Killam Apartment REIT Announces $50 Million Public Offering of Trust Units

06 Junho 2018 - 5:28PM

NOT FOR DISTRIBUTION TO THE UNITED STATES

NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES

Killam Apartment REIT ("Killam") (TSX:KMP.UN) is pleased to

announce that it has reached an agreement with a syndicate of

underwriters led by RBC Capital Markets to issue to the public,

subject to regulatory approval, on a bought deal

basis, 3,345,000 trust units (the "Units") for $14.95 per

Unit for gross proceeds of $50,007,750 (the "Offering").

Killam has granted the Underwriters an

over-allotment option for the purposes of covering the

Underwriters' over-allocation position for an

additional 501,750 Units, exercisable up to 30 days after

closing of the Offering.

Killam intends to use the net proceeds from the

Offering to fully repay its credit facility (current outstanding

balance of approximately $30 million), to fund future acquisitions

and developments and for general trust purposes.

Killam will, within the next few days, file with

the securities commissions and other similar regulatory authorities

in each of the provinces of Canada, excluding Quebec, a preliminary

short form prospectus relating to the issuance of the Units.

Closing of the Offering is expected to take place on or about June

26, 2018, and is subject to customary closing conditions, including

the approval of the Toronto Stock Exchange.

This press release is not an offering of

securities for sale in the United States. The Units being offered

have not been and will not be registered under the United States

Securities Act of 1933, as amended (the "U.S. Securities Act"), and

state securities laws. Accordingly, the Units may not be offered or

sold in the United States absent registration or an exemption from

the registration requirements of the U.S. Securities Act.

About Killam Apartment REIT

Killam Apartment REIT, based in Halifax, Nova

Scotia, is one of Canada's largest residential landlords, owning,

operating, managing and developing a $2.5 billion portfolio of

apartments and manufactured home communities. Killam’s strategy to

enhance value and profitability focuses on three priorities: 1)

increasing earnings from existing operations, 2) expanding the

portfolio and diversifying geographically through accretive

acquisitions, with an emphasis on newer properties, and 3)

developing high-quality properties in its core markets.

For information, please

contact:

Philip FraserPresident &

CEOpfraser@killamreit.com(902) 453-4536

or

Nancy Alexander, CPA, CA Senior Director,

Investor Relations & Performance

Analyticsnalexander@killamREIT.com(902) 442-0374

Note: The Toronto Stock Exchange has neither

approved nor disapproved of the information contained herein.

Certain statements in this report may constitute forward-looking

statements relating to the size and anticipated closing date of the

Offering and the anticipated use of the net proceeds of the

Offering, which are based on our expectations, estimates, forecast

and projections, which we believe are reasonable as of the current

date. Such forward-looking statements involve risks, uncertainties

and other factors which may cause actual results, performance or

achievements of Killam to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements. For more exhaustive information on

these risks and uncertainties, you should refer to our most

recently filed annual information form which is available at

www.sedar.com. Readers, therefore, should not place undue reliance

on any such forward-looking statements. Further, a forward-looking

statement speaks only as of the date on which such statement is

made and should not be relied upon as of any other date. Other than

as required by law, Killam does not undertake to update any of such

forward-looking statements.

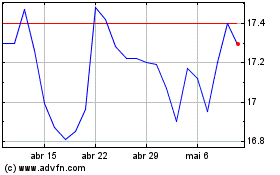

Killam Apartment REIT (TSX:KMP.UN)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

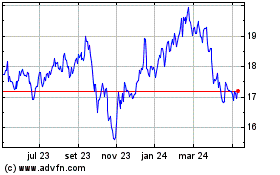

Killam Apartment REIT (TSX:KMP.UN)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025