Western Forest Products Inc. (TSX: WEF) (“Western” or the

“Company”) reported a net loss of $17.4 million in the third

quarter of 2023, as compared to a net loss of $20.7 million in the

second quarter of 2023, and net income of $6.6 million in the third

quarter of 2022. Results in the third quarter of 2023 reflect more

challenging macroeconomic conditions, resulting in lower product

prices and reduced demand compared to the same period last year. We

curtailed certain sawmill operations during the third quarter of

2023, to manage inventories and match production to product

demand.

Adjusted EBITDA was negative $11.6 million in

the third quarter of 2023, as compared to Adjusted EBITDA of

negative $12.0 million in the second quarter of 2023, and adjusted

EBITDA of $17.3 million in the third quarter of 2022.

Operating loss prior to restructuring and other

items was $25.8 million in third quarter of 2023, as compared to

income of $4.7 million in the third quarter of 2022.

Highlights:

- Announced a

$35.9 million agreement to sell a 34% interest in a newly formed

forestry Limited Partnership to four Vancouver Island First

Nations

- Celebrated one

year anniversary of glulam business asset acquisition from Calvert

Company, Inc. with operations accretive to EBITDA in that year

- Completed

installation of machine stress rated lumber grader to support

increased product value and mass timber market growth

- Recognized an

export tax recovery of $4.3 million on finalization of the softwood

lumber duty rate

| (millions of Canadian dollars

except per share amounts and where otherwise noted) |

Q32023 |

|

Q32022 |

|

Q22023 |

|

YTD2023 |

|

YTD2022 |

|

Revenue |

$ |

231.1 |

|

|

$ |

356.0 |

|

|

$ |

276.0 |

|

|

$ |

770.9 |

|

|

$ |

1,153.0 |

|

| Export tax expense |

|

5.2 |

|

|

|

8.0 |

|

|

|

6.2 |

|

|

|

16.1 |

|

|

|

34.2 |

|

| Export tax recovery |

|

(4.3 |

) |

|

|

(18.0 |

) |

|

|

- |

|

|

|

(4.3 |

) |

|

|

(18.0 |

) |

| Stumpage expense |

|

5.9 |

|

|

|

36.4 |

|

|

|

14.3 |

|

|

|

35.7 |

|

|

|

90.1 |

|

| Adjusted EBITDA (1) |

|

(11.6 |

) |

|

|

17.3 |

|

|

|

(12.0 |

) |

|

|

(28.7 |

) |

|

|

148.9 |

|

| Adjusted EBITDA margin

(1) |

|

(5% |

) |

|

|

5% |

|

|

|

(4% |

) |

|

|

(4% |

) |

|

|

13% |

|

| Operating income (loss) prior

to restructuring and other items |

$ |

(25.8 |

) |

|

$ |

4.7 |

|

|

$ |

(25.1 |

) |

|

$ |

(69.0 |

) |

|

$ |

110.3 |

|

| Net income (loss) |

|

(17.4 |

) |

|

|

6.6 |

|

|

|

(20.7 |

) |

|

|

(55.8 |

) |

|

|

83.2 |

|

| Earnings (loss) per share,

diluted |

|

(0.05 |

) |

|

|

0.02 |

|

|

|

(0.07 |

) |

|

|

(0.17 |

) |

|

|

0.25 |

|

| Net debt (cash) (2), end of

period |

|

59.5 |

|

|

|

(35.4 |

) |

|

|

34.6 |

|

|

|

|

|

| Liquidity (1), end of

period |

|

170.2 |

|

|

|

269.1 |

|

|

|

195.5 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commenting on the quarter, Western’s President

and CEO Steven Hofer said, “While our results in the quarter

reflect the continued challenging operating environment and cost

structure in our British Columbia operations, we are encouraged by

the progress we’ve made in repositioning our business for the

future. The agreement announced with the Tlowitsis, We Wai Kai, Wei

Wai Kum and K’ómoks First Nations is a significant step forward.

This partnership will provide a collaborative forest stewardship

and business model that is key to the operational stability in

Coastal BC that we need to support reinvestment, and we are excited

to move it forward.”

Summary of Third Quarter 2023

Results

We reported Adjusted EBITDA of negative $11.6

million in the third quarter of 2023, which included $4.3 million

in export tax recovery, as compared to positive $17.3 million in

the same period last year, which included $18.0 million in export

tax recovery. Results in the third quarter of 2023 continue to

reflect more challenging macroeconomic and lumber market

conditions, as compared to the same period last year.

Net loss was $17.4 million in the third quarter

of 2023, as compared to net income of $6.6 million in the same

period last year. Operating loss prior to restructuring and other

items was $25.8 million in the third quarter of 2023, as compared

to income of $4.7 million in the same period last year.

Sales

Lumber revenue was $179.9 million in the third

quarter of 2023 as compared to $267.1 million in the same period

last year. The decrease of 33% was due to lower lumber shipment

volumes and lower average lumber prices, partially offset by a

stronger sales mix and stronger US Dollar (“USD”) to Canadian

Dollar (“CAD”) average exchange rate. Our average realized lumber

price decreased by 7% to $1,388 per thousand board feet in the

third quarter of 2023, as compared to $1,495 per thousand board

feet in the same period last year.

Specialty lumber shipments represented 55% of

total lumber shipment volumes in the third quarter of 2023, as

compared to 39% in the same period last year, yielding a stronger

sales mix. Industrial lumber shipment volumes remained flat

compared to the same period last year with incremental volume from

the acquisition of our Calvert engineered wood products division

offset by lower volumes in certain other product lines. Cedar

lumber shipment volumes increased 21% compared to the same period

last year due to improved take-away through the home centre

segment. Japan lumber shipment volumes decreased 17% compared to

the same period last year due to increased levels of supply from

domestic manufacturing, Europe and Russia. Commodity lumber

shipment volumes decreased 47% compared to the same period last

year due to weaker market demand.

Log revenue was $38.4 million in the third

quarter of 2023, as compared to $72.5 million in the same period

last year. The decrease of 47% was due to lower log sales volumes

and lower domestic log prices.

By-products and other revenue were $12.8

million, as compared to $16.4 million in the same period last year.

The decrease of 22% was due to lower chip prices and lower volumes

as the result of reduced sawmill production, partially offset by

higher revenue from harvesting services provided to third

parties.

Operations

Lumber production was 126 million board feet in

the third quarter of 2023, as compared to 169 million board feet in

the same period last year. During the third quarter of 2023 we

curtailed certain sawmill operations to match production to market

demand and manage inventory levels. A higher specialty mix of

production led to increased secondary processing volumes and costs

as compared to the third quarter of 2022.

We harvested 678,000 cubic metres of logs from

our BC coastal operations in the third quarter of 2023, as compared

to 800,000 cubic metres in the same period last year, due to an

extended fire-risk season and reduced heli-logging contractor

availability.

Despite lower harvest volumes, Timberlands

operating cash costs per cubic metre declined 26% in the third

quarter of 2023, compared to the same period last year, primarily

as a result of lower stumpage per cubic metre. A reduction in more

costly heli-logging harvest and management of road building

activity also contributed to the lower unit costs.

BC Coastal sawlog purchases were 116,000 cubic

metres in the third quarter of 2023, as compared to 302,000 cubic

metres in the same period last year. We managed sawlog purchases to

match fibre requirements at our BC manufacturing facilities.

Freight expense was $15.7 million in the third

quarter of 2023 as compared to $25.6 million in the same period

last year. The decrease of 39% was due to lower lumber and export

shipments and lower container, rail and trucking rates. In

addition, lack of container availability in the third quarter of

2022 necessitated the use of higher cost breakbulk vessels.

Adjusted EBITDA and operating income included

$5.2 million of countervailing duty (“CV”) and anti-dumping duty

(“AD”) expense in the third quarter of 2023, as compared to $8.0

million in the same period of 2022. Export tax expense declined due

to lower duty rates, lumber prices and US-destined lumber shipment

volumes, partially offset by a stronger USD.

During the third quarter of 2023, we recognized

a recovery of $4.3 million on the finalization of duty rates from

8.99% to 8.05% for shipments made in 2021. The comparative quarter

of 2022 included a recovery of $18.0 million on the finalization of

duty rates from 20.23% to 8.59% or shipments made in 2020.

Corporate and Other

Selling and administration expense was $9.6

million in the third quarter of 2023 as compared to $11.1 million

in the same period last year, primarily as a result of reduced

incentive compensation expense.

Other income was $2.2 million in the third

quarter of 2023 as compared to $4.0 million in the same period last

year, resulting primarily from lower unrealized foreign exchange

gains on export tax receivables.

Finance costs were $0.5 million in the third

quarter of 2023 as compared to finance income of $0.7 million in

the same period last year. Interest expense on higher average

borrowings were partially offset by interest revenue from the

export duty receivable.

Income Taxes

Income tax recovery was $6.5 million on a net

loss before tax of $23.9 million in the third quarter of 2023, as

compared to an expense of $3.0 million on income before tax of $9.6

million in the same period last year. The effective tax rate was

27% as compared to 31% in the same period last year.

Net Income (Loss)

Net loss was $17.4 million in the third quarter

of 2023, as compared to net income of $6.6 million for the same

period last year. More challenging macroeconomic conditions

resulted in lower lumber demand and prices and impacted results

quarter over quarter.

Summary of Year to Date 2023

Results

We reported Adjusted EBITDA of negative $28.7

million for the first nine months of 2023, as compared to $148.9

million for the same period last year. Results in the nine months

of 2023 continue to reflect more challenging macroeconomic and

lumber market conditions, as compared to the same period last

year.

Net loss was $55.8 million for the first nine

months of 2023, as compared to net income of $83.2 million for the

same period last year. Operating loss prior to restructuring and

other items was $69.0 million in the first nine months of 2023, as

compared to income of $110.3 million in the same period last

year.

Sales

Lumber revenue was $603.3 million in the first

nine months of 2023 as compared to $932.8 million in the same

period last year. The decrease of 35% was due to lower lumber

shipment volumes and average lumber prices, partially offset by a

slightly stronger sales mix and stronger USD to CAD average

exchange rate. Our average realized lumber price was $1,334 per

thousand board feet in the first nine months of 2023, as compared

to $1,661 per thousand board feet in the same period last year, a

decrease of 20%.

Speciality lumber shipments represented 49% of

total lumber shipment volumes in the first nine months of 2023, as

compared to 45% in the same period last year, yielding a slightly

stronger sales mix. Industrial lumber shipment volumes increased

22% compared to the same period last year with incremental volume

from the acquisition of our Calvert engineered wood products

division and growth primarily in Douglas fir timbers. Cedar lumber

shipments decreased 13% compared to the same period last year as

buyers managed inventory levels to market conditions. Japan lumber

shipment volumes decreased 35% compared to the same period last

year due to increased levels of supply from domestic manufacturing,

Europe and Russia. Commodity lumber shipments decreased 25%

compared to the same period last year due to weaker market

demand.

Log revenue was $129.8 million in the first nine

months of 2023, as compared to $176.0 million in the same period

last year. The decrease of 26% was due to lower average domestic

log prices, partially offset by higher log sales volume, as we

balanced log inventories to lumber market conditions and fibre

requirements of our manufacturing facilities.

By-product and other revenue were $37.8 million

in the first nine months of 2023 as compared to $44.2 million in

the same period last year. The decrease of 14% was due to lower

chip prices and lower volumes as the result of reduced sawmill

production, partially offset by higher revenue from harvesting

services provided to third parties.

Operations

Lumber production was 436 million board feet in

the first nine months of 2023, as compared to 517 million board

feet in the same period last year. During the first nine months of

2023 we took operating curtailments at certain sawmills to match

production to market demand and manage inventory.

We harvested 2,234,000 cubic metres of logs from

our BC coastal operations in the first nine months of 2023, as

compared to 2,451,000 cubic metres in the same period last year,

due to an extended fire-risk season, reduced heli-logging

contractor availability in the third quarter of 2023 and matching

harvest volumes to market conditions.

Despite lower harvest volumes, Timberlands

operating cash costs per cubic metre declined 22% in the first nine

months of 2023, compared to the same period last year, primarily as

a result of lower stumpage per cubic metre and management of road

building activity.

BC Coastal sawlog purchases were 475,000 cubic

metres in the first nine months of 2023, as compared to 920,000

cubic metres in the same period last year. We managed sawlog

purchases to match fibre requirements at our BC manufacturing

facilities.

Freight expense was $59.3 million in the first

nine months of 2023 as compared to $82.7 million in the same period

last year. The decrease of 28% was due to lower lumber and export

shipments and lower container, rail and trucking rates. In

addition, lack of container availability in the first nine months

of 2022 necessitated the use of higher cost breakbulk vessels.

Adjusted EBITDA and operating income included

$16.1 million of CV and AD expense in the first nine months of

2023, as compared to $34.2 million in the same period of 2022. In

the first nine months of 2023, we recognized a recovery of $4.3

million on the finalization of duty rates from 8.99% to 8.05% for

shipments made in 2021. The comparative period of 2022 included a

recovery of $18.0 million on the finalization of duty rates from

20.23% to 8.59% for shipments made in 2020.

Export tax expense declined due to lower average

duty rates, lumber prices and US-destined lumber shipment

volumes.

Corporate and Other

Selling and administration expense was $32.0

million for the first nine months of 2023 as compared to $34.0

million in the same period last year, primarily as a result of

reduced incentive compensation expense.

Restructuring costs were $6.6 million in the

first nine months of 2023 as compared to $0.6 million in the same

period last year. The increase was primarily due to retirement and

other benefits related to our Alberni Pacific Division (“APD”)

facility and rightsizing of various operational functions within

our business.

Other income was $1.3 million in the first nine

months of 2023 as compared to income of $4.1 million in the same

period last year, resulting primarily from lower unrealized foreign

exchange gains on export tax receivables partially offset by gains

on the sale of equipment and other assets.

Finance costs were $1.2 million in the first

nine months of 2023 as compared to a negligible amount in the same

period last year. Interest expense on higher average borrowings

were partly offset by revenue from the export duty receivable.

Income Taxes

Income tax recovery was $19.7 million on a net

loss before tax of $75.5 million in the first nine months of 2023,

as compared to an expense of $30.6 million on income before tax of

$113.8 million in the same period last year. The effective tax rate

was 26% as compared to 27% in the same period last year.

Net Income (Loss)

Net loss was $55.8 million in the first nine

months of 2023 as compared to net income of $83.2 million for the

same period of last year. More challenging macroeconomic conditions

during the first nine months of 2023 resulted in lower lumber

demand and prices and impacted results year over year.

Alberni Pacific Division

The Company previously announced we would not

restart our APD facility in its current configuration and had

established a multi-party working group to explore viable

industrial manufacturing solutions for the site over a 90-day

period. On April 27, 2023, we announced we had commenced

negotiations and due diligence processes related to the proposals

we received, which are ongoing. Operations at the APD facility have

been curtailed since fall 2022 and will remain curtailed through

the negotiations.

Indigenous Relationships

We respect the treaty and Aboriginal rights of

Indigenous groups, and we are committed to open dialogue and

meaningful actions in support of reconciliation. We are actively

investing time and resources in capacity building and fostering

positive working relationships with Indigenous groups with

traditional territories within which Western operates. For details

of our progress in 2022, please see “Indigenous Relationships” in

our Management’s Discussion and Analysis for the year ended

December 31, 2022. Work continues on several

Nation-led, integrated resource management

planning initiatives across five of the Tree Farm Licence (“TFL”)

areas where Western operates.

TFL 39 Block 2 Transaction

On October 23, 2023, Western and four Vancouver

Island First Nations (Tlowitsis, We Wai Kai, Wei Wai Kum, and

K’ómoks) (collectively, “Nations”) announced an agreement for the

Nations to acquire a 34% interest from Western in a newly formed

Limited Partnership (“Partnership”) for $35.9 million. The

Partnership will consist of certain assts and liabilities of

Western’s Mid Island Forest Operation, including Block 2 of TFL 39.

The operations of the new Partnership will cover approximately

157,000 hectares of forest land in the traditional territories of

the Nations near the communities of Campbell River and Sayward on

eastern Vancouver Island. The Partnership will manage an allowable

annual cut (“AAC”) of 904,540 cubic metres of timber, and includes

a long-term fibre agreement to support Western’s BC coastal

manufacturing operations. The formation of the Partnership and

acquisition by the Nations is subject to various closing

conditions, including subdivision and tenure transfer approvals

from the BC Ministry of Forests. Western and the Nations are

working towards closing the acquisition in the first quarter of

2024.

Regulatory Environment

Since 2020, the Province of BC (“the Province”)

has introduced various policy initiatives and regulatory changes

that impact the BC forest sector, including: fibre recovery, lumber

remanufacturing, old growth forest management, forest stewardship

and the exportation of logs.

Tripartite Framework Agreement on Nature

Conservation (“Nature Agreement”)

On November 3, 2023, the Government of Canada,

the Province and the First Nations Leadership Council announced the

signing of the Nature Agreement, extending through March 2030, and

intended to further conserve and protect land and water, species

and biodiversity in BC. The Nature Agreement includes up to $1

billion in government funding in support of the Government of

Canada’s goal to protect 30% of Canada’s terrestrial and aquatic

ecosystems by 2030. The Company is unable to assess the potential

impact of the Nature Agreement on the Company’s business at this

time.

TFL 44

In June 2023, the Province set a new AAC for TFL

44, reducing the allowable annual log harvest from 793,600 cubic

metres to 642,800 cubic metres. The new AAC was effective

immediately and reflects harvest reductions associated with forest

resources and socio-economic objectives of the Province, including

the reallocation of previously unharvested volume to new forest

licences.

The TFL 44 licence is held by the Tsawak-qin

Forestry Limited Partnership, a partnership between Western and

Huumiis Ventures Limited Partnership, a limited partnership

beneficially owned by the Huu-ay-aht First Nations. The Company

strongly opposes the AAC determination and the allocation of

unharvested volume to new forest licences in light of their serious

concerns that the allocation significantly affected the AAC

determination and are continuing to pursue this matter with the

Province. Given the foregoing, the Company is unable to assess the

potential impact of this AAC determination on the Company’s

business at this time.

TFL 19

We expect the Provincial Chief Forester to

determine a new AAC for TFL 19 before the end of 2023. While

we cannot predict the outcome of the determination, the Management

Plan that we submitted in 2020, recommended an 18% lower AAC

(approximately 130,000 cubic metres), consistent with the timber

supply forecasts from previous Management Plans.

Dividend and Capital

Allocation

We remain committed to a balanced approach to

capital allocation. We will continue to evaluate opportunities to

invest strategic and discretionary capital in jurisdictions that

create the opportunity to grow long-term shareholder value.

Quarterly Dividend

In response to the weaker lumber market

conditions and corresponding financial results, Western is

suspending its quarterly dividend until further notice, effective

November 7, 2023. The Board of Directors (“Board”) will continue to

review the Company’s dividend on a quarterly basis. Any decision to

declare and pay dividends in the future will be made at the

discretion of our Board, after considering our operating results,

financial condition, cash requirements, financing agreement

restrictions and other factors our Board may deem relevant.

Dividends of $4.0 million and $11.9 million were

paid in the three and nine months ending September 30, 2023,

respectively, as compared to $4.1 million and $11.4 million in the

same period last year.

Normal Course Issuer Bid (“NCIB”)

On August 3, 2023, the Company renewed its NCIB

permitting the purchase and cancellation of up to 15,837,277 common

shares, representing 5% of the Company’s common shares outstanding

as of August 2, 2023. The renewed NCIB commenced on August 11, 2023

and will end no later than August 10, 2024. The Company also

entered into an automatic share purchase plan with a designated

broker to facilitate purchases of its common shares under the

renewed NCIB at times when the Company would ordinarily not be

permitted to purchase its common shares due to regulatory

restrictions or self-imposed blackout periods.

During the first nine months ended September 30,

2023, no common shares were repurchased under our current NCIB.

Strategy and Outlook

Western’s long-term business objective is to

create and grow shareholder value by building a sustainable,

margin-focused specialty products business of scale to compete

successfully in global markets. For more detail on our strategic

initiatives and actions, refer to “Strategy and Outlook” in our

Management’s Discussion and Analysis for the year ended December

31, 2022.

Market Outlook

Near-term we expect lumber markets to remain

volatile as we head into the typically slower fall and winter

seasons. Consumers continue to adjust to higher interest rates and

macroeconomic conditions which is driving a rebalancing of lumber

supply and demand.

Demand and prices for Cedar timber and premium

appearance products are expected to remain stable, while Cedar

decking, trim and fencing products are expected to remain weaker.

In Japan, we see near-term opportunities to increase volumes as

domestic production has been impacted by a fire at a large Japanese

sawmill. We anticipate prices to modestly improve in the near-term.

Demand for our Industrial lumber products will be product line

specific but are expected to remain stable over the near-term.

North American demand and prices for our commodity products are

expected to remain volatile, while lumber demand and prices in

China are expected to remain weak.

We expect sawlog markets to follow conditions in

the lumber markets, while residual chip pricing is expected to

modestly improve in the fourth quarter of 2023 due to stronger

northern bleached softwood kraft prices to China.

We remain excited about the long-term growth

opportunity for wood products and the positive impacts they have in

a low carbon world.

Non-GAAP Financial Measures

Reference is made in this news release to the

following non-GAAP measures: Adjusted EBITDA, Adjusted EBITDA

margin, Net debt to capitalization and total Liquidity are used as

benchmark measurements of our operating results and as benchmarks

relative to our competitors. These non-GAAP measures are commonly

used by securities analysts, investors and other interested parties

to evaluate our financial performance. These non-GAAP measures do

not have any standardized meaning prescribed by IFRS and may not be

comparable to similar measures presented by other issuers. The

following table provides a reconciliation of these non-GAAP

measures to figures as reported in our unaudited condensed

consolidated financial statements:

(millions of Canadian dollars except where otherwise noted)

|

Adjusted EBITDA |

Q32023 |

Q32022 |

Q22023 |

YTD2023 |

YTD2022 |

|

Net income (loss) |

$ |

(17.4 |

) |

$ |

6.6 |

|

$ |

(20.7 |

) |

$ |

(55.8 |

) |

$ |

83.2 |

|

|

Add: |

|

|

|

|

|

|

Amortization |

|

14.1 |

|

|

12.7 |

|

|

13.2 |

|

|

40.4 |

|

|

38.2 |

|

|

Changes in fair value of biological assets |

|

- |

|

|

(0.2 |

) |

|

(0.1 |

) |

|

(0.2 |

) |

|

0.3 |

|

|

Operating restructuring items |

|

(0.2 |

) |

|

(0.2 |

) |

|

1.6 |

|

|

6.6 |

|

|

0.6 |

|

|

Other expense (income) |

|

(2.2 |

) |

|

(4.0 |

) |

|

0.8 |

|

|

(1.3 |

) |

|

(4.1 |

) |

|

Finance costs |

|

0.5 |

|

|

(0.7 |

) |

|

0.5 |

|

|

1.2 |

|

|

- |

|

|

Income tax expense (recovery) |

|

(6.5 |

) |

|

3.0 |

|

|

(7.3 |

) |

|

(19.7 |

) |

|

30.6 |

|

|

Adjusted EBITDA |

$ |

(11.6 |

) |

$ |

17.3 |

|

$ |

(12.0 |

) |

$ |

(28.7 |

) |

$ |

148.9 |

|

|

Adjusted EBITDA margin |

|

|

|

|

|

|

Total revenue |

$ |

231.1 |

|

$ |

356.0 |

|

$ |

276.0 |

|

$ |

770.9 |

|

$ |

1,153.0 |

|

|

Adjusted EBITDA |

|

(11.6 |

) |

|

17.3 |

|

|

(12.0 |

) |

|

(28.7 |

) |

|

148.9 |

|

|

Adjusted EBITDA margin |

|

(5% |

) |

|

5% |

|

|

(4% |

) |

|

(4% |

) |

|

13% |

|

|

Net debt to capitalization |

Sept. 302023 |

Sept. 302022 |

Jun. 302023 |

|

|

|

Net debt (cash) |

|

|

|

|

|

|

Total debt |

$ |

62.0 |

|

$ |

- |

|

$ |

36.8 |

|

|

|

|

Bank indebtedness |

|

0.5 |

|

|

- |

|

|

1.0 |

|

|

|

|

Cash and cash equivalents |

|

(3.0 |

) |

|

(35.4 |

) |

|

(3.2 |

) |

|

|

|

|

$ |

59.5 |

|

$ |

(35.4 |

) |

$ |

34.6 |

|

|

|

|

Capitalization |

|

|

|

|

|

|

Net debt (cash) |

$ |

59.5 |

|

$ |

(35.4 |

) |

$ |

34.6 |

|

|

|

|

Total equity attributable to equity shareholders of the

Company |

|

580.3 |

|

|

676.0 |

|

|

599.5 |

|

|

|

|

|

$ |

639.8 |

|

$ |

640.6 |

|

$ |

634.1 |

|

|

|

|

Net debt to capitalization |

|

9% |

|

|

0% |

|

|

5% |

|

|

|

|

Total liquidity |

Sept. 302023 |

Sept. 302022 |

Jun. 302023 |

|

|

|

Cash and cash equivalents |

$ |

3.0 |

|

$ |

35.4 |

|

$ |

3.2 |

|

|

|

|

Available credit facility |

|

250.0 |

|

|

250.0 |

|

|

250.0 |

|

|

|

|

Bank indebtedness |

|

(0.5 |

) |

|

- |

|

|

(1.0 |

) |

|

|

|

Credit facility drawings |

|

(62.2 |

) |

|

- |

|

|

(37.0 |

) |

|

|

|

Outstanding letters of credit |

|

(20.1 |

) |

|

(16.3 |

) |

|

(19.7 |

) |

|

|

|

|

$ |

170.2 |

|

$ |

269.1 |

|

$ |

195.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Figures in the table above may not equal or sum to figures

presented elsewhere due to rounding.

Forward Looking Statements and Information

This press release contains statements that may

constitute forward-looking statements under the applicable

securities laws. Readers are cautioned against placing undue

reliance on forward-looking statements. All statements herein,

other than statements of historical fact, may be forward-looking

statements and can be identified by the use of words such as

“will”, “commit”, “project”, “estimate”, “expect”, “anticipate”,

“plan”, “target”, “forecast”, “intend”, “believe”, “seek”, “could”,

“should”, “may”, “likely”, “continue”, “pursue” and similar

references to future periods. Forward-looking statements in this

press release include, but are not limited to, statements relating

to our current intent, belief or expectations with respect to:

domestic and international market conditions, demands and growth;

economic conditions; our growth, marketing, production, wholesale,

operational and capital allocation plans, investments and

strategies, including but not limited to payment of a dividend or

repurchase of shares; fibre availability and regulatory

developments; changes to stumpage rates and the expected timing

thereof; the impact of COVID-19; the execution of our sales and

marketing strategy; the development and completion of integrated

resource management plans or forest landscape plan pilots by First

Nations; the impact of the Nature Agreement on the Company’s

operations; the impact of the determination of a new AAC for TFL

19; the Company’s pursuit of the TFL 44 AAC determination with

government; the potential for viable industrial manufacturing

solutions for the APD facility; the timing and outcome of the

negotiation processes for the APD facility; the completion of and

expected timing of the acquisition by the Nations; and the expected

timing and cost of completion of the Company’s announced strategic

investments. Although such statements reflect management’s current

reasonable beliefs, expectations and assumptions as to, amongst

other things, the future supply and demand of forest products,

global and regional economic activity and the consistency of the

regulatory framework within which the Company currently operates,

there can be no assurance that forward-looking statements are

accurate, and actual results and performance may materially

vary.

Many factors could cause our actual results or

performance to be materially different including: economic and

financial conditions including inflation, international demand for

forest products, the Company’s ability to export its products, cost

and availability of shipping carrier capacity, competition and

selling prices, international trade disputes and sanctions, changes

in foreign currency exchange rates, labour disputes and

disruptions, ability to recruit workers, natural disasters, the

impact of climate change, relations with First Nations groups,

First Nations’ claims and settlements, the availability of fibre

and allowable annual cut, the ability to obtain operational

permits, development and changes in laws and regulations affecting

the forest industry including as related to old growth timber

management and the Manufactured Forest Products Regulation, changes

in the price of key materials for our products, changes in

opportunities, information systems security, future developments

relating to COVID-19 and other factors referenced under the “Risks

and Uncertainties” section of our MD&A in our 2022 Annual

Report dated February 16, 2023. The foregoing list is not

exhaustive, as other factors could adversely affect our actual

results and performance. Forward-looking statements are based only

on information currently available to us and refer only as of the

date hereof. Except as required by law, we undertake no obligation

to update forward-looking statements.

Reference is made in this press release to

Adjusted Earnings Before Interest, Tax, Depreciation and

Amortization (“Adjusted EBITDA”). Adjusted EBITDA is defined as

operating income prior to operating restructuring items and other

income (expense) plus amortization of plant, equipment, right of

use and timber licence assets, impairment adjustments, and changes

in fair value of biological assets. Adjusted EBITDA margin is

Adjusted EBITDA as a proportion of revenue. Western uses Adjusted

EBITDA and Adjusted EBITDA margin as benchmark measurements of our

own operating results and as benchmarks relative to our

competitors. We consider Adjusted EBITDA to be a meaningful

supplement to operating income as a performance measure primarily

because amortization expense, impairment adjustments and changes in

the fair value of biological assets are non-cash costs and vary

widely from company to company in a manner that we consider largely

independent of the underlying cost efficiency of their operating

facilities. Further, the inclusion of operating restructuring items

which are unpredictable in nature and timing may make comparisons

of our operating results between periods more difficult. We also

believe Adjusted EBITDA and Adjusted EBITDA margin are commonly

used by securities analysts, investors and other interested parties

to evaluate our financial performance.

Adjusted EBITDA does not represent cash

generated from operations as defined by IFRS and it is not

necessarily indicative of cash available to fund cash needs.

Furthermore, Adjusted EBITDA does not reflect the impact of certain

items that affect our net income. Adjusted EBITDA and Adjusted

EBITDA margin are not measures of financial performance under IFRS,

and should not be considered as alternatives to measures of

performance under IFRS. Moreover, because all companies do not

calculate Adjusted EBITDA in the same manner, Adjusted EBITDA and

Adjusted EBITDA margin calculated by Western may differ from

similar measures calculated by other companies. A reconciliation

between the Company’s net income as reported in accordance with

IFRS and Adjusted EBITDA is included in this press release.

Also in this press release management may use

key performance indicators such as net debt, and net debt to

capitalization. Net debt is defined as long-term debt and bank

indebtedness less cash and cash equivalents. Net debt to

capitalization is a ratio defined as net debt divided by

capitalization, with capitalization being the sum of net debt and

equity. These key performance indicators are non-GAAP financial

measures that do not have a standardized meaning and may not be

comparable to similar measures used by other issuers. They are not

recognized by IFRS, but are meaningful in that they indicate the

Company’s ability to meet its obligations on an ongoing basis, and

indicate whether the Company is more or less leveraged than in the

past.

Western is an integrated forest products company

building a margin-focused log and lumber business to compete

successfully in global softwood markets. With operations and

employees located primarily on the coast of British Columbia and

Washington State, Western is a premier supplier of high-value,

specialty forest products to worldwide markets. Western has a

lumber capacity in excess of 1.0 billion board feet from seven

sawmills, as well as operates four remanufacturing facilities and

two glulam manufacturing facilities. The Company sources timber

from its private lands, long-term licenses, First Nations

arrangements, and market purchases. Western supplements its

production through a wholesale program providing customers with a

comprehensive range of specialty products.

TELECONFERENCE CALL

NOTIFICATION:

Wednesday, November 8, 2023 at 9:00 a.m. PST (12:00 p.m.

EST)

To participate in the teleconference please dial

416-340-2217 or 1-800-952-5114 (passcode: 9879996#). This call will

be taped, available one hour after the teleconference, and on

replay until December 9, 2023 at 8:59 p.m. PST (11:59 p.m. EST). To

hear a complete replay, please call 905-694-9451 / 1-800-408-3053

(passcode: 7251741#).

For further information, please contact:Stephen

WilliamsExecutive Vice President & Chief Financial Officer(604)

648-4500

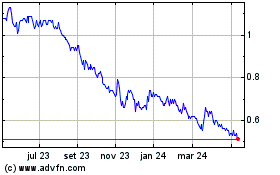

Western Forest Products (TSX:WEF)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

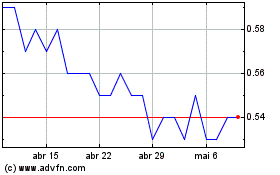

Western Forest Products (TSX:WEF)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024