PDD Holdings Inc. (“PDD Holdings” or the “Company”) (NASDAQ: PDD),

today announced its unaudited financial results for the fourth

quarter ended and the fiscal year ended December 31, 2023.

Fourth Quarter 2023

Highlights

- Total revenues in

the quarter were RMB88,881.0 million (US$1 12,518.6 million),

an increase of 123% from RMB39,820.0 million in the same quarter of

2022.

- Operating profit

in the quarter was RMB22,395.0 million (US$3,154.3 million), an

increase of 146% from RMB9,113.7 million in the same quarter of

2022. Non-GAAP2 operating

profit in the quarter was RMB24,579.9 million (US$3,462.0

million), an increase of 112% from RMB11,600.1 million in the same

quarter of 2022.

- Net income attributable to

ordinary shareholders in the quarter was RMB23,280.3

million (US$3,279.0 million), an increase of 146% from RMB9,453.7

million in the same quarter of 2022. Non-GAAP net income

attributable to ordinary shareholders in the quarter was

RMB25,476.5 million (US$3,588.3 million), an increase of 110% from

RMB12,105.8 million in the same quarter of 2022.

“2023 represents a pivotal chapter in our

corporate history as we transition towards high-quality

development,” said Mr. Lei Chen, Chairman and Co-Chief Executive

Officer of PDD Holdings. “In 2024, we remain dedicated to further

improving consumer experiences, enhancing technology innovations,

and generating positive impacts in our communities.”

“In the fourth quarter, we saw growing demand

driven by encouraging consumer sentiment,” said Mr. Jiazhen Zhao,

Executive Director and Co-Chief Executive Officer of PDD Holdings.

“We will continue our high-quality development strategy, stay

dedicated to offer great value and exceptional service, and keep

building thriving communities that can benefit all.”

“In 2023, our R&D investment exceeded RMB10

billion for the second consecutive year, underscoring our

dedication to technology and agricultural advancements,” said Ms.

Jun Liu, VP of Finance of PDD Holdings. “Our focus remains on

creating lasting value through strategic initiatives with

sustainable and positive impacts.”

Fourth Quarter 2023 Unaudited Financial

Results

Total revenues were RMB88,881.0

million (US$12,518.6 million), an increase of 123% from RMB39,820.0

million in the same quarter of 2022. The increase was primarily due

to an increase in revenues from online marketing services and

transaction services.

- Revenues from online

marketing services and others were RMB48,675.6 million

(US$6,855.8 million), an increase of 57% from RMB31,023.4 million

in the same quarter of 2022.

- Revenues from transaction

services were RMB40,205.4 million (US$5,662.8 million), an

increase of 357% from RMB8,796.6 million in the same quarter of

2022.

Total costs of revenues were

RMB35,078.3 million (US$4,940.7 million), an increase of 293% from

RMB8,926.7 million in the same quarter of 2022. The increase mainly

came from the increased fulfilment fees, payment processing fees,

maintenance costs and call center expenses.

Total operating expenses were

RMB31,407.8 million (US$4,423.7 million), an increase of 44% from

RMB21,779.6 million in the same quarter of 2022. The increase was

primarily due to an increase in sales and marketing expenses.

- Sales and marketing

expenses were RMB26,638.5 million (US$3,752.0 million), an

increase of 50% from RMB17,732.4 million in the same quarter of

2022, mainly due to the increased spending in promotion and

advertising activities.

- General and administrative

expenses were RMB1,904.8 million (US$268.3 million),

compared with RMB1,640.5 million in the same quarter of 2022.

- Research and development

expenses were RMB2,864.4 million (US$403.4 million),

compared with RMB2,406.7 million in the same quarter of 2022.

Operating profit in the quarter

was RMB22,395.0 million (US$3,154.3 million), an increase of 146%

from RMB9,113.7 million in the same quarter of 2022.

Non-GAAP operating profit in the quarter was

RMB24,579.9 million (US$3,462.0 million), an increase of 112% from

RMB11,600.1 million in the same quarter of 2022.

Net income attributable to ordinary

shareholders in the quarter was RMB23,280.3 million

(US$3,279.0 million), an increase of 146% from RMB9,453.7 million

in the same quarter of 2022. Non-GAAP net income

attributable to ordinary shareholders in the quarter was

RMB25,476.5 million (US$3,588.3 million), an increase of 110% from

RMB12,105.8 million in the same quarter of 2022.

Basic earnings per ADS was

RMB17.00 (US$2.39) and diluted earnings per ADS was RMB15.83

(US$2.23), compared with basic earnings per ADS of RMB7.42 and

diluted earnings per ADS of RMB6.52 in the same quarter of 2022.

Non-GAAP diluted earnings per ADS was RMB17.32

(US$2.40), compared with RMB8.34 in the same quarter of 2022.

Net cash generated from operating

activities was RMB36,890.7 million (US$5,195.9 million),

compared with RMB26,550.3 million in the same quarter of 2022,

mainly due to the increase in net income.

Cash, cash equivalents and short-term

investments were RMB217.2 billion (US$30.6 billion) as of

December 31, 2023, compared with RMB149.4 billion as of December

31, 2022.

Fiscal Year 2023 Unaudited Financial

Results

Total revenues were

RMB247,639.2 million (US$34,879.3 million), representing an

increase of 90% from RMB130,557.6 million in 2022. The increase was

primarily due to an increase in revenues from online marketing

services and transaction services.

- Revenues from online

marketing services and others were RMB153,540.6 million

(US$21,625.7 million), representing an increase of 49% from

RMB102,931.1 million in 2022.

- Revenues from transaction

services were RMB94,098.7 million (US$13,253.5 million),

representing an increase of 241% from RMB27,626.5 million in

2022.

Total costs of revenues were

RMB91,723.6 million (US$12,919.0 million), an increase of 192% from

RMB31,462.3 million in 2022. The increase mainly came from the

increased fulfilment fees, payment processing fees, maintenance

costs and call center expenses.

Total operating expenses were

RMB97,216.9 million (US$13,692.7 million), an increase of 42% from

RMB68,693.4 million in 2022.

- Sales and marketing

expenses were RMB82,188.9 million (US$11,576.1 million),

an increase of 51% from RMB54,343.7 million in 2022, mainly due to

the increased spending in promotion and advertising

activities.

- General and administrative

expenses were RMB4,075.6 million (US$574.0 million),

compared with RMB3,964.9 million in 2022.

- Research and development

expenses were RMB10,952.4 million (US$1,542.6 million),

compared with RMB10,384.7 million in 2022.

Operating profit was

RMB58,698.8 million (US$8,267.5 million), an increase of 93% from

RMB30,401.9 million in 2022. Non-GAAP operating

profit was RMB65,777.6 million (US$9,264.6 million), an

increase of 73% from RMB38,120.3 million in 2022.

Net income attributable to ordinary

shareholders was RMB60,026.5 million (US$8,454.6 million),

an increase of 90% from RMB31,538.1 million in 2022.

Non-GAAP net income attributable to ordinary

shareholders was RMB67,899.3 million (US$9,563.4 million),

an increase of 72% from RMB39,529.7 million in 2022.

Basic earnings per ADS was

RMB44.33 (US$6.24) and diluted earnings per ADS was RMB41.15

(US$5.80), compared with basic earnings per ADS of RMB24.94 and

diluted earnings per ADS of RMB21.93 in 2022. Non-GAAP

diluted earnings per ADS was RMB46.51 (US$6.56), compared

with RMB27.45 in 2022.

Net cash generated from operating

activities was RMB94,162.5 million (US$13,262.5 million),

compared with RMB48,507.9 million in 2022, mainly due to the

increase in net income and the changes in working capitals.

Conference Call

The Company’s management will hold an earnings

conference call at 7:30 AM ET on March 20, 2024 (11:30 AM GMT and

7:30 PM HKT on the same day).

The conference call will be webcast live at

https://investor.pddholdings.com/investor-events. The webcast will

be available for replay at the same website following the

conclusion of the call.

Use of Non-GAAP Financial Measures

In evaluating the business, the Company

considers and uses non-GAAP measures, such as non-GAAP operating

profit, non-GAAP net income attributable to ordinary shareholders,

non-GAAP diluted earnings per ordinary share and non-GAAP diluted

earnings per ADS, as supplemental measures to review and assess

operating performance. The presentation of these non-GAAP financial

measures is not intended to be considered in isolation or as a

substitute for the financial information prepared and presented in

accordance with accounting principles generally accepted in the

United States of America (“U.S. GAAP”). The Company’s non-GAAP

financial measures exclude the impact of share-based compensation

expenses, fair value change of certain investments, and interest

expenses related to the convertible bonds’ amortization to face

value.

The Company presents these non-GAAP financial

measures because they are used by management to evaluate operating

performance and formulate business plans. The Company believes that

the non-GAAP financial measures help identify underlying trends in

its business by excluding the impact of share-based compensation

expenses, fair value change of certain investments, and interest

expenses related to the convertible bonds’ amortization to face

value, which are non-cash charges. The Company also believes that

the non-GAAP financial measures may provide further information

about the Company’s results of operations, and enhance the overall

understanding of the Company’s past performance and future

prospects.

The Company’s non-GAAP financial measures are

not defined under U.S. GAAP and are not presented in accordance

with U.S. GAAP. The non-GAAP financial measures have limitations as

analytical tools. These non-GAAP financial measures do not reflect

all items of income and expenses that affect the Company’s

operations and do not represent the residual cash flow available

for discretionary expenditures. Further, these non-GAAP measures

may differ from the non-GAAP information used by other companies,

including peer companies, and therefore their comparability may be

limited. The Company compensates for these limitations by

reconciling the non-GAAP financial measures to the nearest U.S.

GAAP performance measure, all of which should be considered when

evaluating performance. The Company encourages you to review the

Company’s financial information in its entirety and not rely on a

single financial measure.

For more information on the non-GAAP financial

measures, please see the table captioned “Reconciliation of

Non-GAAP Measures to The Most Directly Comparable GAAP Measures”

set forth at the end of this press release.Safe Harbor

Statements

This announcement contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “aims,”

“future,” “intends,” “plans,” “believes,” “estimates,” “confident,”

“potential,” “continue” or other similar expressions. Among other

things, the business outlook and quotations from management in this

announcement, as well as the Company’s strategic and operational

plans, contain forward-looking statements. The Company may also

make written or oral forward-looking statements in its periodic

reports to the U.S. Securities and Exchange Commission (the “SEC”),

in its annual report to shareholders, in press releases and other

written materials and in oral statements made by its officers,

directors or employees to third parties. Statements that are not

historical facts, including but not limited to statements about the

Company’s beliefs and expectations, are forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties. A number of factors could cause actual results to

differ materially from those contained in any forward-looking

statement, including but not limited to the following: the

Company’s growth strategies; its future business development,

results of operations and financial condition; its ability to

understand buyer needs and provide products and services to attract

and retain buyers; its ability to maintain and enhance the

recognition and reputation of its brand; its ability to rely on

merchants and third-party logistics service providers to provide

delivery services to buyers; its ability to maintain and improve

quality control policies and measures; its ability to establish and

maintain relationships with merchants; trends and competition in

the e-commerce markets globally and in the countries or regions

where the Company has operations; changes in its revenues and

certain cost or expense items; the expected growth of e-commerce

markets globally and in the countries or regions where the Company

has operations; developments in the relevant governmental policies

and regulations relating to the Company’s industry; and general

economic and business conditions globally and in the countries or

regions where the Company has operations; and assumptions

underlying or related to any of the foregoing. Further information

regarding these and other risks is included in the Company’s

filings with the SEC. All information provided in this press

release and in the attachments is as of the date of this press

release, and the Company undertakes no obligation to update any

forward-looking statement, except as required under applicable

law.

About PDD Holdings

PDD Holdings is a multinational commerce group

that owns and operates a portfolio of businesses. PDD Holdings aims

to bring more businesses and people into the digital economy so

that local communities and small businesses can benefit from the

increased productivity and new opportunities.

|

PDD HOLDINGS INC. CONDENSED CONSOLIDATED BALANCE

SHEETS(Amounts in thousands of Renminbi (“RMB”) and U.S. dollars

(“US$”)) |

| |

| |

|

As of |

| |

|

December31, 2022 |

|

December 31, 2023 |

|

|

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

|

(Unaudited) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

34,326,192 |

|

59,794,469 |

|

8,421,875 |

|

Restricted cash |

|

57,974,225 |

|

61,985,436 |

|

8,730,466 |

|

Receivables from online payment platforms |

|

587,696 |

|

3,914,117 |

|

551,292 |

|

Short-term investments |

|

115,112,554 |

|

157,415,365 |

|

22,171,490 |

|

Amounts due from related parties |

|

6,318,830 |

|

7,428,070 |

|

1,046,222 |

|

Prepayments and other current assets |

|

2,298,379 |

|

4,213,015 |

|

593,390 |

|

Total current assets |

|

216,617,876 |

|

294,750,472 |

|

41,514,735 |

|

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

Property, equipment and software, net |

|

1,044,847 |

|

979,597 |

|

137,973 |

|

Intangible assets |

|

134,002 |

|

21,148 |

|

2,979 |

|

Right-of-use assets |

|

1,416,081 |

|

4,104,889 |

|

578,162 |

|

Deferred tax assets |

|

1,045,030 |

|

270,738 |

|

38,133 |

|

Other non-current assets |

|

16,862,117 |

|

47,951,276 |

|

6,753,796 |

|

Total non-current assets |

|

20,502,077 |

|

53,327,648 |

|

7,511,043 |

|

|

|

|

|

|

|

|

|

Total Assets |

|

237,119,953 |

|

348,078,120 |

|

49,025,778 |

|

PDD HOLDINGS INC. CONDENSED CONSOLIDATED BALANCE

SHEETS(Amounts in thousands of Renminbi (“RMB”) and U.S. dollars

(“US$”)) |

|

|

|

|

|

As of |

| |

|

December31, 2022 |

|

December 31, 2023 |

|

|

|

RMB |

|

RMB |

|

US$ |

| |

|

|

|

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

| Current

liabilities |

|

|

|

|

|

|

| Amounts due to related

parties |

|

1,676,391 |

|

1,238,776 |

|

174,478 |

| Customer advances and deferred

revenues |

|

1,389,655 |

|

2,144,610 |

|

302,062 |

| Payable to merchants |

|

63,316,695 |

|

74,997,252 |

|

10,563,142 |

| Accrued expenses and other

liabilities |

|

20,960,723 |

|

55,351,399 |

|

7,796,081 |

| Merchant deposits |

|

15,058,229 |

|

16,878,746 |

|

2,377,322 |

| Convertible bonds, current

portion |

|

13,885,751 |

|

648,570 |

|

91,349 |

| Lease liabilities |

|

602,036 |

|

1,641,548 |

|

231,207 |

| Total current

liabilities |

|

116,889,480 |

|

152,900,901 |

|

21,535,641 |

| |

|

|

|

|

|

|

| Non-current

liabilities |

|

|

|

|

|

|

| Convertible bonds |

|

1,575,755 |

|

5,231,523 |

|

736,845 |

| Lease liabilities |

|

870,782 |

|

2,644,260 |

|

372,436 |

| Deferred tax liabilities |

|

13,025 |

|

59,829 |

|

8,427 |

| Total non-current

liabilities |

|

2,459,562 |

|

7,935,612 |

|

1,117,708 |

| |

|

|

|

|

|

|

| Total

Liabilities |

|

119,349,042 |

|

160,836,513 |

|

22,653,349 |

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Shareholders’

equity |

|

|

|

|

|

|

| Ordinary shares |

|

170 |

|

177 |

|

25 |

| Additional paid-in

capital |

|

99,250,468 |

|

107,293,091 |

|

15,111,916 |

| Statutory reserves |

|

5,000 |

|

105,982 |

|

14,927 |

| Accumulated other

comprehensive income |

|

3,322,238 |

|

4,723,760 |

|

665,328 |

| Retained earnings |

|

15,193,035 |

|

75,118,597 |

|

10,580,233 |

| Total Shareholders’

Equity |

|

117,770,911 |

|

187,241,607 |

|

26,372,429 |

| |

|

|

|

|

|

|

| Total Liabilities and

Shareholders’ Equity |

|

237,119,953 |

|

348,078,120 |

|

49,025,778 |

| |

|

|

|

|

|

|

|

PDD HOLDINGS INC.CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Amounts in thousands of RMB and US$) |

|

|

|

|

|

For the three months ended December 31, |

|

For the year ended December 31, |

| |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

| |

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

Revenues |

|

39,820,028 |

|

|

88,881,036 |

|

|

12,518,632 |

|

|

130,557,589 |

|

|

247,639,205 |

|

|

34,879,253 |

|

| Costs of revenues |

|

(8,926,705 |

) |

|

(35,078,272 |

) |

|

(4,940,671 |

) |

|

(31,462,298 |

) |

|

(91,723,577 |

) |

|

(12,918,996 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Sales and marketing

expenses |

|

(17,732,384 |

) |

|

(26,638,524 |

) |

|

(3,751,958 |

) |

|

(54,343,719 |

) |

|

(82,188,870 |

) |

|

(11,576,060 |

) |

| General and administrative

expenses |

|

(1,640,527 |

) |

|

(1,904,842 |

) |

|

(268,291 |

) |

|

(3,964,935 |

) |

|

(4,075,622 |

) |

|

(574,039 |

) |

| Research and development

expenses |

|

(2,406,677 |

) |

|

(2,864,430 |

) |

|

(403,447 |

) |

|

(10,384,716 |

) |

|

(10,952,374 |

) |

|

(1,542,610 |

) |

| Total operating

expenses |

|

(21,779,588 |

) |

|

(31,407,796 |

) |

|

(4,423,696 |

) |

|

(68,693,370 |

) |

|

(97,216,866 |

) |

|

(13,692,709 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

profit |

|

9,113,735 |

|

|

22,394,968 |

|

|

3,154,265 |

|

|

30,401,921 |

|

|

58,698,762 |

|

|

8,267,548 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest and investment

income, net |

|

1,351,698 |

|

|

4,359,384 |

|

|

614,006 |

|

|

3,997,100 |

|

|

10,238,080 |

|

|

1,442,003 |

|

| Interest expenses |

|

(12,221 |

) |

|

(8,155 |

) |

|

(1,149 |

) |

|

(51,655 |

) |

|

(43,987 |

) |

|

(6,195 |

) |

| Foreign exchange (loss)/

gain |

|

(23,819 |

) |

|

(198,819 |

) |

|

(28,003 |

) |

|

(149,710 |

) |

|

35,721 |

|

|

5,031 |

|

| Other income, net |

|

168,825 |

|

|

328,204 |

|

|

46,227 |

|

|

2,221,358 |

|

|

2,952,579 |

|

|

415,862 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Profit before income

tax and share of results of equity investees |

|

10,598,218 |

|

|

26,875,582 |

|

|

3,785,346 |

|

|

36,419,014 |

|

|

71,881,155 |

|

|

10,124,249 |

|

| Share of results of equity

investees |

|

(78,908 |

) |

|

(15,066 |

) |

|

(2,122 |

) |

|

(155,285 |

) |

|

(4,707 |

) |

|

(663 |

) |

| Income tax expenses |

|

(1,065,613 |

) |

|

(3,580,207 |

) |

|

(504,262 |

) |

|

(4,725,667 |

) |

|

(11,849,904 |

) |

|

(1,669,024 |

) |

| Net

income |

|

9,453,697 |

|

|

23,280,309 |

|

|

3,278,962 |

|

|

31,538,062 |

|

|

60,026,544 |

|

|

8,454,562 |

|

|

PDD HOLDINGS INC.CONDENSED CONSOLIDATED STATEMENTS OF

INCOME(Amounts in thousands of RMB and US$, except for per share

data) |

| |

|

|

|

|

| |

|

For the three months ended December 31, |

|

For the year ended December 31, |

| |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

|

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

(Unaudited) |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net

income |

|

9,453,697 |

|

23,280,309 |

|

3,278,962 |

|

31,538,062 |

|

60,026,544 |

|

8,454,562 |

| Net income

attributable to ordinary shareholders |

|

9,453,697 |

|

23,280,309 |

|

3,278,962 |

|

31,538,062 |

|

60,026,544 |

|

8,454,562 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per ordinary

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

-Basic |

|

1.85 |

|

4.25 |

|

0.60 |

|

6.24 |

|

11.08 |

|

1.56 |

|

-Diluted |

|

1.63 |

|

3.96 |

|

0.56 |

|

5.48 |

|

10.29 |

|

1.45 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per ADS (4

ordinary shares equals 1 ADS ): |

|

|

|

|

|

|

|

|

|

|

|

|

|

-Basic |

|

7.42 |

|

17.00 |

|

2.39 |

|

24.94 |

|

44.33 |

|

6.24 |

|

-Diluted |

|

6.52 |

|

15.83 |

|

2.23 |

|

21.93 |

|

41.15 |

|

5.80 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

number of outstanding ordinary shares (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

-Basic |

|

5,099,138 |

|

5,478,111 |

|

5,478,111 |

|

5,057,540 |

|

5,416,106 |

|

5,416,106 |

|

-Diluted |

|

5,809,212 |

|

5,882,980 |

|

5,882,980 |

|

5,761,291 |

|

5,839,630 |

|

5,839,630 |

|

PDD HOLDINGS INC.NOTES TO FINANCIAL INFORMATION(Amounts in

thousands of RMB and US$) |

| |

|

|

|

|

| |

|

For the three months ended December 31, |

|

For the year ended December 31, |

| |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

|

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

(Unaudited) |

|

(Unaudited) |

| Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

- Online marketing services and others |

|

31,023,400 |

|

48,675,618 |

|

6,855,817 |

|

102,931,095 |

|

153,540,553 |

|

21,625,735 |

|

- Transaction services |

|

8,796,628 |

|

40,205,418 |

|

5,662,815 |

|

27,626,494 |

|

94,098,652 |

|

13,253,518 |

| Total |

|

39,820,028 |

|

88,881,036 |

|

12,518,632 |

|

130,557,589 |

|

247,639,205 |

|

34,879,253 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PDD HOLDINGS INC.NOTES TO FINANCIAL INFORMATION(Amounts in

thousands of RMB and US$) |

| |

| |

|

For the three months ended December 31, |

|

For the year ended December 31, |

| |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

|

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

(Unaudited) |

|

(Unaudited) |

| Share-based

compensation expenses included in: |

|

|

|

|

|

|

|

|

|

|

|

|

| Costs of revenues |

|

11,777 |

|

46,404 |

|

6,536 |

|

33,788 |

|

132,470 |

|

18,658 |

| Sales and marketing

expenses |

|

535,550 |

|

411,048 |

|

57,895 |

|

2,158,676 |

|

2,354,097 |

|

331,568 |

| General and administrative

expenses |

|

1,279,760 |

|

1,230,358 |

|

173,292 |

|

3,004,327 |

|

2,289,272 |

|

322,437 |

| Research and development

expenses |

|

659,298 |

|

497,134 |

|

70,020 |

|

2,521,574 |

|

2,302,955 |

|

324,364 |

| Total |

|

2,486,385 |

|

2,184,944 |

|

307,743 |

|

7,718,365 |

|

7,078,794 |

|

997,027 |

|

PDD HOLDINGS INC. CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS (Amounts in thousands of RMB and US$) |

| |

| |

|

For the three months ended December 31, |

|

For the year ended December 31, |

| |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

| |

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

(Unaudited) |

|

(Unaudited) |

|

Net cash generated from operating activities |

|

26,550,262 |

|

|

36,890,671 |

|

|

5,195,942 |

|

|

48,507,860 |

|

|

94,162,531 |

|

|

13,262,515 |

|

|

Net cash used in investing activities |

|

(8,559,916 |

) |

|

(16,470,671 |

) |

|

(2,319,845 |

) |

|

(22,361,670 |

) |

|

(55,431,278 |

) |

|

(7,807,332 |

) |

| Net cash generated from/ (used

in) financing activities |

|

9,510 |

|

|

(8,968,297 |

) |

|

(1,263,158 |

) |

|

10,079 |

|

|

(8,960,626 |

) |

|

(1,262,078 |

) |

| Effect of exchange rate

changes on cash, cash equivalents and restricted cash |

|

(109,374 |

) |

|

(1,025,057 |

) |

|

(144,377 |

) |

|

100,177 |

|

|

(291,139 |

) |

|

(41,006 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Increase in cash, cash

equivalents and restricted cash |

|

17,890,482 |

|

|

10,426,646 |

|

|

1,468,562 |

|

|

26,256,446 |

|

|

29,479,488 |

|

|

4,152,099 |

|

| Cash, cash equivalents

and restricted cash at beginning of period/ year |

|

74,409,935 |

|

|

111,353,259 |

|

|

15,683,779 |

|

|

66,043,971 |

|

|

92,300,417 |

|

|

13,000,242 |

|

| Cash, cash equivalents

and restricted cash at end of period/ year |

|

92,300,417 |

|

|

121,779,905 |

|

|

17,152,341 |

|

|

92,300,417 |

|

|

121,779,905 |

|

|

17,152,341 |

|

|

PDD HOLDINGS INC.RECONCILIATION OF NON-GAAP MEASURES TO THE MOST

DIRECTLY COMPARABLE GAAP MEASURES(Amounts in thousands of RMB and

US$, except for per share data) |

| |

|

|

|

|

| |

|

For the three months ended December 31, |

|

For the year ended December 31, |

| |

|

2022 |

|

2023 |

|

2022 |

|

2023 |

|

|

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

| |

|

(Unaudited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

(Unaudited) |

|

(Unaudited) |

| Operating profit |

|

9,113,735 |

|

22,394,968 |

|

3,154,265 |

|

30,401,921 |

|

58,698,762 |

|

8,267,548 |

| Add: Share-based compensation

expenses |

|

2,486,385 |

|

2,184,944 |

|

307,743 |

|

7,718,365 |

|

7,078,794 |

|

997,027 |

| Non-GAAP operating

profit |

|

11,600,120 |

|

24,579,912 |

|

3,462,008 |

|

38,120,286 |

|

65,777,556 |

|

9,264,575 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to

ordinary shareholders |

|

9,453,697 |

|

23,280,309 |

|

3,278,962 |

|

31,538,062 |

|

60,026,544 |

|

8,454,562 |

| Add: Share-based compensation

expenses |

|

2,486,385 |

|

2,184,944 |

|

307,743 |

|

7,718,365 |

|

7,078,794 |

|

997,027 |

| Add: Interest expenses related

to convertible bonds’ amortization to face value |

|

12,221 |

|

8,155 |

|

1,149 |

|

51,655 |

|

43,987 |

|

6,195 |

| Add: Loss from fair value

change of certain investments |

|

153,467 |

|

3,052 |

|

430 |

|

221,640 |

|

749,967 |

|

105,631 |

| Non-GAAP net income

attributable to ordinary shareholders |

|

12,105,770 |

|

25,476,460 |

|

3,588,284 |

|

39,529,722 |

|

67,899,292 |

|

9,563,415 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP diluted

weighted-average number of ordinary shares outstanding (in

thousands) |

|

5,809,212 |

|

5,882,980 |

|

5,882,980 |

|

5,761,291 |

|

5,839,630 |

|

5,839,630 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per ordinary

share |

|

1.63 |

|

3.96 |

|

0.56 |

|

5.48 |

|

10.29 |

|

1.45 |

| Add: Non-GAAP adjustments to

earnings per ordinary share |

|

0.45 |

|

0.37 |

|

0.04 |

|

1.38 |

|

1.34 |

|

0.19 |

| Non-GAAP diluted earnings per

ordinary share |

|

2.08 |

|

4.33 |

|

0.60 |

|

6.86 |

|

11.63 |

|

1.64 |

| Non-GAAP diluted earnings per

ADS |

|

8.34 |

|

17.32 |

|

2.40 |

|

27.45 |

|

46.51 |

|

6.56 |

______________________

1 This announcement contains translations of

certain Renminbi (“RMB”) amounts into U.S. dollars (“US$”) at a

specified rate solely for the convenience of the reader. Unless

otherwise noted, the translation of RMB into US$ has been made at

RMB7.0999 to US$1.00, the noon buying rate in effect on December

29, 2023 as set forth in the H.10 Statistical Release of the

Federal Reserve Board.2 The Company’s non-GAAP financial measures

exclude share-based compensation expenses, fair value change of

certain investments, and interest expenses related to the

convertible bonds’ amortization to face value. See “Reconciliation

of Non-GAAP Measures to The Most Directly Comparable GAAP Measures”

set forth at the end of this press release.

For investor and media inquiries, please contact:

investor@pddholdings.com

media@pddholdings.com

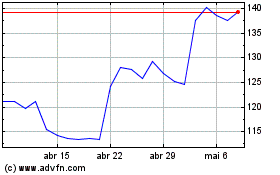

PDD (NASDAQ:PDD)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

PDD (NASDAQ:PDD)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024