Coil: 2023 FIRST-HALF RESULTS

2023 FIRST-HALF RESULTS

- Sales at €11.8M (down 15.4%), affected by the

contraction of the tolling business in a challenging economic

climate.

- Current operating income down by €(1.4)M due to lower

sales and inflation in operating costs

- Non-recurring income of €1.5M relating to exceptional

write-backs of depreciation and provisions in respect of investment

subsidies in Germany

- Minor net income loss of €(0.1)M

- Net debt under control at 27% of equity at 30 June

2023

- Market recovery expected in 2024

COIL, world leader in aluminium anodising, has

released its results for the first half of the 2023 financial

year.

The first half of 2023 was marked by a sharp

slowdown in global growth, high inflation and rising interest

rates. Like all industrial sectors, the Company's activities were

heavily impacted by these difficult macroeconomic conditions.

During the period, tolling activities (79% of

2023 half-year sales) were adversely affected by i) metal

distributors' conservative expectations of market trends, based on

a sharp fall in the LME aluminium price, which led them to keep

their inventories at minimum levels, and ii) the emergence of a

competitor in the European continuous anodising market. Against

this backdrop, tolling sales declined by -20.6% compared with an

unfavourable basis of comparison in the first half of 2022, which

had grown by +18.5% driven by the post-COVID19 economic

recovery.

Package sales, which include metal, (21% of

first-half 2023 sales) recorded solid growth of +11.1%, driven

mainly by the development of sales in Europe, with major deliveries

made during the period for top-of-the-range architectural projects.

Meanwhile, the Company strengthened its pipeline of prospects in

Asia, which will lead to new orders in 2024.

The Company has done its utmost to limit the

impact of the slowdown in tolling activities, by raising its prices

in line with inflation and by adapting its investments and

production capacity to the lower level of demand. Nevertheless, the

impact of a sharp fall in sales on the Company's results was

significant since variable costs represent only around 36% of

sales.

On the positive side, half-year results were

positively impacted by €1.5M of exceptional items (exceptional

write-back of depreciation on investment subsidies in Germany and

write-back of provisions for interest due in the event of repayment

of these subsidies). These items follow the audit carried out this

summer by the German authorities (Landesförderinstitut

Sachsen-Anhalt) in connection with the subsidies paid for the

construction of the Bernburg plant -the examination of the award

certificates having revealed that the requirements of the award

notice dated 2 May 2012 had been met.

Overall, in a difficult economic climate, the

Company managed to record a net income close to breakeven, while

continuing to post a solid balance sheet at 30 June 2023.

Sales for the first half of 2023 came to €11.8M,

down €2.2M on the high basis of comparison in the first half of

2022.

EBITDA fell by €2.5M to break even. This was

mainly due to (i) a lower gross margin, reflecting lower sales,

changes in the product mix and higher variable production costs,

and (ii) higher operating expenses in an inflationary

environment.

The contraction in volumes in tolling activities

weighed significantly on recurring operating income, which fell by

€2.4M to a loss of €(1.4)M, compared with a profit of €1.1M in the

first half of 2022.

Operating profit was €0.7M, including €0.7M of

non-recurring items relating to an exceptional write-back of

depreciation on investment subsidies in Germany, which had no

impact on the Company's cash position.

Net income fell by €0.1M. It includes

exceptional financial income of €0.7M, relating to a reversal of

provisions for interest due in the event of repayment of the

subsidies in Germany.

- Simplified income

statement

|

(€M) |

2023 H1(6 months) |

2022 H1(6 months) |

Variation |

2022(12 months) |

|

Sales |

11.79 |

13.95 |

- 15.4 % |

26.7 |

|

Tolling sales |

9.28 |

11.68 |

- 20.6 % |

20.6 |

|

Package sales1 |

2.52 |

2.27 |

+ 11.1 % |

5.9 |

|

EBITDA |

0.01 |

2.52 |

- 2.5 M€ |

2.9 |

|

% of sales |

0.1% |

18.1% |

|

10.9% |

|

Recurring operating profit |

(1.40) |

1.01 |

- 2.4 M€ |

(0.1) |

|

% of sales |

(11.9)% |

7.2% |

|

(0.4)% |

|

Operating profit |

(0.66) |

1.01 |

- 1.7 M€ |

(2.6) |

|

% of sales |

(5.6)% |

7.2% |

|

(9.9)% |

|

Income before tax |

(0.10) |

0.85 |

- 1.0 M€ |

(2.9) |

|

Net income |

(0.11) |

0.80 |

- 0.9 M€ |

(3.0) |

|

% of sales |

(0.9)% |

5.7% |

|

(11.2)% |

After taking into account profit for the

half-year, shareholders' equity at 30 June 2023 was €23.5M, down

€0.1M on 31 December 2022. Net financial debt at 30 June 2023 was

€6.3M (up €0.1M on the end of 2022) and remained at a reasonable

level, representing 27% of equity, compared with 26% at 31 December

2022.

Sales for the third quarter of 2023 came to

€5.3M, down 21.5% year-on-year. Over the first 9 months of the

year, sales came to €17.1M, down by -17.4% on the same period last

year, with tolling sales (€13.5M) down 18.8% and package sales

(€3.6M) down 11.7%.

In a difficult economic climate, the Company is

maintaining a cautious approach and does not anticipate a recovery

in demand for tolling services before the end of the financial

year. The Company is taking steps to limit the impact of this

slowdown on its results by supporting the commercial development of

its package sales and by maximising the flexibility of its

industrial facilities.

The Company is confident in its long-term

development prospects, and is capitalising on its broad portfolio

of premium, sustainable products with a lower carbon footprint to

prepare for the expected upturn in its markets from 2024

onwards.

The financial statements were approved by the

Board of Directors on 31 October 2023. They are included in the

half-yearly financial report for 2023 available on the Company's

financial website. (http://investors.coil.be).

2023 annual sales figures will be published on 2

February 2024 after the close of trading.

About COIL

COIL is the world's leading anodiser in the

building and industrial sectors and trades under the ALOXIDE brand

name.

Anodising is an electrochemical process

(electrolysis) which develops a natural, protective oxide layer on

the surface of aluminium and can be coloured in a range of UV-proof

finishes. It gives the metal excellent resistance to corrosion

and/or reinforces its functional qualities. Anodising preserves all

the natural and ecological properties of aluminium; it retains its

high rigidity and excellent strength-to-weight ratio, its

non-magnetic properties, its exceptional resistance to corrosion.

The metal remains totally and repeatedly recyclable through simple

re-melting. Anodised aluminium is used in a wide variety of

industries and applications: architecture, design, manufacturing

and the automotive sector.

COIL deploys an industrial model that creates

value by leveraging its unique know-how, its operational

excellence, the quality of its investments and the expertise of its

people. COIL has around 110 employees in Belgium and Germany and

generated a turnover of €26,5 million in 2022.

Listed on Euronext Growth Paris | Isin:

BE0160342011 | Reuters: ALCOI.PA | Bloomberg: ALCOI: FP

For more information, please visit

www.aloxide.com

Contact

|

COILTim Hutton | Chief Executive Officer

tim.hutton@coil.be | Tél. : +32 (0)11 88 01 88 |

CALYPTUSCyril Combe cyril.combe@calyptus.net |

Tél. : +33 (0)1 53 65 68 68 |

1 Anodising and metal included.

- COILpressrelease31oct2023_EN_def

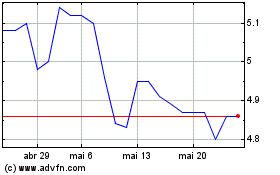

COIL (EU:ALCOI)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

COIL (EU:ALCOI)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024