SMCP - Press Release - 2023 H1 Results

H1

2023

ResultsPress release - Paris,

July 27th, 2023

Good sales

performance driven

by APAC and

EuropeResilient profitability in a

challenging environmentExtension of financing

successfully secured

- H1 2023 Sales

at €610m, a progression of +8% on an organic0F0F1 basis (+9% at

constant exchange rates) vs. H1 2022, despite a high comparison

basis. The performance comes from both like-for-like (+5%) and from

network expansion;

- Good

performance in Europe despite a challenging environment in France

and a high basis of comparison. After two years with an outstanding

performance, slight decline in America in the first semester,

particularly in Canada, offset by US resilience. Asia Pacific’s

strong improvement of trend during the semester with Mainland China

back to growth and a good performance in the rest of the

region;

- Store network

is increasing in the second quarter (23 net openings) to reach

1,658 POS;

- Adjusted EBIT

at €36m (6% of sales) from €45m in H1 2022 (8% of sales) impacted

by inflation and old seasons liquidation plan;

- Net profit at

€14m from €21m in H1 2022;

- Sound balance

sheet structure and financial flexibility secured in the

mid-term;

-

Confirmation of 2023

objectives.

Commenting on those results, Isabelle

Guichot, CEO of SMCP, stated: “The Group recorded a good

performance over the first half, driven by strong momentum in Asia

and Europe. After two years of very strong growth, the America

posted a slight decline. By brand, SMCP benefitted from the

double-digit growth of Sandro and the “Other brands” division

(Claudie Pierlot and Fursac). Despite a complex economic

environment, we were able to capitalize on the desirability of our

brands to pursue our growth trajectory and post resilient

profitability over the first six months of the year. We also

successfully pursued the deployment of our CSR strategy, with an

increasing proportion of our collections produced from sustainable

materials, and all boutiques in eight of our European countries

powered 100% by green energy. For the second half of the year, we

have a clear action plan focused on pursuing our full-price

strategy, excellent cost control and prioritizing our investments,

while continuing to expand our network and improve the productivity

of our teams. We are therefore confident in our ability to achieve

our objectives for the full year 2023.”

| €m

except % |

Q2

2022 |

Q2

2023 |

Organic change |

Reported change |

|

H1

2022 |

H1

2023 |

Organic change |

Reported change |

|

Sales by region |

|

|

|

|

|

| France |

101.0 |

98.0 |

-3.0% |

-3.0% |

|

194.7 |

203.9 |

+4.7% |

+4.7% |

| EMEA ex.

France |

90.3 |

100.6 |

+11.6% |

+11.4% |

|

173.4 |

189.1 |

+9.4% |

+9.1% |

| America |

44.5 |

41.3 |

-4.8% |

-7.2% |

|

83.1 |

80.3 |

-3.7% |

-3.4% |

|

Asia Pacific |

46.6 |

65.5 |

+43.1% |

+40.4% |

|

114.2 |

136.5 |

+19.0% |

+19.5% |

|

Sales by brand |

|

|

|

|

|

| Sandro |

132.7 |

149.5 |

+13.4% |

+12.7% |

|

266.8 |

295.5 |

+10.6% |

+10.8% |

| Maje |

111.7 |

114.6 |

+3.4% |

+2.6% |

|

223.9 |

228.5 |

+1.9% |

+2.0% |

| Other

brands1F1F2 |

37.9 |

41.1 |

+8.2% |

+8.3% |

|

74.7 |

85.9 |

+14.9% |

+14.9% |

|

TOTAL |

282.4 |

305.3 |

+8.7% |

+8.1% |

|

565.4 |

609.8 |

+7.7% |

+7.9% |

SALES BREAKDOWN

BY REGION

In France, sales reached €204m,

up +5% organic compared to H1 2022 which was a record level. The

second quarter was impacted by a challenging economic and social

environment. Strikes, social tensions and persistent inflation

discouraged consumption and touristic flows. In addition, the

second quarter suffered from unfavorable calendar effects, with the

start of public sales being delayed by one week compared to last

year. The semester’s performance is driven by Sandro and by “Other

brands” as well as digital sales.The network is growing with seven

net openings in the second quarter.

In EMEA, sales

reached €189m, an organic increase of +9% compared to H1 2022

despite a high basis of comparison. The semester’s performance is

driven by the largest markets such as Germany, Spain, Italy, and

the Middle East, except the UK, impacted by a challenging economic

environment. Such growth is driven by like-for-like (B&M and

digital) but also by network expansion.The latest regained growth

momentum in the second quarter with fifteen net openings (notably

in Spain, Germany and Turkey).

In America, after two years in

a row of outstanding performance, sales reached €80m, a slight

organic decrease of 4% compared to H1 2022. This slowdown is

particularly due to Canada’s slow post-Covid recovery, accentuated

by the retail market’s recomposition and by the lack of tourism

from China. Sales in the US are resilient and are close to 2022

level, despite a challenging, promotional environment.The network

regained growth momentum in the second quarter with four net

openings.

In APAC, sales reached €137m,

+19% organic vs H1 2022. The trend is strongly improving during the

semester with +3% organic in the first quarter and +43% in the

second quarter. Mainland China is back to growth in the second

quarter (+53%), resulting in a double-digit growth in H1. Excluding

Mainland China, the region also recorded a particularly good

performance notably in Hong-Kong, Macau, Singapore and Malaysia,

with good touristic flows.The network is slightly decreasing by

three POS in the second quarter from network evolution’s phasing

(but +2 POS overall in H1).

Unless stated

otherwise, all figures used to analyze the performance are

disclosed by taking into account the impact of the application of

IFRS 16.

|

KEY FIGURES (€m) |

H1 2022 |

H1 2023 |

Change as reported |

|

Sales |

565.4 |

609.8 |

+7.9% |

| Adjusted

EBITDA |

121.8 |

115.7 |

-5.0% |

| Adjusted

EBIT |

45.2 |

36.3 |

-19.6% |

| Net Income

Group Share |

20.7 |

14.0 |

-32.1% |

| EPS2F2F3

(€) |

0.28 |

0.19 |

-32.9% |

| Diluted

EPS3F3F4 (€) |

0.26 |

0.18 |

-31.4% |

| FCF |

4.9 |

-8.7 |

- |

H1

2023 CONSOLIDATED

RESULTS

Adjusted EBITDA reached €116m

in H1 2023 (adjusted EBITDA margin of 19% of sales), compared with

€122m in H1 2022.

Management gross margin (73%) decreased by one

point due to a bigger part of liquidation of previous years’

collections (especially in China and at Claudie Pierlot), resulting

in a reduction of the level of inventories. However, retail gross

margin remains at a very high level on current collections, and the

average discount rate in season is stable vs 2022, despite a

competitive and promotional environment in most of the

regions.Total Opex (store costs4F4F5 and general

and administrative expenses) as a percentage of sales increased by

one point, due to the impact of inflation on rents and wages, and

the pursuit of investment in infrastructure and IT systems.

Depreciation,

amortization, and

provisions amounted to -€79m in H1 2023, compared

with -€77m in H1 2022. Excluding IFRS 16, depreciation and

amortization represent 4.0% of sales in H1 2023, nearly stable vs

2022 (4.2% in H1 2022).

As a result, adjusted EBIT

reached €36m in H1 2023 compared with €45m in H1 2022. The adjusted

EBIT margin is 6% in H1 2023 (8% in H1 2022).

Other non-current expenses are

not very significant (-€1m), and stable vs 2022.

Financial

expenses are slightly increasing at -€13m in H1 2023 (vs

-€12M in H1 2022), the increase in interest rates was offset by a

reduction in average outstanding gross debt.

With an income

tax expense at -€5m in H1 2023 (vs -€9m in H1 2022),

Net income - Group share remains

positive at €14m (€21m in H1 2022).

H1 2023

BALANCE SHEET AND NET FINANCIAL

DEBT

The Group maintained a strict control over its

inventories and investments during the semester. Inventories went

down from €292m year-end 2022 to €278m as of June 30th, 2023.

Capex was relatively stable as a percentage of

sales, representing 3.9% of sales in H1 2023, compared with 3.7% in

FY 2022.

Net financial debt at €306m as

of June 30th, 2023, vs €293M on December 31st, 2022, and €314m on

June 30th, 2022. The maturity of the main lines of financing

(including the revolving credit facility) has been renegotiated and

extended to 2026 and 2027 depending on the lines, confirming SMCP's

financial flexibility. Banks’ agreement has been obtained, and the

effective extension is in the course of being executed.

CONCLUSION

AND OUTLOOK

After a good performance in the first semester

in terms of growth, with a resilient profitability in a challenging

macro-economic and social environment, SMCP defined a roadmap for

the second semester around 4 pillars:

- Pursuit of full-price

strategy;

- Costs

discipline;

- Prioritization

of infrastructure investments while continuing network

expansion;

- Improved

productivity.

In addition, the second semester, traditionally

more profitable than the first semester, will also benefit

from:

- The normalization (vs Q4 2022) of

the situation in Greater China, a key market for the Group both in

terms of sales and profitability;

- And from a more

homogeneous performance by brand, notably at Maje, the most

profitable brand of the Group.

Based on these elements and provided

geopolitical situation and macro-economic/social context do not

deteriorate during the rest of the year, SMCP confirms its 2023

full-year guidance.

OTHER

INFORMATION

The Board of Directors held a meeting today and

approved the consolidated accounts for the first half of 2023. The

limited review procedures have been completed by the auditors and

the related report is being issued.

FINANCIAL

CALENDAR

October 26, 2023 – 2023 Q3 Sales publication

A conference call with

investors and analysts will be held today by CEO Isabelle Guichot

and CFO Patricia Huyghues Despointes, from 6:00 p.m. (Paris time).

Related slides will also be available on the website

(www.smcp.com), in the Finance section.

FINANCIAL INDICATORS NOT DEFINED IN

IFRS

The Group uses certain key financial and

non-financial measures to analyze the performance of its business.

The principal performance indicators used include the number of its

points of sale, like-for-like sales growth, Adjusted EBITDA and

Adjusted EBITDA margin, Adjusted EBIT and Adjusted EBIT margin.

Number of points of sale

The number of the Group’s points of sale

comprises total retail points of sale open at the relevant date,

which includes (i) directly-operated stores, including

free-standing stores, concessions in department stores,

affiliate-operated stores, factory outlets and online stores, and

(ii) partnered retail points of sale.

Organic sales growth

Organic sales growth refers to the performance

of the Group at constant currency and scope, i.e. excluding the

acquisition of Fursac.

Like-for-like sales growth

Like-for-like sales growth corresponds to retail

sales from directly operated points of sale on a like-for-like

basis in a given period compared with the same period in the

previous year, expressed as a percentage change between the two

periods. Like-for-like points of sale for a given period include

all of the Group’s points of sale that were open at the beginning

of the previous period and exclude points of sale closed during the

period, including points of sale closed for renovation for more

than one month, as well as points of sale that changed their

activity (for example, Sandro points of sale changing from Sandro

Femme to Sandro Homme or to a mixed Sandro Femme and Sandro Homme

store). Like-for-like sales growth percentage is presented at

constant exchange rates (sales for year N and year N-1 in foreign

currencies are converted at the average N-1 rate, as presented in

the annexes to the Group's consolidated financial statements as of

December 31 for the year N in question).

Adjusted EBITDA and adjusted EBITDA

margin

Adjusted EBITDA is defined by the Group as

operating income before depreciation, amortization, provisions, and

charges related to share-based long-term incentive plans (LTIP).

Consequently, Adjusted EBITDA corresponds to EBITDA before charges

related to LTIP.Adjusted EBITDA is not a standardized accounting

measure that meets a single generally accepted definition. It must

not be considered as a substitute for operating income, net income,

cash flow from operating activities, or as a measure of liquidity.

Adjusted EBITDA margin corresponds to adjusted EBITDA divided by

net sales.

Adjusted EBIT and adjusted EBIT

margin

Adjusted EBIT is defined by the Group as earning

before interests, taxes, and charges related to share-based

long-term incentive plans (LTIP). Consequently, Adjusted EBIT

corresponds to EBIT before charges related to LTIP. Adjusted EBIT

margin corresponds to Adjusted EBIT divided by net sales.

Management Gross margin

Management gross margin corresponds to the sales

after deducting rebates and cost of sales only. The accounting

gross margin (as appearing in the accounts) corresponds to the

sales after deducting the rebates, the cost of sales and the

commissions paid to the department stores and affiliates.

Retail Margin

Retail margin corresponds to the management

gross margin after taking into account the points of sale’s direct

expenses such as rent, personnel costs, commissions paid to the

department stores and other operating costs. The table below

summarizes the reconciliation of the management gross margin and

the retail margin with the accounting gross margin as included in

the Group’s financial statements for the following periods:

|

(€m) – excluding IFRS 16 |

H1 2022 |

H1

2023 |

|

Gross margin (as appearing in the

accounts) |

363.3 |

384.3 |

| Readjustment

of the commissions and other adjustments |

57.6 |

61.8 |

|

Management Gross margin |

420.9 |

446.1 |

| Direct costs

of point of sales |

-243.0 |

-269.8 |

| Retail

margin |

177.9 |

176.3 |

Net financial debt

Net financial debt represents the net financial

debt portion bearing interest. It corresponds to current and

non-current financial debt, net of cash and cash equivalents and

net of current bank overdrafts.

***

METHODOLOGY NOTE

Unless otherwise indicated, amounts are

expressed in millions of euros and rounded to the first digit after

the decimal point. In general, figures presented in this press

release are rounded to the nearest full unit. As a result, the sum

of rounded amounts may show non-material differences with the total

as reported. Note that ratios and differences are calculated based

on underlying amounts and not based on rounded amounts.

***

DISCLAIMER: FORWARD-LOOKING STATEMENTS

Certain information contained in this document

includes projections and forecasts. These projections and forecasts

are based on SMCP management's current views and assumptions. Such

forward-looking statements are not guarantees of future performance

of the Group. Actual results or performances may differ materially

from those in such projections and forecasts as a result of

numerous factors, risks and uncertainties, including the impact of

the current COVID-19 outbreak. These risks and uncertainties

include those discussed or identified under Chapter 3 “Risk factors

and internal control” of the Company’s Universal Registration

Document filed with the French Financial Markets Authority

(Autorité des Marchés Financiers - AMF) on 11 April 2023 and

available on SMCP's website (www.smcp.com).This document has not

been independently verified. SMCP makes no representation or

undertaking as to the accuracy or completeness of such information.

None of the SMCP or any of its affiliate’s representatives shall

bear any liability (in negligence or otherwise) for any loss

arising from any use of this document or its contents or otherwise

arising in connection with this document.

APPENDICES

Breakdown of DOS

|

Number of DOS |

H1-22 |

2022 |

Q1-23 |

H1-23 |

|

Q2-23

variation |

H1-23

variation |

| |

|

|

|

|

|

|

|

| By

region |

|

|

|

|

|

|

|

| France |

462 |

460 |

456 |

463 |

|

+7 |

+3 |

| EMEA |

394 |

395 |

391 |

399 |

|

+8 |

+4 |

| America |

167 |

166 |

164 |

167 |

|

+3 |

+1 |

| APAC |

251 |

259 |

305 |

301 |

|

-4 |

+42* |

| |

|

|

|

|

|

|

|

| By

brand |

|

|

|

|

|

|

|

| Sandro |

546 |

551 |

569 |

575 |

|

+6 |

+24 |

| Maje |

453 |

457 |

476 |

477 |

|

+1 |

+20 |

| Claudie

Pierlot |

206 |

201 |

203 |

206 |

|

+3 |

+5 |

| Suite 341 |

2 |

2 |

- |

- |

|

- |

-2 |

| Fursac |

67 |

69 |

68 |

72 |

|

+4 |

+3 |

|

Total DOS |

1,274 |

1,280 |

1,316 |

1,330 |

|

+14 |

+50 |

* Including the stores operated in Retail in Australia and New

Zealand from January 2023.

Breakdown of POS

|

Number of POS |

H1-22 |

2022 |

Q1-23 |

H1-23 |

|

Q2-23

variation |

H1-23

variation |

| |

|

|

|

|

|

|

|

| By

region |

|

|

|

|

|

|

|

| France |

463 |

461 |

457 |

464 |

|

+7 |

+3 |

| EMEA |

542 |

552 |

505 |

520 |

|

+15 |

-32* |

| America |

195 |

198 |

196 |

200 |

|

+4 |

+2 |

| APAC |

470 |

472 |

477 |

474 |

|

-3 |

+2 |

| |

|

|

|

|

|

|

|

| By

brand |

|

|

|

|

|

|

|

| Sandro |

742 |

752 |

733 |

744 |

|

+11 |

-8 |

| Maje |

620 |

627 |

611 |

615 |

|

+4 |

-12 |

| Claudie

Pierlot |

239 |

233 |

223 |

227 |

|

+4 |

-6 |

| Suite 341 |

2 |

2 |

- |

- |

|

- |

-2 |

| Fursac |

67 |

69 |

68 |

72 |

|

+4 |

+3 |

|

Total POS |

1,670 |

1,683 |

1,635 |

1,658 |

|

+23 |

-25 |

|

o/w Partners POS |

396 |

403 |

319 |

328 |

|

+9 |

-75** |

*Including the closure by the local partner of the POS in

Russia, which were not supplied since February 2022** Including the

closure by the local partner of the POS in Russia, which were not

supplied since February 2022, and the transfer of Australia/NZ

stores from POS to DOS

CONSOLIDATED FINANCIAL STATEMENTS

|

INCOME STATEMENT (€m) |

H1 2022 |

H1 2023 |

|

Sales |

565.4 |

609.8 |

| Adjusted

EBITDA |

121.8 |

115.7 |

| D&A |

-76.7 |

-79.4 |

|

Adjusted EBIT |

45.2 |

36.3 |

| Allocation of

LTIP |

-3.2 |

-3.5 |

|

EBIT |

42.0 |

32.8 |

| Other

non-recurring income and expenses |

-0.8 |

-0.9 |

|

Operating profit |

41.2 |

31.9 |

| Financial

result |

-11.8 |

-12.7 |

| Profit

before tax |

29.4 |

19.2 |

| Income tax |

-8.7 |

-5.1 |

| Net

income - Group

share |

20.7 |

14.0 |

|

BALANCE SHEET - ASSETS (€m) |

As of Dec. 31, 2022 |

As of June 30, 2023 |

|

Goodwill |

626.3 |

631.3 |

|

Trademarks, other intangible & right-of-use assets |

1 128.5 |

1 116.9 |

|

Property, plant and equipment |

82.5 |

76.3 |

|

Non-current financial assets |

18.7 |

18.6 |

|

Deferred tax assets |

35.7 |

36.3 |

|

Non-current assets |

1 891.7 |

1 879.5 |

|

Inventories and work in progress |

291.6 |

278.1 |

|

Accounts receivables |

62.9 |

65.5 |

|

Other receivables |

61.4 |

86.7 |

|

Cash and cash equivalents |

73.3 |

33.8 |

|

Current assets |

489.2 |

464.1 |

|

|

|

|

|

Total assets |

2 380.9 |

2 343.6 |

|

|

|

|

|

|

BALANCE SHEET - EQUITY & LIABILITIES (€m) |

As of Dec. 31, 2022 |

As of June 30, 2023 |

|

Total Equity |

1 172.1 |

1 191.6 |

|

Non-current lease liabilities |

302.9 |

295.5 |

|

Non-current financial debt |

261.9 |

84.4 |

|

Other financial liabilities |

0.1 |

0.2 |

|

Provisions and other non-current liabilities |

0.7 |

0.5 |

|

Net employee defined benefit liabilities |

4.2 |

4.5 |

|

Deferred tax liabilities |

169.2 |

176.5 |

|

Non-current liabilities |

739.0 |

561.6 |

|

Trade and other payables |

171.8 |

158.3 |

|

Current lease liabilities |

100.0 |

94.8 |

|

Bank overdrafts and short-term financial borrowings and debt |

104.2 |

255.2 |

|

Short-term provisions |

1.6 |

1.6 |

|

Other current liabilities |

92.2 |

80.5 |

|

Current liabilities |

469.8 |

590.4 |

|

|

|

|

|

Total Equity &

Liabilities |

2 380.9 |

2 343.6 |

|

NET FINANCIAL DEBT (€m) |

As of Dec. 31, 2022 |

As of June 30, 2023 |

| Non-current

financial debt & other financial liabilities |

-262.0 |

-84.5 |

| Bank

overdrafts and short-term financial liability |

-104.2 |

-255.2 |

| Cash and cash

equivalents |

73.3 |

33.8 |

|

Net financial debt |

-292.9 |

-306.0 |

| adjusted

EBITDA (excl. IFRS) – 12 months |

151.3 |

139.5 |

|

Net financial debt / adjusted EBITDA |

1,9x |

2.2x |

|

CASH FLOW STATEMENT (€m) |

H1 2022 |

H1 2023 |

| Adjusted

EBIT |

45.2 |

36.3 |

| D&A |

76.7 |

79.4 |

| Changes in

working capital |

-27.7 |

-11.4 |

| Income tax

expense |

-5.4 |

-13.3 |

|

Net cash flow from operating activities |

88.8 |

91.0 |

| Capital

expenditure |

-18.7 |

-24.0 |

| Others |

- |

-6.1 |

|

Net cash flow from investing activities |

-18.7 |

-30.1 |

| Treasury

shares purchase program |

-2.4 |

- |

| Change in

long-term borrowings and debt |

- |

- |

| Change in

short-term borrowings and debt |

-74.1 |

-73.0 |

| Net interests

paid |

-6.8 |

-9.0 |

| Other

financial income and expenses |

0.6 |

-0.9 |

| Reimbursement

of rent lease |

-59.8 |

-65.3 |

|

Net cash flow from financing activities |

-142.5 |

-148.2 |

| Net foreign

exchange difference |

0.8 |

-0.5 |

|

Change in net cash |

-71.6 |

-87.8 |

|

FCF (€m) |

H1 2022 |

H1 2023 |

| Adjusted

EBIT |

45.2 |

36.3 |

| D&A |

76.7 |

79.4 |

| Change in

working capital |

-27.7 |

-11.4 |

| Income

tax |

-5.4 |

-13.3 |

|

Net cash flow from operating activities |

88.8 |

91.0 |

| Capital

expenditure (operating and financial) |

-18.7 |

-24.0 |

| Reimbursement

of rent lease |

-59.8 |

-65.3 |

| Interest &

Other financial |

-6.2 |

-9.9 |

| Other &

FX |

0.8 |

-0.5 |

|

Free cash-flow |

4.9 |

-8.7 |

ABOUT SMCP

SMCP is a global leader in the accessible luxury

market with four unique Parisian brands: Sandro, Maje, Claudie

Pierlot and Fursac. Present in 46 countries, the Group comprises a

network of over 1,600 stores globally and a strong digital presence

in all its key markets. Evelyne Chetrite and Judith Milgrom founded

Sandro and Maje in Paris, in 1984 and 1998 respectively, and

continue to provide creative direction for the brands. Claudie

Pierlot and Fursac were respectively acquired by SMCP in 2009 and

2019. SMCP is listed on the Euronext Paris regulated market

(compartment A, ISIN Code FR0013214145, ticker: SMCP).

CONTACTS

|

INVESTORS/PRESS

|

|

| |

|

|

SMCP

|

BRUNSWICK |

|

Amélie

Dernis |

Hugues Boëton |

|

|

Tristan Roquet Montegon |

|

+33 (0) 1 55 80 51

00 |

+33 (0) 1 53 96 83 83 |

|

amelie.dernis@smcp.com |

smcp@brunswickgroup.com |

1 Organic growth | All references in this document to the

“organic sales performance” refer to the performance of the Group

at constant currency and scope

2 Claudie Pierlot and Fursac brands3 Net Income

Group Share divided by the average number of ordinary shares as of

June 30th, 2023, minus existing treasury shares held by the Group.4

Net Income Group Share divided by the average number of common

shares as of June 30th, 2023, minus the treasury shares held by the

company, plus the common shares that may be issued in the future.

This includes the conversion of the Class G preferred shares and

the performance bonus shares – LTIP which are prorated according to

the performance criteria reached as of June 30th, 2023.5 Excluding

IFRS 16

- Press Release - SMCP - 2023 H1 Results

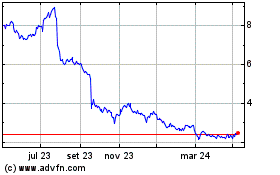

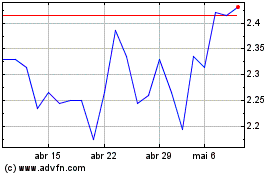

SMCP (EU:SMCP)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

SMCP (EU:SMCP)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024