Atlanticus Holdings Corporation (NASDAQ: ATLC) (Atlanticus, the

Company, we, our or us), a financial technology company which

enables its bank, retail and healthcare partners to offer more

inclusive financial services to millions of everyday Americans,

today announced its financial results for the fourth quarter and

full year ended December 31, 2023. An accompanying earnings

presentation is available in the Investors section of the Company’s

website at www.atlanticus.com or by clicking here.

Financial and Operating Highlights

Fourth Quarter 2023 Highlights (all comparisons to the

Fourth Quarter 2022)

- Managed receivables2 increased 13.7% to $2.4 billion

- Total operating revenue increased 14.9% to $308.6 million.

- Return on average shareholders’ equity of 20.7%3

- Purchase volume of $683.4 million.

- Over 387,000 new accounts served during the quarter, 3.6

million total accounts served1

- Net income attributable to common shareholders of $20.0

million, or $1.10 per diluted common share

1) In our calculation of total accounts served,

we include all accounts with account activity and accounts that

have open lines of credit at the end of the referenced period.2)

Managed receivables is a non-GAAP financial measure and excludes

the results of our Auto Finance receivables. See Non-GAAP Financial

Measures for important additional information3) Return on average

shareholders’ equity is calculated using Net Income attributable to

common shareholders as the numerator and the average of Total

shareholders’ equity as of December 31, 2023 and September 30, 2023

as the denominator, annualized.

Management Commentary

Jeff Howard, President and Chief Executive Officer at Atlanticus

stated, “We continue to maintain our focus on managing risk,

achieving adequate returns on our shareholder’s capital, and when

appropriate, growth. We have maintained our conservative approach

to underwriting that began in mid-2022 and will continue to do so

until data, not forecasts, indicate a change would be prudent. Our

most recent data indicate that the consumers we serve have adjusted

to higher cost of living while benefiting from higher wage growth,

which has resulted in a more stable credit environment. With this

backdrop, we were able to sustain growth across each of our

business lines. We once again achieved double digit growth in

receivables purchased and receivables growth on the year in our

retail credit line of business. This is primarily the result of

continued growth with our strategic partners as well as new

partnerships. We anticipate increased opportunities for growth as

providers of prime credit continue to tighten their underwriting

standards. We have already seen an increase both in the flow of

applications we assess on behalf of our bank partner and the

importance of our solution to new and existing merchant

relationships. Our general purpose receivables also grew year over

year even with our more conservative credit posture as we continue

to grow the total number of customers we serve through our

omnichannel origination platform. We are optimistic about growth

for our general purpose receivables in 2024 but we will continue to

employ our conservative approach to underwriting. While this may

reduce the pace of growth in the short-term, our outlook for

long-term growth remains.”

“As credit conditions continue to stabilize and macro-economic

uncertainty abates, we believe the markets that we serve provide

exceptional opportunity for long-term, sustained growth. Within our

general-purpose credit card, retail credit, healthcare payments,

and auto-finance lines of business we are well positioned with a

diversified product platform to help meet the financial needs of

the over 100 million consumers with less than perfect credit who

are overlooked by large banks. Our role is to continue to leverage

our experience, our 27 years of data aggregation and proven

analytics, and our technology to bring best in class products to

these consumers in our effort to Empower Better Financial Outcomes

for Everyday Americans.”

| Financial

Results |

For the Three Months Ended December

31, |

|

|

|

For the Year Ended December 31, |

|

|

| ($ in thousands,

except per share data) |

|

2023 |

|

|

|

2022 |

|

|

% Change |

|

|

2023 |

|

|

|

2022 |

|

|

% Change |

|

Total operating revenue, net |

$ |

308,600 |

|

|

$ |

268,664 |

|

|

14.9 |

% |

|

$ |

1,155,246 |

|

|

$ |

1,046,104 |

|

|

10.4 |

% |

| Other non-operating

revenue |

|

490 |

|

|

|

429 |

|

|

nm |

|

|

630 |

|

|

|

809 |

|

|

nm |

| Total revenue |

|

309,090 |

|

|

|

269,093 |

|

|

14.9 |

% |

|

|

1,155,876 |

|

|

|

1,046,913 |

|

|

10.4 |

% |

|

Interest expense |

|

(32,619 |

) |

|

|

(24,002 |

) |

|

35.9 |

% |

|

|

(109,342 |

) |

|

|

(81,851 |

) |

|

33.6 |

% |

|

Provision for credit losses |

|

(601 |

) |

|

|

(542 |

) |

|

nm |

|

|

(2,152 |

) |

|

|

(1,252 |

) |

|

nm |

|

Changes in fair value of loans |

|

(184,072 |

) |

|

|

(162,206 |

) |

|

13.5 |

% |

|

|

(689,577 |

) |

|

|

(577,069 |

) |

|

19.5 |

% |

| Net margin |

$ |

91,798 |

|

|

$ |

82,343 |

|

|

11.5 |

% |

|

$ |

354,805 |

|

|

$ |

386,741 |

|

|

-8.3 |

% |

| Total operating expenses |

$ |

61,093 |

|

|

$ |

52,561 |

|

|

16.2 |

% |

|

$ |

226,247 |

|

|

$ |

237,469 |

|

|

-4.7 |

% |

| Net income |

$ |

26,273 |

|

|

$ |

23,690 |

|

|

10.9 |

% |

|

$ |

101,954 |

|

|

$ |

134,612 |

|

|

-24.3 |

% |

| Net income attributable to

controlling interests |

$ |

26,304 |

|

|

$ |

23,991 |

|

|

9.6 |

% |

|

$ |

102,845 |

|

|

$ |

135,597 |

|

|

-24.2 |

% |

| Preferred stock and preferred

unit dividends and discount accretion |

$ |

(6,341 |

) |

|

$ |

(6,317 |

) |

|

nm |

|

$ |

(25,198 |

) |

|

$ |

(25,076 |

) |

|

nm |

| Net income attributable to

common shareholders |

$ |

19,963 |

|

|

$ |

17,674 |

|

|

13.0 |

% |

|

$ |

77,647 |

|

|

$ |

110,521 |

|

|

-29.7 |

% |

| Net income attributable to

common shareholders per common share—basic |

$ |

1.37 |

|

|

$ |

1.22 |

|

|

11.4 |

% |

|

$ |

5.35 |

|

|

$ |

7.55 |

|

|

-29.1 |

% |

| Net income attributable to

common shareholders per common share—diluted |

$ |

1.10 |

|

|

$ |

0.98 |

|

|

12.2 |

% |

|

$ |

4.24 |

|

|

$ |

5.83 |

|

|

-27.3 |

% |

*nm = not meaningful

Managed Receivables

Managed receivables increased 13.7% to $2.4 billion with over

$291.4 million in net receivables growth from December 31, 2022,

largely driven by growth both in the private label credit and

general purpose credit card products offered by our bank partners.

Total accounts served increased 9.0% to 3.6 million. While some of

our merchant partners continue to face year-over-year growth

challenges, others are still benefiting from continued consumer

spending and a growing economy. Our general purpose credit card

portfolio continues to grow in terms of total customers served and

therefore we continue to experience growth in total managed

receivables. We expect continued growth in our managed receivables

when compared to prior periods in 2023 which were restricted due to

tightened underwriting standards adopted during the second quarter

2022 (and continued in subsequent quarters). As these new

underwriting standards have now been applied across our portfolio,

it has allowed us to expand the offerings our bank partners make

available to consumers.

Total Operating Revenue

Total operating revenue consists of: 1) interest income, finance

charges and late fees on consumer loans, 2) other fees on credit

products including annual and merchant fees and 3) ancillary,

interchange and servicing income on loan portfolios.

During the quarter and full year ended December 31, 2023, total

operating revenue increased 14.9% to $308.6 million and 10.4% to

$1.2 billion, respectively. Finance and fee billings on our fair

value receivables increased to $268.2 million and $970.0 million

for the quarter and year ended December 31, 2023, respectively from

$232.6 million and $874.7 million for the quarter and year ended

December 31, 2022, respectively.

We are currently experiencing continued period-over-period

growth in private label credit and general purpose credit card

receivables and to a lesser extent in our CAR receivables—growth

that we expect to result in net period-over-period growth in our

total interest income and related fees for these operations for

2024. Future periods’ growth is also dependent on the addition of

new retail partners to expand the reach of private label credit

operations as well as growth within existing partnerships and the

level of marketing investment for the general purpose credit card

operations.

Interest Expense

Interest expense was $32.6 million and $109.3 million for the

quarter and full year ended December 31, 2023, respectively,

compared to $24.0 million and $81.9 million for the quarter and

full year ended December 31, 2022, respectively. The elevated

expenses were primarily driven by the planned increases in

outstanding debt in proportion to growth in our receivables coupled

with increases in the cost of capital.

Outstanding notes payable, net of unamortized debt issuance

costs and discounts, associated with our private label credit and

general purpose credit card platform increased to $1,796.0 million

as of December 31, 2023 from $1,586.0 million as of December 31,

2022. The majority of this increase in outstanding debt relates to

the addition of multiple revolving credit facilities during 2023.

Recent increases in the federal funds rate have started to increase

our interest expense as we have raised additional capital (or

replaced existing facilities) over the last two years. We

anticipate additional debt financing over the next few quarters as

we continue to grow coupled with increased effective interest rates

resulting from federal funds rate increases. As such, we expect our

quarterly interest expense for these operations to increase

compared to prior periods. However, we do not expect our interest

expense to increase significantly in the short term (absent raising

additional capital) because over 85% of interest rates on our

outstanding debt are fixed. Adding to interest expense in 2024, in

January and February, 2024, we sold a combined $57.3 million

aggregate principal amount of 9.25% Senior Notes due 2029.

Changes in Fair Value of Loans

Changes in fair value of loans increased to $184.1 million and

$689.6 million for the quarter and year ended December 31, 2023,

respectively, compared to $162.2 million and $577.1 million for the

quarter and year ended December 31, 2022, respectively. This

increase was largely driven by growth in underlying

receivables.

We include asset performance degradation in our forecasts to

reflect the possibility of delinquency rates increasing in the near

term (and the corresponding increase in charge-offs and decrease in

payments) above the level that historical and current trends would

suggest. As receivables associated with both 1) assets acquired

prior to our tightened underwriting standards (mentioned above) and

2) those assets negatively impacted by inflation, gradually become

a smaller percentage of the portfolio, we expect to see overall

improvements in the measured fair value of our portfolios of

acquired receivables.

Total Operating Expenses

Total operating expenses increased 16.2% in the quarter but

decreased 4.7% for the full year when compared to the same periods

in 2022.

For the quarter, operating expenses increased, driven by

increases in variable servicing costs associated with growth in our

receivables as well as growth in both the number of employees

and inflationary compensation pressure. Marketing costs,

corresponding to growth in our accounts served also contributed to

increases for the quarter.

We expect increased levels of expenditures associated with

anticipated growth in private label credit and general purpose

credit card operations. These expenses will primarily relate to the

variable costs of marketing efforts and card and loan servicing

expenses associated with new receivable acquisitions.

Net Income Attributable to Common

Shareholders

Net income attributable to common shareholders increased 13.0%

to $20.0 million, or $1.10 per diluted share and decreased 29.7% to

$77.6 million, or $4.24 per diluted share, for the quarter and full

year ended December 31, 2023 and 2022, respectively.

Share Repurchases

We repurchased and retired 575,156 shares of our common stock at

an aggregate cost of $17.6 million, in the year ended December 31,

2023.

We will continue to evaluate the best use of our capital to

increase shareholder value over time.

About Atlanticus Holdings Corporation

Empowering Better Financial Outcomes for Everyday Americans

Atlanticus™ technology enables bank, retail, and healthcare

partners to offer more inclusive financial services to everyday

Americans through the use of proprietary analytics. We apply the

experience gained and infrastructure built from servicing over 20

million customers and over $39 billion in consumer loans over more

than 25 years of operating history to support lenders that

originate a range of consumer loan products. These products include

retail and healthcare private label credit and general purpose

credit cards marketed through our omnichannel platform, including

retail point-of-sale, healthcare point-of-care, direct mail

solicitation, internet-based marketing, and partnerships with third

parties. Additionally, through our Auto Finance subsidiary,

Atlanticus serves the individual needs of automotive dealers and

automotive non-prime financial organizations with multiple

financing and service programs.

Forward-Looking Statements

This press release contains forward-looking statements that

reflect the Company's current views with respect to, among other

things, its business, long-term growth plans and opportunities,

operations, financial performance, revenue, amount and pace of

growth of managed receivables, underwriting approach, total

interest income and related fees and charges, debt financing,

liquidity, interest rates, interest expense, operating expense,

fair value of receivables, credit conditions, consumer spending,

and the economy. You generally can identify these statements by the

use of words such as outlook, potential, continue, may, seek,

approximately, predict, believe, expect, plan, intend, estimate or

anticipate and similar expressions or the negative versions of

these words or comparable words, as well as future or conditional

verbs such as will, should, would, likely and could. These

statements are subject to certain risks and uncertainties that

could cause actual results to differ materially from those included

in the forward-looking statements. These risks and uncertainties

include those risks described in the Company's filings with the

Securities and Exchange Commission and include, but are not limited

to, risks related to COVID-19 and its impact on the Company, bank

partners, merchant partners, consumers, loan demand, the capital

markets, labor availability, supply chains and the economy in

general; the Company's ability to retain existing, and attract new,

merchant partners and funding sources; changes in market interest

rates; increases in loan delinquencies; its ability to operate

successfully in a highly regulated industry; the outcome of

litigation and regulatory matters; the effect of management

changes; cyberattacks and security vulnerabilities in its products

and services; and the Company's ability to compete successfully in

highly competitive markets. The forward-looking statements speak

only as of the date on which they are made, and, except to the

extent required by federal securities laws, the Company disclaims

any obligation to update any forward-looking statement to reflect

events or circumstances after the date on which the statement is

made or to reflect the occurrence of unanticipated events. In light

of these risks and uncertainties, there is no assurance that the

events or results suggested by the forward-looking statements will

in fact occur, and you should not place undue reliance on these

forward-looking statements.

Contact:Investor Relations(770)

828-2000investors@atlanticus.com

|

Atlanticus Holdings Corporation and

SubsidiariesConsolidated Balance Sheets

(Dollars in thousands) |

| |

|

|

|

| |

December 31, |

|

December 31, |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

| Assets |

|

|

|

| Unrestricted cash and cash

equivalents (including $158.0 million and $202.2 million associated

with variable interest entities at December 31, 2023 and December

31, 2022, respectively) |

$ |

339,338 |

|

|

$ |

384,984 |

|

| Restricted cash and cash

equivalents (including $20.5 million and $27.6 million associated

with variable interest entities at December 31, 2023 and December

31, 2022, respectively) |

|

44,315 |

|

|

|

48,208 |

|

| Loans, interest and fees

receivable: |

|

|

|

| Loans at fair value (including

$2,128.6 million and $1,735.9 million associated with variable

interest entities at December 31, 2023 and December 31, 2022,

respectively) |

|

2,173,759 |

|

|

|

1,817,976 |

|

| Loans at amortized cost |

|

118,045 |

|

|

|

105,267 |

|

| Allowances for credit

losses |

|

(1,759 |

) |

|

|

(1,643 |

) |

| Deferred revenue |

|

(17,861 |

) |

|

|

(16,190 |

) |

| Net loans, interest and fees

receivable |

|

2,272,184 |

|

|

|

1,905,410 |

|

| Property at cost, net of

depreciation |

|

11,445 |

|

|

|

10,013 |

|

| Operating lease right-of-use

assets |

|

11,310 |

|

|

|

11,782 |

|

| Prepaid expenses and other

assets |

|

27,853 |

|

|

|

27,417 |

|

| Total assets |

$ |

2,706,445 |

|

|

$ |

2,387,814 |

|

|

Liabilities |

|

|

|

| Accounts payable and accrued

expenses |

$ |

61,634 |

|

|

$ |

44,332 |

|

| Operating lease

liabilities |

|

20,180 |

|

|

|

20,112 |

|

| Notes payable, net (including

$1,795.9 million and $1,586.0 million associated with variable

interest entities at December 31, 2023 and December 31, 2022,

respectively) |

|

1,861,685 |

|

|

|

1,653,306 |

|

| Senior notes, net |

|

144,453 |

|

|

|

144,385 |

|

| Income tax liability |

|

85,826 |

|

|

|

60,689 |

|

| Total liabilities |

|

2,173,778 |

|

|

|

1,922,824 |

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Preferred stock, no par value,

10,000,000 shares authorized: |

|

|

|

| Series A preferred stock,

400,000 shares issued and outstanding at December 31, 2023

(liquidation preference - $40.0 million); 400,000 shares issued and

outstanding at December 31, 2022 (1) |

|

40,000 |

|

|

|

40,000 |

|

| Class B preferred units issued

to noncontrolling interests |

|

100,250 |

|

|

|

99,950 |

|

|

|

|

|

|

| Shareholders'

Equity |

|

|

|

| Series B preferred stock, no

par value, 3,256,561 shares issued and outstanding at December 31,

2023 (liquidation preference - $81.4 million); 3,204,640 shares

issued and outstanding at December 31, 2022 (1) |

|

— |

|

|

|

— |

|

| Common stock, no par value,

150,000,000 shares authorized: 14,603,563 and 14,453,415 shares

issued and outstanding at December 31, 2023 and December 31, 2022,

respectively |

|

— |

|

|

|

— |

|

| Paid-in capital |

|

87,415 |

|

|

|

121,996 |

|

| Retained earnings |

|

307,260 |

|

|

|

204,415 |

|

| Total shareholders’

equity |

|

394,675 |

|

|

|

326,411 |

|

| Noncontrolling interests |

|

(2,258 |

) |

|

|

(1,371 |

) |

| Total equity |

|

392,417 |

|

|

|

325,040 |

|

| Total liabilities,

shareholders’ equity and temporary equity |

$ |

2,706,445 |

|

|

$ |

2,387,814 |

|

|

|

|

|

|

(1) Both the Series A preferred stock and the Series B preferred

stock have no par value and are part of the same aggregate

10,000,000 shares authorized

|

Atlanticus Holdings Corporation and

SubsidiariesConsolidated Statements of

Income(Dollars in thousands, except per share

data) |

| |

| |

For the Year Ended |

|

|

|

2023 |

|

|

|

2022 |

|

| Revenue: |

|

|

|

| Consumer loans, including past

due fees |

$ |

879,123 |

|

|

$ |

786,235 |

|

| Fees and related income on

earning assets |

|

238,775 |

|

|

|

217,071 |

|

| Other revenue |

|

37,348 |

|

|

|

42,798 |

|

| Total operating revenue,

net |

|

1,155,246 |

|

|

|

1,046,104 |

|

| Other non-operating

revenue |

|

630 |

|

|

|

809 |

|

| Total revenue |

|

1,155,876 |

|

|

|

1,046,913 |

|

|

|

|

|

|

| Interest expense |

|

(109,342 |

) |

|

|

(81,851 |

) |

| Provision for credit

losses |

|

(2,152 |

) |

|

|

(1,252 |

) |

| Changes in fair value of

loans |

|

(689,577 |

) |

|

|

(577,069 |

) |

| Net margin |

|

354,805 |

|

|

|

386,741 |

|

|

|

|

|

|

| Operating expenses: |

|

|

|

| Salaries and benefits |

|

43,906 |

|

|

|

43,063 |

|

| Card and loan servicing |

|

100,620 |

|

|

|

95,428 |

|

| Marketing and

solicitation |

|

52,421 |

|

|

|

62,403 |

|

| Depreciation |

|

2,560 |

|

|

|

2,175 |

|

| Other |

|

26,740 |

|

|

|

34,400 |

|

| Total operating expenses |

|

226,247 |

|

|

|

237,469 |

|

| Income before income

taxes |

|

128,558 |

|

|

|

149,272 |

|

| Income tax expense |

|

(26,604 |

) |

|

|

(14,660 |

) |

| Net income |

|

101,954 |

|

|

|

134,612 |

|

| Net loss attributable to

noncontrolling interests |

|

891 |

|

|

|

985 |

|

| Net income attributable to

controlling interests |

|

102,845 |

|

|

|

135,597 |

|

| Preferred stock and preferred

unit dividends and discount accretion |

|

(25,198 |

) |

|

|

(25,076 |

) |

| Net income attributable to

common shareholders |

$ |

77,647 |

|

|

$ |

110,521 |

|

| Net income attributable to

common shareholders per common share—basic |

$ |

5.35 |

|

|

$ |

7.55 |

|

| Net income attributable to

common shareholders per common share—diluted |

$ |

4.24 |

|

|

$ |

5.83 |

|

|

|

|

|

|

|

Atlanticus Holdings Corporation and

SubsidiariesConsolidated Statements of

Shareholders’ Equity and Temporary EquityFor

the Years Ended December 31, 2023 and

2022(Dollars in thousands) |

| |

| |

Series B Preferred Stock |

|

Common Stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Temporary Equity |

|

|

Shares Issued |

|

Amount |

|

Shares Issued |

|

Amount |

|

Paid-In Capital |

|

Retained Earnings (Deficit) |

|

Noncontrolling Interests |

|

Total Equity |

|

|

Series A Preferred Stock |

|

Class B Preferred Units |

|

Balance at January 1, 2022 |

3,188,533 |

|

|

$ |

— |

|

14,804,408 |

|

|

$ |

— |

|

$ |

227,763 |

|

|

$ |

60,236 |

|

$ |

(500 |

) |

|

$ |

287,499 |

|

|

|

$ |

40,000 |

|

$ |

99,650 |

| Cumulative effects from

adoption of the CECL standard |

— |

|

|

|

— |

|

— |

|

|

|

— |

|

|

— |

|

|

|

8,582 |

|

|

— |

|

|

|

8,582 |

|

|

|

|

— |

|

|

— |

| Accretion of discount

associated with issuance of subsidiary equity |

— |

|

|

|

— |

|

— |

|

|

|

— |

|

|

(300 |

) |

|

|

— |

|

|

— |

|

|

|

(300 |

) |

|

|

|

— |

|

|

300 |

| Discount associated with

repurchase of preferred stock |

— |

|

|

|

— |

|

— |

|

|

|

— |

|

|

18 |

|

|

|

— |

|

|

— |

|

|

|

18 |

|

|

|

|

— |

|

|

— |

| Preferred stock and preferred

unit dividends |

— |

|

|

|

— |

|

— |

|

|

|

— |

|

|

(24,794 |

) |

|

|

— |

|

|

— |

|

|

|

(24,794 |

) |

|

|

|

— |

|

|

— |

| Stock option exercises and

proceeds related thereto |

— |

|

|

|

— |

|

1,211,141 |

|

|

|

— |

|

|

3,731 |

|

|

|

— |

|

|

— |

|

|

|

3,731 |

|

|

|

|

— |

|

|

— |

| Compensatory stock issuances,

net of forfeitures |

— |

|

|

|

— |

|

112,027 |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

— |

| Issuance of series B preferred

stock, net |

19,607 |

|

|

|

— |

|

— |

|

|

|

— |

|

|

437 |

|

|

|

— |

|

|

— |

|

|

|

437 |

|

|

|

|

— |

|

|

— |

| Contributions by owners of

noncontrolling interests |

— |

|

|

|

— |

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

114 |

|

|

|

114 |

|

|

|

|

— |

|

|

— |

| Stock-based compensation

costs |

— |

|

|

|

— |

|

— |

|

|

|

— |

|

|

4,167 |

|

|

|

— |

|

|

— |

|

|

|

4,167 |

|

|

|

|

— |

|

|

— |

| Redemption and retirement of

preferred shares |

(3,500 |

) |

|

|

— |

|

— |

|

|

|

— |

|

|

(87 |

) |

|

|

— |

|

|

— |

|

|

|

(87 |

) |

|

|

|

— |

|

|

— |

| Redemption and retirement of

common shares |

— |

|

|

|

— |

|

(1,674,161 |

) |

|

|

— |

|

|

(88,939 |

) |

|

|

— |

|

|

— |

|

|

|

(88,939 |

) |

|

|

|

— |

|

|

— |

| Net income (loss) |

— |

|

|

|

— |

|

— |

|

|

|

— |

|

|

— |

|

|

|

135,597 |

|

|

(985 |

) |

|

|

134,612 |

|

|

|

|

|

|

— |

| Balance at December 31,

2022 |

3,204,640 |

|

|

$ |

— |

|

14,453,415 |

|

|

$ |

— |

|

$ |

121,996 |

|

|

$ |

204,415 |

|

$ |

(1,371 |

) |

|

$ |

325,040 |

|

|

|

$ |

40,000 |

|

$ |

99,950 |

| Accretion of discount

associated with issuance of subsidiary equity |

— |

|

|

|

— |

|

— |

|

|

|

— |

|

|

(300 |

) |

|

|

— |

|

|

— |

|

|

|

(300 |

) |

|

|

|

— |

|

|

300 |

| Discount associated with

repurchase of preferred stock |

— |

|

|

|

— |

|

— |

|

|

|

— |

|

|

16 |

|

|

|

— |

|

|

— |

|

|

|

16 |

|

|

|

|

— |

|

|

— |

| Preferred stock and preferred

unit dividends |

— |

|

|

|

— |

|

— |

|

|

|

— |

|

|

(24,914 |

) |

|

|

— |

|

|

— |

|

|

|

(24,914 |

) |

|

|

|

— |

|

|

— |

| Stock option exercises and

proceeds related thereto |

— |

|

|

|

— |

|

576,758 |

|

|

|

— |

|

|

3,405 |

|

|

|

— |

|

|

— |

|

|

|

3,405 |

|

|

|

|

— |

|

|

— |

| Compensatory stock issuances,

net of forfeitures |

— |

|

|

|

— |

|

148,546 |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

— |

| Issuance of series B preferred

stock, net |

53,727 |

|

|

|

— |

|

— |

|

|

|

— |

|

|

1,118 |

|

|

|

— |

|

|

— |

|

|

|

1,118 |

|

|

|

|

— |

|

|

— |

| Contributions by owners of

noncontrolling interests |

— |

|

|

|

— |

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

|

4 |

|

|

|

4 |

|

|

|

|

— |

|

|

— |

| Stock-based compensation

costs |

— |

|

|

|

— |

|

— |

|

|

|

— |

|

|

3,783 |

|

|

|

— |

|

|

— |

|

|

|

3,783 |

|

|

|

|

— |

|

|

— |

| Redemption and retirement of

preferred shares |

(1,806 |

) |

|

|

— |

|

— |

|

|

|

— |

|

|

(45 |

) |

|

|

— |

|

|

— |

|

|

|

(45 |

) |

|

|

|

— |

|

|

— |

| Redemption and retirement of

common shares |

— |

|

|

|

— |

|

(575,156 |

) |

|

|

— |

|

|

(17,644 |

) |

|

|

— |

|

|

— |

|

|

|

(17,644 |

) |

|

|

|

— |

|

|

— |

| Net income (loss) |

— |

|

|

|

— |

|

— |

|

|

|

— |

|

|

— |

|

|

|

102,845 |

|

|

(891 |

) |

|

|

101,954 |

|

|

|

|

— |

|

|

— |

| Balance at December 31,

2023 |

3,256,561 |

|

|

$ |

— |

|

14,603,563 |

|

|

$ |

— |

|

$ |

87,415 |

|

|

$ |

307,260 |

|

$ |

(2,258 |

) |

|

$ |

392,417 |

|

|

|

$ |

40,000 |

|

$ |

100,250 |

Additional Information

Additional trends and data with respect to our private label

credit and general purpose credit card receivables can be found in

our latest Form 10-K filing with the Securities and Exchange

Commission under Management's Discussion and Analysis of Financial

Condition and Results of Operations.

Calculation of Non-GAAP Financial Measures

This press release presents information about managed

receivables, which is a non-GAAP financial measure provided as a

supplement to the results provided in accordance with accounting

principles generally accepted in the United States of America

(GAAP). In addition to financial measures presented in accordance

with GAAP, we present managed receivables, total managed yield,

combined principal net charge-offs, and fair value to face value

ratio, all of which are non-GAAP financial measures. These non-GAAP

financial measures aid in the evaluation of the performance of our

credit portfolios, including our risk management, servicing and

collection activities and our valuation of purchased receivables.

The credit performance of our managed receivables provides

information concerning the quality of loan originations and the

related credit risks inherent with the portfolios. Management

relies heavily upon financial data and results prepared on the

managed basis in order to manage our business, make planning

decisions, evaluate our performance and allocate resources.

These non-GAAP financial measures are presented for supplemental

informational purposes only. These non-GAAP financial measures have

limitations as analytical tools and should not be considered in

isolation from, or as a substitute for, GAAP financial measures.

These non-GAAP financial measures may differ from the non-GAAP

financial measures used by other companies. A reconciliation of

non-GAAP financial measures to the most directly comparable GAAP

financial measures or the calculation of the non-GAAP financial

measures are provided below for each of the fiscal periods

indicated.

These non-GAAP financial measures include only the performance

of those receivables underlying consolidated subsidiaries (for

receivables carried at amortized cost basis and fair value) and

exclude the performance of receivables held by our former equity

method investee. As the receivables underlying our former equity

method investee reflect a small and diminishing portion of our

overall receivables base, we do not believe their inclusion or

exclusion in the overall results is material. Additionally, we

calculate average managed receivables based on the quarter-end

balances.

The comparison of non-GAAP managed receivables to our GAAP

financial statements requires an understanding that managed

receivables reflect the face value of loans, interest and fees

receivable without any consideration for potential credit

losses or other adjustments to reflect fair value.

A reconciliation of Loans at fair value to Loans

at amortized cost is as follows:

| |

At or for the Three Months Ended |

|

|

|

2023 |

|

|

2022 |

|

| (in

Millions) |

Dec. 31 (1) |

Sep. 30 (1) |

Jun. 30 (1) |

Mar. 31 (1) |

Dec. 31 (1) |

Sep. 30 (1) |

Jun. 30 (1) |

Mar. 31 (1) |

|

Loans at fair value |

$ |

2,173.8 |

|

$ |

2,050.0 |

|

$ |

1,916.1 |

|

$ |

1,795.6 |

|

$ |

1,818.0 |

|

$ |

1,728.1 |

|

$ |

1,616.9 |

|

$ |

1,405.8 |

|

| Fair value mark against

receivable (2) |

$ |

237.5 |

|

$ |

265.2 |

|

$ |

257.9 |

|

$ |

260.1 |

|

$ |

302.1 |

|

$ |

322.3 |

|

$ |

293.0 |

|

$ |

272.9 |

|

| Loans at amortized cost |

$ |

2,411.3 |

|

$ |

2,315.2 |

|

$ |

2,174.0 |

|

$ |

2,055.7 |

|

$ |

2,120.1 |

|

$ |

2,050.4 |

|

$ |

1,909.9 |

|

$ |

1,678.7 |

|

| Total managed receivables |

$ |

2,411.3 |

|

$ |

2,315.2 |

|

$ |

2,174.0 |

|

$ |

2,055.7 |

|

$ |

2,120.1 |

|

$ |

2,050.4 |

|

$ |

1,909.9 |

|

$ |

1,678.7 |

|

| Fair value to face value ratio

(3) |

|

90.2 |

% |

|

88.5 |

% |

|

88.1 |

% |

|

87.3 |

% |

|

85.8 |

% |

|

84.3 |

% |

|

84.7 |

% |

|

83.7 |

% |

|

(1 |

) |

We

elected the fair value option to account for certain loans

receivable associated with our private label credit and

general purpose credit card platform that were acquired on or after

January 1, 2020, and, as discussed in more detail in the Form

10-K for the year ended December 31, 2023, on January 1, 2022, we

elected the fair value option under ASU 2016-13 for those

private label credit and general purpose credit card receivables

that were previously accounted for under the amortized cost

method. |

|

(2 |

) |

The fair value mark against receivables reflects the difference

between the face value of a receivable and the net present

value of the expected cash flows associated with that

receivable. |

|

(3 |

) |

The Fair value to face value ratio is calculated using Loans at

fair value as the numerator, and Loans at amortized

cost as the denominator. |

|

|

|

|

A reconciliation of our operating revenues, net of finance and

fee charge-offs, to comparable amounts used in our calculation of

Total managed yield is as follows:

| |

At or for the Three Months Ended |

|

|

|

2023 |

|

|

2022 |

|

| (in

Millions) |

Dec. 31 |

Sep. 30 |

Jun. 30 |

Mar. 31 |

Dec. 31 |

Sep. 30 |

Jun. 30 |

Mar. 31 |

|

Consumer loans, including past due fees |

$ |

214.6 |

|

$ |

214.6 |

|

$ |

210.3 |

|

$ |

200.5 |

|

$ |

202.9 |

|

$ |

208.9 |

|

$ |

182.8 |

|

$ |

156.5 |

|

| Fees and related income on

earning assets |

|

71.7 |

|

|

59.8 |

|

|

62.9 |

|

|

44.3 |

|

|

48.0 |

|

|

48.5 |

|

|

65.8 |

|

|

54.7 |

|

| Other revenue |

|

12.0 |

|

|

10.2 |

|

|

7.6 |

|

|

6.7 |

|

|

8.5 |

|

|

11.1 |

|

|

12.2 |

|

|

10.0 |

|

| Total operating revenue – Caas

Segment |

|

298.3 |

|

|

284.6 |

|

|

280.8 |

|

|

251.5 |

|

|

259.4 |

|

|

268.5 |

|

|

260.8 |

|

|

221.2 |

|

| Adjustments due to

acceleration of merchant fee discount amortization under fair value

accounting |

|

6.5 |

|

|

(6.8 |

) |

|

(10.6 |

) |

|

(0.5 |

) |

|

3.4 |

|

|

(7.9 |

) |

|

(12.1 |

) |

|

1.8 |

|

| Adjustments due to

acceleration of annual fees recognition under fair value

accounting |

|

(12.6 |

) |

|

(3.1 |

) |

|

(9.8 |

) |

|

7.3 |

|

|

7.9 |

|

|

10.0 |

|

|

(6.6 |

) |

|

(1.3 |

) |

| Removal of finance

charge-offs |

|

(59.5 |

) |

|

(47.1 |

) |

|

(54.2 |

) |

|

(61.7 |

) |

|

(58.3 |

) |

|

(45.3 |

) |

|

(41.2 |

) |

|

(32.5 |

) |

| Total managed yield |

$ |

232.7 |

|

$ |

227.6 |

|

$ |

206.2 |

|

$ |

196.6 |

|

$ |

212.4 |

|

$ |

225.3 |

|

$ |

200.9 |

|

$ |

189.2 |

|

The calculation of Combined principal net charge-offs is as

follows:

| |

|

2023 |

|

|

2022 |

|

| (in

Millions) |

Dec. 31 (1) |

Sep. 30 (1) |

Jun. 30 (1) |

Mar. 31 (1) |

Dec. 31 (1) |

Sep. 30 (1) |

Jun. 30 (1) |

Mar. 31 (1) |

|

Charge-offs on loans at fair value |

$ |

215.2 |

|

$ |

173.5 |

|

$ |

180.0 |

|

$ |

191.9 |

|

$ |

182.3 |

|

$ |

134.4 |

|

$ |

126.5 |

|

$ |

101.3 |

|

| Gross charge-offs on non-fair

value accounts |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Finance charge-offs (2) |

|

(59.5 |

) |

|

(47.1 |

) |

|

(54.2 |

) |

|

(61.7 |

) |

|

(58.3 |

) |

|

(45.3 |

) |

|

(41.2 |

) |

|

(32.5 |

) |

| Recoveries on non-fair value

accounts |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Combined principal net

charge-offs |

$ |

155.7 |

|

$ |

126.4 |

|

$ |

125.8 |

|

$ |

130.2 |

|

$ |

124.0 |

|

$ |

89.1 |

|

$ |

85.3 |

|

$ |

68.8 |

|

|

(1 |

) |

On

January 1, 2022, we elected the fair value method under ASU

2016-13 for those private label credit and general purpose credit

card receivables that were previously accounted for under the

amortized cost method. |

|

(2 |

) |

Finance charge-offs are included as a component of our Provision

for credit losses and Changes in fair value of loans in the

consolidated statements of income. |

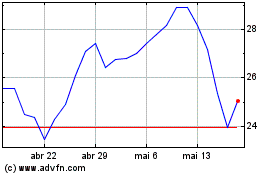

Atlanticus (NASDAQ:ATLC)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Atlanticus (NASDAQ:ATLC)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025