Axogen, Inc. (NASDAQ: AXGN), a global leader in developing and

marketing innovative surgical solutions for peripheral nerve

injuries, today reported financial results and business highlights

for the fourth quarter and full-year ended December 31, 2023.

Fourth Quarter 2023

Financial Results and Business Highlights

- Fourth quarter revenue was $42.9

million, an 18.7% increase compared to the fourth quarter of

2022.

- The Company estimates that revenues

from emergent trauma procedures represented approximately half of

total revenues during the fourth quarter and grew mid-single digits

versus the fourth quarter of 2022.

- The Company

estimates that revenues from scheduled non-trauma procedures

represented approximately half of total revenues during the fourth

quarter and grew more than 25% versus the fourth quarter of

2022.

- Gross margin was 78.7% for the fourth

quarter compared to 83.0% in the fourth quarter of 2022.

- Net loss for the quarter was $3.9

million, or $0.09 per share, compared to net loss of $5.4 million,

or $0.13 per share in the fourth quarter of 2022.

- Adjusted net loss for the quarter was

$2.6 million, or $0.06 per share, compared to adjusted net loss of

$1.1 million, or $0.03 per share in the fourth quarter of

2022.

- Adjusted EBITDA was $0.6 million for

the quarter, compared to an adjusted EBITDA loss of $0.7 million in

the fourth quarter of 2022.

- The balance of all cash, cash

equivalents, and investments on December 31, 2023 was $37.0

million, as compared to a balance of $38.6 million on

September 30, 2023.

“We are pleased with our solid performance in the fourth

quarter, and we are encouraged by the continued momentum we’ve seen

in this first quarter,” commented Karen Zaderej, chairman, CEO, and

president of Axogen, Inc. “Looking ahead, we remain focused on

further penetrating core accounts by leveraging our growing body of

clinical evidence and expanding use cases with our innovative new

products and applications. Additionally, we are excited to expand

our leadership position in nerve repair with the 2024 Q2 launch of

Avive+ Sofit Tissue Matrix, supporting our mission of restoring

nerve function and quality of life to patients with peripheral

nerve injuries.”

Full-Year Financial Results and Business

Highlights

- Full-year 2023 revenue was $159.0

million, a 14.7% increase compared to 2022 revenue of $138.6

million.

- Revenue from Core Accounts represents

approximately 65% of total revenue.

- Gross margin was 80.4% for the

full-year, compared to 82.6% in 2022.

- Net loss for the year was $21.7

million, or $0.51 per share, compared to net loss of $28.9 million,

or $0.69 per share in 2022.

- Adjusted net loss was $7.3 million for

the full-year, or $0.17 per share, compared to 12.6 million for the

full-year, or $0.30 per share in 2022.

- Adjusted EBITDA loss was $1.1 million

for the full-year, compared to an adjusted EBITDA loss of $9.3

million for 2022.

- Core Accounts totaled 376, a 13.3%

growth over the prior year level of 332.

- Ended the fourth quarter with 116

direct sales representatives compared to 116 at the end of the

third quarter and 115 on December 31, 2022.

Summary of Operational and Business

Highlights

- We recently completed a productive

Pre-BLA meeting with FDA. We have aligned with FDA on a rolling

submission process and the content of the modules for submission.

We anticipate the filing to be completed in the third quarter of

2024. Subject to ongoing engagement with FDA, we currently believe

the submission timetable will allow for a potential approval in

mid-2025.

- In August 2023, we began processing

tissue in the new, state-of-the-art biologics processing facility,

which provides for up to three times the previous capacity and was

designed for long-term growth and expansion.

- During 2023, we surpassed 100,000

Avance nerve graft implants since launch in 2007.

- We are continuing to expand our

offering in the nerve protection market with the national launch of

Axoguard HA+ Nerve Protector™ in 2023 and expect to launch Avive+

Soft Tissue Matrix™ in the second quarter of 2024.

- We launched Resensation® for

implant-based reconstruction allowing us to access an additional

10-15% of the overall breast reconstruction market. As part of this

launch, we have established a comprehensive training program to

support the adoption of this innovative approach to bring sensation

to more patients undergoing mastectomy.

- We ended the year

with 245 peer-reviewed clinical publications featuring Axogen’s

nerve repair product portfolio.

2024 Financial

Guidance

We expect revenue to be in the range of $177 million to $181

million, which represents an annual growth rate of approximately

11% to 14%. Additionally, we anticipate gross margin for the full

year to be in the range of 76% to 79%.

Conference Call

The Company will host a conference call and webcast for the

investment community today at 8:00 a.m. ET. Investors interested in

participating in the conference call by phone may do so by dialing

toll free at (877) 407-0993 or use the direct dial-in number at

(201) 689-8795. Those interested in listening to the conference

call live via the Internet may do so by visiting the Investors page

of the Company's website at www.axogeninc.com and clicking on the

webcast link.

Following the conference call, a replay will be available in the

Investors section of the Company's website at www.axogeninc.com

under Investors.

About Axogen

Axogen (AXGN) is the leading Company focused specifically on the

science, development, and commercialization of technologies for

peripheral nerve regeneration and repair. Axogen employees are

passionate about helping to restore peripheral nerve function and

quality of life to patients with physical damage or transection to

peripheral nerves by providing innovative, clinically proven, and

economically effective repair solutions for surgeons and health

care providers. Peripheral nerves provide the pathways for both

motor and sensory signals throughout the body. Every day, people

suffer traumatic injuries or undergo surgical procedures that

impact the function of their peripheral nerves. Physical damage to

a peripheral nerve, or the inability to properly reconnect

peripheral nerves, can result in the loss of muscle or organ

function, the loss of sensory feeling, or the initiation of

pain.

Axogen's platform for peripheral nerve repair features a

comprehensive portfolio of products that are used across two

primary application categories: scheduled, non-trauma procedures

and emergent trauma procedures. Scheduled procedures are generally

characterized as those where a patient is seeking relief from

conditions caused by a nerve defect or surgical procedure. These

procedures include providing sensation for women seeking breast

reconstruction following a mastectomy, nerve reconstruction

following the surgical removal of painful neuromas, oral and

maxillofacial procedures, and nerve decompression. Emergent

procedures are generally characterized as procedures resulting from

injuries that are initially present in an ER. These procedures are

typically referred to and completed by a specialist either

immediately or within a few days following the initial injury.

Axogen’s product portfolio includes Avance® nerve graft, a

biologically active off-the-shelf processed human nerve allograft

for bridging severed peripheral nerves without the comorbidities

associated with a second surgical site; Axoguard Nerve Connector®,

a porcine submucosa ECM coaptation aid for tensionless repair of

severed peripheral nerves; Axoguard Nerve Protector®, a porcine

submucosa ECM product used to wrap and protect damaged peripheral

nerves and reinforce the nerve reconstruction while preventing soft

tissue attachments; Axoguard HA+ Nerve Protector™, a porcine

submucosa ECM base layer coated with a proprietary

hyaluronate-alginate gel, a next-generation technology designed to

enhance nerve gliding and provide short- and long-term protection

for peripheral nerve injuries; and Axoguard Nerve Cap®, a porcine

submucosa ECM product used to protect a peripheral nerve end and

separate the nerve from the surrounding environment to reduce the

development of symptomatic or painful neuroma. The Axogen portfolio

of products is available in the United States, Canada, Germany, the

United Kingdom, Spain, South Korea, and several other

countries.

For more information, visit

www.axogeninc.com.

Cautionary Statements Concerning

Forward-Looking Statements

This press release contains “forward-looking” statements as

defined in the Private Securities Litigation Reform Act of 1995.

These statements are based on management's current expectations or

predictions of future conditions, events, or results based on

various assumptions and management's estimates of trends and

economic factors in the markets in which we are active, as well as

our business plans. Words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,”

“forecasts,” “continue,” “may,” “should,” “will,” “goals,” and

variations of such words and similar expressions are intended to

identify such forward-looking statements. Forward-looking

statements include the Company’s estimates regarding the revenues

from scheduled non-trauma procedures and emergent trauma procedures

as a portion of the total revenues, Ms. Zaderej’s statements on the

Company’s future focus, the Company’s portfolio of clinical data

supports the products’ efficacy, cost and time savings, the

anticipated timing of the full BLA submission and our expectations

that the BLA will be approved in mid-2025, the expected timing of

the launch of Avive+ Soft Tissue Matrix, our expectations regarding

our ability to access an additional 10-15% of the overall breast

reconstruction market, as well as statements related to the 2024

financial outlook, including revenue range and gross margins.

Actual results or events could differ materially from those

described in any forward-looking statements as a result of various

factors, including, without limitation, global supply chain issues,

hospital staffing issues, product development, product potential,

clinical outcomes, regulatory process and approvals, financial

performance, sales growth, surgeon and product adoption, market

awareness of our products, data validation, our visibility at and

sponsorship of conferences and educational events, global business

disruption caused by Russia’s invasion of Ukraine and related

sanctions, recent geopolitical conflicts in the Middle East,

potential disruptions due to management transitions, as well as

those risk factors described under Part I, Item 1A., “Risk

Factors,” of our Annual Report on Form 10-K for the most recently

ended fiscal year. Forward-looking statements are not a guarantee

of future performance, and actual results may differ materially

from those projected. The forward-looking statements are

representative only as of the date they are made and, except as

required by applicable law, we assume no responsibility to publicly

update or revise any forward-looking statements.

About Non-GAAP Financial Measures

To supplement our consolidated financial statements, we use the

non-GAAP financial measures of EBITDA, which measures earnings

before interest, income taxes, depreciation and amortization, and

Adjusted EBITDA which further excludes non-cash stock compensation

expense and litigation and related expenses. We also use the

non-GAAP financial measures of Adjusted Net Income or Loss and

Adjusted Net Income or Loss Per Common Share - basic and diluted

which excludes non-cash stock compensation expense and litigation

and related expenses from Net Loss and Net Loss Per Common Share -

basic and diluted, respectively. These non-GAAP measures are not

based on any comprehensive set of accounting rules or principles

and should not be considered a substitute for, or superior to,

financial measures calculated in accordance with GAAP, and may be

different from non-GAAP measures used by other companies. In

addition, these non-GAAP measures should be read in conjunction

with our financial statements prepared in accordance with GAAP. The

reconciliations of the non-GAAP measures to the most directly

comparable financial measures calculated and presented in

accordance with GAAP should be carefully evaluated.

We use these non-GAAP financial measures for financial and

operational decision-making and as a means to evaluate

period-to-period comparisons. We believe that these non-GAAP

financial measures provide meaningful supplemental information

regarding our performance and that both management and investors

benefit from referring to these non-GAAP financial measures in

assessing our performance and when planning, forecasting, and

analyzing future periods. We believe these non-GAAP financial

measures are useful to investors because (1) they allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision-making and (2) they are used by

our institutional investors and the analyst community to help them

analyze the performance of our business, the Company’s cash

available for operations, and the Company’s ability to meet future

capital expenditure and working capital requirements.

Contact:Axogen, Inc.Harold D. Tamayo, Vice President of Finance

and Investor Relations htamayo@axogeninc.com

|

AXOGEN, INC.CONSOLIDATED BALANCE

SHEETS(unaudited)December 31,

2023 and 2022(In Thousands, Except Share and Per

Share Amounts) |

|

|

|

|

December 31, 2023 |

|

December 31, 2022 |

| Assets |

|

|

|

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

31,024 |

|

|

$ |

15,284 |

|

|

Restricted cash |

|

6,002 |

|

|

|

6,251 |

|

|

Investments |

|

— |

|

|

|

33,505 |

|

|

Accounts receivable, net of allowance for doubtful accounts of $337

and $650, respectively |

|

25,147 |

|

|

|

22,186 |

|

|

Inventory |

|

23,020 |

|

|

|

18,905 |

|

|

Prepaid expenses and other |

|

2,811 |

|

|

|

1,944 |

|

|

Total current assets |

|

88,004 |

|

|

|

98,075 |

|

| Property and

equipment, net |

|

88,730 |

|

|

|

79,294 |

|

| Operating lease

right-of-use assets |

|

15,562 |

|

|

|

14,369 |

|

| Intangible assets,

net |

|

4,531 |

|

|

|

3,649 |

|

|

Total assets |

$ |

196,827 |

|

|

$ |

195,387 |

|

| |

|

|

|

| Liabilities and

shareholders’ equity |

|

|

|

| Current

liabilities: |

|

|

|

|

Accounts payable and accrued expenses |

|

28,883 |

|

|

|

22,443 |

|

|

Current maturities of long-term lease obligations |

|

1,547 |

|

|

|

1,310 |

|

|

Total current liabilities |

|

30,430 |

|

|

|

23,753 |

|

| |

|

|

|

| Long-term debt, net of

debt discount and financing fees |

|

46,603 |

|

|

|

45,712 |

|

| Long-term lease

obligations |

|

21,142 |

|

|

|

20,405 |

|

| Debt derivative

liabilities |

|

2,987 |

|

|

|

4,518 |

|

|

Total liabilities |

|

101,162 |

|

|

|

94,388 |

|

| |

|

|

|

| Commitments and

contingencies - see Note 14 |

|

|

|

| |

|

|

|

| Shareholders’

equity: |

|

|

|

|

Common stock, $0.01 par value per share; 100,000,000 shares

authorized; 43,124,496 and 42,445,517 shares issued and

outstanding |

|

431 |

|

|

|

424 |

|

|

Additional paid-in capital |

|

376,530 |

|

|

|

360,155 |

|

|

Accumulated deficit |

|

(281,296 |

) |

|

|

(259,580 |

) |

|

Total shareholders’ equity |

|

95,665 |

|

|

|

100,999 |

|

|

Total liabilities and shareholders’ equity |

$ |

196,827 |

|

|

$ |

195,387 |

|

|

AXOGEN, INC.CONSOLIDATED STATEMENTS

OF OPERATIONSYears ended December 31, 2023 ,

2022 and 2021(In Thousands, Except Share and Per

Share Amounts) |

| |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

2021 |

|

| Revenues |

$ |

159,012 |

|

|

$ |

138,584 |

|

|

$ |

127,358 |

|

| Cost of goods

sold |

|

31,138 |

|

|

|

24,147 |

|

|

|

22,931 |

|

|

Gross profit |

|

127,874 |

|

|

|

114,437 |

|

|

|

104,427 |

|

| Costs and

expenses: |

|

|

|

|

|

|

Sales and marketing |

|

86,060 |

|

|

|

80,228 |

|

|

|

73,328 |

|

|

Research and development |

|

28,333 |

|

|

|

27,158 |

|

|

|

24,177 |

|

|

General and administrative |

|

34,943 |

|

|

|

36,758 |

|

|

|

32,338 |

|

|

Total costs and expenses |

|

149,336 |

|

|

|

144,144 |

|

|

|

129,843 |

|

|

Loss from operations |

|

(21,462 |

) |

|

|

(29,707 |

) |

|

|

(25,416 |

) |

| Other (expense)

income: |

|

|

|

|

|

|

Investment income |

|

1,487 |

|

|

|

569 |

|

|

|

93 |

|

|

Interest expense |

|

(2,835 |

) |

|

|

(624 |

) |

|

|

(1,356 |

) |

|

Change in fair value of derivatives |

|

1,531 |

|

|

|

1,044 |

|

|

|

(28 |

) |

|

Other expense |

|

(437 |

) |

|

|

(230 |

) |

|

|

(278 |

) |

|

Total other income (expense), net |

|

(254 |

) |

|

|

759 |

|

|

|

(1,569 |

) |

| Net loss |

$ |

(21,716 |

) |

|

$ |

(28,948 |

) |

|

$ |

(26,985 |

) |

| |

|

|

|

|

|

| Weighted average common shares

outstanding — basic and diluted |

|

42,879,000 |

|

|

|

42,083,000 |

|

|

|

41,215,000 |

|

| Loss per common share — basic

and diluted |

$ |

(0.51 |

) |

|

$ |

(0.69 |

) |

|

$ |

(0.65 |

) |

|

AXOGEN, Inc.RECONCILIATION OF GAAP

FINANCIAL MEASURES TO NON-GAAP FINANCIAL

MEASURESThree Months and Year Ended

December 31, 2023 and

2022(unaudited)(In Thousands,

Except Per Share Amounts) |

| |

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, 2023 |

|

December 31, 2022 |

|

December 31, 2023 |

|

December 31, 2022 |

| |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(3,893 |

) |

|

$ |

(5,415 |

) |

|

$ |

(21,716 |

) |

|

$ |

(28,948 |

) |

| Depreciation and amortization

expense |

|

|

1,617 |

|

|

|

713 |

|

|

|

4,491 |

|

|

|

3,093 |

|

| Investment income |

|

|

(336 |

) |

|

|

(397 |

) |

|

|

(1,487 |

) |

|

|

(569 |

) |

| Income tax expense |

|

|

9 |

|

|

|

125 |

|

|

|

|

|

189 |

|

| Interest expense |

|

|

1,843 |

|

|

|

(40 |

) |

|

|

2,835 |

|

|

|

624 |

|

| EBITDA - non

GAAP |

|

$ |

(760 |

) |

|

$ |

(5,014 |

) |

|

$ |

(15,538 |

) |

|

$ |

(25,611 |

) |

| |

|

|

|

|

|

|

|

|

| Non cash stock-based

compensation expense |

|

|

1,327 |

|

|

|

4,154 |

|

|

|

14,418 |

|

|

|

15,591 |

|

| Litigation and related

costs |

|

|

— |

|

|

|

177 |

|

|

|

— |

|

|

|

761 |

|

| Adjusted EBITDA - non

GAAP |

|

$ |

567 |

|

|

$ |

(683 |

) |

|

|

(1,120 |

) |

|

$ |

(9,259 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(3,893 |

) |

|

$ |

(5,415 |

) |

|

$ |

(21,716 |

) |

|

$ |

(28,948 |

) |

| Non cash stock-based

compensation expense |

|

|

1,327 |

|

|

|

4,154 |

|

|

|

14,418 |

|

|

|

15,591 |

|

| Litigation and related

costs |

|

|

— |

|

|

|

177 |

|

|

|

— |

|

|

|

761 |

|

| Adjusted net loss -

non GAAP |

|

$ |

(2,566 |

) |

|

$ |

(1,083 |

) |

|

$ |

(7,298 |

) |

|

$ |

(12,596 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average

common shares outstanding basic and diluted |

|

|

43,048,446 |

|

|

|

42,306,012 |

|

|

|

42,878,542 |

|

|

|

42,083,125 |

|

| |

|

|

|

|

|

|

|

|

| Loss per common share

— basic and diluted |

|

$ |

(0.09 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.51 |

) |

|

$ |

(0.69 |

) |

| Non cash stock-based

compensation expense |

|

$ |

0.03 |

|

|

$ |

0.10 |

|

|

$ |

0.34 |

|

|

$ |

0.37 |

|

| Litigation and related

costs |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.02 |

|

| Adjusted net loss per

common share - basis and diluted - non GAAP |

|

$ |

(0.06 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.30 |

) |

| |

|

|

|

|

|

|

|

|

|

AXOGEN, INC.CONSOLIDATED STATEMENTS OF SHAREHOLDERS’

EQUITYYears ended December 31, 2023, 2022 and 2021(In

Thousands) |

| |

Common Stock |

|

AdditionalPaid-inCapital |

|

AccumulatedDeficit |

|

TotalShareholders’Equity |

| |

Shares |

|

|

Amount |

|

|

|

|

Balance, December 31, 2020 |

40,619 |

|

|

$ |

406 |

|

|

$ |

326,390 |

|

|

$ |

(203,647 |

) |

|

$ |

123,149 |

|

| |

|

|

|

|

|

|

|

|

|

|

— |

|

| Stock-based compensation |

— |

|

|

|

— |

|

|

|

10,919 |

|

|

|

— |

|

|

|

10,919 |

|

| Issuance of restricted and

performance stock units |

254 |

|

|

|

2 |

|

|

|

(2 |

) |

|

|

— |

|

|

|

— |

|

| Shares surrendered by

employees to pay tax withholdings |

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Exercise of stock options and

employee stock purchase plan |

864 |

|

|

|

9 |

|

|

|

5,458 |

|

|

|

— |

|

|

|

5,467 |

|

| Net loss |

— |

|

|

|

— |

|

|

|

— |

|

|

|

(26,985 |

) |

|

|

(26,985 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Balance, December 31,

2021 |

41,737 |

|

|

|

417 |

|

|

|

342,765 |

|

|

|

(230,632 |

) |

|

|

112,550 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

— |

|

|

|

— |

|

|

|

15,591 |

|

|

|

— |

|

|

|

15,591 |

|

| Issuance of restricted and

performance stock units |

343 |

|

|

|

3 |

|

|

|

(3 |

) |

|

|

— |

|

|

|

— |

|

| Exercise of stock options and

employee stock purchase plan |

365 |

|

|

|

4 |

|

|

|

1,802 |

|

|

|

— |

|

|

|

1,806 |

|

| Net loss |

— |

|

|

|

— |

|

|

|

— |

|

|

|

(28,948 |

) |

|

|

(28,948 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Balance, December 31,

2022 |

42,445 |

|

|

|

424 |

|

|

|

360,155 |

|

|

|

(259,580 |

) |

|

|

100,999 |

|

| |

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

— |

|

|

|

— |

|

|

|

14,418 |

|

|

|

— |

|

|

|

14,418 |

|

| Issuance of restricted and

performance stock units |

369 |

|

|

|

4 |

|

|

|

(4 |

) |

|

|

— |

|

|

|

— |

|

| Exercise of stock options and

employee stock purchase plan |

310 |

|

|

|

3 |

|

|

|

1,961 |

|

|

|

— |

|

|

|

1,964 |

|

| Net loss |

— |

|

|

|

— |

|

|

|

|

|

(21,716 |

) |

|

|

(21,716 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Balance, December 31,

2023 |

43,124 |

|

|

$ |

431 |

|

|

$ |

376,530 |

|

|

$ |

(281,296 |

) |

|

$ |

95,665 |

|

|

AXOGEN, INC.CONSOLIDATED STATEMENTS

OF CASH FLOWSYears ended December 31, 2023,

2022 and 2021(In Thousands) |

| |

| |

|

2023 |

|

|

|

2022 |

|

|

|

2021 |

|

| Cash flows from

operating activities: |

|

|

|

|

|

|

Net loss |

$ |

(21,716 |

) |

|

$ |

(28,948 |

) |

|

$ |

(26,985 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

Depreciation |

|

4,218 |

|

|

|

2,827 |

|

|

|

2,744 |

|

|

Amortization of right-of-use assets |

|

1,062 |

|

|

|

1,761 |

|

|

|

1,795 |

|

|

Amortization of intangible assets |

|

273 |

|

|

|

265 |

|

|

|

202 |

|

|

Amortization of debt discount and deferred financing fees |

|

891 |

|

|

|

891 |

|

|

|

831 |

|

|

Loss on disposal of equipment |

|

56 |

|

|

|

— |

|

|

|

— |

|

|

Loss on extinguishment of debt |

|

|

|

|

|

|

Provision for bad debt |

|

(271 |

) |

|

|

612 |

|

|

|

(41 |

) |

|

Provision for inventory write-down |

|

1,939 |

|

|

|

1,769 |

|

|

|

3,314 |

|

|

Investment losses (gains) |

|

(666 |

) |

|

|

(228 |

) |

|

|

68 |

|

|

Change in fair value of derivatives |

|

(1,531 |

) |

|

|

(1,044 |

) |

|

|

28 |

|

|

Stock-based compensation |

|

14,418 |

|

|

|

15,591 |

|

|

|

10,919 |

|

|

Change in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

(2,691 |

) |

|

|

(4,639 |

) |

|

|

(499 |

) |

|

Inventory |

|

(6,054 |

) |

|

|

(3,656 |

) |

|

|

(7,478 |

) |

|

Prepaid expenses and other |

|

(867 |

) |

|

|

(84 |

) |

|

|

2,435 |

|

|

Accounts payable and accrued expenses |

|

6,509 |

|

|

|

660 |

|

|

|

(270 |

) |

|

Operating lease obligations |

|

(1,269 |

) |

|

|

(1,841 |

) |

|

|

(463 |

) |

|

Cash paid for interest portion of finance leases |

|

(3 |

) |

|

|

(2 |

) |

|

|

(2 |

) |

|

Contract and other liabilities |

|

(14 |

) |

|

|

— |

|

|

|

(3 |

) |

| Net cash used in

operating activities |

|

(5,716 |

) |

|

|

(16,066 |

) |

|

|

(13,405 |

) |

| |

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

Purchase of property and equipment |

|

(13,872 |

) |

|

|

(20,078 |

) |

|

|

(27,811 |

) |

|

Economic development grant proceeds |

|

— |

|

|

|

— |

|

|

|

950 |

|

|

Purchase of investments |

|

(10,203 |

) |

|

|

(39,247 |

) |

|

|

(68,699 |

) |

|

Proceeds from sale of investments |

|

44,374 |

|

|

|

57,300 |

|

|

|

72,500 |

|

|

Cash payments for intangible assets |

|

(1,046 |

) |

|

|

(1,175 |

) |

|

|

(589 |

) |

| Net cash provided by

(used in) investing activities |

|

19,253 |

|

|

|

(3,200 |

) |

|

|

(23,649 |

) |

| |

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

Proceeds from issuance of long-term debt |

|

— |

|

|

|

— |

|

|

|

15,000 |

|

|

Cash paid for debt portion of finance leases |

|

(10 |

) |

|

|

(12 |

) |

|

|

(15 |

) |

|

Proceeds from exercise of stock options and ESPP stock

purchases |

|

1,964 |

|

|

|

1,806 |

|

|

|

5,467 |

|

| Net cash provided by

financing activities |

|

1,954 |

|

|

|

1,794 |

|

|

|

20,452 |

|

| Net increase

(decrease) in cash, cash equivalents, and restricted

cash |

|

15,491 |

|

|

|

(17,472 |

) |

|

|

(16,602 |

) |

| Cash, cash

equivalents, and restricted cash, beginning of period |

|

21,535 |

|

|

|

39,007 |

|

|

|

55,609 |

|

| Cash, cash

equivalents, and restricted cash, end of period |

$ |

37,026 |

|

|

$ |

21,535 |

|

|

$ |

39,007 |

|

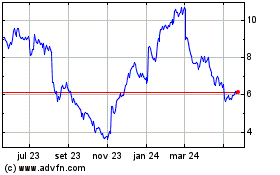

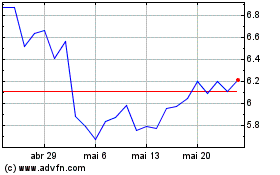

Axogen (NASDAQ:AXGN)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Axogen (NASDAQ:AXGN)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024