Wilmington Capital Management Inc. (“Wilmington” or the

“Corporation”) reported net income for the three months ended

September 30, 2023, of $2.4 million or $0.19 per share compared to

net income of $0.3 million or $0.03 per share for the same period

in 2022. For the nine months ended September 30, 2023,

the Corporation reported net income of $2.5 million or $0.20 per

share compared to net income of $2.3 million or $0.19 per share for

the same period in 2022.

OPERATIONS REVIEW – For the Quarter Ended September 30,

2023As at September 30, 2023, Wilmington had assets under

management in its operating platforms of approximately $402 million

($100 million representing Wilmington’s share). A summary of the

Corporation and the operations of its investees is set out

below.

Marinas Maple Leaf Partnerships The Maple Leaf

Partnerships now own 21 marinas with over 8,800 boat slips and dry

rack slips, all within 2 hours driving time from Toronto, Ontario.

Boat sales showed signs of slowing late in the third quarter and

management is looking to reduce inventory levels, which are

somewhat elevated. Rental income and parts and service income

remained steady through to the end of the 2023 boating season.

Closing of lot sales continues at Champlain Shores (formerly Bay

Moorings). Proceeds from lot sales were used to repay $3.5 million

of the outstanding revolving loan facility with the Corporation.

Borrowings under the revolving and non-revolving loan facilities at

the end of the quarter amounted to $4.8 million.

Real Estate Land Held for Development The

Corporation’s development plan for the Seton project will be

comprised of three phases being a 96,000 square foot self-storage

facility, a retail area and a 17 bay car condo project. A

development permit application has been filed and once approved a

tender process will be initiated.

Sunchaser Partnership The Sunchaser Partnership continued to

experience strong seasonal demand during the third quarter.

Seasonal rental rates remain healthy and the 150-site expansion of

one of the existing RV resorts was substantially completed and

leased up for the 2024 season.

Bow City Partnership On August 9, 2023, the Corporation sold its

19.72% interest in the Bow City Partnerships at its fair market

value for total consideration of $3.9 million. The Corporation

determined that a majority of the development upside in the Bow

City Partnerships had been realized and the proceeds realized on

the sale were better redeployed in new opportunities.

Private Equity Northbridge, Northbridge Fund

2016, Northbridge Fund 2021 SP#1 and Northbridge Fund 2022 SP#2 and

Northbridge Fund SP#4 Subsequent to September 30, 2023, the

shareholders of Northbridge agreed in principle to support the wind

up the funds managed by Northbridge as proposed by the General

Partners of the funds. The aggregate proceeds are expected to be

approximately $8.3 million comprised of cash and direct holdings in

energy securities.

Outlook Wilmington has had a long history of

successfully recycling its capital for reinvestment in alternative

asset classes capable of creating value for its shareholders. In

the nine months ended September 30, 2023, Wilmington monetized the

value embedded in its Bow City investment and deployed capital by

continuing its acquisition strategy of consolidating the ownership

of “first class” marinas located in the Muskoka/Georgian Bay

region, all located within 2 hours drive north of Toronto, Ontario,

and acquiring the Seton self-storage development lands. Wilmington

is also in the process of monetizing its investment in Northbridge

and the underlying energy funds.

The strategy of monetizing the value embedded in its investments

and subsequently recycling the capital into new opportunities has,

to date, met with considerable success. Looking forward, a

significant portion of the Corporation’s liquidity has been

earmarked for the Seton development and to some extent to

acquisitions that may arise in its marina and RV resort platforms.

The Corporation will continue to examine ways to maximize value for

its shareholders through reinvestment of capital and, where

appropriate, unlocking the embedded value created to date within

existing investments.

Exception from MI 61-101 As certain limited

partner purchasers of the Corporation’s interests in the Bow City

partnerships are” related parties” of the Corporation (within the

meaning of MI 61-101 - “Protection of Minority Security Holders in

Special Transactions” (“MI 61-101”)), the Transaction is considered

a “related party transaction” under MI 61-101. The Corporation is

relying on exemptions from the formal valuation and minority

approval requirements of MI 61-101 that would otherwise apply in

respect of the Transaction, pursuant to Section 5.5(a) and Section

5.7(a) (Fair Market Value Not More Than 25% of Market

Capitalization) of MI 61-101.

FINANCIAL RESULTS

STATEMENT OF CONSOLIDATED INCOME AND

COMPREHENSIVE INCOME (unaudited)

|

For the |

|

Three months ended September 30, |

|

Nine months ended September 30, |

|

|

(CDN $ thousands, except per share amounts) |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

| Management fee revenue |

|

305 |

|

133 |

|

640 |

|

378 |

|

| Interest and other income |

|

1,022 |

|

635 |

|

2,660 |

|

1,621 |

|

|

|

|

1,327 |

|

768 |

|

3,300 |

|

1,999 |

|

|

Expenses |

|

|

|

|

|

| General and administrative |

|

(423 |

) |

(411 |

) |

(1,331 |

) |

(1,297 |

) |

| Amortization |

|

(7 |

) |

(7 |

) |

(21 |

) |

(21 |

) |

| Finance costs |

|

(2 |

) |

(2 |

) |

(5 |

) |

(7 |

) |

| Stock-based compensation |

|

(23 |

) |

(64 |

) |

(94 |

) |

(272 |

) |

|

|

|

(455 |

) |

(484 |

) |

(1,451 |

) |

(1,597 |

) |

|

Fair value adjustments and other activities |

|

|

|

|

|

| Fair value adjustments to

investments |

|

1,700 |

|

130 |

|

1,180 |

|

2,355 |

|

| Realized loss in Energy

Securities |

|

--- |

|

--- |

|

--- |

|

(146 |

) |

| Equity accounted income

(loss) |

|

19 |

|

(7 |

) |

(6 |

) |

146 |

|

|

|

|

1,719 |

|

123 |

|

1,174 |

|

2,355 |

|

|

Income before income taxes |

|

2,591 |

|

407 |

|

3,023 |

|

2,757 |

|

|

Current income tax recovery (expense) |

|

(347 |

) |

(70 |

) |

(540 |

) |

(87 |

) |

|

Deferred income tax recovery (expense) |

|

140 |

|

(15 |

) |

37 |

|

(340 |

) |

|

Provision for income taxes |

|

(207 |

) |

(85 |

) |

(503 |

) |

(427 |

) |

|

Net income |

|

2,384 |

|

322 |

|

2,520 |

|

2,330 |

|

|

Other comprehensive income |

|

|

|

|

|

| Items that will not

be reclassified to net income: |

|

|

|

|

Fair value adjustments to investments |

|

(518 |

) |

1,945 |

|

(688 |

) |

2,898 |

|

|

Related income taxes |

|

(30 |

) |

(247 |

) |

(17 |

) |

(334 |

) |

|

Other comprehensive income (loss), net of income taxes |

(548 |

) |

1,698 |

|

(705 |

) |

2,564 |

|

|

Comprehensive income |

|

1,836 |

|

2,020 |

|

1,815 |

|

4,894 |

|

|

|

|

|

|

|

|

| Net income per share |

|

|

|

|

|

|

Basic |

|

0.19 |

|

0.03 |

|

0.20 |

|

0.19 |

|

|

Diluted |

|

0.19 |

|

0.03 |

|

0.20 |

|

0.19 |

|

| |

|

|

|

|

|

|

|

|

|

CONSOLIDATED BALANCE SHEETS

| (unaudited) |

|

|

September 30, |

December 31, |

|

(CDN $ thousands) |

|

|

2023 |

2022 |

|

|

|

|

|

|

| Assets |

|

|

|

|

| NON-CURRENT ASSETS |

|

|

|

|

| Investment in Maple Leaf

Partnerships |

|

|

22,535 |

18,637 |

| Investment in Bow City

Partnerships |

|

|

--- |

3,864 |

| Investment in Sunchaser

Partnership |

|

|

3,461 |

1,806 |

| Investment in Northbridge and

Energy Securities |

|

|

9,220 |

7,284 |

| Land held for development |

|

|

6,494 |

--- |

| Right-of-use asset |

|

|

71 |

92 |

|

|

|

|

41,781 |

31,683 |

| CURRENT ASSETS |

|

|

|

|

| Cash |

|

|

1,362 |

4,007 |

| Short term securities |

|

|

23,000 |

22,000 |

| Amounts receivable and other

assets |

|

|

6,424 |

13,083 |

|

Total assets |

|

|

72,567 |

70,773 |

|

|

|

|

|

|

| Liabilities |

|

|

|

|

| NON-CURRENT LIABILITIES |

|

|

|

|

| Deferred income tax

liabilities |

|

|

1,295 |

1,316 |

| Lease liabilities |

|

|

102 |

116 |

|

|

|

|

1,397 |

1,432 |

| CURRENT LIABILITIES |

|

|

|

|

| Lease liabilities |

|

|

38 |

38 |

| Income taxes payable |

|

|

489 |

118 |

|

Amounts payable and other |

|

|

621 |

790 |

|

Total liabilities |

|

|

2,545 |

2,378 |

|

|

|

|

|

|

| Equity |

|

|

|

|

| Shareholders’ equity |

|

|

51,270 |

51,179 |

| Contributed surplus |

|

|

1,203 |

1,482 |

| Retained earnings |

|

|

9,902 |

7,382 |

| Accumulated other comprehensive

income |

|

|

7,647 |

8,352 |

|

Total equity |

|

|

70,022 |

68,395 |

|

Total liabilities and equity |

|

|

72,567 |

70,773 |

|

|

|

|

|

|

Executive Officers of the Corporation will be

available at 403-705-8038 to answer any questions on the

Corporation’s financial results.

STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS AND OTHER MEASUREMENTSCertain statements

included in this document may constitute forward-looking statements

or information under applicable securities legislation.

Forward-looking statements that are predictive in nature, depend

upon or refer to future events or conditions, include statements

regarding the operations, business, financial conditions, expected

financial results, performance, opportunities, priorities, ongoing

objectives, strategies and outlook of the Corporation and its

investee entities and contain words such as "anticipate",

"believe", "expect", "plan", "intend", "estimate", "propose", or

similar expressions and statements relating to matters that are not

historical facts constitute “forward-looking information” within

the meaning of applicable Canadian securities legislation.

While the Corporation believes the anticipated

future results, performance or achievements reflected or implied in

those forward-looking statements are based upon reasonable

assumptions and expectations, the reader should not place undue

reliance on forward-looking statements and information because they

involve known and unknown risks, uncertainties and other factors,

many of which are beyond the Corporation’s control, which may cause

the actual results, performance and achievements of the Corporation

to differ materially from anticipated future results, performance

or achievement expressed or implied by such forward-looking

statements and information.

Factors and risks that could cause actual

results to differ materially from those contemplated or implied by

forward-looking statements include but are not limited to: the

ability of management of Wilmington and its investee entities to

execute its and their business plans; availability of equity and

debt financing and refinancing within the equity and capital

markets; strategic actions including dispositions; business

competition; delays in business operations; the risk of carrying

out operations with minimal environmental impact; industry

conditions including changes in laws and regulations including the

adoption of new environmental laws and regulations and changes in

how they are interpreted and enforced; operational matters related

to investee entities business; incorrect assessments of the value

of acquisitions; fluctuations in interest rates; stock market

volatility; general economic, market and business conditions; risks

associated with existing and potential future law suits and

regulatory actions against Wilmington and its investee entities;

uncertainties associated with regulatory approvals; uncertainty of

government policy changes; uncertainties associated with credit

facilities; changes in income tax laws, tax laws; changes in

accounting policies and methods used to report financial condition

(including uncertainties associated with critical accounting

assumptions and estimates); the effect of applying future

accounting changes; and other risks, factors and uncertainties

described elsewhere in this document or in Wilmington's other

filings with Canadian securities regulatory authorities.

The foregoing list of important factors that may

affect future results is not exhaustive. When relying on the

forward-looking statements, investors and others should carefully

consider the foregoing factors and other uncertainties and

potential events. Except as required by law, the Corporation

undertakes no obligation to publicly update or revise any

forward-looking statements or information, that may be as a result

of new information, future events or otherwise. These

forward-looking statements are effective only as of the date of

this document.

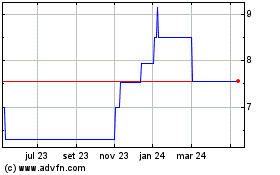

Wilmington Capital Manag... (TSX:WCM.B)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Wilmington Capital Manag... (TSX:WCM.B)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024