Artificial Intelligence company, AnalytixInsight Inc.

(“AnalytixInsight”, or the “Company”) (

TSX-V: ALY; OTCQB:

ATIXF), is pleased to announce that its FinTech affiliate,

MarketWall, has appointed a board of directors for its European

online financial brokerage subsidiary, InvestoPro. MarketWall has

applied to become a European online financial broker through its

wholly-owned subsidiary, InvestoPro, and is awaiting regulatory

approvals.

The board of directors for InvestoPro has been

constituted with the following seven members:

Massimo Tessitore (Chair): Head

of Digital Channels - Branch Platform & Digital Business

Partner Commercial Banking, Private and Insurance of Intesa

Sanpaolo,

Laura Stoduto: General Director

of Morval SIM, a subsidiary of Intesa Sanpaolo,

Giuseppe Attanà: Board Member

of Banca IMI S.p.a., Board Member of Be Consulting S.p.a., Board

Member of Intesa Sanpaolo Vita S.p.a.,

Marco Roscio Ricon: CEO of

MarketWall,

Luca Canevello: Innovation

Manager of MarketWall,

Prakash Hariharan: Board

Chairman and CEO of AnalytixInsight, and

Chaith Kondragunta: Board

Member of AnalytixInsight.

The board of directors for MarketWall remains

unchanged, consisting of Massimo Tessitore, Marco Roscio Ricon and

Prakash Hariharan.

InvestoPro will be a significant evolution for

MarketWall’s business, once approved. InvestoPro will offer online

stock-trading and FinTech-enabled services on multi-device trading

platforms (e.g., mobile, wearables, smart-TV) combined with high

value financial content and education. InvestoPro will use Intesa

Sanpaolo as its execution broker. InvestoPro will be offered

initially in Italy with intentions to expand to other European

countries.

MarketWall also operates www.marketwall.com

which provides financial content, news, real-time quotes, and video

news stories. This financial portal together with MarketWall’s

other digital channels draws an audience of over approximately 2

million monthly views. MarketWall is a Samsung Electronics partner,

and has developed financial apps that are already pre-loaded on

certain Samsung devices. These existing initiatives contribute to

MarketWall’s consumer brand awareness in Europe which will benefit

InvestoPro, when launched.

AnalytixInsight believes the need for online

banking and online trading platforms are increasing because of

consumer behavior shifts caused by the COVID-19 pandemic and

expects MarketWall’s business will benefit from this trend

shift.

Intesa Sanpaolo is one of the top banking groups

in Europe with approximately 11.8 million customers and

approximately 3,700 branches throughout Italy. It has emerged as

Italy's first digital bank and is investing 2.8 billion euros in a

strategic plan to increase the bank’s digitized business to 70%,

with mobile being at the heart of the digital ecosystem.

CONTACT INFORMATION:

Scott

Urquhart

VP Corporate DevelopmentScott.Urquhart@AnalytixInsight.com

ABOUT MARKETWALL S.R.L.

MarketWall is a FinTech company focused on the

design and development of software solutions as part of a fully

integrated ecosystem of Smart Devices – Web, Mobile, Wearables and

Smart TV. Our aim is to innovate methods to access financial

markets by combining technology, data and user experience.

We work to empower market data experience and investment knowledge

by developing B2B and B2B2C multidevice platforms for major players

in the Financial and Technology industries. Our platforms cover

50,000 stocks and provide news, real-time quotes for EU and US

markets and other financial contents.

MarketWall is 49% owned by AnalytixInsight Inc.,

and 33% owned by Intesa Sanpaolo.

ABOUT ANALYTIXINSIGHT INC.

AnalytixInsight Inc. is an Artificial

Intelligence, machine-learning company. AnalytixInsight’s financial

analytics platform CapitalCube.com algorithmically analyzes market

price data and regulatory filings to create insightful actionable

narratives and research on approximately 50,000 global companies

and ETFs, providing high-quality financial research and content for

investors, information providers, finance portals and media.

AnalytixInsight also designs and implements Workforce Optimization

solutions for large global enterprises. AnalytixInsight holds a 49%

interest in MarketWall, a developer of FinTech solutions for

financial institutions. For more information, visit

AnalytixInsight.com.

Regulatory Statements

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Forward-looking information includes, without

limitation, statements regarding the growth of the Company’s

business operations; the relationship between the Company and

Intesa Sanpaolo, the impact to MarketWall resulting from Intesa

Sanpaolo’s plans, the ability for MarketWall or InvestoPro to

obtain regulatory approvals to become an online broker, the impact

of Covid-19 on the Company and MarketWall’s business, the use of

the Company’s content by various parties; and the Company’s future

performance. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

“plans”, “expects” or “does not expect”, “is expected”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or

“does not anticipate”, or “believes”, or variations of such words

and phrases or state that certain actions, events or results “may”,

“could”, “would”, “might” or “will be taken”, “occur” or “be

achieved”. Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

AnalytixInsight Inc., as the case may be, to be materially

different from those expressed or implied by such forward-looking

information, including but not limited to: general business,

economic, competitive, geopolitical and social uncertainties; the

Company’s technology and revenue generation; risks associated with

operation in the technology sector; ability to successfully

integrate new technology and employees; foreign operations risks;

and other risks inherent in the technology industry. Although

AnalytixInsight has attempted to identify important factors that

could cause actual results to differ materially from those

contained in forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that such information will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such statements.

Accordingly, readers should not place undue reliance on

forward-looking information. AnalytixInsight does not undertake to

update any forward-looking information, except in accordance with

applicable securities laws.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE

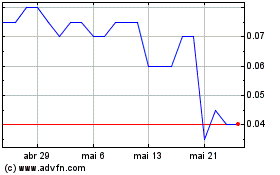

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

AnalytixInsight (TSXV:ALY)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024