false

0001748790

0001748790

2025-03-10

2025-03-10

0001748790

amcr:OrdinarySharesParValue0.01PerShareMember

2025-03-10

2025-03-10

0001748790

amcr:Sec1.125GuaranteedSeniorNotesDue2027Member

2025-03-10

2025-03-10

0001748790

amcr:Sec5.450GuaranteedSeniorNotesDue2029Member

2025-03-10

2025-03-10

0001748790

amcr:Sec3.950GuaranteedSeniorNotesDue2032Member

2025-03-10

2025-03-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 10, 2025

AMCOR

PLC

(Exact

name of registrant as specified in its charter)

| Jersey |

001-38932 |

98-1455367 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 83 Tower Road North |

|

| Warmley, Bristol |

|

| United Kingdom |

BS30 8XP |

| (Address of principal executive offices) |

(Zip Code) |

+44 117 9753200

(Registrant’s

telephone number, including area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| x |

Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Ordinary Shares, par value $0.01 per share |

|

AMCR |

|

The New York Stock Exchange |

| 1.125%

Guaranteed Senior Notes Due 2027 |

|

AUKF/27 |

|

The New York Stock Exchange |

| 5.450% Guaranteed Senior Notes Due 2029 |

|

AMCR/29 |

|

The New York Stock Exchange |

| 3.950% Guaranteed Senior Notes Due 2032 |

|

AMCR/32 |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

¨ Emerging growth company

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

As previously announced, on

November 19, 2024, Amcor plc (“Amcor”), Aurora Spirit, Inc., a wholly-owned subsidiary of Amcor (“Merger Sub”),

and Berry Global Group, Inc. (“Berry”), entered into an Agreement and Plan of Merger (the “Merger Agreement”).

Upon the terms and subject to the conditions set forth in the Merger Agreement, Merger Sub will merge (such merger, the “Merger”)

with and into Berry, with Berry surviving as a wholly-owned subsidiary of Amcor.

The consummation of the Merger

is conditioned on, among other things, the expiration or termination of any applicable waiting period under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976, as amended (the “HSR Act”), relating to the consummation of the Merger.

On March 10, 2025, the waiting

period under the HSR Act with respect to the Merger expired. Amcor and Berry currently expect that the Merger will close in the middle

of calendar year 2025, subject to the satisfaction or waiver of certain other closing conditions.

On March 11, 2025, Amcor and

Berry issued a joint press release announcing the expiration of the waiting period under the HSR Act. A copy of the joint press release

is attached as Exhibit 99.1 hereto and incorporated by reference herein.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

Important Information for Investors and Shareholders

This communication does not constitute an offer

to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote or approval in any jurisdiction.

It does not constitute a prospectus or prospectus equivalent document. No offering of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. In connection with the proposed transaction between

Amcor plc (“Amcor”) and Berry Global Group, Inc. (“Berry”), on January 13, 2025, Amcor filed with the Securities

and Exchange Commission (the “SEC”) a registration statement on Form S-4, as amended on January 21, 2025, containing a joint

proxy statement of Amcor and Berry that also constitutes a prospectus of Amcor. The registration statement was declared effective by the

SEC on January 23, 2025 and Amcor and Berry commenced mailing the definitive joint proxy statement/prospectus to their respective shareholders

on or about January 23, 2025. INVESTORS AND SECURITY HOLDERS OF AMCOR AND BERRY ARE URGED TO READ THE DEFINITIVE JOINT PROXY STATEMENT/PROSPECTUS

AND OTHER DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT

INFORMATION. Investors and security holders may obtain free copies of the registration statement and the definitive joint proxy statement/prospectus

and other documents filed with the SEC by Amcor or Berry through the website maintained by the SEC at http://www.sec.gov. Copies of the

documents filed with the SEC by Amcor are available free of charge on Amcor’s website at amcor.com under the tab “Investors”

and under the heading “Financial Information” and subheading “SEC Filings.” Copies of the documents filed with

the SEC by Berry are available free of charge on Berry’s website at berryglobal.com under the tab “Investors” and under

the heading “Financials” and subheading “SEC Filings.”

Cautionary Statement Regarding Forward-Looking Statements

This Current Report contains certain

statements that are “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking statements are generally identified with words like “believe,”

“expect,” “target,” “project,” “may,” “could,” “would,”

“approximately,” “possible,” “will,” “should,” “intend,”

“plan,” “anticipate,” "commit," “estimate,” “potential,”

"ambitions," “outlook,” or “continue,” the negative of these words, other terms of similar

meaning, or the use of future dates. Such statements, including projections as to the anticipated benefits of the proposed

Transaction (as defined herein), the impact of the proposed Transaction on Amcor's and Berry Global Group Inc.’s

(“Berry”) business and future financial and operating results and prospects, and the amount and timing of synergies from

the proposed Transaction, are based on the current estimates, assumptions, projections and expectations of the management of Amcor

and Berry and are qualified by the inherent risks and uncertainties surrounding future expectations generally. Actual results could

differ materially from those currently anticipated due to a number of risks and uncertainties many of which are beyond Amcor's and

Berry’s control. Neither Amcor nor Berry nor any of their respective directors, executive officers, or advisors, provide any

representation, assurance, or guarantee that the occurrence of the events expressed or implied in any forward-looking statements

will actually occur or if any of them do occur, what impact they will have on the business, results of operations or financial

condition of Amcor and Berry. Should any risks and uncertainties develop into actual events, these developments could have a

material adverse effect on Amcor's and Berry’s respective businesses, the proposed Transaction and the ability to successfully

complete the proposed Transaction and realize its expected benefits. Risks and uncertainties that could cause actual results to

differ from expectations include, but are not limited to: occurrence of any event, change or other circumstance that could give rise

to the termination of the Agreement and Plan of Merger ("Merger Agreement") in connection with the proposed merger (the

"Transaction") of Amcor and Berry; risk that the conditions to the completion of the proposed Transaction with Berry

(including regulatory approvals) are not satisfied in a timely manner or at all; risks arising from the integration of the Amcor and

Berry businesses; risk that the anticipated benefits of the proposed Transaction may not be realized when expected or at all; risk

of unexpected costs or expenses resulting from the proposed Transaction; risk of litigation related to the proposed Transaction;

risks related to the disruption of management's time from ongoing business operations as a result of the proposed Transaction; risk

that the proposed Transaction may have an adverse effect on Amcor’s and Berry’s respective ability to retain key

personnel and customers; general economic, market and social developments and conditions; evolving legal, regulatory and tax regimes

under which Amcor or Berry operates; potential business uncertainty, including changes to existing business relationships, during

the pendency of the proposed Transaction that could affect Amcor’s and Berry’s respective financial performance; changes

in consumer demand patterns and customer requirements in numerous industries; the loss of key customers, a reduction in their

production requirements, or consolidation among key customers; significant competition in the industries and regions in which Amcor

or Berry operates; an inability to expand Amcor’s and Berry’s respective current businesses effectively through either

organic growth, including product innovation, investments, or acquisitions; challenging global economic conditions; impacts of

operating internationally; price fluctuations or shortages in the availability of raw materials, energy, and other inputs which

could adversely affect Amcor’s and Berry’s respective businesses; production, supply, and other commercial risks,

including counterparty credit risks, which may be exacerbated in times of economic volatility; pandemics, epidemics, or other

disease outbreaks; an inability to attract and retain Amcor’s and Berry’s respective global executive teams and

Amcor’s and Berry’s respective skilled workforce and manage key transitions; labor disputes and an inability to renew

collective bargaining agreements at acceptable terms; physical impacts of climate change; cybersecurity risks, which could disrupt

Amcor’s and Berry’s respective operations or risk of loss of Amcor’s and Berry’s respective sensitive

business information; failures or disruptions in Amcor’s and Berry’s respective information technology systems which

could disrupt Amcor’s and Berry’s respective operations, compromise customer, employee, supplier, and other data; a

significant increase in Amcor’s and Berry’s respective indebtedness or a downgrade in Amcor’s and Berry’s

respective credit ratings could reduce Amcor’s and Berry’s respective operating flexibility and increase Amcor’s

and Berry’s respective borrowing costs and negatively affect Amcor’s and Berry’s respective financial condition

and results of operations; rising interest rates that increase Amcor’s and Berry’s respective borrowing costs on

Amcor’s and Berry’s respective variable rate indebtedness and could have other negative impacts; foreign exchange rate

risk; a significant write-down of goodwill and/or other intangible assets; a failure to maintain an effective system of internal

control over financial reporting; an inability of Amcor’s and Berry’s respective insurance policies, including

Amcor’s and Berry’s respective use of a captive insurance company, to provide adequate protection against all of the

risks Amcor and Berry face; an inability to defend Amcor’s or Berry’s respective intellectual property rights or

intellectual property infringement claims against Amcor or Berry; litigation, including product liability claims or litigation

related to Environmental, Social, and Governance ("ESG"), matters or regulatory developments; increasing scrutiny and

changing expectations from investors, customers, suppliers, and governments with respect to Amcor’s and Berry’s

respective ESG practices and commitments resulting in additional costs or exposure to additional risks; changing ESG government

regulations including climate-related rules; changing environmental, health, and safety laws; changes in tax laws or changes in

Amcor’s and Berry’s respective geographic mix of earnings; and other risks and uncertainties are supplemented by those

identified from time to time in Amcor’s and Berry’s filings with the Securities and Exchange Commission (the

“SEC”), including without limitation, those described under Part I, "Item 1A - Risk Factors” in Amcor’s

Annual Report on Form 10-K for the fiscal year ended June 30, 2024 and Berry’s Annual Report on Form 10-K for the fiscal year

ended September 28, 2024, each as updated by Amcor’s or Berry’s quarterly reports on Form 10-Q. You can obtain copies of

Amcor’s and Berry’s filings with the SEC for free at the SEC’s website (www.sec.gov). Forward-looking statements

included herein are made only as of the date hereof and Amcor and Berry do not undertake any obligation to update any

forward-looking statements, or any other information in this communication, as a result of new information, future developments or

otherwise, or to correct any inaccuracies or omissions in them which become apparent, except as expressly required by law. All

forward-looking statements in this communication are qualified in their entirety by this cautionary statement.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| Date: March 11, 2025 |

|

| |

|

| AMCOR PLC |

|

| |

|

| /s/ Damien Clayton |

|

| Name: Damien Clayton |

|

| Title: Company Secretary |

|

Exhibit 99.1

Amcor

and Berry Global REceive US antitrust clearance for combination; on track for closing in mid calendar year 2025

ZURICH, SWITZERLAND

and EVANSVILLE, INDIANA, Mar. 11, 2025 – Amcor plc (“Amcor”) (NYSE: AMCR, ASX: AMC) and Berry Global Group,

Inc. (“Berry”) (NYSE: BERY) today announced the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements

Act of 1976 ("HSR Act") in connection with the previously announced combination of the two companies. Expiration of the waiting

period satisfies another closing condition necessary for completing the combination.

The companies also

confirm that a number of additional approvals have been received from regulatory authorities in recent weeks, including antitrust clearances

from China and Brazil.

Progress toward

obtaining remaining regulatory approvals and other customary closing conditions is well advanced. The companies continue to expect transaction

close in the middle of calendar year 2025.

Amcor Investor Relations Contacts

| Tracey Whitehead |

Damien Bird |

Damon Wright |

| Global Head of Investor Relations |

Vice President Investor Relations Asia Pacific |

Vice President Investor Relations North America |

T: +61 408 037 590

E: tracey.whitehead@amcor.com |

T: +61 481 900 499

E: damien.bird@amcor.com |

T: +1 224 313 7141

E: damon.wright@amcor.com |

| |

|

|

Amcor Media Contacts

Australia

James Strong |

Europe

Ernesto Duran |

North America

Julie Liedtke |

Managing Director

Sodali & Co |

Amcor Head of Global Communications |

Amcor Director, Media Relations |

Berry Investor Relations / Media

Contact

Dustin Stilwell

VP, Head of Investor Relations

T: +1 812 306 2964

E: ir@berryglobal.com

E: mediarelations@berryglobal.com

About Amcor

Amcor plc is a

global leader in developing and producing responsible packaging solutions across a variety of materials for food, beverage, pharmaceutical,

medical, home and personal-care, and other products. Amcor works with leading companies around the world to protect products, differentiate

brands, and improve supply chains. The Company offers a range of innovative, differentiating flexible and rigid packaging, specialty

cartons, closures and services. The company is focused on making packaging that is increasingly recyclable, reusable, lighter weight

and made using an increasing amount of recycled content. In fiscal year 2024, 41,000 Amcor people generated $13.6 billion in annual sales

from operations that span 212 locations in 40 countries. NYSE: AMCR; ASX: AMC

About Berry

Berry is a global

leader in innovative packaging solutions that we believe make life better for people and the planet. We do this every day by leveraging

our unmatched global capabilities, sustainability leadership, and deep innovation expertise to serve customers of all sizes around the

world. Harnessing the strength in our diversity and industry-leading talent of over 34,000 global employees across more than 200 locations,

we partner with customers to develop, design, and manufacture innovative products with an eye toward the circular economy. The challenges

we solve and the innovations we pioneer benefit our customers at every stage of their journey.

Cautionary Statement Regarding Forward-Looking

Statements

This document

contains certain statements that are “forward-looking statements” within the meaning of the safe harbor provisions of

the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identified with words like

“believe,” “expect,” “target,” “project,” “may,” “could,”

“would,” “approximately,” “possible,” “will,” “should,”

“intend,” “plan,” “anticipate,” "commit," “estimate,”

“potential,” "ambitions," “outlook,” or “continue,” the negative of these words, other

terms of similar meaning, or the use of future dates. Such statements, including projections as to the anticipated benefits of the

proposed Transaction (as defined herein), the impact of the proposed Transaction on Amcor's and Berry Global Group Inc.’s

(“Berry”) business and future financial and operating results and prospects, and the amount and timing of synergies from

the proposed Transaction, are based on the current estimates, assumptions, projections and expectations of the management of Amcor

and Berry and are qualified by the inherent risks and uncertainties surrounding future expectations generally. Actual results could

differ materially from those currently anticipated due to a number of risks and uncertainties many of which are beyond Amcor's and

Berry’s control. Neither Amcor nor Berry nor any of their respective directors, executive officers, or advisors, provide any

representation, assurance, or guarantee that the occurrence of the events expressed or implied in any forward-looking statements

will actually occur or if any of them do occur, what impact they will have on the business, results of operations or financial

condition of Amcor and Berry. Should any risks and uncertainties develop into actual events, these developments could have a

material adverse effect on Amcor's and Berry’s respective businesses, the proposed Transaction and the ability to successfully

complete the proposed Transaction and realize its expected benefits. Risks and uncertainties that could cause actual results to

differ from expectations include, but are not limited to: occurrence of any event, change or other circumstance that could give rise

to the termination of the Agreement and Plan of Merger ("Merger Agreement") in connection with the proposed merger (the

"Transaction") of Amcor and Berry; risk that the conditions to the completion of the proposed Transaction with Berry

(including regulatory approvals) are not satisfied in a timely manner or at all; risks arising from the integration of the Amcor and

Berry businesses; risk that the anticipated benefits of the proposed Transaction may not be realized when expected or at all; risk

of unexpected costs or expenses resulting from the proposed Transaction; risk of litigation related to the proposed Transaction;

risks related to the disruption of management's time from ongoing business operations as a result of the proposed Transaction; risk

that the proposed Transaction may have an adverse effect on Amcor’s and Berry’s respective ability to retain key

personnel and customers; general economic, market and social developments and conditions; evolving legal, regulatory and tax regimes

under which Amcor or Berry operates; potential business uncertainty, including changes to existing business relationships,

during the pendency of the proposed Transaction that could affect Amcor’s and Berry’s respective financial performance;

changes in consumer demand patterns and customer requirements in numerous industries; the loss of key customers, a reduction in

their production requirements, or consolidation among key customers; significant competition in the industries and regions in which

Amcor or Berry operates; an inability to expand Amcor’s and Berry’s respective current businesses effectively through

either organic growth, including product innovation, investments, or acquisitions; challenging global economic conditions; impacts

of operating internationally; price fluctuations or shortages in the availability of raw materials, energy, and other inputs which

could adversely affect Amcor’s and Berry’s respective businesses; production, supply, and other commercial risks,

including counterparty credit risks, which may be exacerbated in times of economic volatility; pandemics, epidemics, or other

disease outbreaks; an inability to attract and retain Amcor’s and Berry’s respective global executive teams and

Amcor’s and Berry’s respective skilled workforce and manage key transitions; labor disputes and an inability to renew

collective bargaining agreements at acceptable terms; physical impacts of climate change; cybersecurity risks, which could disrupt

Amcor’s and Berry’s respective operations or risk of loss of Amcor’s and Berry’s respective sensitive

business information; failures or disruptions in Amcor’s and Berry’s respective information technology systems which

could disrupt Amcor’s and Berry’s respective operations, compromise customer, employee, supplier, and other data; a

significant increase in Amcor’s and Berry’s respective indebtedness or a downgrade in Amcor’s and Berry’s

respective credit ratings could reduce Amcor’s and Berry’s respective operating flexibility and increase Amcor’s

and Berry’s respective borrowing costs and negatively affect Amcor’s and Berry’s respective financial condition

and results of operations; rising interest rates that increase Amcor’s and Berry’s respective borrowing costs on

Amcor’s and Berry’s respective variable rate indebtedness and could have other negative impacts; foreign exchange rate

risk; a significant write-down of goodwill and/or other intangible assets; a failure to maintain an effective system of internal

control over financial reporting; an inability of Amcor’s and Berry’s respective insurance policies, including

Amcor’s and Berry’s respective use of a captive insurance company, to provide adequate protection against all of the

risks Amcor and Berry face; an inability to defend Amcor’s or Berry’s respective intellectual property rights or

intellectual property infringement claims against Amcor or Berry; litigation, including product liability claims or litigation

related to Environmental, Social, and Governance ("ESG"), matters or regulatory developments; increasing scrutiny and

changing expectations from investors, customers, suppliers, and governments with respect to Amcor’s and Berry’s

respective ESG practices and commitments resulting in additional costs or exposure to additional risks; changing ESG government

regulations including climate-related rules; changing environmental, health, and safety laws; changes in tax laws or changes in

Amcor’s and Berry’s respective geographic mix of earnings; and other risks and uncertainties are supplemented by those

identified from time to time in Amcor’s and Berry’s filings with the Securities and Exchange Commission (the

“SEC”), including without limitation, those described under Part I, "Item 1A - Risk Factors” in Amcor’s

Annual Report on Form 10-K for the fiscal year ended June 30, 2024 and Berry’s Annual Report on Form 10-K for the fiscal year

ended September 28, 2024, each as updated by Amcor’s or Berry’s quarterly reports on Form 10-Q. You can obtain copies of

Amcor’s and Berry’s filings with the SEC for free at the SEC’s website (www.sec.gov). Forward-looking statements

included herein are made only as of the date hereof and Amcor and Berry do not undertake any obligation to update any

forward-looking statements, or any other information in this communication, as a result of new information, future developments or

otherwise, or to correct any inaccuracies or omissions in them which become apparent, except as expressly required by law. All

forward-looking statements in this communication are qualified in their entirety by this cautionary statement.

v3.25.0.1

Cover

|

Mar. 10, 2025 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 10, 2025

|

| Entity File Number |

001-38932

|

| Entity Registrant Name |

AMCOR

PLC

|

| Entity Central Index Key |

0001748790

|

| Entity Tax Identification Number |

98-1455367

|

| Entity Incorporation, State or Country Code |

Y9

|

| Entity Address, Address Line One |

83 Tower Road North

|

| Entity Address, City or Town |

Warmley, Bristol

|

| Entity Address, Country |

GB

|

| Entity Address, Postal Zip Code |

BS30 8XP

|

| Country Region |

+44

|

| City Area Code |

117

|

| Local Phone Number |

9753200

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Ordinary Shares, par value $0.01 per share[Member] |

|

| Title of 12(b) Security |

Ordinary Shares, par value $0.01 per share

|

| Trading Symbol |

AMCR

|

| Security Exchange Name |

NYSE

|

| 1.125% Guaranteed Senior Notes Due 2027 [Member] |

|

| Title of 12(b) Security |

1.125%

Guaranteed Senior Notes Due 2027

|

| Trading Symbol |

AUKF/27

|

| Security Exchange Name |

NYSE

|

| 5.450% Guaranteed Senior Notes Due 2029 [Member] |

|

| Title of 12(b) Security |

5.450% Guaranteed Senior Notes Due 2029

|

| Trading Symbol |

AMCR/29

|

| Security Exchange Name |

NYSE

|

| 3.950% Guaranteed Senior Notes Due 2032 [Member] |

|

| Title of 12(b) Security |

3.950% Guaranteed Senior Notes Due 2032

|

| Trading Symbol |

AMCR/32

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amcr_OrdinarySharesParValue0.01PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amcr_Sec1.125GuaranteedSeniorNotesDue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amcr_Sec5.450GuaranteedSeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=amcr_Sec3.950GuaranteedSeniorNotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

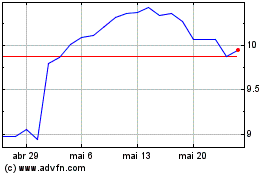

Amcor (NYSE:AMCR)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Amcor (NYSE:AMCR)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025