Birchcliff Energy Ltd. (“

Birchcliff” or the

“

Corporation”) (TSX: BIR) is pleased to announce

that it has filed its annual audited financial statements (the

“

financial statements”) and related management’s

discussion and analysis and its annual information form (the

“

AIF”) for the financial year ended December 31,

2023 (collectively, the “

Annual Filings”). The AIF

contains the reserves data and other oil and gas information as

required by National Instrument 51-101 – Standards of Disclosure

for Oil and Gas Activities. The financial and reserves information

contained in the Annual Filings is consistent with the unaudited

financial and reserves information disclosed in the press release

issued by Birchcliff on February 14, 2024.

The Annual Filings are available electronically

on Birchcliff’s website at www.birchcliffenergy.com and on SEDAR+

at www.sedarplus.ca.

CAPITAL PROGRAM UPDATE

Birchcliff’s disciplined capital budget of $240

million to $260 million for 2024 reflects its commitment to

maintaining a strong balance sheet, while focusing on sustainable

shareholder returns and the continued development of the

Corporation’s world-class asset base. Birchcliff expects to bring

29 wells on production in 2024 as part of its capital program,

which utilizes its latest wellbore and completions design and

targets high rate-of-return wells with strong capital efficiencies

and attractive paybacks.

As previously announced, Birchcliff is delaying

the drilling of 13 wells until late Q2 and into Q3 2024, with these

wells expected to come on production in Q4 2024, aligned with the

anticipated improvement in commodity prices. Birchcliff is closely

monitoring commodity prices and this deferral provides it with the

flexibility to further adjust its 2024 capital program if

necessary.

In Pouce Coupe, the Corporation completed the

drilling of its 5-well 04-30 pad in December 2023 and the wells

were turned over to production through Birchcliff’s permanent

facilities in late February 2024. This pad was drilled in the Lower

Montney and targeted high-rate natural gas.

In February 2024, Birchcliff completed the

drilling of its 5-well 16-17 pad in Pouce Coupe and the wells are

anticipated to be turned over to production in April 2024. This pad

targeted condensate-rich natural gas with three wells drilled in

the Lower Montney and two wells in the Upper Montney.

In Gordondale, Birchcliff completed the drilling

of its 2-well 02-27 pad targeting liquids-rich natural gas wells in

the Lower Montney in early March 2024, with the wells anticipated

to be turned over to production in Q2 2024.

Birchcliff currently has one drilling rig at

work in the Gordondale area drilling its 4-well 01-10 pad. This pad

is targeting oil wells in the Lower Montney and is anticipated to

be turned over to production in Q2 2024. Following the drilling of

this pad, it is currently expected that the drilling rigs will be

shut down until late Q2 2024.

With respect to Birchcliff’s future development

area in Elmworth, the formal planning is underway for the

construction of a proposed 100% owned and operated natural gas

processing plant in the area, including determining processing and

takeaway capacity and the specific timelines for consultation and

construction. Birchcliff may consider investing capital in 2024 to

continue to build, protect and optimize its Elmworth Montney land

position.

Birchcliff looks forward to providing an update

on its capital program and well results in conjunction with the

release of its Q1 2024 results on May 15, 2024. If required,

Birchcliff plans to provide updated guidance at that time.

Forward-Looking Statements

Certain statements contained in this press

release constitute forward‐looking statements and forward-looking

information (collectively referred to as “forward‐looking

statements”) within the meaning of applicable Canadian

securities laws. The forward-looking statements contained in this

press release relate to future events or Birchcliff’s future plans,

strategy, operations, performance or financial position and are

based on Birchcliff’s current expectations, estimates, projections,

beliefs and assumptions. Such forward-looking statements have been

made by Birchcliff in light of the information available to it at

the time the statements were made and reflect its experience and

perception of historical trends. All statements and information

other than historical fact may be forward‐looking statements. Such

forward‐looking statements are often, but not always, identified by

the use of words such as “plan”, “focus”, “future”, “outlook”,

“expect”, “anticipate”, “estimate”, “forecast”, “guidance”,

“budget”, “continue”, “targeting”, “may”, “will”, “could” and other

similar words and expressions.

By their nature, forward-looking statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward‐looking statements. Accordingly,

readers are cautioned not to place undue reliance on such

forward-looking statements. Although Birchcliff believes that the

expectations reflected in the forward-looking statements are

reasonable, there can be no assurance that such expectations will

prove to be correct and Birchcliff makes no representation that

actual results achieved will be the same in whole or in part as

those set out in the forward-looking statements.

In particular, this press release contains

forward‐looking statements relating to the following: that

Birchcliff’s disciplined capital budget of $240 million to $260

million for 2024 reflects its commitment to maintaining a strong

balance sheet, while focusing on sustainable shareholder returns

and the continued development of the Corporation’s world-class

asset base; that Birchcliff expects to bring 29 wells on production

in 2024 as part of its capital program, which utilizes its latest

wellbore and completions design and targets high rate-of-return

wells with strong capital efficiencies and attractive paybacks;

that Birchcliff is delaying the drilling of 13 wells until late Q2

and into Q3 2024, with these wells expected to come on production

in Q4 2024, aligned with the anticipated improvement in commodity

prices; that this deferral provides Birchcliff with the flexibility

to further adjust its 2024 capital program if necessary; other

statements regarding Birchcliff’s 2024 capital program and its

exploration, production and development activities and the timing

thereof (including: targeted product types; the expected timing for

wells to be drilled and brought on production; and that following

the drilling of the 01-10 pad, the drilling rigs will be shut down

until late Q2 2024); statements regarding Elmworth (including: the

construction of a proposed 100% owned and operated natural gas

processing plant in the area; and that Birchcliff may consider

investing capital in 2024 to continue to build, protect and

optimize its Elmworth Montney land position); and that Birchcliff

will provide an update on its capital program in conjunction with

the release of its Q1 2024 results on May 15, 2024.

With respect to the forward‐looking statements

contained in this press release, assumptions have been made

regarding, among other things: prevailing and future commodity

prices and differentials, exchange rates, interest rates, inflation

rates, royalty rates and tax rates; the state of the economy,

financial markets and the exploration, development and production

business; the political environment in which Birchcliff operates;

the regulatory framework regarding royalties, taxes, environmental,

climate change and other laws; the Corporation’s ability to comply

with existing and future laws; future cash flow, debt and dividend

levels; future operating, transportation, general and

administrative and other expenses; Birchcliff’s ability to access

capital and obtain financing on acceptable terms; the timing and

amount of capital expenditures and the sources of funding for

capital expenditures and other activities; the sufficiency of

budgeted capital expenditures to carry out planned operations; the

successful and timely implementation of capital projects and the

timing, location and extent of future drilling and other

operations; results of operations; Birchcliff’s ability to continue

to develop its assets and obtain the anticipated benefits

therefrom; the performance of existing and future wells; the impact

of competition on Birchcliff; the availability of, demand for and

cost of labour, services and materials; the ability to obtain any

necessary regulatory or other approvals in a timely manner; the

satisfaction by third parties of their obligations to Birchcliff;

the ability of Birchcliff to secure adequate processing and

transportation for its products; Birchcliff’s ability to

successfully market natural gas and liquids; the results of the

Corporation’s risk management and market diversification

activities; and Birchcliff’s natural gas market exposure.

With respect to Birchcliff’s forecast of capital

expenditures for 2024, such forecast assumes that the 2024 capital

program will be carried out as currently contemplated and excludes

any potential acquisitions, dispositions and the capitalized

portion of cash incentive payments that have not been approved by

the Corporation’s board of directors. The amount and allocation of

capital expenditures for exploration and development activities by

area and the number and types of wells to be drilled and brought on

production is dependent upon results achieved and is subject to

review and modification by management on an ongoing basis

throughout the year. Actual spending may vary due to a variety of

factors, including commodity prices, economic conditions, results

of operations and costs of labour, services and materials. With

respect to statements regarding future wells to be drilled and

brought on production, such statements assume: the continuing

validity of the geological and other technical interpretations

performed by Birchcliff’s technical staff, which indicate that

commercially economic volumes can be recovered from Birchcliff’s

lands as a result of drilling future wells; and that commodity

prices and general economic conditions will warrant proceeding with

the drilling of such wells.

Birchcliff’s actual results, performance or

achievements could differ materially from those anticipated in the

forward-looking statements as a result of both known and unknown

risks and uncertainties including, but not limited to: the risks

posed by pandemics (including COVID-19), epidemics and global

conflict (including the Russian invasion of Ukraine and the

Israel-Hamas conflict) and their impacts on supply and demand and

commodity prices; actions taken by OPEC and other major producers

of crude oil and the impact such actions may have on supply and

demand and commodity prices; the uncertainty of estimates and

projections relating to production, revenue, costs, expenses and

reserves; the risk that any of the Corporation’s material

assumptions prove to be materially inaccurate; general economic,

market and business conditions which will, among other things,

impact the demand for and market prices of Birchcliff’s products

and Birchcliff’s access to capital; volatility of crude oil and

natural gas prices; risks associated with increasing costs, whether

due to high inflation rates, supply chain disruptions or other

factors; fluctuations in exchange and interest rates; stock market

volatility; loss of market demand; an inability to access

sufficient capital from internal and external sources on terms

acceptable to the Corporation; risks associated with Birchcliff’s

credit facilities, including a failure to comply with covenants

under the agreement governing Birchcliff’s credit facilities and

the risk that the borrowing base limit may be redetermined;

fluctuations in the costs of borrowing; operational risks and

liabilities inherent in oil and natural gas operations; the

occurrence of unexpected events such as fires, severe weather,

explosions, blow-outs, equipment failures, transportation incidents

and other similar events; an inability to access sufficient water

or other fluids needed for operations; uncertainty that development

activities in connection with Birchcliff’s assets will be economic;

an inability to access or implement some or all of the technology

necessary to operate its assets and achieve expected future

results; the accuracy of estimates of reserves, future net revenue

and production levels; geological, technical, drilling,

construction and processing problems; uncertainty of geological and

technical data; horizontal drilling and completions techniques and

the failure of drilling results to meet expectations for reserves

or production; delays or changes in plans with respect to

exploration or development projects or capital expenditures; the

accuracy of cost estimates and variances in Birchcliff’s actual

costs and economic returns from those anticipated; changes to the

regulatory framework in the locations where the Corporation

operates; political uncertainty and uncertainty associated with

government policy changes; actions by government authorities; an

inability of the Corporation to comply with existing and future

laws and the cost of compliance with such laws; dependence on

facilities, gathering lines and pipelines; uncertainties and risks

associated with pipeline restrictions and outages to third-party

infrastructure that could cause disruptions to production; the lack

of available pipeline capacity and an inability to secure adequate

and cost-effective processing and transportation for Birchcliff’s

products; an inability to satisfy obligations under Birchcliff’s

firm marketing and transportation arrangements; shortages in

equipment and skilled personnel; the absence or loss of key

employees; competition for, among other things, capital,

undeveloped lands, equipment and skilled personnel; management of

Birchcliff’s growth; environmental and climate change risks, claims

and liabilities; potential litigation; default under or breach of

agreements by counterparties and potential enforceability issues in

contracts; claims by Indigenous peoples; the reassessment by taxing

or regulatory authorities of the Corporation’s prior transactions

and filings; unforeseen title defects; third-party claims regarding

the Corporation’s right to use technology and equipment;

uncertainties associated with the outcome of litigation or other

proceedings involving Birchcliff; uncertainties associated with

counterparty credit risk; risks associated with Birchcliff’s risk

management and market diversification activities; risks associated

with the declaration and payment of future dividends; the failure

to obtain any required approvals in a timely manner or at all; the

failure to complete or realize the anticipated benefits of

acquisitions and dispositions and the risk of unforeseen

difficulties in integrating acquired assets into Birchcliff’s

operations; negative public perception of the oil and natural gas

industry and fossil fuels; the Corporation’s reliance on hydraulic

fracturing; market competition, including from alternative energy

sources; changing demand for petroleum products; the availability

of insurance and the risk that certain losses may not be insured;

breaches or failure of information systems and security (including

risks associated with cyber-attacks); risks associated with the

ownership of the Corporation’s securities; and the accuracy of the

Corporation’s accounting estimates and judgments.

Readers are cautioned that the foregoing lists

of factors are not exhaustive. Additional information on these and

other risk factors that could affect results of operations,

financial performance or financial results are included in the AIF

under the heading “Risk Factors” and in other reports filed with

Canadian securities regulatory authorities.

This press release contains information that may

constitute future-oriented financial information or financial

outlook information (collectively, “FOFI”) about

Birchcliff’s prospective financial performance, financial position

or cash flows, all of which is subject to the same assumptions,

risk factors, limitations and qualifications as set forth above.

Readers are cautioned that the assumptions used in the preparation

of such information, although considered reasonable at the time of

preparation, may prove to be imprecise or inaccurate and, as such,

undue reliance should not be placed on FOFI. Birchcliff’s actual

results, performance and achievements could differ materially from

those expressed in, or implied by, FOFI. Birchcliff has included

FOFI in order to provide readers with a more complete perspective

on Birchcliff’s future operations and management’s current

expectations relating to Birchcliff’s future performance. Readers

are cautioned that such information may not be appropriate for

other purposes.

Management has included the above summary of

assumptions and risks related to forward-looking statements

provided in this press release in order to provide readers with a

more complete perspective on Birchcliff’s future operations and

management’s current expectations relating to Birchcliff’s future

performance. Readers are cautioned that this information may not be

appropriate for other purposes.

The forward-looking statements and FOFI

contained in this press release are expressly qualified by the

foregoing cautionary statements. The forward-looking statements and

FOFI contained herein are made as of the date of this press

release. Unless required by applicable laws, Birchcliff does not

undertake any obligation to publicly update or revise any

forward-looking statements or FOFI, whether as a result of new

information, future events or otherwise.

ABOUT BIRCHCLIFF:

Birchcliff is a dividend-paying, intermediate

oil and natural gas company based in Calgary, Alberta with

operations focused on the Montney/Doig Resource Play in Alberta.

Birchcliff’s common shares are listed for trading on the Toronto

Stock Exchange under the symbol “BIR”.

| For further

information, please contact: |

|

Birchcliff Energy Ltd.Suite 1000, 600 – 3rd Avenue

S.W. Calgary, Alberta T2P 0G5Telephone: (403) 261-6401Email:

info@birchcliffenergy.comwww.birchcliffenergy.com |

|

Chris Carlsen –

President and Chief Executive OfficerBruno Geremia

– Executive Vice President and Chief Financial Officer |

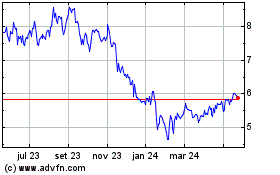

Birchcliff Energy (TSX:BIR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

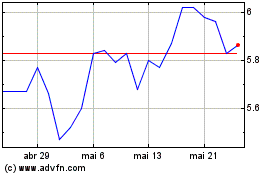

Birchcliff Energy (TSX:BIR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025