AvePoint (NASDAQ: AVPT), the most advanced platform to

optimize SaaS operations and secure collaboration, today

announced financial results for the fourth quarter and full

year ended December 31, 2023.

“Our fourth quarter results were an outstanding close to our

strongest year yet as a public company,” said Dr. Tianyi Jiang

(TJ), CEO and Co-Founder, AvePoint. “The strength and

differentiation of our platform offering, coupled with the

continued customer demand to manage and protect critical data,

reduce costs and improve productivity, enabled us to meaningfully

outperform our financial guidance, as well as show substantial cash

flow generation and improvement across key customer metrics.

Looking ahead, our ability to secure and manage organizations’

rapidly expanding data estates leaves us well positioned to drive

businesses’ generative AI adoption in 2024 and beyond.”

Fourth Quarter 2023 Financial

Highlights

- Revenue: Total revenue was $74.6 million, up

17% from the fourth quarter of 2022. Within total revenue, SaaS

revenue was $45.3 million, up 37% from the fourth quarter of

2022.

- Gross Profit: GAAP gross profit was $55.0

million, compared to $44.8 million for the fourth quarter of 2022.

Non-GAAP gross profit was $56.1 million, compared to $45.9 million

for the fourth quarter of 2022. Non-GAAP gross margin was 75.2%,

compared to 72.2% for the fourth quarter of 2022.

- Operating Income/(Loss): GAAP operating

income was $0.9 million, compared to a GAAP operating loss of

$(8.0) million for the fourth quarter of 2022. Non-GAAP operating

income was $10.3 million, compared to $1.4 million for the fourth

quarter of 2022.

Full Year 2023 Financial Highlights

- Revenue: Total revenue was $271.8 million, up

17% from the full year 2022. Within total revenue, SaaS revenue was

$161.0 million, up 37% from the full year 2022.

- Gross Profit: GAAP gross profit was $194.4

million, compared to $166.1 million for the full year 2022.

Non-GAAP gross profit was $198.5 million, compared to $169.3

million for the full year 2022. Non-GAAP gross margin was 73.0%,

compared to 72.9% for the full year 2022.

- Operating Income/(Loss): GAAP operating

loss was $(15.4) million, compared to $(41.1) million for the full

year 2022. Non-GAAP operating income was $22.2 million, compared to

a non-GAAP operating loss of $(2.9) million for the full year

2022.

- Cash and short-term investments: $226.9

million as of December 31, 2023.

- Cash from operations: for the twelve months

ended December 31, 2023, the Company generated $34.7 million of

cash from operations, compared to $(0.8) million in the prior year

period.

Fourth Quarter 2023 Key Performance Indicators and

Recent Business Highlights

- ARR as of December 31, 2023 was $264.5 million, up 23%

year-over-year. Adjusted for FX, ARR grew 24%.

- Adjusted for FX, dollar-based gross retention rate was 87%,

while dollar-based net retention rate was 109%. On an as-reported

basis, dollar-based gross retention rate was 86%, while

dollar-based net retention rate was 108%.

- Announced the launch of AvePoint Opus, our AI-powered

information lifecycle management solution, to enable organizations

to manage information and ensure compliance, optimize cloud

storage, and streamline processes.

- Continued our focus on accelerating the adoption of generative

AI around the globe, including signing an agreement on February 28,

2024 to invest in a new growth equity fund, A3Ventures, which will

pursue B2B software companies that are ready for the global stage,

including those that accelerate innovation in areas complementing

AvePoint’s technology portfolio and building on the Company’s cloud

platform.

- Launched AvePoint AI, our program integrating AI across all

aspects of our Company – from our products and services to our own

business and operations. In addition, the program will include the

opening of an AI Industry lab in partnership with the Economic

Development Board of Singapore and other institutes of higher

learning.

Financial Outlook

For the first quarter of 2024, the Company expects:

- Total revenues of $71.4 million to $73.4 million, or

year-over-year growth of 22% at the midpoint.

- Non-GAAP operating income of $3.3 million to $4.3 million.

For the full year 2024, the Company expects:

- Total ARR of $314.7 million to $320.7 million, or

year-over-year growth of 20% at the midpoint.

- Total revenues of $308.6 million to $316.6 million, or

year-over-year growth of 15% at the midpoint.

- Non-GAAP operating income of $27.4 million to $30.4

million.

Quarterly Conference Call

AvePoint will host a conference call today, February 29, 2024,

to review its fourth quarter and full year 2023 financial results

and to discuss its financial outlook. The call is scheduled to

begin at 4:30pm ET. You may access the call and register with a

live operator by dialing 1 (833) 816-1428 for US participants and 1

(412) 317-0520 for outside the US. The passcode for the call is

5410286. Investors can also join by webcast by visiting

https://ir.avepoint.com/events. The webcast will be available live,

and a replay will be available following the completion of the live

broadcast for approximately 90 days.

About AvePoint

Collaborate with Confidence. AvePoint provides the most advanced

platform to optimize SaaS operations and secure collaboration. Over

17,000 customers worldwide rely on our solutions to modernize the

digital workplace across Microsoft, Google, Salesforce and other

collaboration environments. AvePoint's global channel partner

program includes over 3,500 managed service providers, value added

resellers and systems integrators, with our solutions available in

more than 100 cloud marketplaces. To learn more, visit

www.avepoint.com.

Non-GAAP Financial Measures

To supplement AvePoint’s consolidated financial statements

presented in accordance with GAAP, the company uses non-GAAP

measures of certain components of financial performance. These

non-GAAP measures include non-GAAP gross profit, non-GAAP gross

margin, non-GAAP operating expenses (including percentage of

revenue figures), non-GAAP operating income and non-GAAP operating

margin. The company has included a reconciliation of GAAP to

non-GAAP financial measures at the end of this press release. These

reconciliations adjust the related GAAP financial measures to

exclude stock-based compensation expense and the amortization of

acquired intangible assets. The company believes the presentation

of its non-GAAP financial measures provides a better representation

as to its overall operating performance. The presentation of

AvePoint’s non-GAAP financial measures is not meant to be

considered in isolation or as a substitute for its financial

results prepared in accordance with GAAP, and AvePoint’s non-GAAP

measures may be different from non-GAAP measures used by other

companies.

Disclosure Information

AvePoint uses the https://ir.avepoint.com/ website as a means of

disclosing material non-public information and for complying with

its disclosure obligations under Regulation FD.

Forward-Looking Statements

This press release contains certain forward-looking statements

within the meaning of the “safe harbor” provisions of the United

States Private Securities Litigation Reform Act of 1995 and other

federal securities laws including statements regarding the future

performance of and market opportunities for AvePoint. These

forward-looking statements generally are identified by the words

“believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,”

and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Many factors could

cause actual future events to differ materially from the

forward-looking statements in this press release, including but not

limited to: changes in the competitive and regulated industries in

which AvePoint operates, variations in operating performance across

competitors, changes in laws and regulations affecting AvePoint’s

business and changes in AvePoint’s ability to implement business

plans, forecasts, and ability to identify and realize additional

opportunities, and the risk of downturns in the market and the

technology industry. You should carefully consider the foregoing

factors and the other risks and uncertainties described in the

“Risk Factors” section of AvePoint’s most recent Annual Report on

Form 10-K and its registration statement on Form S-1 and related

prospectus and prospectus supplements filed with the SEC. Copies of

these and other documents filed by AvePoint from time to time are

available on the SEC's website, www.sec.gov. These filings identify

and address other important risks and uncertainties that could

cause actual events and results to differ materially from those

contained in the forward-looking statements. Forward-looking

statements speak only as of the date they are made. Readers are

cautioned not to put undue reliance on forward-looking statements,

and AvePoint does not assume any obligation and does not intend to

update or revise these forward-looking statements after the date of

this release, whether as a result of new information, future

events, or otherwise, except as required by law. AvePoint does not

give any assurance that it will achieve its expectations. Unless

the context otherwise indicates, references in this press release

to the terms “AvePoint”, “the Company”, “we”, “our” and “us” refer

to AvePoint, Inc. and its subsidiaries.

Investor Contact AvePointJamie

Arestiair@avepoint.com(551) 220-5654

Media ContactAvePointNicole

Cacipr@avepoint.com (201) 201-8143

AvePoint, Inc.Condensed Consolidated Statements

of Operations(In thousands, except per share

amounts)(Unaudited)

| |

|

Three Months Ended |

|

|

Year Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SaaS |

|

$ |

45,260 |

|

|

$ |

33,049 |

|

|

$ |

160,961 |

|

|

$ |

117,180 |

|

|

Term license and support |

|

|

12,270 |

|

|

|

14,713 |

|

|

|

52,744 |

|

|

|

57,214 |

|

|

Services |

|

|

13,788 |

|

|

|

12,052 |

|

|

|

44,795 |

|

|

|

41,283 |

|

|

Maintenance |

|

|

3,306 |

|

|

|

3,794 |

|

|

|

13,325 |

|

|

|

16,662 |

|

| Total revenue |

|

|

74,624 |

|

|

|

63,608 |

|

|

|

271,825 |

|

|

|

232,339 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SaaS |

|

|

9,338 |

|

|

|

8,379 |

|

|

|

35,924 |

|

|

|

27,313 |

|

|

Term license and support |

|

|

505 |

|

|

|

406 |

|

|

|

1,946 |

|

|

|

2,006 |

|

|

Services |

|

|

9,576 |

|

|

|

9,833 |

|

|

|

38,807 |

|

|

|

36,037 |

|

|

Maintenance |

|

|

199 |

|

|

|

172 |

|

|

|

783 |

|

|

|

920 |

|

| Total cost of revenue |

|

|

19,618 |

|

|

|

18,790 |

|

|

|

77,460 |

|

|

|

66,276 |

|

| Gross profit |

|

|

55,006 |

|

|

|

44,818 |

|

|

|

194,365 |

|

|

|

166,063 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

29,127 |

|

|

|

28,636 |

|

|

|

112,105 |

|

|

|

110,638 |

|

|

General and administrative |

|

|

15,592 |

|

|

|

16,721 |

|

|

|

61,271 |

|

|

|

65,132 |

|

|

Research and development |

|

|

9,409 |

|

|

|

7,509 |

|

|

|

36,340 |

|

|

|

31,359 |

|

| Total operating expenses |

|

|

54,128 |

|

|

|

52,866 |

|

|

|

209,716 |

|

|

|

207,129 |

|

| Income (loss) from

operations |

|

|

878 |

|

|

|

(8,048 |

) |

|

|

(15,351 |

) |

|

|

(41,066 |

) |

| Other (expense) income,

net |

|

|

(1,687 |

) |

|

|

1,340 |

|

|

|

(3,263 |

) |

|

|

7,416 |

|

| Loss before income taxes |

|

|

(809 |

) |

|

|

(6,708 |

) |

|

|

(18,614 |

) |

|

|

(33,650 |

) |

| Income tax (benefit)

expense |

|

|

(5,245 |

) |

|

|

4,939 |

|

|

|

2,887 |

|

|

|

5,038 |

|

| Net income (loss) |

|

$ |

4,436 |

|

|

$ |

(11,647 |

) |

|

$ |

(21,501 |

) |

|

$ |

(38,688 |

) |

| Net income attributable to

noncontrolling interest |

|

|

(167 |

) |

|

|

(1,072 |

) |

|

|

(224 |

) |

|

|

(2,942 |

) |

| Net loss attributable to

AvePoint, Inc. |

|

$ |

4,269 |

|

|

$ |

(12,719 |

) |

|

$ |

(21,725 |

) |

|

$ |

(41,630 |

) |

| Net loss available to common

shareholders |

|

$ |

4,269 |

|

|

$ |

(12,719 |

) |

|

$ |

(21,725 |

) |

|

$ |

(41,630 |

) |

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.02 |

|

|

$ |

(0.07 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.23 |

) |

|

Diluted |

|

$ |

0.02 |

|

|

$ |

(0.07 |

) |

|

$ |

(0.12 |

) |

|

$ |

(0.23 |

) |

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

181,152 |

|

|

|

181,795 |

|

|

|

182,257 |

|

|

|

181,957 |

|

|

Diluted |

|

|

198,570 |

|

|

|

181,795 |

|

|

|

182,257 |

|

|

|

181,957 |

|

AvePoint, Inc.Condensed Consolidated

Balance Sheets(In thousands, except par value)

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

223,162 |

|

|

$ |

227,188 |

|

|

Short-term investments |

|

|

3,721 |

|

|

|

2,620 |

|

|

Accounts receivable, net of allowance of $926 and $725,

respectively |

|

|

85,877 |

|

|

|

66,474 |

|

|

Prepaid expenses and other current assets |

|

|

12,824 |

|

|

|

10,013 |

|

| Total current assets |

|

|

325,584 |

|

|

|

306,295 |

|

| Property and equipment,

net |

|

|

5,118 |

|

|

|

5,537 |

|

| Goodwill |

|

|

19,156 |

|

|

|

18,904 |

|

| Intangible assets, net |

|

|

10,546 |

|

|

|

11,079 |

|

| Operating lease right-of-use

assets |

|

|

13,908 |

|

|

|

15,855 |

|

| Deferred contract costs |

|

|

54,675 |

|

|

|

48,553 |

|

| Other assets |

|

|

13,595 |

|

|

|

9,310 |

|

| Total assets |

|

$ |

442,582 |

|

|

$ |

415,533 |

|

| Liabilities, mezzanine

equity, and stockholders’ equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,384 |

|

|

$ |

1,519 |

|

|

Accrued expenses and other current liabilities |

|

|

53,766 |

|

|

|

47,784 |

|

|

Current portion of deferred revenue |

|

|

121,515 |

|

|

|

93,405 |

|

| Total current liabilities |

|

|

176,665 |

|

|

|

142,708 |

|

| Long-term operating lease

liabilities |

|

|

9,383 |

|

|

|

11,348 |

|

| Long-term portion of deferred

revenue |

|

|

7,741 |

|

|

|

8,085 |

|

| Earn-out shares

liabilities |

|

|

18,346 |

|

|

|

6,631 |

|

| Other liabilities |

|

|

5,603 |

|

|

|

3,607 |

|

| Total liabilities |

|

|

217,738 |

|

|

|

172,379 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Mezzanine equity |

|

|

|

|

|

|

|

|

|

Redeemable noncontrolling interest |

|

|

6,038 |

|

|

|

14,007 |

|

| Total mezzanine equity |

|

|

6,038 |

|

|

|

14,007 |

|

| Stockholders’ equity |

|

|

|

|

|

|

|

|

|

Common stock, $0.0001 par value; 1,000,000 shares authorized,

184,652 and 185,278 shares issued and outstanding as of December

31, 2023 and 2022, respectively |

|

|

18 |

|

|

|

19 |

|

|

Additional paid-in capital |

|

|

667,881 |

|

|

|

665,715 |

|

|

Treasury stock |

|

|

— |

|

|

|

(21,666 |

) |

|

Accumulated other comprehensive income |

|

|

3,196 |

|

|

|

2,006 |

|

|

Accumulated deficit |

|

|

(460,496 |

) |

|

|

(416,927 |

) |

| Noncontrolling interest |

|

|

8,207 |

|

|

|

— |

|

| Total stockholders’

equity |

|

|

218,806 |

|

|

|

229,147 |

|

| Total liabilities, mezzanine

equity, and stockholders’ equity |

|

$ |

442,582 |

|

|

$ |

415,533 |

|

AvePoint, Inc.Condensed Consolidated Statements

of Cash Flows(In thousands)(Unaudited)

| |

|

Year Ended |

|

| |

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

Operating activities |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(21,501 |

) |

|

$ |

(38,688 |

) |

| Adjustments to reconcile net

loss to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

4,687 |

|

|

|

3,494 |

|

|

Operating lease right-of-use assets expense |

|

|

6,234 |

|

|

|

5,945 |

|

|

Foreign currency remeasurement loss |

|

|

— |

|

|

|

835 |

|

|

Stock-based compensation |

|

|

36,048 |

|

|

|

37,218 |

|

|

Deferred income taxes |

|

|

(864 |

) |

|

|

3,701 |

|

|

Other |

|

|

1,068 |

|

|

|

(607 |

) |

|

Change in value of earn-out and warrant liabilities |

|

|

11,454 |

|

|

|

(4,402 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(19,448 |

) |

|

|

(14,388 |

) |

|

Prepaid expenses and other current assets |

|

|

(2,773 |

) |

|

|

(2,108 |

) |

|

Deferred contract costs and other assets |

|

|

(7,687 |

) |

|

|

(9,596 |

) |

|

Accounts payable, accrued expenses, operating lease liabilities and

other liabilities |

|

|

609 |

|

|

|

(2,553 |

) |

|

Deferred revenue |

|

|

26,867 |

|

|

|

20,375 |

|

| Net cash provided by (used in)

operating activities |

|

|

34,694 |

|

|

|

(774 |

) |

| Investing

activities |

|

|

|

|

|

|

|

|

| Maturities of investments |

|

|

2,620 |

|

|

|

183,554 |

|

| Purchases of investments |

|

|

(3,497 |

) |

|

|

(180,969 |

) |

| Cash paid in business

combinations and asset acquisitions, net of cash acquired |

|

|

— |

|

|

|

(18,572 |

) |

| Capitalization of internal-use

software |

|

|

(1,434 |

) |

|

|

(1,612 |

) |

| Purchase of property and

equipment |

|

|

(2,087 |

) |

|

|

(3,853 |

) |

| Investment in notes |

|

|

(1,250 |

) |

|

|

— |

|

| Net cash used in investing

activities |

|

|

(5,648 |

) |

|

|

(21,452 |

) |

| Financing

activities |

|

|

|

|

|

|

|

|

| Repurchase of common

stock |

|

|

(39,036 |

) |

|

|

(19,927 |

) |

| Proceeds from stock option

exercises |

|

|

5,569 |

|

|

|

2,818 |

|

| Repayments of finance

leases |

|

|

(64 |

) |

|

|

(39 |

) |

| Payments of debt issuance

costs |

|

|

(136 |

) |

|

|

— |

|

| Net cash used in financing

activities |

|

|

(33,667 |

) |

|

|

(17,148 |

) |

| Effect of exchange rates on

cash |

|

|

595 |

|

|

|

(1,655 |

) |

| Net decrease in cash and cash

equivalents |

|

|

(4,026 |

) |

|

|

(41,029 |

) |

| Cash and cash equivalents at

beginning of period |

|

|

227,188 |

|

|

|

268,217 |

|

| Cash and cash equivalents at

end of period |

|

$ |

223,162 |

|

|

$ |

227,188 |

|

| Supplemental

disclosures of cash flow information |

|

|

|

|

|

|

|

|

|

Income taxes paid |

|

$ |

6,112 |

|

|

$ |

3,320 |

|

|

Contingent consideration in business combinations |

|

$ |

— |

|

|

$ |

5,635 |

|

|

Common stock issued in business combination |

|

$ |

— |

|

|

$ |

1,517 |

|

|

Loan to certain acquiree shareholders |

|

$ |

— |

|

|

$ |

235 |

|

AvePoint, Inc.Non-GAAP Reconciliations(In

thousands)(Unaudited)

| |

|

Three Months Ended |

|

|

Year Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Non-GAAP operating income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP operating loss |

|

$ |

878 |

|

|

$ |

(8,048 |

) |

|

$ |

(15,351 |

) |

|

$ |

(41,066 |

) |

| Stock-based compensation

expense |

|

|

9,073 |

|

|

|

8,931 |

|

|

|

36,048 |

|

|

|

37,218 |

|

| Amortization of acquired

intangible assets |

|

|

350 |

|

|

|

527 |

|

|

|

1,456 |

|

|

|

955 |

|

| Non-GAAP operating income

(loss) |

|

$ |

10,301 |

|

|

$ |

1,410 |

|

|

$ |

22,153 |

|

|

$ |

(2,893 |

) |

| Non-GAAP operating margin |

|

|

13.8 |

% |

|

|

2.2 |

% |

|

|

8.1 |

% |

|

|

-1.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP gross

profit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP gross profit |

|

$ |

55,006 |

|

|

$ |

44,818 |

|

|

$ |

194,365 |

|

|

$ |

166,063 |

|

| Stock-based compensation

expense |

|

|

869 |

|

|

|

692 |

|

|

|

3,161 |

|

|

|

2,640 |

|

| Amortization of acquired

intangible assets |

|

|

239 |

|

|

|

393 |

|

|

|

964 |

|

|

|

617 |

|

| Non-GAAP gross profit |

|

$ |

56,114 |

|

|

$ |

45,903 |

|

|

$ |

198,490 |

|

|

$ |

169,320 |

|

| Non-GAAP gross margin |

|

|

75.2 |

% |

|

|

72.2 |

% |

|

|

73.0 |

% |

|

|

72.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP sales and

marketing |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP sales and marketing |

|

$ |

29,127 |

|

|

$ |

28,636 |

|

|

$ |

112,105 |

|

|

$ |

110,638 |

|

| Stock-based compensation

expense |

|

|

(2,251 |

) |

|

|

(2,688 |

) |

|

|

(9,518 |

) |

|

|

(11,393 |

) |

| Amortization of acquired

intangible assets |

|

|

(111 |

) |

|

|

(134 |

) |

|

|

(492 |

) |

|

|

(338 |

) |

| Non-GAAP sales and

marketing |

|

$ |

26,765 |

|

|

$ |

25,814 |

|

|

$ |

102,095 |

|

|

$ |

98,907 |

|

| Non-GAAP sales and marketing

as a % of revenue |

|

|

35.9 |

% |

|

|

40.6 |

% |

|

|

37.6 |

% |

|

|

42.6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP general and

administrative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP general and

administrative |

|

$ |

15,592 |

|

|

$ |

16,721 |

|

|

$ |

61,271 |

|

|

$ |

65,132 |

|

| Stock-based compensation

expense |

|

|

(4,787 |

) |

|

|

(4,573 |

) |

|

|

(19,338 |

) |

|

|

(19,398 |

) |

| Non-GAAP general and

administrative |

|

$ |

10,805 |

|

|

$ |

12,148 |

|

|

$ |

41,933 |

|

|

$ |

45,734 |

|

| Non-GAAP general and

administrative as a % of revenue |

|

|

14.5 |

% |

|

|

19.1 |

% |

|

|

15.4 |

% |

|

|

19.7 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP research and

development |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP research and

development |

|

$ |

9,409 |

|

|

$ |

7,509 |

|

|

$ |

36,340 |

|

|

$ |

31,359 |

|

| Stock-based compensation

expense |

|

|

(1,166 |

) |

|

|

(978 |

) |

|

|

(4,031 |

) |

|

|

(3,787 |

) |

| Non-GAAP research and

development |

|

$ |

8,243 |

|

|

$ |

6,531 |

|

|

$ |

32,309 |

|

|

$ |

27,572 |

|

| Non-GAAP research and

development as a % of revenue |

|

|

11.0 |

% |

|

|

10.3 |

% |

|

|

11.9 |

% |

|

|

11.9 |

% |

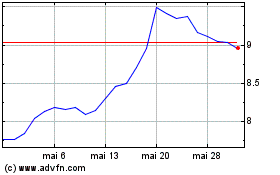

AvePoint (NASDAQ:AVPT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

AvePoint (NASDAQ:AVPT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025