CRWD Stock: CrowdStrike Beats Wall Street Estimates in Q4

08 Março 2023 - 7:31AM

Finscreener.org

Shares of

leading cybersecurity

company,

CrowdStrike (NASDAQ:

CRWD) are up close to 6%

in early market trading today after its earnings and revenue for

fiscal Q4 of 2023 (ended in January) beat consensus

estimates.

CrowdStrike reported revenue of

$637 million and adjusted earnings of $0.47 per share.

Comparatively, Wall Street forecast the company to report revenue

of $625 million and adjusted earnings of $0.43 per share in the

quarter.

Let’s see what impacted the

performance of CrowdStrike in Q4 and if the tech stock remains a

top bet for long term investors.

Is CrowdStrike stock a buy, sell or hold?

In Q4 of fiscal 2023, CrowdStrike

increased sales by 48% year over year. Its subscription sales were

also up 48% at $598.3 million, accounting for more than 90% of

total revenue. The company ended the quarter with annual recurring

revenue of $2.56 billion, an increase of almost 50% compared to the

year-ago period.

Due to rising inflation and a

challenging macro-environment, CrowdStrike’s adjusted gross margins

fell to 77% compared to 79% in fiscal Q4 of 2022. Its adjusted net

income also rose by 20% year over year to $95.6 million.

George Kurtz, CrowdStrike’s

president, chief executive officer, and co-founder, stated,

“CrowdStrike delivered a record fourth quarter that exceeded our

expectations across the board.

He added, “Highlights of the

quarter included record net new ARR of $222 million, record net new

subscription customers of 1,873, record operating and free cash

flow and a rule of 81 on a free cash flow basis. CrowdStrike’s

growing market share showcases customersU+02019 recognition of the

Falcon platform’s technology leadership and advanced AI that drives

better security outcomes, consolidation and lower TCO.”

CrowdStrike added 1,873 net new

subscription customers in the quarter, taking its total to 23,019

subscription customers, an increase of 41% year over year. Its

module adoption rates stood at 62%, 39%, and 22% for five or more,

six or more, and seven or more modules, respectively.

CrowdStrike announced a strategic

alliance with Dell Technologies to help enterprises prevent, detect

and respond to cyber threats. Its Falcon platform is available with

volume licensing as part of the deal, and it can soon be added to

the purchase of Dell’s line-up of personal computers.

What next for CRWD stock price?

CrowdStrike expects its total

addressable market to expand from $76 billion in 2023 to $97.8

billion in 2025, providing the company with enough room to drive

top-line growth higher in the next few years.

CRWD ended the year with a net

customer retention rate of 125.3% which shows existing customers

increased spending by 25.3% in the last 12 months. A highly engaged

customer base allows CrowdStrike to cross-sell its portfolio of

products and generate cash flows amid a difficult market

cycle.

Similar to most other SaaS

(software-as-a-service) companies, CrowdStrike also benefits from

high operating leverage, which means it can expand profit margins

at a much faster pace than expenses.

In Q4 of fiscal 2023, it reported

an operating margin of 15%, while this metric stood at just 7% in

fiscal 2021. The company also ended Q4 with a free cash flow of

$209 million, indicating a margin of 33%.

Analysts tracking CrowdStrike

stock expect sales to increase by 32.6% year over year to $3

billion, while adjusted earnings are forecast to increase by 33% to

$2 per share in fiscal 2024. So, CRWD stock is priced at 10x

forward sales and 65x forward earnings.

Despite its lofty valuation,

CrowdStrike remains a top bet due to its improving margins, stellar

revenue growth, and robust customer engagement rates.

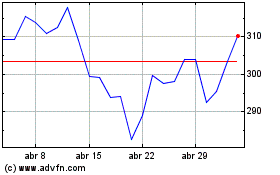

CrowdStrike (NASDAQ:CRWD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

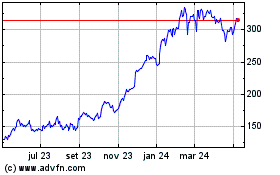

CrowdStrike (NASDAQ:CRWD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024