Atlanticus Announces Approval of Quarterly Preferred Stock Dividend

12 Novembro 2024 - 7:04PM

Atlanticus Holdings Corporation (NASDAQ: ATLC) (“Atlanticus,” the

“Company,” “we” or “our”), a financial technology company that

enables its bank, retail and healthcare partners to offer more

inclusive financial services to millions of everyday Americans,

today announced that its Board of Directors approved a quarterly

dividend of $0.476563 per share to Series B Cumulative Perpetual

Preferred shareholders. The cash dividend will be paid on or about

December 16, 2024 to holders of record of Atlanticus’ Series B

Cumulative Perpetual Preferred Stock on the close of business on

December 1, 2024.

About Atlanticus Holdings

Corporation

Empowering Better Financial Outcomes for

Everyday Americans

Atlanticus™ technology enables bank,

retail, and healthcare partners to offer more inclusive financial

services to everyday Americans through the use of proprietary

analytics. We apply the experience gained and infrastructure built

from servicing over 20 million customers and over $40

billion in consumer loans over more than 25 years of operating

history to support lenders that originate a range of consumer loan

products. These products include retail and healthcare private

label credit and general purpose credit cards marketed through our

omnichannel platform, including retail point-of-sale, healthcare

point-of-care, direct mail solicitation, internet-based marketing,

and partnerships with third parties. Additionally, through our Auto

Finance subsidiary, Atlanticus serves the individual

needs of automotive dealers and automotive non-prime financial

organizations with multiple financing and service programs.

Forward-Looking Statements

This press release contains forward-looking

statements that reflect the Company's current views with respect to

the payment of dividends in the future. You generally can identify

these statements by the use of words such as “outlook,”

“potential,” “continue,” “may,” “seek,” “approximately,” “predict,”

“believe,” “expect,” “plan,” “intend,” “estimate” or “anticipate”

and similar expressions or the negative versions of these words or

comparable words, as well as future or conditional verbs such as

“will,” “should,” “would,” “likely” and “could.” These statements

are subject to certain risks and uncertainties that could cause

actual results to differ materially from those included in the

forward-looking statements. These risks and uncertainties include

those risks described in the Company's filings with the Securities

and Exchange Commission and include, but are not limited to, risks

related to COVID-19 and its impact on the Company, bank partners,

merchant partners, consumers, loan demand, the capital markets,

labor availability, supply chains and the economy in general; the

Company's ability to retain existing, and attract new, merchant

partners and funding sources; changes in market interest rates;

increases in loan delinquencies; its ability to operate

successfully in a highly regulated industry; the outcome of

litigation and regulatory matters; the effect of management

changes; cyberattacks and security vulnerabilities in its products

and services; and the Company's ability to compete successfully in

highly competitive markets. The forward-looking statements speak

only as of the date on which they are made, and, except to the

extent required by federal securities laws, the Company disclaims

any obligation to update any forward-looking statement to reflect

events or circumstances after the date on which the statement is

made or to reflect the occurrence of unanticipated events. In light

of these risks and uncertainties, there is no assurance that the

events or results suggested by the forward-looking statements will

in fact occur, and you should not place undue reliance on these

forward-looking statements.

Contact:Investor Relations(770)

828-2000investors@atlanticus.com

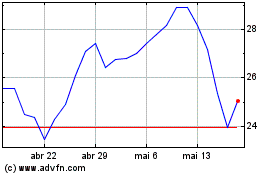

Atlanticus (NASDAQ:ATLC)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Atlanticus (NASDAQ:ATLC)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025