Iris Energy Commences 5.5 EH/s Installation and Confirms No Deposits with Silicon Valley Bank, Silvergate Capital, or Signature Bank

13 Março 2023 - 8:57AM

Iris Energy Limited (NASDAQ: IREN) (together with its subsidiaries,

“Iris Energy”, “the Company” or “the Group”), a leading owner and

operator of institutional-grade, highly efficient Bitcoin mining

data centers powered by 100% renewable energy, today announced it

has commenced taking delivery of, and installing, miners in respect

of its ramp up to 5.5 EH/s of operating capacity, and also

confirmed it does not hold deposits with Silicon Valley Bank,

Silvergate Capital or Signature Bank.

Commencement of 5.5 EH/s

installation

Further to the Company’s announcement on

February 13, 2023 that it is increasing its self-mining operating

capacity to 5.5 EH/s, the Company is pleased to advise that it has

commenced taking delivery of, and installing, the newly acquired

miners.

Delivery of the remaining miners is expected by

the end of March, with the majority of these miners expected to be

operational shortly thereafter.

160MW of data center infrastructure (supporting

~4.9 EH/s) is available immediately, with commissioning of the

first 20MW at Childress (supporting the remaining ~0.6 EH/s)

expected in the coming months.

No deposits with Silicon Valley Bank,

Silvergate Capital or Signature Bank

In respect of recent market events, in

particular developments in relation to Silicon Valley Bank,

Silvergate Capital and Signature Bank, the Company confirms it does

not hold deposits or securities or maintain any accounts with any

of these entities.

About Iris Energy

Iris Energy is a sustainable Bitcoin mining

company that supports the decarbonization of energy markets and the

global Bitcoin network.

- 100% renewables:

Iris Energy targets markets with low-cost, under-utilized renewable

energy, and where the Company can support local communities

- Long-term security

over infrastructure, land and power supply: Iris Energy builds,

owns and operates its electrical infrastructure and proprietary

data centers, providing long-term security and operational control

over its assets

- Seasoned management

team: Iris Energy’s team has an impressive track record of success

across energy, infrastructure, renewables, finance, digital assets

and data centers with cumulative experience in delivering >$25bn

in energy and infrastructure projects globally

Forward-Looking Statements

This investor update includes “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements generally relate to

future events or Iris Energy’s future financial or operating

performance. For example, forward-looking statements include but

are not limited to the Company’s business strategy, expected

operational and financial results, and expected increase in power

capacity and hashrate. In some cases, you can identify

forward-looking statements by terminology such as “anticipate,”

“believe,” “may,” “can,” “should,” “could,” “might,” “plan,”

“possible,” “project,” “strive,” “budget,” “forecast,” “expect,”

“intend,” “target”, “will,” “estimate,” “predict,” “potential,”

“continue,” “scheduled” or the negatives of these terms or

variations of them or similar terminology, but the absence of these

words does not mean that statement is not forward-looking. Such

forward-looking statements are subject to risks, uncertainties, and

other factors which could cause actual results to differ materially

from those expressed or implied by such forward looking statements.

In addition, any statements or information that refer to

expectations, beliefs, plans, projections, objectives, performance

or other characterizations of future events or circumstances,

including any underlying assumptions, are forward-looking.

These forward-looking statements are based on

management’s current expectations and beliefs. These statements are

neither promises nor guarantees, but involve known and unknown

risks, uncertainties and other important factors that may cause

Iris Energy’s actual results, performance or achievements to be

materially different from any future results, performance or

achievements expressed or implied by the forward-looking

statements, including, but not limited to: Iris Energy’s limited

operating history with operating losses; electricity outage,

limitation of electricity supply or increase in electricity costs,

as well as limitations on the availability of electrical supply for

Bitcoin mining due to restrictions imposed by governmental

authorities or otherwise; long term outage or limitation of the

internet connection at Iris Energy’s sites; any critical failure of

key electrical or data center equipment; serial defects or

underperformance with respect to Iris Energy’s equipment; failure

of suppliers to perform under the relevant supply contracts for

equipment that has already been procured which may delay Iris

Energy’s expansion plans; supply chain and logistics issues for

Iris Energy or Iris Energy’s suppliers; cancellation or withdrawal

of required operating and other permits and licenses; customary

risks in developing greenfield infrastructure projects; Iris

Energy’s evolving business model and strategy; Iris Energy’s

ability to successfully manage its growth; Iris Energy’s ability to

raise additional financing (whether because of the conditions of

the markets, Iris Energy’s financial condition or otherwise) on a

timely basis, or at all, which could adversely impact the Company’s

ability to meet its capital commitments (including payments due

under any hardware purchase contracts or debt financing

obligations) and the Company’s growth plans; the failure of Iris

Energy’s wholly-owned special purpose vehicles to make required

payments of principal and/or interest under their limited recourse

equipment financing arrangements when due or otherwise comply with

the terms thereof, as a result of which the lender thereunder has

declared the entire principal amount of each loan to be immediately

due and payable, and is taking steps to enforce the indebtedness

and its rights in the Bitcoin miners with respect to certain of

such loans and other assets securing such loans, including

appointing a receiver with respect to such special purpose

vehicles, which is expected to result in the loss of the relevant

Bitcoin miners securing such loans and has materially reduced the

Company’s operating capacity, and could also lead to bankruptcy or

liquidation of the relevant special purpose vehicles, and

materially and adversely impact the Company’s business, operating

expansion plans, financial condition, cash flows and results of

operations; the terms of any additional financing or any

refinancing, restructuring or modification to the terms of any

existing financing, which could be less favorable or require Iris

Energy to comply with more onerous covenants or restrictions, any

of which could restrict its business operations and adversely

impact its financial condition, cash flows and results of

operations; competition; Bitcoin prices, global hashrate and the

market value of Bitcoin miners, any of which could adversely impact

its financial condition, cash flows and results of operations, as

well as its ability to raise additional financing and the ability

of its wholly owned special purpose vehicles to make required

payments of principal and/or interest on their equipment financing

facilities; risks related to health pandemics including those of

COVID-19; changes in regulation of digital assets; and other

important factors discussed under the caption “Risk Factors” in

Iris Energy’s annual report on Form 20-F filed with the SEC on

September 13, 2022, and the Company’s report on Form 6 K filed with

the SEC on February 15, 2023, as such factors may be updated from

time to time in its other filings with the SEC, accessible on the

SEC’s website at www.sec.gov and the Investor Relations section of

Iris Energy’s website at https://investors.irisenergy.co.

These and other important factors could cause

actual results to differ materially from those indicated by the

forward-looking statements made in this investor update. Any

forward-looking statement that Iris Energy makes in this investor

update speaks only as of the date of such statement. Except as

required by law, Iris Energy disclaims any obligation to update or

revise, or to publicly announce any update or revision to, any of

the forward-looking statements, whether as a result of new

information, future events or otherwise.

Contacts

|

Investors |

Media |

|

Lincoln Tan |

Jon Snowball |

|

Iris Energy |

Domestique |

|

+61 407 423 395 |

+61 477 946 068 |

|

lincoln.tan@irisenergy.co |

|

To keep updated on Iris Energy’s news releases

and SEC filings, please subscribe to email alerts at

https://investors.irisenergy.co/ir-resources/email-alerts.

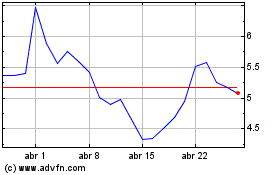

IREN (NASDAQ:IREN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

IREN (NASDAQ:IREN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024