Centerra Gold Inc. (“Centerra” or the “Company”) (TSX: CG) (NYSE:

CGAU) is pleased to announce its strategic plan for each asset in

the Company’s portfolio along with the Company’s approach to

capital allocation.

President and CEO, Paul Tomory, commented, “We

are excited to roll-out our strategic plan that focuses on

maximizing the value for each asset in our portfolio. The plan

identifies the opportunities at each asset that will drive future

value and growth for the Company. Specifically, at Mount Milligan,

we expect strong operational performance in the next few years, and

we will work to optimize operations and maximize the value of the

large deposit. At Öksüt, our life of mine plan demonstrates

particularly strong production and cost performance over the next

two years with a steady gold production profile continuing

throughout the life of mine. Our prefeasibility study on the

Thompson Creek molybdenum mine supports a disciplined path to

restarting operations and realizing significant vertical

integration synergies with the Langeloth Metallurgical Facility.

And finally, at the Goldfield Project, we have decided to

re-evaluate the project scope of work to achieve a lower capital

flowsheet and to maximize the returns on the project. Our

exploration focus will now be on oxide and transition material,

with the timing of an initial resource estimate contingent on

exploration success and metallurgical testwork.”

“In conjunction with execution of the strategic

plan, we have also developed a capital allocation strategy which

focuses on returning capital to shareholders through dividends and

share buybacks, investing in internal projects and exploration

within our current portfolio and evaluating external opportunities

for growth. We believe that Centerra’s exposure to gold and base

metals is a differentiating factor, however, our strategic plan has

us remaining a gold-focused company. Today’s announcement provides

a clear path to delivering safe and sustainable operations and

creating value for our shareholders and local stakeholders in the

future.”

Mount Milligan Mine (“Mount

Milligan”)

Mount Milligan’s production in the first half of

2023 was impacted by mine sequencing and lower than planned gold

grades as a result of mining in an ore-waste transition zone, which

caused lower metal recoveries and throughput challenges in the

processing plant in the first quarter. The Company has completed

mining in the ore-waste transition zone in Phase 9 and is currently

mining the higher-grade copper and gold zones from Phase 7 and

Phase 9 in the second half of 2023.

Centerra views Mount Milligan’s substantial

resource base as a strategic asset and is advancing work on

productivity and cost efficiencies in concert with mine plan

optimization to offset some of the recent inflationary pressures

that have impacted the industry. In parallel, Centerra is working

to explore ways to maximize the value of the very large mineral

endowment.

Öksüt Mine (“Öksüt”)

As previously disclosed, Öksüt resumed full

operations on June 5, 2023. In June 2023, the mine started ramping

up its crushing, stacking, and processing activities and produced

20,503 ounces during the month. Öksüt continues to process

gold-in-carbon inventory, and on July 31, 2023 Centerra issued 2023

gold production guidance of 180,000 to 190,000 ounces.

The Company expects elevated production at Öksüt

through mid-2024, as the inventory and stockpiles are processed

through the adsorption, desorption, and recovery (“ADR”) plant, at

which point, the production levels are expected to return to steady

state. The life of mine (“LOM”) plan, in the table below, has been

updated to reflect the restart of operations and other

optimizations. The updated Öksüt LOM will generate positive free

cash flow, and the mine remains a strategic asset in Centerra’s

portfolio.

Öksüt LOM Plan

|

|

Gold Production (Koz) |

Gold Production Costs ($/oz) |

AISC on a by-product basisNG

($/oz) |

Additions to PP&E / Total Capital

ExpendituresNG(2)

($M) |

|

Q2 YTD 2023 |

20.5 |

$404 |

$1,484 |

$11 |

|

2023(1) |

180 – 190 |

$450 – $500 |

$650 – $700 |

$35 – $45 |

|

2024 |

190 – 210 |

$600 – $700 |

$800 – $900 |

$30 – $40 |

|

2025 |

125 – 145 |

$725 – $825 |

$875 – $975 |

$10 – $15 |

|

2026 |

110 – 130 |

$800 – $900 |

$925 – $1,025 |

$5 – $10 |

|

2027 |

110 – 130 |

$800 – $900 |

$925 – $1,025 |

$5 – $10 |

|

2028 |

100 – 120 |

$900 – $1,000 |

$975 – $1,075 |

$0 – $5 |

|

2029 |

40 – 50 |

$1,500 – $1,600 |

$1,600 – $1,700 |

- |

(1) As a result of restarting activities at

Öksüt, Centerra published Öksüt guidance on July 31, 2023 in

conjunction with the Company’s second quarter 2023 results. (2)

Additions to Property, Plant, and Equipment (“PP&E”) is the

same as Total Capital ExpendituresNG for full year estimates in

2023-2029.

Molybdenum Business Unit

The Molybdenum Business Unit (“MBU”) is a fully

integrated business in North America with a long operating history.

The MBU consists of the Thompson Creek Mine (“Thompson Creek”) in

Idaho, the Endako Mine (“Endako”) in northern British Columbia, a

joint venture in which Centerra owns a 75% interest and the

remaining 25% is held by Sojitz Moly Resources, Inc., and the

Langeloth Metallurgical Facility (“Langeloth”) near Pittsburgh,

Pennsylvania. The two mines have been in care and maintenance since

late 2014 and mid-2015, respectively, with significant

infrastructure in place that is in excellent condition, while

Langeloth has continued to operate at reduced capacity processing

third party concentrates and selling finished molybdenum

products.

The Company has completed a prefeasibility study

(“PFS”) on the restart of mining at Thompson Creek, with the

objective of realizing value for the MBU. A restart of Thompson

Creek, vertically integrated with operations at Langeloth, would

result in a combined $373 million after-tax net present value (5%)

(“NPV5%”) and 16% after-tax internal rate of return (“IRR”), based

on a flat molybdenum price of $20 per pound.

Langeloth is among the largest molybdenum

conversion plants in North America and is a unique and strategic

asset given its proximity to the North American steel market.

Significant synergies and margin improvements that will enhance

future cash flow generation and profitability from the MBU will

result from: (1) increased capacity utilization at Langeloth from

the current level of 30-35% to leverage fixed costs; (2) ability to

blend the high-quality Thompson Creek concentrate with lower

quality third-party concentrates; and (3) ability to produce an

increased volume of higher margin final molybdenum products.

Overall, the restart and integration of Thompson Creek with

Langeloth presents an opportunity to establish a fully integrated

business that can leverage existing infrastructure and create

long-term value through profitable operations and significant

optionality.

The Thompson Creek PFS includes an optimized

mine plan with an 11-year mine life. A summary of the PFS

production profile is included in the table below.

Thompson Creek PFS Production Profile

|

|

Ore Mined(M tonnes) |

Grade(% Mo) |

Molybdenum Production(Mlbs) |

|

Year 1 |

5 |

0.03% |

3 |

|

Year 2 – Year 3(1) |

10 |

0.05% |

11 |

|

Year 4 – Year 8(1) |

9 |

0.07% |

13 |

|

Year 9 – Year 11(1) |

8 |

0.08% |

14 |

|

Total LOM |

95 |

0.07% |

134 |

(1) Ore mined, grade, and molybdenum production

are annual weighted averages for the stated period. NOTE: Numbers

may not add due to rounding.

The cost profile associated with the Thompson

Creek PFS, shown in the table below, is split into three phases,

largely driven by the grade profile in the production table above.

The average production cost breakdown over the LOM is approximately

50% mining, 35% processing, and 15% general and administration.

Thompson Creek PFS Cost Profile

|

|

Production Costs($/lb Mo) |

AISC on a by-product

basisNG($/lb Mo) |

|

Year 2 – Year 3 |

$13 – $16 |

$15 – $18 |

|

Year 4 – Year 8 |

$10 – $13 |

$12 – $15 |

|

Year 9 – Year 11 |

$7 – $10 |

$8 – $11 |

In line with the Company’s disciplined approach

to capital allocation, Centerra expects to phase the operations

restart at Thompson Creek. The PFS, requiring between $350 and $400

million of pre-production capital expenditures, includes an

optimized mine design, which leads to a longer mine life and

provides for greater exposure to molybdenum price cycles. As

previously disclosed with the Company’s outlook on February 23,

2023, capital spending at Thompson Creek in 2023 is expected to be

$9 to $10 million associated with advancement of project studies

including project de-risking activities such as geotechnical

drilling, additional engineering costs and site early works.

The Company has commenced a feasibility study

(“FS”) for Thompson Creek, which is expected to be completed by

mid-2024. Upon completion of the FS, the Company expects to

authorize a limited notice to proceed, requiring $100 to $125

million of capital for pre-stripping within current authorizations

and to purchase long lead items. While the current authorizations

support early works and certain activities defined in the limited

notice to proceed stage, the Company has initiated discussions with

the appropriate authorities to obtain a modified permit for the

full scope of the optimized mine plan. The Company expects to

authorize full notice to proceed in mid-2025, linked to sufficient

progress toward permit modification approvals for the optimized

mine plan, at which time the remaining $250 to $275 million of

capital will be released to complete the project. First production

is expected in the second half of 2027. A breakdown of the PFS

capital spending profile is included in the table below.

Thompson Creek PFS Capital Expenditures

|

Stage |

Expected Timeframe |

Additions to PP&E / Capital

ExpendituresNG(1)

($M) |

|

Limited notice to proceed |

Mid-2024 to Mid-2025 |

$100 – $125 |

|

Full notice to proceed |

Mid-2025 to Mid-2027 |

$250 – $275 |

|

Total Pre-Production Non-Sustaining Capital

ExpendituresNG |

$350 – $400 |

(1) Additions to Property, Plant, and Equipment

(“PP&E”) is the same as Total Capital ExpendituresNG.

The Thompson Creek PFS and synergies at

Langeloth demonstrate solid economics at flat molybdenum prices of

$20 per pound. The sensitivity of project economics due to changes

in molybdenum prices is illustrated in the table below.

Project Economics Sensitivity to Molybdenum

Prices

|

Project Economics |

Molybdenum Price ($/pound) |

|

$17.50 |

$20 (PFS price) |

$22.50 |

$25 |

|

NPV5% |

$153M |

$373M |

$569M |

$761M |

|

IRR |

10% |

16% |

20% |

25% |

Endako is expected to remain in care and

maintenance as the Company focuses on the Thompson Creek restart.

Endako is an important molybdenum asset with a large defined

resource in a top-tier jurisdiction, with valuable modern plant

infrastructure, providing longer-term optionality. Should Endako be

restarted in the future, it could support many years of continuous

mining from Centerra’s MBU.

While Centerra remains primarily a gold mining

business, the Company sees value from its exposure to base metals.

As part of the value maximizing plan for the MBU, the Company will

evaluate all strategic options for the assets.

Goldfield Project

As previously disclosed with the Company’s

second quarter results on July 31, 2023, after a review of the

Goldfield Project (“Goldfield”), the Company has made the decision

to re-evaluate the project scope of work to achieve a lower capital

flowsheet and to maximize returns on the project. As a result, it

will now focus exploration activities only on oxide and transition

material, principally in the Gemfield and nearby deposit areas. Due

to this strategic pivot, Centerra will take additional time to

perform exploration activities in Goldfield’s large, underexplored

land position before releasing an initial resource estimate. The

timing for Goldfield’s initial resource estimate will be contingent

on exploration success and metallurgical testwork. Centerra will

provide an update on exploration progress at Goldfield with the

Company’s third quarter 2023 results. The Company continues to

believe that Goldfield presents an attractive opportunity in a top

mining jurisdiction.

Kemess

Kemess is a past producing mine located in the

Toodoggone district within British Columbia’s prolific Golden

Horseshoe, a highly prospective area with multiple gold and copper

discoveries. Kemess benefits from infrastructure already on-site,

including a process plant, water treatment plant, air strip, and an

open pit available for waste storage. In addition, Kemess has

several permits in place and an impact benefit agreement with its

First Nation partner. Centerra’s strategic approach at Kemess is to

leverage the existing infrastructure to unlock regional potential

and continue to evaluate the underground prospect of Kemess which

could be a future source of gold and copper production.

Capital Allocation

Centerra expects to generate significant free

cash flow in the short- and medium-term and has developed a capital

allocation strategy that focuses on three key areas: (1) returning

capital to shareholders through continued dividends and share

buybacks; (2) investing in internal growth projects and exploration

within the Company’s current portfolio, including the Thompson

Creek restart, the Goldfield project and greenfield exploration;

and (3) evaluating external opportunities for growth. Even after

accounting for these three areas of priority, the Company expects

to maintain a significant cash balance through the end of 2024 and

beyond.

Exploration

Total exploration expenditures estimated for

2023 are expected to be $40 to $50 million. This includes

exploration spending at Goldfield of $16 to $20 million, $16 to $19

million on greenfield and generative exploration projects, and $8

to $11 million on brownfield exploration. In 2023, brownfield

exploration at Mount Milligan is focused on resource expansion

drilling programs within the open-pit and to the west and southwest

of the ultimate pit margins, while exploration at Öksüt will

continue to test oxide gold potential at peripheral prospects and

assess potential for deeper porphyry-style copper-gold

mineralization. In the next few years, Centerra will continue to

invest in exploration spending with roughly 50% of annual

exploration spending allocated to brownfield and 50% allocated to

greenfield activities.

About Centerra Gold

Centerra Gold Inc. is a Canadian-based gold

mining company focused on operating, developing, exploring and

acquiring gold and copper properties in North America, Türkiye, and

other markets worldwide. Centerra operates two mines: the Mount

Milligan Mine in British Columbia, Canada, and the Öksüt Mine in

Türkiye. The Company also owns the Goldfield District Project in

Nevada, United States, the Kemess Underground Project in British

Columbia, Canada, and owns and operates the Molybdenum Business

Unit in the United States and Canada. Centerra’s shares trade on

the Toronto Stock Exchange (“TSX”) under the symbol CG and on the

New York Stock Exchange (“NYSE”) under the symbol CGAU. The Company

is based in Toronto, Ontario, Canada.

For more information:

Lisa WilkinsonVice President, Investor Relations & Corporate

Communications(416)

204-3780lisa.wilkinson@centerragold.com

Shae FrosstManager, Investor Relations(416)

204-2159shae.frosst@centerragold.com

Additional information on Centerra is available on the

Company’s website at www.centerragold.com and at

SEDAR at www.sedar.com and EDGAR at

www.sec.gov/edgar.

Qualified Persons

Andrey Shabunin, Professional Engineer, member

of Professional Engineers of Ontario and General Manager of Öksüt

Mine at Öksüt Madencilik Sanayi Ticaret A.Ş., a wholly owned

subsidiary of Centerra, has reviewed and approved the scientific

and technical information under the heading “Öksüt Mine (“Öksüt”)”

in this news release. Mr. Shabunin is a Qualified Person within the

meaning of National Instrument 43-101 – Standards of Disclosure for

Mineral Projects of the Canadian Securities Administrators (“NI

43-101”).

Jean-Francois St-Onge, Professional Engineer,

member of the Professional Engineer of Ontario (PEO) and Centerra’s

Senior Director, Technical Services, has reviewed and approved the

scientific and technical information in this news release related

to mining. Mr. St-Onge is a Qualified Person within the meaning of

NI 43-101.

Lars Weiershäuser, PhD, P.Geo, and Centerra’s

Director, Geology, has reviewed and approved the scientific and

technical information included in this news release related to

geology and mineral resources. Dr. Weiershäuser is a Qualified

Person within the meaning of NI 43-101.

Anna Malevich, Professional Engineer, member of

the Professional Engineers of Ontario (PEO) and Centerra’s Senior

Director, Projects has reviewed and approved the scientific and

technical information included in this news release related to

processing and metallurgy. Ms. Malevich is a Qualified Person

within the meaning of 43-101.

All other scientific and technical information

presented in this document was reviewed and approved by Centerra’s

geological and mining staff under the supervision of W. Paul

Chawrun, Professional Engineer, member of the Professional

Engineers of Ontario (PEO) and Centerra’s Executive Vice President

and Chief Operating Officer. Mr. Chawrun is a Qualified Person

within the meaning of NI 43-101.

Caution Regarding Forward-Looking

Information:

Information contained in this document which is

not a statement of historical fact, and the documents incorporated

by reference herein, may be “forward-looking information” for the

purposes of Canadian securities laws and within the meaning of the

United States Private Securities Litigation Reform Act of 1995.

Such forward-looking information involves risks, uncertainties and

other factors that could cause actual results, performance,

prospects and opportunities to differ materially from those

expressed or implied by such forward-looking information. The words

"achieve", “advance”, “assume”, “anticipate”, “approach”,

“believe”, “budget”, “contemplate”, “contingent”, “continue”,

“could”, “deliver”, “de-risk”, “develop”, “enhance”, “estimate”,

“evaluate”, “expand”, “expect”, “explore”, “focus”, “forecast”,

“future”, “generate”, “growth”, “in line”, “improve”, “intend”,

“may”, “maximize”, “modify”, “obtain”, “offset”, “on track”,

“optimize”, “path”, “plan”, "potential", “re-evaluate”, “realize”,

“remaining”, “restart”, “result”, “schedule”, “sees”, “seek”,

“strategy”, “subject to”, “target”, “test”, “understand”, “update”,

“will”, and similar expressions identify forward-looking

information. These forward-looking statements relate to, among

other things: statements regarding the Company’s strategic plan for

each asset in its portfolio and maximizing the value thereof, 2023

Guidance, including production, costs, capital expenditures and

cash flows; the expected profile of the Company’s future production

and costs; expectations that the Mount Milligan Mine is on track to

access higher grades in the second half of 2023 and Mount Milligan

Mine’s production will be weighted to the back end of 2023;

expectations of gold processing at the Öksüt Mine, including

processing Öksüt Mine’s gold in carbon inventory and gold in ore

stockpiles and on the heap leach pad; strategic options for the

entire Molybdenum Business Unit; re-evaluating the Goldfield

Project including achieving a lower capital flow sheet and

maximizing returns on the project; the Company’s capital allocation

strategy regarding dividends and share buybacks; investing in

internal projects and exploration within the Company’s current

portfolio; evaluating external opportunities for growth; and

ongoing evaluations of a restart of the Thompson Creek Mine,

including synergies created at Langeloth its operating capacities

and the use of the concentrate from the Thompson Creek Mine,

projected net present value and internal rates of return on such a

restart and receiving required permitting and authorization from

the relevant authorities concerning a restart; the future of Endako

if restarted; exploration activities and metallurgical test work at

the Goldfield Project; the regional potential and underground

prospects at Kemess; and the future exploration plans for the

Company.

Forward-looking information is necessarily based

upon a number of estimates and assumptions that, while considered

reasonable by Centerra, are inherently subject to significant

technical, political, business, economic and competitive

uncertainties and contingencies. Known and unknown factors could

cause actual results to differ materially from those projected in

the forward- looking information. Factors and assumptions that

could cause actual results or events to differ materially from

current expectations include, among other things: (A) strategic,

legal, planning and other risks, including: political risks

associated with the Company’s operations in Türkiye, the USA and

Canada; resource nationalism including the management of external

stakeholder expectations; the Company receiving approval for the

renewal of its normal course issuer bid; the impact of changes in,

or to the more aggressive enforcement of, laws, regulations and

government practices, including unjustified civil or criminal

action against the Company, its affiliates, or its current or

former employees; risks that community activism may result in

increased contributory demands or business interruptions; the risks

related to outstanding litigation affecting the Company; the impact

of any sanctions imposed by Canada, the United States or other

jurisdictions against various Russian and Turkish individuals and

entities; potential defects of title in the Company’s properties

that are not known as of the date hereof; the inability of the

Company and its subsidiaries to enforce their legal rights in

certain circumstances; risks related to anti-corruption

legislation; Centerra not being able to replace mineral reserves;

Indigenous claims and consultative issues relating to the Company’s

properties which are in proximity to Indigenous communities; and

potential risks related to kidnapping or acts of terrorism; (B)

risks relating to financial matters, including: sensitivity of the

Company’s business to the volatility of gold, copper and other

mineral prices; the use of provisionally-priced sales contracts for

production at the Mount Milligan Mine; reliance on a few key

customers for the gold-copper concentrate at the Mount Milligan

Mine; use of commodity derivatives; the imprecision of the

Company’s mineral reserves and resources estimates and the

assumptions they rely on; the accuracy of the Company’s production

and cost estimates; the impact of restrictive covenants in the

Company’s credit facilities which may, among other things, restrict

the Company from pursuing certain business activities or making

distributions from its subsidiaries; changes to tax regimes; the

Company’s ability to obtain future financing; the impact of global

financial conditions; the impact of currency fluctuations; the

effect of market conditions on the Company’s short-term

investments; the Company’s ability to make payments, including any

payments of principal and interest on the Company’s debt

facilities, which depends on the cash flow of its subsidiaries; and

(C) risks related to operational matters and geotechnical issues

and the Company’s continued ability to successfully manage such

matters, including: the Company receiving the required

authorizations and permits for the restart of Thompson Creek; the

ability of the Company to blend concentrate from Thompson Creek at

Langeloth; the stability of the pit walls at the Company’s

operations; the integrity of tailings storage facilities and the

management thereof, including as to stability, compliance with

laws, regulations, licenses and permits, controlling seepages and

storage of water, where applicable; the risk of having sufficient

water to continue operations at the Mount Milligan Mine and achieve

expected mill throughput; changes to, or delays in the Company’s

supply chain and transportation routes, including cessation or

disruption in rail and shipping networks, whether caused by

decisions of third-party providers or force majeure events

(including, but not limited to: labour action, flooding, wildfires,

earthquakes, COVID-19, or other global events such as wars); the

success of the Company’s future exploration and development

activities, including the financial and political risks inherent in

carrying out exploration activities; inherent risks associated with

the use of sodium cyanide in the mining operations; the adequacy of

the Company’s insurance to mitigate operational and corporate

risks; mechanical breakdowns; the occurrence of any labour unrest

or disturbance and the ability of the Company to successfully

renegotiate collective agreements when required; the risk that

Centerra’s workforce and operations may be exposed to widespread

epidemic or pandemic; seismic activity, including earthquakes;

wildfires; long lead-times required for equipment and supplies

given the remote location of some of the Company’s operating

properties and disruptions caused by global events; reliance on a

limited number of suppliers for certain consumables, equipment and

components; the ability of the Company to address physical and

transition risks from climate change and sufficiently manage

stakeholder expectations on climate-related issues; the Company’s

ability to accurately predict decommissioning and reclamation costs

and the assumptions they rely upon; the Company’s ability to

attract and retain qualified personnel; competition for mineral

acquisition opportunities; risks associated with the conduct of

joint ventures/partnerships; and, the Company’s ability to manage

its projects effectively and to mitigate the potential lack of

availability of contractors, budget and timing overruns, and

project resources. For additional risk factors, please see section

titled “Risks Factors” in the Company’s most recently filed Annual

Information Form (“AIF”) available on SEDAR at www.sedar.com and

EDGAR at www.sec.gov/edgar.

There can be no assurances that forward-looking

information and statements will prove to be accurate, as many

factors and future events, both known and unknown could cause

actual results, performance or achievements to vary or differ

materially from the results, performance or achievements that are

or may be expressed or implied by such forward-looking statements

contained herein or incorporated by reference. Accordingly, all

such factors should be considered carefully when making decisions

with respect to Centerra, and prospective investors should not

place undue reliance on forward-looking information.

Forward-looking information is as of September 18, 2023. Centerra

assumes no obligation to update or revise forward-looking

information to reflect changes in assumptions, changes in

circumstances or any other events affecting such forward-looking

information, except as required by applicable law.

Non-GAAP and Other Financial Measures

This document contains “specified financial

measures” within the meaning of NI 52-112, specifically the

non-GAAP financial measures, non-GAAP ratios and supplementary

financial measures described below. Management believes that the

use of these measures assists analysts, investors and other

stakeholders of the Company in understanding the costs associated

with producing gold and copper, understanding the economics of gold

and copper mining, assessing operating performance, the Company’s

ability to generate free cash flow from current operations and on

an overall Company basis, and for planning and forecasting of

future periods. However, the measures have limitations as

analytical tools as they may be influenced by the point in the life

cycle of a specific mine and the level of additional exploration or

other expenditures a company has to make to fully develop its

properties. The specified financial measures used in this document

do not have any standardized meaning prescribed by IFRS and may not

be comparable to similar measures presented by other issuers, even

as compared to other issuers who may be applying the World Gold

Council (“WGC”) guidelines. Accordingly, these specified financial

measures should not be considered in isolation, or as a substitute

for, analysis of the Company’s recognized measures presented in

accordance with IFRS.

Definitions

The following is a description of the non-GAAP

financial measures, non-GAAP ratios and supplementary financial

measures used in this document:

- All-in sustaining costs on a

by-product basis per ounce is a non-GAAP ratio calculated as all-in

sustaining costs on a by-product basis divided by ounces of gold

sold. All-in sustaining costs on a by-product basis is a non-GAAP

financial measure calculated as the aggregate of production costs

as recorded in the condensed consolidated statements of (loss)

earnings, refining and transport costs, the cash component of

capitalized stripping and sustaining capital expenditures, lease

payments related to sustaining assets, corporate general and

administrative expenses, accretion expenses, asset retirement

depletion expenses, copper and silver revenue and the associated

impact of hedges of by-product sales revenue. When calculating

all-in sustaining costs on a by-product basis, all revenue received

from the sale of copper from the Mount Milligan Mine, as reduced by

the effect of the copper stream, is treated as a reduction of costs

incurred. A reconciliation of all-in sustaining costs on a

by-product basis to the nearest IFRS measure is set out below.

Management uses these measures to monitor the cost management

effectiveness of each of its operating mines.

- Sustaining capital expenditures and

Non-sustaining capital expenditures are non-GAAP financial

measures. Sustaining capital expenditures are defined as those

expenditures required to sustain current operations and exclude all

expenditures incurred at new operations or major projects at

existing operations where these projects will materially benefit

the operation. Non-sustaining capital expenditures are primarily

costs incurred at ‘new operations’ and costs related to ‘major

projects at existing operations’ where these projects will

materially benefit the operation. A material benefit to an existing

operation is considered to be at least a 10% increase in annual or

life of mine production, net present value, or reserves compared to

the remaining life of mine of the operation. A reconciliation of

sustaining capital expenditures and non-sustaining capital

expenditures to the nearest IFRS measures is set out below.

Management uses the distinction of the sustaining and

non-sustaining capital expenditures as an input into the

calculation of all-in sustaining costs per ounce and all-in costs

per ounce.

Certain unit costs, including all-in

sustaining costs on a by-product basis (including and excluding

revenue-based taxes) per ounce, are non-GAAP ratios which include

as a component certain non-GAAP financial measures including all-in

sustaining costs on a by-product basis which can be reconciled as

follows:

|

|

Three months ended June 30, |

|

|

Consolidated |

Mount Milligan |

Öksüt |

|

(Unaudited - $millions, unless otherwise

specified) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

2022 |

|

Production costs attributable to gold |

51.3 |

|

40.0 |

|

47.0 |

|

40.0 |

|

4.3 |

— |

|

Production costs attributable to copper |

29.3 |

|

29.8 |

|

29.3 |

|

29.8 |

|

— |

— |

| Total

production costs excluding molybdenum segment, as reported |

80.6 |

|

69.8 |

|

76.3 |

|

69.8 |

|

4.3 |

— |

| Adjust

for: |

|

|

|

|

|

|

| Third

party smelting, refining and transport costs |

3.2 |

|

3.0 |

|

3.2 |

|

3.0 |

|

— |

— |

|

By-product and co-product credits |

(34.7 |

) |

(43.5 |

) |

(34.7 |

) |

(43.5 |

) |

— |

— |

| Adjusted

production costs |

49.1 |

|

29.3 |

|

44.8 |

|

29.3 |

|

4.3 |

— |

| Corporate

general administrative and other costs |

10.2 |

|

11.7 |

|

— |

|

0.4 |

|

— |

— |

|

Reclamation and remediation - accretion (operating sites) |

1.1 |

|

2.1 |

|

0.6 |

|

0.6 |

|

0.5 |

1.5 |

|

Sustaining capital expenditures |

20.6 |

|

24.5 |

|

13.3 |

|

20.2 |

|

7.3 |

4.2 |

|

Sustaining leases |

1.4 |

|

1.4 |

|

1.3 |

|

1.3 |

|

0.1 |

0.1 |

| All-in

sustaining costs on a by-product basis |

82.4 |

|

69.0 |

|

60.0 |

|

51.8 |

|

12.2 |

5.8 |

|

Exploration and evaluation costs |

18.6 |

|

13.4 |

|

0.9 |

|

3.1 |

|

0.5 |

1.2 |

|

Non-sustaining capital expenditures(1) |

1.8 |

|

1.0 |

|

— |

|

0.6 |

|

— |

— |

| Care and

maintenance and other costs |

7.3 |

|

3.2 |

|

— |

|

— |

|

4.7 |

0.1 |

| All-in

costs on a by-product basis |

110.0 |

|

86.6 |

|

60.9 |

|

55.5 |

|

17.4 |

7.1 |

| Ounces

sold (000s) |

48.2 |

|

41.6 |

|

37.5 |

|

41.6 |

|

10.7 |

— |

| Pounds

sold (millions) |

12.8 |

|

18.9 |

|

12.8 |

|

18.9 |

|

— |

— |

| Gold

production costs ($/oz) |

1,066 |

|

961 |

|

1,255 |

|

961 |

|

404 |

n/a |

| All-in

sustaining costs on a by-product basis ($/oz) |

1,711 |

|

1,659 |

|

1,599 |

|

1,245 |

|

1,143 |

n/a |

| All-in

costs on a by-product basis ($/oz) |

2,284 |

|

2,082 |

|

1,624 |

|

1,334 |

|

1,625 |

n/a |

| Gold -

All-in sustaining costs on a co-product basis ($/oz) |

1,656 |

|

1,699 |

|

1,529 |

|

1,286 |

|

1,143 |

n/a |

| Copper

production costs ($/pound) |

2.28 |

|

1.58 |

|

2.28 |

|

1.58 |

|

n/a |

n/a |

|

Copper - All-in sustaining costs on a co-product basis

($/pound) |

2.77 |

|

2.10 |

|

2.77 |

|

2.10 |

|

n/a |

n/a |

(1) Non-sustaining capital

expenditures are distinct projects designed to have a significant

increase in the net present value of the mine. In the current

quarter, non-sustaining capital expenditures include costs related

to the installation of the staged flotation reactors at the Mount

Milligan Mine.

Certain unit costs, including all-in

sustaining costs on a by-product basis (including and excluding

revenue-based taxes) per ounce, are non-GAAP ratios which include

as a component certain non-GAAP financial measures including all-in

sustaining costs on a by-product basis which can be reconciled as

follows:

|

|

Six months ended June 30, |

|

|

Consolidated |

Mount Milligan |

Öksüt |

|

(Unaudited - $millions, unless otherwise

specified) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

2022 |

|

Production costs attributable to gold |

94.6 |

|

85.2 |

|

90.3 |

|

64.0 |

|

4.3 |

21.1 |

|

Production costs attributable to copper |

70.6 |

|

64.4 |

|

70.6 |

|

64.4 |

|

— |

— |

| Total

production costs excluding molybdenum segment, as reported |

165.2 |

|

149.6 |

|

160.9 |

|

128.4 |

|

4.3 |

21.1 |

| Adjust

for: |

|

|

|

|

|

|

| Third

party smelting, refining and transport costs |

5.0 |

|

6.2 |

|

5.0 |

|

6.0 |

|

— |

0.2 |

|

By-product and co-product credits |

(89.2 |

) |

(119.0 |

) |

(89.2 |

) |

(119.0 |

) |

— |

— |

| Adjusted

production costs |

81.0 |

|

36.8 |

|

76.7 |

|

15.4 |

|

4.3 |

21.3 |

| Corporate

general administrative and other costs |

24.9 |

|

24.0 |

|

0.1 |

|

0.5 |

|

— |

— |

|

Reclamation and remediation - accretion (operating sites) |

2.1 |

|

3.6 |

|

1.2 |

|

1.1 |

|

0.9 |

2.5 |

|

Sustaining capital expenditures |

25.5 |

|

39.2 |

|

15.1 |

|

32.8 |

|

10.4 |

6.4 |

|

Sustaining lease payments |

2.8 |

|

2.9 |

|

2.5 |

|

2.6 |

|

0.3 |

0.3 |

| All-in

sustaining costs on a by-product basis |

136.3 |

|

106.5 |

|

95.6 |

|

52.4 |

|

15.9 |

30.5 |

|

Exploration and study costs |

33.8 |

|

21.6 |

|

1.3 |

|

6.5 |

|

0.9 |

1.7 |

|

Non-sustaining capital expenditures |

1.8 |

|

1.8 |

|

— |

|

1.5 |

|

— |

— |

| Care and

maintenance and other costs |

20.2 |

|

5.8 |

|

— |

|

— |

|

14.2 |

0.1 |

| All-in

costs on a by-product basis |

192.1 |

|

135.7 |

|

96.9 |

|

60.4 |

|

31.0 |

32.3 |

| Ounces

sold (000s) |

87.1 |

|

136.5 |

|

76.5 |

|

81.8 |

|

10.7 |

54.7 |

| Pounds

sold (millions) |

28.2 |

|

38.4 |

|

28.2 |

|

38.4 |

|

— |

— |

| Gold

production costs ($/oz) |

1,085 |

|

624 |

|

1,181 |

|

783 |

|

404 |

386 |

| All-in

sustaining costs on a by-product basis ($/oz) |

1,564 |

|

780 |

|

1,250 |

|

641 |

|

1,484 |

557 |

| All-in

costs on a by-product basis ($/oz) |

2,205 |

|

994 |

|

1,267 |

|

738 |

|

2,896 |

590 |

| Gold -

All-in sustaining costs on a co-product basis ($/oz) |

1,635 |

|

1,008 |

|

1,330 |

|

1,021 |

|

1,484 |

557 |

| Copper

production costs ($/pound) |

2.51 |

|

1.68 |

|

2.51 |

|

1.68 |

|

n/a |

n/a |

|

Copper - All-in sustaining costs on a co-product basis

($/pound) |

2.81 |

|

2.18 |

|

2.81 |

|

2.18 |

|

n/a |

n/a |

Free cash flow (deficit) is a non-GAAP

financial measure and can be reconciled as follows:

|

|

Three months ended June 30, |

|

|

Consolidated |

Mount Milligan |

Öksüt |

Molybdenum |

Other |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2023 |

|

|

2022 |

|

|

Cash (used in) provided by operating

activities(1) |

$ |

33.4 |

|

$ |

(3.5 |

) |

$ |

21.6 |

|

$ |

80.9 |

|

$ |

7.7 |

|

$ |

(51.2 |

) |

$ |

30.7 |

|

$ |

(6.1 |

) |

$ |

(26.6 |

) |

$ |

(27.1 |

) |

|

Deduct: |

|

|

|

|

|

|

|

|

|

|

|

Property, plant & equipment additions(1) |

|

(22.8 |

) |

|

(27.7 |

) |

|

(12.8 |

) |

|

(23.4 |

) |

|

(7.3 |

) |

|

(4.2 |

) |

|

(0.1 |

) |

|

— |

|

|

(2.6 |

) |

|

(0.1 |

) |

|

Free cash flow (deficit) |

$ |

10.6 |

|

$ |

(31.2 |

) |

$ |

8.8 |

|

$ |

57.5 |

|

$ |

0.4 |

|

$ |

(55.4 |

) |

$ |

30.6 |

|

$ |

(6.1 |

) |

$ |

(29.2 |

) |

$ |

(27.2 |

) |

(1) As presented in the Company’s

condensed consolidated statements of cash flows.

|

|

Six months ended June 30, |

|

|

Consolidated |

Mount Milligan |

Öksüt |

Molybdenum |

Other |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Cash (used in) provided by operating

activities(1) |

$ |

(66.4 |

) |

$ |

24.8 |

|

$ |

49.2 |

|

$ |

101.7 |

|

$ |

(13.1 |

) |

$ |

12.4 |

|

$ |

(45.9 |

) |

$ |

(25.9 |

) |

$ |

(56.6 |

) |

$ |

(63.4 |

) |

|

Deduct: |

|

|

|

|

|

|

|

|

|

|

|

Property, plant & equipment additions(1) |

|

(28.9 |

) |

|

(46.9 |

) |

|

(15.8 |

) |

|

(37.8 |

) |

|

(10.4 |

) |

|

(6.4 |

) |

|

(0.1 |

) |

|

(0.3 |

) |

|

(2.6 |

) |

|

(2.4 |

) |

|

Free cash (deficit) flow |

$ |

(95.3 |

) |

$ |

(22.1 |

) |

$ |

33.4 |

|

$ |

63.9 |

|

$ |

(23.5 |

) |

$ |

6.0 |

|

$ |

(46.0 |

) |

$ |

(26.2 |

) |

$ |

(59.2 |

) |

$ |

(65.8 |

) |

(1) As presented in the Company’s

condensed consolidated statements of cash flows.

Sustaining capital expenditures and

non-sustaining capital expenditures are non-GAAP measures and can

be reconciled as follows:

|

|

Three months ended June 30, |

|

|

Consolidated |

Mount Milligan |

Öksüt |

Molybdenum |

Other |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

2022 |

|

2023 |

|

|

2022 |

|

|

2023 |

|

2022 |

|

2023 |

|

|

2022 |

|

|

Additions to

PP&E(1) |

$ |

20.8 |

|

$ |

25.2 |

|

$ |

11.8 |

$ |

18.3 |

$ |

7.0 |

|

$ |

5.6 |

|

$ |

0.1 |

$ |

0.2 |

$ |

1.9 |

|

$ |

1.1 |

|

| Adjust

for: |

|

|

|

|

|

|

|

|

|

|

|

Costs capitalized to the ARO assets |

|

2.1 |

|

|

0.6 |

|

|

1.2 |

|

2.2 |

|

0.9 |

|

|

(0.7 |

) |

|

— |

|

— |

|

— |

|

|

(0.9 |

) |

|

Costs capitalized to the ROU assets |

|

0.2 |

|

|

(0.2 |

) |

|

0.2 |

|

— |

|

— |

|

|

(0.2 |

) |

|

— |

|

— |

|

— |

|

|

— |

|

|

Costs relating to the acquisition of Goldfield Project |

|

— |

|

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

— |

|

|

— |

|

|

Other(2) |

|

(0.6 |

) |

|

0.1 |

|

|

0.1 |

|

0.4 |

|

(0.6 |

) |

|

(0.5 |

) |

|

— |

|

— |

|

(0.1 |

) |

|

0.2 |

|

|

Capital expenditures |

$ |

22.5 |

|

$ |

25.7 |

|

$ |

13.3 |

$ |

20.9 |

$ |

7.3 |

|

$ |

4.2 |

|

$ |

0.1 |

$ |

0.2 |

$ |

1.8 |

|

$ |

0.4 |

|

|

Sustaining capital expenditures |

|

20.7 |

|

|

24.7 |

|

|

13.3 |

|

20.3 |

|

7.3 |

|

|

4.2 |

|

|

0.1 |

|

0.2 |

|

— |

|

|

0.1 |

|

|

Non-sustaining capital expenditures |

|

1.8 |

|

|

1.0 |

|

|

— |

|

0.6 |

|

— |

|

|

— |

|

|

— |

|

— |

|

1.8 |

|

|

0.4 |

|

(1) As presented in the Company’s

condensed consolidated financial

statements.(2) Includes reclassification of

insurance and capital spares from supplies inventory to

PP&E.

|

|

Six months ended June 30, |

|

|

Consolidated |

Mount Milligan |

Öksüt |

Molybdenum |

Other |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

2023 |

|

|

2022 |

|

|

2023 |

|

2022 |

|

2023 |

|

|

2022 |

|

|

Additions to

PP&E(1) |

$ |

28.8 |

|

$ |

235.4 |

|

$ |

16.1 |

|

$ |

28.0 |

$ |

10.7 |

|

$ |

5.1 |

|

$ |

0.1 |

$ |

0.4 |

$ |

1.9 |

|

$ |

201.9 |

|

| Adjust

for: |

|

|

|

|

|

|

|

|

|

|

|

Costs capitalized to the ARO assets |

|

(0.8 |

) |

|

13.9 |

|

|

(0.6 |

) |

|

5.9 |

|

(0.2 |

) |

|

1.20 |

|

|

— |

|

— |

|

0.0 |

|

|

6.8 |

|

|

Costs capitalized to the ROU assets |

|

0.1 |

|

|

(0.2 |

) |

|

0.10 |

|

|

0.0 |

|

0.0 |

|

|

(0.2 |

) |

|

— |

|

— |

|

— |

|

|

— |

|

|

Costs relating to the acquisition of Goldfield Project |

|

0.0 |

|

|

(208.2 |

) |

|

— |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

— |

|

0.0 |

|

|

(208.2 |

) |

|

Other(2) |

|

(0.7 |

) |

|

0.8 |

|

|

(0.5 |

) |

|

0.4 |

|

(0.1 |

) |

|

0.2 |

|

|

— |

|

0.2 |

|

(0.1 |

) |

|

— |

|

|

Capital expenditures |

$ |

27.4 |

|

$ |

41.7 |

|

$ |

15.1 |

|

$ |

34.3 |

$ |

10.4 |

|

$ |

6.3 |

|

$ |

0.1 |

$ |

0.6 |

$ |

1.8 |

|

$ |

0.5 |

|

|

Sustaining capital expenditures |

|

25.6 |

|

|

39.8 |

|

|

15.1 |

|

|

32.8 |

|

10.4 |

|

|

6.3 |

|

|

0.1 |

|

0.6 |

|

— |

|

|

0.1 |

|

|

Non-sustaining capital expenditures |

|

1.8 |

|

|

1.9 |

|

|

— |

|

|

1.5 |

|

— |

|

|

— |

|

|

— |

|

— |

|

1.8 |

|

|

0.4 |

|

(1) As presented in the Company’s

consolidated financial statements.(2) Includes

reclassification of insurance and capital spares from supplies

inventory to PP&E

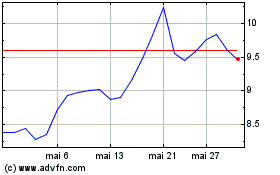

Centerra Gold (TSX:CG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Centerra Gold (TSX:CG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024