CREDIT AGRICOLE SA: Crédit Agricole and Worldline enter into

exclusive discussions to create a major player in merchant services

in France

Crédit Agricole and

Worldlineenter

into exclusive

discussions to create

a major playerin merchant

services in France

A unique

alliance to create

a major

payments player

in the largest

Continental Europe payment market

ofc.€ 700

billion Merchant Sales Value

(“MSV”)

Strategic

long-term partnershipbetween

the leading French

retail banking Credit Agricole

Group and Worldline

Contemplated

creation of a joint company fully

operational by 2025

combiningCrédit

Agricole’s merchant

acquiring footprint, French market

intimacy and distribution power

with Worldline’s

leading innovation, technologyand global

infrastructure

Paris, La Défense,

April 19,

2023 – Worldline

[Euronext: WLN], a global leader in

payment services, and Crédit Agricole

SA [Euronext:

ACA], announced

today the signing of a

non-binding exclusive agreement

regarding a strategic partnership to

create a major player

in the French payment market.

Gilles

Grapinet, CEO of Worldline, said:

“The contemplated strategic alliance we announce today between

Worldline and Crédit Agricole is a landmark transaction for the

Group. I am very proud that Worldline has been selected by Crédit

Agricole for a strategic long-term partnership combining our

merchant services capabilities, with the joint ambition to create a

player able to deliver premier services to all merchants operating

in France. The perfect fit of Worldline’s state-of-the-art

products, technology and services at scale combined with Crédit

Agricole Group unique distribution network and acquiring market

leadership would be a key differentiating factor for our

customers.

For Worldline, this is a unique opportunity to

further expand our footprint and to achieve scale within a few

years on the largest continental European acquiring market. Through

this strategic partnership, Worldline would also benefit from

additional specific French market offerings while we intend to

invest together with Crédit Agricole into an ambitious and

differentiating innovation roadmap leveraging the Worldline

leading-edge global value proposition.

Structured primarily as a contribution in kind

of our respective technological capabilities, commercial footprint

and distribution capabilities to a joint company, this major

contemplated transaction fully preserves our balance sheet and

financial and strategic flexibility.”

Jean-Paul Mazoyer, Deputy

General Manager of Crédit Agricole S.A. in charge of Technology,

Digital and Payments, commented: “Payments are a

cornerstone of the relationship with our customers, hence a

strategic business for the Credit Agricole Group. The partnership

with Worldline would allow us to strengthen our market leadership

in France for merchant payment solutions and fully aligns with

Credit Agricole’s 2025 ambitions to outperform the market growth by

2x on merchant payments solutions. Worldline is a French and

European leader in in-store and online acceptance and a prominent

payments processor in Europe.

Worldline is already a

trusted partner of the Credit Agricole Group and, through this

deepened strategic partnership, we would jointly develop

comprehensive services for French merchants on the whole merchant

services value chain (acceptance and acquiring) which is a

fast-moving and critical area to their business. This integrated

mastery would allow us to equip merchants with innovative

all-in-one offers that integrate natively in their ecosystem and

provide value added business services.”

Attractive

and evolving French

payment market

France is a highly attractive and strategic

market for Worldline. France is the 2nd largest

economy in Continental Europe, enjoying robust economic

performance, sustained by consistent policy frameworks and strong

institutions, as well as an attractive investment environment.

The French payment industry shows solid dynamics

with a sizable and growing addressable market and a high level of

readiness and receptiveness towards cashless payment methods. With

aggregated Merchant Sales Value (MSV) of c.€ 700 billion, the

French payment market is by far the largest payment market in

Continental Europe.

With cash penetration still high, at c.40% of

payment volumes, the French market offers an attractive growth

opportunity driven by the secular shift from cash to card and by

continued demand for innovation. Combined with French “Cartes

Bancaires” domestic scheme and its strong and resilient market

share capturing c.80% of card transactions volumes, these market

trends make France a particularly attractive country in the broader

European context.

The contemplated alliance between Crédit

Agricole and Worldline is a unique opportunity for both companies

to significantly expand their merchant services activities in this

high-potential market.

A partnership to

create a major

player in the French market

Leveraging the strengths of the two companies,

the contemplated partnership would offer a state-of-the-art

combination of technological and commercial offerings at scale

allowing to adequately respond to any type of evolving merchant

needs, whether local or global. It would be fueled by:

- Worldline’s vertical expertise

embedded into strong instore and online capabilities to serve

merchants at scale thanks to its global solutions, platforms and

payment applications, and;

- Crédit Agricole’s strong

distribution networks through the 39 Crédit Agricole ‘s Regional

Banks and LCL bank, combining a deep French market presence with

more than 16,000 banking advisors for enterprises1 and local

knowledge in merchants acquiring.

The partnership would be ensured by the set-up

of a fully licensed joint-company between Crédit Agricole and

Worldline. The joint-company would be majority owned (50% of total

capital plus one share) and fully consolidated by Worldline. It

would be in charge of leveraging Worldline’s global European

processing platforms and of developing all the innovative products

dedicated to the French market. The joint-company would also be in

charge of the commercial development of the alliance, both directly

for largest merchants in particular, and by providing an active

support to the bank distribution channels.

The contemplated joint-company would offer to

the key accounts in France a full-service offering leveraging

Worldline’s global acceptance and acquiring platform, including the

domestic “Cartes Bancaires” scheme. In parallel, Worldline would be

able to offer to its international merchants an access to the

domestic scheme, further expanding its broad range of payment

schemes.

With respect to SMBs, this planned combination

would also bring to merchants, whatever their size or location,

deep access to an enriched offering of payment brands and means,

and value-added services covering all their needs, from mobile

acceptance devices to more traditional Point-of-Sales (POS: Point

Of Sale) solutions for seamless payment experience, ultimately

improving merchant experience and consumer purchasing journeys.

These new all-in-one solutions combining instore

and online capabilities at large and local scale to serve French

merchants and consumers in the best way, coupled with the power of

Crédit Agricole’s distribution network, would be a key

differentiating factor to create a payments major player in

France.

Key steps of the

partnership implementation

The contemplated operation remains subject to

both parties’ works council consultation and to corporate

authorizations and customary regulatory approval:

- 2023-2024: Joint investment phase

of € 80 million equally financed by Worldline and Crédit Agricole

for the product and offering design, and joint company

implementation

- 2025 onwards: Full implementation

of the joint company starting to generate revenues and OMDA.

Contacts

Investor Relations

Worldline

Laurent Marie+33 7 84 50 18

90laurent.marie@worldline.com

Benoit d’Amécourt+33 6 75 51 41

47benoit.damecourt@worldline.com

Communication Worldline

Sandrine van der Ghinst+32 499 585

380sandrine.vanderghinst@worldline.com

Hélène Carlander+33 7 72 25 96

04helene.carlander@worldline.com

Investor Relations Crédit

Agricole SA

|

Institutional shareholders |

+ 33 1 43 23 04 31 |

investor.relations@credit-agricole-sa.fr |

|

Individual shareholders |

+ 33 800 000 777 (freephone number – France only) |

relation@actionnaires.credit-agricole.com |

| |

|

|

|

Clotilde L’Angevin |

+ 33 1 43 23 32 45 |

clotilde.langevin@credit-agricole-sa.fr |

|

Equity

investors: |

|

|

|

Jean-Yann AsserafFethi Azzoug |

+ 33 1 57 72 23 81+ 33 1 57 72 03 75 |

jean-yann.asseraf@credit-agricole-sa.fr

fethi.azzoug@credit-agricole-sa.fr |

|

Joséphine Brouard |

+ 33 1 43 23 48 33 |

joséphine.brouard@credit-agricole-sa.fr |

|

Oriane Cante |

+ 33 1 43 23 03 07 |

oriane.cante@credit-agricole-sa.fr |

|

Nicolas Ianna |

+ 33 1 43 23 55 51 |

nicolas.ianna@credit-agricole-sa.fr |

|

Leila Mamou |

+ 33 1 57 72 07 93 |

leila.mamou@credit-agricole-sa.fr |

|

Anna Pigoulevski |

+ 33 1 43 23 40 59 |

anna.pigoulevski@credit-agricole-sa.fr |

|

Annabelle Wiriath |

+ 33 1 43 23 55 52 |

annabelle.wiriath@credit-agricole-sa.fr |

| |

|

|

|

Credit investors and rating agencies: |

|

|

Caroline Crépin |

+ 33 1 43 23 83 65 |

caroline.crepin@credit-agricole-sa.fr |

|

Rhita Alami Hassani |

+ 33 1 43 23 15 27 |

rhita.alamihassani@credit-agricole-sa.fr |

|

Florence Quintin de Kercadio |

+ 33 1 43 23 25 32 |

florence.quintindekercadio@credit-agricole-sa.fr |

Communication Crédit

Agricole

Alexandre

Barat + 33 1 57 72

12

19 alexandre.barat@credit-agricole-sa.frOlivier

Tassain + 33 1 43 23

25

41 olivier.tassain@credit-agricole-sa.frMathilde

Durand + 33 1 57 72

19 43

mathilde.durand@credit-agricole-sa.frBénédicte

Gouvert

+33 1 49 53 43

64 benedicte.gouvert@ca-fnca.fr

Follow

us

About Worldline

Worldline [Euronext: WLN] helps businesses of

all shapes and sizes to accelerate their growth journey – quickly,

simply, and securely. With advanced payments technology, local

expertise and solutions customised for hundreds of markets and

industries, Worldline powers the growth of over one million

businesses around the world. Worldline generated a 4.4 billion

euros revenue in 2022. worldline.com

Worldline’s corporate purpose (“raison d’être”)

is to design and operate leading digital payment and transactional

solutions that enable sustainable economic growth and reinforce

trust and security in our societies. Worldline makes them

environmentally friendly, widely accessible, and supports social

transformation.

About Crédit Agricole

Group

The Crédit Agricole Group is the leading partner

of the French economy and one of the largest banking groups in

Europe. It is the leading retail bank in Europe as well as the

first European asset manager, the first bancassurer in Europe and

the third European player in project finance.

Built on its strong cooperative and mutual

roots, its 145,000 employees and the 27,000 directors of its Local

and Regional Banks, the Crédit Agricole Group is a responsible and

responsive bank serving 53 million customers, 11,5 million mutual

shareholders and 800,000 individual shareholders.

Thanks to its universal customer-focused retail

banking model – based on the cooperation between its retail banks

and their r elated business lines –, the Crédit Agricole Group

supports its customers’ projects in France and around the world:

day-to-day banking, home loans, consumer finance, savings,

insurances, asset management, real estate, leasing and factoring,

and corporate and investment banking.

Crédit Agricole also stands out for its dynamic,

innovative corporate social responsibility policy, for the benefit

of the economy. This policy is based on a pragmatic approach which

permeates across the Group and engages each

employee.Disclaimer Worldline

This document contains forward-looking

statements that involve risks and uncertainties, including

references, concerning the Group's expected growth and

profitability in the future which may significantly impact the

expected performance indicated in the forward-looking statements.

These risks and uncertainties are linked to factors out of the

control of the Company and not precisely estimated, such as market

conditions or competitors’ behaviors. Any forward-looking

statements made in this document are statements about Worldline’s

beliefs and expectations and should be evaluated as such.

Forward-looking statements include statements that may relate to

Worldline’s plans, objectives, strategies, goals, future events,

future revenues or synergies, or performance, and other information

that is not historical information. Actual events or results may

differ from those described in this document due to a number of

risks and uncertainties that are described within the 2021

Universal Registration Document filed with the French Autorité des

marchés financiers (AMF) on April 25, 2022 under the filling

number: D.22-0342 and its Amendment filed on July 29, 2022 under

the filling number: D. 21-0342-A01.

Worldline does not undertake, and specifically

disclaims, any obligation or responsibility to update or amend any

of the information above except as otherwise required by law.

This document is disseminated for information

purposes only and does not constitute an offer to purchase, or a

solicitation of an offer to sell, any securities in the United

States or any other jurisdiction. Securities may not be offered or

sold in the United States unless they have been registered under

the U.S. Securities Act of 1933, as amended (the “U.S. Securities

Act”) or the securities laws of any U.S. state, or are exempt from

registration. The securities that may be offered in any transaction

have not been and will not be registered under the U.S. Securities

Act or the securities laws of any U.S. state and Worldline does not

intend to make a public offering of any such securities in the

United States.

1 Pro/SME/Agri/Flux

- 2023 04 19 PR Worldline and Credit Agricole strategic

partnership

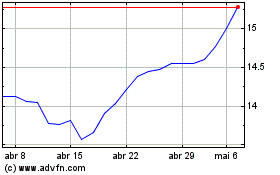

Credit Agricole (EU:ACA)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Credit Agricole (EU:ACA)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024