Solstice Gold Corp. (TSXV: SGC) (“

Solstice”, “we”,

“our” or the “

Company”) is pleased to announce

that we have completed the acquisition of the portfolio of 86

royalty and project interests (the "

Portfolio")

announced on September 15, 2021 (the

“

Transaction”). The Portfolio was acquired from

renowned prospector Perry English through his company 1544230

Ontario Inc., along with his business partner Gravel Ridge

Resources Ltd. and its principals for a cash purchase price of

C$3.8 million and 400,000 common shares of Solstice. The purchase

price was reduced by $198,750, comprising cash payments received

from third party option agreements due to Solstice at the closing

of the Transaction for a net purchase price of $3.6MM. In addition,

the Company is pleased to announce that, further to the Company’s

news release dated September 15, 2021, the Company has closed its

non-brokered private placement financing for total proceeds of

$2,500,000 (the “

Private Placement”). Newly

appointed Director Mike Timmins subscribed for $100,000 (1,000,000

shares) of the Private Placement through his holding company,

Pumpkin Mining Corporation. In addition, as announced on September

15, 2021, certain directors (being Kevin Reid, Michael Gentile and

Blair Schultz) have completed the early exercise of their warrants

for total proceeds of approximately $1,640,000. Directors and

management now collectively own approximately 40% of the issued and

outstanding shares of the Company.

For further details on the Transaction, please

see:

https://www.solsticegold.com/site/assets/files/5531/transaction_final_v1.pdf

“With the completion of this Transaction and

well supported financing, we believe Solstice has established

itself as a unique investment opportunity in the mining exploration

space. Shareholders not only have exposure to top tier exploration

assets that we are advancing internally both in Red Lake, Ontario

and next to Meliadine in Nunavut, but also have exposure, through

the Transaction, to exploration and potential discovery by third

parties on 45 projects located in key mining districts in Ontario

and Quebec. These are all generating option and share payments

along with potential future royalties and we expect payback of our

acquisition costs within three years. Currently, we own 52

potential future royalties, and this number is expected to grow as

we seek to sell or option 100% interests in a further 30 projects

that we own through the Transaction. Effectively, at payback, we

expect to own a large royalty portfolio at zero net cost to

Solstice. With an approximate 40% share ownership, the board and

management are strongly aligned with all investors as we seek to

provide future shareholder value through discovery and the

successful implementation of our business strategies” stated

Chairman David Adamson.

Closing of Financing

The Private Placement consisted of the issuance

by the Company of a total of 25,000,000 common shares (the

“Shares”), at a price of at $0.10 per Share. All

Shares issued pursuant to the Private Placement are subject to a

four-month hold period expiring on February 5, 2022 in

accordance with applicable Canadian securities laws and are

also subject to the Exchange Hold Period (as defined by the TSX

Venture Exchange (“TSXV”) rules and policies) and

have been legended accordingly.

The proceeds from the Private Placement were

used exclusively to complete the Transaction.

In connection with the Private Placement, Dave

Fischer, Chief Financial Officer of the Company, subscribed for

150,000 Shares for a total purchase price of $15,000. The issuance

of Shares to Mr. Fischer and to Pumpkin Mining Corporation pursuant

to the Private Placement constitutes a “related party transaction”

within the meaning of Policy 5.9 of the TSXV and Multilateral

Instrument 61-101 - Protection of Minority Security Holders in

Special Transactions (“MI 61-101”) as a result of

Mr. Fischer being a senior officer of the Company and Mr. Timmins

being a director of the Company and the sole shareholder of Pumpkin

Mining Corporation. The Company is relying on the exemption from

the formal valuation requirement in section 5.5(b) of MI 61-101 (as

a result of its Shares being listed on the TSXV) and the exemption

from the minority approval requirement in section 5.7(1)(b) of MI

61-101 (as neither the fair market value of Shares purchased, nor

the consideration paid, by Mr. Fischer and Pumpkin Mining

Corporation has exceeded $2,500,000). Further details in respect of

the Private Placement will be included in a material change report

to be filed by the Company. The material change report will be

filed less than 21 days prior to closing of the Private Placement

due to the timing of the announcement of the Private Placement and

the Company wished to complete the Private Placement in an

expeditious manner.

For additional details, please see the Company’s

corporate presentation at:

https://www.solsticegold.com/investors/presentations/

About Solstice Gold

Solstice is a gold-focused exploration company

engaged in the exploration of our high-quality exploration assets

in top tier mining jurisdictions. Our 55 km2 Red Lake Extension

project along with the combined 96 km2 Taillon, Moreau and Berens

projects are located on the north end of the prolific Red Lake Gold

District in Ontario. Our district scale KGP project covers 886 km2

with certain other rights covering an adjacent 683 km2, all with no

underlying option or earn in payments. KGP has seen over $12MM

dollars spent on significant field work, identified a 10 km2 gold

boulder field and now prepared with multiple drill-ready targets.

KGP is located in Nunavut, Canada, only 26 km from Rankin Inlet and

approximately 7 km from the Meliadine gold deposits owned by Agnico

Eagle Mines Limited. Solstice has approximately 152 million shares

outstanding.

Solstice is committed to responsible exploration

and development in the communities in which we work. For more

details on Solstice Gold, our exploration projects and details on

our recently acquired portfolio of projects please see our

Corporate Presentation available at www.solsticegold.com.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

Sandy Barham, M.Sc., P.Geo., Senior Geologist,

is the Qualified Person as defined by NI 43-101 standards

responsible for reviewing and approving the technical content of

this news release.

On Behalf of Solstice Gold

Corp.

David Adamson,

Ph.D.Chairman

For further information please visit our website

at www.solsticegold.com or contact:

Marty Tunney,

P.Eng. President info@solsticegold.com

Phone: (604) 622-5040

Forward Looking Statements

This news release contains certain

forward-looking statements (“FLS”) including, but not limited to

the Company’s expectations, intentions, plans and beliefs in

connection with the Company’s planned exploration activities, and

the expected benefits and returns to the Company following the

acquisition. FLS can often be identified by forward-looking words

such as “approximate or (~)”, “emerging”, “goal”, “plan”, “intent”,

“estimate”, “expects”, “potential”, “scheduled”, “may” and “will”

or similar words suggesting future outcomes or other expectations,

beliefs, plans, objectives, assumptions, intentions or statements

about future events or performance. There is also no guarantee that

continued exploration at Solstice exploration projects, all of

which are at an early stage of exploration, will lead to the

discovery of an economic gold deposit. Factors that could cause

actual results to differ materially from any FLS include, but are

not limited to, failure of the Company to raise sufficient proceeds

in the financing to satisfy the purchase price of the portfolio

acquisition, failure of the Company to obtain TSX Venture Exchange

approval on terms acceptable to the Company or at all, the future

impacts of the COVID 19 pandemic and government response to such

pandemic, the ability of the Company to continue exploration at its

projects during the pandemic and the risk of future lack of access

to the projects as a result thereof, delays in obtaining or

failures to obtain required governmental, environmental or other

project approvals, inability to locate source rocks, inflation,

changes in exchange rates, fluctuations in commodity prices, delays

in the development of projects, regulatory approvals and other

factors. FLS are subject to risks, uncertainties and other factors

that could cause actual results to differ materially from expected

results.

Potential shareholders and prospective investors

should be aware that these statements are subject to known and

unknown risks, uncertainties and other factors that could cause

actual results to differ materially from those suggested by the

FLS. Shareholders are cautioned not to place undue reliance on FLS.

By their nature FLS involve numerous assumptions, inherent risks

and uncertainties, both general and specific, that contribute to

the possibility that the predictions, forecasts, projections and

various future events will not occur. Solstice undertakes no

obligation to update publicly or otherwise revise any FLS whether

as a result of new information, future events or other such factors

which affect this information, except as required by law.

This news release contains information with

respect to adjacent or other mineral properties in respect of which

the Company has no interest or rights to explore or mine or

acquire. Readers are cautioned that mineral deposits on adjacent or

similar properties are not indicative of mineral deposits on the

Company’s properties, nor is there certainty that Solstice’s

projects will contain economic mineralization. This news release

mentions other companies that are unrelated to Solstice and this

does not imply any agreements, partnerships or rights with respect

to any of these companies or their properties other than where

explicitly defined. Past performance is no guarantee of future

performance and all investors are urged to consult their investment

professionals before making an investment decision.

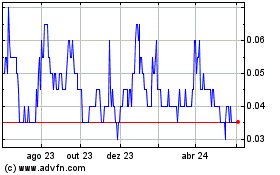

Solstice Gold (TSXV:SGC)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

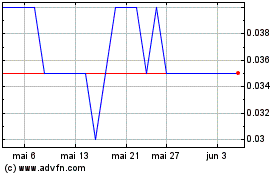

Solstice Gold (TSXV:SGC)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025