AFRICA OIL 2017 FOURTH QUARTER AND FULL YEAR FINANCIAL AND

OPERATING RESULTS

(AOI–TSX, AOI–Nasdaq-Stockholm) … Africa Oil

Corp. (“Africa Oil” or the “Company”) is pleased to announce

its financial and operating results for the three months and year

ended December 31, 2017.

As at December 31, 2017, the Company had cash of

$392.3 million and working capital of $436.3 million as compared to

cash of $463.1 million and working capital of $435.0 million at

December 31, 2016. During the second quarter of 2017, further to

the previously announced farmout agreement (press release 4th

February 2016), the Company and Maersk agreed to payment terms

related to the $75.0 million advance development carry. Africa Oil

is due to receive equal quarterly payments of $18.75 million at the

end of each calendar quarter during 2018. These proceeds were

recognized in accounts receivable and intangible exploration assets

during 2017.

On November 13, 2017 the Company announced that

it has entered into a strategic partnership with Eco (Atlantic) Oil

and Gas Ltd. (“Eco”) (TSXV:EOG or AIM:ECO) for exploration in West

Africa and Guyana. Under the terms of an investment agreement (the

“Investment Agreement”), AOC acquired 29.2 million common shares at

CAD$0.48 per share for a total consideration of $11.1

million. The Investment Agreement also provides the Company

with the right to participate in any future Eco equity issuances,

on a pro rata basis, and to appoint one nominee to Eco’s board of

directors. Keith Hill, President and CEO of AOC, has joined

the Eco board of directors as of November 29, 2017. As part of the

Investment Agreement, the parties have also entered into a

Strategic Alliance Agreement (the “SAA”), whereby they will jointly

pursue new exploration projects. Pursuant to the terms of the SAA,

AOC will be entitled to bid jointly on any new assets or ventures

proposed to be acquired by Eco, on the same terms as ECO and for an

interest at least equal to the Company’s percentage holding of the

common shares in Eco from time to time. Additionally, under the

terms of the SAA, AOC will also have a right of first offer on the

farmout of exploration properties currently held by Eco. The

Company currently holds an 18.9% shareholding interest in Eco. Eco

holds working interests in four exploration blocks offshore Namibia

and one exploration block offshore Guyana.

Blocks 10BB and 13T (Kenya)

The 2017 exploration and appraisal drilling

campaign was completed in the fourth quarter, following the

drilling of the Amosing-7 appraisal well. The PR Marriott Rig-46

has been demobilized. Two discoveries were made during the

campaign.

In January 2017, the Erut-1 well resulted in a

discovery, proving that oil has migrated to the northern limit of

the South Lokichar basin. The second discovery was made during May

2017, at Emekuya-1, encountering significant oil sands,

demonstrating oil charge across an extensive part of the Greater

Etom structure and further de-risking the northern area of the

basin.

The Etiir-1 exploration well, which targeted a

large, shallow, structural closure immediately to the west of the

Greater Etom structure, spudded in late June and was unsuccessful

with no material reservoir development or shows encountered.

Although dry, drilling results will be utilized in defining the

westerly extent of the Greater Etom Structure. The Etiir-1 well has

been plugged and abandoned.

The Ekales-3 well was drilled to a total

measured depth of 2,721 meters and finished drilling during the

third quarter of 2017. The well targeted an undrilled fault block

adjacent to the Ekales field. While reservoir and oil shows were

encountered, and oil sampled, the well was deemed

non-commercial.

Multiple appraisal wells have been drilled in

the Ngamia, Amosing and Etom fields during 2017: Ngamia-10 (65

meters of net oil pay), Amosing-6 (35 meters of net oil and gas

pay), Amosing-7 (25 meters of net oil and gas pay) and Etom-3 (25

meters of net oil and gas pay). An extensive wireline evaluation

program, including sampling has been undertaken on all appraisal

wells. The Ngamia-10, Amosing-6 and 7 and Etom-3 wells have all

improved the definition of the limits of their respective fields.

However, the presence of rift edge facies has limited their net

pay. These drilling results will be incorporated into the

geological models that will be utilized for potential field

development plans.

The Auwerwer and Lokone reservoirs in the Etom-2

well were tested utilising artificial lift and flowed at 752 bopd

and 580 bopd respectively which was lower than anticipated. As a

result, the Joint Venture Partners will undertake further technical

work to assess how representative the tests may have been and

identify potential options to increase flow rates from the Etom

field.

Activity is now focused on collecting dynamic

field data through extended production and water injection testing.

The Ngamia-11 appraisal well (143 meters of net oil pay) has been

completed and is being utilized in a waterflood pilot test planned

to be run throughout the first half of 2018. The waterflood pilot

will include the previously drilled Ngamia 3, 6 and 8 wells. This

pilot is designed to deliver a long-term assessment of the enhanced

oil recovery that may be expected as a result of water injection.

The waterflood pilot follows up the successful water injection

testing program which was completed during the first half of 2017

on the Ngamia and Amosing fields. Additionally, the partnership

aims to initiate extended well testing on wells in the Amosing and

Ngamia fields, commencing early in 2018, with produced oil from

testing initially being stored in the field and later transported

as part of the Early Oil Production Scheme (EOPS). The first

production from EOPS is expected to commence in the first half of

2018, subject to receiving the necessary consents and

approvals.

In January 2018 the Joint Venture Partners have

proposed to the Government of Kenya that the Amosing and Ngamia

fields be developed as the initial stage of the South Lokichar

development. This phase of the development is planned to include a

60,000 to 80,000 barrels of oil per day (bopd) Central Processing

Facility (CPF) and an export pipeline to Lamu, some 750 kilometers

from the South Lokichar basin on the Kenyan coast. This approach is

expected to bring significant benefits as it enables an early Final

Investment Decision (FID) of the Amosing and Ngamia fields taking

full advantage of the current low-cost environment for both the

field and infrastructure development, as well as providing the best

opportunity to deliver first oil in a timeline that meets the

Government of Kenya expectations. The installed infrastructure can

then be utilized for the optimization of the remaining and yet to

be discovered South Lokichar oil fields, allowing the incremental

development of these fields to be completed in an efficient and low

cost manner post first oil.

The initial stage is planned to include 210

wells through 18 well pads at Ngamia and 70 wells through seven

well pads at Amosing, with a planned plateau rate of 60,000 to

80,000 bopd. Additional stages of development are expected to

increase plateau production to 100,000 bopd or greater. It is

anticipated that Front End Engineering and Design (FEED) for the

initial stage will commence in 2018, with FID targeted for 2019 and

first oil in 2021/22.

A Joint Development Agreement (“JDA”), setting

out a structure for the Government of Kenya and the Kenya Joint

Venture Partners to progress the development of the export

pipeline, was signed on 25 October 2017. The JDA allows important

studies to commence such as FEED, Environmental and Social Impact

Assessments (“ESIA”), as well as studies on pipeline financing and

ownership. These have been initiated and will be continue

throughout 2018.

Africa Oil Corp. has a 25% working interest in

Blocks 10BB and 13T with Tullow Oil plc (50% and Operator) and

Maersk Olie og Gas A/S (25%) holding the remaining interests.

During 2017, the Joint Venture Partners entered

the Second Additional Exploration Period on Block 10BA.

The Company’s consolidated financial statements,

notes to the financial statements, management’s discussion and

analysis for the year ended December 31, 2017 and 2016, and the

2017 Annual Information Form have been filed on SEDAR

(www.sedar.com) and are available on the Company’s website

(www.africaoilcorp.com).

About Africa oil

Africa Oil Corp. is a Canadian oil and gas

company with assets in Kenya and Ethiopia. The Company is listed on

the Toronto Stock Exchange and on Nasdaq Stockholm under the symbol

"AOI".

Additional Information

The information in this release is subject to

the disclosure requirements of Africa Oil Corp. under the EU Market

Abuse Regulation and the Swedish Securities Market Act. This

information was publicly communicated on February 28, 2018 at 4:30

p.m. Pacific Time.

FORWARD LOOKING INFORMATION

Certain statements made and information

contained herein constitute "forward-looking information" (within

the meaning of applicable Canadian securities legislation). Such

statements and information (together, "forward looking statements")

relate to future events or the Company's future performance,

business prospects or opportunities. Forward-looking statements

include, but are not limited to, statements with respect to

estimates of reserves and or resources, future production levels,

future capital expenditures and their allocation to exploration and

development activities, future drilling and other exploration and

development activities, ultimate recovery of reserves or resources

and dates by which certain areas will be explored, developed or

reach expected operating capacity, that are based on forecasts of

future results, estimates of amounts not yet determinable and

assumptions of management.

All statements other than statements of

historical fact may be forward-looking statements. Statements

concerning proven and probable reserves and resource estimates may

also be deemed to constitute forward-looking statements and reflect

conclusions that are based on certain assumptions that the reserves

and resources can be economically exploited. Any statements that

express or involve discussions with respect to predictions,

expectations, beliefs, plans, projections, objectives, assumptions

or future events or performance (often, but not always, using words

or phrases such as "seek", "anticipate", "plan", "continue",

"estimate", "expect, "may", "will", "project", "predict",

"potential", "targeting", "intend", "could", "might", "should",

"believe" and similar expressions) are not statements of historical

fact and may be "forward-looking statements". Forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause actual results or events to differ

materially from those anticipated in such forward-looking

statements. The Company believes that the expectations reflected in

those forward-looking statements are reasonable, but no assurance

can be given that these expectations will prove to be correct and

such forward-looking statements should not be unduly relied upon.

The Company does not intend, and does not assume any obligation, to

update these forward-looking statements, except as required by

applicable laws. These forward-looking statements involve risks and

uncertainties relating to, among other things, changes in oil

prices, results of exploration and development activities,

uninsured risks, regulatory changes, defects in title, availability

of materials and equipment, timeliness of government or other

regulatory approvals, actual performance of facilities,

availability of financing on reasonable terms, availability of

third party service providers, equipment and processes relative to

specifications and expectations and unanticipated environmental

impacts on operations. Actual results may differ materially from

those expressed or implied by such forward-looking statements.

ON BEHALF OF THE BOARD

“Keith C. Hill”

President and CEO

---

For the complete release and report see attached

file.

aoc_180228_12m17

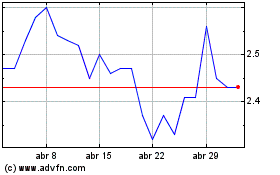

Africa Oil (TSX:AOI)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Africa Oil (TSX:AOI)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025