UBISOFT REPORTS FULL-YEAR 2020-21 EARNINGS FIGURES

UBISOFT REPORTS

FULL-YEAR

2020-21 EARNINGS FIGURES

Record net

bookings and non-IFRS operating

incomeRising value of

Ubisoft’s portfolio and technology

assetsBack catalog share of net bookings

firmly above 50% for the 3rd

consecutive year2021-22 targets

reflecting

growth initiatives

Ubisoft FY21 Earnings & Sales

- Full-year net bookings and

non-IFRS operating income in line with

targets:

|

|

In €m |

Reported change vs.

2019-20 |

In % of total net

bookings |

|

|

12 months 2020-21 |

12 months 2019-20 |

|

IFRS 15 sales |

2,223.8 |

+39.4% |

NA |

NA |

|

Net bookings |

2,240.6 |

+46.1% |

NA |

NA |

|

Digital net bookings |

1,609.0 |

+27.6% |

71.8% |

82.2% |

|

PRI net bookings |

780.0 |

+11.0% |

34.8% |

45.8% |

|

Back-catalog net bookings |

1,288.4 |

+15.5% |

57.5% |

72.7% |

|

IFRS operating income |

289.4 |

NA |

NA |

NA |

|

Non-IFRS operating income |

473.3 |

NA |

21.1% |

2.2% |

- All time high activity

with 141 million unique

players on PC and consoles, up 20%

- Significant progression of

Ubisoft’s portfolio

value over 12

months:

- Record performance for the

Assassin’s Creed® franchise, with

total yearly revenue up 50% vs prior record set in 2012-13

- Spectacular growth of Just

Dance®

- Rainbow

Six®: One of the industry’s top 10 most

played games in 20201. Double-digit player acquisition growth.

Record viewership for Esports regional leagues. Upcoming release of

Rainbow Six Quarantine to broaden audience

reach

- The

Division®: 40 million unique players.

Expansion of the universe with The Division

Heartland on consoles and PC as well as a

mobile game

- Robust growth for

Brawlhalla®, Far

Cry®, For

Honor®,

Rabbids®, The

Crew®, Watch

Dogs®

- Solid on-going sales-through trends

for Immortals Fenyx Rising™, a

player-favorite new IP

- Significant portfolio expansion to

come: Avatar,

Beyond

Good &

Evil™

2, Riders

Republic™, Skull &

Bones™, Star

Wars™

- Rising value of Ubisoft’s

technology assets:

- Rollout of Ubisoft

Connect

-

i3D.net:

a fast-growing hosting leader in the video game space

- 2021-22 targets:

Net bookings up single digit. Non-IFRS operating income between 420

& 500 M€

Paris, May

11,

2021 – Today, Ubisoft released

its earnings figures for fiscal 2020-21, i.e. the twelve months

ended March 31, 2021.

Yves Guillemot, Co-Founder and Chief Executive

Officer, said “Our teams demonstrated incredible resilience during

a challenging year, delivering amazing games and experiences. We

also relied on a deep and diversified back-catalog which, again,

outperformed our expectations and represented for the third

consecutive year more than 50% of our total net bookings,

progressively cementing the recurring profile of our business. Our

assets have never been so strong.

Alongside these successes, we have pursued the

transformation of our organization that we had initiated 18 months

ago to ensure Ubisoft is positioned to meaningfully grow audience

and recurring revenues over the coming years. We have also

implemented profound changes to ensure the continued development of

an inclusive working environment where our talents can thrive and

deliver the game experiences that players will love and share.”

Frédérick Duguet, Chief Financial Officer, said

“Ubisoft delivered a record year at the top and bottom lines thanks

to an underlying performance that was significantly stronger than

expected. This reflects the progress achieved in the

diversification and recurrence of our revenues. We can rely on a

deep portfolio of owned IPs, from our tentpole franchises, Rainbow

Six, Assassin’s Creed, The Division, Far Cry, Just Dance, Ghost

Recon and Watch Dogs to fan-favorite brands like For Honor, The

Crew, Brawlhalla and Mario + Rabbids.

Our FY22 line-up will be the most diversified we

have ever had, with ambitious post-launch plans as well as premium

and F2P new releases. Our financial targets reflect these growth

initiatives which are intended to generate significant value over

the long term.”

Yves Guillemot added “We continue to build our

portfolio, notably our biggest brands as demonstrated by the

recently announced expansion of The Division’s universe. We also

keep enhancing our technology assets, in particular our fast

growing i3D.net hosting activity as well as Ubisoft Connect. Thanks

to these expanding assets and a solid balance sheet, we are in a

strong position to capitalize on the many opportunities offered by

the market and are entering an exciting phase of our

development.”

Note The Group presents

indicators which are not prepared strictly in accordance with IFRS

as it considers that they are the best reflection of its operating

and financial performance. The definitions of the non-IFRS

indicators as well as a reconciliation table between the IFRS

consolidated income statement and the non-IFRS consolidated income

statement are provided in an appendix to this press release.

Income statement and key financial data

|

In € millions |

2020-21 |

% |

2019-20 |

% |

|

|

IFRS 15 sales |

2,223.8 |

|

1,594.8 |

|

|

|

Deferred revenues related to IFRS 15 |

16.7 |

|

(60.8) |

|

|

|

Net bookings |

2,240.6 |

|

1,534.0 |

|

|

|

Gross margin based on net bookings |

1,914.8 |

85.5% |

1,280.9 |

83.5% |

|

|

Non-IFRS R&D expenses |

-784.9 |

-35.0% |

(680.9) |

-44.4% |

|

|

Non-IFRS selling expenses |

-438.1 |

-19.6% |

(382.2) |

-24.9% |

|

|

Non-IFRS G&A expenses |

-218.4 |

-9.7% |

(183.6) |

-12.0% |

|

|

Total non-IFRS SG&A expenses |

-656.6 |

-29.3% |

(565.8) |

-36.9% |

|

|

Non-IFRS operating income |

473.3 |

21.1% |

34.2 |

2.2% |

|

|

IFRS operating income |

289.4 |

|

(59.5) |

|

|

|

Non-IFRS diluted EPS (in €) |

2.48 |

|

(0.09) |

|

|

|

IFRS diluted EPS (in €) |

0.85 |

|

(1.12) |

|

|

|

Non-IFRS cash flows from operating

activities(1) |

169.0 |

|

(86.4) |

|

|

|

R&D investment expenditure |

1,104.2 |

|

909.6 |

|

|

|

Non-IFRS net cash/(debt) position |

79.2 |

|

(100.6) |

|

|

(1) Based on the consolidated cash flow

statement for comparison with other industry players (not audited

by the Statutory Auditors).

Sales and net bookings

IFRS 15 sales for the fourth quarter of 2020-21

came to €501.8 million, up 4.3% (or 8.7% at constant exchange

rates2) on the €481.1 million generated in fourth-quarter 2019-20.

IFRS 15 sales for full-year 2020-21 totaled €2,223.8 million, up

39.4% (or 42.7% at constant exchange rates) versus the 2019-20

figure of €1,594.8 million.

Fourth-quarter 2020-21 net bookings totaled

€484.9 million, up 16.2% (or 21.1% at constant exchange rates) on

the €417.4 million recorded for fourth-quarter 2019-20.Net bookings

for full-year 2020-21 amounted to €2,240.6 million, up 46.1% (or

49.5% at constant exchange rates) on the €1,534.0 million figure

for 2019-20, in line with the target of between €2,220 million and

€2,280 million.

Main income statement

items3

Non-IFRS operating income came in at €473.3

million, versus €34.2 million in 2019-20, in line with the target

of between €450 and 500 million.

Non-IFRS attributable net income amounted to

€313.5 million, representing non-IFRS diluted earnings per share

(EPS) of €2.48, compared with non-IFRS attributable net loss of

€10.2 million and non-IFRS diluted loss per share of €0.09 for

2019-20.

IFRS attributable net income totaled €103.1

million, representing IFRS diluted EPS of €0.85 (compared with IFRS

attributable net loss of €125,6 million and IFRS diluted loss per

share of €1.12 for 2019-20).

Main cash flow

statement4 items

Non-IFRS cash flows from operating activities

represented a net cash inflow of €169.0 million in 2020-21 (versus

a net cash outflow of €86.4 million in 2019-20). It reflects a

positive €64.6 million in non-IFRS cash flow from operations

(versus a negative €169.9 million in 2019-20) and an €104.5

million decrease in non-IFRS working capital requirement (compared

with an €83.4 million decrease in 2019-20).

Main balance sheet items and

liquidity

At March 31, 2021, the Group’s equity was €1,656

million and its non-IFRS net cash was €79 million versus non-IFRS

net debt of €101 million at end of March 2020. IFRS net debt

totaled €227 million at March 31, 2021, of which €306 million

related to the IFRS16 accounting restatement.

Outlook

First-quarter 2021-22

Net bookings for the first quarter of 2021-22

are expected to come in at around €320 million.

Full-year 2021-22

The Company is introducing its targets for

2021-22:

- Net bookings single-digit

growth

- Non-IFRS operating income comprised

between 420 M€ and 500 M€

The top-line growth will be driven by both

back-catalog and new releases. Back-catalog growth will be spurred

by its underlying robust dynamic, by a significantly stronger

release slate in 2020-21 than in 2019-20 and by bigger post-launch

plans, more than compensating for the high comparison 2020-21 base

resulting from the lockdown impact on overall engagement. Ubisoft

also expects to release a solid and well-diversified line-up,

including premium and F2P titles. The year will notably see the

release of Far Cry 6, Rainbow Six Quarantine, Riders Republic, The

Division Heartland and Roller™ Champions. Skull and Bones will now

be released in 2022-23.

Transformation of the

organization

Ubisoft continued to evolve its organization

over the past 18 months to adapt to a fast-changing industry and to

ensure its culture is stronger than ever. Some of the profound

changes notably include:

- Adding expertise and production

acumen to its editorial department in order to continue delivering

high quality standards, strong marketability and differentiation

between its games;

- Redesigning

processes, HR organization and compensation policy to ensure strong

accountability;

- Appointing a new

Chief People Officer as well as coopting a new independent Board

member, both of whom bring recognized experience in conducting

change within major corporations;

- Appointing new

heads of Diversity & Inclusion and Workplace Culture to

formalize Ubisoft’s values and align the organization around

them.

Recent significant events:

Appointment of Anika Grant as Chief

People Officer: Ubisoft announced the appointment of Anika

Grant as its new Chief People Officer and member of Ubisoft’s

Executive Committee. In this role, Anika oversees all aspects of

Ubisoft’s people strategy and drives HR excellence at the company.

Anika brings immense international experience leading HR

transformation in major, fast-paced, and customer-focused

organizations across various sectors.

Shares purchased from March 22 to April

9: Ubisoft Entertainment SA acquired 596,000 shares at an

average price of €65.8 for a total amount of €39.2m which can be

allocated to the stock-based compensation program or could be

cancelled, as per the regulations in force.

New records for Rainbow

Six Esports regional

leagues: On March 26th Ubisoft announced its best

performance to date for Tom Clancy’s Rainbow Six Esports regional

leagues, with record-breaking peak concurrent viewers and average

minute audience results in each of its four regional leagues.

Expansion of the Tom Clancy’s The

Division® universe:

Ubisoft unveiled its plans for the expansion of the franchise,

notably including:

- The upcoming launch of The Division

Heartland in fiscal 2021-22, a PC & consoles free-to-play game

currently under development at Red Storm;

- The development of

a game on mobile that will be released beyond fiscal 2021-22;

- Brand-new content

as part of The Division 2 update coming late calendar 2021;

- The previously

announced movie directed by Rawson Marshall Thurber and in

development with Netflix, starring Jessica Chastain and Jake

Gyllenhaal.

Conference call

Ubisoft will hold a conference call today, Tuesday May 11, 2021,

at 6:15 p.m. Paris time/12:15 p.m. New York time.The conference

call can be accessed live and via replay by clicking on the

following link:

https://edge.media-server.com/mmc/p/a6fvyu29

Contacts

|

Investor RelationsJean-Benoît RoquetteSVP Investor

Relations+ 33 1 48 18 52 39Jean-benoit.roquette@ubisoft.com |

Press Relations Michael Burk Senior Director of

Corporate Public Relations + 33 1 48 18 24 03

Michael.burk@ubisoft.com |

| Alexandre

Enjalbert Senior Investor Relations Manager + 33 1 48 18 50 78

Alexandre.enjalbert@ubisoft.com |

|

DisclaimerThis press release

may contain estimated financial data, information on future

projects and transactions and future financial results/performance.

Such forward-looking data are provided for information purposes

only. They are subject to market risks and uncertainties and may

vary significantly compared with the actual results that will be

published. The estimated financial data have been approved by the

Supervisory Board on May 11, 2021, and have not been audited by the

Statutory Auditors. (Additional information is provided in the most

recent Ubisoft Registration Document filed on June 5, 2020 with the

French Financial Markets Authority (l’Autorité des Marchés

Financiers)).

About UbisoftUbisoft is a

leading creator, publisher and distributor of interactive

entertainment and services, with a rich portfolio of world-renowned

brands, including Assassin’s Creed, Far Cry, For Honor, Just Dance,

Watch Dogs, and Tom Clancy’s video game series including Ghost

Recon®, Rainbow Six and The Division. The teams throughout

Ubisoft’s worldwide network of studios and business offices are

committed to delivering original and memorable gaming experiences

across all popular platforms, including consoles, mobile phones,

tablets and PCs. For the 2020-21 fiscal year, Ubisoft generated net

bookings of €2,241 million. To learn more, please visit:

www.ubisoftgroup.com.

© 2021 Ubisoft Entertainment. All Rights

Reserved. Ubisoft and the Ubisoft logo are registered trademarks in

the US and/or other countries.

APPENDICES

Definition of non-IFRS financial

indicators

Net bookings corresponds to the sales excluding

the services component and integrating the unconditional amounts

related to license contracts recognized independently of the

performance obligation realization.

Player Recurring Investment (PRI) corresponds to

sales of digital items, DLC, season passes, subscriptions and

advertising.

Non-IFRS operating income calculated based on

net bookings corresponds to operating income less the following

items:

- Stock-based compensation expense

arising on free share plans, group savings plans and/or stock

options.

- Depreciation of acquired intangible

assets with indefinite useful lives.

- Non-operating income and expenses

resulting from restructuring operations within the Group.

Non-IFRS operating margin corresponds to

non-IFRS operating income expressed as a percentage of net

bookings. This ratio is an indicator of the Group’s financial

performance.

Non-IFRS net income corresponds to net income

less the following items:

- The above-described deductions used

to calculate non-IFRS operating income.

- Income and expenses arising on

revaluations, carried out after the measurement period, of the

potential variable consideration granted in relation to business

combinations.

- OCEANE bonds’ interest expense

recognized in accordance with IFRS9.

- The tax impacts on these

adjustments.

Non-IFRS attributable net income corresponds to

non-IFRS net income attributable to owners of the parent.

Non-IFRS diluted EPS corresponds to non-IFRS

attributable net income divided by the weighted average number of

shares after exercise of the rights attached to dilutive

instruments.

The adjusted cash flow statement includes:

- Non-IFRS cash flow from operations

which comprises:

- The costs of internally developed

software and external developments (presented under cash flows from

investing activities in the IFRS cash flow statement) as these

costs are an integral part of the Group's operations.

- The restatement of impacts (after

tax) related to the application of IFRS 15.

- The restatement of commitments

related to leases due to the application of IFRS 16.

- Current and deferred taxes.

- Non-IFRS change in working capital

requirement which includes movements in deferred taxes and restates

the impacts (after tax) related to the application of IFRS 15, thus

cancelling out the income or expenses presented in non-IFRS cash

flow from operations.

- Non-IFRS cash flows from operating

activities which includes:

- the costs of internal and external

licenses development (presented under cash flows from investing

activities in the IFRS cash flow statement and included in non-IFRS

cash flow from operations in the adjusted cash flow

statement);

- the restatement of lease

commitments relating to the application of IFRS 16 presented under

IFRS in cash flow from financing activities.

- Non-IFRS cash flows from investing

activities which excludes the costs of internal and external

licenses development that are presented under non-IFRS cash flow

from operations.

Free cash flow corresponds to cash flows from

non-IFRS operating activities after cash inflows/outflows arising

on the disposal/acquisition of other intangible assets and

property, plant and equipment.

Free cash flow before working capital

requirement corresponds to cash flow from operations after cash

inflows/outflows arising on (i) the disposal/acquisition of other

intangible assets and property, plant and equipment and (ii)

commitments related to leases recognized on the application of IFRS

16.

Cash flow from non-IFRS financing activities,

which excludes lease commitments relating to the application of

IFRS16 presented in non-IFRS cash flow from operation.

IFRS net cash/(debt) position corresponds to

cash and cash equivalents and cash management financial assets less

financial liabilities excluding derivatives.

Non-IFRS net cash/(debt) position corresponds to

the net cash/(debt) position as adjusted for commitments related to

leases (IFRS 16).

Breakdown of net bookings by geographic

region

|

|

Q42020-21 |

Q42019-20 |

12 months

2020-21 |

12 months

2019-20 |

|

Europe |

36% |

31% |

36% |

33% |

| Northern

America |

48% |

49% |

49% |

49% |

|

Rest of the world |

16% |

20% |

15% |

18% |

|

TOTAL |

100% |

100% |

100% |

100% |

Breakdown of net bookings by

platform

|

|

Q42020-21 |

Q42019-20 |

12 months

2020-21 |

12 months

2019-20 |

|

PLAYSTATION®4 &PLAYSTATION®5* |

27% |

26% |

33% |

30% |

| XBOX One™

&XBOX Series X/S™* |

23% |

14% |

21% |

16% |

| PC |

21% |

30% |

23% |

28% |

| NINTENDO

SWITCH™ |

13% |

10% |

11% |

9% |

| MOBILE |

9% |

16% |

8% |

11% |

|

Others** |

7% |

4% |

4% |

6% |

|

TOTAL |

100% |

100% |

100% |

100% |

* Backwards compatibility allows users of new-generation

consoles to continue playing games previously purchased on the

older generation of consoles. **Ancillaries, etc.

Title release

schedule1st

quarter (April -

June

2021)

|

DIGITAL

ONLY |

|

|

|

ANNO® 1800: Tourist Season |

PC |

|

ASSASSIN’S CREED® VALHALLA: Wrath of the Druids |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, STADIA, XBOX

ONE, XBOX SERIES X/S |

|

FOR HONOR®: Year 5 – Season 2 |

AMAZON LUNA, PC, PLAYSTATION®4, STADIA, XBOX ONE |

|

IMMORTALS FENYX RISING™: The Lost Gods |

AMAZON LUNA, NINTENDO SWITCH™, PC, PLAYSTATION®4,

PLAYSTATION®5, STADIA, XBOX ONE, XBOX SERIES X/S |

|

TOM CLANCY’S RAINBOW SIX®: Siege Year 6 – Season 2 |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, STADIA, XBOX

ONE, XBOX SERIES X/S |

|

TOM CLANCY’S THE DIVISION® 2: Season 6 |

AMAZON LUNA, PC, PLAYSTATION®4, STADIA, XBOX ONE |

|

UNO®: 50th Anniversary |

NINTENDO SWITCH™, PC, PLAYSTATION®4, STADIA, XBOX

ONE |

|

WATCH DOGS®: LEGION – Bloodline |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, STADIA, XBOX

ONE, XBOX SERIES X/S |

|

WATCH DOGS®: LEGION – Update 1 & 2 |

AMAZON LUNA, PC, PLAYSTATION®4, PLAYSTATION®5, STADIA, XBOX

ONE, XBOX SERIES X/S |

EXTRACTS FROM THE CONSOLIDATED FINANCIAL

STATEMENTS ATMARCH 31, 2021

Consolidated income statement (IFRS,

extract from the accounts which have undergone an audit by

Statutory Auditors).

|

In € millions |

|

03.31.2021 |

|

03.31.2020 |

|

|

|

| |

|

|

|

|

|

IFRS 15 Sales |

2,223.8 |

|

1,594.8 |

| Cost of

sales |

(325.7) |

|

(253.1) |

|

Gross Margin |

1,898.1 |

|

1,341.8 |

| Research

and Development costs |

(827.1) |

|

(720.8) |

|

Marketing costs |

(442.8) |

|

(386.6) |

| General

and Administrative costs |

(228.4) |

|

(193.0) |

|

Current operating income |

399.8 |

|

41.3 |

| Other

non-current operating income & expense |

(110.4) |

|

(100.8) |

|

Operating income |

289.4 |

|

(59.5) |

| Net

borrowing costs |

(17.4) |

|

(13.9) |

| Net

foreign exchange gains/losses |

(8.2) |

|

(3.8) |

| Other

financial income |

1.0 |

|

0.1 |

| Other

financial expenses |

(27.0) |

|

(1.5) |

|

Net financial income |

(51.6) |

|

(19.1) |

| Income

tax |

(132.6) |

|

(45.7) |

|

Consolidated net income |

105.2 |

|

(124.2) |

| Net

income attributable to owners of the parent company |

103.1 |

|

(125.6) |

| Net

income attributable to non-controlling interests |

2.1 |

|

1.4 |

|

Earnings per share attributable to parent

company |

|

|

|

|

Basic earnings per share (in €) |

0.87 |

|

(1.12) |

|

Diluted earnings per share (in €) |

0.85 |

|

(1.12) |

| Weighted

average number of shares in issue |

118 980 402 |

|

112 050 132 |

|

Diluted weighted average number of shares |

126 286 728 |

|

112 050 132 |

Reconciliation of IFRS Net income and non-IFRS Net

income

|

In millions of euros, except for per share

data |

2020-21 |

2019-20 |

|

IFRS |

Adjustment |

Non-IFRS |

IFRS |

Adjustment |

Non-IFRS |

|

IFRS15 Sales |

2,223.8 |

|

2,223.8 |

1,594.8 |

|

1,594.8 |

|

Deferred services/other differences between the 2 standards |

|

16.7 |

16.7 |

|

(60.8) |

(60.8) |

|

Net bookings |

|

|

2,240.6 |

|

|

1,534.0 |

|

Total Operating expenses |

(1,934.5) |

167.2 |

(1,767.2) |

(1,654.3) |

154.6 |

(1,499.7) |

|

Stock-based compensation |

(56.8) |

56.8 |

0.0 |

(53.8) |

53.8 |

0.0 |

|

Non-current operating income & expense |

(110.4) |

110.4 |

0.0 |

(100.8) |

100.8 |

0.0 |

|

Operating Income |

289.4 |

184.0 |

473.3 |

(59.5) |

93.7 |

34.2 |

|

Net Financial income |

(51.6) |

32.4 |

(19.2) |

(19.1) |

8.2 |

(10.9) |

|

Income tax |

(132.6) |

(5.9) |

(138.6) |

(45.7) |

13.5 |

(32.2) |

|

Consolidated Net Income |

105.2 |

210.4 |

315.6 |

(124.2) |

115.5 |

(8.8) |

|

Net income attributable to owners of the parent

company |

103.1 |

|

313.5 |

(125.6) |

|

(10.2) |

|

Net income attributable to non-controlling

interests |

2.1 |

|

2.1 |

1.4 |

|

1.4 |

|

Diluted weighted average number of shares |

126 286 728 |

|

126 286 728 |

112 050 132 |

|

112 050 132 |

|

Diluted earnings per share |

0.85 |

1.64 |

2.48 |

(1.12) |

1.03 |

(0.09) |

Consolidated balance sheet (IFRS,

extract from the accounts which have undergone an audit by

Statutory Auditors)

|

ASSETS |

Net |

Net |

|

In € millions |

31.03.2021 |

31.03.2020 |

|

Goodwill |

220.7 |

334.6 |

|

Other intangible assets |

1,453.2 |

1,115.3 |

|

Property, plant and equipment |

199.8 |

174.4 |

|

Right of use assets |

282.1 |

229.9 |

|

Investments in associates |

0.0 |

0.0 |

|

Non-current financial assets |

16.1 |

13.7 |

|

Deferred tax assets |

173.1 |

169.3 |

|

Non-current assets |

2,345.0 |

2,037.2 |

|

Inventory |

23.1 |

12.4 |

|

Trade receivables |

342.7 |

307.1 |

|

Other receivables |

260.6 |

127.5 |

|

Other current financial assets |

0.0 |

0.5 |

|

Current tax assets |

45.7 |

41.0 |

|

Cash management financial assets* |

239.9 |

0.0 |

|

Cash and cash equivalents |

1,627.7 |

1,079.2 |

|

Current assets |

2,539.8 |

1,567.6 |

|

Total assets |

4,884.8 |

3,604.8 |

| |

|

|

| |

|

|

|

LIABILITIES AND EQUITY |

Net |

Net |

|

In € millions |

31.03.2021 |

31.03.2020 |

|

Capital |

9.6 |

9.4 |

|

Premiums |

556.0 |

475.4 |

|

Consolidated reserves |

987.1 |

955.4 |

|

Consolidated earnings |

103.1 |

(125.6) |

|

Equity attributable to owners of the parent

company |

1,655.7 |

1,314.6 |

|

Non-controlling interests |

9.3 |

7.2 |

|

Total equity |

1,665.0 |

1,321.7 |

|

Provisions |

5.0 |

3.1 |

|

Employee benefit |

21.6 |

15.8 |

|

Long-term borrowings and other financial liabilities |

1894.9 |

1176.2 |

|

Deferred tax liabilities |

158.5 |

109.5 |

|

Other non-current liabilities |

34.4 |

59.6 |

|

Non-current liabilities |

2,114.3 |

1,364.2 |

|

Short-term borrowings and other financial liabilities |

200.0 |

246.9 |

|

Trade payables |

152.0 |

139.2 |

|

Other liabilities |

737.8 |

517.7 |

|

Current tax liabilities |

15.8 |

15.1 |

|

Current liabilities |

1,105.5 |

918.9 |

|

Total liabilities |

3,219.8 |

2,283.1 |

|

Total liabilities and equity |

4,884.8 |

3,604.8 |

*Shares of UCITS invested in short-term maturity

securities, which do not meet the criteria for qualification as

cash equivalents defined by IAS 7.Consolidated cash flow

statement for comparison with other industry players

(non-audited)

|

In € millions |

03.31.2021 |

03.31.2020 |

| Non-IFRS

Cash flows from operating activities |

|

|

| Consolidated

earnings |

105.2 |

(124.2) |

| +/- Net

Depreciation on internal & external games & movies |

433.4 |

422.5 |

| +/- Other

depreciation on fixed assets |

225.3 |

196.9 |

| +/- Net

Provisions |

(16.1) |

2.3 |

| +/- Cost of

share-based compensation |

56.8 |

53.8 |

| +/- Gains /

losses on disposals |

0.9 |

0.7 |

| +/- Other income

and expenses calculated |

32.6 |

10.7 |

| +/- Cost of

internal development and license development |

(753.2) |

(651.2) |

| +/- IFRS 15

Impact |

15.4 |

(45.6) |

| +/- IFRS 16

Impact |

(35.7) |

(35.6) |

|

NON-IFRS CASH FLOW FROM OPERATION |

64.6 |

(169.9) |

| Inventory |

10.9 |

20.2 |

| Trade

receivables |

(45.7) |

182.9 |

| Other assets |

(126.7) |

25.0 |

| Trade

payables |

1.2 |

(49.2) |

| Other

liabilities |

264.8 |

(95.4) |

| +/-

Non-IFRS Change in working capital |

104.5 |

83.4 |

|

Non-IFRS CASH FLOW GENERATED BY OPERATING

ACTIVITIES |

169.0 |

(86.4) |

| Cash

flows from investing activities |

|

|

| - Payments for

the acquisition of intangible assets and property, plant and

equipment |

(96.8) |

(104.9) |

| + Proceeds from

the disposal of intangible assets and property, plant and

equipment |

0.1 |

0.2 |

|

Free Cash-Flow |

72.3 |

(191.1) |

| +/- Payments for

the acquisition of financial assets |

(200.4) |

(216.7) |

| + Refund of loans

and other financial assets |

198.1 |

211.5 |

| +/- Changes in

scope (1) |

(16.0) |

(143.7) |

|

NON-IFRS CASH GENERATED BY INVESTING

ACTIVITIES |

(114.9) |

(253.7) |

| Cash

flows from financing activities |

|

|

| + New

borrowings |

1,139.6 |

935.2 |

| - Refund of

borrowings |

(506.8) |

(584.9) |

| + Funds received

from shareholders in capital increases |

80.7 |

81.5 |

| +/- Cash

management financial assets |

(239.9) |

0.0 |

| +/- Sales /

purchases of own shares |

25.8 |

35.3 |

|

CASH GENERATED BY FINANCING ACTIVITIES |

499.5 |

467.1 |

| Net

change in cash and cash equivalents |

553.6 |

127.0 |

| Cash and cash

equivalents at the beginning of the fiscal year |

986.9 |

878.6 |

| Foreign exchange

losses/gains |

24.7 |

(18.7) |

|

Cash and cash equivalents at the end of the

period |

1,565.2 |

986.9 |

|

(1) Including cash in companies acquired and disposed of |

0.0 |

20.2 |

| |

|

|

|

RECONCILIATION OF NON-IFRS NET CASH POSTION |

|

|

| Cash and

cash equivalents at the end of the period |

1,565.2 |

986.9 |

| Bank borrowings

and from the restatement of leases |

(1,938.8) |

(1,220.6) |

| Commercial

papers |

(93.5) |

(110.0) |

| IFRS 16 |

306.4 |

243.0 |

| Cash management

financial assets |

239.9 |

0.0 |

|

NON-IFRS NET CASH POSITION |

79.2 |

(100.6) |

Consolidated cash flow statement (IFRS, extract from the

accounts which have undergone an audit Statutory

Auditors)

|

In € millions |

03.31.2021 |

03.31.2020 |

| Cash flows

from operating activities |

|

|

| Consolidated

earnings |

105.2 |

(124.2) |

| +/- Net

amortization and depreciation on property, plant and equipment and

intangible assets |

658.7 |

619.4 |

| +/- Net

Provisions |

(16.1) |

2.3 |

| +/- Cost of

share-based compensation |

56.8 |

53.8 |

| +/- Gains / losses

on disposals |

0.9 |

0.7 |

| +/- Other income

and expenses calculated |

32.6 |

10.7 |

| +/- Income Tax

Expense |

132.6 |

45.7 |

|

TOTAL CASH FLOW FROM OPERATING ACTIVITIES |

970.7 |

608.2 |

| Inventory |

10.9 |

20.2 |

| Trade

receivables |

(45.7) |

182.9 |

| Other assets |

(131.4) |

58.2 |

| Trade

payables |

1.2 |

(49.2) |

| Other

liabilities |

316.8 |

(51.8) |

| Deferred income

and prepaid expenses |

(81.1) |

(96.5) |

| +/- Change

in working capital |

70.6 |

63.7 |

| +/- Current Income

tax expense |

(83.4) |

(71.6) |

|

TOTAL CASH FLOW GENERATED BY OPERATING

ACTIVITIES |

958.0 |

600.4 |

| Cash flows

from investing activities |

|

|

| - Payments for the

acquisition of internal & external developments |

(753.2) |

(651.2) |

| - Payments for the

acquisition of intangible assets and property, plant and

equipment |

(96.8) |

(104.9) |

| + Proceeds from

the disposal of intangible assets and property, plant and

equipment |

0.1 |

0.2 |

| +/- Payments for

the acquisition of financial assets |

(200.4) |

(215.7) |

| + Refund of loans

and other financial assets |

198.1 |

210.5 |

| +/- Changes in

scope (1) |

(16.0) |

(143.7) |

|

CASH GENERATED BY INVESTING ACTIVITIES |

(868.2) |

(904.9) |

| Cash flows

from financing activities |

|

|

| + New

borrowings |

1,139.6 |

935.2 |

| - Refund of

leases |

(35.7) |

(35.6) |

| - Refund of

borrowings |

(506.8) |

(584.9) |

| + Funds received

from shareholders in capital increases |

80.7 |

81.5 |

|

+/- Cash management financial assets |

(239.9) |

0.0 |

| +/- Sales /

purchases of own shares |

25.8 |

35.3 |

|

CASH GENERATED BY FINANCING ACTIVITIES |

463.8 |

431.5 |

| Net change

in cash and cash equivalents |

553.6 |

127.0 |

| Cash and cash

equivalents at the beginning of the fiscal year |

986.9 |

878.6 |

| Foreign exchange

losses/gains |

24.7 |

(18.7) |

| Cash and

cash equivalents at the end of the period |

1,565.2 |

986.9 |

|

(1) Including cash in companies acquired and disposed of |

0.0 |

20.2 |

| |

|

|

|

RECONCILIATION OF NET CASH POSTION |

|

|

| Cash and

cash equivalents at the end of the period |

1,565.2 |

986.9 |

| Bank borrowings

and from the restatement of leases |

(1,938.8) |

(1,220.6) |

| Commercial

papers |

(93.5) |

(110.0) |

| Cash management

financial assets |

239.9 |

0 |

|

IFRS NET CASH POSITION |

(227.2) |

(343.6) |

1 Consoles premium and free-to-play scope. Internal estimates.2

Sales at constant exchange rates are calculated by applying to the

data for the period under review the average exchange rates used

for the same period of the previous fiscal year.3 See the

presentation published on Ubisoft’s website for further information

on movements in the income and cash flow statement. 4 Based on the

consolidated cash flow statement for comparison with other industry

players (non-audited)

- Ubisoft FY21 Earnings & Sales

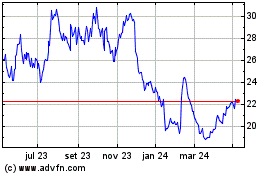

UBISoft Entertainment (EU:UBI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

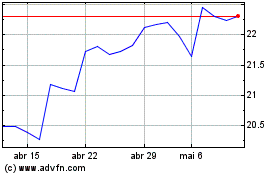

UBISoft Entertainment (EU:UBI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024