S&P 500 Retail Earnings to Showcase Consumer Demand This Week

14 Agosto 2023 - 6:34AM

Finscreener.org

Stocks are up 15% in 2023 due to

the rally driven by tech stocks. Equities are, in fact, the

best-performing asset class this year after

Bitcoin, which has

surged 54.4% year-to-date. Let’s see what investors should expect

from Wall Street in the next five days.

Walmart and retail earnings under focus

Big-box retailers such as

Walmart (NYSE: WMT), Home Depot

(NYSE: HD)

and Target

(NYSE:

TGT) will report earnings this week, which will be

used as a proxy for retail sales and consumer spending. If these

companies

beat consensus estimates, the U.S. consumer remains in decent

shape.

Analysts expect Walmart

to report sales of $160 billion in

the July quarter, an increase of 4.6% year over year. But analysts

are forecast to decline 4.5% to $1.69 per share in the July

quarter.

Home Depot sales are estimated to

fall 3.5% to $42.24 billion, while earnings might narrow by 20% to

$4.60 per share in the quarter ended in July.

Target’s sales might decline 2.8%

to $25.3 billion, but earnings are forecast to more than triple to

$1.43 per share.

Moreover, the Census Bureau is

set to release detailed national retail sales figures for July on

Tuesday, providing insights into consumer spending patterns for the

month. Retail sales, which are unadjusted for inflation, are

anticipated to have increased by 0.4% in July. This would represent

the fourth straight month of growth.

On an annual basis, the growth is

expected to be around 1%, the most sluggish rate since the

pandemic-triggered downturns in early 2020. After a 7% rise last

year, the National Retail Federation (NRF) anticipates growth in

retail spending of 4% to 6% in 2023, reaching between $5.13 to

$5.23 trillion.

Another interest rate hike?

Details from the FOMC Meeting,

The Federal Reserve will unveil the minutes from the FOMC meeting

that took place between July 25-26 on Wednesday. At this meeting,

policymakers elevated interest rates by a quarter percent, marking

the 11th and possibly the last hike in this tightening

cycle.

These minutes shed light on

possible future monetary policies and whether there are plans among

Fed officials to adjust rates further to align with the

bankU+02019s inflation target of 2%. Based on the CME GroupU+02019s

FedWatch Tool, thereU+02019s a 90% chance that the Fed will

maintain the current rates in the upcoming policy assembly in

September.

Housing market index

Housing Market Insights will

bring fresh data on the housing sector, encompassing July building

permits and housing starts statistics, along with the NAHB’s

Housing Market Index for August. Housing starts for July are

estimated to have marginally increased to 1.44 million from 1.43

million in June.

The NAHB’s Housing Market Index,

a reflection of future sales predictions derived from a homebuilder

survey, is likely to remain consistent with a score of 56. This

index has been on an upward trend for seven consecutive months

since its low in December, showcasing a resilient housing demand

despite the challenges of escalating mortgage rates and limited

housing stock.

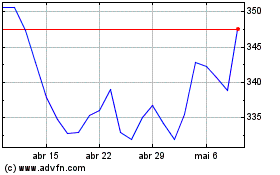

Home Depot (NYSE:HD)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Home Depot (NYSE:HD)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024