Kinross Gold Corporation (“Kinross” or the “Company”) (TSX: K,

NYSE: KGC) is pleased to announce that the Toronto Stock Exchange

(the “TSX”) has accepted the notice filed by the Company to renew

its normal course issuer bid (“NCIB”) program.

Under the NCIB program, the Company is

authorized to purchase up to 108,440,227 of its common shares (out

of the 1,227,579,280 common shares outstanding as at July 31, 2023)

representing up to 10% of the Company’s public float of

1,084,402,272 common shares, during the period starting on August

9, 2023 and ending on August 8, 2024.

In deciding to establish the NCIB program, the

Company believes that the market price of the common shares may

not, from time to time, fully reflect their value and accordingly

the purchase of the common shares would be in the best interest of

the Company and an attractive and appropriate use of available

funds.

Kinross may make purchases, from time to time,

through the facilities of the TSX, the New York Stock Exchange (the

“NYSE”) and/or alternative Canadian trading systems, if eligible,

or by such other means as may be permitted by the TSX and/or NYSE

or under applicable law. Daily repurchases on the TSX will be

limited to a maximum of 780,692 common shares, representing 25% of

the average daily trading volume for the six months ended July 31,

2023 (being 3,122,768 common shares), except where purchases are

made in accordance with the “block purchase exception” of the TSX

rules. Subject to certain exceptions for block purchases, the

maximum number of common shares which can be purchased per day on

the NYSE will be 25% of the average daily trading volume for the

four calendar weeks preceding the date of purchase. All shares

purchased by the Company under the NCIB program will be cancelled.

Pursuant to the terms of the previous normal course issuer bid

approved by the TSX on July 29, 2022, as amended with such

amendment approved by the TSX on September 30, 2022, the Company

was authorized to repurchase up to 114,047,070 of its common shares

and repurchased an aggregate of 78,857,250 common shares, which

shares were cancelled.

Purchases will be made by the Company in

accordance with the requirements of the TSX and/or the NYSE and the

price which the Company will pay for any such common shares will be

the market price of any such common shares at the time of

acquisition, or such other price as may be permitted by the TSX

and/or the NYSE.

In connection with the NCIB program, the Company

has entered into an automatic repurchase plan with its designated

broker to allow for purchases of its common shares during certain

pre-determined black-out periods, based on Company instructions

provided when not in black out, should the Company determine to

proceed with purchases under the ASPP. Outside of these

pre-determined black-out periods, any repurchases of common shares

will be repurchased in accordance with management’s discretion,

subject to applicable law. Although the Company has a present

intention to acquire its common shares pursuant to the NCIB

program, the Company will not be obligated to make any purchases

under this NCIB.

About Kinross Gold

Corporation

Kinross is a Canadian-based global senior gold

mining company with operations and projects in the United States,

Brazil, Mauritania, Chile and Canada. Our focus is on delivering

value based on the core principles of responsible mining,

operational excellence, disciplined growth, and balance sheet

strength. Kinross maintains listings on the Toronto Stock Exchange

(symbol:K) and the New York Stock Exchange (symbol:KGC).

Media Contact Victoria

BarringtonSenior Director, Corporate Communicationsphone:

647-788-4153victoria.barrington@kinross.com

Investor Relations ContactChris

LichtenheldtVice-President, Investor Relationsphone:

647-365-2761chris.lichtenheldt@kinross.com

Cautionary statement on forward-looking

information

All statements, other than statements of

historical fact, contained or incorporated by reference in this

news release including, but not limited to, any information as to

the future financial or operating performance of Kinross,

constitute “forward-looking information” or “forward-looking

statements” within the meaning of certain securities laws,

including the provisions of the Securities Act (Ontario) and the

provisions for “safe harbor” under the United States Private

Securities Litigation Reform Act of 1995 and are based on

expectations, estimates and projections as of the date of this news

release. Forward-looking statements contained in this news release,

include, but are not limited to, those relating to potential

purchases under the Company’s NCIB. The words “anticipate”,

“continue”, “estimates”, “expects”, “forecast”, “guidance”,

“intends”, “outlook”, “progress”, “potential”, “prioritize”, or

variations of or similar such words and phrases or statements that

certain actions, events or results may, could, should or will be

achieved, received or taken, or will occur or result and similar

such expressions identify forward-looking statements.

Forward-looking statements are necessarily based upon a number of

estimates and assumptions that, while considered reasonable by

Kinross as of the date of such statements, are inherently subject

to significant business, economic and competitive uncertainties and

contingencies. The estimates, models and assumptions of Kinross

referenced, contained or incorporated by reference in this news

release, which may prove to be incorrect, include, but are not

limited to, the various assumptions set forth herein and in our

Management’s Discussion and Analysis (“MD&A”) for the year

ended December 31, 2022, and the Annual Information Form dated

March 31, 2023. Known and unknown factors could cause actual

results to differ materially from those projected in the

forward-looking statements. Such factors include, but are not

limited to: the inaccuracy of any of the foregoing assumptions.

Many of these uncertainties and contingencies can directly or

indirectly affect, and could cause, Kinross’ actual results to

differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, Kinross,

including but not limited to resulting in an impairment charge on

goodwill and/or assets. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Forward-looking statements are

provided for the purpose of providing information about

management’s expectations and plans relating to the future. All of

the forward-looking statements made in this news release are

qualified by this cautionary statement and those made in our other

filings with the securities regulators of Canada and the United

States including, but not limited to, the cautionary statements

made in the “Risk Analysis” section of our MD&A for the year

ended December 31, 2022 and the Annual Information Form dated March

31, 2023. These factors are not intended to represent a complete

list of the factors that could affect Kinross. Kinross disclaims

any intention or obligation to update or revise any forward-looking

statements or to explain any material difference between subsequent

actual events and such forward-looking statements, except to the

extent required by applicable law.

Source: Kinross Gold Corporation

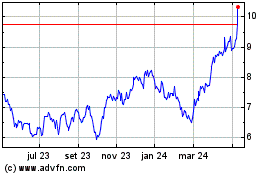

Kinross Gold (TSX:K)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

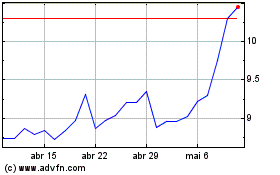

Kinross Gold (TSX:K)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025