Centerra Gold Inc. (“Centerra” or the “Company”) (TSX: CG) (NYSE:

CGAU) announces its 2023 year-end estimates for mineral reserves

and mineral resources. Proven and probable gold mineral reserves

were 3.6 million ounces and proven and probable copper mineral

reserves were 961 million pounds, as of December 31,

2023. Measured and indicated gold mineral resources were 6.9

million ounces as of December 31, 2023, driven by a significant

increase at Mount Milligan. The Company is encouraged by the large

mineral endowment at Mount Milligan setting the stage for potential

future mine life growth.

Centerra Year-End Gold Mineral Reserves

and Mineral Resources(1)

|

|

2023 |

2022 |

|

Property |

Tonnes (kt) |

Grade (g/t) |

Contained Gold (koz) |

Tonnes (kt) |

Grade (g/t) |

Contained Gold (koz) |

|

Proven and Probable Gold Mineral Reserves |

|

Mount Milligan Mine |

250,025 |

0.35 |

2,822 |

223,957 |

0.37 |

2,643 |

|

Öksüt Mine |

25,255 |

1.01 |

819 |

27,098 |

1.08 |

941 |

|

Kemess Underground |

- |

- |

- |

107,381 |

0.50 |

1,868 |

|

Total |

275,280 |

0.41 |

3,641 |

358,436 |

0.46 |

5,452 |

|

Measured and Indicated Gold Mineral Resources |

|

Mount Milligan Mine |

259,860 |

0.27 |

2,333 |

182,734 |

0.30 |

1,740 |

|

Öksüt Mine |

6,752 |

0.55 |

119 |

17,377 |

0.49 |

272 |

|

Kemess Open Pit |

111,682 |

0.27 |

980 |

- |

- |

- |

|

Kemess Underground |

139,920 |

0.50 |

2,265 |

173,719 |

0.31 |

1,737 |

|

Kemess East |

93,454 |

0.39 |

1,182 |

177,500 |

0.40 |

2,305 |

|

Total |

611,668 |

0.35 |

6,880 |

551,330 |

0.34 |

6,053 |

|

Inferred Gold Mineral Resources |

|

Mount Milligan Mine |

7,795 |

0.34 |

84 |

5,685 |

0.46 |

83 |

|

Öksüt Mine |

348 |

0.78 |

9 |

2,329 |

0.41 |

31 |

|

Kemess Open Pit |

13,691 |

0.26 |

116 |

- |

- |

- |

|

Kemess Underground |

- |

- |

- |

47,700 |

0.34 |

529 |

|

Kemess East |

- |

- |

- |

29,300 |

0.30 |

283 |

|

Total |

21,833 |

0.30 |

209 |

85,014 |

0.34 |

926 |

1) As of December 31, 2023. Refer to Tables “Centerra Gold Inc.

2023 Year-End Mineral Reserve and Resources Summary – Gold” and

“Centerra Gold Inc. 2023 Year-End Mineral Reserve and Resources

Summary – Other Metals”, including their respective footnotes and

the “Additional Footnotes” section below.

- Mount Milligan:

Centerra entered into an additional agreement with RGLD Gold AG, a

subsidiary of Royal Gold, Inc., relating to Mount Milligan, which

immediately extends the mine life by two years to 2035 and grows

the mineral resources to 510 million tonnes, inclusive of reserves.

For additional details, please refer to the announcement entitled

“Centerra Gold Announces Mount Milligan Mine Life Extension and New

Agreements with Royal Gold”, which was issued in conjunction with

this news release on February 14, 2024.

- Kemess: The Kemess

underground block cave project is not a priority for Centerra’s

project pipeline at this time. The prior mineral reserves and

resources estimate produced for this project were completed with

costs and commodity price assumptions that are no longer

applicable. As a result, the Company has applied current capital,

operating and metal price assumptions to reclassify the historical

reserves as a blend of open pit and underground resources.

Confirmation and exploration drilling, as well as technical studies

are planned for 2024 and are expected to provide an updated mining

and processing concept which may unlock additional value. Kemess

benefits from infrastructure already on site, several permits in

place, and an impact benefit agreement with its First Nation

partners. Centerra remains optimistic that Kemess could be a future

source of gold and copper production.

Centerra Year-End Copper Mineral

Reserves and Mineral Resources(1)

|

|

2023 |

2022 |

|

Property |

Tonnes(kt) |

Grade (% copper) |

Contained Copper (Mlbs) |

Tonnes(kt) |

Grade (% copper) |

Contained Copper (Mlbs) |

|

Proven and Probable Copper Mineral Reserves |

|

Mount Milligan Mine |

250,025 |

0.17 |

961 |

223,957 |

0.18 |

902 |

|

Kemess Underground |

- |

- |

- |

107,381 |

0.27 |

630 |

|

Total |

250,025 |

0.17 |

961 |

331,338 |

0.21 |

1,532 |

|

Measured and Indicated Copper Mineral

Resources |

|

Mount Milligan Mine |

259,860 |

0.15 |

851 |

182,734 |

0.17 |

695 |

|

Kemess Open Pit |

111,682 |

0.14 |

337 |

- |

- |

- |

|

Kemess Underground |

139,920 |

0.25 |

779 |

173,719 |

0.18 |

697 |

|

Kemess East |

93,454 |

0.30 |

628 |

177,500 |

0.36 |

1,410 |

|

Berg |

- |

- |

- |

609,986 |

0.27 |

3,651 |

|

Total Copper |

604,916 |

0.19 |

2,595 |

1,143,939 |

0.26 |

6,453 |

|

Inferred Gold Mineral Resources |

|

Mount Milligan Mine |

7,795 |

0.14 |

24 |

5,685 |

0.07 |

8 |

|

Kemess Open Pit |

13,691 |

0.16 |

48 |

- |

- |

- |

|

Kemess Underground |

- |

- |

- |

47,700 |

0.20 |

210 |

|

Kemess East |

- |

- |

- |

29,300 |

0.31 |

203 |

|

Berg |

- |

- |

- |

28,066 |

0.22 |

138 |

|

Total Copper |

21,486 |

0.15 |

72 |

110,751 |

0.23 |

559 |

1) As of December 31, 2023. Refer to Tables “Centerra Gold Inc.

2023 Year-End Mineral Reserve and Resources Summary – Gold” and

“Centerra Gold Inc. 2023 Year-End Mineral Reserve and Resources

Summary – Other Metals”, including their respective footnotes and

the “Additional Footnotes” section below.

- Berg: In December

2023, Centerra entered into an agreement to sell its 100% interest

in the Berg Property to Surge Copper Corp., which was completed in

January 2024. Surge had been earning into a 70% interest in the

Berg Property, and following the sale, Centerra holds approximately

15% of Surge’s outstanding common shares. As a result, Berg is not

included in Centerra’s overall copper resources at the end of

2023.

Exploration Update

Exploration activities in the fourth quarter of

2023 included drilling, surface rock and soil sampling, geological

mapping, and geophysical surveying, targeting gold and copper

mineralization at the Company’s projects and properties in Canada,

Türkiye, and the United States.

2023 Exploration Highlights

- Significant mineral endowment at

Mount Milligan sets the stage for potential future resource

additions, including possibilities for near-surface additions and

depth extensions.

- Resource delineation for oxide and

transition material continued at the Goldfield project, with

emphasis on extending known mineralization from the Gemfield

deposit.

- Positive initial results at the

Oakley project early in 2023 warranted a follow up drilling

campaign.

- Fourth quarter of 2023 drilling

program included 7,967 metres of drilling.

- Full year 2023 drilling totalled

94.7 kilometres, including greenfield projects.

2024 Exploration Outlook

- Pursue further exploration

activities to identify potential extensions and enhancements to

existing resources at Mount Milligan.

- Commence drill test programs at all

identified target areas in Canada, United States, and Türkiye.

- Continue with advanced exploration

activities at Goldfield and Oakley.

- Exploration expenditures in 2024 are expected to be $35 to $45

million, including $17 to $22 million of brownfield exploration,

and $18 to $23 million of greenfield and generative exploration

programs.

Mount Milligan Mine (“Mount Milligan”)

- Ongoing exploration drilling

program at Mount Milligan aimed at expanding the mineral resource

base significantly.

- In 2023, 80% of exploration

drilling focused on the pit and three brownfield areas, revealing

mineralization in tested areas west of the pit margin and below the

ultimate pit boundary.

- Goldmark, Boundary and South

Boundary present possibilities for near-surface additions, while

North Slope, DWBX Extension, and Saddle West are being tested for

depth extensions.

- Encouraged by the significant

mineral endowment and potential future resource additions at Mount

Milligan, Centerra plans to invest approximately $5 to $7 million

in exploration at Mount Milligan in 2024.

Mount Milligan Brownfield Drilling and

Exploration

Figure 1: Plan view of Mount Milligan pits (2022

and 2023) showing major porphyry corridors.

Figure 2: Long section view of Mount Milligan

pits (2022 and 2023), looking north, showing gold and copper grade

contours.

Figure 3: Long section view of Mount Milligan

pits (2022 and 2023), looking northwest, showing gold and copper

grade contours.

The DWBX zone is the depth

extension of the WBX porphyry-style gold-copper mineralization

currently mined in the pit. Mineralization is associated with

potassic alteration and early quartz veins within the DWBX stock

and stock margins. Results received to-date show the depth

extension of the mineralization and potential to extend the pit to

mine DWBX and DWBX Extension. Some selected significant results

received during the year include:

Hole #23-1475 : 51.6m

@ 0.73 g/t Au, 0.047% Cu from 335mHole #23-1484 : 50.7m @ 1.60 g/t

Au, 0.177% Cu from 173mHole #23-1484 : 72.0m @ 0.65 g/t Au, 0.202%

Cu from 447mHole #23-1487 : 157.6m @ 0.23g/t Au, 0.035% Cu from

271m

The Goldmark zone is directly

west of the current Mount Milligan pit design, situated above the

high grade DWBX zone. Drilling during the year aimed to test the

western extent of the Goldmark mineralization that had been

intersected in previous drilling programs. Shallow porphyry-style

gold and copper mineralization is hosted at the margins of dykes

and the Goldmark stock. High gold-low copper (“HGLC”) style

mineralization occurs throughout the zone. The results show

potential for shallow resource addition and the extension of

mineralization west of the existing pit boundary. Significant

results include:

Hole #23-1480 : 55.5m

@ 1.55 g/t Au, 0.026% Cu from 13mHole #23-1481 : 90.2m @ 0.49 g/t

Au, 0.054% Cu from 419mHole #23-1485 :132.0m @ 0.25 g/t Au, 0.192%

Cu from 366m

The North Slope zone is

approximately 1.5 kilometres from the western margins of the

existing pit boundary. Assays returned show localized shallow zones

of low-grade gold and copper mineralization related to the North

Slope stock, with higher-grade porphyry-style gold and copper

mineralization at depth. Significant results include:

Hole #23-1491 : 58.0m

@ 0.17 g/t Au, 0.102% Cu from 443mHole #23-1493 : 50.5m @ 0.19 g/t

Au, 0.219% Cu from 489mHole #23-1503 : 43.8m @ 0.21 g/t Au, 0.303%

Cu from 439m

The Saddle zone and the

Saddle West zone are south of Goldmark, along the

western margins and within one kilometre of the current pit

boundary. The program was designed for resource expansion,

targeting extension of deep HGLC mineralization below the current

pit. Results returned show potential for deep resource addition

adjacent to and below the current pit boundary. Significant results

include:

Hole # 23-1470 :

61.0m @ 0.895 g/t Au, 0.005% Cu from 476mHole # 23-1467 :

106.7m @ 0.259 g/t Au, 0.023% Cu from 344mHole #23-1471 :

12.3m @ 1.45g/t Au ; 0.022% Cu from 498m

The Boundary zone is within 500

metres of the western margins of the Southern Star pit boundary.

Assays returned show shallow and deep porphyry-style gold and

copper mineralization associated with dykes in the Boundary zone

and the extension of the Southern Star stock at depth.

Mineralization is associated with potassic and propylitic

alteration, often overprinted by quartz-sericite-pyrite alteration,

with early quartz veins and chalcopyrite ± pyrite veins.

Significant results include:

Hole #23-1514 : 25.0m

@ 0.152 g/t Au, 0.181% Cu from 129mHole #23-1509 : 73.7m @ 0.336

g/t Au, 0.066% Cu from 215.3mHole #23-1510 : 42.4m @ 0.202 g/t Au,

0.322% Cu from 511.6mHole #23-1507 : 35.6m @ 0.219 g/t Au, 0.216%

Cu from 455m

In addition to the east-west corridor, drill

testing was carried out within the southwest-northeast corridor at

M6 and Orica, both targets were interpreted as linking to the

Southern Star pit. M6 and Orica drill testing zones are

approximately 1.5 kilometre west and southwest respectively from

the western margins of the Southern Star ultimate pit boundary.

Results received show mineralization potential in a relatively

underexplored area, especially to the southwest. The porphyry-style

gold and copper mineralization in these target areas are expected

to be part of the focus in 2024.

Goldfield Project

(“Goldfield”)

- Goldfield achieved 49 kilometres of

drilling in 2023.

- Fourth quarter exploration program

totalled 4,024 metres in 16 core drill holes and 23,160 metres in

103 reverse circulation holes.

- Three satellite prospects east of

the Gemfield deposit (Jupiter, Callisto, Kendall) were drill

tested, with Jupiter and Callisto indicating a transition from

deeper sulfide to shallow oxide mineralization in the up-dip

projection.

Gemfield deposit and its

immediate satellite target areas are geologically characterized by

gently-dipping, intermediate and felsic volcanic units

unconformably overlain by unconsolidated pebble to cobble

conglomerate and down-dropped by post-mineral normal faults.

Mineralization is typically hosted in stratabound Sandstorm

rhyolite, although lower grade mineralization can be found in

several of the felsic units, and is associated with a large,

widespread blanket of quartz - alunite alteration dominated by

pyrite in a high sulfidation environment. The Jupiter and Callisto

prospects represent deeper sulfide mineralization transitioning to

shallow oxide mineralization in the up-dip projection of the host

stratigraphy. Exploration activities focused on defining the extent

of the oxide mineralization, and additional exploration activities

are planned at both Jupiter and Callisto in 2024. Significant

results received during the year include:

Hole #GEM-23-R122 :

80.0m @ 6.94g/t Au from 65mHole #GEM23D26 : 173.5m @ 1.82 g/t Au

from 441mHole #GEM23R170 : 190.0m @ 1.20 g/t Au from 370mHole

#GEM23R170 : 170.0m @ 0.47 g/t Au from 595mHole #GEM-23-R112 :

80.0m@ 1.41 g/t Au from 315mHole #GEM23R175 : 85.0m@ 1.18 g/t Au

from 435mHole #GEM23R157 : 170.0m @ 0.47 g/t Au from 605mHole

#GEM-23-R125 : 50.0m @ 1.55 g/t Au from 250mHole #GEM-23-R102 :

40.0m @ 1.79 g/t Au from 290mHole #GEM-23-R116 : 200.0m @ 0.35 g/t

Au from 125m

Oakley Project (“Oakley”)

In 2023, Centerra earned into a 70% interest in

Oakley and subsequently acquired the remaining 30% interest from

Excellon Resources Inc., bringing the Company’s total interest in

the project to 100%. Exploration activities in the second half of

2023 continued to define a near-surface, structurally controlled,

low sulfidation epithermal gold occurrence at the Blue Hill

prospect. Additional epithermal style gold prospects were

identified in the fourth quarter in other parts of the project

area. These targets will be drill tested during 2024. Significant

results received during the year include:

Hole #BHC-23-10 :

46.5m @ 0.55 g/t Au from 27.5mHole #BHC-23-10 : 64.0m @ 0.40 g/t Au

from 78.0mHole #BHC-23-11 : 32.9m @ 0.34 g/t Au from 45.2mHole

#BHC-23-11 : 25.0m @ 0.94 g/t Au from 102.0mHole #BHC-23-17 : 39.8m

@ 0.28 g/t Au from 35.5mHole #BHC-23-20 : 45.5m @ 0.43 g/t Au from

79.0mHole #BHC-23-21 : 32.1m @ 0.32 g/t Au from 61.5mHole

#BHC-23-21 : 38.5m @ 0.49 g/t Au from 159.0mHole #BHC-23-27 : 34.1m

@ 0.34 g/t Au from 91.5mHole #BHC-23-27 : 47.0m @ 0.39 g/t Au from

129.4m

Öksüt Mine (“Öksüt”)

In the fourth quarter of 2023, five core drill

holes were completed at Öksüt, aimed to test for a potential deep

porphyry target beneath the Keltepe and Güneytepe pits. The

exploration for deep porphyry deposits was initiated based on

historical drill holes confirming potassic alteration related to

porphyry intrusive on the Öksüt license. In 2024, a detailed

alteration analysis is expected to be carried out using 2023 and

deep historical holes drilled in and around Öksüt.

A full listing of the drill results has been

filed on SEDAR+ at www.sedarplus.ca, EDGAR at www.sec.gov/edgar,

and is available on the Company’s website at

www.centerragold.com.

Centerra Gold Inc. 2023 Year-End Mineral

Reserve and Resources Summary – Gold

(1)as of December 31, 2023 (see additional

footnotes below)

|

Proven and Probable Gold Mineral Reserves |

|

|

Proven |

Probable |

Total Proven and Probable |

|

Property |

Tonnes |

Grade |

Contained Gold (koz) |

Tonnes |

Grade |

Contained Gold (koz) |

Tonnes |

Grade |

Contained Gold (koz) |

|

(kt) |

(g/t) |

(kt) |

(g/t) |

(kt) |

(g/t) |

|

Mount Milligan (4) |

215,640 |

0.34 |

2,387 |

34,386 |

0.39 |

435 |

250,025 |

0.35 |

2,822 |

|

Öksüt |

1,140 |

1.10 |

40 |

24,116 |

1.00 |

779 |

25,255 |

1.01 |

819 |

|

Total |

216,780 |

0.35 |

2,427 |

58,502 |

0.64 |

1,214 |

275,280 |

0.41 |

3,641 |

|

|

|

Measured and Indicated Gold Mineral Resources

(2) |

|

|

Measured |

Indicated |

Total Measured and Indicated |

|

Property |

Tonnes |

Grade |

Contained Gold (koz) |

Tonnes |

Grade |

Contained Gold (koz) |

Tonnes |

Grade |

Contained Gold (koz) |

|

(kt) |

(g/t) |

(kt) |

(g/t) |

(kt) |

(g/t) |

|

Mount Milligan (4) |

118,289 |

0.25 |

966 |

141,571 |

0.30 |

1,367 |

259,860 |

0.27 |

2,333 |

|

Öksüt |

907 |

0.45 |

13 |

5,844 |

0.56 |

106 |

6,752 |

0.55 |

119 |

|

Kemess Open Pit |

|

|

|

111,682 |

0.27 |

980 |

111,682 |

0.27 |

980 |

|

Kemess Underground |

- |

- |

- |

139,920 |

0.50 |

2,265 |

139,920 |

0.50 |

2,265 |

|

Kemess East |

- |

- |

- |

93,454 |

0.39 |

1,182 |

93,454 |

0.39 |

1,182 |

|

Total |

119,197 |

0.26 |

979 |

492,471 |

0.37 |

5,901 |

611,668 |

0.35 |

6,880 |

|

|

|

Inferred Gold Mineral Resources

(3) |

|

|

Property |

Tonnes |

Grade |

Contained Gold (koz) |

|

(kt) |

(g/t) |

|

Mount Milligan (4) |

7,795 |

0.34 |

84 |

|

Öksüt |

348 |

0.78 |

9 |

|

Kemess Open Pit |

13,691 |

0.26 |

116 |

|

Kemess Underground |

- |

- |

- |

|

Kemess East |

- |

- |

- |

|

Total |

21,833 |

0.30 |

209 |

1) Centerra’s equity interests as of this news release are as

follows: Mount Milligan 100%, Öksüt 100%, Kemess Open Pit, Kemess

Underground and Kemess East 100%. Mineral reserves and resources

for these properties are presented on a 100% basis. Numbers may not

add up due to rounding.2) Mineral resources are in addition to

mineral reserves. Mineral resources do not have demonstrated

economic viability. 3) Inferred mineral resources have a great

amount of uncertainty as to their existence and as to whether they

can be mined economically. It cannot be assumed that all or part of

the inferred mineral resources will ever be upgraded to a higher

category. 4) Production at Mount Milligan is subject to a streaming

agreement with RGLD Gold AG and Royal Gold, Inc. (collectively,

“Royal Gold”) which entitles Royal Gold to 35% of gold sales from

the Mount Milligan Mine. Under the stream arrangement, Royal Gold

will pay a reduced price per ounce of gold delivered. Mineral

reserves and resources for the Mount Milligan property are

presented on a 100% basis.

Centerra Gold Inc. 2023 Year-End Mineral

Reserve and Resources Summary - Other Metals

(1) as of December 31, 2023 (see

additional footnotes below)

|

|

Tonnes(kt) |

CopperGrade(%) |

ContainedCopper(Mlbs) |

MolybdenumGrade(%) |

ContainedMolybdenum(Mlbs) |

SilverGrade(g/t) |

ContainedSilver(koz) |

|

|

|

Proven Mineral Reserves |

|

Mount Milligan (4) |

215,640 |

0.17 |

828 |

- |

- |

- |

- |

|

Probable Mineral Reserves |

|

Mount Milligan (4) |

34,386 |

0.18 |

134 |

- |

- |

- |

- |

|

Total Proven and Probable Mineral Reserves |

|

Mount Milligan (4) |

250,025 |

0.17 |

961 |

- |

- |

- |

- |

|

Total Copper |

250,025 |

0.17 |

961 |

- |

- |

- |

- |

|

|

|

|

|

|

|

|

|

|

Measured Mineral Resources

(2) |

|

Mount Milligan (4) |

118,289 |

0.17 |

433 |

- |

- |

- |

- |

|

Kemess Open Pit |

- |

- |

- |

- |

- |

- |

- |

|

Kemess Underground |

- |

- |

- |

- |

- |

- |

- |

|

Kemess East |

- |

- |

- |

- |

- |

- |

- |

|

Thompson Creek |

57,645 |

- |

- |

0.07 |

92 |

- |

- |

|

Endako |

47,100 |

- |

- |

0.05 |

48 |

- |

- |

|

|

|

Indicated Mineral Resources

(2) |

|

Mount Milligan (4) |

141,571 |

0.13 |

418 |

- |

- |

- |

- |

|

Kemess Open Pit |

111,682 |

0.14 |

337 |

- |

- |

1.19 |

4,262 |

|

Kemess Underground |

139,920 |

0.25 |

779 |

- |

- |

1.90 |

8,544 |

|

Kemess East |

93,454 |

0.30 |

628 |

- |

- |

1.66 |

5,000 |

|

Thompson Creek |

59,498 |

- |

- |

0.07 |

85 |

- |

- |

|

Endako |

122,175 |

- |

- |

0.04 |

118 |

- |

- |

|

|

|

Total Measured and Indicated Mineral Resources

(2) |

|

Mount Milligan (4) |

259,860 |

0.15 |

851 |

- |

- |

- |

- |

|

Kemess Open Pit |

111,682 |

0.14 |

337 |

- |

- |

1.19 |

4,262 |

|

Kemess Underground |

139,920 |

0.25 |

779 |

- |

- |

1.90 |

8,544 |

|

Kemess East |

93,454 |

0.30 |

628 |

- |

- |

1.66 |

5,000 |

|

Total Copper and Silver |

604,916 |

0.19 |

2,595 |

- |

- |

1.61 |

17,806 |

|

Thompson Creek |

117,143 |

- |

- |

0.07 |

177 |

- |

- |

|

Endako |

169,275 |

- |

- |

0.04 |

166 |

- |

- |

|

Total Molybdenum |

286,418 |

- |

- |

0.05 |

343 |

- |

- |

|

|

|

Inferred Mineral Resources

(3) |

|

Mount Milligan (4) |

7,795 |

0.14 |

24 |

- |

- |

- |

- |

|

Kemess Open Pit |

13,691 |

0.16 |

48 |

- |

- |

1.40 |

615 |

|

Kemess Underground |

- |

- |

- |

- |

- |

- |

- |

|

Kemess East |

- |

- |

- |

- |

- |

- |

- |

|

Total Copper and Silver |

21,486 |

0.15 |

72 |

0 |

- |

- |

- |

|

Thompson Creek |

806 |

- |

- |

0.04 |

1 |

- |

- |

|

Endako |

47,325 |

- |

- |

0.04 |

44 |

- |

- |

|

Total Molybdenum |

48,131 |

- |

- |

0.04 |

45 |

- |

- |

1) Centerra’s equity interests as of this news release are as

follows: Mount Milligan 100%, Kemess Open Pit, Kemess Underground,

and Kemess East 100%, Thompson Creek 100%, and Endako 75%. Mineral

reserves and resources for these properties are presented on a 100%

basis. Numbers may not add up due to

rounding. 2)

Mineral resources are in addition to mineral reserves. Mineral

resources do not have demonstrated economic

viability. 3) Inferred

mineral resources have a great amount of uncertainty as to their

existence and as to whether they can be mined economically. It

cannot be assumed that all or part of the inferred mineral

resources will ever be upgraded to a higher

category. 4) Production

at Mount Milligan is subject to a streaming agreement which

entitles Royal Gold to 18.75% of copper sales from the Mount

Milligan Mine. Under the stream arrangement, Royal Gold will pay a

reduced percentage of the spot price per metric tonne of copper

delivered. Mineral reserves and resources for the Mount Milligan

property are presented on a 100%

basis.

Additional Footnotes

General

- A conversion factor of 31.1035

grams per troy ounce of gold is used in the mineral reserve and

mineral resource estimates.

Mount Milligan Mine

- The mineral reserves have been

estimated based on a gold price of $1,500 per ounce, copper price

of $3.50 per pound and an exchange rate of 1USD:1.30CAD.

- The open pit mineral reserves are

estimated based on a Net Smelter Return (“NSR”) cut-off of $8.65

per tonne (C$11.25 per tonne) that takes into consideration

metallurgical recoveries, concentrate grades, transportation costs,

and smelter treatment charges to determine economic viability.

- The mineral resources have been

estimated based on a gold price of $1,800 per ounce, copper price

of $3.75 per pound, and an exchange rate of 1USD:1.30CAD.

- The open pit mineral resources are

constrained by a pit shell and are reported based on a NSR cut-off

of $8.46 per tonne (C$11.00 per tonne) that takes into

consideration metallurgical recoveries, concentrate grades,

transportation costs, and smelter treatment charges to determine

economic viability.

- Further information concerning the

Mount Milligan deposit, operation, as well as environmental and

other risks is described in Centerra’s most recently filed Annual

Information Form and in the Mount Milligan Mine Technical Report

(“TR”), each of which has been filed on SEDAR+ at www.sedarplus.ca

and EDGAR at www.sec.gov/edgar. Sample preparation, analytical

techniques, laboratories used, and quality assurance-quality

control protocols used during the exploration drilling programs are

consistent with industry standards and were carried out by

independent, certified assay labs.

- The resource tables above do not

include the 2023 exploration drill results.

Öksüt Mine

- The mineral reserves have been

estimated based on a gold price of $1,425 per ounce and an exchange

rate of 1USD:18.5TL.

- The open pit mineral reserves are

estimated based on 0.16 grams of gold per tonne cut-off grade.

- Open pit optimization used a

tonne-weighted LOM metallurgical recovery of 77% (Keltepe Pit 76%,

Güneytepe Pit 86%).

- The mineral resources have been

estimated based on a gold price of $1,800 per ounce.

- Open pit mineral resources are

constrained by a pit shell and are estimated based on 0.16 grams of

gold per tonne cut-off grade.

- Further information concerning the

Öksüt deposit, operation, as well as environmental and other risks

is described in Centerra’s most recently filed Annual Information

Form which is available on SEDAR+ at www.sedarplus.ca and

EDGAR at www.sec.gov/edgar and the Technical Report on

the Öksüt Project, dated September 3, 2015, which is available on

SEDAR+ at www.sedarplus.ca. Sample preparation, analytical

techniques, laboratories used, and quality assurance-quality

control protocols used during the exploration drilling programs are

consistent with industry standards and were carried out by

independent, certified assay labs.

Kemess Main

- The mineral resources have been

estimated based on a gold price of $1,800 per ounce, copper price

of $3.75 per pound and an exchange rate of 1USD:1.30CAD.

- The mineral resources are estimated

based on a NSR cut-off of C$12.92 open pit and a NSR shut-off value

of C$22.92 per tonne for underground block cave mining option that

takes into consideration metallurgical recoveries, concentrate

grades, transportation costs, and smelter treatment charges.

- Further information concerning the

Kemess Underground and Open Pit deposits are described in the

technical report dated July 14, 2017, and filed on SEDAR+ at

www.sedarplus.ca by AuRico Metals Inc. The technical report

describes the exploration history, geology, and style of gold

mineralization at the Kemess Main deposit. Sample preparation,

analytical techniques, laboratories used, and quality

assurance-quality control protocols used during the exploration

drilling programs are consistent with industry standards and were

carried out by independent, certified assay labs.

Kemess East

- The mineral resources have been

estimated based on a gold price of $1,800 per ounce, copper price

of $3.75 per pound, and an exchange rate of 1USD:1.30CAD.

- The mineral resources are estimated

based on a NSR shut-off of C$22.92 per tonne for underground block

cave mining option that takes into consideration metallurgical

recoveries, concentrate grades, transportation costs, and smelter

treatment charges.

- Further information concerning the

Kemess East project is described in the technical report dated July

14, 2017, and filed on SEDAR+ at www.sedarplus.ca by AuRico Metals

Inc. The technical report describes the exploration history,

geology, and style of gold mineralization at the Kemess East

project. Sample preparation, analytical techniques, laboratories

used, and quality assurance-quality control protocols used during

the exploration drilling programs are consistent with industry

standards and were carried out by independent, certified assay

labs.

Thompson Creek Mine

- The mineral resources have been

estimated based on a molybdenum price of $14.00 per pound.

- The open pit mineral resources are

constrained by a pit shell and are estimated based on a 0.030%

molybdenum cut-off grade.

- Further information concerning the

Thompson Creek deposit is described in the technical report dated

February 2011 and filed on SEDAR+ at www.sedarplus.ca by

Thompson Creek Metals Company Inc. The technical report describes

the exploration history, geology, and style of molybdenum

mineralization at the Thompson Creek deposit. Sample preparation,

analytical techniques, laboratories used, and quality

assurance-quality control protocols used during the exploration

drilling programs are consistent with industry standards and were

carried out by independent, certified assay labs.

Endako Mine

- The mineral resources have been

estimated based on a molybdenum price of CAD14.00 per pound and an

exchange rate of 1USD:1.25CAD.

- The open pit mineral resources are

constrained by a pit shell and are estimated based on a 0.025%

molybdenum cut-off grade.

- Further information concerning the

Endako deposit is described in the technical report dated September

12, 2011, and filed on SEDAR+ at www.sedarplus.ca by Thompson

Creek Metals Company Inc. The technical report describes the

exploration history, geology, and style of molybdenum

mineralization at the Endako deposit. Sample preparation,

analytical techniques, laboratories used, and quality

assurance-quality control protocols used during the exploration

drilling programs are consistent with industry standards and were

carried out by independent, certified assay labs.

Qualified Person – Mineral Reserves and

Resources

Jean-Francois St-Onge, Professional Engineer,

member of the Professional Engineers of Ontario (PEO) and

Centerra’s Senior Director, Technical Services, has reviewed and

approved the scientific and technical information related to

mineral reserves at Mount Milligan and mineral resources at Kemess

Open Pit, Kemess Underground and Kemess East contained in this news

release. Mr. St-Onge is a Qualified Person within the meaning of

Canadian Securities Administrator’s NI 43-101 Standards of

Disclosure for Mineral Projects.

Andrey Shabunin, Professional Engineer, member

of Professional Engineers of Ontario (PEO) and General Manager of

Öksüt Mine, has reviewed and approved the scientific and technical

information related to mineral reserves at Öksüt contained in this

news release. Mr. Shabunin is a Qualified Person within the meaning

of Canadian Securities Administrator’s NI 43-101 Standards of

Disclosure for Mineral Projects.

AC (Chris) Hunter, Professional Geoscientist,

member of the Engineers and Geoscientists of British Columbia

(EGBC) and Centerra’s Senior Geologist, has reviewed and approved

the scientific and technical information related to mineral

resources estimates at Mount Milligan contained in this news

release. Mr. Hunter is a Qualified Person within the meaning of

Canadian Securities Administrator’s NI 43-101 Standards of

Disclosure for Mineral Projects.

Lars Weiershäuser, PhD, P.Geo., and Centerra’s

Director, Geology, has reviewed and approved the scientific and

technical information related to mineral resources estimates

contained related to Öksüt in this news release. Dr. Weiershäuser

is a Qualified Person within the meaning of Canadian Securities

Administrator’s NI 43-101 Standards of Disclosure for Mineral

Projects.

All other scientific and technical information

presented in this document were prepared in accordance with the

standards of the Canadian Institute of Mining, Metallurgy and

Petroleum and NI 43-101 and were reviewed, verified, and compiled

by Centerra’s geological and mining staff under the supervision of

W. Paul Chawrun, Professional Engineer, member of the Professional

Engineers of Ontario (PEO) and Centerra’s Executive Vice President

and Chief Operating Officer and Anna Malevich, Professional

Engineer, member of the Professional Engineers of Ontario (PEO) and

Centerra’s Senior Director, Projects each of whom is a qualified

person for the purpose of NI 43-101.

All mineral reserve and resources have been

estimated in accordance with the standards of the Canadian

Institute of Mining, Metallurgy and Petroleum and NI 43-101.

Mineral reserve and mineral resource estimates

are forward-looking information and are based on key assumptions

and are subject to material risk factors. If any event arising from

these risks occurs, the Company’s business, prospects, financial

condition, results of operations or cash flows, and the market

price of Centerra’s shares could be adversely affected. Additional

risks and uncertainties not currently known to the Company, or that

are currently deemed immaterial, may also materially and adversely

affect the Company’s business operations, prospects, financial

condition, results of operations or cash flows, and the market

price of Centerra’s shares. See the section entitled “Risk That Can

Affect Centerra’s Business” in the Company’s annual Management’s

Discussion and Analysis (MD&A) for the year-ended December 31,

2022, available on SEDAR+ at www.sedarplus.ca and EDGAR at

www.sec.gov/edgar and see also the discussion below under the

heading “Caution Regarding Forward-looking Information”.

Qualified Person & QA/QC –

Exploration

Exploration information and related scientific

and technical information in this document regarding the Mount

Milligan Mine were prepared, reviewed, verified, and compiled in

accordance with the standards of NI 43-101 by Cheyenne Sica, Member

of the Association of Professional Geoscientists Ontario and Member

of Engineers and Geoscientists British Columbia, and Exploration

Manager at Centerra’s Mount Milligan Mine, who is the qualified

person for the purpose of NI 43-101. Sample preparation, analytical

techniques, laboratories used, and quality assurance and quality

control protocols used during the exploration drilling programs are

done consistent with industry standards while independent certified

assay labs are used. The Mount Milligan Mine’s deposit is described

in the Company’s most recently filed annual information form and a

technical report dated November 7, 2022 (with an effective date of

December 31, 2021) prepared in accordance with NI 43-101, both of

which are available on SEDAR+ at www.sedarplus.ca and EDGAR at

www.sec.gov/edgar.

Exploration information and related scientific

and technical information in this document regarding the Öksüt

Mine, the Goldfield District Project, Oakley Project, and all other

exploration projects were prepared, reviewed, verified, and

compiled in accordance with the standards of NI 43-101 by Richard

Adofo, Member of the Professional Association of Geoscientists

Ontario and Vice President, Exploration & Resource at Centerra,

who is the qualified person for the purpose of NI 43-101. Sample

preparation, analytical techniques, laboratories used, and quality

assurance and quality control protocols used during the exploration

drilling programs are done consistent with industry standards while

independent certified assay labs are used. The Öksüt deposit is

described in the Company’s most recently filed annual information

form, which is available on SEDAR+ at www.sedarplus.ca and EDGAR at

www.sec.gov/edgar, and in a technical report dated September 3,

2015 (with an effective date of June 30, 2015) prepared in

accordance with NI 43-101, which is available on SEDAR+ at

www.sedarplus.ca. The Goldfield District Project is described in in

the Company’s most recently filed annual information form, which is

available on SEDAR+ at www.sedarplus.ca and EDGAR at

www.sec.gov/edgar.

All other scientific and technical information

presented in this document were prepared in accordance with the

standards of the Canadian Institute of Mining, Metallurgy and

Petroleum and NI 43-101 and were reviewed, verified, and compiled

by Centerra’s geological and mining staff under the supervision of

W. Paul Chawrun, Professional Engineer, member of the Professional

Engineers of Ontario (PEO), who is a qualified person for the

purpose of NI 43-101.

About Centerra Gold

Centerra Gold Inc. is a Canadian-based gold

mining company focused on operating, developing, exploring and

acquiring gold and copper properties in North America, Türkiye, and

other markets worldwide. Centerra operates two mines: the Mount

Milligan Mine in British Columbia, Canada, and the Öksüt Mine in

Türkiye. The Company also owns the Goldfield District Project in

Nevada, United States, the Kemess Project in British Columbia,

Canada, and owns and operates the Molybdenum Business Unit in the

United States and Canada. Centerra’s shares trade on the Toronto

Stock Exchange (“TSX”) under the symbol CG and on the New York

Stock Exchange (“NYSE”) under the symbol CGAU. The Company is based

in Toronto, Ontario, Canada.

For more

information:

Lisa Wilkinson Vice President, Investor Relations &

Corporate Communications (416)

204-3780 lisa.wilkinson@centerragold.com

Lana Pisarenko Senior Manager, Investor

Relations lana.pisarenko@centerragold.com

Additional information on Centerra is available on the

Company’s website at www.centerragold.com, on SEDAR+ at

www.sedarplus.ca and EDGAR at www.sec.gov/edgar.

Caution Regarding Forward-Looking

Information

This news release contains or incorporates by

reference “forward-looking statements” and “forward-looking

information” as defined under applicable Canadian and U.S.

securities legislation. All statements, other than statements of

historical fact, which address events, results, outcomes or

developments that the Company expects to occur are, or may be

deemed to be, forward-looking statements. Such forward-looking

information involves risks, uncertainties and other factors that

could cause actual results, performance, prospects and

opportunities to differ materially from those expressed or implied

by such forward-looking information. Forward-looking statements are

generally, but not always, identified by the use of forward-looking

terminology such as “assume”, “continue”, “estimate”, “expect”,

“ongoing”, “plan”, “potential”, “target” or “update”, or variations

of such words and phrases and similar expressions or statements

that certain actions, events or results “may”, “could”, “would” or

“will” be taken, occur or be achieved or the negative connotation

of such terms. Such statements include but may not be limited to:

mineral reserve and mineral resource estimates; life of mine

estimates and operating and capital costs; future exploration

potential; timing and scope of future exploration (brownfields or

greenfields); and other statements that express management’s

expectations or estimates of future plans and performance,

operational, geological or financial results, estimates or amounts

not yet determinable and assumptions of management.

The Company cautions that forward-looking

statements are necessarily based upon a number of factors and

assumptions that, while considered reasonable by the Company at the

time of making such statements, are inherently subject to

significant business, economic, technical, legal, political and

competitive uncertainties and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements and undue reliance

should not be placed on such statements and information.

Market price fluctuations in gold, copper, and

other metals, as well as increased capital or production costs or

reduced recovery rates may render ore reserves containing lower

grades of mineralization uneconomic and may ultimately result in a

restatement of mineral reserves. The extent to which mineral

resources may ultimately be reclassified as proven or probable

mineral reserves is dependent upon the demonstration of their

profitable recovery. Economic and technological factors, which may

change over time, always influence the evaluation of mineral

reserves or mineral resources. Centerra has not adjusted mineral

resource figures in consideration of these risks and, therefore,

Centerra can give no assurances that any mineral resource estimate

will ultimately be reclassified as proven and probable mineral

reserves.

Mineral resources are not mineral reserves, and

do not have demonstrated economic viability, but do have reasonable

prospects for economic extraction. Measured and indicated mineral

resources are sufficiently well defined to allow geological and

grade continuity to be reasonably assumed and permit the

application of technical and economic parameters in assessing the

economic viability of the resource. Inferred mineral resources are

estimated on limited information not sufficient to verify

geological and grade continuity or to allow technical and economic

parameters to be applied. Inferred mineral resources are too

speculative geologically to have economic considerations applied to

them to enable them to be categorized as mineral reserves. There is

no certainty that mineral resources of any category can be upgraded

to mineral reserves through continued exploration.

Centerra’s mineral reserve and mineral resource

figures are estimates, and Centerra can provide no assurances that

the indicated levels of gold or copper will be produced, or that

Centerra will receive the metal prices assumed in determining its

mineral reserves. Such estimates are expressions of judgment based

on knowledge, mining experience, analysis of drilling results, and

industry practices. Valid estimates made at a given time may

significantly change when new information becomes available. While

Centerra believes that these mineral reserve and mineral resource

estimates are well established, and the best estimates of

Centerra’s management, by their nature mineral reserve and mineral

resource estimates are imprecise and depend, to a certain extent,

upon analysis of drilling results and statistical inferences, which

may ultimately prove unreliable. If Centerra’s mineral reserve or

mineral reserve estimates for its properties are inaccurate or are

reduced in the future, this could have an adverse impact on

Centerra’s future cash flows, earnings, results, or operations and

financial condition.

Centerra estimates the future mine life of its

operations. Centerra can give no assurance that mine life estimates

will be achieved. Failure to achieve these estimates could have an

adverse impact on Centerra’s future cash flows, earnings, results

of operations, and financial condition.

Additional risk factors and details with respect

to risk factors that may affect the Company’s ability to achieve

the expectations set forth in the forward-looking statements

contained in this news release are set out in the Company’s latest

40-F/Annual Information Form and Management’s Discussion and

Analysis, each under the heading “Risk Factors”, which are

available on SEDAR+ (www.sedarplus.ca) or on EDGAR

(www.sec.gov/edgar). The foregoing should be reviewed in

conjunction with the information, risk factors and assumptions

found in this news release.

The Company disclaims any intention or

obligation to update or revise any forward-looking statements,

whether written or oral, or whether as a result of new information,

future events or otherwise, except as required by applicable

law.

Photos accompanying this announcement are

available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/8b93d132-3314-484f-a1c9-524607d8fd46

https://www.globenewswire.com/NewsRoom/AttachmentNg/d4c5b748-fb3b-470e-b4d8-5cb8e8321492

https://www.globenewswire.com/NewsRoom/AttachmentNg/a7a5d594-9768-497a-9494-84ba337ace91

A PDF accompanying this announcement is available at

http://ml.globenewswire.com/Resource/Download/a73c967f-de0b-4b8c-84d1-37aca33bc48d

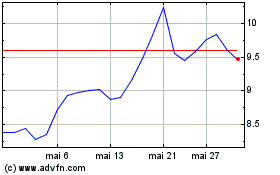

Centerra Gold (TSX:CG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Centerra Gold (TSX:CG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024