Thesis Gold Inc. ("

Thesis" or the

"

Company") (TSXV: TAU | WKN: A3EP87 | OTCQX:

THSGF) is pleased to announce that the Company has entered into an

agreement with Clarus Securities Inc. as lead agent (the

“

Lead Agent”) and bookrunner (the

“

Bookrunner”), on behalf of a syndicate of agents

(collectively, the “

Agents”), in connection with a

marketed best-efforts equity private placement of up to

approximately C$20 million (the “

Offering”).

Dr. Ewan Webster, President and CEO, commented,

“This financing is a pivotal step in advancing our strategic

objectives. This funding will enable us to accelerate critical path

items, optimize our exploration and development activities, and

ultimately enhance the value of our Lawyers-Ranch Project. By

securing these additional resources, we are better positioned to

achieve our ambitious goals and deliver substantial value to our

shareholders.”

The Offering will consist of (i) up to 8,849,500

premium flow-through common shares (the “Premium FT Shares”) at a

price of $1.13 per Premium FT Share for gross proceeds of up to

$9,999,935; (ii) up to 5,555,600 flow-through common shares (the

“FT Shares”) at a price of $0.90 per FT Share for gross proceeds of

up to $5,000,040; and (iii) up to 6,666,600 non flow-through common

shares (the “Common Shares”) at a price of $0.75 per Common Share

for gross proceeds of up to $4,999,950. All securities issued

pursuant to the Offering will be subject to a four-month hold

period in accordance with the policies of the TSX Venture Exchange

and applicable securities laws. The Company does not expect that

the Offering will result in the creation of any new control person

of the Company. The Offering is subject to approval by the TSX

Venture Exchange.

In consideration of the services rendered by the

Agents in connection with the Offering, the Company has agreed to

pay to the Agents upon closing of the Offering (the

“Closing”) a cash commission equal to 6% of the

gross proceeds from the Offering (the "Agents'

Commission"). In addition, the Company agreed to issue to

the Agents on Closing, non-transferable compensation options (the

"Compensation Options") to acquire a number of

common shares of the Company which is equal to 6% of the aggregate

number of Premium FT Shares, FT Shares and Common Shares of the

Company sold under the Offering, at an exercise price equal to

$0.95 per share for a period of 18 months following the date of

Closing. The Company also agreed to pay all reasonable costs and

expenses of the Agents in connection with the Offering. The Company

intends to use the net proceeds of the Offering to fund exploration

and development expenditures at the Company’s Lawyers-Ranch Project

in British Columbia and for working capital purposes.

The gross proceeds from the sale of Premium FT

Shares and FT Shares will be used by the Company to incur eligible

“Canadian exploration expenses” that will qualify as “flow-through

mining expenditures” as such terms are defined in the Income Tax

Act (Canada) (the “Qualifying Expenditures”)

related to the Company’s projects in Canada. All Qualifying

Expenditures will be renounced in favour of the subscribers of the

Flow-Through Shares effective December 31, 2024. The net proceeds

from the sale of the shares will be used by the Company for working

capital and general corporate purposes.

The Offering is scheduled to close on or before

June 25, 2024, and is subject to certain conditions. The securities

to be issued under this Offering will be offered by way of private

placement exemptions in all the provinces of Canada and other

jurisdictions as may be agreed between the Company and the

Agents.

On behalf of the Board of DirectorsThesis Gold

Inc.

"Ewan Webster"

Ewan Webster Ph.D., P.Geo.President, CEO, and Director

About Thesis Gold Inc.

Thesis Gold is unlocking the combined potential

of the Lawyers-Ranch Gold-Silver Project in the Toodoggone mining

district of north central British Columbia, Canada. A 2022

Preliminary Economic Assessment for the Lawyers project alone

projected an open-pit mining operation yielding an average of

163,000 gold equivalent ounces annually over a 12-year span1. By

integrating the Ranch Project, the Company aims to enhance the

economics and bolster the overall project’s potential. Central to

this ambition was the expansive 2023 drill program, which continues

to define a high-grade out-of-pit Mineral Resource at Lawyers and

augment the near-surface high-grade deposits at Ranch. The project

now boasts a combined Measured & Indicated Mineral Resource of

4.0 Moz and an Inferred Mineral Resource of 727 koz, at respective

grades of 1.51 and 1.82 g/t AuEq2. The Company roadmap includes,

new metallurgical work (now delivered), a robust 2024 exploration

and drill program and a combined updated Preliminary Economic

Assessment slated for Q3 2024. Through these strategic moves,

Thesis Gold intends to elevate the Ranch-Lawyers Project to the

forefront of global precious metals ventures.

1Please refer to the Company’s Preliminary

Economic Assessment entitled, “Preliminary Economic Assessment,

Lawyers Gold-Silver Project” with an effective date of September 9,

2022 filed under the Company’s profile on SEDAR+ at

www.sedarplus.ca.

2Details of the mineral resource estimate will

be provided in a technical report with an expected effective date

of May 1, 2024, prepared in accordance with National Instrument

43-101—Standards of Disclosure for Mineral Projects (“NI

43-101”), which will be filed under the Company's SEDAR+

profile on or about June 13, 2024.

The scientific and technical content of this

news release has been reviewed and approved by Michael Dufresne,

M.Sc, P.Geol., P.Geo., a qualified person as defined by NI

43-101.

For further information or investor

relations inquiries, please contact:

Dave BurwellVice President Corporate

DevelopmentEmail: daveb@thesisgold.com Tel: 403-410-7907Toll Free:

1-888-221-0915

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this press release.

Cautionary Statement Regarding

Forward-Looking InformationThis press release contains

"forward-looking information" within the meaning of applicable

Canadian securities legislation. Forward-looking information

includes, without limitation, statements regarding the use of

proceeds from the Company's recently completed financings and the

future plans or prospects of the Company. Generally,

forward-looking information can be identified by the use of

forward-looking terminology such as "plans", "expects" or "does not

expect", "is expected", "budget", "scheduled", "estimates",

"forecasts", "intends", "anticipates" or "does not anticipate", or

"believes", or variations of such words and phrases or state that

certain actions, events or results "may", "could", "would", "might"

or "will be taken", "occur" or "be achieved". Forward-looking

statements are necessarily based upon a number of assumptions that,

while considered reasonable by management, are inherently subject

to business, market, and economic risks, uncertainties, and

contingencies that may cause actual results, performance, or

achievements to be materially different from those expressed or

implied by forward-looking statements. Although the Company has

attempted to identify important factors that could cause actual

results to differ materially from those contained in

forward-looking information, there may be other factors that cause

results not to be as anticipated, estimated, or intended. There can

be no assurance that such information will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking information. Other factors

which could materially affect such forward-looking information are

described in the risk factors in the Company's most recent annual

management's discussion and analysis, which is available on the

Company's profile on SEDAR+ at www.sedarplus.ca. The Company does

not undertake to update any forward-looking information, except in

accordance with applicable securities laws.

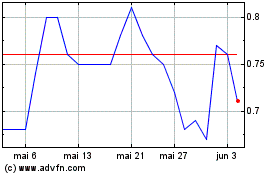

Common Stock (TSXV:TAU)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Common Stock (TSXV:TAU)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025