Rogers Communications Inc. (“Rogers”), Shaw Communications Inc.

(“Shaw”) and Quebecor Inc. (“Quebecor”) today announced that they

have entered into a definitive agreement (the “Agreement”) for the

sale of Freedom Mobile Inc. (“Freedom”) to Videotron Ltd., a

subsidiary of Quebecor (the “Freedom Transaction”), subject to

regulatory approvals and closing of the merger of Shaw and Rogers

announced on March 15, 2021 (the “Rogers-Shaw Transaction”).

The parties strongly believe the Freedom Transaction provides

the best opportunity to create a strong fourth national wireless

services provider and addresses the concerns raised by the

Commissioner of Competition and the Minister of Innovation, Science

and Industry regarding the Rogers-Shaw Transaction. With this

Agreement, the new combined business of Videotron and Freedom will

be well-positioned to launch a strong, competitive national 5G

offering, using Videotron’s 3500 MHz holdings. Accordingly, the

parties believe the Rogers-Shaw Transaction should now be

approved.

This definitive agreement is substantially consistent with the

terms previously announced on June 17, 2022.

“We are very pleased with this Agreement, and we are determined

to continue building on Freedom’s assets,” said Pierre Karl

Péladeau, President and CEO of Quebecor. “Quebecor has shown that

it is the best player to create real competition and disrupt the

market. Our strong track record combined with Freedom’s solid

Canadian footprint will allow us to offer consumers in British

Columbia, Alberta and Ontario more choice, value, and affordability

through discounted multiservice bundles and innovative

products.”

“This Agreement with Quebecor brings us one step closer to

completing our merger with Shaw,” said Tony Staffieri, President

and CEO of Rogers. “We strongly believe that this divestiture

solution addresses the concerns raised by the Commissioner of

Competition and the Minister of Innovation, Science and Industry

and we look forward to securing the outstanding regulatory

approvals for our merger with Shaw so that we can start delivering

its significant long-term benefits to Canadian consumers and

businesses, including improved network resiliency.”

“My family, our management team, and our people are extremely

proud of what we built with Freedom Mobile. Over the past six years

we invested billions of dollars and launched products and services

that disrupted the marketplace and helped redefine what Canadians

can expect from their wireless carrier, but there’s much more that

could be done as next generation networks are deployed, technology

becomes more sophisticated and consumers’ demands for fast and

responsive applications continue to increase,” said Brad Shaw,

Executive Chairman and CEO of Shaw. “Bringing Freedom Mobile and

Quebecor together will expand Freedom’s scope to create a national

provider with greater ability to invest and compete for the future

growth and technology Canadians will need.”

Required ApprovalsThe Freedom Transaction is

conditional on, among other things, clearance under

the Competition Act and approval of the Minister of

Innovation, Science and Industry. It is also conditional on, and

would close substantially concurrently with, closing of the

Rogers-Shaw Transaction. As previously announced, Rogers, Shaw and

the Shaw Family Living Trust have agreed to extend the outside date

of the Rogers-Shaw Transaction to December 31, 2022 (which outside

date may be further extended to January 31, 2023 at the option of

Rogers or Shaw, provided Rogers has committed financing available

to complete the merger), demonstrating their commitment to

completing this transformative combination.

The Rogers-Shaw Transaction, which would see Shaw merge with

Rogers, has already been approved by the shareholders of Shaw and

the Court of Queen’s Bench of Alberta, and the Canadian

Radio-television and Telecommunications Commission, and remains

subject to review by the Competition Tribunal and approval by the

Minister of Innovation, Science and Industry. The Commissioner of

Competition has applied for an order of the Competition Tribunal

that the parties not proceed with the Rogers-Shaw Transaction, and

closing of the Rogers-Shaw Transaction is conditional on either

agreement with the Commissioner of Competition or the Competition

Tribunal disposing of the application on terms that allow the

transaction to close.

Rogers’ standalone financial guidance for 2022, provided on

April 20, 2022, remains unchanged.

Caution Regarding Forward Looking

StatementsThis news release includes “forward-looking

statements” within the meaning of applicable securities laws,

including, without limitation, statements about the terms and

conditions of the Freedom Transaction, the anticipated benefits and

effects of the Freedom Transaction and the Rogers-Shaw Transaction

and the timing thereof, including the expected impact of the

Freedom Transaction on competitive conditions in Canada’s

telecommunications industry or wireless markets and the ability of

Quebecor to emerge as Canada’s fourth national wireless competitor,

the potential timing and anticipated receipt of the required

regulatory approvals and clearances for the Freedom Transaction and

the Rogers-Shaw Transaction, and the anticipated timing for closing

of the Freedom Transaction and the Rogers-Shaw Transaction.

Forward-looking information may in some cases be identified by

words such as “will”, “anticipates”, “believes”, “expects”,

“intends” and similar expressions suggesting future events or

future performance.

We caution that all forward-looking information is inherently

subject to change and uncertainty and that actual results may

differ materially from those expressed or implied by the

forward-looking information. A number of risks, uncertainties and

other factors could cause actual results and events to differ

materially from those expressed or implied in the forward-looking

information or could cause the current objectives, strategies and

intentions of Rogers, Shaw or Quebecor to change. Such risks,

uncertainties and other factors include, among others, the

possibility that the Freedom Transaction or the Rogers-Shaw

Transaction will not be completed in the expected timeframe or at

all; the failure to obtain any necessary regulatory approvals and

clearances in connection with the Freedom Transaction or the

Rogers-Shaw Transaction in the expected timeframe or at all; the

possibility that the parties will not be able to reach a resolution

with the Commissioner of Competition or the Minister of Innovation,

Science and Industry regarding the Rogers-Shaw Transaction; the

outcome and timing of pending or potential litigation or regulatory

proceedings associated with the Rogers-Shaw Transaction or the

Freedom Transaction, including the proceeding commenced on

May 9, 2022 by the Commissioner of Competition before the

Competition Tribunal to block the Rogers-Shaw Transaction and any

appeals from any decision rendered by the Competition Tribunal; the

failure to realize the anticipated benefits of the Freedom

Transaction and the Rogers-Shaw Transaction in the expected

timeframes or at all; and general economic, business and political

conditions. Accordingly, we warn investors to exercise caution when

considering statements containing forward-looking information and

that it would be unreasonable to rely on such statements as

creating legal rights regarding the future results or plans of

Rogers, Shaw or Quebecor. We cannot guarantee that any

forward-looking information will materialize and you are cautioned

not to place undue reliance on this forward-looking information.

Any forward-looking information contained in this news release

represent expectations as of the date of this news release and are

subject to change after such date. A comprehensive discussion of

other risks that impact each of Rogers, Shaw and Quebecor can also

be found in its public reports and filings, which are available

under their respective profiles, as applicable, at www.sedar.com

and www.sec.gov.

Forward-looking information is provided herein for the purpose

of giving information about the Freedom Transaction and the

Rogers-Shaw Transaction, their expected timing and their

anticipated benefits. Readers are cautioned that such information

may not be appropriate for other purposes. The completion of the

Freedom Transaction and the Rogers-Shaw Transaction is subject to

certain closing conditions, termination rights and other risks and

uncertainties including, without limitation, regulatory approvals

and clearances. There can be no assurance that such closing

conditions will be satisfied, that such regulatory approvals and

clearances will be obtained or that either the Freedom Transaction

or the Rogers-Shaw Transaction will occur, or that either will

occur on the terms and conditions described herein or previously

announced. The Freedom Transaction and the Rogers-Shaw Transaction

could be modified, restructured or terminated. There can be no

assurance that one or both of the Freedom Transaction or the

Rogers-Shaw Transaction will be acceptable to regulatory

authorities or will be completed in order to permit the other

transaction to be consummated. There can also be no assurance that

the outside date of the Rogers-Shaw Transaction will be further

extended by the parties, or that the outside date of the Freedom

Transaction will be extended by the parties to the extent necessary

to permit closing of either transaction to occur. Finally, there

can be no assurance that the anticipated benefits of either the

Freedom Transaction or the Rogers-Shaw Transaction will be achieved

in the expected timeframes or at all.

All forward-looking statements are made pursuant to the “safe

harbour” provisions of the applicable Canadian and United States

securities laws. None of Rogers, Shaw or Quebecor is under any

obligation (and each of Rogers, Shaw and Quebecor expressly

disclaims any such obligation) to update or alter any statements

containing forward-looking information, the factors or assumptions

underlying them, whether as a result of new information, future

events or otherwise, except as required by law. All of the

forward-looking information in this news release is qualified by

the cautionary statements herein.

About Rogers Rogers is a leading Canadian

technology and media company that provides communications services

and entertainment to consumers and businesses. Rogers shares are

publicly traded on the Toronto Stock Exchange (TSX: RCI.A and

RCI.B) and on the New York Stock Exchange (NYSE: RCI). For more

information, please visit: www.rogers.com or

http://investors.rogers.com.

About Quebecor Inc. Quebecor, a Canadian leader

in telecommunications, entertainment, news media and culture, is

one of the best-performing integrated communications companies in

the industry. Driven by their determination to deliver the best

possible customer experience, all of Quebecor’s subsidiaries and

brands are differentiated by their high-quality, multiplatform,

convergent products and services.

Québec-based Quebecor (TSX: QBR.A, QBR.B) employs nearly 10,000

people in Canada.

A family business founded in 1950, Quebecor is strongly

committed to the community. Every year, it actively supports more

than 400 organizations in the vital fields of culture, health,

education, the environment and entrepreneurship.

About Shaw Communications Inc. Shaw is a

leading Canadian connectivity company. The Wireline division

consists of Consumer and Business services. Consumer serves

residential customers with broadband Internet, Shaw Go WiFi, video

and digital phone. Business provides business customers with

Internet, data, WiFi, digital phone, and video services. The

Wireless division provides wireless voice and LTE data services.

Shaw is traded on the Toronto and New York stock exchanges and is

included in the S&P/TSX 60 Index (Symbol: TSX – SJR.B, NYSE –

SJR, and TSXV – SJR.A). For more information, please visit

www.shaw.ca.

For more information:Rogers

Communications media

contact1-844-226-1338media@rci.rogers.com

Rogers Communications investment community

contactPaul

Carpino647-435-6470paul.carpino@rci.rogers.com

Shaw Communications Inc. media contactChethan

Lakshman, VP, External

Affairs403-930-8448chethan.lakshman@sjrb.ca

Shaw Communications investment community

contactinvestor.relations@sjrb.ca

Quebecor Inc. media

contactmedias@quebecor.com

Quebecor Inc. investor relations contactHugues

Simard, Chief Financial Officerhugues.simard@quebecor.com

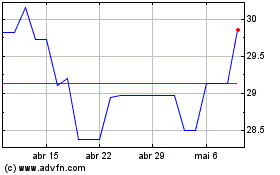

Quebecor (TSX:QBR.A)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Quebecor (TSX:QBR.A)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024