ATS Corporation (TSX: ATS) (NYSE: ATS) (“ATS” or the “Company”) has

announced today that it has entered into an agreement with a fund

managed by Mason Capital Management LLC (the “Selling Shareholder”)

and Scotiabank (the “Underwriter”), acting as Sole Bookrunner,

pursuant to which the Underwriter has agreed to purchase, on a

bought deal basis, 3,500,000 common shares of ATS (the

“Shares”) from the Selling Shareholder, at a price of C$46.55 per

Share for gross proceeds to the Selling Shareholder of

approximately C$163 million (the “Offering”). The Offering is

expected to close on or about April 3, 2024 (the “Closing”).

The Selling Shareholder has granted the

Underwriter an over-allotment option, exercisable, in whole or in

part, at any time until and including 30 days following the Closing

of the Offering, to purchase up to an additional 147,000

Shares.

All of the shares in the Offering will be sold

by the Selling Shareholder. The Company will not receive any

proceeds from the sale of the Shares by the Selling

Shareholder.

The Selling Shareholder notes, “As a long-time

investor in ATS, Mason remains committed to the Company as

reflected by our significant ownership stake. We are proud of the

Company's growth and achievements to date. We look forward to our

ongoing partnership with the Company's management team, board and

other stakeholders to continue driving growth and increasing

shareholder value, and have full confidence in management and ATS’

value creation strategies.”

As part of the Offering, the Selling Shareholder

has agreed, subject to certain exceptions, not to sell any Shares

or other securities of ATS held by the Selling Shareholder as of

the Closing for a period of 180 days from the Closing.

The Shares are being offered for sale pursuant

to the Offering in all of the provinces and territories of Canada,

other than Quebec, by way of a prospectus supplement (the

“Prospectus Supplement”) to the Company’s short form base shelf

prospectus dated March 27, 2024 (the “Base Shelf Prospectus”). The

Company has filed a registration statement on Form F-10 (the

“Registration Statement”) (including the Base Shelf Prospectus) and

the Prospectus Supplement with the U.S. Securities and Exchange

Commission (the “SEC”) in accordance with the multi-jurisdictional

disclosure system established between Canada and the United States

for the Offering. Before you invest, you should read the Base Shelf

Prospectus, the Prospectus Supplement, when available, the

documents incorporated by reference therein, the Registration

Statement containing such documents and other documents the Company

has filed with the SEC, for more complete information about the

Company and the Offering. When available, these documents may be

accessed for free on the System for Electronic Document Analysis

and Retrieval ("SEDAR+") at www.sedarplus.com. You may also get

these documents for free by visiting the SEC’s Electronic Data

Gathering, Analysis and Retrieval (“EDGAR”) system on the SEC

website at www.sec.gov.

Alternatively, copies of the Registration

Statement, the Base Shelf Prospectus and the Prospectus Supplement

relating to the Offering may be obtained, when available, upon

request from Scotiabank at Attention: Equity Capital Markets, 40

Temperance Street, 6th Floor, Toronto, Ontario M5H 0B4, by

telephone at (416) 863-7704 or by email at

equityprospectus@scotiabank.com or from Scotia Capital (USA) Inc.,

250 Vesey Street, 24th Floor, New York, NY 10281, Attention: Equity

Capital Markets, by telephone at (212) 255-6854 or by email at

us.ecm@scotiabank.com.

No securities regulatory authority has either

approved or disapproved the contents of this news release. This

news release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any province, state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of any such

province, state or jurisdiction.

About ATS Corporation

ATS Corporation is an industry-leading

automation solutions provider to many of the world's most

successful companies. ATS uses its extensive knowledge base and

global capabilities in custom automation, repeat automation,

automation products and value-added solutions including

pre-automation and after-sales services, to address the

sophisticated manufacturing automation systems and service needs of

multinational customers in markets such as life sciences,

transportation, food & beverage, consumer products, and energy.

Founded in 1978, ATS employs over 7,000 people at more than 65

manufacturing facilities and over 85 offices in North America,

Europe, Southeast Asia and Oceania. The Company's common shares are

traded on the Toronto Stock Exchange and the New York Stock

Exchange under the symbol ATS.

Forward-looking Statements

This press release includes forward-looking

statements. Forward-looking statements include the Company’s

financial performance outlook and statements regarding goals,

beliefs, strategies, objectives, plans or current expectations,

including with respect to the Offering.

Forward-looking statements are inherently

subject to significant known and unknown risks, uncertainties, and

other factors that may cause the actual results, performance, or

achievements of ATS, or developments in ATS’ business or in its

industry, to differ materially from the anticipated results,

performance, achievements, or developments expressed or implied by

such forward-looking statements, including, without limitation, the

risk factors described in ATS’ annual information form for the

fiscal year ended March 31, 2023, which are available on SEDAR+ at

www.sedarplus.com and on EDGAR at www.sec.gov. ATS has attempted to

identify important factors that could cause actual results to

materially differ from current expectations, however, there may be

other factors that cause actual results to differ materially from

such expectations.

Forward-looking statements contained in this

press release are made as of the date hereof and are subject to

change. All forward-looking statements in this press release are

qualified by these cautionary statements. Except as required by

applicable law, ATS undertakes no obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

| For more information,

contact:David GalisonHead of Investor Relations ATS

Corporation730 Fountain Street NorthCambridge, ON, N3H 4R7(519)

653-6500 dgalison@atsautomation.com |

For general media

inquiries, contact:Matthew RobinsonDirector, Corporate

CommunicationsATS Corporation730 Fountain Street NorthCambridge,

ON, N3H 4R7(519) 653-6500 mrobinson@atsautomation.com |

SOURCE: ATS Corporation

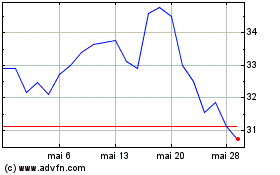

ATS (NYSE:ATS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

ATS (NYSE:ATS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024