Great-West Lifeco announces offering of Series Y Preferred Shares

01 Outubro 2021 - 10:01AM

Great-West Lifeco Inc.

(

TSX:GWO) (“

Lifeco”)

announced today that it has entered into an agreement with a

syndicate of underwriters led by BMO Capital Markets, RBC Capital

Markets, Scotiabank, CIBC Capital Markets and TD Securities

pursuant to which the underwriters have agreed to purchase, on a

bought deal basis, 8,000,000 Non-Cumulative First Preferred Shares,

Series Y (the “

Series Y Shares”) from Lifeco for

sale to the public at a price of $25.00 per Series Y Share,

representing aggregate gross proceeds of $200,000,000.

The Series Y Shares will yield 4.50% per annum,

payable quarterly, as and when declared by the Board of Directors

of the Company. The Series Y Shares will not be redeemable prior to

December 31, 2026. On or after December 31, 2026, Lifeco may, on

not less than 30 nor more than 60 days’ notice, redeem for cash the

Series Y Shares in whole or in part, at the Company’s option, at

$26.00 per share if redeemed on or after December 31, 2026 and

prior to December 31, 2027; $25.75 per share if redeemed on or

after December 31, 2027 and prior to December 31, 2028; $25.50 per

share if redeemed on or after December 31, 2028 and prior to

December 31, 2029; $25.25 per share if redeemed on or after

December 31, 2029 and prior to December 31, 2030; and $25.00 per

share if redeemed on or after December 31, 2030, in each case

together with all declared and unpaid dividends up to but excluding

the date of redemption.

The net proceeds of the offering will be used

for general corporate purposes. The Series Y Share offering is

expected to close on October 8, 2021 and is subject to customary

closing conditions.

The Series Y Shares have not been and will not

be registered under the U.S. Securities Act of 1933, as amended,

and may not be offered or sold in the United States absent

registration or an applicable exemption from the registration

requirements. This news release shall not constitute an offer to

sell or the solicitation of an offer to buy nor shall there be any

sale of the Series Y Shares in any State in which such offer,

solicitation or sale would be unlawful.

Great-West LifecoGreat-West Lifeco Inc. is an

international financial services holding company with interests in

life insurance, health insurance, retirement and investment

services, asset management and reinsurance businesses. We operate

in Canada, the United States and Europe under the brands Canada

Life, Empower Retirement, Putnam Investments, and Irish Life. At

the end of 2020, our companies had approximately 24,500 employees,

205,000 advisor relationships, and thousands of distribution

partners – all serving our more than 30 million customer

relationships across these regions. Lifeco and its companies have

approximately $2.2 trillion in consolidated assets under

administration as of June 30, 2021 and are members of the Power

Corporation group of companies. Lifeco trades on the Toronto Stock

Exchange (TSX) under the ticker symbol GWO. To learn more, visit

www.greatwestlifeco.com.

Cautionary note regarding Forward-Looking

InformationThis release may contain forward-looking

information. Forward-looking information includes statements that

are predictive in nature, depend upon or refer to future events or

conditions, or include words such as “will”, “may”, “expects”,

“anticipates”, “intends”, “plans”, “believes”, “estimates”,

“objective”, “target”, “potential” and other similar expressions or

negative versions thereof. These statements include, without

limitation, statements about the expected closing of the offering

of the Series Y Shares, the issuance of the Series Y Shares, and

the intended use of proceeds from the offering of Series Y

Shares.

Forward-looking statements are based on expectations, forecasts,

estimates, predictions, projections and conclusions about future

events that were current at the time of the statements and are

inherently subject to, among other things, risks, uncertainties and

assumptions about Lifeco, economic factors and the financial

services industry generally, including the insurance, mutual fund

and retirement solutions industries. They are not guarantees of

future performance, and the reader is cautioned that actual events

and results could differ materially from those expressed or implied

by forward-looking statements. Many of these assumptions are based

on factors and events that are not within the control of Lifeco and

there is no assurance that they will prove to be correct. Whether

or not actual results differ from forward-looking information may

depend on numerous factors, developments and assumptions. These

assumptions and factors are discussed in Lifeco’s filings with

securities regulators, including but not limited to factors set out

under “Risk Factors” in Lifeco’s annual information form dated

February 10, 2021, including documents incorporated by reference

therein, and under “Risk Management and Control Practices” and

“Summary of Critical Accounting Estimates” in Lifeco’s management’s

discussion and analysis for the twelve months ended December 31,

2020, which, along with other filings, is available for review at

www.sedar.com. The reader is also cautioned to consider these and

other factors, uncertainties and potential events carefully and not

to place undue reliance on forward-looking information. Other than

as specifically required by applicable law, Lifeco does not intend

to update any forward-looking information whether as a result of

new information, future events or otherwise.

|

For

more

information

contact: |

|

| Media

Relations |

Investor

Relations |

| Liz Kulyk |

Deirdre Neary |

| 204-391-8515 |

647-328-2134 |

|

Media.relations@canadalife.com |

Deirdre.neary@canadalife.com |

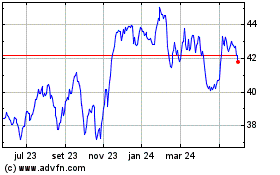

Great West Lifeco (TSX:GWO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

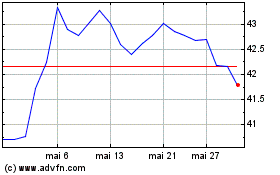

Great West Lifeco (TSX:GWO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024