Quarterly information at 30 September 2020

Rueil Malmaison, 20 October 2020, 5.45pm

Quarterly information at 30 September

2020

- Revenue for the first nine months of the year: €30.8 billion

(down 12%)

- Most business lines returning to normal in the third quarter

after being hit hard in the second quarter by lockdowns in France

and many other countries

- Contracting: close to full capacity in the three business lines

(VINCI Energies, Eurovia and VINCI Construction)

- VINCI Autoroutes: limited decline in traffic levels compared

with 2019

- VINCI Airports: slightly positive summer development in

passenger numbers, interrupted in September due to the renewed

spread of the pandemic

- Contracting order book remained at an all-time high of €42.8

billion (up 15%), due to firm order intake in major projects

- Sharp year-on-year decline in debt levels; very strong

liquidity

- 2020 outlook: earnings expected to fall significantly;

confidence in the Group’s ability to bounce back in 2021

| Consolidated revenue |

|

|

|

|

| |

First nine months |

2020/2019 change |

| (in €

millions) |

2020 |

2019 |

Actual |

Like-for-like1 |

|

Concessions |

4,515 |

6,493 |

-30.5% |

-33.2% |

|

VINCI Autoroutes |

3,526 |

4,288 |

-17.8% |

-17.8% |

|

VINCI Airports |

818 |

1,965 |

-58.4% |

-63.4% |

|

Other concessions(VINCI Highways, VINCI Railways and VINCI

Stadium) |

171 |

240 |

-28.6% |

-27.4% |

|

Contracting |

25,990 |

28,073 |

-7.4% |

-8.5% |

|

VINCI Energies |

9,586 |

9,800 |

-2.2% |

-6.3% |

|

Eurovia |

6,894 |

7,465 |

-7.7% |

-7.2% |

|

VINCI Construction |

9,511 |

10,808 |

-12.0% |

-11.5% |

| VINCI

Immobilier |

749 |

811 |

-7.6% |

-7.6% |

|

Eliminations and adjustments |

(476) |

(520) |

|

|

| VINCI

Group total2 |

30,778 |

34,857 |

-11.7% |

-13.2% |

| of which:

France |

16,300 |

19,298 |

-15.5% |

-16.0% |

|

International |

14,478 |

15,559 |

-6.9% |

-9.8% |

|

Europe excl. France |

8,805 |

9,454 |

-6.9% |

-12.8% |

|

International excl. Europe |

5,673 |

6,105 |

-7.1% |

-4.8% |

|

|

|

|

|

|

| Change in

motorway traffic at VINCI Autoroutes |

-21.2% |

-0.3% |

|

|

| Change in

VINCI Airports passenger numbers3 |

-67.9% |

+6.8% |

|

|

| Order

intake (in € billions) |

33.3 |

31.9 |

+4% |

|

| Order book4 (in € billions) |

42.8 |

37.3 |

+15% |

|

|

Net financial debt4 (in € billions) |

(20.8) |

(23.2) |

+2.4 |

|

|

Liquidity4 (in € billions) |

18.5 |

14.4 |

+4.1 |

|

I.

Consolidated key figures

VINCI’s revenue in the third quarter of

2020 amounted to €12.3 billion, down only 6.4% on an actual basis

(down 6.7% like-for-like) compared with the third quarter of

2019. After a second quarter in which business levels were

hit hard by lockdowns in France and many other countries, these

figures show a clear improvement in the trend and show that most of

VINCI’s operations, in France and abroad, are returning to

normal.

Consolidated revenue in the first nine

months of 2020 came to €30.8 billion5, down 11.7% on an actual

basis compared with the year-earlier period (down 13.2% in

organic terms, with a 2.0% positive impact from changes in the

consolidation scope and a 0.5% negative impact from exchange-rate

movements).

- In France (53% of the total), where business

levels were particularly badly affected at the height of the public

health crisis in the second quarter, nine-month revenue was €16.3

billion, down 15.5% on an actual basis or down 16.0%

like-for-like.

- Outside France (47% of the total), revenue was

€14.5 billion, down 6.9% on an actual basis or 9.8% like-for-like.

Changes in scope, which boosted revenue by 4%, mainly concerned

London Gatwick airport (integrated in May 2019) and VINCI Energies’

most recent acquisitions. Exchange-rate movements had a 1.1%

negative impact, as many currencies fell against the euro.

Order intake in the Contracting business

in the first nine months of 2020 totalled €33.3 billion,

4% more than in the first nine months of 2019.

That increase was driven by several major

contract wins in Europe, including two works packages on the HS2

rail project in the United Kingdom, a contract for The Link

building in Paris La Défense (Total’s future head office), several

works packages on the Grand Paris Express project and preparatory

work on Avrieux shafts for the Lyon-Turin rail line. VINCI also won

two major contracts in Canada, one to rehabilitate the

Louis-Hippolyte-La Fontaine tunnel in Montreal and one to build the

southern segment of the West Calgary Ring Road.

However, as a result of the electoral timetable,

order intake has slowed for small and medium-sized projects in

France in the last few months.

The order book amounted to €42.8 billion

at 30 September 2020, up 15% year-on-year. It represented

14 months of average business activity in the Contracting business,

as opposed to 12 months at end-September 2019. International

business made up 59% of the order book (57% at end-September

2019).

II. Revenue by

business line (first nine months of 2020)

- CONCESSIONS: €4,515 million (down 30.5% actual; down 33.2%

like-for-like)

VINCI Autoroutes: €3,526 million (down 17.8%

both actual and like-for-like)

After falling 52% in the second quarter

of 2020 because of travel limitations imposed in France, traffic

levels recovered strongly in the third quarter, limiting the

year-on-year contraction to 4.3%. Heavy-vehicle traffic

was resilient with a decline of only 1.6%, while light-vehicle

traffic was down 4.7%. During the summer, intra-European traffic

was affected by a lack of co-ordination between the various

countries in terms of public health policy.

Traffic levels in the first nine months of 2020

were down 21.2% year-on-year (down 23.1% for light vehicles and

down 8.8% for heavy vehicles).

VINCI Airports: €818 million (down 58.4% actual;

down 63.4% like-for-like)

The gradual reopening of borders in the Schengen

area from 15 June and the loosening of travel restrictions in many

countries allowed passenger numbers to recover steadily during the

summer period. Airports with significant exposure to tourist,

family and domestic travel benefited most from this, particularly

in Portugal and France.

However, the slight positive trend came to an

end in September because of new restrictions to tackle the renewed

spread of Covid-19. Business travel remains, at this stage, very

limited.

Passenger numbers in the third quarter of 2020

were down 79.1% year-on-year, with a total of 15 million across the

45 airports in the VINCI Airports network. In the first nine months

of the year, passenger numbers fell by 67.9% compared with the same

period in 2019.

Other concessions (VINCI Highways, VINCI

Railways and VINCI Stadium): €171 million (down 28.6% actual; down

27.4% like-for-like)

Other concessions included in the consolidated

revenue figure mainly relate to the following companies: Lima

Expresa6; Gefyra (Rion-Antirion bridge in Greece); Mesea

(maintenance work on the Tours-Bordeaux high-speed rail line) and

VINCI Stadium. The pandemic continued to affect these companies’

business levels in the third quarter (revenue down 22.7%), but less

badly than in the previous quarter (down 57.5%).

·CONTRACTING: €25,990 million (down 7.4% actual;

down 8.5% like-for-like)

VINCI Energies: €9,586 million (down 2.2%

actual; down 6.3% like-for-like)

VINCI Energies’ revenue rose 1% in the

third quarter of 2020, supported by its most recent acquisitions,

which have mainly been in Europe. The like-for-like decline in

revenue was limited to 3% after a 15% drop in the second quarter,

confirming that business levels are returning to normal at VINCI

Energies, which is showing its resilience in particularly tough

economic conditions.

In France (44% of the total), revenue was €4,170

million in the first nine months of the year, down 6.8% on an

actual basis or down 8.0% like-for-like. The strong post-lockdown

recovery took business levels in the third quarter close to the

previous year.

Outside France (56% of the total), revenue was

€5,415 million in the first nine months, up 1.6% on an actual basis

or down 4.8% like-for-like. Business growth in Europe offset the

contraction in other international markets, with VINCI Energies

experiencing occasional difficulties in the United States, in

Southeast Asia (Singapore and Indonesia) and in Brazil.

VINCI Energies’ order intake was stable

year-on-year in the first nine months of 2020. The order book

amounted to €10.2 billion, up 8% over 12 months. It represented

nine months of VINCI Energies’ average business activity.

Eurovia: €6,894 million (down 7.7% actual; down

7.2% like-for-like)

Upturn in revenue in the third quarter

(down 1% like-for-like as opposed to a 19% decline in the second

quarter). In France, the resumption in on-site activity began in

mid-April and accelerated in May. That trend continued in the third

quarter. Outside France, business levels remained buoyant in most

of Eurovia’s countries.

In France (50% of the total), revenue was €3,444

million in the first nine months of 2020, down 15.5% on an actual

basis or 15.8% like-for-like, after worksites shut down almost

completely during lockdown.

Outside France (50% of the total), revenue was

€3,450 million in the first nine months, up 1.8% on an actual basis

or 3.3% like-for-like. Even at the peak of the public health

crisis, business activity continued in most of Eurovia’s countries.

Revenue even rose in the United States, the United Kingdom, the

Czech Republic and – excluding currency effects – Chile. Revenue

was stable in Germany but fell in Canada, Poland and Slovakia.

Eurovia’s order intake fell 12% year-on-year in

the first nine months of 2020, with the post-electoral situation in

France not conducive to starting new projects. The order book

amounted to €8.4 billion, up 1% over 12 months. It represented more

than 10 months of Eurovia’s average business activity, the same as

at end-September 2019.

VINCI Construction: €9,511 million (down 12.0%

actual; down 11.5% like-for-like)

The resumption in worksite activity

accelerated in the third quarter (revenue down 1% like-for-like as

opposed to 28% in the second quarter), particularly in France,

where business levels were hit hard during lockdown. That

resumption took shape more quickly on public works sites than on

building sites, due to constraints related to social distancing

rules.

In France (49% of the total), revenue was €4,655

million in the first nine months of 2020, down 19.4% on an actual

basis or down 19.9% like-for-like. Almost all worksites shut down

on 17 March, when France’s lockdown began, before reopening

gradually from late April.

Outside France (51% of the total), revenue was

€4,856 million in the first nine months, with the decline limited

to 3.5% on an actual basis or 1.7% like-for-like. Business

conditions varied fairly widely between business lines and

geographical zones, depending on decisions taken by the local

health authorities. Revenue rose in North America and Central

Europe, but fell in Asia, Oceania and to a lesser extent the United

Kingdom. Revenue in the Major Projects division was boosted by the

build-up of several large recently-won projects, offsetting the

slight fall in business levels at Soletanche Freyssinet.

VINCI Construction’s order intake rose 20%

year-on-year in the first nine months of 2020. The order book

reached a record-high level of €24.2 billion, up 25% over 12

months. It represented 21 months of VINCI Construction’s average

business activity (versus 16 months at end-September 2019).

VINCI Immobilier: €749 million (down 7.6% both actual and

like-for-like)

VINCI Immobilier’s consolidated revenue fell

8.2% in the third quarter. This represented an improvement on the

29% decline in the second quarter, when revenue suffered from the

shutdown of building sites for more than a month. In the first nine

months of the year, revenue fell 8% to €749 million.

During the same period, the number of homes

reserved in France, including those of the Urbat subsidiary, fell

37% to 3,125. In the third quarter, the decline was limited to

11%.

III.

Financial position

Consolidated net financial debt at 30

September 2020 amounted to €20.8 billion, down €2.4

billion over 12 months and down €0.8 billion since the beginning of

the year.

VINCI has maintained a very strong liquidity

position. At 30 September 2020, liquidity amounted to €18.5 billion

(€14.4 billion at end-September 2019), comprising:

- Managed net cash of €6.6 billion (€5.1 billion at 30 September

2019), resulting from good operational cash control during the

period;

- €0.6 billion of commercial paper issued (€1.3 billion at 30

September 2019);

- Unused confirmed bank credit facilities totalling €11.3

billion, including €8.0 billion due to expire in November 2024 and

an additional €3.3 billion credit facility arranged in the spring

for a renewable term of six months. Since its cash position remains

very strong, VINCI has decided not to extend this latter credit

facility from October 2020.

IV. Outlook (barring any

further adverse pandemic-related developments and excluding

exceptional events)

VINCI is confirming the full-year forecasts

presented when it published its first-half financial

statements:

- VINCI Autoroutes: a 15-20% contraction in

traffic levels compared with 2019;

- Contracting: a 5-10% fall in revenue and a

150-200 basis point decline in Ebit margin compared with 2019.

For VINCI Airports, whereas the

Group previously expected the fall in passenger numbers to be

around 65% compared with 2019, September’s introduction of new

travel restrictions in response to the second wave of the pandemic

has led to a more conservative assumption of around 70%.

Developments in terms of revenue based on these

assumptions will have a significant impact on the Group’s earnings.

That impact cannot be quantified reliably at the moment, because of

the public health situation and the numerous uncertainties

affecting the economic environment.

In the circumstances, the Group’s earnings are

likely to show a year-on-year decline in the second half of 2020.

However, that decline, barring exceptional items, should be much

less pronounced than that seen in the first half of 2020.

Furthermore, measures taken to reduce the impact

of lower business levels on cash outflows should result in a

reduction in net financial debt at the end of the year.

VINCI’s management remains confident in the

Group’s ability to bounce back in 2021, particularly with the

support of economic stimulus measures announced in France and many

other countries. The Group expects its earnings to rise relative to

2020, but remain lower than their 2019 level overall.

V. Other recent

highlights

On 30 September 2020, VINCI signed an agreement

to build and maintain a motorway in Kenya as part of VINCI

Concessions’ first public-private partnership in Africa. The works

will be carried out by VINCI Construction.

On 1 October 2020, VINCI Energies integrated

Transelec Common Inc, a leading provider of energy and telecoms

infrastructure services in Quebec.

On 2 October 2020, VINCI announced that it had

presented Grupo ACS with a non-binding proposal for the acquisition

of Grupo ACS’s "Industrial Services" division. The scope of the

acquisition would include, in addition to the engineering and works

activities, interests in eight concessions and PPPs relating mainly

to energy projects as well as a platform for the development of new

projects in the renewable energy sector. This proposal has been

examined by Grupo ACS’s Board of Directors, which has declared

itself open to negotiations. Completion of the transaction remains

conditional, in particular, on the performance of a due diligence

exercise in the coming months. This will include examining

information forming the basis of a carve-out plan for the

activities that would not be transferred to VINCI, including the

Zero-E company and 15 concessions. The final terms and conditions

of the transaction will be agreed upon at the end of the due

diligence process. The proposal would be subject to the required

regulatory approvals, including merger control. ACS and VINCI

will inform the market, at the appropriate time, of the eventual

outcome and result of these negotiations.

·New appointment

Belen Marcos, previously chair of Cintra

(Ferrovial group) in the United States, has been appointed as chair

of VINCI Highways and executive vice president of VINCI

Concessions.

·London Gatwick Airport

In August 2020, London Gatwick Airport, a

50.01%-owned subsidiary of VINCI Airports, entered discussions with

its lenders regarding expected developments regarding its financial

covenants. On 22 September 2020, given the exceptional

circumstances affecting air travel, a large majority of lenders

accepted the company’s request that they temporarily waive those

financial covenants.

Conference call

The Group will comment on its revenue and

business activities in the period ended 30 September 2020 in a

conference call to be held in English today (Tuesday 20 October

2020) at 18.00 Paris time.

To take part, please dial one of the following

numbers from 17.55:In French: +33 (0)1 72 72 74 03

PIN: 26034552# In English (UK number): +44 (0) 20 7194

3759

PIN: 26034552#

In English (US number): +1 646 722

4916

PIN: 26034552#

Playback number (available within two hours): In

French: +33 (0)1 70 71 01

60

PIN: 418953376#In English (UK number): +44 (0) 20 3364

5147

PIN: 418953376#In English (US number): +1 646 722 4969

PIN: 418953376#

**********

|

Diary |

|

5 February 2021 |

Publication of full-year 2020 results (before the market open) |

|

**********

About VINCIVINCI is a global

player in concessions and contracting, employing more than 210,000

people in some 100 countries. We design, finance, build and operate

infrastructure and facilities that help improve daily life and

mobility for all. Because we believe in all-round performance,

above and beyond economic and financial results, we are committed

to operating in an environmentally and socially responsible manner.

And because our projects are in the public interest, we consider

that reaching out to all our stakeholders and engaging in dialogue

with them is essential in the conduct of our business activities.

Based on that approach, VINCI’s ambition is to create long-term

value for its customers, shareholders, employees, partners and

society in general. www.vinci.com

INVESTOR RELATIONSGrégoire ThibaultTel: +33 (0)1 47 16 45

07gregoire.thibault@vinci.com

Alexandra BournazelTel: +33 (0)1 47 16 33

46alexandra.bournazel@vinci.com

PRESS CONTACTStéphanie MalekTel: +33 (0)1 47 16 31

82 stephanie.malek@vinci.com

APPENDICES

APPENDIX A: ADDITIONAL INFORMATION ON CONSOLIDATED

REVENUE

Consolidated revenue* in the first nine

months of the year - Breakdown by region and business

line

| |

Nine

months to 30 Sept. |

Nine

months to 30 Sept. |

2020/2019 change |

| (in €

millions) |

2020 |

2019 |

Actual |

Like-for-like |

|

FRANCE |

|

|

|

|

|

Concessions |

3,727 |

4,666 |

-20.1% |

-20.1% |

|

VINCI Autoroutes |

3,526 |

4,288 |

-17.8% |

-17.8% |

|

VINCI Airports |

146 |

287 |

-49.0% |

-49.0% |

|

Other concessions(VINCI Highways, VINCI Railways and VINCI

Stadium) |

55 |

92 |

-39.8% |

-39.8% |

|

Contracting |

12,269 |

14,321 |

-14.3% |

-15.0% |

|

VINCI Energies |

4,170 |

4,473 |

-6.8% |

-8.0% |

|

Eurovia |

3,444 |

4,075 |

-15.5% |

-15.8% |

|

VINCI Construction |

4,655 |

5,774 |

-19.4% |

-19.9% |

| VINCI

Immobilier |

747 |

811 |

-7.8% |

-7.8% |

|

Eliminations and adjustments |

(443) |

(500) |

|

|

| Total France |

16,300 |

19,298 |

-15.5% |

-16.0% |

|

|

|

|

|

|

|

INTERNATIONAL |

|

|

|

|

|

Concessions |

788 |

1,827 |

-56.9% |

-62.3% |

|

VINCI Airports |

672 |

1,679 |

-60.0% |

-65.5% |

|

Other concessions(VINCI Highways, VINCI Railways and VINCI

Stadium) |

116 |

148 |

-21.7% |

-19.5% |

|

Contracting |

13,721 |

13,752 |

-0.2% |

-1.7% |

|

VINCI Energies |

5,415 |

5,328 |

+1.6% |

-4.8% |

|

Eurovia |

3,450 |

3,390 |

+1.8% |

+3.3% |

|

VINCI Construction |

4,856 |

5,034 |

-3.5% |

-1.7% |

|

Eliminations, adjustments and other |

(33) |

(20) |

|

|

| Total

International |

14,478 |

15,559 |

-6.9% |

-9.8% |

* Excluding concession subsidiaries’ revenue from works done by

non-Group companies.

Consolidated third-quarter

revenue*

| |

Third

quarter |

Third

quarter |

2020/2019 change |

| (in €

millions) |

2020 |

2019 |

Actual |

Like-for-like |

|

Concessions |

1,923 |

2,657 |

-27.6% |

-27.4% |

| VINCI Autoroutes |

1,633 |

1,680 |

-2.8% |

-2.8% |

|

VINCI Airports |

226 |

896 |

-74.7% |

-74.5% |

|

Other concessions(VINCI Highways, VINCI Railways and VINCI

Stadium) |

63 |

82 |

-22.7% |

-20.5% |

|

Contracting |

10,234 |

10,336 |

-1.0% |

-1.4% |

| VINCI Energies |

3,452 |

3,430 |

+0.7% |

-2.9% |

| Eurovia |

3,069 |

3,112 |

-1.4% |

-0.6% |

|

VINCI Construction |

3,712 |

3,794 |

-2.2% |

-0.8% |

| VINCI

Immobilier |

313 |

341 |

-8.2% |

-8.2% |

|

Eliminations and adjustments |

(184) |

(207) |

|

|

| Total

revenue* |

12,286 |

13,128 |

-6.4% |

-6.7% |

| of which: France |

6,817 |

7,036 |

-3.1% |

-3.6% |

|

International |

5,469 |

6,092 |

-10.2% |

-10.4% |

* Excluding concession subsidiaries’ revenue

from works done by non-Group companies.

Revenue* - Quarterly developments in

2020

| |

Change Q1 2020 vs. Q1 2019 |

Change Q2 2020 vs. Q2 2019 |

Change Q3 2020 vs. Q3 2019 |

| (in €

millions) |

Actual |

Like-for-like |

Actual |

Like-for-like |

Actual |

Like-for-like |

|

Concessions |

+2.6% |

-6.3% |

-59.1% |

-61.2% |

-27.6% |

-27.4% |

| VINCI Autoroutes |

-5.0% |

-5.0% |

-45.7% |

-45.7% |

-2.8% |

-2.8% |

|

VINCI Airports |

+24.2% |

-9.7% |

-89.1% |

-90.7% |

-74.7% |

-74.5% |

|

Other concessions (VINCI Highways, VINCI Railways and VINCI

Stadium) |

-0.5% |

-0.8% |

-57.5% |

-56.5% |

-22.7% |

-20.5% |

|

Contracting |

-0.3% |

-2.4% |

-20.1% |

-21.0% |

-1.0% |

-1.4% |

| VINCI Energies |

+5.1% |

unch. |

-11.7% |

-15.3% |

+0.7% |

-2.9% |

| Eurovia |

-1.5% |

-1.5% |

-18.9% |

-18.5% |

-1.4% |

-0.6% |

|

VINCI Construction |

-4.7% |

-5.1% |

-28.4% |

-28.0% |

-2.2% |

-0.8% |

| VINCI

Immobilier |

+24.8% |

+24.8% |

-29.0% |

-29.0% |

-8.2% |

-8.2% |

|

Eliminations and adjustments |

|

|

|

|

|

|

| Total

revenue* |

unch. |

-3.3% |

-26.9% |

-28.3% |

-6.4% |

-6.7% |

| of which: France |

-6.3% |

-7.1% |

-36.3% |

-36.5% |

-3.1% |

-3.6% |

|

International |

+8.5% |

+1.6% |

-15.1% |

-18.2% |

-10.2% |

-10.4% |

* Excluding concession subsidiaries’ revenue

from works done by non-Group companies.

APPENDIX B: CONTRACTING ORDER BOOK AND

ORDER INTAKE

Order book

|

|

At 30 September |

Change |

|

At |

Change |

|

Order book (in € billions) |

2020 |

2019 |

over 12 months |

|

31 Dec. 2019 |

vs. 31 Dec. 2019 |

| VINCI Energies |

10.2 |

9.5 |

+8% |

|

9.1 |

+13% |

| Eurovia |

8.4 |

8.4 |

+1% |

|

8.0 |

+6% |

| VINCI

Construction |

24.2 |

19.4 |

+25% |

|

19.4 |

+24% |

| Total

Contracting |

42.8 |

37.3 |

+15% |

|

36.5 |

+17% |

| of which: |

|

|

|

|

|

|

| France |

17.6 |

16.0 |

+10% |

|

15.5 |

+14% |

| International |

25.2 |

21.3 |

+18% |

|

20.9 |

+20% |

|

Europe excl. France |

14.3 |

10.2 |

+41% |

|

9.9 |

+45% |

|

Rest of the world |

10.8 |

11.1 |

-3% |

|

11.0 |

-2% |

Order intake

| |

Nine months to 30 Sept. |

|

| (in €

billions) |

2020 |

2019 |

Change 2020 / 2019 |

| VINCI Energies |

10.8 |

10.8 |

unch. |

| Eurovia |

7.6 |

8.7 |

-12% |

| VINCI

Construction |

14.9 |

12.4 |

+20% |

| Total

Contracting |

33.3 |

31.9 |

+4% |

| of which: |

|

|

|

| France |

14.3 |

15.2 |

-6% |

| International |

19.0 |

16.7 |

+14% |

APPENDIX C: VINCI AUTOROUTES AND VINCI AIRPORTS

INDICATORS

Traffic on motorway

concessions*

| |

Third quarter |

Nine

months to 30 Sept. |

|

(millions of km travelled) |

2020 |

2020/2019 change |

2020 |

2020/2019change |

| VINCI Autoroutes |

15,831 |

-4.3% |

31,863 |

-21.2% |

| Light vehicles |

14,108 |

-4.7% |

26,909 |

-23.1% |

|

Heavy vehicles |

1,723 |

-1.6% |

4,955 |

-8.8% |

| of which: |

|

|

|

|

| ASF |

10,010 |

-4.9% |

19,992 |

-21.2% |

| Light vehicles |

8,865 |

-5.4% |

16,676 |

-23.4% |

|

Heavy vehicles |

1,145 |

-1.3% |

3,316 |

-8.0% |

| Escota |

2,103 |

-3.0% |

4,487 |

-19.8% |

| Light vehicles |

1,939 |

-3.0% |

4,030 |

-20.7% |

|

Heavy vehicles |

164 |

-3.1% |

457 |

-11.7% |

| Cofiroute (intercity network) |

3,612 |

-3.5% |

7,178 |

-21.7% |

| Light vehicles |

3,210 |

-3.7% |

6,029 |

-23.7% |

| Heavy vehicles |

402 |

-2.0% |

1,149 |

-9.7% |

|

Arcour |

107 |

-5.8% |

206 |

-23.7% |

| Light vehicles |

95 |

-6.4% |

174 |

-25.5% |

|

Heavy vehicles |

12 |

-0.7% |

32 |

-12.6% |

* Excluding A86 duplex.

VINCI Autoroutes revenue

| in the first nine months of 2020 |

VINCI Autoroutes |

Of which: |

|

|

|

ASF |

Escota |

Cofiroute |

Arcour |

|

| Toll revenue (in € millions) |

3,462.5 |

2,025.1 |

491.3 |

902.1 |

44.0 |

|

| 2020/2019

change |

-17.8% |

-17.5% |

-17.1% |

-18.6% |

-19.7% |

|

| Revenue (in € millions) |

3,525.5 |

2,065.2 |

499.3 |

913.4 |

44.3 |

|

| 2020/2019

change |

-17.8% |

-17.5% |

-17.1% |

-18.7% |

-19.6% |

|

VINCI Airports’ passenger

traffic1

| |

Third quarter |

Nine months to 30 Sept. |

Rolling 12-month period |

| (in

thousands of passengers) |

2020 |

2020/2019 change |

2020 |

2020/2019 change |

Sept. 2019 to Sept. 2020 |

Change vs. previous 12-month period |

| Portugal (ANA) |

5,192 |

-71.8% |

14,926 |

-67.5% |

28,159 |

-51.7% |

| of which Lisbon |

2,124 |

-76.9% |

7,775 |

-67.3% |

15,146 |

-50.5% |

| United Kingdom |

2,408 |

-84.9% |

10,984 |

-73.4% |

22,601 |

-57.3% |

| of which LGW |

1,915 |

-86.4% |

9,460 |

-73.9% |

19,755 |

-57.5% |

| France |

1,875 |

-68.3% |

5,559 |

-65.0% |

10,115 |

-50.0% |

| of which ADL |

953 |

-71.7% |

3,021 |

-66.7% |

5,709 |

-51.2% |

| Cambodia |

106 |

-96.2% |

2,055 |

-76.7% |

4,874 |

-58.4% |

| United States |

739 |

-72.1% |

3,113 |

-59.3% |

5,796 |

-42.5% |

| Brazil |

476 |

-75.2% |

2,621 |

-53.6% |

4,752 |

-39.1% |

| Serbia |

478 |

-77.7% |

1,486 |

-68.7% |

2,895 |

-51.5% |

| Dominican Republic |

416 |

-70.4% |

1,806 |

-57.3% |

3,213 |

-40.8% |

| Sweden |

106 |

-84.7% |

464 |

-73.6% |

986 |

-56.1% |

|

Total equity-accounted subsidiaries |

11,795 |

-77.3% |

43,012 |

-68.3% |

83,392 |

-52.3% |

| Japan (40%) |

2,622 |

-80.6% |

12,138 |

-68.9% |

24,840 |

-51.9% |

| Chile (40%) |

488 |

-92.1% |

6,876 |

-63.3% |

12,793 |

-48.9% |

| Costa Rica (45%) |

1 |

-99.6% |

429 |

-55.4% |

691 |

-42.4% |

| Rennes-Dinard (49%) |

107 |

-62.6% |

228 |

-69.6% |

426 |

-56.0% |

|

Total equity-accounted subsidiaries |

3,218 |

-84.0% |

19,671 |

-67.0% |

38,750 |

-50.9% |

| Total

passengers managed by VINCI Airports |

15,013 |

-79.1% |

62,683 |

-67.9% |

122,142 |

-51.8% |

1 Figures at 100% including airports’ passenger numbers

over the full period.

APPENDIX D: GLOSSARY

Concession subsidiaries’ revenue from works done

by non-Group companies: this indicator relates to construction work

done by concession companies as programme manager on behalf of

concession grantors. Consideration for that work is recognised as

an intangible asset or financial asset depending on the accounting

model applied to the concession contract, in accordance with IFRIC

12 “Service Concession Arrangements”. It excludes work done by

Contracting business lines.

Like-for-like revenue growth: this indicator

measures the change in revenue at constant scope and exchange

rates.

- Constant scope: the scope effect is neutralised as follows.

- For revenue in year N, revenue from companies that joined the

Group in year N is deducted.

- For revenue in year N-1, the full-year revenue of companies

that joined the Group in year N-1 is included, and revenue from

companies that left the Group in years N-1 and N is excluded.

- Constant exchange rates: the currency effect is neutralised by

applying exchange rates in year N to foreign currency revenue in

year N-1.

Net financial surplus/debt: this corresponds to

the difference between financial assets and financial debt. If the

assets outweigh the liabilities, the balance represents a net

financial surplus, and if the liabilities outweigh the assets, the

balance represents net financial debt. Financial debt includes

bonds and other borrowings and financial debt (including

derivatives and other liabilities relating to hedging instruments).

Financial assets include cash and cash equivalents and assets

relating to derivative instruments.

Until 31 December 2018, financial debt included

liabilities consisting of the present value of lease payments

remaining due in respect of finance leases as defined by IAS 17. On

1 January 2019, IAS 17 was replaced by IFRS 16, which specifies a

single method for recognising leases. The Group now recognises

right-of-use assets use under non-current assets, along with a

liability corresponding to the present value of lease payments

still to be made. That liability is not included in net financial

surplus/debt as defined by the Group, and is presented directly on

the balance sheet.

Order book: in the Contracting business (VINCI

Energies, Eurovia, VINCI Construction), the order book represents

the volume of business yet to be carried out on projects where the

contract is in force (in particular after service orders have been

obtained or after conditions precedent have been met) and

financed.

Order intake:

- In the Contracting business lines (VINCI Energies, Eurovia,

VINCI Construction), a new order is recorded when the contract has

been not only signed but is also in force (for example, after the

service order has been obtained or after conditions precedent have

been met) and when the project’s financing is in place. The amount

recorded in order intake corresponds to the contractual

revenue.

- For VINCI Immobilier, order intake corresponds to the value of

properties sold off-plan or sold after completion in accordance

with a notarised deed, or revenue from property development

contracts where the works order has been given by the project

owner.

For joint

property developments:

- If VINCI Immobilier has sole control over the development

company, it is fully consolidated. In that case, 100% of the

contract value is included in order intake;

- If the development company is jointly controlled, it is

accounted for under the equity method and its order intake is not

included in the total.

VINCI Airports passenger traffic: this is the

number of passengers who have travelled on commercial flights from

or to a VINCI Airports airport during a given period.

VINCI Autoroutes motorway traffic: this is the

number of kilometres travelled by light and heavy vehicles on the

motorway network managed by VINCI Autoroutes during a given

period.

1See glossary.

2 Excluding concession subsidiaries’ revenue from works done by

non-Group companies (see glossary).

3 Figures at 100% including passenger numbers at

all airports managed by VINCI Airports over the full period.

4 Period-end.

5 Excluding concession

subsidiaries’ revenue from works done by non-Group companies (see

glossary).

6 Previously Lamsac, the holder of concessions for two sections

of the Lima ring road in Peru.

II.

- 20 10 2020 VINCI-CP T3 2020 EN

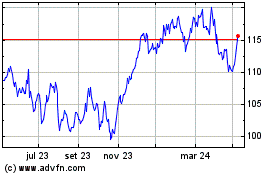

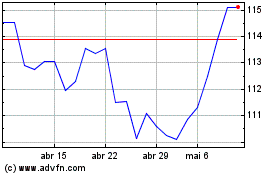

Vinci (EU:DG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Vinci (EU:DG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024