SMCP - 2024 Q1 Sales

2024 first quarterPress release -

Paris, April 25th, 2024

Q1 sales down by 5% in a

macroeconomic environment that remains

challengingDetailing the action plan to deliver

growth and profitability

First quarter sales

- Q1 2024 sales

at €287m, decreasing by -5% on an organic basis vs Q1 2023, against

strong comparables.

- Good

performance in America, resilience in Europe (excl. France) and

slow consumption in China

- Sandro and

Maje slight organic growth excluding China

- Maintained

stringent discount rate policy, with a 2 points improvement of the

in-season discount rate, mainly in Europe and North America

- On-going

network optimization with 11 net closings during the quarter,

mainly in Asia to reach 1,719 points of sales worldwide

Details and targets of mid-term action plan,

based on four key priorities:

- Get back to

profitable growth and gain market shares

- From 2026

onward, once the network is optimized, get back to a mid-single

digit sales CAGR

- EBIT margin

c.10% in 2026 and c. 12% by 5-years

- Rebalance

geographical footprint

- Retail:

network optimisation with c.100 closings of dilutive stores, mainly

in China over the 2 coming years

- Wholesale:

acceleration of the expansion, through partnerships

- Gain in

agility and leverage on technological innovation to improve

efficiency to deliver profitability

- Increase the

Group’s negotiating leverage on all types of expenses

- Action plan

rollout from 2024, with progressive effects, to reach €25m

additional EBIT in 2026

- Protect cash

to deliver a sound financial structure

- Asset light

investments based on a selective approach

- Free-cash-flow

generation of €50m in 2026

Commenting on these results, Isabelle

Guichot, CEO of SMCP, stated: « As anticipated, our

first quarter remained on a similar trend to that seen in the

second half of 2023. We are satisfied with our performance in the

United States and our resilience in Europe, except in France, where

consumer spending remains volatile. In Asia, our business continues

to be affected in China by low in-store traffic, while our sales

are dynamic in South-East Asia. During the first quarter, we

continued to implement our medium-term action plan, and over the

coming months we expect to fully benefit from our global geographic

footprint and accelerating performance in high-potential regions.

We also expect to gain from our latest technological investments

(particularly in digital technology) to achieve greater efficiency,

and to continue our disciplined management to ensure profitable

growth and a solid financial structure»

| €m

except % Unaudited figures |

Q1 2023 |

Q1 2024 |

Organicchange |

ReportedChange |

|

Sales by region |

| France |

106.0 |

98.2 |

-7.4% |

-7.4% |

| EMEA |

88.6 |

89.4 |

+0.1% |

+0.9% |

| America |

39 .0 |

42.0 |

+8.9% |

+7.7% |

|

APAC |

71.0 |

57.3 |

-15.7% |

-19.4% |

|

Sales by Brand |

| Sandro |

146.0 |

140.4 |

-2.9% |

-3.8% |

| Maje |

113.8 |

108.9 |

-3.2% |

-4.3% |

| Other

brands1 |

44.8 |

37.5 |

-16.4% |

-16.2% |

|

TOTAL |

304.6 |

286.8 |

-5.0% |

-5.8% |

SALES BY

REGION

In France, sales reached €98m

in the first quarter, down -7% on an organic basis vs Q1 2023,

which marked a record (Q1 2023 was +13% up vs Q1 2022). The trend

in the first quarter 2024 was in line with Q4 2023, but saw an

improvement following the end of the official sales period for

Sandro, Maje and Fursac, thanks to a good reception of their

Spring/Summer collections. While B&M sales were resilient with

a nearly flat like-for-like performance for Sandro and Maje,

digital sales decreased, impacted by a strong basis of comparison

in 2023, especially for Claudie Pierlot.

In EMEA, sales amounted to

€89m, in line with Q1 2023. This good performance, given the high

basis of comparison, was driven by the South of Europe, especially

in brick & mortar. The quarter was tougher in the UK, in the

continuity of Q4 2023. Retail partners registered a good

performance, especially in the strategic markets (Middle East and

Turkey). Apart from the temporary impact of a few relocations

currently under process, the network remained relatively

stable.

In America, sales were up by

+9% organic vs Q1 2023, at €42m. The region signs the best

performance of the Group. The US and Mexico recorded a very good

performance for both brands Sandro and Maje. Sales in Canada

continued to improve sequentially through the quarter and have been

back to a positive trend since February. In line with the Group’s

strategy of geographical rebalancing, the network increased by 3

net openings in Q1.

In Asia Pacific, sales at €57m

decreased by -16% on an organic basis vs Q1 2023, with a very

polarized situation across the continent. While in Greater China,

sales continue to be strongly affected by low traffic in malls, the

Group delivered a good performance in South-East Asia (strong

double-digit positive in Singapore, Malaysia, Thailand, and

Vietnam). To be noted also the first delivery of Fursac merchandise

to our South Korea partner. As expected, the network decreased with

10 net closings in China, as initially planned.

CONCLUSION AND

PERSPECTIVES

After a year 2023 impacted by a challenging

macroeconomic environment, and the first quarter of 2024 following

the same trend, the Group provides today more details on its

mid-term action plan, articulated around four key priorities:

1. Reboost growth and

gain market shares

- Continue to

work on brand desirability and enhance brand relevance and

positioning by reaffirming the place and role of each brand within

the portfolio of SMCP: expressing identity, cultivating strategic

“raison d’être”, reinforcing the specificities of each brand and

developing complementarity while reducing overlap

- Optimize

collection architecture and product merchandising, by simplifying

merchandising, sharpening collection architecture in stores and

boosting the men segment

- Maximize

product offer beyond Ready-to-wear by reinforcing existing lines

(bags, shoes, and glasses) and by developing new opportunities

(beauty, perfume, lifestyle, home, travel and experience)

- Transform

digital challenges into opportunities to reboost sales, reaffirm

omnichannel leverage and regain profitability

- These

initiatives lead to a mid-single digit sales CAGR from 2026

onwards, once the network is optimised

2. Leverage global

exposure

- On the retail

network, the geographical footprint has been rebalanced between

regions. In North America, the network is returning to growth in

key areas in the US. In Europe, the network will remain largely

stable in the mid-term with some selective optimizations (in

Northern Europe and for Claudie Pierlot), some qualitative

relocations and flagship openings in capitals. In Greater China,

the network will decrease by 15-20% in 2024 (40 DOS) and should

continue to be optimized in 2025, to improve productivity. In

South-East Asia, qualitative openings are scheduled to capitalize

on the momentum of those markets. In total, the hundred of closings

are mainly scheduled in 2024 and 2025

- Regarding the

non-retail network, the acceleration of development with partners

is a proven way to explore markets which could otherwise be

challenging to penetrate directly, and with a relative effect on

EBIT margin. Mid-term target is to open 40 to 50 sales points per

year to increase the non-retail share mix by 5 points, from 8% to

13% of Group sales

3. Gain in agility and

leverage on innovation to improve efficiency to deliver

profitability

- Optimize

production process to enhance Gross Margin by implementing stricter

and more transversal buying process for raw materials and

components (leverage Group negotiations, rationalize suppliers’

portfolio, review contractual terms), while respecting each brand’s

DNA and style asperities

- Accelerate on

sustainable innovation by mutualizing the reservation of

sustainable raw materials and fibers between brands to assess the

potential of innovative materials

- Reinforce

technical innovation and leverage artificial intelligence

- Be more agile

on Claudie Pierlot’s and Fursac’s development by twisting business

models to boost profitability:

- By reviewing

Claudie Pierlot’s existing operating model: optimisation of the

network with 30 closings by mid-term in Europe and Asia and

capitalize on strong digital penetration

- By

concentrating Fursac’s development on department stores (low capex,

traffic driver and variable costs structure)

4. Protect cash to

deliver a sound financial structure

- The initiatives

detailed above will enable the Group to progressively improve the

EBIT by €25m until 2026; thanks to savings in all costs categories:

- Production

costs: more transversality in raw materials and components

purchases and leveraging Group negotiations with a rationalized

suppliers’ portfolio

- OPEX: rent

optimisation in stores (renegotiations) and in HQ, adjustment of

staff costs, particularly in China; reviewing indirect purchases

(IT, logistics, etc.) by a renegotiation of contract terms;

lowering weight of D&A by optimising investments

- The Group’s

5-year target remains to reach c.12% of EBIT margin (and to reach

c.10% in 2026)

- The priority is

given to the most relutive investments to optimize free-cash-flow

generation, reach €50m in 2026, and accelerate net debt

reduction

Management remains fully committed to delivering

the action plan and expects effects by mid-term.

NEXT

EVENTS

June 6th, 2024 – Annual Shareholders’

Meeting

July 25th, 2024 (post market close) –

Publication of 2024 first semester results

A conference call with

investors and analysts will be held today by CEO Isabelle Guichot

and CFO Patricia Huyghues Despointes, from 9:00 a.m. (Paris

time).

Related slides will

also be available on the website (www.smcp.com), in the Finance

section.

APPENDICES

Breakdown of DOS

|

Number of DOS |

Q1-23 |

2023 |

Q1-24 |

|

vs.2023 |

vs.Q1-23 |

| |

|

|

|

|

|

|

| By

region |

|

|

|

|

|

|

| France |

456 |

470 |

473 |

|

+3 |

+17 |

| EMEA |

391 |

411 |

410 |

|

-1 |

+19 |

| America |

164 |

176 |

177 |

|

+1 |

+13 |

| APAC |

305 |

316 |

304 |

|

-12 |

-1 |

| |

|

|

|

|

|

|

| By

brand |

|

|

|

|

|

|

| Sandro |

569 |

591 |

586 |

|

-5 |

+17 |

| Maje |

476 |

490 |

488 |

|

-2 |

+12 |

| Claudie

Pierlot |

203 |

210 |

209 |

|

-1 |

+6 |

| Fursac |

68 |

82 |

81 |

|

-1 |

+13 |

|

Total DOS |

1,316 |

1,373 |

1,364 |

|

-9 |

+48 |

Breakdown of POS

|

Number of POS |

Q1-23 |

2023 |

Q1-24 |

|

vs.2023 |

vs.Q1-23 |

| |

|

|

|

|

|

|

| By

region |

|

|

|

|

|

|

| France |

457 |

471 |

473 |

|

+2 |

+16 |

| EMEA |

505 |

555 |

549 |

|

-6 |

+44 |

| America |

196 |

215 |

218 |

|

+3 |

+22 |

| APAC |

477 |

489 |

479 |

|

-10 |

+2 |

| |

|

|

|

|

|

|

| By

brand |

|

|

|

|

|

|

| Sandro |

733 |

775 |

767 |

|

-8 |

+34 |

| Maje |

611 |

640 |

636 |

|

-4 |

+25 |

| Claudie

Pierlot |

223 |

233 |

234 |

|

+1 |

+11 |

| Fursac |

68 |

82 |

82 |

|

- |

+14 |

|

Total POS |

1,635 |

1,730 |

1,719 |

|

-11 |

+84 |

|

o/w Partners POS |

319 |

357 |

355 |

|

-2 |

+36 |

FINANCIAL INDICATORS NOT DEFINED IN

IFRS

Number of points of sale

(POS)

The number of the Group’s points of sale

comprises total retail points of sale open at the relevant date,

which includes (i) directly operated stores (DOS), including

free-standing stores, concessions in department stores,

affiliate-operated stores, outlets and online stores, and (ii)

partnered retail points of sale.

Organic sales growth

Organic sales growth is the total sales in a

given period compared to the same period in the previous year. It

is expressed as a percentage change between the two periods and is

presented at constant rates (sales for period N and period N-1 in

foreign currencies are converted at the average rate for year N-1)

and excluding the effects of changes in the scope of

consolidation.

Like-for-like sales growth

Like-for-like sales growth corresponds to retail

sales from directly operated points of sale on a like-for-like

basis in a given period compared with the same period in the

previous year. Like-for-like points of sale for a given period

include all of the Group’s points of sale that were open at the

beginning of the previous period and exclude points of sale closed

during the period, including points of sale closed for renovation

for more than one month, as well as points of sale that changed

their activity (for example, Sandro points of sale changing from

Sandro Femme to Sandro Homme or to a mixed Sandro Femme and Sandro

Homme store). Like-for-like sales growth percentage is presented at

constant exchange rates.

***

METHODOLOGY NOTE

Unless otherwise indicated, amounts are

expressed in millions of euros. In general, figures presented in

this press release are rounded to the nearest full unit. As a

result, the sum of rounded amounts may show non-material

differences with the total as reported. Note that ratios and

differences are calculated based on underlying amounts and not

based on rounded amounts.

***

DISCLAIMER: FORWARD-LOOKING STATEMENTS

Certain information contained in this document

includes projections and forecasts. These projections and forecasts

are based on SMCP management's current views and assumptions. Such

forward-looking statements are not guarantees of future performance

of the Group. Actual results or performances may differ materially

from those in such projections and forecasts as a result of

numerous factors, risks and uncertainties. These risks and

uncertainties include those discussed or identified under Chapter 3

“Risk factors and internal control” of the Company’s Universal

Registration Document filed with the French Financial Markets

Authority (Autorité des Marchés Financiers - AMF) on 5 April 2024

and available on SMCP's website (www.smcp.com).This document has

not been independently verified. SMCP makes no representation or

undertaking as to the accuracy or completeness of such information.

None of the SMCP or any of its affiliate’s representatives shall

bear any liability (in negligence or otherwise) for any loss

arising from any use of this document or its contents or otherwise

arising in connection with this document.

ABOUT SMCP

SMCP is a global leader in the accessible luxury

market with four unique Parisian brands: Sandro, Maje, Claudie

Pierlot and Fursac. Present in 46 countries, the Group comprises a

network of over 1,600 stores globally and a strong digital presence

in all its key markets. Evelyne Chetrite and Judith Milgrom founded

Sandro and Maje in Paris, in 1984 and 1998 respectively, and

continue to provide creative direction for the brands. Claudie

Pierlot and Fursac were respectively acquired by SMCP in 2009 and

2019. SMCP is listed on the Euronext Paris regulated market

(compartment A, ISIN Code FR0013214145, ticker: SMCP).

CONTACTS

| |

|

|

INVESTORS/PRESS

|

|

| |

|

|

SMCP

|

BRUNSWICK |

|

Amélie

Dernis |

Hugues Boëton |

|

|

Tristan Roquet Montegon |

|

+33 (0) 1 55 80 51

00 |

+33 (0) 1 53 96 83 83 |

|

amelie.dernis@smcp.com |

smcp@brunswickgroup.com |

1 Claudie Pierlot and Fursac brands

- Press Release - SMCP - 2024 Q1 Sales

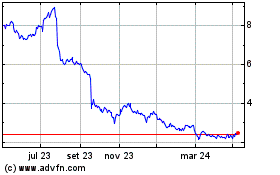

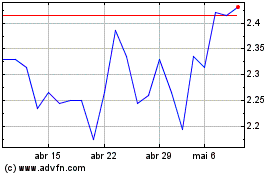

SMCP (EU:SMCP)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

SMCP (EU:SMCP)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024