Atari launches an offering of bonds convertible into new ordinary

shares of Atari maturing in 2026 with a 6.50% coupon for a nominal

amount of approximately 30 million euros

Atari launches

an offering of bonds convertible into new ordinary shares of Atari

maturing in 2026 with a 6.50% coupon for a nominal amount of

approximately 30 million euros

- Issuance of bonds convertible into ordinary shares

without shareholders' preferential subscription rights, by way of a

public offering and with a four-day priority subscription period,

on an irreducible and reducible basis

- Public subscription period and priority subscription

period: from May 25, 2023 to May 30, 2023 (included) at 5:00 p.m.

(Paris time)

- Subscription price set at 0.15 euro per convertible

bond

- Subscription commitment of Irata LLC to subscribe for

100% of the Offering

- Key financial information as of March 31,

2023

PARIS, FRANCE

(May 25, 2023 - 7:45 am CET) - Atari® (the

"Company") — one of the world's most iconic

consumer brands and interactive entertainment producers —announced

today the launch of an offering of senior unsecured bonds

convertible into new ordinary shares maturing on July 31, 2026 (the

"Convertible Bonds"), for a nominal amount of

approximately 30 million euros, without shareholders' preferential

subscription rights, by way of a public offering in France and with

a priority subscription period for shareholders to subscribe for

the bonds on a reducible and irreducible basis (the

"Offering").

Legal framework of the

Offering

The Offering is being carried out by way of a

public offering in France, except offerings as defined in paragraph

1 of article L.411-2 of the French Monetary and Financial Code,

without preferential subscription rights for shareholders with a

priority subscription period, in accordance with the 13th and 23rd

resolutions adopted by the combined general meeting of shareholders

of the Company held on September 27, 2022.

A priority subscription period of four business

days, from May 25, 2023 to May 30, 2023 (included), is granted to

the shareholders whose shares are registered in their account on

May 24, 2023, which will enable them to subscribe in priority to

the Convertible Bonds (i) on an irreducible basis up to the amount

of their share in the share capital of the Company and (ii) on a

reducible basis to a number of Convertible Bonds higher than the

number to which they can subscribe on an irreducible basis,

allocated in proportion to their irreducible applications and, in

any event, up to the limit of their demand. This priority period is

neither transferable nor negotiable.

Convertible Bonds not subscribed for, on an

irreducible or reducible basis, within the priority subscription

period by shareholders will be offered to the public in the context

of a public offering in France, it being specified that the

Offering is subject to a subscription commitment by Irata LLC

(“Irata”) for the entire amount of the

convertible bond offering during the subscription period (the

“Subscription Commitment”). Any orders received

within the public offering are therefore likely not to be

served.

The subscription price of the Convertible Bonds

under the priority subscription period will be equal to the

subscription price of the Convertible Bonds in the public offering

and is set at 0.15 euro per share. The subscription price per

Convertible Bond shall be equal to the nominal value of each

Convertible Bond, to be fully paid up in cash and/or by way of

set-off of claims at the time of subscription. On the basis of the

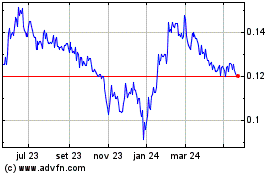

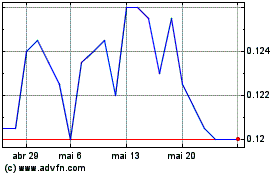

closing price of the Company's shares on May 23, 2023, i.e. 0.1304

euro, the subscription price of one Convertible Bond of 0.15 euro

represents a premium of 15%.

Subscription commitment

Irata, a 27.73% shareholder of the Company and

held by Wade Rosen, chairman and CEO of Atari, has irrevocably

undertaken in the Subscription Commitment to subscribe to the

Offering during the priority subscription period of the Offering,

on an irreducible basis, up to the amount of its stake in the

Company's share capital (i.e. a total number of 55,460,000

Convertible Bonds) and on a reducible basis, up to the balance of

the total amount of the Offering not subscribed by it on an

irreducible basis, i.e. up to a maximum total amount (including

conversion premium) of 21,681,000 euros (i.e., up to 144,540,000

Convertible Bonds). Moreover, in the event that at the end of the

subscription period of the Offering, the subscriptions do not

represent 100% of the amount of the Offering, Irata has irrevocably

and unconditionally undertaken to subscribe for the Convertible

Bonds which will have not been fully paid by the subscribers,

allowing for full subscription of this threshold of 100% of the

principal amount of this convertible bonds offering, i.e. up to a

maximum of 200,000,000 Convertible Bonds for an amount of 30

million euros.

The amount of the Subscription Commitment will

be paid, in priority, by way of set-off against due claims that

Irata holds on the Company in respect of shareholders' loans

previously granted, for an aggregate amount of €16,333,740.68 and

the balance in cash.

In addition, Irata has agreed not to convert the

Convertible Bonds prior to June 30, 2025 (date on which the

triggering threshold for a mandatory tender offering on the

Company's shares is raised from 30% to 50% of the shares and/or the

voting rights), provided that in the event of a tender offer on

Atari's securities filed by a third party prior to June 30, 2025,

Irata will have the option to convert its Convertible Bonds prior

to such date. As from January 1, 2024, Irata also retains the right

to convert its Convertible Bonds upon clearance by AMF (décision de

conformité) of a tender offer on the Company's securities filed by

Irata (or an affiliate).

Use of

proceeds

On the basis of 100% of the Offering, the gross

proceeds from the Offering will amount to approximately 30 million

euros and the net proceeds will amount to 29 million euros, it

being specified that Irata's subscription to the Offering will be

made by way of debt set-off in respect of the repayment of

shareholder loans up to its current amount of €16,333,740.68, thus

reinforcing the balance sheet of the Company.

The balance of the proceeds from the Offering

will enable the Company to increase its financial flexibility and

general corporate purposes in the context of the development of its

transformation strategy:

- Continued investment in growth initiatives, notably with the

on-going development of more than 12 new games that are expected to

be launched in the next 18 months; and

- Seize additional acquisition of opportunities that may arise,

including intellectual property rights and direct minority

investment in companies offering value-added solutions for the

Group.

Prior to the Offering, the Company does not have

sufficient consolidated net working capital to meet its current

obligations for the next (12) months, including the expected

contribution of Night Dive Studios. Based on current and planned

development projects, notably given the expenses incurred for the

ongoing development of new games, the Company will be able to fund

its operations until the end of the month of June 2023, without

taking into account the proceeds from the Offer. The net amount of

additional cash required by the Company to meet its needs over the

next 12 months amounts to around 4.5 million euros.

Although the Company currently benefits from the

continued financial support of its principal shareholder Irata

through September 2023, the Offering is the preferred solution for

the Company to finance its activity, it being specified that this

transaction is subject to the firm and irrevocable Subscription

Commitment by Irata covering 100% of the Offering amount. In the

event of completion of the Offering, the Company will have

sufficient consolidated net working capital to meet its cash

requirements over the next twelve (12) months.

Date of issue and interest

The Convertible Bonds shall be issued at par and

will bear interest from June 5, 2023 (the "Issue

Date") at a rate of 6.50% per annum, payable semi-annually

in arrears on July 31 and January 31 of each year (or if such date

is not a business day the following business day), and for the

first time on January 31, 2024, being 0.00975 euro per Convertible

Bond per year.

Conversion Right

Holders of Convertible Bonds will be granted a

conversion right into new shares of the Company (the

"Conversion Right") that they are entitled to

exercise at any time from the Issue Date (included) until the

seventh business day (included) preceding the Maturity Date, or the

relevant early redemption date, as the case may be.

The conversion ratio is set at one share per

Convertible Bond, subject to customary adjustments, as described in

the terms and conditions of the Convertible Bonds in the Securities

Note.

The new shares potentially delivered will be

fully fungible with the existing shares of the Company, and shall

bear, in any case, current dividend from the date of their delivery

and shall be admitted to trading on the Euronext Growth market in

Paris ("Euronext Growth") (ISIN:

FR0010478248).

Redemption of Convertible

Bonds

Unless previously converted, redeemed or

repurchased and cancelled, the Convertible Bonds will be redeemed

at par on July 31, 2026 (or the following business day if such date

is not a business day) (the "Maturity Date").

The Convertible Bonds may be redeemed prior to

the Maturity Date, at the Company's option, and at the holders'

option, under certain conditions.

In particular, the Convertible Bonds may be

redeemed early in full at par plus accrued and unpaid interest at

the option of the Company at any time on or after August 21, 2025

and until the Maturity Date, subject to at least 30 (but nor more

than 60) calendar days' prior notice, if the arithmetic average

calculated over a period of 20 consecutive trading days selected by

the Company from among the 40 consecutive trading days preceding

the date of publication of the notice of early redemption, of the

daily product of (i) the volume-weighted average price of the

Company's shares on Euronext Growth on each trading day during the

considered period and (ii) the applicable conversion ratio in

effect on each of these dates exceeds 130% of the nominal value of

the Convertible Bonds.

The Convertible Bonds may also be redeemed early

in full at par plus accrued and unpaid interest at the option of

the Company at any time if the amount of the Convertible Bonds

outstanding is equal or less than 20% of the total amount of the

Offering.

In the event of a change of control of the

Company, the holders of the Convertible Bonds may request the early

redemption of their Convertible Bonds prior to the Maturity Date at

par plus accrued and unpaid interest.

Admission to trading

Application will be made for the Convertible

Bonds to be listed on Euronext Growth before 5 July, 2023 at the

latest.

Dilution

For information purposes, based on a 30 million

euros Offering and a 0.15 euro conversion price, the impact of the

issuance on the shareholding of a shareholder holding 1% of the

Company's share capital prior to the issue and not subscribing to

it would be as follows:

|

|

Ownership interest (in %) |

|

|

On a non-diluted basis |

On a diluted basis(1) |

|

Prior to Offering |

1.00% |

0.97% |

|

Following the Offering and conversion into shares of 200,000,000

Convertible Bonds resulting from the present transaction (100%

completion) |

0.68% |

0.66% |

(1) After issuance of

a maximum total number of 14,354,103 ordinary shares resulting from

the exercise or conversion of all existing dilutive instruments

(BSA, options, free shares).

Indicative

timetable

|

May 15, 2023 |

Company's Board of Directors meeting authorizing the launch of the

Offering and delegating to the Chief Executive Officer the powers

to set its main characteristics |

|

May 23, 2023 |

Chief Executive Officer decision to launch the Offering and to set

its main characteristics |

|

May 24, 2023 |

Publication of the amendment to the URD and approval of the AMF of

the Prospectus Record date at the end of which the holders of

existing shares registered in the accounts are deemed to be able to

participate in the Offering within the priority subscription

period |

|

May 25, 2023 (before opening of the Euronext Paris markets) |

Publication of a press release by the Company (i) announcing that

it has obtained the approval of the AMF, (ii) the launch and terms

of the Convertible Bonds and (iii) the availability of the

Prospectus |

|

May 25, 2023 |

Publication of the Euronext notice relating to the Offering Opening

of the priority subscription period of the Convertible Bonds

Opening of the public offering |

|

May 30, 2023 |

Closing of the priority subscription period of the Convertible

Bonds (5pm) Closing of the public offering (5pm) |

|

May 31, 2023 |

Deadline for financial intermediaries to communicate the

subscriptions to Uptevia (10am) |

|

June 1, 2023 |

Publication of a press release by the Company announcing the final

terms of the Convertible Bonds (after closing of Euronext Paris

markets) Publication by Euronext of the notice of admission of the

Convertible Bonds |

|

June 5, 2023 |

Issuance and settlement-delivery of the Convertible Bonds |

|

July 5, 2023 at the latest |

Admission of the Convertible Bonds to trading on Euronext

Growth |

Provision of the

prospectus

The prospectus (the

"Prospectus") comprises (i) the Company's

universal registration document approved by the AMF on July 27,

2022 under number D.22-0661 (the "Universal Registration

Document"), (ii) an amendment to the Universal

Registration Document filed with the AMF on May 24, 2023 under

number D.22-0661-A01 (the "Amendment") and (iii) a

securities note (including the summary of the Prospectus as set

forth in the appendix to this press release) (the

"Securities Note") and is made available to the

public after the approval of the Prospectus by the AMF under number

23-180 on May 24, 2023.

Copies of the

Prospectus will be available free of charge at the Company's

registered office, 25 rue Godot de Mauroy, 75009 Paris, France. The

Prospectus will also be available on the Company's website

(https://www.atari-investisseurs.fr) as well as on the AMF's

website (www.amf-france.org).

The attention of investors is drawn to the risk

factors described in section 5 "Risk factors" of the Universal

Registration Document, in section 4 "Risk factors" of the Amendment

and in section 2 "Risk factors relating to the offer" of the

Securities Note. The realization of some or all of these risks

could have a negative impact on the business activity, situation,

financial results or objectives of the Group.

Key financial information as of March 31, 2023

(unaudited)

For the fiscal year ended March 31, 2023, the

revenues of the Group for the year are expected to stand at around

€10M, a decrease of around 30% compared to previous fiscal year.

Financial information as of March 31, 2023 for the four business

lines of the Group:

- Games - Games revenues are expected to reach

around €7.0M, compared to revenues of €5.7M for the last financial

year.

- Hardware - Hardware revenues for the period

are expected to reach around €0.8M, compared to revenues of €3.1M

for the last financial year.

- Licensing - Licensing revenues for the period

are expected to be around €1.2M, compared to €1.3M for the last

financial year.

- Web3 - Web3 revenues for the period are

expected to be around €0.8M, a decrease compared to previous period

which accounted for exceptional sales of certain digital

assets.

ABOUT

ATARI

Atari is an interactive entertainment company

and an iconic gaming industry brand that transcends generations and

audiences. The company is globally recognized for its

multi-platform, interactive entertainment and licensed products.

Atari owns and/or manages a portfolio of more than 200 unique games

and franchises, including world-renowned brands like Asteroids®,

Centipede®, Missile Command®, Pong®, and RollerCoaster Tycoon®.

Atari has offices in New York and Paris. Visit us online at

www.atari.com.

Atari shares are listed in France on Euronext

Growth Paris (ISIN Code FR0010478248, Ticker ALATA) and OTC Pink

Current (Ticker PONGF).

©2023 Atari Interactive, Inc. Atari wordmark and

logo are trademarks owned by Atari Interactive, Inc.

Contacts

Atari - Investor RelationsTel + 33 1 83 64 61 57

- investisseur@atari-sa.com | www.atari.com/news/

Calyptus - Marie Calleux Tel + 33 1 53 65 68 68 -

atari@calyptus.net

Listing Sponsor - EurolandTel +33 1 44 70 20

84Julia Bridger - jbridger@elcorp.com

FORWARD-LOOKING STATEMENTS

This press release contains certain non-factual

elements, including but not restricted to certain statements

concerning its future results and other future events. These

statements are based on the current vision and assumptions of

Atari’s leadership team. They include various known and unknown

uncertainties and risks that could result in material differences

in relation to the expected results, profitability and events. In

addition, Atari, its shareholders and its respective affiliates,

directors, executives, advisors and employees have not checked the

accuracy of and make no representations or warranties concerning

the statistical or forward-looking information contained in this

press release that is taken from or derived from third-party

sources or industry publications. If applicable, these statistical

data and forward-looking information are used in this press release

exclusively for information.

DISCLAIMER

The distribution of this press release and the

offer and sale of the Convertible Bonds may be restricted by law in

certain jurisdictions and persons into whose possession this

document or other information referred to herein comes should

inform themselves about and observe any such restriction. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction.

Not for release, directly or indirectly in or

into the United States, Canada, South Africa, Japan or Australia.

This document (and the information contained herein) does not

contain or constitute an offer of securities for sale, or

solicitation of an offer to purchase securities, in the United

States, Canada, South Africa, Japan or Australia or any other

jurisdiction where such an offer or solicitation would be unlawful.

The securities referred to herein have not been and will not be

registered under the U.S. Securities Act of 1933, as amended (the

“Securities Act”), or under the securities laws of

any state or other jurisdiction of the United States, and may not

be offered or sold in the United States except pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and in compliance

with the securities laws of any state or any other jurisdiction of

the United States. No public offering of the securities will be

made in the United States.

This press release and the information contained

herein do not constitute either an offer to sell or purchase, or

the solicitation of an offer to sell or purchase, securities of the

Company.

No communication or information in respect of

any securities mentioned in this press release may be distributed

to the public in any jurisdiction where registration or approval is

required. No steps have been taken or will be taken in any

jurisdiction where such steps would be required. The offering or

subscription of the Company’s securities may be subject to specific

legal or regulatory restrictions in certain jurisdictions.

This press release does not, and shall not, in

any circumstances, constitute a public offering, a sale offer nor

an invitation to the public in connection with any offer of

securities. The distribution of this document may be restricted by

law in certain jurisdictions. Persons into whose possession this

document comes are required to inform themselves about and to

observe any such restrictions.

This announcement is an advertisement and not a

prospectus within the meaning of Regulation (EU) 2017/1129, as

amended (the "Prospectus Regulation").

With respect to the member states of the

European Economic Area other than France, no action has been

undertaken or will be undertaken to make an offer to the public of

the securities referred to herein requiring a publication of a

prospectus in any relevant member state. As a result, the

securities may not and will not be offered in any relevant member

state except in accordance with the exemptions set forth in Article

1 (4) of the Prospectus Regulation or under any other circumstances

which do not require the publication by the Company of a prospectus

pursuant to Article 3 of the Prospectus Regulation and/or to

applicable regulations of that relevant member state.

The distribution of this press release has not

been made, and has not been approved, by an “authorised person”

within the meaning of Article 21(1) of the Financial Services and

Markets Act 2000. As a consequence, this press release is only

being distributed to, and is only directed at, persons in the

United Kingdom that (i) are “investment professionals” falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (as amended, the

“Order”), (ii) are persons falling within Article

49(2)(a) to (d) (“high net worth companies, unincorporated

associations, etc.”) of the Order, or (iii) are persons to whom an

invitation or inducement to engage in investment activity (within

the meaning of Article 21 of the Financial Services and Markets Act

2000) in connection with the issue or sale of any securities may

otherwise lawfully be communicated or caused to be communicated

(all such persons together being referred to as “Relevant

Persons”). Any investment or investment activity to which

this document relates is available only to Relevant Persons and

will be engaged in only with Relevant Persons. Any person who is

not a Relevant Person should not act or rely on this document or

any of its contents.

This announcement may not be published,

forwarded or distributed, directly or indirectly, in the United

States of America, Canada, Australia, South Africa or Japan.

Appendix - Summary of the Securities

Note

SUMMARY

Section 1 - Introduction

Name and international securities

identification number (ISIN) of the securities- ISIN code

of convertible bonds: FR001400HYI7- ISIN code of ordinary shares:

FR0010478248- ticker of ordinary shares: ALATAIdentity and

contact details of the issuer- Atari, 25 rue Godot de

Mauroy – 75009 Paris, France (the “Company”)-

Legal Entity Identifier (LEI): 969500EY082T9MF5R336

Identity and contact details of the

competent authority approving the

Prospectus: Autorité des marchés

financiers (AMF), 17, place de la Bourse, 75082 Paris Cedex

02Date of the approbation of the Prospectus by the

AMF: 24 may 2023

Warning: The summary should be

read as an introduction to the Prospectus. Any decision to invest

in the securities should be based on a consideration of the

Prospectus as a whole by the investor. The investor could lose all

or part of the invested capital in the event of a decline in the

Company's share price. When a claim relating to the information

contained in the Prospectus is brought before a court, the

plaintiff investor might, under national law of a member state of

the European Union or a member state of the European Economic Area

(“EEA”), have to bear the costs of translating the

Prospectus before the legal proceedings are initiated. Civil

liability attaches only to those persons who have tabled the

summary including any translation thereof, but only where the

summary is misleading, inaccurate or inconsistent, when read

together with the other parts of the Prospectus, or where it does

not provide, when read together with the other parts of the

Prospectus, key information in order to aid investors when

considering whether to invest in such securities.

Section 2 – Key Information on the

Issuer

Point 2.1 – Who is the issuer of the

securities?

Headquarters / Legal form / LEI /

Applicable law / Country of incorporation- Headquarters:

25 rue Godot de Mauroy – 75009 Paris, France- Legal form: société

anonyme à conseil d’administration- LEI : 969500EY082T9MF5R336-

Applicable law: French law- Country of incorporation:

FranceMain activitiesAtari is an interactive

entertainment company and iconic gaming industry brand that

transcends generations and audiences. The Company is globally

recognized for its multi-platform, interactive entertainment, and

licensed products. Atari owns and/or manages a portfolio of more

than 200 unique games and franchises, including world-renowned

brands like Pong®, Breakout®, Asteroids®, Missile Command®,

Centipede®, and RollerCoaster Tycoon®.Atari’s strategy is to

develop, directly or through licensing agreements, video games,

hardware, consumer products and media content at the crossroads of

interactive entertainment, the digital world, and web3 to generate

revenue by monetizing its portfolio of intellectual property. Atari

does this both directly, with revenues generated from video game

commercialisation on the Atari VCS, PC, consoles, mobile or

multimedia platforms, and indirectly, with licensing agreements

granted to third parties who are then responsible for product

manufacturing in exchange for royalties paid to Atari under

multi-year contracts. The Group’s organization is structured around

four main lines of business: Games, Hardware, Licensing, and Web3.

For the fiscal year ending 31 March 2022, the Group's revenues are

expected to be 14.9 million Euros, compared to 18.9 million Euros

in 2021, and a net loss of 23.8 million Euros in 2022. As of 30

September 2022, the Group's revenues amounted to 4.3 million Euros

compared to 6 million Euros as of September 30, 2021.On 22 March

2023, Atari announced that it had entered into an agreement to

acquire 100% of Night Dive Studios Inc. (“Night

Dive”), a full service game development and publishing

company based in Vancouver, Washington, USA (the

“Acquisition”). The purchase price of Night Dive

consists of (i) an initial consideration of US$9.5 million payable

in cash and in Atari shares (i.e., 38,129,423 shares issued on 12

May 2023) plus (ii) an earn-out of up to US$10 million, payable in

cash over the next three years based on the future performance of

Night Dive. The Acquisition has been completed on 12 May

2023.Major shareholdersAs of the date of this

Prospectus, the share capital is of 4,206,637.09 euros divided into

420,663,709 ordinary shares each with a par value €0.01 and the

allocation of the Company's shareholders is, on the basis of

information brought to the Company's attention, as follows:

|

Shareholders |

Shares |

% capital |

Theoretical voting rights |

% theoretical voting rights |

Exercisable voting rights |

% exercisable voting rights |

|

Irata LLC(1) |

116,634,518 |

27.73% |

116,634,518 |

27.55% |

116,634,518 |

27.76% |

|

Actionnaires de Night Dive |

- |

- |

- |

- |

- |

- |

|

Stephen Kick |

31,463,004 |

7.48% |

31,463,004 |

7.43% |

31,463,004 |

7.49% |

|

Lawrence Kuperman |

1,682,180 |

0.40% |

1,682,180 |

0.40% |

1,682,180 |

0.40% |

|

Subtotal |

33,145,184 |

7.88% |

33,145,184 |

7.83% |

33,145,184 |

7.89% |

|

M. Alexandre Zyngier |

3,779,778 |

0.90% |

3,779,778 |

0.89% |

3,779,778 |

0.90% |

|

Treasury shares |

3,253,426 |

0.77% |

3,253,425 |

0.77% |

- |

- |

|

Public |

263,850,803 |

62.72% |

266,546,144 |

62.96% |

266,546,144 |

63.45% |

|

Total(2) |

420,663,709 |

100.00% |

423,359,049 |

100.00% |

420,105,624 |

100.00% |

(1) IRATA LLC is the holding company owned by

Wade Rosen, Chairman of the Board of Directors and Chief Executive

Officer of the Company. Following the closing of the Acquisition on

May 12, 2023, Wade Rosen Revocable Trust has transferred 4,984,238

shares in the context of the contribution, received to Irata.(2)

2,695,340 shares have double voting rightsKey managing

directors- Wade Rosen, Chairman of the Board of Directors

and Chief Executive Officer of the CompanyStatutory

auditorsDeloitte & Associés (member

of the Regional Association of Auditors of Versailles and Centre),

represented by Benoit Pimont, Signatory Partner, 6, place de la

Pyramide, 92908 Paris La Défense Cedex.B.E.A.S.

SARL (member of the Regional Association of Auditors of

Versailles and Centre), 6, place de la Pyramide, 92908 Paris La

Défense Cedex.

Point 2.2 What is the key financial

information regarding the issuer?

Historical key financial

informationThe tables below present selected financial

information of the Company derived from its financial statements as

of 31 March 2020, 2021 and 2022 and from its half-annual financial

statements as of 30 September 2021 and 2022.

Selected financial information from the

Company's income statement:

|

(M€) |

31 March 2022 |

31 March 2021 |

31 March 2020 |

30 September 2022 |

30 September 2021 |

|

CURRENT OPERATING INCOME (LOSS) |

(2.3) |

(3.4) |

2.9 |

(4.2) |

(2.8) |

|

OPERATING INCOME (LOSS) |

(23.0) |

(11.6) |

2.9 |

(5.2) |

(2.8) |

|

NET INCOME (LOSS) |

(23.8) |

(11.9) |

2.0 |

(5.4) |

(3.5) |

Selected financial information from the

Company's balance sheet:

|

ASSETS (M€) |

31 March 2022 |

31 March 2021 |

31 March 2020 |

30 September 2022 |

30 September 2021 |

|

Non-current assets |

18.9 |

31.3 |

38 |

22.0 |

30.4 |

|

Current assets |

7.0 |

9.1 |

5.8 |

6.7 |

9.5 |

|

Total assets |

26.0 |

40.4 |

43.8 |

28.7 |

39.9 |

|

EQUITY & LIABILITIES (M€) |

|

|

|

|

|

|

Total equity |

4.4 |

24.1 |

28.1 |

12.9 |

23.9 |

|

Non-current liabilities |

8.0 |

2.3 |

3.7 |

4.6 |

3.3 |

|

Current liabilities |

13.6 |

13.9 |

11.9 |

11.2 |

12.7 |

|

Total equity and liabilities |

26.0 |

40.4 |

43.8 |

28.7 |

39.9 |

Selected financial information from the

Company's cash flow statement:

|

(M€) |

31 March 2022 |

31 March 2021 |

31 March 2020 |

30 September 2022 |

30 September 2021 |

|

Net cash (used)/generated in operating activities |

(5.8) |

(4.6) |

1.1 |

(7.1) |

(3.3) |

|

Net cash (used)/generated in investing activities |

(4.3) |

(3.1) |

(9.6) |

(2.6) |

(1.8) |

|

Net cash provided (used in) by financing activities |

7.6 |

7.8 |

1.5 |

9.4 |

3.4 |

|

Other cash flows |

0.7 |

0.6 |

0.2 |

2.2 |

(0.1) |

|

Net change in cash and cash equivalent |

(1.8) |

0.7 |

(6.7) |

1.9 |

(1.7) |

Pro forma informationOn May 12,

2023, ATARI completed the acquisition of 100% of Night Dive. In

this context, the Company has prepared unaudited pro forma

consolidated financial information taking into account the

Acquisition, a summary of which is presented below on a voluntary

basis. The pro forma consolidated financial position of Atari as of

September 30, 2022 has been prepared to illustrate the impact of

the Acquisition and the related financing with retroactive effect

to September 30, 2022. The pro forma consolidated income statement

of the Atari Group for the six-month period ended September 30,

2022 has been prepared assuming that the Acquisition and its

financing were completed on April 1, 2022. The unaudited pro forma

consolidated financial information is based on a number of

assumptions that Atari believes are reasonable as of the date of

this document and in the context of the Acquisition. A detailed

post-acquisition analysis may reveal differences in accounting

principles that have not been taken into account in the preparation

of the pro forma financial information. The pro forma financial

information has not been audited by Atari’s statutory auditor and

is based, in addition to the corresponding audited consolidated

financial statements of Atari, on information prepared by Night

Dive for the period ended on September 30, 2022. In addition, the

financial information of Night Dive used for the preparation of the

pro forma financial information has not been audited and are not

being audited in the United-States. As a result, undue reliance

should not be placed on the unaudited pro forma financial

information set forth in this Prospectus, which, beyond their

illustrative nature, may not accurately reflect the current or

future performance of the combined entity.

Key unaudited pro forma financial

information from the combined balance sheet as at 30 September

2022

|

In ‘000s € |

ATARI SA Consolidated financial statements |

Night Dive Actuals |

Adjustments |

Night Dive Restated |

Business Combination IFRS 3 |

Financing |

Pro forma Consolidated information |

|

Goodwill |

|

|

|

|

6,807 |

|

6,807 |

|

Intangible Assets License and IP(*) |

1.924 |

175 |

559 |

734 |

|

|

2.658 |

|

Intangible Assets R&D Capitalized(*) |

5.327 |

0 |

4.331 |

4.331 |

|

|

9.658 |

|

Intangible Assets digital Digital Assets(*) |

1.143 |

0 |

0 |

0 |

|

|

1.143 |

|

Property, Plant and Equipment |

0 |

0 |

0 |

0 |

|

|

0 |

|

Rights of use relating to leases |

1.577 |

0 |

0 |

0 |

|

|

1.577 |

|

Other non-current assets |

9.792 |

2.855 |

-2.855 |

0 |

|

|

9.792 |

|

Deferred tax assets |

2.272 |

0 |

0 |

0 |

|

|

2.272 |

|

Total Non-current assets |

22.035 |

3.030 |

2.035 |

5.065 |

6.807 |

|

33.907 |

|

Inventories |

603 |

0 |

0 |

0 |

|

|

603 |

|

Trade receivables |

2.389 |

0 |

360 |

360 |

|

|

2.749 |

|

Cash and cash equivalents |

2.493 |

190 |

0 |

190 |

-4.747 |

4.747 |

2.683 |

|

Other current assets |

1.206 |

55 |

0 |

55 |

|

|

1.261 |

|

Assets held for sale |

0 |

0 |

0 |

0 |

|

|

0 |

|

Total current assets |

6.691 |

245 |

360 |

605 |

-4.747 |

4.747 |

7.296 |

|

Total Assets |

28.726 |

3.275 |

2.395 |

5.670 |

2.060 |

4,747 |

41.203 |

|

Shareholders’ equity |

12.934 |

3.177 |

38 |

3.215 |

2.060. |

|

18.209 |

|

Non-current financial liabilities |

2.472 |

0 |

0 |

0 |

|

4.747 |

7.219 |

|

Long term lease liabilities |

1.288 |

0 |

0 |

0 |

|

|

1.288 |

|

Other non-current liabilities |

841 |

98 |

-98 |

0 |

|

|

841 |

|

Total non-current liabilities |

4.601 |

98 |

-98 |

0 |

|

4.747 |

9.348 |

|

Provision for current contingencies and losses |

435 |

0 |

0 |

0 |

|

|

435 |

|

Current financial liabilities |

97 |

0 |

0 |

0 |

|

|

97 |

|

Short-term rental debts |

402 |

|

|

|

|

|

402 |

|

Trade payables |

5.290 |

0 |

228 |

228 |

|

|

5.518 |

|

Other current liabilities |

4.841 |

0 |

2.227 |

2.227 |

|

|

7.068 |

|

Liabilities held for sale |

126 |

|

|

|

|

|

126 |

|

Total current liabilities |

11.191 |

0 |

2.455 |

2.455 |

0 |

|

13.646 |

|

Total Equity and liabilities |

28.726 |

3.275 |

2.395 |

5.670 |

2.060 |

4.747 |

41.203 |

(*) The "Intangible assets" line in Atari's

balance sheet has been disaggregated into three separate lines

"License and IP", "R&D Capitalized ", and "Digital Assets".

This distinction is applied only for pro forma reporting purposes

and has no impact on Atari's future financial statements.

Key unaudited pro forma financial

information from the combined income statement for the six-month

period ended 30 September 2022

|

In ‘000s € |

ATARI SA Consolidated Financial Statements |

Night Dive Actuals |

Adjustments |

Night Dive Restated |

Financing |

Pro forma Consolidated information |

|

Total Revenues |

4.341 |

1.560 |

-24 |

1.536 |

|

5.877 |

|

Cost of goods sold |

-1.025 |

-1.015 |

439 |

-576 |

|

-1.601 |

|

Gross Margin |

3.316 |

545 |

415 |

960 |

|

4.276 |

|

Research and Development expenses |

-2.297 |

-130 |

-149 |

-279 |

|

-2.576 |

|

Marketing and Selling expenses |

-303 |

-127 |

4 |

-123 |

|

-426 |

|

General and administrative expenses |

-4.905 |

-221 |

14 |

-207 |

|

-5.112 |

|

Current operating income (loss) |

-4.189 |

67 |

284 |

351 |

|

-3.838 |

|

Other income (expenses) |

-980 |

1 |

0 |

1 |

|

-979 |

|

Operating income (loss) |

-5.169 |

68 |

284 |

352 |

|

-4.817 |

|

Cost of debt |

-108 |

0 |

0 |

0 |

-190 |

-298 |

|

Other financial income (expense) |

-94 |

0 |

0 |

0 |

|

-94 |

|

Share of net operating profit of equity affiliates |

0 |

0 |

0 |

0 |

|

0 |

|

Income tax |

-7 |

0 |

0 |

0 |

|

-7 |

|

Net income from Continuing operations |

-5.378 |

68 |

284 |

352 |

-190 |

-5.216 |

|

Profit (Loss) from discontinued operations |

-64 |

0 |

0 |

0 |

|

-64 |

|

Net income (Loss) |

-5.442 |

68 |

284 |

352 |

-190 |

-5.301 |

|

Minority interests |

0 |

0 |

0 |

0 |

|

0 |

|

Net income group share |

-5.442 |

68 |

284 |

352 |

-190 |

-5.280 |

The pro forma financial information does not

reflect the earn-out (up to $10 million) that may be paid in cash

over the next three years. This will be estimated and recorded in

Atari SA's consolidated financial statements as of September 30,

2023, based on Atari's estimates.

Key financial information as of 31 March

2023 (unaudited)For the fiscal year ended March 31, 2023,

the revenues of the Group for the year is expected to stand at

around €10 M, a decrease of around 30% compared to previous fiscal

year. Financial information as of 31 March 2023 for the four

business lines of the Group:

- Games - Games revenues are expected to reach

around €7.0 M, compared to €5.7 M in previous period.

- Hardware - Hardware revenues for the period

are expected to reach around €0.8 M, compared to €3.1 M in previous

financial year.

- Licensing - Licensing revenues for the period

are expected to be around €1.2 M, compared to €1.3 M in previous

financial year.

- Web3 - Web3 revenues for the period are

expected to be around €0.8 M, in decrease compared to previous

period which accounted for exceptional sales of certain digital

assets.

Point 2.3 What are the key risks that are

specific to the issuer?

Main risks specific to the

Company: risks are classified according to three levels of

materiality (low, moderate, high).

- Risks related to the future results of operations and financial

condition presented in the pro forma financial information

(moderate): The pro forma financial information has not been

audited by Atari's auditor and is based, in addition to Atari's

corresponding audited consolidated financial statements, on

information prepared by Night Dive for the period ended September

30, 2022. In addition, the financial information of Night Dive used

in the preparation of the pro forma financial information is

unaudited and unaudited in the United States.

- Risks related to Night Dive's development process and delayed

releases of games (high): Night Dive has experienced development

delays for its products in the past which caused it to delay or

cancel release dates. Any failure to meet anticipated production or

release schedules likely would result in a delay of revenue and/or

possibly a significant shortfall in Atari's revenue, increase its

development and/or marketing expenses, harm its profitability, and

cause its operating results to be materially different than

anticipated.

- Risk associated with expansion into new business sectors

(high): The Group intends to expand its operations beyond video

game publishing activity, which requires new technological,

technical and commercial expertise. Difficulties encountered in the

development of these new projects, in their timing or in the level

of competition in those new business sectors may challenge the

commercial success of the Group in those new projects.

- Risk associated with liquidity and going concern (moderate): As

at September 30, 2022, the Company reported a net loss of €5.4M

(compared with €3.5M as of September 30, 2021). Shareholders’

equity was €13.0M as of September 30, 2022, compared to €4.4M as of

March 31, 2022. As of March 31, 2023 net debt stood at €6.8M

compared to a net debt of €4.6M in previous year, and includes 2.0M

€ of cash and 8.9 M€ of financial debt. The Company conducted a

review of its liquidity risk based on projections of all of its

four activities: Gaming, Hardware, Licensing and Web3. The net

amount of additional cash required by the Company to meet its needs

over the next 12 months amount to around EUR 4.5 M. Based on

current and planned development projects and including the

contribution from Night Dive, the Company will be able to fund its

operations until the end of the month of June 2023. The Company

currently benefits from the continued financial support of its

principal shareholder Irata LLC through September 2023, and could

benefit from the financial flexibility provided by the Offering,

that is subject an irrevocable Subscription Commitment by Irata LLC

covering 100% of the Offering amount, to meet its cash requirements

over the next twelve (12) months.

- Risk associated with the success of games (high): The main

risks intrinsic to video game publishing concern the lifetime of a

given game and changes in technologies. The commercial success of

games depends on the public’s response, which is not always

predictable and may negatively impact Group’s revenues and future

earnings.

- Risk associated with development process of games and delayed

releases of games (high): Atari may have to delay the launch of a

video game for several reasons. Delays in launch or termination of

games and their release could negatively impact the Group’s

revenues, income and future earnings. Any failures in production

may also result in increased development costs.

- Risk related to litigation (moderate): The Group is subject to

regular threats of litigation in the ordinary course of business

related to its commercial operations and will vigorously defend any

such cases if filed.

- Risk related to piracy (moderate): Highly organized pirate

operations in the video game industry have been expanding globally.

In addition, the proliferation of technology designed to circumvent

the protection measures integrated into games, the availability of

broadband access to the Internet and the ability to download

pirated copies of games from various Internet sites all have

contributed to ongoing and expanded piracy. These illegal

activities could adversely affect the Group's business.

Section 3 – Key information on the

securitiesPoint 3.1 – What are the main features

of the securities?

Class and number of securities to be

admitted to trading The offering (hereinafter, the

“Offering”) relates to 200,000,000 bonds

convertible into new ordinary shares of the Company, to be issued

without shareholders' preferential subscription rights with a

priority subscription period and maturing 31 July 2026 (the

“Convertible Bonds”).The centralization of the

financial service of the Convertible Bonds (payment of interest,

centralization of requests for redemption of the Convertible Bonds,

etc.) will be performed by Uptevia (12, place des Etats-Unis, CS

40083, 92549 MONTROUGE CEDEX). The initial calculation agent will

be Conv-Ex Advisors Limited (30 Crown Place, London EC2A 4EB,

United Kingdom).The shares likely to be issued upon conversion of

the Convertible Bonds will all be of the same nominal value and

class as the existing shares of the Company. They will be admitted

to trading on the multilateral trading facility of Euronext Growth

in Paris, on the same listing line as the existing shares of the

Company under the same ISIN code FR0010478248.Currency,

denomination, nominal value, number of offered securities and

maturityCurrency: euro.Number of securities to be offered:

200,000,000 Convertible Bonds of €0.15 nominal value eachMaturity:

31 July 2026. Rights attached to the

securitiesSeniority of the Convertible Bonds: Exclusively

in the event of security interests granted by the Company and/or

Atari US Holding Inc. for the benefit of holders of other bonds or

other negotiable financial instruments representing debt securities

issued or guaranteed by the Company. Interest rate: The Convertible

Bonds will bear interest from the issue date, which is 5 June 2023

(the “Issue Date”) according to the indicative

timeline, at a nominal rate of 6.50% per annum, payable

semi-annually in arrears on 31 July and on 31 January of each year

(or if such date is not a business day the following business day)

beginning on 31 January 2024 (each, an “Interest Payment

Date”), being 0.00975 euros per Convertible Bond per year.

It being precised that the amount paid to Bondholders will be

rounded to tow decimals (€0.01).Maturity date and term of the loan:

The term of the loan is three years and two months from the Issue

Date. Thus, the Convertible Bonds will mature on 31 July 2026

inclusive (the “Maturity Date”).Conversion right:

Each holder of Convertible Bonds (the

“Bondholders”) will have the right to convert all

or part of its Convertible Bonds into shares of the Company during

the conversion period. Conversion Period and Conversion Ratio: From

the Issue Date until and including the seventh business day

preceding the Maturity Date, the Bondholders will be entitled to

exercise, at any time, their conversion right for all or part of

the Convertible Bonds they hold (the “Conversion

Right”), subject to the preservation of the rights of the

Bondholders and the settlement of fractional shares, at a ratio of

one (1) new Atari share for one (1) Convertible Bond (the

“Conversion Ratio”).In the event of a share

capital increase or issuance of new shares or securities conferring

rights to receive shares or any other financial transactions

conferring preferential subscription rights (including in the form

of subscription warrants) or reserving a priority subscription

period for the benefit of the shareholders, and in the event of a

merger or a spin-off (scission), the Company shall be entitled to

suspend the exercise of the Conversion Right for a period not

exceeding three (3) months or such other period as may be

established by applicable regulations. The Conversion Ratio may

also be adjusted (see “Maintenance of the rights of the

Bondholders” below).Terms of redemption of the Convertible Bonds:

Normal redemption: Subject to early redemption at the option of the

Company, in cash in full on the Maturity Date by redemption at par

plus interests.Early redemption of the Convertible Bonds at the

option of the Company:

- At any time, without limitation as to price or quantity, either

by way of repurchase on or off-market, or by way of tender or

exchange offers or otherwise;

- By redemption on or after 21 August 2025 and until maturity of

the Convertible Bonds, subject to at least 30 calendar days' prior

notice, at a price equal to the Early Redemption Price, if the

arithmetic mean, calculated in respect of 20 consecutive trading

days during which the shares of the Company are listed, chosen by

the Company among the period of 40 consecutive trading days

immediately preceding the day of the publication of the early

redemption notice, of the daily product of (i) the volume weighted

average price of the Company's shares on Euronext Growth on each

trading day and (ii) the Conversion Ratio applicable on each such

dates exceeds 130% of the nominal value of the Convertible

Bonds.

- At the Early Redemption Price, if the amount of the Convertible

Bonds outstanding is equal or less than 20 % of the total

amount of the issue.

The “Early Redemption Price”

shall be equal to par plus accrued interest from the last Interest

Payment Date to the date of scheduled redemption.Early Redemption

at the Option of the Noteholders: In cash in the event of a Change

of Control.A “Change of Control” means the fact,

for one or more natural persons or legal entities, acting alone or

in concert (other than Irata LLC), to acquire control of the

Company, it being specified that the notion of

"control" means, for the purposes of this

definition, the fact of holding (directly or indirectly through

companies controlled by the person or persons concerned) (x) a

majority of the voting rights attached to the Company's shares or

(y) more than 40% of such voting rights if no other shareholder of

the Company, acting alone or in concert, holds (directly or

indirectly through companies controlled by such shareholder or

shareholders) a percentage of the voting rights greater than that

so held.Early Redemption: possible in cash, at the Early Redemption

Price.Rights of Bondholders to interest on the Convertible Bonds:

In the event of exercise of the Conversion Right, no interest will

be paid to the holders of Convertible Bonds in respect of the

period between the last Interest Payment Date, or, as the case may

be, the Issue Date, and the date on which delivery of the shares

occurs.Maintenance of the rights of the Bondholders: the Conversion

Ratio will be adjusted in the event of a reduction in the Company's

capital and in the event of financial transactions of the Company,

in particular in the event of the distribution of a

dividend.Representative of the body of Bondholders: Aether

Financial Services.Description of the underlying shares: As of the

date of this Prospectus, the Issuer's shares are admitted to

trading under the denomination "ALATA" on Euronext Growth (ISIN

code FR0010478248). The shares are denominated in euro. The new

ordinary shares issued upon conversion of the Convertible Bonds

will carry current dividend rights. A double voting right is

granted to shares held in registered form for at least two years by

the same shareholder.Relative seniority of the securities

in the issuer’s capital structure in the event of

insolvencyThe Convertible Bonds and interest thereon

constitute direct, unconditional, unsecured and unsubordinated

obligations of the Company and rank equally (pari passu) among

themselves and (subject to exceptions provided by law) rank equally

with all unsecured and unsubordinated indebtedness and payment

obligations of the Company, present or future.Restrictions

on the free transfer of securitiesNoneDividend

policyThe Company has not distributed any dividends in the

last three fiscal years and does not intend to propose any dividend

payment for fiscal year ended 31 March 2023.

Point 3.2 – Where will the securities be

traded?

The Convertible Bonds will be admitted to

trading on Euronext Growth within thirty (30) days following

settlement and delivery.

Point 3.3 - Is there a guarantee attached

to the securities

Not applicable

Point 3.4 – What are the key risks that

are specific to the securities?

Main risk factors related to the

securities Bondholders are advised to consider the main

key securities risks listed hereinafter:

- It is not certain that a market will develop for the

Convertible Bonds: The Convertible Bonds will be admitted to

trading on Euronext Growth within thirty (30) days following

settlement and delivery. However, no assurance can be given that an

active market for the Convertible Bonds will develop or that

Bondholders will be able to sell their Convertible Bonds on such

market at satisfactory price and liquidity, in particular given the

fact that the main shareholder has undertaken to subscribe to 100%

of the of the Convertible Bonds. In addition, if such a market were

to develop, it cannot be excluded that the market price of the

Convertible Bonds would be subject to significant volatility. If an

active market does not develop, the liquidity and price of the

Convertible Bonds will be affected. Finally, there is no obligation

to make a market in the Convertible Bonds and the Company has not

mandated any intermediary to ensure the liquidity of the

Convertible Bonds.

- The Company may not be able to pay the interest or redeem the

Convertible Bonds: The Company may not have sufficient financial

capacity to pay the interest or redeem the Convertible Bonds. The

Company's ability to pay interest and to redeem the Convertible

Bonds will depend, among other things, on its financial situation

at the time of payment of interest or redemption and may be limited

by applicable law, by the terms of its indebtedness and, if

applicable, by the terms of any new financing in place at that time

that may replace, increase or modify the Company's existing or

future debt.

- The market price of the Company’s shares may fluctuate and fall

below the conversion price of the Convertible Bonds: The Company's

shares may be traded at a price below the market price prevailing

on the date of determination of the conversion price of the

Convertible Bonds. The Company cannot provide any assurance that

the Company's share market price will not fall below the such

price. The Company's cannot provide any assurance that, subsequent

to the conversion of the Convertible Bonds, investors will be able

to sell their shares at a price at least equal to or greater than

such price.

- The conversion of the Convertible Bonds or the sale of the

shares resulting from the conversion of the Convertible Bonds on

the market by bondholders is likely to have an adverse impact on

the market price of the shares: The conversion of the Convertible

Bonds or the sale of the shares resulting from the conversion of

the Convertible Bonds by Bondholders is likely to have an adverse

impact on the market price of the Company's shares. The Company

cannot foresee the possible effects of these events on the market

price of the shares.

- Bondholders have limited anti-dilution protection: The

Conversion Ratio applicable in the event of conversion into new

shares of the Convertible Bonds will only be adjusted in limited

circumstances. Therefore, the Conversion Ratio will not be adjusted

in all cases where an event relating to the Company or any other

event would be likely to affect the value of the Company's shares

or, more generally, to have a dilutive impact.

- The early redemption of the Convertible Bonds is subject to the

approval of the Bondholders' meeting: In the event notably (i) of a

breach by the Company of its obligations under the Convertible

Bonds, (ii) cross default, (iii) preventive or collective

insolvency proceeding or (iv) delisting of the Company's shares,

the early redemption of the Convertible Bonds may only be triggered

if a majority of the Bondholders have approved the request. Given

Irata's subscription commitment and the significant holding of

Convertible Bonds that could result, there is no guarantee that a

vote in favor of early redemption will be obtained.

- Risk related to meetings and vote of Noteholders, modification

and waivers: Certain provisions permit in certain cases defined

majorities to bind all Bondholders including Bondholders who did

not attend (or were not represented) and vote at the relevant

general meeting, Bondholders who voted in a manner contrary to the

majority and Bondholders who did not respond to, or rejected, the

relevant resolution. If a decision is adopted by a majority of

Bondholders and such modifications were to impair or limit the

rights of the Bondholders, this may have a negative impact on the

market value of the Convertible Bonds and hence Bondholders may

lose part of their investment.

Section 4 – Key information on the

admission to tradingPoint 4.1 – Under which

conditions and timetable can I invest in these

securities?

Structure of the Offering: the

offer of the Convertible Bonds is carried out by way of a public

offering, without preferential subscription rights for shareholders

with a priority subscription period of four business days, which

will enable them to subscribe in priority to the Convertible Bonds

(i) on an irreducible basis up to the amount of their share in the

share capital of the Company and (ii) on a reducible basis to a

number of Convertible Bonds higher than the number to which they

can subscribe on an irreducible basis, allocated in proportion to

their irreducible applications and, in any event, up to the limit

of their demand.Convertible Bonds not subscribed for, on an

irreducible or a reducible basis, within the priority subscription

period by shareholders will be offered to the public in a public

offering in France (the “Public Offering”), it

being specified that Irata commits to subscribe the Offering for

the entire Offering during the priority subscription period. The

orders received within the Public Offering are therefore likely not

to be served. The Offering is made under the 13th and 23rd

resolutions adopted by the combined general meeting of the

Company's shareholders held on 27 September 2022 (the

“Offering”).Priority subscription

period: a priority subscription period of four consecutive

trading days, from 25 May 2023 to 30 May 2023 (included), is

granted to the shareholders whose shares are registered in their

account on 24 May 2023. This priority subscription period is

neither transferable nor negotiable.Subscription price of

the Convertible Bonds: 0.15 euro per Convertible Bond,

equal to the nominal value of each Convertible Bond, to be fully

paid up by payment in cash (in cash and / or by debt setoff) at the

time of subscription. On the basis of the closing price of the

Company's shares on 23 may 2023, i.e. 0.1304 euros, the

subscription price of one Convertible Bond of 0.15 euros represents

a premium of 15%.Amount of the offer: the total

amount of the offer amounts to 30 million euros, by issue of

200,000,000 Convertible Bonds.Revocation of subscription

orders: subscription orders are

irrevocable.Notifications to the subscribers of the

Convertible Bonds: the subscribers having placed

subscription orders on an irreducible basis are assured, subject to

the effective completion of the Offering, to receive the number of

Convertible Bonds they will have subscribed for within the

applicable deadlines. Subscribers who have placed orders to

subscribe for the Convertible Bonds on a reducible basis and within

the Public Offering will be informed of their allocation by their

financial intermediary.Subscription intent of the Company's

main shareholders or members of its administrative or management

bodies or of any other person intending to subscribe for more than

5%: Irata LLC (the “Irata”), a 27.73%

shareholder of the Company and held by Mr. Wade Rosen, has

irrevocably undertaken to subscribe to the Offering (the

“Subscription Commitment”) during the priority

subscription period of the offering of the Convertible Bonds, on an

irreducible basis, up to the amount of its stake in the Company's

share capital (i.e. a total number of 55,460,000 Convertible Bonds)

and on a reducible basis, up to the balance of the total amount of

the Offering not subscribed by it on an irreducible basis, i.e. up

to a maximum total amount (including issue premium) of 21,681,000

euros (i.e., up to 144,450,000 Convertible Bonds). Moreover, in the

event that at the end of the subscription period of the Offering,

the subscriptions do not represent 100% of the amount of the

Offering, Irata has irrevocably and unconditionally undertaken to

subscribe for the Convertible Bonds, which will have not been fully

paid by the subscribers, allowing for full subscription of this

threshold of 100% of the principal amount of this convertible bonds

offering, i.e. up to a maximum of 200,000,000 Convertible Bonds for

an amount of 30 million euros.The amount of the Subscription

Commitment will be paid, in priority, by way of set-off against

certain, determined in quantum and due debts that Irata holds on

the Company in respect of shareholders' loans previously granted,

for an aggregate amount of EUR 16,333,740.68 and the balance in

cash. All the debts arising from the Irata loans granted to the

Company will be cleared either by this subscription by way of debt

set-off, depending on the amount subscribed to Irata, or by the

proceeds of the Offering.In addition, Irata has agreed not to

convert the Convertible Bonds prior to 30 June 2025 (date on which

the triggering threshold for a mandatory public offering on the

Company's shares is raised from 30% to 50% of the shares and/or the

voting rights)1, provided that in the event of a tender offer on

Atari's securities filed by a third party prior to 30 June 2025,

Irata will have the option to convert its Convertible Bonds prior

to such date. As from 1 January 2024, Irata also retains the right

to convert its Convertible Bonds upon clearance by AMF (décision de

conformité) of a tender offer on the Company's securities filed by

Irata (or an affiliate).Countries in which the offer will

be open to the public: the Offering will be open to the

public only in France.Restrictions applicable to the

offering: the distribution of the Prospectus and the

subscription for the Convertible Bonds may, in certain countries,

in particular in the United States of America, the United Kingdom,

Canada, Australia, Japan or South Africa, be subject to specific

regulations.Methods of payment of funds and financial

intermediaries:Holders of administered registered shares

or bearer shares: subscriptions for the Convertible Bonds and

payments of funds by subscribers whose existing shares are held in

administered registered form or bearer form will be received by

their financial intermediaries holding the accounts until 30 May

2023 inclusive in accordance with the indicative timetable.Pure

registered shareholders: subscriptions for the Convertible Bonds

and payments of funds by subscribers whose existing shares are held

in pure registered form will be received by Uptevia up to and

including 30 May 2023 in accordance with the indicative

timetable.Payment of the subscription price: each

subscription must be accompanied by the payment of the subscription

price. Subscriptions for which payments have not been made will be

cancelled by operation of law without any need for a formal

notice.Centralizing institution :

Uptevia.Guarantee: the Offering will not be

subject to a guarantee. Settlement and delivery of the

Convertible Bonds: according to the indicative timetable,

the Convertible Bonds are expected to be book-entry only and

tradable as of 5 June 2023. The Convertible Bonds will be the

subject of an application for admission to trading by Euroclear

France, which will be responsible for the settlement of the

Convertible Bonds between account holders and custodians.

Application will also be made to Euroclear Bank S.A./N.V. and

Clearstream Banking SA and an application for admission to trading

on the multilateral trading facility of Euronext Growth in Paris

will be made.Indicative timetable of the

transaction:

| 15 May 2023 |

Company's Board

of Directors meeting authorizing the launch of the Offering and

delegating to the Chief Executive Officer the powers to set its

main characteristics |

| 23 May 2023 |

Chief Executive Officer decision to launch the Offering and to set

its main characteristics |

| 24 May 2023 |

Publication of the amendment to the URD and approval of the AMF of

the ProspectusRecord date at the end of which the holders of

existing shares registered in the accounts are deemed to be able to

participate in the Offering within the priority subscription

period |

| 25 May 2023

(before opening of Euronext Paris markets) |

Publication of a

press release by the Company (i) announcing that it has obtained

the approval of the AMF, (ii) the launch and terms of the

Convertible Bonds and (iii) the availability of the Prospectus |

| 25 May 2023 |

Publication of the Euronext notice (avis d'émission des

obligations)Opening of the priority subscription period of the

Convertible BondsOpening of the public offering |

| 30 May 2023 |

Closing of the

priority subscription period of the Convertible Bonds (5pm)Closing

of the public offering (5pm) |

| 31 May 2023 |

Deadline for

financial intermediaries to communicate the subscriptions to

Uptevia (10am) |

| 1 June 2023 |

Publication of a

press release by the Company announcing the final terms of the

Convertible Bonds (after closing of Euronext Paris

markets)Publication of the Euronext notice (avis d'admission des

obligations) |

| 5 June 2023 |

Issuance and settlement-delivery of the Convertible Bonds |

| 5 July 2023 at

the latest |

Admission of the Convertible Bonds to trading on Euronext

Growth |

The public will be informed, if necessary, of

any change in the above indicative timetable by means of a press

release issued by the Company and posted on its website and a

notice issued by Euronext.Company's lockup: not

applicable.Lockup agreements: not applicable.

Amount and percentage of

dilutionImpact of the issue on the share of shareholder’s

equityFor information purposes, the impact of the issuance and

conversion into new shares only of all the Convertible Bonds on the

Group's share of equity per share (calculated on the basis of the

consolidated equity attributable to the Group as of 31 March 2022

and the number of shares comprising the Company's share capital as

of the date of this Prospectus after deduction of treasury shares)

would be as follows:

|

|

Shareholders' equity per share (in euros) |

|

|

Non diluted basis |

Diluted basis(1) |

|

Prior to the Offering |

0.10 € |

0.10 € |

|

After the Offering and conversion into shares of 200,000,000

Convertible Bonds resulting from the present transaction (100%

completion) |

0.12 € |

0.11 € |

(1) After issuance of a maximum total number of

14,354,103 ordinary shares to be issued upon exercise or conversion

of all existing dilutive instruments (warrants, options, bonus

shares).Theoretical impact of the transaction on the shareholder's

situationOn an indicative basis, the impact of the issue on the

ownership interest (calculations based on a number of 420.663.709

shares making up the Company's share capital as of the date of the

Prospectus and without taking into account treasury shares) of a

shareholder holding 1% of the Company’s share capital prior to the

issue and not subscribing to it, is as follows:

|

|

Ownership interest (in %) |

|

|

On a non-diluted basis |

On a diluted basis(1) |

|

Prior to the Offering |

1.00% |

0.97% |

|

Following the Offering and conversion into shares of 200,000,000

Convertible Bonds (100% completion) |

0.68% |

0.66% |

(1) After issuance of a maximum total number of 14,354,103

ordinary shares resulting from the exercise or conversion of all

existing dilutive instruments (BSA, options, free shares).

Impact on the distribution of the company's

capital and voting rightsFollowing issuance and conversion into

shares of 200,000,000 Convertible Bonds resulting from the present

transaction, the allocation of the Company's capital (on a

non-diluted basis) will be as follows (assuming subscription at

100% by Irata):

|

Shareholders |

Shares |

% of capital |

Theoretical voting rights |

% theoretical voting rights |

Exercisable voting rights |

% exercisable voting rights |

|

Irata LLC(1) |

316,634,518 |

51.02% |

316,634,518 |

50.79% |

316,634,518 |

51.06% |

|

Night Dive shareholders |

- |

- |

- |

- |

- |

- |

|

Stephen Kick |

31,463,004 |

5.07% |

31,463,004 |

5.05% |

31,463,004 |

5.07% |

|

Lawrence Kuperman |

1,682,180 |

0.27% |

1,682,180 |

0.27% |

1,682,180 |

0.27% |

|

Subtotal |

33,145,184 |

5.34% |

33,145,184 |

5.32% |

33,145,184 |

5.35% |

|

M. Alexandre Zyngier |

3,779,778 |

0.61% |

3,779,778 |

0.61% |

3,779,778 |

0.61% |

|

Treasury shares |

3,253,425 |

0.52% |

3,253,425 |

0.52% |

- |

- |

|

Public |

263,850,803 |

42.51% |

266,546,143 |

42.76% |

266,546,143 |

42.98% |

|

Total(2) |

620,663,709 |

100.00% |

623,359,049 |

100.00% |

620,105,624 |

100.00% |

(1) IRATA LLC is the holding company owned by

Wade Rosen, Chairman of the Company’s Board of Directors. Following

the closing of the Acquisition on May 12, 2023, Wade Rosen

Revocable Trust has transferred 4,984,238 shares received to

Irata.(2) 2,695,340 shares have double voting rights

Estimate of the total

expenses of the offer: On an indicative basis, total

expenses related to the issuance (remuneration of financial

intermediaries and administrative legal fees) are approximately 1M

euros. No fees will be borne by the investor.

Point 4.2 – Why is this Prospectus being

produced?

Use and estimated net amount of

proceeds: On the basis of 100% of the Offering, the gross

proceeds from the Offering will amount to €30M and the net proceeds

will amount to €29M, it being specified that Irata's subscription

to the Offering will be made by way of debt set-off in respect of

the repayment of shareholder loans up to its current amount of 16

million euros, thus reinforcing the balance sheet of the Company.

The balance of the proceeds from the Offering will enable the