Brera Holdings PLC (“Brera Holdings”, “Brera” or the “Company”)

(Nasdaq: BREA), which one year ago became the first Italian

football team to IPO on Nasdaq, today describes some of the

benefits of the multi-club ownership (“MCO”) model.

As the only publicly-listed MCO company in the world today,

holding six assets in its professional sports team portfolio, Brera

has already begun to diversify its sports holdings.

In December 2023, Sir Jim Ratcliffe, CEO of INEOS, submitted a

tender offer to acquire 25% of Manchester United PLC (NYSE: MANU).

The tender offer price of $33 per share represents a 74% premium to

the price Brera paid upon its purchase of a minority interest in

MANU in June 2023, and Brera has decided to tender all of its

shares.

In March 2023, Brera expanded to Africa with the establishment

of Brera Tchumene FC, a team then admitted to the Second Division

League in Mozambique. After winning its post-season tournament, the

team was promoted to Mocambola, the First Division in

Mozambique.

Brera believes it’s important for shareholders to understand the

benefits of the MCO business model, and felt it’s best to provide

some background and history to demonstrate the opportunity.

While most sports fans are familiar with international

professional sports business practices, Americans are just now

being introduced to terms like player transfer fees and rights, in

part, thanks to the mega-deals driving the recent mania for

baseball’s $700 million man Shohei Ohtani and soccer legend Lionel

Messi finally playing in the United States. Outright mayhem ensues

each time Ohtani takes the mound in Los Angeles, and when Messi

hits the pitch (or, as the Yanks say, field) in Miami.

Fans often dream about owning their favorite team, but for

99.99% of fans, no matter the sport, venue or country, professional

sports ownership has been reserved for the billionaire elite.

The allure of professional sports team ownership is so

appealing, that A-listers Ryan Reynolds and Rob McElhenney

purchased Welsh soccer team, Wrexham AFC, for $2.5 million in 2021.

Not only have the two already turned Wrexham into a champion, which

was promoted to one of England’s higher divisions, they also seemed

to connect with Wrexham’s fan base at home and now abroad.

Sports teams outside of the United States take a holistic

approach to team ownership and are more judicious with their

budgets. Owners typically own their stadiums and must strive to

deliver a strong team, or risk demotion to a lower tier league,

losing out on substantial revenue and profit. Conversely, this

international ownership dynamic means that turning around

under-capitalized or mismanaged lower tier pro sports teams can be

extremely lucrative.

One such example is the purchase of Union Saint-Gilloise, by

Tony Bloom and Alex Muzio, who took Union SG back to Belgium’s top

flight after a 48-year absence, and are playing in the UEFA

Champions League.

The UEFA Champions League’s international audience, like the

FIFA World Cup, dwarfs the NFL’s Superbowl and offers a massive

prize pool. The 32 clubs that participated in the 2021-2022

championship split over 2 billion euros ($2.35 billion) from UEFA,

which is in addition to their regular season earnings.

Red Bull, which owns five football teams in Europe and the

Americas, and Manchester City, which partnered with 13 clubs in

five continents, are leading the privately-held MCO movement that

continues to grow with moves like Chelsea’s owners’ majority stake

acquisition in French Ligue 1 club Strasbourg.

Union SG’s Bloom is the owner of Brighton & Hove Albion, now

an English Premier League club that was in danger of being demoted

from League One, England’s third football tier, when he purchased

the club. Brighton & Hove Albion is now in the hunt for a top

seven Premier League finish, which would qualify it for a spot in

one of the European tournaments. The club’s estimated valuation has

increased by hundreds of millions of dollars, since his

purchase.

UEFA published research shows that over 180 clubs worldwide were

part of an MCO model and UEFA president Aleksander Ceferin has been

very vocal in his support of MCO expansion.

Most recently, one of the highest profile MCO moves is currently

taking place, as mentioned earlier with Sir Jim Ratcliffe, is in

line to buy a quarter of Manchester United from the Glazer family.

Ratcliffe’s INEOS already owns two European football clubs, OGC

Nice and Lausanne, in addition to his other sports properties,

including INEOS Grenadiers cycling team, which is a mainstay at the

largest races, like the Tour de France.

“We remain on target with our sports team rollup and are now

ready to begin the next chapter in expanding the multi-club

ownership movement and believe that our unique model, including

Nasdaq-listed shares, and rapid international expansion plans, will

appeal to fans and savvy investors. As we grow the Brera brand and

tournament exposure, we believe that we will benefit from increased

industry exposure that these mega deals generate and, whether it’s

on the pitch or in the board room, Brera is playing to win,” stated

Pierre Galoppi, Chief Executive Officer of Brera Holdings.

ABOUT BRERA HOLDINGS PLC

Brera Holdings PLC (Nasdaq: BREA) is focused on expanding its

social impact football (American soccer) business by developing a

global portfolio of emerging football and other sports clubs with

increased opportunities to earn tournament prizes, gain

sponsorships, and provide other professional football- and

sports-related consulting services.

The Company seeks to build on the legacy and brand of Brera FC,

the first football club that was acquired by the Company in 2022.

Brera FC, known as "The Third Team of Milan," is an amateur

football association which has been building an alternative

football legacy since its founding in 2000. The Company owns the

trademarked FENIX Trophy Tournament, a non-professional

pan-European football competition recognized by UEFA, inaugurated

in September 2021 and organized by Brera FC. "FENIX" is an acronym

for "Friendly European Non-professional Innovative Xenial." BBC

Sport has called the FENIX Trophy "the Champions League for

amateurs," and Brera FC hosted the 2023 finals at Milan's legendary

San Siro Stadium. In October 2022, the Internet Marketing

Association at its IMPACT 22 Conference named Brera FC as its award

recipient for "Social Impact Through Soccer," recognizing the

Company's focus at an international level with this

distinction.

In March 2023, the Company expanded to Africa with the

establishment of Brera Tchumene FC, a team then admitted to the

Second Division League in Mozambique, a country of nearly 32

million people. Brera Tchumene FC won its post-season tournament

and in November 2023 was promoted to Mocambola, the First Division

in Mozambique. In April 2023, the Company acquired 90% of the

European first division football team Fudbalski Klub Akademija

Pandev in North Macedonia, a country with participation rights in

two major Union of European Football Association ("UEFA")

competitions.

In June 2023, Brera acquired a strategic stake in Manchester

United PLC. In July 2023, the Company completed the acquisition of

a majority ownership in the Italian Serie A1 women's professional

volleyball team UYBA Volley S.s.d.a.r.l. In September 2023, the

Company assumed control of Bayanzurkh Sporting Ilch FC, a team in

the Mongolian National Premier League, which will become Brera Ilch

FC when the football season resumes in March 2024. In January 2024,

the Company announced the launch of a proactive search for an

Italian Serie B football club target designed to bring multi-club

ownership of the highest tiers of professional sports ownership to

mass investors through the Company's Nasdaq-listed shares. The

Company is focused on bottom-up value creation from undervalued

sports clubs and talent, innovation-powered business growth, and

socially-impactful outcomes. See www.breraholdings.com

Cautionary Note Regarding Forward-Looking

Statements

This press release contains forward-looking statements that are

subject to various risks and uncertainties. Such statements include

statements regarding the Company's ability to grow its business and

other statements that are not historical facts, including

statements which may be accompanied by the words "intends," "may,"

"will," "plans," "expects," "anticipates," "projects," "predicts,"

"estimates," "aims," "believes," "hopes," "potential" or similar

words. Actual results could differ materially from those described

in these forward-looking statements due to a number of factors,

including without limitation, the Company's ability to continue as

a going concern, the popularity and/or competitive success of the

Company's acquired football and other sports teams, the Company's

ability to attract players and staff for acquired clubs,

unsuccessful acquisitions or other strategic transactions, the

possibility of a decline in the popularity of football or other

sports, the Company's ability to expand its fanbase, sponsors and

commercial partners, general economic conditions, and other risk

factors detailed in the Company's filings with the SEC. The

forward-looking statements contained in this press release are made

as of the date of this press release, and the Company does not

undertake any responsibility to update such forward-looking

statements except in accordance with applicable law.

CONTACT INFORMATION:

FOR MEDIA AND INVESTOR RELATIONSPierre Galoppi, Chief Executive

OfficerBrera Holdings PLCpierre@breraholdings.com

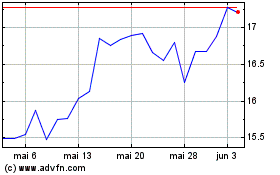

Manchester United (NYSE:MANU)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Manchester United (NYSE:MANU)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025