IAMGOLD Corporation (“

IAMGOLD” or

the “

Company”) today announced that it has entered

into an agreement with a syndicate of underwriters led by National

Bank Financial Markets, BMO Capital Markets and RBC Capital Markets

pursuant to which they have agreed to purchase, on a bought deal

basis, 72,000,000 common shares of the Company at a price

of US$4.17 per common share (the “

Offering

Price”), for aggregate gross proceeds to the Company of

approximately US$300 million (the “

Offering”). The

underwriters will also have the option, exercisable in whole or in

part, at any time up to 30 days following the closing of the

Offering, to purchase up to an additional 10,800,000 common

shares at the Offering Price to cover over-allotments, if any. In

the event that the option is exercised in its entirety, the

aggregate gross proceeds of the Offering to the Company will be

approximately US$345 million.

Use of Proceeds

IAMGOLD intends to use the net proceeds of the

Offering, including the net proceeds from the Over-Allotment Option

should it be exercised, towards the repurchase of the 9.7% interest

(“Transferred Interest”) in the Côté Gold Mine

from Sumitomo Metal Mining Co. Ltd. (“Sumitomo”),

in order to return to its full 70% interest in the Côté Gold Mine.

The net proceeds of the Offering are to be deposited in an

interest-bearing account or used to repay drawn amounts under its

credit facility, in accordance with good cash management practices,

until the completion of the aforementioned repurchase which is

expected to be completed prior to the end of the calendar year.

Based on the current ramp-up schedule of the

Côté Gold Mine as well as prevailing market conditions which could

impact the amount of required expenditures during the ramp-up of

Côté Gold and operating cash flows from the Company's existing

operations, the Company believes that the net proceeds of the

Offering, combined with cash and cash equivalents at March 31,

2024, expected cash flows from operations, the expected proceeds

from the sale of the remaining Bambouk assets and the available

liquidity provided by the undrawn amounts under the credit

facility, will be sufficient to fund the repurchase of the

Transferred Interest.

The repurchase will increase the Company’s

exposure to the Côté Gold Mine and result in additional economic

benefits and cashflows and remove associated costs of holding the

option to repurchase the 9.7% interest.

Background on Côté Joint Venture &

Sumitomo Repurchase Agreement

The Côté Gold Mine is being operated through a

joint venture (the "Côté Gold UJV" or

"UJV") between IAMGOLD, as the operator, and

Sumitomo. The UJV is governed by the Côté Gold Joint Venture

Agreement.

IAMGOLD’s participation is 60.3% in the UJV and

has an option to repurchase a 9.7% interest from Sumitomo as part

of the JV Funding and Amending Agreement (the “JV Funding

Agreement”) announced on December 19, 2022. Under the

terms of the JV Funding Agreement the Company has the right to

repurchase its 9.7% interest (“Transferred

Interest”) in the Côté Gold Mine from Sumitomo on May 31st

and November 30th of every year from November 30, 2023 up to and

including November 30, 2026.

The JV Funding Agreement also provides that

until the earlier of the Company repurchasing the Transferred

Interest and November 30, 2026, the Company will pay a repurchase

option fee to Sumitomo equal to the three-month Secured Overnight

Financing Rate ("SOFR") plus 4% on the

contributions made by Sumitomo due to the Transferred Interest.

The purchase price for this repurchase is equal

to the initial funding of US$250 million contributed by Sumitomo

for the Transferred Interest, plus the incremental contributions

made, less incremental gold production received, by Sumitomo due to

its increased ownership up to achieving commercial production, plus

any accrued and unpaid amounts for the option fee payable

thereon.

In its financial statements, the Company

recognizes a financial liability for the Côté Gold Repurchase

Option equal to the current repurchase price (including the accrued

and unpaid amount for the option fee). As at March 31, 2024, this

financial liability was US $366.8 million.

Transaction Details

The Offering will be made in all provinces and

territories of Canada (other than Québec and Nunavut) by way of a

final prospectus supplement to the Company’s existing base shelf

prospectus dated September 1, 2022 (the “Base Shelf

Prospectus”) to be filed on or about May 22, 2024 (the

“Prospectus Supplement”) with the securities

regulatory authorities in each of the provinces and territories in

Canada. The Offering will be made in the United States pursuant to

a preliminary prospectus supplement and a final prospectus

supplement (together, the “U.S. Prospectus Supplements”), filed as

part of an effective registration statement on Form F-10 (the

“Registration Statement”), filed with the U.S.

Securities and Exchange Commission (“SEC”) under

the Canada/U.S. multi-jurisdictional disclosure system.

The Offering is scheduled to close on or about

May 24, 2024, and is subject to certain conditions including, but

not limited to, the receipt of all necessary approvals including

the approval of the Toronto Stock Exchange and the New York Stock

Exchange.

The Company has filed the Registration Statement

(including the Base Shelf Prospectus) with the SEC for the Offering

to which this communication relates. The Company has filed the Base

Shelf Prospectus with each of the securities regulatory authorities

in each of the provinces and territories in Canada. Before you

invest, you should read the Registration Statement, the Base Shelf

Prospectus, the U.S. Prospectus Supplements, the Prospectus

Supplement and the documents incorporated by reference therein and

other documents the Company has filed with the SEC and with the

Canadian securities regulators, as applicable, for more complete

information about the Company and the Offering. You may get

documents filed with the SEC for free on the SEC’s Electronic Data

Gathering, Analysis and Retrieval system at www.sec.gov. Access to

the Base Shelf Prospectus, the Prospectus Supplement and any

amendments to such documents are provided in accordance with

securities legislation relating to procedures for providing access

to a base shelf prospectus, a shelf prospectus supplement and any

amendment to such documents. The Base Shelf Prospectus is, and the

Prospectus Supplement will be (within two business days from the

date hereof), accessible on SEDAR+ at www.sedarplus.com or

www.sedarplus.ca. An electronic or paper copy of the Registration

Statement, the Base Shelf Prospectus, the U.S. Prospectus

Supplements, the Prospectus Supplement, and any amendment to such

documents may be obtained, without charge, in Canada, from National

Bank Financial Inc., by phone at (416) 869-8414 or by e-mail at

NBF-Syndication@bnc.ca; BMO Nesbitt Burns Inc., Brampton

Distribution Centre C/O The Data Group of Companies by phone at

905-791-3151 Ext 4312 or by email at torbramwarehouse@datagroup.ca;

and from RBC Dominion Securities Inc., by phone at 416-842-5349 or

by email at Distribution.RBCDS@rbccm.com by providing the contact

with an email address or address, as applicable, and in the United

States, from National Bank of Canada Financial Inc., 65 E. 55th

St., 8th Floor, New York, New York 10022; by phone at (416)

869-8414 or by e-mail at NBF-Syndication@bnc.ca; BMO Capital

Markets Corp., Attention: Equity Syndicate Department, 151 W 42nd

Street, 32nd Floor, New York, New York 10036, by phone at (800)

414-3627 or by email at bmoprospectus@bmo.com; and from RBC Capital

Markets, LLC, 200 Vesey Street, 8th Floor, New York, NY 10281-8098;

Attention: Equity Syndicate; by phone at 877-822-4089 or by email

at equityprospectus@rbccm.com by providing the contact with an

email address or address, as applicable.

This news release shall not constitute an offer

to sell or the solicitation of an offer to buy nor shall there be

any sale of the common shares in any jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of that

jurisdiction.

CAUTIONARY STATEMENT ON FORWARD-LOOKING

INFORMATION

This news release contains forward-looking

statements. All statements, other than of historical fact, that

address activities, events or developments that the Company

believes, expects or anticipates will or may occur in the future

(including, without limitation, statements with respect to the

timing of the completion and size of the Offering and the use of

the proceeds of the Offering) are forward-looking statements.

Forward-looking statements are generally identifiable by use of the

words “may”, “will”, “should”, “would”, “could”, “continue”,

“expect”, “budget”, “aim”, “can”, “focus”, “forecast”,

“anticipate”, “estimate”, “believe”, “intend”, “plan”, “schedule”,

“guidance”, “outlook”, “potential”, “seek”, “targets”, “cover”,

“strategy”, “during”, “ongoing”, “subject to”, “future”,

“objectives”, “opportunities”, “committed”, “prospective”, or

“project” or the negative of these words or other variations on

these words or comparable terminology. The Company cautions the

reader that forward-looking statements are necessarily based upon a

number of estimates and assumptions that, while considered

reasonable by management, are inherently subject to significant

business, financial, operational and other risks, uncertainties,

contingencies and other factors, including those described below,

which could cause actual results, performance or achievements of

the Company to be materially different from results, performance or

achievements expressed or implied by such forward-looking

statements and, as such, undue reliance must not be placed on them.

Forward-looking statements are also based on numerous material

factors and assumptions, including with respect to: the Company's

present and future business strategies; operations performance

within expected ranges; anticipated future production and cash

flows; the Company’s ability to repurchase the Transferred Interest

on its expected terms or at all; local and global economic

conditions and the environment in which the Company will operate in

the future; the price of precious metals, other minerals and key

commodities; projected mineral grades; international exchanges

rates; anticipated capital and operating costs; the availability

and timing of required governmental and other approvals for the

construction of the Company's projects.

Forward-looking statements are subject to a

number of risks and uncertainties, many of which are beyond the

Company’s ability to control or predict, that may cause the actual

results of the Company to differ materially from those discussed in

the forward-looking statements. Factors that could cause actual

results or events to differ materially from current expectations

include, among other things, without limitation, failure to meet

expected, estimated or planned gold production, unexpected

increases in all-in sustaining costs or other costs, unexpected

increases in capital expenditures and exploration expenditures,

variation in the mineral content within the material identified as

Mineral Resources and Mineral Reserves from that predicted, changes

in development or mining plans due to changes in logistical,

technical or other factors, the possibility that future exploration

results will not be consistent with the Company’s expectations,

changes in the Company’s relationship with Sumitomo, instability in

financial markets, currency exchange risk, changes in world gold

markets, cybersecurity risks, and other risks disclosed in

IAMGOLD’s most recent Form 40-F and Annual Information Form and in

IAMGOLD’s management’s discussion and analysis of financial

position and results of operations for the first quarter ended

March 31, 2024 on file with the SEC and Canadian securities

regulatory authorities. Any forward-looking statement speaks only

as of the date on which it is made and, except as may be required

by applicable securities laws, the Company disclaims any intent or

obligation to update any forward-looking statement.

About IAMGOLD

IAMGOLD is an intermediate gold producer and

developer based in Canada with operating mines in North America and

West Africa. The Company has commenced production at the

large-scale, long life Côté Gold Mine. In addition, the Company has

an established portfolio of early stage and advanced exploration

projects within high potential mining districts.

IAMGOLD is committed to maintaining its culture

of accountable mining through high standards of Environmental,

Social and Governance practices. IAMGOLD is listed on the New York

Stock Exchange (NYSE: IAG) and the Toronto Stock Exchange (TSX:

IMG).

IAMGOLD Contact Information

Graeme Jennings, Vice President, Investor

Relations Tel: 416 360 4743 | Mobile: 416 388

6883info@iamgold.com

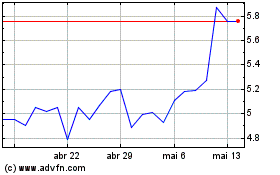

IAMGOLD (TSX:IMG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

IAMGOLD (TSX:IMG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024