Forsys Metals Announces C$8.5 Million Bought Deal Private Placement

22 Março 2021 - 5:11PM

Forsys Metals Corp. (TSX: FSY) (FSE: F2T) (NSX:

FSY) (“Forsys” or the “Company”) is pleased to announce

that it has entered into an agreement with Canaccord Genuity Corp.

(“Canaccord Genuity”) and Red Cloud Securities Inc. (together with

Canaccord Genuity, the “Co-Lead Underwriters”) pursuant to which

the Co-Lead Underwriters, as lead underwriters and joint

bookrunners on behalf of a syndicate of underwriters (the

“Underwriters”) shall purchase for resale to substituted

purchasers, 17,000,000 units of the Company (the “Units”) at a

price of C$0.50 per Unit (the “Offering Price”) on a “bought deal”

private placement basis for gross proceeds of C$8,500,000 (the

“Offering”). Each Unit shall be comprised of one common share in

the capital of the Company (each a “Common Share”) and one-half of

one Common Share purchase warrant (each whole warrant, a

“Warrant”). Each Warrant shall be exercisable into one Common Share

at a price of C$0.75 per Common Share at any time on or before the

date which is 24 months after the Closing Date (as defined below).

The Company has granted the Co-Lead Underwriters

an underwriters’ option, exercisable up to 48 hours prior to the

Closing Date, to purchase for resale up to 3,000,000 additional

Units at the Offering Price to raise additional gross proceeds of

up to C$1,500,000.

The net proceeds of the Offering will be used

for the exploration and advancement of the Company’s Norasa Project

in Namibia and for general working capital purposes. The Offering

is scheduled to close on or about April 14, 2021 (the “Closing

Date”) and is subject to certain conditions, including, but not

limited to, the receipt of all necessary regulatory and other

approvals, including the approval of the listing of the Common

Shares as well as the Common Shares issuable upon the exercise of

the Warrants on the Toronto Stock Exchange. All securities issued

or issuable under the Offering will be subject to a hold period of

four months following the Closing Date.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the "U.S. Securities Act"), or any state securities laws

and may not be offered or sold within the United States or to or

for the account or benefit of a U.S. person (as defined in

Regulation S under the U.S. Securities Act) unless registered under

the U.S. Securities Act and applicable state securities laws or an

exemption from such registration is available.

About Forsys Metals Corp.Forsys

Metals Corp. is an emerging uranium developer with 100% ownership

of the Norasa project that comprises the fully permitted Valencia

uranium project and the Namibplaas uranium project in Namibia,

Africa a politically stable and mining friendly jurisdiction.

Information regarding current National Instrument 43‐101 compliant

Resource and Reserves at Valencia and Namibplaas are available on

the Company’s website and under the Company’s filings on SEDAR.

On behalf of the Board of Directors of Forsys

Metals Corp. Mark Frewin, Interim Chief Executive Officer.

For additional information please contact:

Jorge Estepa, Corporate SecretaryTelephone:

(416) 818-4035 or Email: je@forsysmetals.com

Forward-Looking Information

This news release contains projections and

forward‐looking information that involve various risks and

uncertainties regarding future events. Such forward‐looking

information includes statements about the completion of the

Offering and the use of proceeds therefrom and can include without

limitation statements based on current expectations involving a

number of risks and uncertainties and are not guarantees of future

performance of the Company. The following are important factors

that could cause Forsys actual results to differ materially from

those expressed or implied by such forward looking statements:

fluctuations in uranium prices and currency exchange rates;

uncertainties relating to interpretation of drill results and the

geology; continuity and grade of mineral deposits; uncertainty of

estimates of capital and operating costs; recovery rates,

production estimates and estimated economic return; general market

conditions; the uncertainty of future profitability; and the

uncertainty of access to additional capital. Full description of

these risks can be found in Forsys Annual Information Form

available on the Company’s profile on the SEDAR website at

www.sedar.com. These risks and uncertainties could cause actual

results and the Company’s plans and objectives to differ materially

from those expressed in the forward‐looking information. Actual

results and future events could differ materially from anticipated

in such information. These and all subsequent written and oral

forward‐looking information are based on estimates and opinions of

management on the dates they are made and expressed qualified in

their entirety by this notice. The Company assumes no obligation to

update forward‐looking information should circumstance or

management’s estimates or opinions change. The Toronto

Stock Exchange has not reviewed and does not accept

responsibility for the adequacy or accuracy of this release.

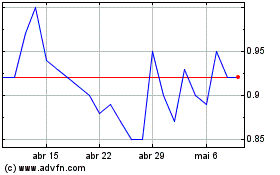

Forsys Metals (TSX:FSY)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

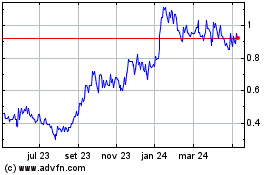

Forsys Metals (TSX:FSY)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024