Swiss Water Reports Strong Third Quarter and Nine-Month Results

06 Novembro 2019 - 7:00PM

Swiss Water Decaffeinated Coffee Inc. (

TSX – SWP)

(“Swiss Water” or “the company”) today reported strong financial

results for the third quarter and first nine months of 2019. Swiss

Water is a premium green coffee decaffeinator which employs the

proprietary SWISS WATER® Process to decaffeinate green coffee

without the use of chemicals.

With volumes up 16% year-over-year, Swiss Water

has once again reported double-digit growth in the amount of coffee

delivered to customers during the first nine months of 2019. In

addition, the company improved its nine-month operating income by

15% over the same period last year. Swiss Water continues to

increase its market share and win new business, as more and more

industry participants and coffee consumers move away from chemical

decaffeination in favor of chemical free processes. At the same

time, growing demand from existing customers is fueling robust

growth. Swiss Water also maintained the positive trend toward

improved operating margins and manufacturing efficiency established

in the first half of the year, while remaining sharply focused on

producing high-quality premium decaffeinated coffee.

“We are pleased to report that the strong growth

in volumes we have achieved over the past several quarters

continued through the third quarter and first nine months of this

year. Thanks to a number of positive market trends, as well as our

strategic investments in sales and marketing both in North America

and overseas, we are seeing new business coming from all our

geographic markets and customer categories. We are particularly

proud of the fact that our business in Europe, where we launched a

new subsidiary in January, is up by 56% year-to-date”, said Frank

Dennis, Swiss Water’s President and CEO. “Going forward, we will

continue to invest in our production infrastructure and human

resources to prepare for the significant growth that we anticipate

in the future. To this end, our new state-of-the-art production

facility in Delta, BC is nearing completion and on-track for

commissioning toward the end of Q4. We should be in a position to

begin shipping commercially from the new plant in the first quarter

of 2020.”

Below is a summary of Swiss Water’s operational

and financial results.

Operational highlights

The following table shows year-over-year changes

in volumes shipped during the third quarter and nine months ended

September 30, 2019.

|

|

|

3 months endedSeptember 30, 2019 |

9 months endedSeptember 30, 2019 |

|

|

Change in total volumes shipped |

|

+8% |

+16% |

|

|

|

|

|

|

|

|

By Customer Type |

|

|

|

|

|

Roasters |

|

+9% |

+13% |

|

|

Importers |

|

+6% |

+23% |

|

|

Specialty |

|

-3% |

+9% |

|

|

Commercial |

|

+14% |

+21% |

|

Financial highlights

|

In $000’s except per share |

3 months ended September 30, |

9 months ended September 30, |

|

amounts (unaudited) |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Sales |

$ |

23,645 |

$ |

23,087 |

$ |

72,707 |

$ |

66,960 |

|

Gross profit |

|

4,737 |

|

4,439 |

|

12,388 |

|

11,235 |

|

Operating income |

|

2,291 |

|

1,927 |

|

4,623 |

|

4,013 |

|

Net income |

|

884 |

|

1,828 |

|

2,228 |

|

3,612 |

|

EBITDA1 |

|

3,485 |

|

2,717 |

|

8,894 |

|

5,695 |

|

Net income - basic2 |

$ |

0.10 |

$ |

0.20 |

$ |

0.25 |

$ |

0.40 |

|

Net income - diluted2 |

$ |

0.10 |

$ |

0.18 |

$ |

0.25 |

$ |

0.31 |

1 EBITDA is defined in the

‘Non-IFRS Measures’ section of the MD&A and is a “Non-GAAP

Financial Measure” as defined by CSA Staff Notice

52-306.2 Per-share calculations are based on the

weighted average number of shares outstanding during the

period.

- Third quarter revenue was $23.6 million, an increase of 2% over

Q3 of 2018. Nine-month revenue was $72.2 million, an 8%

year-over-year improvement. The increase in revenue in both periods

was due to growth in volumes and a higher average US dollar (“US$”)

exchange rate, as well as increases in green coffee sales volumes,

partially offset by a lower coffee futures price (“NY’C’”).

- Quarterly gross profit was $4.7 million, compared to $4.4

million in Q3 2018. Looked at sequentially, Q3 gross profit was up

by $0.6 million from $4.1 million in Q2 of this year. Gross profit

for the first nine months increased to $12.4 million from $11.2

million in the same period last year. The improvement in

year-to-date gross profit was a result of increased overall process

volumes and a higher proportion of regular volumes in our sales

mix, as well as improved supply chain efficiencies and management’s

ongoing efforts to control operating costs. These positive factors

were partially offset by the impact of higher labour costs.

Nine-month gross profit was also negatively impacted by a spike in

natural gas prices during the first quarter due to a pipeline

explosion in October 2018. This significantly reduced energy supply

and increased gas prices in British Columbia last winter. Going

forward, the company remains tightly focused on margin maintenance

and improvement, and continues to seek ways to manage variable and

fixed costs across all of its operations, while vigorously

maintaining product quality.

- Operating expenses decreased by 3% to $2.4 million in the third

quarter and increased by 8% to $7.8 million for the first nine

months of this year, compared to the same periods in 2018. The Q3

decrease was due to lower sales and marketing expenses during the

period, while the nine-month increase was due to higher staffing

and staff-related expenses, as well as an increase in research and

development activity during the second quarter.

- Operating income increased by $0.4 million, or 19%, to $2.3

million in the third quarter and was up by $0.6 million, or 15%, to

$4.6 million for the first nine months, compared to the same

periods last year.

- For the third quarter, Swiss Water reported net income of $0.9

million, compared to net income of $1.8 million in Q3 2018.

Year-to-date net income was $2.2 million, compared to $3.6 million

in the first three quarters of last year. This year’s improved

operating income was offset by increases in non-operating expenses.

The increased expenses were driven by a loss on risk management

activities, the revaluation of an embedded derivative, and higher

finance expense in relation to interest on leases as a result of

the adoption of IFRS 16 – Leases.

- Third quarter EBITDA was $3.5 million, up by $0.8 million, or

28%, over Q3 2018. Nine-month EBITDA was $8.9 million, up by

$3.2 million, or 56% over the same period last year. In both

periods, the significant increase in EBITDA was largely due to the

adoption of new accounting standards related to leases.

Operationally, EBITDA was enhanced by the strong growth in volumes,

ongoing efforts to enhance cost recovery, and an increased

financial contribution from Seaforth, the company’s supply chain

subsidiary.

Construction of Swiss Water’s new decaffeination

facility, which is located in Delta, BC, is nearing

completion. The new production line is expected to be

commissioned in the fourth quarter of this year.

Quarterly Dividends

Subsequent to the end of the third quarter, on

October 15, 2019, the company paid an eligible dividend in the

amount of $0.6 million ($0.0625 per share) to shareholders of

record on September 30, 2019.

Company Profile

Swiss Water Decaffeinated Coffee Inc. is a leading

specialty coffee company and a premium green coffee decaffeinator

which employs the proprietary SWISS WATER® Process to decaffeinate

green coffee without the use of chemicals. It also owns Seaforth

Supply Chain Solutions, a green coffee handling and storage

business. Both businesses are located in the cities of Burnaby and

Delta, British Columbia.

Additional Information

A more detailed discussion of Swiss Water

Decaffeinated Coffee Inc.’s recent financial results is provided in

the company’s Management Discussion and Analysis filed on SEDAR

(www.sedar.com) and on the company’s website

(https://investor.swisswater.com/).

For more information, please contact:

Iain Carswell, Chief Financial OfficerSwiss Water

Decaffeinated Coffee Inc.Phone: 604.420.4050Email:

investor-relations@swisswater.comWebsite:

investor.swisswater.com

Forward-Looking Statements

Certain statements in this press release may

constitute “forward-looking” statements which involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, levels of activity, performance or achievements to

be materially different from any future results, levels of

activity, performance or achievements expressed or implied by such

forward-looking statements. When used in this press release, such

statements may include such words as “may”, “will”, “expect”,

“believe”, “plan” and other similar terminology. These statements

reflect management’s current expectations regarding future events

and operating performance, as well as management’s current

estimates, but which are based on numerous assumptions and may

prove to be incorrect. These statements are neither promises nor

guarantees, but involve known and unknown risks and uncertainties,

including, but not limited to, risks related to processing volumes

and sales growth, operating results, supply of utilities, supply of

coffee, general industry conditions, commodity price risks,

technology, competition, foreign exchange rates, construction

timing, costs and financing of capital projects, and general

economic conditions.

The forward-looking statements and financial

outlook information contained herein are made as of the date of

this press release and are expressly qualified in their entirety by

this cautionary statement. Except to the extent required by

applicable securities law, Swiss Water Decaffeinated Coffee Inc.

undertakes no obligation to publicly update or revise any such

statements to reflect any change in management’s expectations or in

events, conditions, or circumstances on which any such statements

may be based, or that may affect the likelihood that actual results

will differ from those described herein.

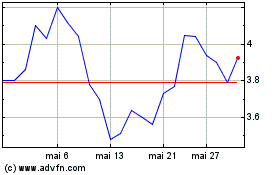

Swiss Water Decaffeinate... (TSX:SWP)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Swiss Water Decaffeinate... (TSX:SWP)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025