Economic Investment Trust Limited Announces Renewal of Normal Course Issuer Bid

04 Março 2022 - 7:00PM

Economic Investment Trust Limited (TSX: EVT) (the “Company”)

announced today that the Toronto Stock Exchange (the “Exchange”)

has accepted a notice filed by the Company of its intention to

proceed with the renewal of its Normal Course Issuer Bid (the

“Bid”) to be transacted through the facilities of the Exchange or

through alternative Canadian trading systems.

The notice provides that the Company may, during

the 12-month period commencing March 9, 2022 and ending March 8,

2023, purchase up to 279,276 common shares in the capital of the

Company (“Shares”) in total, being approximately 5% of the total

number of 5,585,535 Shares outstanding as at February 24, 2022. The

price which the Company will pay for any such Shares will be the

prevailing market price at the time of acquisition. The actual

number of Shares which may be purchased pursuant to the Bid will be

determined by management of the Company. Any Shares purchased

pursuant to the Bid will be cancelled.

The average daily trading volume of the Shares

on the Exchange for the most recently completed six calendar months

is 332. Under the Bid, the Company may purchase up to 1,000 Shares

on the Exchange during any trading day.

The timing of purchases will be determined by

management of the Company, which will be based on market

conditions, share price, best use of available cash, and other

factors. The funding for any purchase pursuant to the Bid will be

financed out of the working capital of the Company.

The Company’s previous Normal Course Issuer Bid

(the “Previous NCIB”) expires on March 8, 2022. Under the Previous

NCIB, the Company obtained the approval of the Exchange to purchase

up to 279,386 Shares, which represented 5% of the 5,587,735 Shares

issued and outstanding as at the close of business on March 2,

2021. The Company purchased on the open market and cancelled an

aggregate of 2,200 Shares under the Previous NCIB at an average

price of $118.78 per Share.

The Board of Directors believes that, in the

event the Shares trade in a price range that does not fully reflect

their value, the purchase of the Shares would be an appropriate use

of corporate funds in the best interests of the Company and its

shareholders. Furthermore, the purchases are expected to benefit

all persons who continue to hold Shares by increasing their equity

interest in the Company if the repurchased Shares are

cancelled.

About Economic Investment Trust

Limited

The Company is a closed-end investment

corporation that trades on the Exchange. The Company has always

been an investment vehicle for long-term growth through investment

in common equities, as management believes that over long period of

time, common equities, as an asset class, will outperform

fixed-income instruments or balanced funds. The investment

objective is to earn an above-average rate of return, primarily

through long-term capital appreciation and dividend income. The

equity investments in the portfolio reflect investment

opportunities world-wide. For more information, please visit:

https://www.evt.ca/.

Forward-Looking Statements

This press release may contain forward-looking

information within the meaning of applicable securities regulation.

The words “may”, “will”, “would”, “should”, “could”, “expects”,

“plans”, “intends”, “trends”, “indications”, “anticipates”,

“believes”, “estimates”, “predicts”, “likely” or “potential” or the

negative or other variations of these words or other comparable

words or phrases, are intended to identify forward-looking

statements. These statements include, without limitation,

statements regarding the Company’s intentions and expectations with

respect to the Bid and purchases thereunder, and the effects of

purchases under the Bid. Purchases made under the Bid are not

guaranteed and may be suspended at the discretion of the Board of

Directors. Forward-looking information is based on a number of

assumptions and is subject to a number of risks and uncertainties

that may cause the results or events mentioned in this press

release to differ materially from those that are discussed in or

implied by such forward-looking information. These risks and

uncertainties include, but are not limited to, general, local

economic, and business conditions. All forward-looking information

in this press release speaks as of the date hereof. The Company

does not undertake to update any such forward-looking information

whether as a result of new information, future events or otherwise.

Additional information about these assumptions and risks and

uncertainties is disclosed in filings with securities regulators

filed on SEDAR (www.sedar.com).

For more information, please

contact:

Richard B. CartyCorporate SecretaryEconomic

Investment Trust LimitedTelephone: (416) 947-2578Fax: (416)

362-2592

Scott Ewert Vice-PresidentEconomic Investment

Trust LimitedTelephone: (416) 947-2578Fax: (416) 362-2592

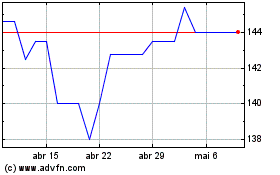

Economic Investment (TSX:EVT)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Economic Investment (TSX:EVT)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024