Atari announces the success of its offering of bonds convertible

into new ordinary shares of Atari due July 2026 for a nominal

amount of 30 million euros

Atari

announces the success of its

offering of

bonds convertible

into new ordinary shares

of Atari due

July 2026

for a nominal

amount of 30 million

euros

PARIS, FRANCE

(June

1st, 2023

- 5:45pm CET)

- Atari® (the "Company") — one of

the world's most iconic consumer brands and interactive

entertainment producers —announced today the success of its

offering of senior unsecured bonds convertible into new ordinary

shares due July 31, 2026 (the "Convertible

Bonds"), for a nominal amount of 30 million euros, without

shareholders' preferential subscription rights, by way of a public

offering in France and with a priority subscription period for

shareholders to subscribe for the bonds on a irreducible and

reducible basis (the "Offering").

In the context of the

priority subscription period, demand from the Company’s existing

shareholders amounted to 205,067,730 Convertible Bonds,

representing approx. 102.50% of the total Offering (including

Irata's subscription commitment).

The Offering was fully

subscribed within the priority subscription period. Irata LLC

("Irata"), a 27.73% shareholder of the Company

held by Wade Rosen, chairman and CEO of the Company made an

irrevocable undertaking to subscribe for Convertible Bonds on an

irreducible basis up to the amount of its entire share in the

Company's capital, and on a reducible basis for the remainder of

the Offering. As a result, Irata subscribed to 195,163,398 of the

200,000,000 Convertible Bonds issued corresponding to 97.58% of the

total amount of the Offering, (approx. €16.3 M by debt set-off and

€12.9 M in cash).

Legal

framework of the

Offering

The Offering was carried out by way of a public

offering in France, except offerings as defined in paragraph 1 of

article L.411-2 of the French Monetary and Financial Code, without

preferential subscription rights for shareholders with a priority

subscription period, in accordance with the 13th and 23rd

resolutions adopted by the combined general meeting of shareholders

of the Company held on September 27, 2022.

The subscription price of the Convertible Bonds

under the priority subscription period was set at 0.15 euro per

Convertible Bonds. On the basis of the closing price of the

Company’s shares on May 23, 2023, i.e. 0.1304 euro, the

subscription price of one Convertible Bond of 0.15 euro represents

a premium of 15%.

Date of issue and interest

The Convertible Bonds shall be issued at par and

will bear interest from June 5, 2023 (the “Issue

Date”) at a rate of 6.50% per annum, payable semi-annually

in arrears on July 31 and January 31 of each year (or if such date

is not a business day the following business day), and for the

first time on January 31, 2024.

Admission to trading

Application has been made for the Convertible

Bonds to be listed on Euronext Growth on June 5, 2023.

Shareholding structure

To the Company's

knowledge, the allocation of the Company's share capital (on a

non-diluted basis) on the date of the AMF's approval on the

Prospectus (as defined below) and following the issuance of the

Convertible Bonds and assuming their conversion into shares, was

and would be as follows:

|

|

Before the Offering |

After the Offering and

conversion of the

Convertible Bonds |

|

|

Existing shares |

Exercisable voting rights |

Existing shares |

Exercisable voting rights |

|

|

Number of shares |

% of capital |

Number of voting rights |

% of voting rights |

Number of shares |

% of capital |

Number of voting rights |

% of voting rights |

|

Irata LLC |

116,634,518 |

27.73% |

116,634,518 |

27.76% |

311,797,916 |

50.24% |

311,797,916 |

50.28% |

|

Night Dive shareholders |

|

|

|

|

|

|

|

|

|

Stephen Kick |

31,463,004 |

7.48% |

31,463,004 |

7.49% |

31,463,004 |

5.07% |

31,463,004 |

5.07% |

|

Lawrence Kuperman |

1,682,180 |

0.40% |

1,682,180 |

0.40% |

1,682,180 |

0.27% |

1,682,180 |

0.27% |

|

Subtotal |

33,145,184 |

7.88% |

33,145,184 |

7.89% |

33,145,184 |

5.34% |

33,145,184 |

5.35% |

|

Alexandre Zyngier |

3,779,778 |

0.90% |

3,779,778 |

0.90% |

3,779,778 |

0.61% |

3,779,778 |

0.61% |

|

Treasury shares |

3,253,426 |

0.77% |

- |

- |

3,253,426 |

0.52% |

|

|

|

Public |

263,850,803 |

62.72% |

266,546,144 |

63.45% |

268,687,405 |

43.29% |

271,382,746 |

43.76% |

|

Total |

420,663,709 |

100% |

420,105,624 |

100% |

620,663,709 |

100% |

620,105,624 |

100% |

Provision of

the prospectus

The prospectus was approved by the AMF under

number 23-180 on May 24, 2023 (the "Prospectus")

and comprises (i) the Company's universal registration document

approved by the AMF on July 27, 2022 under number D.22-0661 (the

"Universal Registration Document"), (ii) an

amendment to the Universal Registration Document filed with the AMF

on May 24, 2023 under number D.22-0661-A01 (the

"Amendment") and (iii) a securities note

(including the summary of the Prospectus) (the "Securities

Note") is made available to the public.

Copies of the

Prospectus will be available free of charge at the Company's

registered office, 25 rue Godot de Mauroy, 75009 Paris, France. The

Prospectus will also be available on the Company's website

(https://www.atari-investisseurs.fr) as well as on the AMF's

website (www.amf-france.org).

The attention of investors is drawn to the risk

factors described in section 5 "Risk factors" of the Universal

Registration Document, in section 4 "Risk factors" of the Amendment

and in section 2 "Risk factors relating to the offer" of the

Securities Note. The realization of some or all of these risks

could have a negative impact on the business activity, situation,

financial results or objectives of the Group.

ABOUT

ATARI

Atari is an interactive entertainment company

and an iconic gaming industry brand that transcends generations and

audiences. The company is globally recognized for its

multi-platform, interactive entertainment and licensed products.

Atari owns and/or manages a portfolio of more than 200 unique games

and franchises, including world-renowned brands like Asteroids®,

Centipede®, Missile Command®, Pong®, and RollerCoaster Tycoon®.

Atari has offices in New York and Paris. Visit us online at

www.atari.com.

Atari shares are listed in France on Euronext

Growth Paris (ISIN Code FR0010478248, Ticker ALATA) and OTC Pink

Current (Ticker PONGF).

©2023 Atari Interactive, Inc. Atari wordmark and

logo are trademarks owned by Atari Interactive, Inc.

Contacts

Atari - Investor RelationsTel + 33 1 83 64 61 57

- investisseur@atari-sa.com | www.atari.com/news/

Calyptus - Marie Calleux Tel + 33 1 53 65 68 68 -

atari@calyptus.net

Listing Sponsor - EurolandTel +33 1 44 70 20

84Julia Bridger - jbridger@elcorp.com

FORWARD-LOOKING STATEMENTS

This press release contains certain non-factual

elements, including but not restricted to certain statements

concerning its future results and other future events. These

statements are based on the current vision and assumptions of

Atari’s leadership team. They include various known and unknown

uncertainties and risks that could result in material differences

in relation to the expected results, profitability and events. In

addition, Atari, its shareholders and its respective affiliates,

directors, executives, advisors and employees have not checked the

accuracy of and make no representations or warranties concerning

the statistical or forward-looking information contained in this

press release that is taken from or derived from third-party

sources or industry publications. If applicable, these statistical

data and forward-looking information are used in this press release

exclusively for information.

DISCLAIMER

The distribution of this press release and the

offer and sale of the Convertible Bonds may be restricted by law in

certain jurisdictions and persons into whose possession this

document or other information referred to herein comes should

inform themselves about and observe any such restriction. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction.

Not for release, directly or indirectly in or

into the United States, Canada, South Africa, Japan or Australia.

This document (and the information contained herein) does not

contain or constitute an offer of securities for sale, or

solicitation of an offer to purchase securities, in the United

States, Canada, South Africa, Japan or Australia or any other

jurisdiction where such an offer or solicitation would be unlawful.

The securities referred to herein have not been and will not be

registered under the U.S. Securities Act of 1933, as amended (the

“Securities Act”), or under the securities laws of

any state or other jurisdiction of the United States, and may not

be offered or sold in the United States except pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and in compliance

with the securities laws of any state or any other jurisdiction of

the United States. No public offering of the securities will be

made in the United States.

This press release and the information contained

herein do not constitute either an offer to sell or purchase, or

the solicitation of an offer to sell or purchase, securities of the

Company.

No communication or information in respect of

any securities mentioned in this press release may be distributed

to the public in any jurisdiction where registration or approval is

required. No steps have been taken or will be taken in any

jurisdiction where such steps would be required. The offering or

subscription of the Company’s securities may be subject to specific

legal or regulatory restrictions in certain jurisdictions.

This press release does not, and shall not, in

any circumstances, constitute a public offering, a sale offer nor

an invitation to the public in connection with any offer of

securities. The distribution of this document may be restricted by

law in certain jurisdictions. Persons into whose possession this

document comes are required to inform themselves about and to

observe any such restrictions.

This announcement is an advertisement and not a

prospectus within the meaning of Regulation (EU) 2017/1129, as

amended (the "Prospectus Regulation").

With respect to the member states of the

European Economic Area other than France, no action has been

undertaken or will be undertaken to make an offer to the public of

the securities referred to herein requiring a publication of a

prospectus in any relevant member state. As a result, the

securities may not and will not be offered in any relevant member

state except in accordance with the exemptions set forth in Article

1 (4) of the Prospectus Regulation or under any other circumstances

which do not require the publication by the Company of a prospectus

pursuant to Article 3 of the Prospectus Regulation and/or to

applicable regulations of that relevant member state.

The distribution of this press release has not

been made, and has not been approved, by an “authorised person”

within the meaning of Article 21(1) of the Financial Services and

Markets Act 2000. As a consequence, this press release is only

being distributed to, and is only directed at, persons in the

United Kingdom that (i) are “investment professionals” falling

within Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005 (as amended, the

“Order”), (ii) are persons falling within Article

49(2)(a) to (d) (“high net worth companies, unincorporated

associations, etc.”) of the Order, or (iii) are persons to whom an

invitation or inducement to engage in investment activity (within

the meaning of Article 21 of the Financial Services and Markets Act

2000) in connection with the issue or sale of any securities may

otherwise lawfully be communicated or caused to be communicated

(all such persons together being referred to as “Relevant

Persons”). Any investment or investment activity to which

this document relates is available only to Relevant Persons and

will be engaged in only with Relevant Persons. Any person who is

not a Relevant Person should not act or rely on this document or

any of its contents.

This announcement may not be published, forwarded or

distributed, directly or indirectly, in the United States of

America, Canada, Australia, South Africa or Japan.

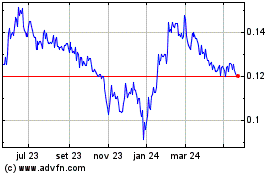

Atari (EU:ALATA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

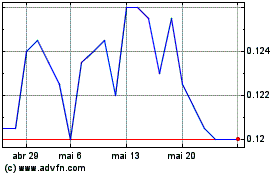

Atari (EU:ALATA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025