Unisync Corp. (“Unisync") (TSX:"UNI")

(OTC:“USYNF”) announces its audited financial results for the

fourth quarter and fiscal year ended September 30, 2023. Unisync

operates through two business units: Unisync Group Limited (“UGL”)

with operations throughout Canada and the USA and 90% owned

Peerless Garments LP (“Peerless”), a domestic manufacturing

operation based in Winnipeg, Manitoba. UGL is a leading

customer-focused provider of corporate apparel, serving many

leading Canadian and American iconic brands. Peerless specializes

in the production and distribution of highly technical protective

garments, military operational clothing, and accessories for a

broad spectrum of Federal, Provincial and Municipal government

departments and agencies.

Results for Fiscal 2023 versus Fiscal

2022

Revenue for the year ended September 30, 2023 of

$103.6 million increased by $7.3 million or 7.6% from the prior

year due to an impressive 13.9% improvement in the UGL segment

revenue, which followed an 18.0% improvement in fiscal 2022

revenues over fiscal 2021.

Gross profit before depreciation, amortization

and one-time non-cash charges fell to a disappointing $18.6 million

or 18.0% of revenue, from $23.5 million or 24.4% of revenue in the

prior year. The UGL segment reported a decline to $16.1 million or

17.4% of segment revenue compared to $20.1 million or 24.7%,

notwithstanding lower revenue in the previous fiscal year. The

Peerless segment’s gross profit margin, before a $0.4 million raw

material non-cash inventory adjustment, remained consistent with

the prior year at 22.1%.

UGL segment gross profit was affected by a $3.4

million non-cash revaluation of the weighted average cost of

inventory in the current year to adjust for the sharp drop in

offshore container delivery costs since the peak experienced in

June 2022, and a non-cash $2.0 million increase in the inventory

obsolescence reserve to adjust PPE and other inventory to net

realizable value. Margins were also adversely affected by the

absorption of higher delivery costs caused by an unprecedented

increase in shipping volumes combined with much lower per shipment

value as airlines reduced employee allotments to meet the demand

for new hires, as well as costs associated with the startup of the

new Guelph satellite 40,000 sq. ft. distribution facility which

opened in July 2023. In addition, UGL’s limited ability to

immediately pass on the broadly based increases in input and

overhead costs experienced since the onset of COVID has culminated

in a major deterioration in customer contribution margins.

Depreciation and amortization expense rose by

$0.8 million from fiscal 2022 to $4.9 million in the current year

on account of the amortization of the lease on the new Guelph

distribution facility and a full year’s amortization of the

Company’s new Enterprise Resource Planning (“ERP”) software that

was completed in fiscal 2022.

At $16.3 million, total general and

administrative expenses for the year ended September 30, 2023 were

down $2.3 million or 12% from fiscal 2022 on a reduction in senior

management and customer service staff levels and with the sale of

the New Jersey operation.

Interest expense of $3.5 million in the current

year doubled from $1.7 million in the prior year due to higher

interest rates on the Company’s short-term borrowings and the

amortization of interest on the new Guelph distribution facility

lease.

A restructuring charge of $0.9 million was

recognized for employee severance costs, legal fees, lease

termination and inventory relocation costs on the shutdown of

distribution and sewing activities at the Company’s Carleton Place,

Ontario and Montreal locations which commenced in September 2023. A

$0.3 million gain was realized on the sale of the assets of the New

Jersey operation in December 2022.

The Company reported a net loss of $9.2 million

for the year ended September 30, 2023 against a loss of $1.3

million in the year before.

Adjusted EBITDA after normalization for non-cash

inventory revaluations of $5.8 million and one-time net

restructuring costs of $0.6 million, was $1.5 million versus $4.9

million for the corresponding period last year.

Adjusted EBITDA does not have a standardized

meaning prescribed by IFRS and is therefore unlikely to be

comparable to similar measures presented by other issuers and

should not be considered in isolation nor as a substitute for

financial information reported under IFRS. Unisync uses non-IFRS

measures, including Adjusted EBITDA, to provide shareholders with

supplemental measures of its operating performance. Unisync

believes adjusted EBITDA is a widely accepted indicator of an

entity’s ability to incur and service debt and commonly used by the

investing community to value businesses.

Results for Q4 2023 versus Q4

2022

Revenue for the three months ended September 30,

2023 of $20.7 million decreased by $4.6 million or 18% over the

three months ended September 30, 2022. The decline was attributable

to the drop in the UGL segment revenue to $17.3 million due to a

$2.4 million or 26% slowdown in airline customer sector demand

compared to the dramatic post pandemic growth experienced in the

same period last year, lost revenue from the December 2022 sale of

the New Jersey operation and a temporary dip in sales to customers

of the Montreal location during the September relocation of

inventory to the Guelph distribution center.

Gross profit for the three months ended

September 30, 2023 before depreciation, amortization and one-time

non-cash charges of $4.0 million, came in at $1.9 million compared

to $6.3 million reported the same period last year. Apart from the

lower absorption of fixed costs caused by the 18% drop in revenues,

the remaining difference resulted from a lower margin sales mix and

year-end inventory adjustments being reflected in the fourth

quarter results. The Peerless segment’s gross profit margin, before

a $0.4 million raw material non-cash inventory adjustment in the

quarter, remained consistent with the prior year at 22%.

Depreciation and amortization expense rose by

$0.5 million over the same quarter last year to $1.1 million due to

the reasons stated above.

At $3.7 million, total general and

administrative expenses for the three months ended September 30,

2023 were down $1.5 million or 29% from the three months ended

September 30, 2022 on a reduction in senior management and customer

service staff levels and with the sale of the New Jersey

operation.

Interest expense of $1.1 million for the current

quarter was up $0.5 million from the same period last year due to

higher interest rates on the Company’s short-term borrowings and

the amortization of interest on the new Guelph distribution

facility lease.

The restructuring charge of $0.9 million as

referenced above in the fiscal 2023 results, was recognized in the

fourth quarter of fiscal 2023.

The Company reported a net loss of $6.7 million

in the quarter ended September 30, 2023 compared to a net loss of

$0.5 million in the same quarter last year for the reasons cited

above.

More detailed information is contained in the

Company’s Consolidated Financial Statements for the fiscal year

ended September 30, 2023 and Management Discussion and Analysis

dated December 28, 2023 which may be accessed at www.sedar.com.

THREE PILLAR APPROACH TO IMPROVED MARGINS

AND PROFITABILITY AT UGL

Immediately following the corporate leadership

changes announced on Feb 25, 2022, UGL began a major downsizing and

restructuring that began with the immediate elimination of two

redundant Vice President positions followed shortly thereafter by

the elimination of three additional Vice President and one Senior

Management positions. This restructuring continued into 2023 with

the appointment of Director Tim Gu to Chairman of the Board on

April 2, 2023 and the commencement of a major operational

consolidation endeavor announced in August, integrating its

Carleton Place, Ontario and its St. Laurent, Quebec based

distribution and small-lot product manufacturing and embellishment

facilities into its recently expanded 140,000 square foot main

facility in Guelph, Ontario. Driven by a vision of a stronger and

more unified company poised for an enhanced service offering and

sustainable profitability and growth, these operational adjustments

are expected to yield improvements in operational efficiency and

future annual savings in direct and administrative labour costs due

to a net reduction of about 20% in the UGL division’s

headcount.

Based on the nature of Company’s long-term

contracts and weighted average costing of inventory, there is a lag

effect before the Company can realize the benefits from customer

price increases and reductions in input pricing as production is

renegotiated and/or moved to lower cost jurisdictions. Both these

processes are now well underway with most clients understanding the

need for changes in offshore production and aggressive price

increases. Onboarding of new account wins such as Via Rail and the

award to our PG subsidiary of a $13.2 million 5 year contract with

the DND for the supply of protective combat uniforms, combined with

the return to more normal offshore container rates, are all

additional positive developments affecting future performance.

BUSINESS OUTLOOK

There has been an unprecedented buildup in large

managed image wear opportunities that came to market in 2023 and

many more scheduled to go to the market RFP stage throughout

2024/25. Some competitors have had performance issues during the

economic turmoil experienced in recent years and/or have signalled

withdrawing from this marketplace, leaving UGL well positioned for

accelerated organic growth in both Canada and the USA. Our

demonstrated capability to manage large complicated operational

uniform programs, combined with a base of credible referenceable

clients provides the opportunity for near-term accelerated

growth.

The Company continues to place strong focus on

the US market. UGL is in advanced discussions with several major

corporations with respect to their image wear programs totaling

close to US$100 million annually in potential new business.

Additionally, UGL has been added as an approved supplier to an

extensive list of major customers that are also scheduled to come

to market in 2024 and into 2025.

The Peerless business segment is positioned to

maintain its current level of revenues and profitability over the

balance of fiscal 2024 barring further delays in the receipt of

technical fabric and/or the exercise of contract options.

Due to the size and imminent nature of the

opportunities in front of us, it is important that we restore our

capital base that has eroded from a multitude of global disruptions

ranging from COVID to major wars. To this end, the Company’s Board

will be pursuing various capital raising opportunities to

effectively capitalize on the growth opportunities in front of

us.

As we move out of this platform building phase,

management and your Board are committed to achieving continued

future growth and the development of an improved level of

profitability to enhance shareholder value.

CORPORATE DEVELOPMENTS

Following the decision earlier in the year by

the Company’s CFO, Richard Smith, to retire, the Company embarked

on a search for his ultimate replacement which resulted in the

hiring of Parvinder Shergill, as Vice President Finance of UGL on

September 6, 2023. Effective December 31, 2023 Mr. Smith has

retired as CFO, and is replaced by Ms. Shergill who will assume the

additional role of VP Finance for the Company. Mr. Smith has agreed

to continue with the Company until the end of February 2024 to

assist in the transition, thereafter moving to a part time advisory

role. We would like to take this opportunity to thank Richard for

the dedication and hard work he has exhibited throughout his

thirteen-year career with Unisync and wish him good health and

happiness in his retirement.

Parvinder obtained a Graduate Diploma in Law in

1995 followed by an MBA from De Montfort University, UK, in 1996

and began her business career as a Tax Consultant with KPMG in Jan

1997. During the following four and a half years she gained

valuable international experience in US, UK and Canadian taxation

matters. Parvinder obtained her CPA designation from the Illinois

Board of Examiners in 2008. She has held positions ranging from

Business Analyst with Microsoft Canada, Director of Finance for

Hill Street Beverage, Founder and CFO of a small business, and more

recently operating as a consultant to a number of businesses - all

while raising her young family. We look forward to Parvinder’s

collaborative nature and strong coaching skills fostering a

positive team dynamic in her new role.

In addition, the Board advises that C Scott

Shepherd has for personal reasons resigned his Vice Chairman role

and the directorship he held from July 16, 2020 to December 1,

2023. The Board would like to thank Scott for the valuable

contributions he has made to the Company in those roles.

On Behalf of the Board of Directors

Douglas F GoodDirector & CEO

Investor relations

contact:Douglas F Good, Director & CEO at 778-370-1725

Email: dgood@unisyncgroup.com

Forward Looking Statements

This news release may contain forward-looking

statements that involve known and unknown risk and uncertainties

that may cause the Company’s actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied in these

forward-looking statements. Any forward-looking statements

contained herein are made as of the date of this news release and

are expressly qualified in their entirety by this cautionary

statement. Except as required by law, the Company undertakes no

obligation to publicly update or revise any such forward-looking

statements to reflect any change in its expectations or in events,

conditions or circumstances on which any such forward-looking

statements may be based, or that may affect the likelihood that

actual results will differ from those set forth in the

forward-looking statements. Neither the TSX nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX) accepts responsibility for the adequacy or accuracy of this

release.

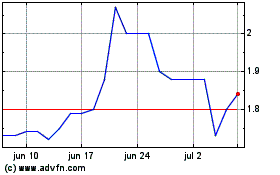

Unisync (TSX:UNI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Unisync (TSX:UNI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024