false

0001840563

0001840563

2025-03-07

2025-03-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

March 7, 2025

| PMGC Holdings Inc. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

001-41875 |

|

33-2382547 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

c/o 120 Newport Center Drive, Ste. 249

Newport Beach, CA |

|

92660 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (866) 794-4940

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13©(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value |

|

ELAB |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01 Other Events.

On March 7, 2025, PMGC Holdings Inc. (the “Company”)

entered into share buyback purchase agreements (the “Agreements”) with two existing shareholders, in which the Company purchased

(the “Repurchase”) thirty two and a half common shares or thirty three common shares after an adjustment was made in accordance

with applicable settlement and transfer agent policies in order to comply with whole share reporting requirements, from one shareholder

and thirty eight common shares from another shareholder at a purchase price of $0.7231 per share, totaling approximately Fifty Two Dollars.

The closing of the Repurchase occurred on March 7, 2025. The Company was approached to purchase these shares individually by these investors

to buy back the shares. The Company may or may not decide to buy back more shares from investors in the future.

The foregoing summary of the Agreements does not

purport to be complete and is qualified in its entirety by reference to the full text of the Agreements, a form of which is filed as Exhibit

99.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 Financial

Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: March

11, 2025

| PMGC Holdings Inc. |

|

| |

|

|

| By: |

/s/ Graydon Bensler |

|

| Name: |

Graydon Bensler |

|

| Title: |

Chief Executive Officer |

|

Exhibit 99.1

SECURITIES PURCHASE AGREEMENT

This Securities Purchase Agreement (this

“Agreement”), dated as of March 7 2025, is entered into by and between [ ], a [ ] [ ] (“Seller”),

and PMGC Holdings Inc. (fka Elevai Labs, Inc.), a Nevada corporation (“Buyer”). Capitalized terms used in this Agreement

have the meanings given to such terms herein.

RECITALS

WHEREAS, Seller owns [ ] shares,

$0.0001 par value per share (the “Common Shares”), of the Buyer;

WHEREAS, Seller wishes to sell to

Buyer, and Buyer wishes to purchase from Seller, all of the Common Shares and the Warrant, subject to the terms and conditions set forth

herein;

NOW, THEREFORE, in consideration

of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt and sufficiency

of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

PURCHASE AND SALE

Section 1.01 Purchase and Sale.

Subject to the terms and conditions set forth herein, at the Closing, Seller shall sell to Buyer, and Buyer shall purchase from Seller,

the Common Shares, free and clear of any mortgage, pledge, lien, charge, security interest, claim, option, equitable interest, restriction

of any kind (including any restriction on use, voting, transfer, receipt of income, or exercise of any other ownership attribute), or

other encumbrance (each, an “Encumbrance”), other than restrictions on transfer arising under applicable federal or state

securities laws, and in exchange therefor Buyer shall pay to Seller an amount equal to the Purchase Price (as defined below).

Section 1.02 Purchase Price. The

purchase price shall equal an aggregate amount equal to (x) the closing price of the Buyer’s common stock as of the day immediately

prior to the Closing (as defined below) as reported on The Nasdaq Stock Market LLC multiplied by (y) the number of Common Shares

purchased herein (the “Purchase Price”). Buyer shall pay the Purchase Price to Seller at the Closing in cash or by wire

transfer of immediately available funds in accordance with the wire transfer instructions set forth in Section 2.03(a) below.

ARTICLE II

CLOSING

Section 2.01 Closing. The closing

of the transactions contemplated by this Agreement (the “Closing”) shall take place simultaneously with the execution

of this Agreement on the date of this Agreement (the “Closing Date”) remotely by exchange of documents and signatures

(or their electronic counterparts). The consummation of the transactions contemplated by this Agreement shall be deemed to occur at 12:01

a.m. New York City time on the Closing Date.

Section 2.02 Seller Closing Deliverables.

At the Closing, Seller shall deliver to Buyer the following:

(a) A stock

power or other instrument of transfer, in form and substance reasonably satisfactory to Buyer and Seller, to transfer the Common Shares

and Warrant, duly executed in blank.1

(b) A

certificate of the managing members of Seller certifying that attached thereto are true and complete copies of all resolutions of the

managing members of Seller authorizing the execution, delivery, and performance of this Agreement, and the other agreements, instruments,

and documents required to be delivered in connection with this Agreement (collectively, the “Transaction Documents”)

to which Seller is a party and the consummation of the transactions contemplated hereby and thereby, and that such resolutions are in

full force and effect.

Section 2.03 Buyer’s Deliveries. At the Closing,

Buyer shall deliver the following to Seller the following:

(a) The aggregate Purchase Price to the following account:

[_______]

(b) A

certificate of the Secretary (or other officer) of Buyer certifying that attached thereto are true and complete copies of all resolutions

of the board of directors of Buyer authorizing the execution, delivery, and performance of this Agreement and the Transaction Documents

to which it is a party and the consummation of the transactions contemplated hereby and thereby, and that such resolutions are in full

force and effect.

ARTICLE III

REPRESENTATIONS AND WARRANTIES OF SELLER

Seller represents and warrants to Buyer

that the statements contained in this ARTICLE III are true and correct as of the date hereof.

Section 3.01 Authorization. Seller

has full power and authority to enter into this Agreement. This Agreement, when executed and delivered by Seller, will constitute valid

and legally binding obligations of Seller, enforceable against Seller in accordance with its terms, except as limited by applicable bankruptcy,

insolvency, reorganization, moratorium, fraudulent conveyance and any other laws of general application affecting enforcement of creditors’

rights generally, and as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF BUYER

Buyer represents and warrants to Seller

that the statements contained in this ARTICLE IV are true and correct as of the date hereof.

Section 4.01 Authorization. Buyer

has full power and authority to enter into this Agreement. This Agreement, when executed and delivered by Buyer, will constitute valid

and legally binding obligations of Buyer, enforceable against Buyer in accordance with its terms, except as limited by applicable bankruptcy,

insolvency, reorganization, moratorium, fraudulent conveyance and any other laws of general application affecting enforcement of creditors’

rights generally, and as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies.

ARTICLE V

COVENANTS

Section 5.01 Specific Performance.

Each party acknowledges that a breach or threatened breach of this Agreement by such party may give rise to irreparable harm to the

other party for which monetary damages may not be an adequate remedy, and hereby agrees that in the event of a breach or a threatened

breach by such party of any such obligations, the other party shall, in addition to any and all other rights and remedies that may be

available to it in respect of such breach, be entitled to seek equitable relief, including a temporary restraining order, an injunction,

or specific performance (without any requirement to post bond).

Section 5.02 Further Assurances. Following

the Closing, each of the parties hereto shall, and shall cause their respective affiliates to, execute and deliver such additional documents

and instruments, including but not limited to Medallion Guarantees, and take such further actions as may be reasonably required to carry

out the provisions hereof and give effect to the transactions contemplated by this Agreement and the other Transaction Documents.

Section 5.03 Mutual Release.

| (a) | Effective as of the Closing, each party, on behalf of itself

and each of its affiliates (such party, the “Releasing Party”), agrees not to sue and fully releases and forever discharges

the other party and its affiliates (such parties, the “Released Parties”) with respect to, and from, any and all claims,

demands, rights, liens, contracts, covenants, proceedings, causes of action, liabilities, obligations, debts, expenses (including reasonable

attorneys’ fees) and losses of whatever kind or nature, in each case arising on or prior to the Closing Date, in law, equity or

otherwise, whether now known or unknown, whether direct or indirect, and whether or not concealed or hidden, all of which such Releasing

Party now owns or holds or has at any time owned or held against such Released Parties relating to the ownership of the Common Shares;

provided, that nothing in this Section 5.03 shall prohibit such Releasing Party from enforcing its rights under this Agreement.

It is the intention of such Releasing Party that such release be effective as a bar to each and every claim, demand and cause of action

hereinabove specified and in furtherance of such intention, such Releasing Party hereby expressly waives, effective as of the Closing,

any and all rights and benefits conferred upon such Releasing Party by the provisions of applicable law and expressly consents that this

release will be given full force and effect according to each and all of its express terms and provisions, including those related to

unknown and unsuspected claims, demands and causes of action, if any, as those relating to any other claims, demands and causes of action

hereinabove specified. |

| (b) | To the extent that the releases above can be construed as falling

within Section 1542 of the Civil Code of California, each such Releasing Party acknowledges that it is familiar with Section 1542 of

the Civil Code of California and hereby expressly, knowingly and voluntarily waives and relinquishes, to the fullest extent permitted

by law, the provisions, protections, rights and benefits afforded by Section 1542, which provides as follows: |

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS

WHICH THE CREDITOR DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE, WHICH IF KNOWN BY HIM OR

HER MUST HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR.

Each such Releasing Party also hereby expressly,

knowingly and voluntarily waives and relinquishes all provisions, protections, rights and benefits they may have under any statutes, precedent

or principles of equity or law in any jurisdiction that are comparable to the provisions, protections, rights and benefits afforded by

Section 1542 of the Civil Code of California.

ARTICLE VI

INDEMNIFICATION

Section 6.01 Indemnification by Seller.

Subject to the other terms and conditions of this Agreement, Seller shall indemnify and defend each of Buyer and its affiliates (collectively,

the “Buyer Indemnitees”) against, and shall hold each of them harmless from and against, and shall pay and reimburse

each of them for, any and all losses incurred or sustained by, or imposed upon, the Buyer Indemnitees based upon, arising out of, with

respect to, or by reason of:

(a) any

inaccuracy in or breach of any of the representations or warranties of Seller contained in this Agreement or the other Transaction Documents;

or

(b) any

breach or non-fulfillment of any covenant, agreement, or obligation to be performed by Seller pursuant to this Agreement or the other

Transaction Documents.

Section 6.02 Indemnification by Buyer.

Subject to the other terms and conditions of this Agreement, Buyer shall indemnify and defend each of Seller and its affiliates (collectively,

the “Seller Indemnitees”) against, and shall hold each of them harmless from and against, and shall pay and reimburse

each of them for, any and all losses incurred or sustained by, or imposed upon, the Seller Indemnitees based upon, arising out of, with

respect to, or by reason of:

(a) any

inaccuracy in or breach of any of the representations or warranties of Buyer contained in this Agreement or the other Transaction Documents;

or

(b) any

breach or non-fulfillment of any covenant, agreement, or obligation to be performed by Buyer pursuant to this Agreement.

Section 6.03 Indemnification Procedures.

Whenever any claim shall arise for indemnification hereunder, the party entitled to indemnification (the “Indemnified Party”)

shall promptly provide written notice of such claim to the other party (the “Indemnifying Party”). In connection with

any claim giving rise to indemnity hereunder resulting from or arising out of any action by a person or entity who is not a party to this

Agreement, the Indemnifying Party, at its sole cost and expense and upon written notice to the Indemnified Party, may assume the defense

of any such action with counsel reasonably satisfactory to the Indemnified Party. The Indemnified Party shall be entitled to participate

in the defense of any such action, with its counsel and at its own cost and expense. If the Indemnifying Party does not assume the defense

of any such action, the Indemnified Party may, but shall not be obligated to, defend against such action in such manner as it may deem

appropriate, including settling such action, after giving notice of it to the Indemnifying Party, on such terms as the Indemnified Party

may deem appropriate and no action taken by the Indemnified Party in accordance with such defense and settlement shall relieve the Indemnifying

Party of its indemnification obligations herein provided with respect to any damages resulting therefrom. The Indemnifying Party shall

not settle any action without the Indemnified Party’s prior written consent (which consent shall not be unreasonably withheld or delayed).

Section 6.04 Survival. Subject

to the limitations and other provisions of this Agreement, the representations and warranties contained herein and all related rights

to indemnification shall survive the Closing. All covenants and agreements of the parties contained herein shall survive the Closing indefinitely

unless another period is explicitly specified herein. Notwithstanding the foregoing, any claims which are timely asserted in writing by

notice from the non-breaching party to the breaching party prior to the expiration date of the applicable survival period shall not thereafter

be barred by the expiration of the relevant representation or warranty and such claims shall survive until finally resolved.

Section 6.05 Cumulative

Remedies. The rights and remedies provided for in this Article are cumulative and are in addition to and not in substitution for any

other rights and remedies available at Law or in equity or otherwise.

ARTICLE VII

MISCELLANEOUS

Section 7.01 Expenses. All costs

and expenses incurred in connection with this Agreement and the transactions contemplated hereby shall be paid by the party incurring

such costs and expenses.

Section 7.02 Notices. All notices,

claims, demands, and other communications hereunder shall be in writing and shall be deemed to have been given: (a) when delivered by

hand (with written confirmation of receipt); (b) when received by the addressee if sent by a nationally recognized overnight courier (receipt

requested); (c) on the date sent by email of a PDF document (with confirmation of transmission) if sent during normal business hours of

the recipient, and on the next business day if sent after normal business hours of the recipient; or (d) on the day after the date mailed,

by certified or registered mail, return receipt requested, postage prepaid, if sent to the respective parties at the following addresses

(or at such other address for a party as shall be specified in a notice given in accordance with this Section 7.02):

with a copy (which shall not

constitute notice) to: |

[ n/a ]

|

| |

|

| If to Buyer: |

PMGC Holdings Inc.

120 Newport Center Drive, Ste 249,

Newport Beach, CA, 92660

Email: bensler.g@pmgcholdings.com

Attention: Graydon Bensler |

| |

|

with a copy (which shall not

constitute notice) to: |

Sichenzia Ross Ference Carmel LLP

1185 Avenue of the Americas,

31st FL.,

New York, NY 10036

Email: rcarmel@srfc.law

Attention: Ross Carmel |

Section 7.03 Interpretation; Headings.

This Agreement shall be construed without regard to any presumption or rule requiring construction or interpretation against the party

drafting an instrument or causing any instrument to be drafted. The headings in this Agreement are for reference only and shall not affect

the interpretation of this Agreement.

Section 7.04 Severability. If

any term or provision of this Agreement is invalid, illegal, or unenforceable in any jurisdiction, such invalidity, illegality, or unenforceability

shall not affect any other term or provision of this Agreement.

Section 7.05 Entire Agreement.

This Agreement and the other Transaction Documents constitute the sole and entire agreement of the parties to this Agreement with respect

to the subject matter contained herein and therein, and supersede all prior and contemporaneous understandings and agreements, both written

and oral, with respect to such subject matter. In the event of any inconsistency between the statements in the body of this Agreement

and those in the other Transaction Documents, the statements in the body of this Agreement will control.

Section 7.06 Successors and Assigns.

This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and permitted

assigns.

Neither party may assign its rights or obligations hereunder

without the prior written consent of the other party, which consent shall not be unreasonably withheld or delayed. No assignment shall

relieve the assigning party of any of its obligations hereunder.

Section 7.07 Amendment and Modification;

Waiver. This Agreement may only be amended, modified, or supplemented by an agreement in writing signed by each party hereto. No waiver

by any party of any of the provisions hereof shall be effective unless explicitly set forth in writing and signed by the party so waiving.

No failure to exercise, or delay in exercising, any right or remedy arising from this Agreement shall operate or be construed as a waiver

thereof. No single or partial exercise of any right or remedy hereunder shall preclude any other or further exercise thereof or the exercise

of any other right or remedy.

Section 7.08 Governing

Law; Submission to Jurisdiction; Waiver of Jury Trial. This Agreement shall be governed by and construed

in accordance with the laws of the State of New York without regard to principles of conflicts of laws. Any action brought by either party

against the other concerning the transactions contemplated by this Agreement, or any other agreement, certificate, instrument or document

contemplated hereby shall be brought only in the state and federal courts located in New York County, New York. The parties to this Agreement

hereby irrevocably waive any objection to jurisdiction and venue of any action instituted hereunder and shall not assert any defense based

on lack of jurisdiction or venue or based upon forum non conveniens. EACH PARTY HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE TO, AND

AGREES NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER OR UNDER ANY OTHER TRANSACTION DOCUMENT OR IN CONNECTION

WITH OR ARISING OUT OF THIS AGREEMENT, ANY OTHER TRANSACTION DOCUMENT OR ANY TRANSACTION CONTEMPLATED HEREBY OR THEREBY.

Section 7.09 Counterparts. This

Agreement may be executed in counterparts (including by means of facsimile and PDF file, each of which shall be deemed an original), each

of which shall be deemed an original, but all of which together shall be deemed to be one and the same agreement. A signed copy of this

Agreement delivered by email or other means of electronic transmission shall be deemed to have the same legal effect as delivery of an

original signed copy of this Agreement.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the parties hereto

have caused this Agreement to be executed as of the date first written above by their duly authorized representatives.

| |

[ ] |

| |

|

|

| |

By |

|

| |

[Name] |

| |

[Title] |

| |

|

| |

PMGC HOLDINGS INC. |

| |

|

| |

By |

|

| |

Graydon Bensler |

| |

Chief Executive Officer |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

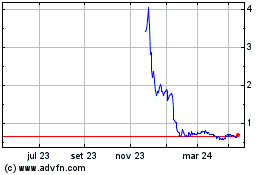

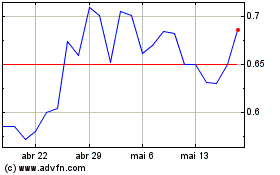

PMGC (NASDAQ:ELAB)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

PMGC (NASDAQ:ELAB)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025