Tower Announces Termination of Intel Acquisition Agreement

16 Agosto 2023 - 4:16AM

MIGDAL HAEMEK, Israel, August 16, 2023 –Tower

Semiconductor (NASDAQ: TSEM & TASE: TSEM), today announced it

has mutually agreed with Intel Corporation to terminate their

previously announced merger agreement entered into in February

2022.

After careful consideration and thorough discussions and having

received no indications regarding certain required regulatory

approval, both parties have agreed to terminate their merger

agreement having passed the August 15, 2023 outside date. Pursuant

to the terms of the merger agreement, and in connection with this

termination, Intel will pay to Tower a reverse termination fee

equal to $353 million.

Russell Ellwanger, Tower Semiconductor CEO, commented, "Tower

was very excited to join Intel to enable Pat Gelsinger’s vision for

Intel’s foundry business. We appreciate the efforts by all parties.

During the past 18 months, we’ve made significant technological,

operational, and business advancements. We are well positioned to

continue to drive our strategic priorities and short-, mid- and

long-term tactics with a continued focus on top and bottom-line

growth."

About Tower Semiconductor Tower Semiconductor

Ltd. (NASDAQ: TSEM, TASE: TSEM), the leading foundry of high value

analog semiconductor solutions, provides technology and

manufacturing platforms for integrated circuits (ICs) in growing

markets such as consumer, industrial, automotive, mobile,

infrastructure, medical and aerospace and defense. Tower

Semiconductor focuses on creating positive and sustainable impact

on the world through long term partnerships and its advanced and

innovative analog technology offering, comprised of a broad range

of customizable process platforms such as SiGe, BiCMOS,

mixed-signal/CMOS, RF CMOS, CMOS image sensor, non-imaging sensors,

integrated power management (BCD and 700V), and MEMS. Tower

Semiconductor also provides world-class design enablement for a

quick and accurate design cycle as well as process transfer

services including development, transfer, and optimization, to IDMs

and fabless companies. To provide multi-fab sourcing and extended

capacity for its customers, Tower Semiconductor owns two

manufacturing facilities in Israel (150mm and 200mm), two in the

U.S. (200mm), two facilities in Japan (200mm and 300mm) which it

owns through its 51% holdings in TPSCo and is sharing a 300mm

manufacturing facility being established in Italy with ST. For more

information, please visit: www.towersemi.com.

Safe Harbor Regarding Forward-Looking

StatementsThis press release includes forward-looking

statements, which are subject to risks and uncertainties. Actual

results may vary from those projected or implied by such

forward-looking statements. A complete discussion of risks and

uncertainties that may affect the accuracy of forward-looking

statements included in this press release or which may otherwise

affect Tower’s business is included under the heading “Risk

Factors” in Tower’s most recent filings on Forms 20-F, F-3, F-4 and

6-K, as were filed with the Securities and Exchange Commission (the

“SEC”) and the Israel Securities Authority. Tower does not intend

to update, and expressly disclaim any obligation to update, the

information contained in this release.

Tower Semiconductor Investor Relations

Contact:

Noit Levi | +972-4-604-7066 | noitle@towersemi.com

- PRESS RELEASE_16AUG2023_Final

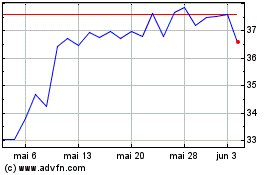

Tower Semiconductor (NASDAQ:TSEM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Tower Semiconductor (NASDAQ:TSEM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024