Iris Energy Limited (NASDAQ: IREN) (“Iris Energy” or “the Company”,

and together with its subsidiaries “the Group”), a leading owner

and operator of institutional-grade, highly efficient proprietary

Bitcoin mining data centers powered by 100% renewable energy, today

announced an update on its financing arrangements as well as a

recent opportunity to utilize prepayments made to Bitmain

Technologies Limited (“Bitmain”).

Highlights

- The Group has limited recourse

equipment financing arrangements in wholly-owned special purpose

vehicles, which have no parent company guarantee or recourse to any

other Group entities. There is no other debt in the Group.

- The Group has $53 million of cash in

the bank as at October 31, 2022.1

- These financing arrangements were

intentionally structured for prudent risk management to protect the

underlying business and data center infrastructure the Group has

built.

- Certain equipment (i.e., Bitcoin

miners) owned by the special purpose vehicles currently produce

insufficient cash flow to service their respective debt financing

obligations, and have a current market value well below the

principal amount of the relevant loans. Restructuring discussions

with the lender remain ongoing.

- 2.4 EH/s of miners2 and all of the

Group’s data center capacity & development pipeline are

unaffected by these financing arrangements.

- The Group is exploring opportunities

to utilize data center capacity that may become available,

recognizing:

- Current scarcity of industry hosting

data center capacity

- Prospect of utilizing $75 million of

prepayments already made to Bitmain in respect of an additional 7.5

EH/s of contracted miners for further self-mining.

- In addition to this financing

update, the Company is pleased to announce that it has utilized an

additional portion of its prepayments with Bitmain, further

reducing unutilized prepayments made to Bitmain from $83 million to

$75 million.

Limited Recourse Equipment Financing

The Group has no debt other than the limited recourse equipment

financing arrangements described below.

The Company has three wholly-owned special purpose vehicles

(referred to as “Non-Recourse SPV 1”, “Non-Recourse SPV 2",

“Non-Recourse SPV 3” and together, “Non-Recourse SPVs”), which were

each incorporated for the specific purpose of financing certain

miners. As at September 30, 2022, the Non-Recourse SPVs had the

following principal amounts outstanding under their respective

limited recourse equipment financing facilities:

- Non-Recourse SPV 1 – $1 million,

secured against 0.2 EH/s of miners.

- Non-Recourse SPV 2 – $32 million,

secured against 1.6 EH/s of miners.

- Non-Recourse SPV 3 – $71 million,

secured against 2.0 EH/s of miners.

The lender to each Non-Recourse SPV has no recourse to, and no

cross collateralization with respect to, assets of the Company or

any other Group entity, including other Non-Recourse SPVs.

Non-Recourse SPVs and their limited recourse equipment financing

arrangements were intentionally structured for prudent risk

management to protect the underlying business and data center

infrastructure the Group has built.

The secured miners owned by each of Non-Recourse SPV 2 and

Non-Recourse SPV 3 currently produce insufficient cash flow to

service their respective debt financing obligations and, in

aggregate:

- Are currently capable of generating

an indicative $2 million of Bitcoin mining monthly gross profit3,

compared to aggregate required monthly principal and interest

payment obligations of $7 million.

- Have a market value which the

Company currently estimates to be approximately $65 to $70

million4, relative to an aggregate $103 million principal amount of

loans outstanding as at September 30, 2022.

Non-Recourse SPV 2 and Non-Recourse SPV 3 are engaged in

discussions with their lender and reached an agreement for a

two-week deferral of scheduled principal payments originally due

under both equipment financing arrangements on October 25, 2022, to

November 8, 2022.

Unless a suitable agreement is reached with the lender on

modified terms for both equipment financing arrangements, the Group

does not intend to provide further financial support to

Non-Recourse SPV 2 and Non-Recourse SPV 3.

In this case, the Company expects that neither of those

Non-Recourse SPVs will be able to make the scheduled principal

payment on November 8, 2022, which would result in a default for

those Non-Recourse SPVs under their respective limited recourse

equipment financing arrangements.5

2.4 EH/s of miners2 and all of the Group’s data centers &

development pipeline are unaffected. The Group is exploring

opportunities to utilize its data center capacity that may become

available in the event the Group elects to no longer provide

financial support to these financing arrangements and the lender

forecloses on the equipment owned by the relevant special purpose

vehicles. Such opportunities include third-party hosting and

self-mining, recognizing:

- Current scarcity of industry hosting

data center capacity.

- Prospect of utilizing $75 million of

prepayments already made to Bitmain in respect of an additional 7.5

EH/s of contracted miners for additional self-mining (see

below).

Bitmain Prepayments

On August 1, 2022, the Company announced it had purchased an

additional 1.7 EH/s of S19j Pro miners, reducing prepayments made

to Bitmain from $130 million to $83 million.

The Company is pleased to announce today that it has utilized an

additional portion of its prepayments with Bitmain to purchase

additional miners, further reducing unutilized prepayments made to

Bitmain from $83 million to $75 million in respect of additional

contracted miners.

The Company simultaneously sold the same purchased miners to a

third party, resulting in net cash proceeds of $8.6 million, which

have been received in full by the Company.6

The remaining $75 million of prepayments the Company has made to

Bitmain relate to an additional 7.5 EH/s of S19j Pro miners, which

is separate and incremental to the Company’s previously announced

6.0 EH/s of capacity.7

Iris Energy’s Co-Founder & Co-CEO, Daniel Roberts, said:

“The limited recourse equipment financing arrangements have been

a recent focus for us. We remain committed to exploring a way in

which we may be able to allow the lender to recover its capital

investment, however, we are also mindful of the current market and

that these arrangements were deliberately structured to minimize

any potential impact on the broader Group during a protracted

market downturn.”

“With respect to the latest utilization of the Bitmain deposits,

this is a testament to the creativity and effort of our team. We

look forward to working with Bitmain to secure further mutually

beneficial outcomes for both parties on the remaining $75 million

of prepayments we have previously paid to them. The receipt of an

additional $8.6 million in cash is also helpful in the context of

current market conditions and our ongoing planning.”

About Iris Energy

Iris Energy is a sustainable Bitcoin mining

company that supports the decarbonization of energy markets and the

global Bitcoin network.

- 100% renewables:

Iris Energy targets markets with low-cost, under-utilized renewable

energy, and where the Company can support local

communities

- Long-term security

over infrastructure, land and power supply: Iris Energy builds,

owns and operates its electrical infrastructure and proprietary

data centers, providing long-term security and operational control

over its assets

-

Seasoned management team: Iris Energy’s team has an impressive

track record of success across energy, infrastructure, renewables,

finance, digital assets and data centers with cumulative experience

in delivering >$25bn in energy and infrastructure projects

globally

Forward-Looking

Statements

This press release includes “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements generally relate to

future events or Iris Energy’s future financial or operating

performance. For example, forward-looking statements include but

are not limited to the expected increase in the Company’s power

capacity and operating capacity, the Company’s business plan, the

Company’s capital raising plans, the ability of the Company’s

special purpose vehicles to service their debt and the consequences

of a failure to make required payments on such debt when due, the

impact of discussions with the lender under limited recourse

equipment financing arrangements in the Company’s special purpose

vehicles, the Company’s anticipated capital expenditures and

additional borrowings, the impact of discussions with Bitmain

regarding the Company’s hardware purchase contract for additional

miners, and the expected schedule for hardware deliveries and for

commencing and/or expanding operations at the Company’s sites. In

some cases, you can identify forward-looking statements by

terminology such as “anticipate,” “believe,” “may,” “can,”

“should,” “could,” “might,” “plan,” “possible,” “project,”

“strive,” “budget,” “forecast,” “expect,” “intend,” “target”,

“will,” “estimate,” “predict,” “potential,” “continue,” “scheduled”

or the negatives of these terms or variations of them or similar

terminology, but the absence of these words does not mean that

statement is not forward-looking. Such forward-looking statements

are subject to risks, uncertainties, and other factors which could

cause actual results to differ materially from those expressed or

implied by such forward looking statements. In addition, any

statements or information that refer to expectations, beliefs,

plans, projections, objectives, performance or other

characterizations of future events or circumstances, including any

underlying assumptions, are forward-looking.

These forward-looking statements are based on

management’s current expectations and beliefs. These statements are

neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause

Iris Energy’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements, including, but not limited to: Iris Energy’s limited

operating history with operating losses; electricity outage,

limitation of electricity supply or increase in electricity costs;

long term outage or limitation of the internet connection at Iris

Energy’s sites; any critical failure of key electrical or data

center equipment; serial defects or underperformance with respect

to Iris Energy’s equipment; failure of suppliers to perform under

the relevant supply contracts for equipment that has already been

procured which may delay Iris Energy’s expansion plans; supply

chain and logistics issues for Iris Energy or Iris Energy’s

suppliers; cancellation or withdrawal of required operating and

other permits and licenses; customary risks in developing

greenfield infrastructure projects; Iris Energy’s evolving business

model and strategy; Iris Energy’s ability to successfully manage

its growth; Iris Energy’s ability to raise additional financing

(whether because of the conditions of the markets, Iris Energy’s

financial condition or otherwise) on a timely basis, or at all,

which could adversely impact the Company’s ability to meet its

capital commitments (including payments due under its hardware

purchase contracts with Bitmain) and the Company’s growth plans;

Iris Energy’s failure to make certain payments due under any one of

its hardware purchase contracts with Bitmain on a timely basis

could result in liquidated damages, claims for specific performance

or other claims against Iris Energy, any of which could result in a

loss of all or a portion of any prepayments or deposits made under

the relevant contract or other liabilities in respect of the

relevant contract, and could also result in Iris Energy not

receiving certain discounts under the relevant contract or

receiving the relevant hardware at all, any of which could

adversely impact its business, operating expansion plans, financial

condition, cash flows and results of operations; the failure of

Iris Energy’s wholly-owned special purpose vehicles to make

required payments of principal and/or interest under their limited

recourse equipment financing arrangements when due, which would

constitute a default and, if not cured within the applicable cure

period (if any), would permit the lender thereunder to declare the

entire principal amount of the relevant loans to be immediately due

and payable, in which case we expect that those entities will not

have sufficient funds to repay such facilities absent a

refinancing, restructuring or modification of the terms of the

relevant facility or other relief or waiver from the lender (which

those entities may not be able to obtain on commercially reasonable

terms or without significant additional cost) and as a result such

lender could seek to foreclose on the Bitcoin miners and any other

assets securing the relevant loans and would have recourse to the

assets of the relevant special purpose vehicle, any of which could

result in the loss of such Bitcoin miners, materially reduce the

Company’s operating capacity, lead to bankruptcy or liquidation of

the relevant special purpose vehicles, and materially and adversely

impact the Company’s business, operating expansion plans, financial

condition, cash flows and results of operations; the terms of any

additional financing or any refinancing, restructuring or

modification to the terms of any existing financing, which could be

less favorable or require Iris Energy to comply with more onerous

covenants or restrictions, any of which could restrict its business

operations and adversely impact its financial condition, cash flows

and results of operations; competition; Bitcoin prices and global

hashrate, which could adversely impact the Company’s financial

condition, cash flows and results of operations, as well as its

ability to raise additional financing and the ability of its

wholly-owned special purpose vehicles to make required payments of

principal and/or interest on their equipment financing facilities;

risks related to health pandemics including those of COVID-19;

changes in regulation of digital assets; and other important

factors discussed under the caption “Risk Factors” in Iris Energy’s

annual report on Form 20-F filed with the SEC on September 13,

2022, as such factors may be updated from time to time in its other

filings with the SEC, accessible on the SEC’s website at

www.sec.gov and the Investor Relations section of Iris Energy’s

website at https://investors.irisenergy.co.

These and other important factors could cause

actual results to differ materially from those indicated by the

forward-looking statements made in this press release. Any

forward-looking statement that Iris Energy makes in this press

release speaks only as of the date of such statement. Except as

required by law, Iris Energy disclaims any obligation to update or

revise, or to publicly announce any update or revision to, any of

the forward-looking statements, whether as a result of new

information, future events or otherwise.

Preliminary Financial

Information

The preliminary financial information for the

month of October 2022 included in this investor update is not

subject to the same closing procedures as our unaudited quarterly

financial results and has not been reviewed by our independent

registered public accounting firm. The preliminary financial

information included in this investor update does not represent a

comprehensive statement of our financial results or financial

position and should not be viewed as a substitute for unaudited

financial statements prepared in accordance with International

Financial Reporting Standards. Accordingly, you should not place

undue reliance on the preliminary financial information included in

this investor update.

Contacts

MediaJon SnowballDomestique+61 477 946 068

InvestorsBom ShinIris Energy+61 411 376

332bom.shin@irisenergy.co

To keep updated on Iris Energy’s news releases and SEC filings,

please subscribe to email alerts at

https://investors.irisenergy.co/ir-resources/email-alerts.

________________________

1 USD equivalent, unaudited preliminary balance.2 Includes 0.2

EH/s of miners owned by Non-Recourse SPV 1 which secure its

equipment financing arrangements.3 Please see the Coinwarz Bitcoin

Mining Calculator

(https://www.coinwarz.com/mining/bitcoin/calculator). Assumptions:

3,600 PH/s (hashrate), 118MW (power consumption), $0.065/kWh

(assuming observed indicative market hosting rates), 0.50% (pool

fees), $20,000 (Bitcoin price), ~264 EH/s (difficulty-implied

global hashrate) and 6.35 (Bitcoin Block Reward) – prefilled link

here.4 Based on recent observed Bitmain pricing of $19/TH for S19j

Pro miners, noting ~45% of the relevant financed miners are lower

efficiency S19j miners.5 Such default would permit the lender to

declare the entire $103 million aggregate principal amount of the

relevant equipment financing facilities to be immediately due and

payable by Non-Recourse SPV 2 and Non-Recourse SPV 3. We expect

that Non-Recourse SPV 2 and Non-Recourse SPV 3 will not have

sufficient funds to repay such equipment financing facilities, in

which case such lender could enforce its security interest and

foreclose on the Bitcoin miners owned by Non-Recourse SPV 2 and

Non-Recourse SPV 3, respectively, which could result in the loss of

such miners and materially reduce the Company’s operating capacity,

and could also lead to bankruptcy or liquidation of the relevant

Non-Recourse SPVs.6 Net cash proceeds is after additional payments

to Bitmain in connection with the purchase of such miners. The

difference between net cash proceeds to Iris Energy of $8.6 million

and the reduction in prepayments made to Bitmain of $8.3 million

relates to additional cash benefits received by Iris Energy as part

of the transaction.7 Excludes any discount arrangements under the

agreement, which may include potential additional miners. The

timing and volume of any additional future deliveries under the

separate $400 million hardware purchase contract for miners are

subject to ongoing discussions with Bitmain. The Company has not

made all recent payments under that contract and does not currently

expect to make upcoming payments in respect of any such additional

future deliveries under that contract. The Company can make no

assurances as to the outcome of these discussions (including any

impact on the Company’s expansion plans or payments made under that

contract).

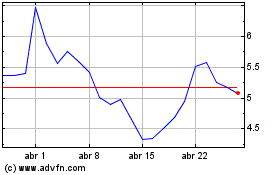

Iris Energy (NASDAQ:IREN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Iris Energy (NASDAQ:IREN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024