Swiss Water Decaffeinated Coffee Inc.

(TSX: SWP)

(“Swiss Water” or “the Company”), a leading specialty coffee

company and premium green coffee decaffeinator, today reported

financial results for the three months and year ended December 31,

2023.

Financial and Operational Highlights for

2023

- During late Q3, commercial

decaffeination on Swiss Water’s second production line in Delta, BC

started for the first time. This marked the completion of the

consolidation of all production activities into one site, and the

end of the transition away from the Company’s legacy production

facility in Burnaby, BC. Production volumes and quality metrics on

the new line steadily increased during the final three months of

the year and enabled the delivery of a very strong fourth

quarter.

- Total sales volume for the fourth

quarter increased by 17%, when compared to Q4 2022. For the full

year, volume decreased by 7%, primarily due to production

constraints realized during the second and third quarters of 2023.

This temporary limitation of capacity occurred as the Company

vacated its old Burnaby site due to the lease expiry there and

before the full commissioning of its second line in Delta.

- Revenue for the quarter and year

ended December 31, 2023, was $41.2 million and $166.3 million

respectively. This represents a $2.8 million decrease in Q4 and a

$10.7 million decrease for the full year when compared to the 2022

result. Volume decline and a drop in the NY ‘C’ contributed to the

year-over-year drop in revenue.

- Swiss Water recorded a net income

of $1.0 million for the fourth quarter, up by $1.2 million from

2022. For the full year, a net loss of $0.5 million was generated,

down by $2.9 million from net income of $2.4 million in 2022. The

fourth quarter increase in net income was primarily due to higher

volumes and efficiencies of scale. The drop in annual gross profit

was due to the lower volume, as well as materially lower green

coffee differential margins and a one-time incremental depreciation

expense of $2.5 million related to the closure of the old Burnaby

facility. In addition, Swiss Water experienced a material increase

in finance expenses due to higher borrowings. These negative

factors were partially offset by gains on risk management

activities, higher finance income, reduced losses on foreign

exchange, and lower income tax expense.

- Fourth quarter adjusted EBITDA1 was

$5.0 million, an increase of $1.9 million over Q4 of 2022. For the

full year, adjusted EBITDA was $13.4 million down by $3.3 million,

when compared to 2022.

- The commissioning of Swiss Water’s

second production line in Delta led to an acceleration in raw

materials usage and increased shipments of finished goods during

the third and fourth quarters of the year. As a result, inventories

closed 2023 at their lowest levels since Q1 of 2022 generating a

material release of working capital back into the business. By the

end of the fourth quarter, the value of inventory on hand had

dropped to $30.3 million from $60.2 million at December 31, 2022.

This provided an opportunity for the Company to pay down some debt

while leaving adequate inventory on hand to support operations and

near-term growth.

- Swiss Water finished the year in a

strong liquidity position with over $11.0 million cash on hand in

anticipation of the maturity of the $15.0 million debenture in

October 2024.

“During the third quarter of 2023, we launched

our new second decaffeination line at our facility in Delta, BC. As

expected, this enabled us to realize a strong recovery of

production volumes during the fourth quarter. Our sales and

logistics teams worked tirelessly throughout the quarter and the

year to manage our capacity and the allocation of available

production. Anticipating the transitional constraints, our team

successfully front-end loaded significant customer demand into Q1,

before our Burnaby shutdown, enabling balanced customer service

through Q3 and facilitating an acceleration of sales during

Q4.”, said Frank Dennis, Swiss Water’s President and CEO. “We

look forward into 2024 with optimism. Swiss Water’s production

activities are now fully consolidated onto one site and the

transition away from our legacy production assets in Burnaby is

complete. The initial performance of our new Delta line 2 has been

very good and we are confident that we can increase the production

rate of this line over time. We have adequate unused capacity to

service our medium-term growth ambitions, and are pleased that this

extra capacity will help enable more roasters to respond to

consumer demand by accelerating their migration to chemical free

decaffeinated coffee.”, Dennis added.

Operational Highlights

The following table shows changes in trading

volumes during the three months and year ended December 31, 2023,

compared to the same periods in 2022.

|

Volumes |

3 months ended December 31, 2023 |

Year ended December 31, 2023 |

|

Change in total volumes |

17% |

-7% |

|

By customer type |

|

|

|

Roasters |

15% |

2% |

|

Importers |

20% |

-17% |

|

Specialty |

8% |

-15% |

|

Commercial |

26% |

-1% |

|

|

|

|

- Total fourth

quarter sales volume increased by 17% compared to the same period

in 2022. The consolidation of production in Delta was completed

during the third quarter and, as a result, Swiss Water is no longer

capacity constrained. This enabled the Company to maximize organic

growth opportunities and clear a small backlog of orders with

existing customers during the fourth quarter. For the full year,

volume decreased by 7%, primarily due to the anticipated capacity

limitations during the second and third quarters of 2023.

-

During 2023 Swiss Water’s largest geographical market by volume was

the United States, followed by Canada and international markets. By

dollar value, 50% of sales were to customers in the United States,

29% were to Canadian customers, and the remaining 21% were to

international customers. Overall, Swiss Water recorded sales of

$166.3 million for the year which represents a $10.7 million, or

6%, decrease from the 2022 result.

-

Inventory levels fell during the second half of 2023 due to the

consumption of the coffee inventories built up to bridge the

production constraints Swiss Water experienced during the

transition from Burnaby and the consolidation of all processing in

Delta. The Company remained focused on optimizing inventory levels

and year-end volumes on hand were rebalanced at levels not recorded

since the first quarter of 2021. Moving forward, Swiss Water is

well positioned with green coffee inventory and can react to

short-term demand increases in most coffee origins. Although the

Company saw a marked reduction in the disruption to green coffee

deliveries and supply chain bottlenecks during the year, some

shipping delays and increased freight rates persist. As a recent

example, the port strike in July 2023 affected more than 30 ports

across BC, including the Port of Vancouver. Swiss Water is

cautiously optimistic that any current and future disruptions will

not have a material impact on its operations in 2024.

Financial Highlights

|

In $000s except per share amounts |

|

3 months ended December 31 |

|

Year ended December 31 |

|

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenue |

|

$ |

41,237 |

|

$ |

43,998 |

|

$ |

166,277 |

|

$ |

176,935 |

|

|

Gross profit |

|

|

6,916 |

|

|

5,759 |

|

|

18,798 |

|

|

26,088 |

|

|

Operating income |

|

|

3,372 |

|

|

2,792 |

|

|

5,630 |

|

|

13,381 |

|

|

Net (loss) income |

|

|

961 |

|

|

(254 |

) |

|

(528 |

) |

|

2,387 |

|

|

Adjusted EBITDA1 |

|

|

5,008 |

|

|

3,087 |

|

|

13,354 |

|

|

16,659 |

|

|

Net (loss) income per share – basic2 |

|

$ |

0.10 |

|

$ |

(0.03 |

) |

$ |

(0.06 |

) |

$ |

0.26 |

|

|

Net (loss) income per share – diluted2 |

|

$ |

0.10 |

|

$ |

(0.03 |

) |

$ |

(0.06 |

) |

$ |

0.26 |

|

1 Adjusted EBITDA is defined in the ‘Non-IFRS

Measures’ section of the MD&A and is a “Non-GAAP Financial

Measure” as defined by CSA Staff Notice 52-306.2 Per-share

calculations are based on the weighted average number of shares

outstanding during the periods. Diluted earnings per share take

into account shares that may be issued upon the exercise of

warrants and RSUs.

- Revenue for the quarter and year

ended December 31, 2023, was $41.2 million and $166.3 million

respectively. This represents a $2.8 million decrease in Q4 and a

$10.7 million decrease for the full year, when compared to the 2022

results. The drop in full-year revenue was an expected result of

the temporary reduction in capacity Swiss Water experienced during

the second and third quarters as it transitioned production out of

Burnaby. Higher than normal volumes shipped in the first and fourth

quarters helped mitigate the impact of the temporary capacity

constraint. A decline in the NY ‘C’ also contributed to the

year-over-year drop in revenue.

- Gross profit for the fourth quarter

was $6.9 million, an increase of $1.2 million from Q4 of 2022. For

the full year, gross profit of $18.8 million was down by $7.3

million from the 2022 level. The fourth quarter increase in gross

profit was primarily due to higher volumes and efficiencies of

scale leveraged from within Swiss Water’s production process.

During Q4, the consolidation of all production into a single

facility also started to generate savings from reduced building

maintenance, utilities consumption, staffing, and transportation

between locations. As anticipated, the year-over-year drop in gross

profit was due to the temporary production constraint described

above, as well as materially lower green coffee differential

margins and the one-time incremental depreciation expense of $2.5

million. In addition, Swiss Water experienced inflationary

pressures on variable production costs, including natural gas,

carbon and labour, as well as on freight and storage costs.

- Net income of $1.0 million for the

fourth quarter was up by $1.2 million from 2022. For the full year,

Swiss Water recorded a net loss of $0.5 million, down by $2.9

million from net income of $2.4 million in 2022. The differences in

net income for both periods were driven by the same factors

influencing gross profit, as described above, as well as a material

increase in finance expenses due to higher borrowings. These

negative factors were partially offset by gains on risk management

activities, higher finance income, reduced losses on foreign

exchange, and lower income tax expense.

- Fourth quarter adjusted EBITDA2 was

$5.0 million, an increase of $1.9 million over Q4 of 2022. For the

full year, adjusted EBITDA was $13.4 million down by $3.3 million,

when compared to 2022. The fourth quarter increase is reflective of

high production volumes and scale efficiencies, while the decrease

in annual adjusted EBITDA was primarily driven by lower volume due

to the capacity constraint during the third quarter transition from

Burnaby, as well as reduced green coffee differential margins.

Adjusted EBITDA

Swiss Water defines Adjusted EBITDA as net

income before interest, depreciation, amortization, impairments,

share-based compensation, gains/losses on foreign exchange,

gains/losses on disposal of property and capital equipment, fair

value adjustments on embedded options, loss on extinguishment of

debt, adjustment for the impact of IFRS 16 - Leases, and provision

for income taxes and other non-cash gains related to a

remeasurement of asset retirement obligation. The Company’s

definition of Adjusted EBITDA also excludes unrealized gains and

losses on the undesignated portion of foreign exchange forward

contracts.

To help readers better understand Swiss Water’s

financial results, the following table provides a reconciliation of

net income, an IFRS measure, to Adjusted EBITDA as follows:

|

In $000s |

3 months ended December 31 |

|

Year ended December 31 |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net income (loss) |

$ |

961 |

|

$ |

(254 |

) |

$ |

(528 |

) |

$ |

2,387 |

|

|

Income tax expense (recovery) |

|

430 |

|

|

(130 |

) |

|

(4 |

) |

|

819 |

|

|

Income (loss) before tax |

$ |

1,391 |

|

$ |

(384 |

) |

$ |

(532 |

) |

$ |

3,206 |

|

|

Loss (gain) on the embedded option |

|

126 |

|

|

(513 |

) |

|

(76 |

) |

|

(513 |

) |

|

Gain on the extinguishment of debt |

|

- |

|

|

(583 |

) |

|

- |

|

|

(583 |

) |

|

Finance income |

|

(492 |

) |

|

(174 |

) |

|

(1,629 |

) |

|

(509 |

) |

|

Finance expense |

|

2,326 |

|

|

1,577 |

|

|

8,265 |

|

|

5,567 |

|

|

Impairment of plant and equipment |

|

- |

|

|

2,470 |

|

|

- |

|

|

2,470 |

|

|

Loss on foreign exchange |

|

377 |

|

|

334 |

|

|

234 |

|

|

2,183 |

|

|

Depreciation and amortization |

|

1,752 |

|

|

1,686 |

|

|

9,188 |

|

|

7,018 |

|

|

Share-based compensation |

|

130 |

|

|

173 |

|

|

597 |

|

|

552 |

|

|

Other gains |

|

- |

|

|

- |

|

|

(175 |

) |

|

- |

|

|

Unrealized loss (gain) on foreign exchange forwards |

|

38 |

|

|

(796 |

) |

|

127 |

|

|

44 |

|

|

Impact of IFRS 16 - Leases |

|

(640 |

) |

|

(703 |

) |

|

(2,645 |

) |

|

(2,776 |

) |

|

Adjusted EBITDA |

$ |

5,008 |

|

$ |

3,087 |

|

$ |

13,354 |

|

$ |

16,659 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Profile

Swiss Water Decaffeinated Coffee Inc. is a

leading specialty coffee company and a premium green coffee

decaffeinator that employs the proprietary Swiss Water® Process to

decaffeinate green coffee without the use of chemical solvents such

as methylene chloride. It also owns Seaforth Supply Chain Solutions

Inc., a green coffee handling and storage business. Both businesses

are located in Delta, British Columbia, Canada.

Additional Information

A conference call to discuss Swiss Water’s

recent financial results will be held on Thursday, March

14, 2024, at 1:00 pm Pacific (4:00 pm Eastern). To access

the conference call, please dial:

-

1-888-506-0062 (toll-free) or

-

1-973-528-0011 (international);

-

participant access code: 200437

A replay will be available through March 28,

2024, at

-

1-877-481-4010 (toll-free) or

-

1-919-882-2331 (international);

-

replay passcode: 50035

A more detailed discussion of Swiss Water

Decaffeinated Coffee Inc.’s recent financial results is provided in

the Company’s Management Discussion and Analysis filed on SEDAR+

and Swiss Water’s website (investor.swisswater.com).

For more information, please

contact:

Iain Carswell, Chief Financial OfficerSwiss

Water Decaffeinated Coffee Inc.Phone: 604.420.4050Email:

investor-relations@swisswater.comWebsite:

investor.swisswater.com

Forward-Looking Statements

Certain statements in this press release may

constitute “forward-looking” statements that involve known and

unknown risks, uncertainties and other factors that may cause the

actual results, levels of activity, performance, or achievements to

be materially different from any future results, levels of

activity, performance or achievements expressed or implied by such

forward-looking statements. When used in this press release, such

statements may include such words as “may”, “will”, “expect”,

“believe”, “plan”, “anticipate” and other similar terminology.

These statements reflect management’s current expectations

regarding future events and operating performance, as well as

management’s current estimates, but which are based on numerous

assumptions and may prove to be incorrect. These statements are

neither promises nor guarantees, but involve known and unknown

risks and uncertainties, including, but not limited to, risks

related to processing volumes and sales growth, operating results,

the supply of utilities, the supply of coffee and packaging

materials, supply of labour force, general industry conditions,

commodity price risks, technology, competition, foreign exchange

rates, construction timing, costs and financing of capital

projects, a potential impact of the COVID-19 and/or other

pandemics, global and local climate changes, changes in interest

rates, inflation, transportation availability, and general economic

conditions. The forward-looking statements and financial outlook

information contained herein are made as of the date of this press

release and are expressly qualified in their entirety by this

cautionary statement. Except to the extent required by applicable

securities law, Swiss Water undertakes no obligation to publicly

update or revise any such statements to reflect any change in

management’s expectations or in events, conditions, or

circumstances on which any such statements may be based, or that

may affect the likelihood that actual results will differ from

those described herein.

1 Adjusted EBITDA is defined in the ‘Non-IFRS

Measures’ section of the MD&A and is a “Non-IFRS Financial

Measure” as defined by CSA Staff Notice 52-306.2 Adjusted EBITDA is

defined in the ‘Non-IFRS Measures’ section of the MD&A and is a

“Non-IFRS Financial Measure” as defined by CSA Staff Notice

52-306.

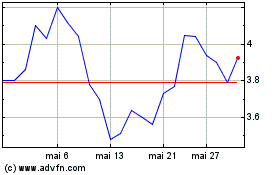

Swiss Water Decaffeinate... (TSX:SWP)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Swiss Water Decaffeinate... (TSX:SWP)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025