MiMedx Group, Inc. (Nasdaq: MDXG) (“MIMEDX” or the “Company”),

today announced operating and financial results for the fourth

quarter and full year 2023.

Recent Operating and Financial Highlights:

- Fourth quarter and full year 2023

net sales of $87 million and $321 million, reflecting 17%

and 20% year-over-year growth, respectively.

- GAAP Net Income for the fourth

quarter and full year 2023 of $53 million and

$58 million, respectively. GAAP Net income margin for the

fourth quarter and full year 2023 were also 62% and 18%,

respectively.

- Adjusted EBITDA1 and Adjusted EBITDA

Margin for the fourth quarter 2023 of $21 million and 24%,

respectively.

- Launched EPIEFFECT®, the latest

addition to the Company’s broad portfolio of Advanced Wound Care

products.

- Announced conversion of outstanding

Series B convertible preferred stock to common stock.

- Announced new senior secured credit

facilities and debt refinancing in January 2024 and repaid $30

million revolving credit facility portion with cash on hand earlier

this week.

Joseph H. Capper, MIMEDX Chief Executive Officer, commented, "We

are once again pleased to report on another impressive quarter of

top-line growth, profitability and cash flow generation as we

closed out a transformative 2023, driven by the improved alignment

and focus of the Company. Moreover, the 20% top-line growth we

achieved for the full-year 2023 exceeded expectations and provides

solid momentum going forward. Additionally, in a very short period

of time, the team has successfully unlocked robust cash flow

generation that should continue to improve with scale over

time."

Mr. Capper continued, "Given the commercial strength of the

organization, we expect 2024 to be another noteworthy year with low

double-digit net sales percentage growth and Adjusted EBITDA margin

above 20%. Our improved cash flow generation and balance sheet

enhancements also provide the necessary support to accelerate our

growth plan as we capitalize on the opportunities before us."

_________________________

1 Adjusted EBITDA and related margins, Adjusted Net Income and

Adjusted EPS are non-GAAP financial measures. See “Reconciliation

of Non-GAAP Measures” for a reconciliation of Adjusted EBITDA and

Adjusted Net Income to Net income (loss) and Adjusted EPS to

Diluted earnings per share, located in “Selected Unaudited

Financial Information” of this release.

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net Income (loss) |

$ |

53,476 |

|

|

$ |

(415 |

) |

|

$ |

58,228 |

|

|

$ |

(30,197 |

) |

| Non-GAAP Adjustments: |

|

|

|

|

|

|

|

|

Depreciation expense |

|

611 |

|

|

|

796 |

|

|

|

2,665 |

|

|

|

3,345 |

|

|

Amortization of intangible assets |

|

192 |

|

|

|

182 |

|

|

|

762 |

|

|

|

701 |

|

|

Interest expense, net |

|

1,593 |

|

|

|

1,450 |

|

|

|

6,457 |

|

|

|

5,016 |

|

|

Income tax provision (benefit) expense |

|

(40,349 |

) |

|

|

28 |

|

|

|

(39,780 |

) |

|

|

206 |

|

|

Investigation, restatement and related expenses |

|

524 |

|

|

|

3,406 |

|

|

|

5,176 |

|

|

|

12,177 |

|

|

Share-based compensation |

|

4,385 |

|

|

|

1,868 |

|

|

|

17,178 |

|

|

|

12,666 |

|

|

Expenses related to disbanding of Regenerative Medicine business

unit |

|

785 |

|

|

|

— |

|

|

|

6,384 |

|

|

|

— |

|

|

Reorganization expenses |

|

— |

|

|

|

— |

|

|

|

1,412 |

|

|

|

3,105 |

|

| Adjusted EBITDA |

$ |

21,217 |

|

|

$ |

7,315 |

|

|

$ |

58,482 |

|

|

$ |

7,019 |

|

| Adjusted EBITDA margin |

|

24.4 |

% |

|

|

9.8 |

% |

|

|

18.2 |

% |

|

|

2.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter and Full Year 2023 Results

Discussion2

Net Sales

MIMEDX reported net sales for the three months ended December

31, 2023, of $87 million, compared to $74 million for the

three months ended December 31, 2022, an increase of 17%. Net sales

growth came from solid contributions in both the Wound &

Surgical end markets and across each of our main sites of

service.

For the full year 2023, MIMEDX reported net sales of

$321 million, compared to $268 million in the prior year

period, reflecting growth of 20%, which was also driven by a

combination of contributions in Wound & Surgical and across our

sites of service.

_________________________2 The following discussion of the

Company's fourth quarter and full year 2023 results are made on a

"continuing operations basis" and exclude the historical costs of

the Regenerative Medicine business unit, which was disbanded

beginning in June 2023. For a full discussion of the impact of

these discontinued operations, please refer to our Annual Report on

Form 10-K filed with the Securities and Exchange Commission for the

year ended December 31, 2023.

Gross Profit and Margin

Gross profit for the three months ended December 31, 2023, was

$73 million, an increase of $13 million as compared to

the prior year period. Gross margin for the three months ended

December 31, 2023 was 84.1%, compared to 80.7% in the prior year

period. The year-over-year improvement in gross margin was driven

by favorable product mix and our continued execution on yield

improvement projects.

For the full year 2023, gross profit was $267 million,

reflecting an increase of $47 million compared to the prior

year period. Additionally, gross margin for the full year 2023 was

83.0%, compared to 82.0% for the full year 2022 and the improvement

was also driven by improved yields and a favorable product mix.

Operating Expenses

Selling, general and administrative ("SG&A") expenses for

the three months ended December 31, 2023, were $54 million

compared to $50 million for the three months ended December

31, 2022. SG&A expense during the fourth quarter 2023 included

increased sales commissions due to higher sales volumes.

For the full year 2023, SG&A expenses totaled

$211 million, compared to $209 million for the prior year

period, reflecting year over year growth of 1.1%. The increase was

driven by higher levels of sales commissions due to higher sales

volumes, as well as increases in stock-based compensation in 2023.

These increases were partially offset by a decrease in professional

services related to certain administrative expenses, including

severance expenses associated with the departure of our former CEO

in 2022.

Research and development expenses were $2 million for the

three months ended December 31, 2023, compared to $3 million

for the three months ended December 31, 2022. For the full year

2023, research and development expenses remained essentially flat

at $13 million compared to 2022. Our R&D expenses in 2022

and 2023 were primarily driven by the development and launches of

our newest products in the portfolio - AMNIOEFFECT, AXIOFILL and

EPIEFFECT - along with additional early-stage Wound & Surgical

products in development.

Investigation, restatement and related expense for the three

months ended December 31, 2023 was $1 million, compared to

$3 million for the three months ended December 31, 2022. For

the full year 2023, investigation, restatement and related expenses

totaled $5 million compared to $12 million in 2022. The

decrease was related to negotiated reductions in legal fees

previously incurred. In addition, following the end of a legal

proceeding, expenses under our last material proceeding involving

indemnification of former officers and directors substantially

ceased in 2023.

Net income from continuing operations for the three months and

full year ended December 31, 2023, were $51 million and

$67 million, respectively, compared to a net income from

continuing operations of $2 million for the three months ended

December 31, 2022 and a net loss from continuing operations of

$20 million for the year ended December 31, 2022. Net income

from continuing operations for the three months and full year ended

December 31, 2023 were positively impacted by a $37 million

income tax provision benefit, reflecting a non-cash reversal of a

valuation allowance that was previously recorded against the

deferred tax asset balance. The reversal was a result of an

analysis following the Company's conclusion that the Company's

disbanded Regenerative Medicine segment qualified as a discontinued

operation, in concert with the Company’s operating results.

Cash and Cash Equivalents

As of December 31, 2023, the Company had $82 million of

cash and cash equivalents compared to $66 million as of

December 31, 2022 and $81 million as of September 30, 2023.

The increase during the year ended December 31, 2023 was primarily

a result of year-over-year increases in net sales, which drove

increases in collections from customers, as well as year-over-year

decreases in operating expenses, partially offset by the $9.5

million repurchase of a portion of the shares of Series B

Convertible Preferred Stock, held by certain funds managed by

Hayfin Capital Management, LLP in October 2023.

Financial Goals

The Company's goal is to deliver net sales percentage growth in

the low double-digits annually.

In 2024, the Company expects to see continued growth in both the

Wound and Surgical end markets, despite more difficult prior year

growth comparisons. In particular, the Company continues to

anticipate solid growth in the private office setting driven by the

recent launch of EPIEFFECT and ongoing changes in purchasing

behaviors related to Medicare reimbursement. Additionally, the

Company expects to continue to drive growth across a variety of

Surgical use cases as the body of evidence for utilization of its

Surgical products, such as AMNIOEFFECT, continues to grow.

For the full year 2024, the Company expects its Adjusted EBITDA

as a percent of net sales to be above 20%.

Conference Call and Webcast

MIMEDX will host a conference call and webcast to review its

fourth quarter and full year 2023 results on Wednesday, February

28, 2024, beginning at 4:30 p.m., Eastern Time. The call can be

accessed using the following information:

Webcast: Click here U.S. Investors:

877-407-6184International Investors: 201-389-0877Conference ID:

13743067

A replay of the webcast will be available for approximately 30

days on the Company’s website at www.mimedx.com following the

conclusion of the event.

Important Cautionary Statement

This press release includes forward-looking statements.

Statements regarding: (i) future sales or sales growth; (ii) our

2024 financial goals and expectations for future financial results,

including levels of net sales, Adjusted EBITDA, and Adjusted EBITDA

margin; (iii) our cash flows; (iv)our expectations regarding the

use of our products, including EPIEFFECT and AMNIOEFFECT; and (v)

continued growth in different care settings. Additional

forward-looking statements may be identified by words such as

"believe," "expect," "may," "plan," “goal,” “outlook,” "potential,"

"will," "preliminary," and similar expressions, and are based on

management's current beliefs and expectations.

Forward-looking statements are subject to risks and

uncertainties, and the Company cautions investors against placing

undue reliance on such statements. Actual results may differ

materially from those set forth in the forward-looking statements.

Factors that could cause actual results to differ from expectations

include: (i) future sales are uncertain and are affected by

competition, access to customers, patient access to healthcare

providers, the reimbursement environment and many other factors;

(ii) the Company may change its plans due to unforeseen

circumstances; (iii) the results of scientific research are

uncertain and may have little or no value; (iv) our ability to sell

our products in other countries depends on a number of factors

including adequate levels of reimbursement, market acceptance of

novel therapies, and our ability to build and manage a direct sales

force or third party distribution relationship; (v) the

effectiveness of amniotic tissue as a therapy for particular

indications or conditions is the subject of further scientific and

clinical studies; and (vi) we may alter the timing and amount of

planned expenditures for research and development based on

regulatory developments. The Company describes additional risks and

uncertainties in the Risk Factors section of its most recent annual

report and quarterly reports filed with the Securities and Exchange

Commission. Any forward-looking statements speak only as of the

date of this press release and the Company assumes no obligation to

update any forward-looking statement.

About MIMEDX

MIMEDX is a pioneer and leader focused on helping humans heal.

With more than a decade of helping clinicians manage chronic and

other hard-to-heal wounds, MIMEDX is dedicated to providing a

leading portfolio of products for applications in the wound care,

burn, and surgical sectors of healthcare. The Company’s vision is

to be the leading global provider of healing solutions through

relentless innovation to restore quality of life. For additional

information, please visit www.mimedx.com.

Contact:Matt NotarianniInvestor

Relations470.304.7291mnotarianni@mimedx.com

Selected Unaudited Financial Information

|

MiMedx Group, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(in thousands) Unaudited |

| |

December 31, 2023 |

|

December 31, 2022 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

82,000 |

|

$ |

65,950 |

|

|

Accounts receivable, net |

|

53,871 |

|

|

43,084 |

|

|

Inventory |

|

21,021 |

|

|

13,183 |

|

|

Prepaid expenses |

|

5,624 |

|

|

7,315 |

|

|

Current assets of discontinued operations |

|

— |

|

|

1,331 |

|

|

Other current assets |

|

1,745 |

|

|

3,335 |

|

|

Total current assets |

|

164,261 |

|

|

134,198 |

|

|

Property and equipment, net |

|

6,974 |

|

|

7,856 |

|

|

Right of use asset |

|

2,132 |

|

|

3,400 |

|

|

Goodwill |

|

19,441 |

|

|

19,441 |

|

|

Intangible assets, net |

|

5,257 |

|

|

5,852 |

|

|

Deferred tax asset |

|

40,777 |

|

|

— |

|

|

Other assets |

|

205 |

|

|

148 |

|

|

Noncurrent assets of discontinued operations |

|

— |

|

|

535 |

|

| Total assets |

$ |

239,047 |

|

$ |

171,430 |

|

| LIABILITIES, CONVERTIBLE

PREFERRED STOCK, AND STOCKHOLDERS’ EQUITY (DEFICIT) |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

9,048 |

|

$ |

8,454 |

|

|

Accrued compensation |

|

22,353 |

|

|

20,856 |

|

|

Accrued expenses |

|

9,361 |

|

|

10,934 |

|

|

Current liabilities of discontinued operations |

|

1,352 |

|

|

1,479 |

|

|

Other current liabilities |

|

3,894 |

|

|

1,834 |

|

|

Total current liabilities |

|

46,008 |

|

|

43,557 |

|

|

Long term debt, net |

|

48,099 |

|

|

48,594 |

|

|

Other liabilities |

|

2,223 |

|

|

4,773 |

|

| Total liabilities |

|

96,330 |

|

|

96,924 |

|

| Convertible preferred

stock |

|

— |

|

|

92,494 |

|

| Total stockholders' equity

(deficit) |

|

142,717 |

|

|

(17,988 |

) |

| Total liabilities, convertible

preferred stock, and stockholders’ equity (deficit) |

$ |

239,047 |

|

$ |

171,430 |

|

| |

|

|

|

|

MiMedx Group, Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(in thousands, except share and per share amounts) Unaudited |

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net sales |

$ |

86,832 |

|

|

$ |

74,375 |

|

|

$ |

321,477 |

|

|

$ |

267,841 |

|

| Cost of sales |

|

13,841 |

|

|

|

14,369 |

|

|

|

54,634 |

|

|

|

48,316 |

|

| Gross profit |

|

72,991 |

|

|

|

60,006 |

|

|

|

266,843 |

|

|

|

219,525 |

|

| |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

54,352 |

|

|

|

49,922 |

|

|

|

211,124 |

|

|

|

208,673 |

|

|

Research and development |

|

2,434 |

|

|

|

2,955 |

|

|

|

12,665 |

|

|

|

12,701 |

|

|

Investigation, restatement and related |

|

524 |

|

|

|

3,406 |

|

|

|

5,176 |

|

|

|

12,177 |

|

|

Amortization of intangible assets |

|

192 |

|

|

|

182 |

|

|

|

762 |

|

|

|

701 |

|

| Operating income (loss) |

|

15,489 |

|

|

|

3,541 |

|

|

|

37,116 |

|

|

|

(14,727 |

) |

| |

|

|

|

|

|

|

|

| Other expense, net |

|

|

|

|

|

|

|

|

Interest expense, net |

|

(1,593 |

) |

|

|

(1,450 |

) |

|

|

(6,457 |

) |

|

|

(5,016 |

) |

|

Other income (expense), net |

|

16 |

|

|

|

(3 |

) |

|

|

(26 |

) |

|

|

(4 |

) |

| Income (loss) from continuing

operations before income tax provision |

|

13,912 |

|

|

|

2,088 |

|

|

|

30,633 |

|

|

|

(19,747 |

) |

| Income tax provision benefit

(expense) |

|

37,375 |

|

|

|

(28 |

) |

|

|

36,806 |

|

|

|

(206 |

) |

| Net income (loss) from

continuing operations |

$ |

51,287 |

|

|

$ |

2,060 |

|

|

$ |

67,439 |

|

|

$ |

(19,953 |

) |

| Income (loss) from

discontinued operations, net of tax |

|

2,189 |

|

|

|

(2,475 |

) |

|

|

(9,211 |

) |

|

|

(10,244 |

) |

| Net income (loss) |

$ |

53,476 |

|

|

$ |

(415 |

) |

|

$ |

58,228 |

|

|

$ |

(30,197 |

) |

| |

|

|

|

|

|

|

|

| Net income (loss) from

continuing operations available to common shareholders |

$ |

44,829 |

|

|

$ |

390 |

|

|

$ |

55,796 |

|

|

$ |

(26,533 |

) |

| |

|

|

|

|

|

|

|

| Basic net income (loss) per

common share: |

|

|

|

|

|

|

|

| Continuing operations |

$ |

0.38 |

|

|

$ |

0.00 |

|

|

$ |

0.48 |

|

|

$ |

(0.24 |

) |

| Discontinued operations |

$ |

0.02 |

|

|

$ |

(0.02 |

) |

|

$ |

(0.08 |

) |

|

$ |

(0.09 |

) |

| Basic net income (loss) per

common share: |

$ |

0.40 |

|

|

$ |

(0.02 |

) |

|

$ |

0.40 |

|

|

$ |

(0.33 |

) |

| |

|

|

|

|

|

|

|

| Diluted net income (loss) per

common share: |

|

|

|

|

|

|

|

| Continuing operations |

$ |

0.31 |

|

|

$ |

0.00 |

|

|

$ |

0.43 |

|

|

$ |

(0.24 |

) |

| Discontinued operations |

$ |

0.01 |

|

|

$ |

(0.02 |

) |

|

$ |

(0.06 |

) |

|

$ |

(0.09 |

) |

| Diluted net income (loss) per

common share: |

$ |

0.32 |

|

|

$ |

(0.02 |

) |

|

$ |

0.37 |

|

|

$ |

(0.33 |

) |

| |

|

|

|

|

|

|

|

| Weighted average common shares

outstanding - basic |

|

119,367,482 |

|

|

|

113,676,496 |

|

|

|

116,495,810 |

|

|

|

112,909,266 |

|

| Weighted average common shares

outstanding - diluted |

|

148,076,079 |

|

|

|

114,233,567 |

|

|

|

145,962,462 |

|

|

|

112,909,266 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MiMedx Group, Inc. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(in thousands) Unaudited |

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net cash flows provided by

(used in) operating activities |

|

10,257 |

|

|

|

(5,624 |

) |

|

|

26,775 |

|

|

|

(17,893 |

) |

| Net cash flows used in

investing activities |

|

(481 |

) |

|

|

(1,709 |

) |

|

|

(2,155 |

) |

|

|

(2,660 |

) |

| Net cash flows used in

financing activities |

|

(8,940 |

) |

|

|

66 |

|

|

|

(8,570 |

) |

|

|

(580 |

) |

| Net change in cash |

$ |

836 |

|

|

$ |

(7,267 |

) |

|

$ |

16,050 |

|

|

$ |

(21,133 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Measures

In addition to our GAAP results, we provide certain non-GAAP

metrics including Adjusted EBITDA, related margins, Free Cash Flow,

Adjusted Net Income, and Adjusted Earnings Per Share ("Adjusted

EPS"). We believe that the presentation of these measures provides

important supplemental information to management and investors

regarding our performance. These measurements are not a substitute

for GAAP measurements. Company management uses these Non-GAAP

measurements as aids in monitoring our ongoing financial

performance from quarter-to-quarter and year-to-year on a regular

basis and for benchmarking against comparable companies.

These non-GAAP financial measures reflect the exclusion of the

following items:

- Share-based compensation expense -

expense recognized related to awards to various employees pursuant

to our share-based compensation plans. This expense is reflected

amongst cost of sales, research and development expense, and

selling, general, and administrative expense in the unaudited

condensed consolidated statements of operations. Refer to Note 11,

Equity, in our Form 10-K for the year ended December 31, 2023 for

details.

- Investigation, restatement, and

related (benefit) expense - expenses incurred toward the legal

defense of certain former officers and directors, net of negotiated

reductions and settlements of amounts previously advanced. This

expense is reflected in the line of the same name in our unaudited

condensed consolidated statements of operations.

- Expenses related to the Disbanding

of Regenerative Medicine - incremental expenses recognized or

incurred directly as a result of our announcement to disband our

Regenerative Medicine segment. This reflects (i) write-downs of

clinical trial assets, (ii) charges associated with the wind-down

of contracts associated with our clinical trial program, (iii)

severance expenses incurred which were directly attributable to the

disbanding, and (iv) impairment of goodwill. Severance expenses are

reflected in research and development expense on the unaudited

condensed consolidated statements of operations. All other charges

are reflected in restructuring expense in the unaudited condensed

consolidated statements of operations.

- Reorganization expense - expenses

incurred toward the realignment of our operating strategy. These

expenses primarily relate to severance expenses related to certain

officers. These expenses are reflected as a component of selling,

general, and administrative expense in the unaudited condensed

consolidated statements of operations.

- Effects of antidilution - reflects

the impact of reflecting certain transactions which are dilutive

for purposes of calculating EPS on a GAAP basis, but are

antidilutive for purposes of calculating Adjusted EPS. For Q4 and

FY 2023, this reflects the adjustment for dividends on the

Company's Series B Preferred Stock to the numerator and incremental

shares which would have been issued if the Series B Preferred Stock

were converted at the beginning of the relevant period, weighted

for the portion of the period that the shares were not converted,

to the denominator. The reflection of this reduced the denominator

by 25.3 million and 27.5 million shares, respectively.

- Income Tax Adjustment - for purposes

of calculating Adjusted Net Income (Loss) and Adjusted Earnings Per

Share, reflects our expectation of a long-term effective tax rate,

which is normalized and balance sheet-agnostic. Actual reporting

tax expense will be based on GAAP earnings, and may differ from the

expected long-term effective tax rate due to a variety of factors,

including the tax treatment of various transactions included in

GAAP net income and other reconciling items that are excluded in

determining Adjusted Net Income (Loss) and Adjusted EPS. The

long-term normalized effective tax rate was 25% for each of the

years ended December 31, 2023 and 2022.

Adjusted EBITDA and Adjusted EBITDA margin

Adjusted EBITDA consists of GAAP net income (loss) excluding:

(i) depreciation, (ii) amortization of intangibles, (iii) interest

expense, net, (iv) income tax provision, (v) investigation,

restatement and related expenses, (vi) reorganization expenses

related to severance charges for certain officers (vii) expenses

related to disbanding of the Regenerative Medicine business unit

and (viii) share-based compensation.

Please refer to the tables at the beginning of this press

release for reconciliation to GAAP net income (loss).

Adjusted Net Income (Loss)

Adjusted Net Income (Loss) provides a view of our operating

performance, exclusive of certain items which are non-recurring or

not reflective of our core operations. Management uses Adjusted Net

Income to assess Company financial performance.

Adjusted Net Income is defined as GAAP net income (loss) plus

(i) investigation restatement and related expenses, (ii) expenses

related to disbanding our Regenerative Medicine business unit,

(iii) reorganization expenses related to severance charges for

certain officers, and (iv) the long-term adjusted effective income

tax rate.

A reconciliation of GAAP Net Income to Adjusted

Net Income appears in the table below (in thousands):

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net income (loss) |

$ |

53,476 |

|

|

$ |

(415 |

) |

|

$ |

58,228 |

|

|

$ |

(30,197 |

) |

| Investigation, restatement and

related expenses |

|

524 |

|

|

|

3,406 |

|

|

|

5,176 |

|

|

|

12,177 |

|

| Expenses related to disbanding

of Regenerative Medicine business unit |

|

785 |

|

|

|

— |

|

|

|

6,384 |

|

|

|

— |

|

| Reorganization expenses |

|

— |

|

|

|

— |

|

|

|

1,412 |

|

|

|

3,105 |

|

| Long-term adjusted effective

income tax rate |

|

(43,958 |

) |

|

|

(726 |

) |

|

|

(47,635 |

) |

|

|

3,883 |

|

| Adjusted net income

(loss) |

$ |

10,827 |

|

|

$ |

2,265 |

|

|

$ |

23,565 |

|

|

$ |

(11,032 |

) |

| |

Adjusted Earnings Per Share

Adjusted Earnings Per Share is intended to provide a normalized

view of earnings per share by removing items that may be irregular,

one-time, or non-recurring from net income. This enables us to

identify underlying trends in our business that could otherwise be

masked by such items. Adjusted Earnings Per Share consists of GAAP

diluted earnings per share including adjustments for: (i) effects

of antidilution, (ii) investigation, restatement and related

expenses, (iii) reorganization expenses related to severance

charges for certain officers and (iv) long-term adjusted effective

income tax rate.

A reconciliation of GAAP diluted earnings per share to Adjusted

Earnings Per Share appears in the table below (per diluted

share):

| |

For the Three Months Ended December 31, |

|

For the Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

GAAP net income (loss) per common share - diluted |

$ |

0.32 |

|

|

$ |

(0.02 |

) |

|

$ |

0.37 |

|

|

$ |

(0.33 |

) |

|

Effects of antidilution |

$ |

0.07 |

|

|

$ |

0.00 |

|

|

$ |

0.03 |

|

|

$ |

0.00 |

|

|

Investigation, restatement and related (benefit) expense |

$ |

0.00 |

|

|

$ |

0.03 |

|

|

$ |

0.04 |

|

|

$ |

0.11 |

|

|

Reorganization expenses |

$ |

0.00 |

|

|

$ |

0.00 |

|

|

$ |

0.01 |

|

|

$ |

0.03 |

|

|

Expenses related to disbanding of Regenerative Medicine business

unit |

$ |

0.01 |

|

|

$ |

0.00 |

|

|

$ |

0.05 |

|

|

$ |

0.00 |

|

|

Long-term adjusted effective income tax rate |

$ |

(0.36 |

) |

|

$ |

0.00 |

|

|

$ |

(0.40 |

) |

|

$ |

0.03 |

|

|

Adjusted Earnings Per Share |

$ |

0.04 |

|

|

$ |

0.01 |

|

|

$ |

0.10 |

|

|

$ |

(0.16 |

) |

|

Weighted average common shares outstanding - adjusted (in

millions) |

|

122.7 |

|

|

|

114.2 |

|

|

|

118.5 |

|

|

|

112.9 |

|

| |

|

|

|

|

|

|

|

Free Cash Flow

Free Cash Flow is intended to provide a measure of our ability

to generate cash in excess of capital investments. It provides

management with a view of cash flows which can be used to finance

operational and strategic investments.

Free Cash Flow is defined as net cash provided by (used in)

operating activities less capital expenditures, including purchases

of equipment.

A reconciliation of GAAP net cash flows provided by (used in)

operating activities to Free Cash Flow appears in the table below

(in thousands):

| |

For the Three Months Ended December 31, |

|

For the Year Ended December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

| Net cash flows provided by

(used in) operating activities |

|

10,257 |

|

|

|

(5,624 |

) |

|

|

26,775 |

|

|

|

(17,893 |

) |

| Capital expenditures,

including purchases of equipment |

|

(427 |

) |

|

|

(667 |

) |

|

|

(1,987 |

) |

|

|

(1,514 |

) |

| Free Cash Flow |

$ |

9,830 |

|

|

$ |

(6,291 |

) |

|

$ |

24,788 |

|

|

$ |

(19,407 |

) |

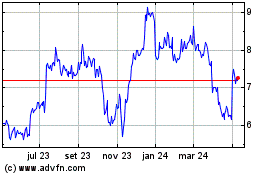

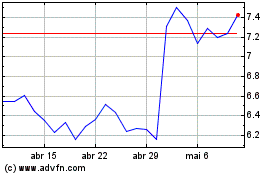

MiMedx (NASDAQ:MDXG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

MiMedx (NASDAQ:MDXG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024