000014693bfb:O2025Q3DividendsMember2024-05-012025-01-310000014693us-gaap:SubsequentEventMemberbfb:O2025Q4DividendsMember2025-02-202025-02-200000014693country:US2023-11-012024-01-310000014693country:US2024-11-012025-01-310000014693country:US2023-05-012024-01-310000014693country:US2024-05-012025-01-310000014693bfb:DevelopedInternationalMember2023-11-012024-01-310000014693bfb:DevelopedInternationalMember2024-11-012025-01-310000014693bfb:DevelopedInternationalMember2023-05-012024-01-310000014693bfb:DevelopedInternationalMember2024-05-012025-01-310000014693bfb:EmergingMember2023-11-012024-01-310000014693bfb:EmergingMember2024-11-012025-01-310000014693bfb:EmergingMember2023-05-012024-01-310000014693bfb:EmergingMember2024-05-012025-01-310000014693bfb:TravelRetailMember2023-11-012024-01-310000014693bfb:TravelRetailMember2024-11-012025-01-310000014693bfb:TravelRetailMember2023-05-012024-01-310000014693bfb:TravelRetailMember2024-05-012025-01-310000014693bfb:NonbrandedandbulkMember2023-11-012024-01-310000014693bfb:NonbrandedandbulkMember2024-11-012025-01-310000014693bfb:NonbrandedandbulkMember2023-05-012024-01-310000014693bfb:NonbrandedandbulkMember2024-05-012025-01-310000014693bfb:WhiskeyMember2023-11-012024-01-310000014693bfb:WhiskeyMember2024-11-012025-01-310000014693bfb:WhiskeyMember2023-05-012024-01-310000014693bfb:WhiskeyMember2024-05-012025-01-310000014693bfb:ReadyToDrinkMember2023-11-012024-01-310000014693bfb:ReadyToDrinkMember2024-11-012025-01-310000014693bfb:ReadyToDrinkMember2023-05-012024-01-310000014693bfb:ReadyToDrinkMember2024-05-012025-01-310000014693bfb:TequilaMember2023-11-012024-01-310000014693bfb:TequilaMember2024-11-012025-01-310000014693bfb:TequilaMember2023-05-012024-01-310000014693bfb:TequilaMember2024-05-012025-01-310000014693bfb:NonbrandedandbulkMember2023-11-012024-01-310000014693bfb:NonbrandedandbulkMember2024-11-012025-01-310000014693bfb:NonbrandedandbulkMember2023-05-012024-01-310000014693bfb:NonbrandedandbulkMember2024-05-012025-01-310000014693bfb:RestofportfolioMember2023-11-012024-01-310000014693bfb:RestofportfolioMember2024-11-012025-01-310000014693bfb:RestofportfolioMember2023-05-012024-01-310000014693bfb:RestofportfolioMember2024-05-012025-01-310000014693us-gaap:PensionPlansDefinedBenefitMember2023-05-012024-01-310000014693us-gaap:PensionPlansDefinedBenefitMember2024-11-012025-01-310000014693us-gaap:PensionPlansDefinedBenefitMember2024-05-012025-01-310000014693us-gaap:PensionPlansDefinedBenefitMember2023-11-012024-01-310000014693us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-05-012025-01-310000014693us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2024-11-012025-01-310000014693us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-11-012024-01-310000014693us-gaap:OtherPostretirementBenefitPlansDefinedBenefitMember2023-05-012024-01-310000014693us-gaap:ForeignExchangeContractMember2024-04-300000014693us-gaap:ForeignExchangeContractMember2025-01-3100000146932023-05-012024-04-300000014693us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-04-300000014693us-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2025-01-310000014693us-gaap:ForeignExchangeContractMember2023-11-012024-01-310000014693us-gaap:ForeignExchangeContractMember2024-11-012025-01-310000014693us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2023-11-012024-01-310000014693us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2024-11-012025-01-310000014693us-gaap:OtherIncomeMemberus-gaap:ForeignExchangeContractMember2023-11-012024-01-310000014693us-gaap:OtherIncomeMemberus-gaap:ForeignExchangeContractMember2024-11-012025-01-310000014693bfb:ForeignCurrencyDenominatedDebtMember2023-11-012024-01-310000014693bfb:ForeignCurrencyDenominatedDebtMember2024-11-012025-01-310000014693us-gaap:OtherIncomeMemberbfb:ForeignCurrencyDenominatedDebtMember2023-11-012024-01-310000014693us-gaap:OtherIncomeMemberbfb:ForeignCurrencyDenominatedDebtMember2024-11-012025-01-310000014693us-gaap:ForeignExchangeContractMember2023-05-012024-01-310000014693us-gaap:ForeignExchangeContractMember2024-05-012025-01-310000014693us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2023-05-012024-01-310000014693us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2024-05-012025-01-310000014693us-gaap:OtherIncomeMemberus-gaap:ForeignExchangeContractMember2023-05-012024-01-310000014693us-gaap:OtherIncomeMemberus-gaap:ForeignExchangeContractMember2024-05-012025-01-310000014693bfb:ForeignCurrencyDenominatedDebtMember2023-05-012024-01-310000014693bfb:ForeignCurrencyDenominatedDebtMember2024-05-012025-01-310000014693us-gaap:OtherIncomeMemberbfb:ForeignCurrencyDenominatedDebtMember2023-05-012024-01-310000014693us-gaap:OtherIncomeMemberbfb:ForeignCurrencyDenominatedDebtMember2024-05-012025-01-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentAssetsMember2024-04-300000014693us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentAssetsMember2025-01-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMember2024-04-300000014693us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherAssetsMember2025-01-310000014693us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberbfb:AccruedExpensesMember2024-04-300000014693us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberbfb:AccruedExpensesMember2025-01-310000014693us-gaap:FairValueInputsLevel2Member2024-04-300000014693us-gaap:FairValueInputsLevel2Member2025-01-310000014693us-gaap:FairValueInputsLevel3Member2024-04-300000014693us-gaap:FairValueInputsLevel3Member2025-01-310000014693us-gaap:AccumulatedTranslationAdjustmentMember2023-11-012024-01-310000014693us-gaap:AccumulatedTranslationAdjustmentMember2024-11-012025-01-310000014693us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-11-012024-01-310000014693us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-11-012025-01-310000014693us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-11-012024-01-310000014693us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-11-012025-01-310000014693us-gaap:AccumulatedTranslationAdjustmentMember2023-05-012024-01-310000014693us-gaap:AccumulatedTranslationAdjustmentMember2024-05-012025-01-310000014693us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-05-012024-01-310000014693us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2024-05-012025-01-310000014693us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-05-012024-01-310000014693us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-05-012025-01-3100000146932023-11-01

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended January 31, 2025

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______________ to _______________

Commission File No. 001-00123

Brown-Forman Corporation

(Exact name of Registrant as specified in its Charter)

| | | | | | | | |

| Delaware | 61-0143150 |

| (State or other jurisdiction of | (IRS Employer |

| incorporation or organization) | Identification No.) |

| | |

| 850 Dixie Highway | |

| Louisville, | Kentucky | 40210 |

| (Address of principal executive offices) | (Zip Code) |

(502) 585-1100

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

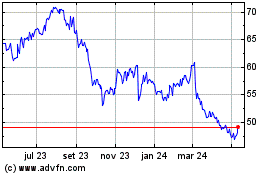

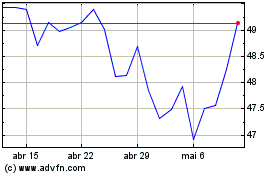

| Class A Common Stock (voting), $0.15 par value | BFA | New York Stock Exchange |

| Class B Common Stock (nonvoting), $0.15 par value | BFB | New York Stock Exchange |

| 1.200% Notes due 2026 | BF26 | New York Stock Exchange |

| 2.600% Notes due 2028 | BF28 | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☑ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☑

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date: February 28, 2025

| | | | | |

| Class A Common Stock (voting), $0.15 par value | 169,129,183 | |

| Class B Common Stock (nonvoting), $0.15 par value | 303,539,962 | |

| | | | | | | | |

| BROWN-FORMAN CORPORATION |

| Index to Quarterly Report Form 10-Q |

| | |

| | Page |

| |

| | |

| Item 1. | | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| |

| | |

| Item 1. | | |

| | |

| Item 1A. | | |

| | |

| Item 2. | | |

| | |

| Item 3. | | |

| | |

| Item 4. | | |

| | |

| Item 5. | | |

| | |

| Item 6. | | |

| | |

| |

| | |

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements (Unaudited)

BROWN-FORMAN CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(Dollars in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| January 31, | | January 31, |

| 2024 | | 2025 | | 2024 | | 2025 |

| Sales | $ | 1,406 | | | $ | 1,348 | | | $ | 4,137 | | | $ | 3,935 | |

| Excise taxes | 337 | | | 313 | | | 923 | | | 854 | |

| Net sales | 1,069 | | | 1,035 | | | 3,214 | | | 3,081 | |

| Cost of sales | 434 | | | 416 | | | 1,257 | | | 1,251 | |

| Gross profit | 635 | | | 619 | | | 1,957 | | | 1,830 | |

| Advertising expenses | 143 | | | 125 | | | 414 | | | 377 | |

| Selling, general, and administrative expenses | 203 | | | 178 | | | 595 | | | 551 | |

| | | | | | | |

Restructuring and other charges | — | | | 31 | | | — | | | 33 | |

| Gain on sale of business | (90) | | | — | | | (90) | | | — | |

| Other expense (income), net | 6 | | | 5 | | | (1) | | | (33) | |

| Operating income | 373 | | | 280 | | | 1,039 | | | 902 | |

| Non-operating postretirement expense | 1 | | | 3 | | | 2 | | | 4 | |

| Interest income | (3) | | | (5) | | | (7) | | | (12) | |

| Interest expense | 33 | | | 31 | | | 93 | | | 95 | |

Equity method investment income and gain on sale | — | | | (81) | | | — | | | (83) | |

| Income before income taxes | 342 | | | 332 | | | 951 | | | 898 | |

| Income taxes | 57 | | | 62 | | | 193 | | | 175 | |

| Net income | $ | 285 | | | $ | 270 | | | $ | 758 | | | $ | 723 | |

| Earnings per share: | | | | | | | |

| Basic | $ | 0.60 | | | $ | 0.57 | | | $ | 1.59 | | | $ | 1.53 | |

| Diluted | $ | 0.60 | | | $ | 0.57 | | | $ | 1.58 | | | $ | 1.53 | |

See notes to the condensed consolidated financial statements.

BROWN-FORMAN CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

(Dollars in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| January 31, | | January 31, |

| 2024 | | 2025 | | 2024 | | 2025 |

| Net income | $ | 285 | | | $ | 270 | | | $ | 758 | | | $ | 723 | |

| Other comprehensive income (loss), net of tax: | | | | | | | |

| Currency translation adjustments | 75 | | | (60) | | | 10 | | | (128) | |

| Cash flow hedge adjustments | (10) | | | 6 | | | (3) | | | 3 | |

| Postretirement benefits adjustments | 1 | | | 2 | | | 4 | | | 3 | |

| Net other comprehensive income (loss) | 66 | | | (52) | | | 11 | | | (122) | |

| Comprehensive income | $ | 351 | | | $ | 218 | | | $ | 769 | | | $ | 601 | |

See notes to the condensed consolidated financial statements.

BROWN-FORMAN CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(Dollars in millions, except per share amounts)

| | | | | | | | | | | |

| April 30, 2024 | | January 31,

2025 |

| Assets | | | |

| Cash and cash equivalents | $ | 446 | | | $ | 599 | |

Accounts receivable, less allowance for doubtful accounts of $8 at April 30 and $7 at January 31 | 769 | | | 855 | |

| Inventories: | | | |

| Barreled whiskey | 1,490 | | | 1,564 | |

| Finished goods | 452 | | | 428 | |

| Work in process | 396 | | | 360 | |

| Raw materials and supplies | 218 | | | 99 | |

| Total inventories | 2,556 | | | 2,451 | |

| Assets held for sale | — | | | 120 | |

| Other current assets | 265 | | | 254 | |

| Total current assets | 4,036 | | | 4,279 | |

| Property, plant and equipment, net | 1,074 | | | 1,041 | |

| Goodwill | 1,455 | | | 1,435 | |

| Other intangible assets | 990 | | | 973 | |

Equity method investments | 270 | | | 3 | |

| Deferred tax assets | 69 | | | 63 | |

| Other assets | 272 | | | 277 | |

| Total assets | $ | 8,166 | | | $ | 8,071 | |

| Liabilities | | | |

| Accounts payable and accrued expenses | $ | 793 | | | $ | 695 | |

| | | |

| Accrued income taxes | 38 | | | 30 | |

| Short-term borrowings | 428 | | | 202 | |

| Current portion of long-term debt | 300 | | | 300 | |

| | | |

| Total current liabilities | 1,559 | | | 1,227 | |

| Long-term debt | 2,372 | | | 2,361 | |

| Deferred tax liabilities | 315 | | | 266 | |

| Accrued pension and other postretirement benefits | 160 | | | 161 | |

| Other liabilities | 243 | | | 233 | |

| Total liabilities | 4,649 | | | 4,248 | |

| Commitments and contingencies | | | |

| Stockholders’ Equity | | | |

| Common stock: | | | |

Class A, voting, $0.15 par value (170,000,000 shares authorized; 170,000,000 shares issued) | 25 | | | 25 | |

Class B, nonvoting, $0.15 par value (400,000,000 shares authorized; 314,532,000 shares issued) | 47 | | | 47 | |

| Additional paid-in capital | 13 | | | 28 | |

| Retained earnings | 4,261 | | | 4,671 | |

| Accumulated other comprehensive income (loss), net of tax | (221) | | | (343) | |

Treasury stock, at cost (11,932,000 and 11,871,000 shares at April 30 and January 31, respectively) | (608) | | | (605) | |

| Total stockholders’ equity | 3,517 | | | 3,823 | |

| Total liabilities and stockholders’ equity | $ | 8,166 | | | $ | 8,071 | |

See notes to the condensed consolidated financial statements.

BROWN-FORMAN CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(Dollars in millions)

| | | | | | | | | | | |

| Nine Months Ended |

| January 31, |

| | 2024 | | 2025 |

| Cash flows from operating activities: | | | |

| Net income | $ | 758 | | | $ | 723 | |

| Adjustments to reconcile net income to net cash provided by operations: | | | |

| Gain on sale of business | (90) | | | — | |

Equity method investment income and gain on sale | — | | | (83) | |

| | | |

| Depreciation and amortization | 66 | | | 66 | |

| Stock-based compensation expense | 18 | | | 20 | |

Deferred income tax provision (benefit) | 3 | | | (43) | |

| | | |

| Change in fair value of contingent consideration | 1 | | | 5 | |

| | | |

| Other, net | (2) | | | (3) | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | (21) | | | (106) | |

| Inventories | (320) | | | (61) | |

| Other current assets | 28 | | | 21 | |

| Accounts payable and accrued expenses | (69) | | | (64) | |

| Accrued income taxes | (2) | | | (10) | |

| Other operating assets and liabilities | (8) | | | (19) | |

| Cash provided by operating activities | 362 | | | 446 | |

| Cash flows from investing activities: | | | |

| Proceeds from sale of business | 194 | | | — | |

Proceeds from sale of equity method investment | — | | | 350 | |

Proceeds from sale of property, plant, equipment, and other | 13 | | | 51 | |

| | | |

| | | |

| Additions to property, plant, and equipment | (148) | | | (117) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Other, net | 4 | | | — | |

Cash provided by investing activities | 63 | | | 284 | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| Net change in short-term borrowings | 492 | | | (227) | |

| | | |

| | | |

| | | |

| | | |

| Payments of withholding taxes related to stock-based awards | (4) | | | (2) | |

| | | |

| Acquisition of treasury stock | (400) | | | — | |

| Dividends paid | (300) | | | (313) | |

| | | |

| Other, net | — | | | (4) | |

| Cash used for financing activities | (212) | | | (546) | |

| Effect of exchange rate changes on cash, cash equivalents, and restricted cash | 2 | | | (20) | |

Net increase in cash, cash equivalents, and restricted cash | 215 | | | 164 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 384 | | | 456 | |

| Cash, cash equivalents, and restricted cash at end of period | 599 | | | 620 | |

| Less: Restricted cash (included in other current assets) at end of period | (10) | | | (21) | |

| | | |

| Cash and cash equivalents at end of period | $ | 589 | | | $ | 599 | |

| Supplemental information: | | | |

| Non-cash additions to property, plant and equipment | $ | 14 | | | $ | 7 | |

| Right-of-use assets obtained in exchange for new lease obligations | $ | 31 | | | $ | 30 | |

See notes to the condensed consolidated financial statements.

BROWN-FORMAN CORPORATION AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

In these notes, “we,” “us,” “our,” “Brown-Forman,” and the “Company” refer to Brown-Forman Corporation and its consolidated subsidiaries, collectively.

1. Condensed Consolidated Financial Statements

We prepared the accompanying unaudited condensed consolidated financial statements pursuant to the rules and regulations of the U.S. Securities and Exchange Commission for interim financial information. In accordance with those rules and regulations, we condensed or omitted certain information and disclosures normally included in annual financial statements prepared in accordance with U.S. generally accepted accounting principles (GAAP). In our opinion, the accompanying financial statements include all adjustments, consisting only of normal recurring adjustments (unless otherwise indicated), necessary for a fair statement of our financial results for the periods presented in these financial statements. The results for interim periods are not necessarily indicative of future or annual results.

We suggest that you read these condensed financial statements together with the financial statements and footnotes included in our Annual Report on Form 10-K for the fiscal year ended April 30, 2024 (2024 Form 10-K). We prepared the accompanying financial statements on a basis that is substantially consistent with the accounting principles applied in our 2024 Form 10-K.

Accounting standards not yet adopted. In November 2023, the Financial Accounting Standards Board (FASB) issued an updated accounting standard requiring additional disclosures about significant segment expenses and other segment items. The update also requires interim disclosure of segment information that is currently required only on an annual basis. We are required to adopt the updated standard for annual disclosures beginning in fiscal 2025, and for interim disclosures in fiscal 2026, with earlier adoption permitted. The update is to be applied retroactively.

In December 2023, the FASB issued an updated accounting standard requiring additional annual disclosures about income taxes, primarily related to the rate reconciliation and information about income taxes paid. We are required to adopt the new guidance beginning in fiscal 2026, with earlier adoption permitted. The update can be applied either prospectively or retrospectively.

In November 2024, the FASB issued an updated accounting standard requiring disaggregation, in the notes to the financial statements, of expense line items in the income statement that include certain categories of expenses. We are required to adopt the updated standard for annual disclosures beginning in fiscal 2028, and for interim disclosures in fiscal 2029, with earlier adoption permitted. The update can be applied either prospectively or retrospectively.

We are currently evaluating the impact that adopting these accounting standards updates will have on our disclosures.

2. Earnings Per Share

We calculate basic earnings per share by dividing net income available to common stockholders by the weighted average number of common shares outstanding during the period. Diluted earnings per share further includes the dilutive effect of stock-based compensation awards. We calculate that dilutive effect using the “treasury stock method” (as defined by GAAP).

The following table presents information concerning basic and diluted earnings per share:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| January 31, | | January 31, |

| (Dollars in millions, except per share amounts) | 2024 | | 2025 | | 2024 | | 2025 |

| | | | | | | |

| | | | | | | |

| Net income available to common stockholders | $ | 285 | | | $ | 270 | | | $ | 758 | | | $ | 723 | |

| | | | | | | |

| Share data (in thousands): | | | | | | | |

| Basic average common shares outstanding | 474,806 | | | 472,661 | | | 477,542 | | | 472,651 | |

| Dilutive effect of stock-based awards | 760 | | | 225 | | | 902 | | | 309 | |

| Diluted average common shares outstanding | 475,566 | | | 472,886 | | | 478,444 | | | 472,960 | |

| | | | | | | |

| Basic earnings per share | $ | 0.60 | | | $ | 0.57 | | | $ | 1.59 | | | $ | 1.53 | |

| Diluted earnings per share | $ | 0.60 | | | $ | 0.57 | | | $ | 1.58 | | | $ | 1.53 | |

We excluded common stock-based awards for approximately 1,658,000 shares and 3,378,000 shares from the calculation of diluted earnings per share for the three months ended January 31, 2024 and 2025, respectively. We excluded common stock-based awards for approximately 1,544,000 shares and 2,993,000 shares from the calculation of diluted earnings per share for the nine months ended January 31, 2024 and 2025, respectively. We excluded those awards because they were not dilutive for those periods under the treasury stock method.

3. Inventories

We value some of our consolidated inventories, including most of our U.S. inventories, at the lower of cost, using the last-in, first-out (LIFO) method or market value. If the LIFO method had not been used, inventories at current cost would have been $512 million higher than reported as of April 30, 2024, and $554 million higher than reported as of January 31, 2025. Changes in the LIFO valuation reserve for interim periods are based on an allocation of the projected change for the entire fiscal year, recognized proportionately over the remainder of the fiscal year.

4. Goodwill and Other Intangible Assets

The following table shows the changes in goodwill (which includes no accumulated impairment losses) and other intangible assets during the nine months ended January 31, 2025:

| | | | | | | | | | | |

| (Dollars in millions) | Goodwill | | Other Intangible Assets |

Balance at April 30, 2024 | $ | 1,455 | | | $ | 990 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Foreign currency translation adjustment | (20) | | | (17) | |

| | | |

Balance at January 31, 2025 | $ | 1,435 | | | $ | 973 | |

Our other intangible assets consist of trademarks and brand names, all with indefinite useful lives.

5. Equity Method Investments

As of April 30, 2024, our equity method investments included a 21.4% ownership of the common stock of The Duckhorn Portfolio, Inc. (“Duckhorn”), which we obtained as partial consideration for our sale of the Sonoma-Cutrer wine business to Duckhorn on April 30, 2024. The carrying amount of our investment in Duckhorn was $267 million as of April 30, 2024, reflecting the fair value of the common stock, based on its quoted market price at the April 30, 2024 closing date of the transaction. Our other equity method investments are immaterial.

Also, effective April 30, 2024, we entered into a transition services agreement (TSA) with Duckhorn related to the sale of the Sonoma-Cutrer wine business. Our cost of sales for the three months and nine months ended January 31, 2025, included $0 million and $24 million, respectively, for Sonoma-Cuter products purchased from Duckhorn under the TSA. Fees earned for transition services provided to Duckhorn under the TSA were immaterial. Services related to the TSA ended on or about August 31, 2024.

On October 6, 2024, Duckhorn entered into a definitive agreement pursuant to which Duckhorn would be acquired by private equity funds. The transaction was completed on December 24, 2024. Upon completion of the transaction, we received cash of $350 million in exchange for our 21.4% ownership interest in Duckhorn. As a result of the transaction, we recognized a $78 million gain on sale of our investment in Duckhorn during the three months ended January 31, 2025.

6. Restructuring and Other Charges

On January 13, 2025, our Board of Directors approved a plan to reduce our structural cost base and realign resources toward future sources of growth (the Plan). In connection with the Plan, we expect to reduce our worldwide headcount by approximately 12% and to close our Louisville-based Brown-Forman Cooperage. We expect the Plan to be substantially implemented in fiscal 2025 with the remainder to be completed by the end of fiscal 2026.

In connection with the Plan, we expect to incur aggregate charges of approximately $60 to $70 million, consisting primarily of approximately $27 to $32 million in severance and other employee-related costs and approximately $33 to $38 million in other restructuring costs, including costs related to the Louisville-based cooperage facility closure. Through January 31, 2025, we have incurred $27 million in restructuring charges and $2 million in other charges associated with the Plan. We also incurred $4 million in other charges associated with a special, one-time early retirement benefit. As of January 31, 2025, $8 million of the charges to be settled in cash have been paid.

Detail on the total restructuring and other charges is provided below:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| January 31, | | January 31, |

| (Dollars in millions) | 2024 | | 2025 | | 2024 | | 2025 |

Restructuring charges: | | | | | | | |

Severance and other employee-related costs | $ | — | | | $ | 19 | | | $ | — | | | $ | 19 | |

Other restructuring charges1 | — | | | 6 | | | — | | | 8 | |

Restructuring charges | — | | | 25 | | | — | | | 27 | |

Other charges2 | — | | | 6 | | | — | | | 6 | |

Total restructuring and other charges | $ | — | | | $ | 31 | | | $ | — | | | $ | 33 | |

1Primarily represents one-time costs related to the cooperage facility closure and other miscellaneous exit costs.

2Represents $4 million in costs associated with a special, one-time early retirement benefit to qualifying U.S. employees and $2 million in impairment charges on certain cooperage facility assets held for sale.

The charges we currently expect to incur in connection with the Plan are subject to a number of assumptions and risks, and actual results may differ materially. We may also incur other material charges not currently contemplated due to events that may occur as a result of, or in connection with, the Plan.

The following table summarizes the activity in our accrued restructuring costs:

| | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Severance and Other Employee-Related Costs | | Other Restructuring Charges | | Total |

Balance at April 30, 2024 | $ | — | | | $ | — | | | $ | — | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Costs incurred and charged to expense | 19 | | | 8 | | | 27 | |

Costs paid or otherwise settled | (2) | | | (6) | | | (8) | |

| | | | | |

| | | | | |

Balance at January 31, 2025 | $ | 17 | | | $ | 2 | | | $ | 19 | |

7. Contingencies

We operate in a litigious environment, and we are sued in the normal course of business. Sometimes plaintiffs seek substantial damages. Significant judgment is required in predicting the outcome of these suits and claims, many of which take years to adjudicate. We accrue estimated costs for a contingency when we believe that a loss is probable and we can make a reasonable estimate of the loss, and then adjust the accrual as appropriate to reflect changes in facts and circumstances. We do not believe it is reasonably possible that these existing loss contingencies, individually or in the aggregate, would have a material adverse effect on our financial position, results of operations, or liquidity. No material accrued loss contingencies were recorded as of January 31, 2025.

8. Debt

Our long-term debt (net of unamortized discount and issuance costs) consisted of:

| | | | | | | | | | | |

| (Principal and carrying amounts in millions) | April 30, 2024 | | January 31,

2025 |

| | | |

| | | |

3.50% senior notes, $300 principal amount, due April 15, 2025 | $ | 300 | | | $ | 300 | |

1.20% senior notes, €300 principal amount, due July 7, 2026 | 321 | | | 312 | |

2.60% senior notes, £300 principal amount, due July 7, 2028 | 375 | | | 372 | |

4.75% senior notes, $650 principal amount, due April 15, 2033 | 643 | | | 644 | |

4.00% senior notes, $300 principal amount, due April 15, 2038 | 295 | | | 295 | |

3.75% senior notes, $250 principal amount, due January 15, 2043 | 248 | | | 248 | |

4.50% senior notes, $500 principal amount, due July 15, 2045 | 490 | | | 490 | |

| | | |

| 2,672 | | | 2,661 | |

| Less current portion | 300 | | | 300 | |

| $ | 2,372 | | | $ | 2,361 | |

Our short-term borrowings consisted of borrowings under our commercial paper program, as follows:

| | | | | | | | | | | |

| (Dollars in millions) | April 30, 2024 | | January 31,

2025 |

| Commercial paper (par amount) | $429 | | $203 |

| Average interest rate | 5.49% | | 4.65% |

| Average remaining days to maturity | 12 | | 16 |

9. Stockholders’ Equity

The following table shows the changes in stockholders’ equity by quarter during the nine months ended January 31, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Class A Common Stock | | Class B Common Stock | | Additional Paid-in Capital | | Retained Earnings | | AOCI | | Treasury Stock | | Total |

Balance at April 30, 2023 | $ | 25 | | | $ | 47 | | | $ | 1 | | | $ | 3,643 | | | $ | (235) | | | $ | (213) | | | $ | 3,268 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net income | | | | | | | 231 | | | | | | | 231 | |

| Net other comprehensive income (loss) | | | | | | | | | 36 | | | | | 36 | |

| Declaration of cash dividends | | | | | | | (197) | | | | | | | (197) | |

| | | | | | | | | | | | | |

| Stock-based compensation expense | | | | | 4 | | | | | | | | | 4 | |

| Stock issued under compensation plans | | | | | | | | | | | 3 | | | 3 | |

| Loss on issuance of treasury stock issued under compensation plans | | | | | (4) | | | (3) | | | | | | | (7) | |

Balance at July 31, 2023 | 25 | | | 47 | | | 1 | | | 3,674 | | | (199) | | | (210) | | | 3,338 | |

| Net income | | | | | | | 242 | | | | | | | 242 | |

| Net other comprehensive income (loss) | | | | | | | | | (91) | | | | | (91) | |

| | | | | | | | | | | | | |

| Acquisition of treasury stock | | | | | | | | | | | (42) | | | (42) | |

| Stock-based compensation expense | | | | | 7 | | | | | | | | | 7 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Balance at October 31, 2023 | 25 | | | 47 | | | 8 | | | 3,916 | | | (290) | | | (252) | | | 3,454 | |

| Net income | | | | | | | 285 | | | | | | | 285 | |

| Net other comprehensive income (loss) | | | | | | | | | 66 | | | | | 66 | |

| Declaration of cash dividends | | | | | | | (206) | | | | | | | (206) | |

| Acquisition of treasury stock | | | | | | | | | | | (361) | | | (361) | |

| Stock-based compensation expense | | | | | 7 | | | | | | | | | 7 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Balance at January 31, 2024 | $ | 25 | | | $ | 47 | | | $ | 15 | | | $ | 3,995 | | | $ | (224) | | | $ | (613) | | | $ | 3,245 | |

| | | | | | | | | | | | | |

The following table shows the changes in stockholders’ equity by quarter during the nine months ended January 31, 2025:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Class A Common Stock | | Class B Common Stock | | Additional Paid-in Capital | | Retained Earnings | | AOCI | | Treasury Stock | | Total |

| Balance at April 30, 2024 | $ | 25 | | | $ | 47 | | | $ | 13 | | | $ | 4,261 | | | $ | (221) | | | $ | (608) | | | $ | 3,517 | |

| | | | | | | | | | | | | |

| Net income | | | | | | | 195 | | | | | | | 195 | |

| Net other comprehensive income (loss) | | | | | | | | | (43) | | | | | (43) | |

| Declaration of cash dividends | | | | | | | (206) | | | | | | | (206) | |

| | | | | | | | | | | | | |

| Stock-based compensation expense | | | | | 4 | | | | | | | | | 4 | |

| Stock issued under compensation plans | | | | | | | | | | | 3 | | | 3 | |

| Loss on issuance of treasury stock issued under compensation plans | | | | | (5) | | | | | | | | | (5) | |

| | | | | | | | | | | | | |

| Balance at July 31, 2024 | 25 | | | 47 | | | 12 | | | 4,250 | | | (264) | | | (605) | | | 3,465 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net income | | | | | | | 258 | | | | | | | 258 | |

| Net other comprehensive income (loss) | | | | | | | | | (27) | | | | | (27) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Stock-based compensation expense | | | | | 9 | | | | | | | | | 9 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance at October 31, 2024 | 25 | | | 47 | | | 21 | | | 4,508 | | | (291) | | | (605) | | | 3,705 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Net income | | | | | | | 270 | | | | | | | 270 | |

| Net other comprehensive income (loss) | | | | | | | | | (52) | | | | | (52) | |

| Declaration of cash dividends | | | | | | | (107) | | | | | | | (107) | |

| | | | | | | | | | | | | |

| Stock-based compensation expense | | | | | 7 | | | | | | | | | 7 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Balance at January 31, 2025 | $ | 25 | | | $ | 47 | | | $ | 28 | | | $ | 4,671 | | | $ | (343) | | | $ | (605) | | | $ | 3,823 | |

The following table shows the change in each component of accumulated other comprehensive income (AOCI), net of tax, during the nine months ended January 31, 2025:

| | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Currency Translation Adjustments | | Cash Flow Hedge Adjustments | | Postretirement Benefits Adjustments | | Total AOCI |

Balance at April 30, 2024 | $ | (111) | | | $ | 10 | | | $ | (120) | | | $ | (221) | |

| Net other comprehensive income (loss) | (128) | | | 3 | | | 3 | | | (122) | |

Balance at January 31, 2025 | $ | (239) | | | $ | 13 | | | $ | (117) | | | $ | (343) | |

The following table shows the cash dividends declared per share on our Class A and Class B common stock during the nine months ended January 31, 2025:

| | | | | | | | | | | | | | | | | | | | |

| Declaration Date | | Record Date | | Payable Date | | Amount per Share |

| May 23, 2024 | | June 7, 2024 | | July 1, 2024 | | $0.2178 |

| July 25, 2024 | | September 3, 2024 | | October 1, 2024 | | $0.2178 |

| November 21, 2024 | | December 6, 2024 | | January 2, 2025 | | $0.2265 |

| | | | | | |

On February 20, 2025, our Board of Directors declared a regular quarterly cash dividend on our Class A and Class B common stock of $0.2265 per share. The dividend is payable on April 1, 2025, to stockholders of record on March 7, 2025.

10. Net Sales

The following table shows our net sales by geography: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| January 31, | | January 31, |

| (Dollars in millions) | 2024 | | 2025 | | 2024 | | 2025 |

United States | $ | 469 | | | $ | 459 | | | $ | 1,442 | | | $ | 1,367 | |

Developed International1 | 310 | | | 298 | | | 910 | | | 867 | |

Emerging2 | 235 | | | 220 | | | 677 | | | 647 | |

Travel Retail3 | 37 | | | 35 | | | 127 | | | 121 | |

Non-branded and bulk4 | 18 | | | 23 | | | 58 | | | 79 | |

| Total | $ | 1,069 | | | $ | 1,035 | | | $ | 3,214 | | | $ | 3,081 | |

1Represents net sales of branded products to “advanced economies” as defined by the International Monetary Fund (IMF), excluding the United States. Our top developed international markets are Germany, Australia, the United Kingdom, France, Canada, and Spain.

2Represents net sales of branded products to “emerging and developing economies” as defined by the IMF. Our top emerging markets are Mexico, Poland, and Brazil.

3Represents net sales of branded products to global duty-free customers, other travel retail customers, and the U.S. military, regardless of customer location.

4Includes net sales of used barrels, contract bottling services, and non-branded bulk whiskey, regardless of customer location.

The following table shows our net sales by product category: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| January 31, | | January 31, |

| (Dollars in millions) | 2024 | | 2025 | | 2024 | | 2025 |

Whiskey1 | $ | 731 | | | $ | 749 | | | $ | 2,167 | | | $ | 2,177 | |

Ready-to-Drink2 | 127 | | | 126 | | | 397 | | | 380 | |

Tequila3 | 76 | | | 68 | | | 238 | | | 202 | |

| | | | | | | |

| | | | | | | |

Non-branded and bulk4 | 18 | | | 23 | | | 58 | | | 79 | |

Rest of portfolio5 | 117 | | | 69 | | | 354 | | | 243 | |

| Total | $ | 1,069 | | | $ | 1,035 | | | $ | 3,214 | | | $ | 3,081 | |

1Includes all whiskey spirits and whiskey-based flavored liqueurs. The brands included in this category are the Jack Daniel's family of brands (excluding the “ready-to-drink” products outlined below), the Woodford Reserve family of brands, the Old Forester family of brands, The GlenDronach, Benriach, Glenglassaugh, Slane Irish Whiskey, and Coopers’ Craft.

2Includes the Jack Daniel’s ready-to-drink (RTD) and ready-to-pour (RTP) products, New Mix, and other RTD/RTP products.

3Includes el Jimador, the Herradura family of brands, and other tequilas.

4Includes net sales of used barrels, contract bottling services, and non-branded bulk whiskey.

5Includes Sonoma-Cutrer (which was divested on April 30, 2024), Korbel California Champagnes, Diplomático, Gin Mare, Chambord, Finlandia Vodka (which was divested on November 1, 2023), Fords Gin, and Korbel Brandy.

11. Pension and Other Postretirement Benefits

The following table shows the components of the net cost recognized for our U.S. pension and other postretirement benefit plans. Information about similar international plans is not presented due to immateriality.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| January 31, | | January 31, |

| (Dollars in millions) | 2024 | | 2025 | | 2024 | | 2025 |

Pension Benefits: | | | | | | | |

| Service cost | $ | 5 | | | $ | 4 | | | $ | 14 | | | $ | 13 | |

| Interest cost | 8 | | | 9 | | | 25 | | | 27 | |

| Expected return on plan assets | (10) | | | (10) | | | (30) | | | (29) | |

| Amortization of: | | | | | | | |

| Prior service cost | — | | | — | | | — | | | 1 | |

Net actuarial loss | 2 | | | 1 | | | 5 | | | 1 | |

Curtailment loss | — | | | 1 | | | — | | | 1 | |

| | | | | | | |

| Net cost | $ | 5 | | | $ | 5 | | | $ | 14 | | | $ | 14 | |

| | | | | | | |

Other Postretirement Benefits: | | | | | | | |

| | | | | | | |

| Interest cost | $ | — | | | $ | — | | | $ | 1 | | | $ | 1 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Special termination benefits | — | | | 1 | | | — | | | 1 | |

Curtailment loss | — | | | 1 | | | — | | | 1 | |

| Net cost | $ | — | | | $ | 2 | | | $ | 1 | | | $ | 3 | |

12. Income Taxes

Our consolidated interim effective tax rate is based on our expected annual operating income, statutory tax rates, and income tax laws in the various jurisdictions where we operate. Significant or unusual items, including adjustments to accruals for tax uncertainties, are recognized in the fiscal quarter in which the related event or a change in judgment occurs. The effective tax rate on ordinary income for the full fiscal year is expected to be 22.5%, which is higher than the U.S. federal statutory rate of 21.0%, due to the impact of state taxes and the tax effects of foreign operations, partially offset by the beneficial impact of the foreign-derived intangible income deduction.

The effective tax rate of 19.5% for the nine months ended January 31, 2025, was lower than the expected tax rate of 22.5% on ordinary income for the full fiscal year ending April 30, 2025, primarily due to the beneficial impact of prior fiscal year true-ups. The effective tax rate of 19.5% for the nine months ended January 31, 2025, was lower than the effective tax rate of 20.3% for the same period last year, primarily due to the beneficial impact of prior fiscal year true-ups in the current year, partially offset by higher state taxes, the increased unfavorable tax effects of foreign earnings, and the absence of the beneficial impact of tax rate differences on the sale of the Finlandia vodka business in the prior fiscal year.

The OECD (Organization for Economic Co-operation and Development) 15% global minimum tax under the Pillar Two Model Rules, which is now effective in countries with enacted legislation, did not materially impact our financial results in the nine months ended January 31, 2025. We will continue to evaluate the impact in future periods as previously-enacting countries issue related guidance and additional countries consider adoption of the global minimum tax rules.

In December 2024, the U.S. Treasury Department and IRS released final and proposed regulations related to the determination under section 987 of taxable income or loss and foreign currency gain or loss with respect to a qualified business unit (QBU). We are currently evaluating the impact of adopting the final regulations on our current year provision, but do not anticipate them to have a material impact.

13. Derivative Financial Instruments and Hedging Activities

We are subject to market risks, including the effect of fluctuations in foreign currency exchange rates, commodity prices, and interest rates. We use derivatives to help manage financial exposures that occur in the normal course of business. We formally document the purpose of each derivative contract, which includes linking the contract to the financial exposure it is designed to mitigate. We do not hold or issue derivatives for trading or speculative purposes.

We use currency derivative contracts to limit our exposure to the foreign currency exchange rate risk that we cannot mitigate internally by using netting strategies. We designate most of these contracts as cash flow hedges of forecasted transactions (expected to occur within two years). We record all changes in the fair value of cash flow hedges in AOCI until the underlying hedged transaction occurs, at which time we reclassify that amount to earnings.

Some of our currency derivatives are not designated as hedges because we use them to partially offset the immediate earnings impact of changes in foreign currency exchange rates on existing assets or liabilities. We immediately recognize the change in fair value of these contracts in earnings.

We had outstanding currency derivatives, related primarily to our euro, British pound, and Australian dollar exposures, with notional amounts for all hedged currencies totaling $566 million at April 30, 2024, and $461 million at January 31, 2025. The maximum term of outstanding derivative contracts was 24 months at both April 30, 2024 and January 31, 2025.

We also use foreign currency-denominated debt instruments to help manage our foreign currency exchange rate risk. We designate a portion of those debt instruments as net investment hedges, which are intended to mitigate foreign currency exposure related to non-U.S. dollar net investments in certain foreign subsidiaries. Any change in value of the designated portion of the hedging instruments is recorded in AOCI, offsetting the foreign currency translation adjustment of the related net investments that is also recorded in AOCI. The amount of foreign currency-denominated debt instruments designated as net investment hedges was $497 million at April 30, 2024, and $491 million at January 31, 2025.

At inception, we expect each financial instrument designated as a hedge to be highly effective in offsetting the financial exposure it is designed to mitigate. We assess the effectiveness of our hedges continually. If we determine that any financial instruments designated as hedges are no longer highly effective, we discontinue hedge accounting for those instruments.

We use forward purchase contracts with suppliers to protect against corn price volatility. We expect to take physical delivery of the corn underlying each contract and use it for production over a reasonable period of time. Accordingly, we account for these contracts as normal purchases rather than as derivative instruments.

The following table presents the pre-tax impact that changes in the fair value of our derivative instruments and non-derivative hedging instruments had on AOCI and earnings:

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | January 31, |

| (Dollars in millions) | Classification | 2024 | | 2025 |

| Derivative Instruments | | | | |

| Currency derivatives designated as cash flow hedges: | | | | |

| Net gain (loss) recognized in AOCI | n/a | $ | (11) | | | $ | 12 | |

| Net gain (loss) reclassified from AOCI into earnings | Sales | 3 | | | 4 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

|

| | | | |

| | | | |

| Currency derivatives not designated as hedging instruments: | | | | |

| Net gain (loss) recognized in earnings | Sales | $ | (3) | | | $ | 6 | |

| Net gain (loss) recognized in earnings | Other income (expense), net | 2 | | | (1) | |

| | | | |

| Non-Derivative Hedging Instruments | | | | |

| Foreign currency-denominated debt designated as net investment hedge: | | | | |

| Net gain (loss) recognized in AOCI | n/a | $ | (19) | | | $ | 22 | |

| Net gain (loss) reclassified from AOCI into earnings | Other income (expense), net | 26 | | | — | |

| | | | |

| | | | |

| | | | |

| Total amounts presented in the accompanying condensed consolidated statements of operations for line items affected by the net gains (losses) shown above: | | | |

| Sales | | $ | 1,406 | | | $ | 1,348 | |

| Other income (expense), net | | (6) | | | (5) | |

| | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | |

| | Nine Months Ended |

| | January 31, |

| (Dollars in millions) | Classification | 2024 | | 2025 |

| Derivative Instruments | | | | |

| Currency derivatives designated as cash flow hedges: | | | | |

| Net gain (loss) recognized in AOCI | n/a | $ | 6 | | | $ | 11 | |

| Net gain (loss) reclassified from AOCI into earnings | Sales | 11 | | | 7 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

|

| | | | |

| | | | |

| Currency derivatives not designated as hedging instruments: | | | | |

| Net gain (loss) recognized in earnings | Sales | $ | (1) | | | $ | 6 | |

| Net gain (loss) recognized in earnings | Other income (expense), net | 8 | | | (6) | |

| | | | |

| Non-Derivative Hedging Instruments | | | | |

| Foreign currency-denominated debt designated as net investment hedge: | | | | |

| Net gain (loss) recognized in AOCI | n/a | $ | (2) | | | $ | 7 | |

| Net gain (loss) reclassified from AOCI into earnings | Other income (expense), net | 26 | | | — | |

| | | | |

| | | | |

| | | | |

| Total amounts presented in the accompanying condensed consolidated statements of operations for line items affected by the net gains (losses) shown above: | | | |

| Sales | | $ | 4,137 | | | $ | 3,935 | |

| Other income (expense), net | | 1 | | | 33 | |

| | | | |

We expect to reclassify $12 million of deferred net gains on cash flow hedges recorded in AOCI as of January 31, 2025 to earnings during the next 12 months. This reclassification would offset the anticipated earnings impact of the underlying hedged exposures. The actual amounts that we ultimately reclassify to earnings will depend on the exchange rates in effect when the underlying hedged transactions occur.

The following table presents the fair values of our derivative instruments: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | April 30, 2024 | | January 31, 2025 |

| (Dollars in millions) |

Classification | | Derivative Assets | | Derivative Liabilities | | Derivative Assets | | Derivative Liabilities |

| Designated as cash flow hedges: | | | | | | | | | |

| Currency derivatives | Other current assets | | $ | 11 | | | $ | (2) | | | $ | 15 | | | $ | (1) | |

| Currency derivatives | Other assets | | 1 | | | (1) | | | 3 | | | — | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Not designated as hedges: | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Currency derivatives | Accrued expenses | | — | | | (1) | | | — | | | — | |

| | | | | | | | | |

The fair values reflected in the above table are presented on a gross basis. However, as discussed further below, the fair values of those instruments subject to net settlement agreements are presented on a net basis in our balance sheets.

In our statements of cash flows, we classify cash flows related to cash flow hedges in the same category as the cash flows from the hedged items.

Credit risk. We are exposed to credit-related losses if the counterparties to our derivative contracts default. This credit risk is limited to the fair value of the contracts. To manage this risk, we contract only with major financial institutions that have investment-grade credit ratings and with whom we have standard International Swaps and Derivatives Association (ISDA) agreements that allow for net settlement of the derivative contracts. Also, we have established counterparty credit guidelines that we monitor regularly, and we monetize contracts when we believe it is warranted. Because of these safeguards, we believe we have no derivative positions that warrant credit valuation adjustments.

Our derivative instruments require us to maintain a specific level of creditworthiness, which we have maintained. If our creditworthiness were to fall below that level, then the counterparties to our derivative instruments could request immediate

payment or collateralization for derivative instruments in net liability positions. The aggregate fair value of our derivatives with creditworthiness requirements that were in a net liability position was $1 million at April 30, 2024, and $0 million at January 31, 2025.

Offsetting. As noted above, our derivative contracts are governed by ISDA agreements that allow for net settlement of derivative contracts with the same counterparty. It is our policy to present the fair values of current derivatives (that is, those with a remaining term of 12 months or less) with the same counterparty on a net basis in our balance sheets. Similarly, we present the fair values of noncurrent derivatives with the same counterparty on a net basis. We do not net current derivatives with noncurrent derivatives in our balance sheets.

The following table summarizes the gross and net amounts of our derivative contracts:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | Gross Amounts of Recognized Assets (Liabilities) | | Gross Amounts Offset in Balance Sheet | | Net Amounts Presented in Balance Sheet | | Gross Amounts Not Offset in Balance Sheet | | Net Amounts |

| April 30, 2024 | | | | | | | | | |

| Derivative assets | $ | 12 | | | $ | (3) | | | $ | 9 | | | $ | — | | | $ | 9 | |

| Derivative liabilities | (4) | | | 3 | | | (1) | | | — | | | (1) | |

| January 31, 2025 | | | | | | | | | |

| Derivative assets | 18 | | | (1) | | | 17 | | | — | | | 17 | |

| Derivative liabilities | (1) | | | 1 | | | — | | | — | | | — | |

No cash collateral was received or pledged related to our derivative contracts as of April 30, 2024, or January 31, 2025.

14. Fair Value Measurements

The following table summarizes the assets and liabilities measured or disclosed at fair value on a recurring basis:

| | | | | | | | | | | | | | | | | | | | | | | |

| April 30, 2024 | | January 31, 2025 |

| | Carrying | | Fair | | Carrying | | Fair |

| (Dollars in millions) | Amount | | Value | | Amount | | Value |

| Assets | | | | | | | |

| Cash and cash equivalents | $ | 446 | | | $ | 446 | | | $ | 599 | | | $ | 599 | |

| Currency derivatives, net | 9 | | | 9 | | | 17 | | | 17 | |

| | | | | | | |

| Liabilities | | | | | | | |

| Currency derivatives, net | 1 | | | 1 | | | — | | | — | |

Contingent consideration | 69 | | | 69 | | | 72 | | | 72 | |

| Short-term borrowings | 428 | | | 428 | | | 202 | | | 202 | |

Long-term debt (including current portion) | 2,672 | | | 2,468 | | | 2,661 | | | 2,487 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Fair value is defined as the exchange price that would be received for an asset or paid to transfer a liability in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants at the measurement date. We categorize the fair values of assets and liabilities into three levels based on the assumptions (inputs) used to determine those values. Level 1 provides the most reliable measure of fair value, while Level 3 generally requires significant management judgment. The three levels are:

•Level 1 – Quoted prices (unadjusted) in active markets for identical assets or liabilities.

•Level 2 – Observable inputs other than those included in Level 1, such as quoted prices for similar assets and liabilities in active markets; quoted prices for identical or similar assets and liabilities in inactive markets; or other inputs that are observable or can be derived from or corroborated by observable market data.

•Level 3 – Unobservable inputs supported by little or no market activity.

We determine the fair values of our currency derivatives (forward contracts) using standard valuation models. The significant inputs used in these models, which are readily available in public markets or can be derived from observable market

transactions, include the applicable spot exchange rates, forward exchange rates, and interest rates. These fair value measurements are categorized as Level 2 within the valuation hierarchy.

We determine the fair value of long-term debt primarily based on the prices at which identical or similar debt has recently traded in the market and also considering the overall market conditions on the date of valuation. These fair value measurements are categorized as Level 2 within the valuation hierarchy.

The fair values of cash, cash equivalents, and short-term borrowings approximate the carrying amounts due to the short maturities of these instruments.

We determine the fair value of our contingent consideration liability using a Monte Carlo simulation model, which requires the use of Level 3 inputs, such as projected future net sales, discount rates, and volatility rates. Changes in any of these Level 3 inputs could result in material changes to the fair value of the contingent consideration and could materially impact the amount of noncash expense (or income) recorded each reporting period.

The following table shows the changes in our contingent consideration liability during the nine months ended January 31, 2025:

| | | | | | | |

| | | |

| | | |

| (Dollars in millions) | | | |

| Balance at April 30, 2024 | | | $ | 69 | |

| | | |

Change in fair value1 | | | 5 | |

| Foreign currency translation adjustment | | | (2) | |

Balance at January 31, 2025 | | | $ | 72 | |

| | | |

1Classified as “other expense (income), net” in the accompanying condensed consolidated statement of operations.

We measure some assets and liabilities at fair value on a nonrecurring basis. That is, we do not measure them at fair value on an ongoing basis, but we do adjust them to fair value in some circumstances (for example, when we determine that an asset is impaired). As discussed in Notes 6 and 14, during the three months ended January 31, 2025, we recognized an impairment charge of $2 million related to certain cooperage facility assets held for sale as part of the restructuring plan approved in January 2025. The impairment charge was based on our measurements of the fair values of those assets, which are classified as Level 2 within the fair value hierarchy. No other material nonrecurring fair value measurements were required during the periods presented in these financial statements.

15. Other Comprehensive Income

The following table shows the components of net other comprehensive income (loss):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Three Months Ended |

| January 31, 2024 | | January 31, 2025 |

| (Dollars in millions) | Pre-Tax | | Tax | | Net | | Pre-Tax | | Tax | | Net |

| Currency translation adjustments: | | | | | | | | | | | |

| Net gain (loss) on currency translation | $ | 61 | | | $ | 4 | | | $ | 65 | | | $ | (55) | | | $ | (5) | | | $ | (60) | |

| Reclassification to earnings | 4 | | | 6 | | | 10 | | | — | | | — | | | — | |

| Other comprehensive income (loss), net | 65 | | | 10 | | | 75 | | | (55) | | | (5) | | | (60) | |

| Cash flow hedge adjustments: | | | | | | | | | | | |

| Net gain (loss) on hedging instruments | (11) | | | 3 | | | (8) | | | 12 | | | (3) | | | 9 | |

Reclassification to earnings1 | (3) | | | 1 | | | (2) | | | (4) | | | 1 | | | (3) | |

| Other comprehensive income (loss), net | (14) | | | 4 | | | (10) | | | 8 | | | (2) | | | 6 | |

| Postretirement benefits adjustments: | | | | | | | | | | | |

| Net actuarial gain (loss) and prior service cost | — | | | — | | | — | | | 1 | | | — | | | 1 | |

Reclassification to earnings2 | 1 | | | — | | | 1 | | | 1 | | | — | | | 1 | |

| Other comprehensive income (loss), net | 1 | | | — | | | 1 | | | 2 | | | — | | | 2 | |

| | | | | | | | | | | |

| Total other comprehensive income (loss), net | $ | 52 | | | $ | 14 | | | $ | 66 | | | $ | (45) | | | $ | (7) | | | $ | (52) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Nine Months Ended | | Nine Months Ended |

| January 31, 2024 | | January 31, 2025 |

| (Dollars in millions) | Pre-Tax | | Tax | | Net | | Pre-Tax | | Tax | | Net |

| Currency translation adjustments: | | | | | | | | | | | |

| Net gain (loss) on currency translation | $ | — | | | $ | — | | | $ | — | | | $ | (126) | | | $ | (2) | | | $ | (128) | |

| Reclassification to earnings | 4 | | | 6 | | | 10 | | | — | | | — | | | — | |

| Other comprehensive income (loss), net | 4 | | | 6 | | | 10 | | | (126) | | | (2) | | | (128) | |

| Cash flow hedge adjustments: | | | | | | | | | | | |

| Net gain (loss) on hedging instruments | 6 | | | (1) | | | 5 | | | 11 | | | (3) | | | 8 | |

Reclassification to earnings1 | (11) | | | 3 | | | (8) | | | (7) | | | 2 | | | (5) | |

| Other comprehensive income (loss), net | (5) | | | 2 | | | (3) | | | 4 | | | (1) | | | 3 | |

| Postretirement benefits adjustments: | | | | | | | | | | | |

| Net actuarial gain (loss) and prior service cost | — | | | — | | | — | | | 1 | | | — | | | 1 | |

Reclassification to earnings2 | 5 | | | (1) | | | 4 | | | 2 | | | — | | | 2 | |

| Other comprehensive income (loss), net | 5 | | | (1) | | | 4 | | | 3 | | | — | | | 3 | |

| | | | | | | | | | | |

| Total other comprehensive income (loss), net | $ | 4 | | | $ | 7 | | | $ | 11 | | | $ | (119) | | | $ | (3) | | | $ | (122) | |

1Pre-tax amount for each period is classified as sales in the accompanying condensed consolidated statements of operations.

2Pre-tax amount for each period is classified as non-operating postretirement expense in the accompanying condensed consolidated statements of operations.

16. Gain on Sale of Business

On November 1, 2023, we sold the Finlandia vodka business to Coca-Cola HBC AG for $194 million in cash. As a result of the sale, we recognized a pre-tax gain of $90 million during the third quarter of fiscal 2024.

17. Assets Held for Sale

As discussed in Note 6, our Board of Directors approved a restructuring plan, which included the planned closure of our Louisville-based cooperage facility. In January 2025, we reached an agreement to close that facility and sell the related assets. This transaction, which is subject to customary closing adjustments and conditions, is expected to close in the first quarter of fiscal 2026.

In connection with this transaction, certain assets met the held for sale criteria as of January 31, 2025. As a result, during the third quarter of fiscal 2025, we recorded a $2 million impairment charge to write down the long-lived assets held for sale to their estimated fair value (net of selling costs). We estimated the fair value based on the expected proceeds from the transaction. The carrying amount of the assets held for sale as of January 31, 2025, was $120 million, consisting of $33 million in property, plant and equipment, net, and $87 million in inventories. The total carrying amount of the assets held for sale is presented as a separate line item in the condensed consolidated balance sheet as of January 31, 2025.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis in conjunction with both our unaudited Condensed Consolidated Financial Statements and related notes included in Part I, Item 1 of this Quarterly Report and our Annual Report on Form 10-K for the fiscal year ended April 30, 2024 (2024 Form 10-K). Note that the results of operations for the nine months ended January 31, 2025, are not necessarily indicative of future or annual results. In this Item, “we,” “us,” “our,” “Brown-Forman,” and the “Company” refer to Brown-Forman Corporation and its consolidated subsidiaries, collectively.

Presentation Basis

Non-GAAP Financial Measures

We report our financial results in accordance with U.S. generally accepted accounting principles (GAAP). Additionally, we use some financial measures in this report that are not measures of financial performance under GAAP. These non-GAAP measures, defined below, should be viewed as supplements to (not substitutes for) our results of operations and other measures reported under GAAP. Other companies may define or calculate these non-GAAP measures differently.

“Organic change” in measures of statements of operations. We present changes in certain measures, or line items, of the statements of operations that are adjusted to an “organic” basis. We use “organic change” for the following measures: (a) organic net sales; (b) organic cost of sales; (c) organic gross profit; (d) organic advertising expenses; (e) organic selling, general, and administrative (SG&A) expenses; (f) organic other expense (income), net; (g) organic operating expenses1; and (h) organic operating income. To calculate these measures, we adjust, as applicable, for (1) acquisitions and divestitures, (2) other items, and (3) foreign exchange. We explain these adjustments below.

•“Acquisitions and divestitures.” This adjustment removes (a) the gain or loss recognized on sale of divested brands and certain assets, (b) any non-recurring effects related to our acquisitions and divestitures (e.g., transaction, transition, and integration costs), (c) the effects of operating activity related to acquired and divested brands for periods not comparable year over year (non-comparable periods), and (d) fair value changes to contingent consideration liabilities. Excluding non-comparable periods allows us to include the effects of acquired and divested brands only to the extent that results are comparable year over year.

During fiscal 2023, we acquired Gin Mare Brand, S.L.U. and Mareliquid Vantguard, S.L.U., which owned the Gin Mare brand (Gin Mare). This adjustment removes the fair value adjustments to Gin Mare’s earn-out contingent consideration liability that is payable in cash no earlier than July 2024 and no later than July 2027.