ABN AMRO announces the acquisition of Hauck Aufhäuser Lampe, strengthening top 3 position in wealth management in Germany

27 Maio 2024 - 9:00PM

ABN AMRO announces the acquisition of Hauck Aufhäuser Lampe,

strengthening top 3 position in wealth management in Germany

ABN AMRO announces the acquisition of Hauck Aufhäuser

Lampe, strengthening top 3 position in wealth management in

Germany

Today, ABN AMRO announces it has reached

an agreement with Fosun International to acquire Hauck Aufhäuser

Lampe (“HAL”), a leading German private bank.

With the acquisition of HAL, Bethmann Bank – ABN

AMRO’s private banking arm in Germany – will become one of the

largest providers of banking services for wealthy private clients,

family businesses and institutional clients in Germany.

The subsidiaries of HAL that provide AIFM/Manco

and Fund Administration services will not be part of the

acquisition. These entities and HAL have closed a co-operation

agreement to continue offering the successful One-Stop-Shop service

offering in the market.

Robert Swaak, CEO of ABN AMRO said: "This is a

rare opportunity to add scale to our German activities. We are

delighted to have reached this agreement. HAL is a long-standing

leader in wealth management and has a very strong fit with ABN

AMRO, both culturally and geographically. We share the desire to

deliver the best individual solution to our clients. The proposed

acquisition will further strengthen our position and offer

employees of the combined group the opportunity to play a driving

role in the consolidating German market. I look forward to working

with the HAL team in realising our shared ambition."

Choy van der Hooft-Cheong, Chief Commercial

Officer Wealth Management at ABN AMRO said: "I am very pleased with

the acquisition of HAL and I am looking forward to meeting our new

colleagues soon. This acquisition will enable us to expand and

improve our current product and services offering to both

individual and business clients in the important German private

banking market."

Michael Bentlage, CEO of HAL, also commented on

the transaction: "I would like to pay tribute to our talented

teams, whose efforts have greatly supported the fantastic

development of the bank in the last 10 years. The proposed

combination with ABN AMRO Germany will strengthen further the

position in the market and gives the combined bank more

opportunities for growth through even broader products and services

to our clients."

Accelerating our strategy

The acquisition of HAL will strengthen our top 3

position in wealth management in Germany, the largest private

banking market in Europe, with combined Assets under Management of

around EUR 70 billion. HAL’s private banking activities and German

footprint are highly aligned and fit extremely well with ABN AMRO’s

existing client base and geographical coverage. The transaction

will strengthen our Wealth Management, Asset Management and

Entrepreneur & Enterprise (E&E) activities. In addition,

ABN AMRO enters the asset servicing business, offering custody

services, especially for illiquid assets. While Bethmann Bank is

one of the largest private equity providers for high net worth

clients, HAL has made a name for itself among institutional

investors and asset managers with its One Stop Shop, Depository

Solutions and Asset Servicing. This complementary offering will be

available to all clients in the future. Furthermore, HAL’s

Investment Banking services will join forces with ABN AMRO Germany

to complement our Corporate Banking ambition in Northwestern

Europe.

Both banks utilise an E&E proposition,

targeting companies and their founders through an integrated wealth

and corporate banking offering. HAL has built up significant

expertise and coverage of the German midcap sector, which will

complement our Corporate Banking ambition in Germany.

Acquisition of HAL’s asset-light, strong fee

income stream fits well with our strategy to broaden the non-NII

income base, as well as complementing our organic growth.

Strengthening financial profile

ABN AMRO has agreed to purchase HAL from Fosun

International for a consideration based on HAL’s shareholders

equity as of the closing date. ABN AMRO will pay EUR 672 million at

closing, which will be adjusted after closing based on audited

financials. The acquisition of HAL is expected to contribute around

EUR 26 billion in Assets under Management and EUR 2 billion in

loans. The combination of HAL and Bethmann Bank will create a

leading private bank in Germany. HAL has been consistently

profitable in past years and its capital is well above regulatory

minima. The overall impact of the acquisition on ABN AMRO’s CET1

ratio is expected to be approximately 45 bps based on Q1 2024

results and following carve-out of the fund administration

business. Around EUR 60 million of pre-tax run-rate cost synergies

are expected to be achieved over a three-year horizon net of

dyssynergies. Moreover, some upside from revenue synergies is

expected. The transaction is expected to have a pro-forma run-rate

return of equity (ROE) uplift of around 0.4% based on Q1 2024

results.

Expected timeline

Completion of the transaction is subject to

relevant regulatory approvals and is expected in Q1 2025.

| ABN AMRO

Press Office Jarco de Swart Senior Press

Officerpressrelations@nl.abnamro.com+31 20 6288900 |

ABN AMRO

Investor RelationsJohn Heijning Head of Investor Relations

investorrelations@nl.abnamro.com+31 20 6282282 |

This press release is published by ABN AMRO Bank N.V.

and contains inside information within the meaning of article 7 (1)

to (4) of Regulation (EU) No 596/2014 (Market Abuse

Regulation).

-------------------------------------------------------

Additional information, not for

publication:

A press conference will be held today, 28 May 2024 about this

transaction.Location: ABN AMRO Germany, Marienforum, Mainzer

Landstraße 1, 60329 Frankfurt/MainTime:12.00- 13.00 hrs.Hosted

by:

- Choy van der Hooft-Cheong, Chief Commercial Officer Wealth

Management, ABN AMRO Bank N.V.

- Hans Hanegraaf, Chief Country Officer ABN AMRO Germany

- Stefan Meine, Chief Commercial Officer Bethmann Bank

Language: German and English

You also have the opportunity to participate in the conference

online. Please use this Link.The password is: ABN_AMRO

ABN AMRO Media Relations and ABN AMRO Investor Relations

will be available for questions and more information about the

transaction from 07:00 CET.

- 20240528 ABN AMRO announces the acquisition of Hauck Aufhäuser

Lampe, strengthening top 3 position in wealth management in

Germany

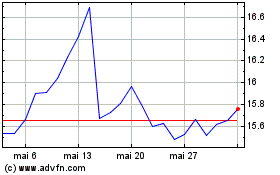

ABN AMRO Bank N.V (EU:ABN)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

ABN AMRO Bank N.V (EU:ABN)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025