Fredonia Mining Inc. (TSXV: FRED) (the “

Company”

or “

Fredonia”) is pleased to announce the closing

of its previously announced non-brokered private placement,

consisting of a total of 17,554,480 units of the Company (each, a

“

Unit”, and collectively the

“

Units”), at a price of $0.05 per Unit for

aggregate gross proceeds to the Company of $877,724 (the

“

Offering”). The Company did not pay any bonus,

finder’s fee, commission, or agency fee in connection with the

Offering.

Each Unit consisted of one common share of the

Company (each, a “Common Share”, and collectively

the “Common Shares”) and one-half of one Common

Share purchase warrant (each whole warrant, a

“Warrant” and collectively the

“Warrants”). Each Warrant entitles the holder

thereof to acquire one Common Share at a price of $0.10 per Common

Share for a period of two years from the closing date of the

Offering.

The Company intends to use the net proceeds of

the Offering for working capital and for general corporate

purposes.

The Units were offered and sold by private

placement in Canada to “accredited investors” within the meaning of

National Instrument 45-106 – Prospectus Exemptions and to other

exempt purchasers in jurisdictions outside Canada. The securities

issued in the Offering will be subject to applicable hold periods

in Canada imposed under applicable securities legislation,

including a hold period of 4 months and one day from the date of

issuance, expiring on June 16, 2024.

The Offering constituted a “related party

transaction” with respect to the Company within the meaning of that

term pursuant to Multilateral Instrument 61-101 of the Canadian

Securities Administrators – Protection of Minority Security Holders

in Special Transactions (“MI 61-101”), as Mr.

Estanislao Auriemma, the Chief Executive Officer and a director of

the Company, purchased 1,881,040 Units in the Offering and Mr.

Ricardo Auriemma, a director of the Company, purchased 2,687,200

Units in the Offering. All insiders participated in the Offering on

the same commercial terms as arm’s length investors.

MI 61-101 provides that related party

transactions are, in the absence of an exemption therefrom, subject

to the requirement to obtain a formal valuation for the subject

matter of the related party transaction and minority shareholder

approval of the related party transaction (which approval must

exclude any votes attached to Common Shares held by the

participating related party). The Company relied on the exemptions

from the formal valuation and minority approval requirements of MI

61-101 provided for in subsections 5.5(b) (Issuer Not Listed on

Specified Markets) and 5.7(1)(b) (Fair Market Value Not More Than

$2,500,000) of MI 61-101, respectively.

A material change report with respect to the

Offering was filed less than 21 days before the closing date, which

was reasonable and necessary in the circumstances for the Company

to take advantage of available financing opportunities. Additional

information with respect to the Offering and the insider

participation therein is available in the material change report

filed on SEDAR+ at www.sedarplus.ca.

No securities offered in the Offering have been,

nor they will be, registered under the United States Securities Act

of 1933, as amended (the “U.S. Securities Act”),

or any U.S. state securities laws, and may not be offered or sold

in the United States without registration under the U.S. Securities

Act and all applicable state securities laws or compliance with the

requirements of an applicable exemption therefrom. This news

release does not constitute an offer to sell or the solicitation of

an offer to buy securities in the United States, nor may there be

any sale of these securities in any jurisdiction in which such

offer, solicitation or sale would be unlawful.

About Fredonia

Fredonia indirectly owns a 100% interest in

certain license areas (totaling approximately 18,300 ha.)

(collectively, the “Project”), all within the

Deseado Massif geological region in the Province of Santa Cruz,

Argentina, including the following principal areas: El Aguila

(approximately 9,100 ha.), Petrificados (approximately 3,000 ha.),

and the flagship, advanced El Dorado-Monserrat property

(approximately 6,200 ha.) located close to AngloGold Ashanti’s

Cerro Vanguardia mine, subject to a 1.5% net smelter return royalty

on the EDM project, and a 0.5% net profits interest on Winki II, El

Aguila I, El Aguila II and Hornia (ex Petrificados).

For further information, please visit the

Company’s website at www.fredoniamanagement.com or

contact: Omar Salas, Chief Financial Officer, Direct:

+1-416-846-7807, Email: omar.salas@icloud.com.

Forward-looking Information Cautionary

Statement

This news release contains “forward‐looking

information” within the meaning of the applicable Canadian

securities legislation that is based on expectations, estimates,

projections and interpretations as at the date of this news

release. The information in this news release about the use of the

proceeds from the Offering and the prospects of the Project, and

any other information herein that is not a historical fact may be

“forward-looking information”. Any statement that involves

discussions with respect to predictions, expectations,

interpretations, beliefs, plans, projections, objectives,

assumptions, future events or performance (often but not always

using phrases such as “expects”, or “does not expect”, “is

expected”, “interpreted”, “management’s view”, “anticipates” or

“does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”,

“estimates”, “believes” or “intends” or variations of such words

and phrases or stating that certain actions, events or results

“may” or “could”, “would”, “might” or “will” be taken to occur or

be achieved) are not statements of historical fact and may be

forward-looking information and are intended to identify

forward-looking information. This forward-looking information is

based on reasonable assumptions and estimates of management of the

Company, at the time such assumptions and estimates were made, and

involves known and unknown risks, uncertainties or other factors

which may cause the actual results, performance or achievements of

the Company to be materially different from any future results,

performance or achievements expressed or implied by such

forward-looking information. Such factors include, among others,

volatility in the trading price of the Common Shares, Fredonia’s

ability to complete further exploration activities, property

interests, the results of exploration activities, risks relating to

mining activities, the global economic climate, metal prices,

dilution, environmental risks, changes in the tax and regulatory

regime, and community and non-governmental actions, and

management’s discretion with respect to use of proceeds. Although

the forward-looking information contained in this news release is

based upon what management believes, or believed at the time, to be

reasonable assumptions, the Company cannot guarantee that actual

results will be consistent with such forward-looking information,

as there may be other factors that cause results not to be as

anticipated, estimated or intended, and neither Company nor any

other person assumes responsibility for the accuracy and

completeness of any such forward looking information. The Company

does not undertake, and assumes no obligation, to update or revise

any such forward looking statements or forward-looking information

contained herein to reflect new events or circumstances, except as

may be required by law.

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

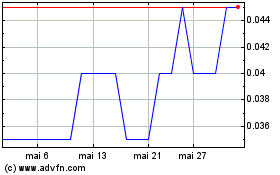

Fredonia Mining (TSXV:FRED)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Fredonia Mining (TSXV:FRED)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024