Oxbridge announces Strategic Partnership with Zoniqx a pioneer in digital asset management & a successful capital raise for Epsilon Cat Re

17 Julho 2024 - 9:15AM

Oxbridge Re Holdings Limited

(Nasdaq: OXBR) (“Oxbridge

Re”), together with its subsidiaries which is engaged in

the business of tokenized Real-World Assets (“RWAs”) initially in

the form of tokenized reinsurance securities, and reinsurance

solutions to property and casualty insurers in the Gulf Coast

region of the United States, announced that its Web3-focused

subsidiary, SurancePlus Inc. (“SurancePlus”), has signed a

partnership agreement with Zoniqx, a pioneer in digital asset

management who previously announced a partnership with Ripple and

PwC as part of their Tokenization & Digital Assets Scale

program. This collaboration aims to further expand the footprint of

SurancePlus as it revolutionizes the reinsurance industry by

leveraging blockchain technology to tokenize reinsurance contracts

and facilitate their deployment on blockchain ecosystems.

Additionally SurancePlus Inc., a subsidiary of

Oxbridge, completed a private placement of 287,705 Participation

Shares represented by the digital tokens, EpsilonCat Re under a

3-year Participation Share Investment Contract, raising

approximately $2.88 million. The offering is the second year of the

Cat Re series. The tokens have been issued on the Avalanche

blockchain and have a targeted 42% return.

SurancePlus previously reported a remarkable

49.11% return on its DeltaCat Re tokenized reinsurance security,

surpassing initial projections. This success underscores the

potential of digital innovations in reinsurance and sets a positive

precedent for future offerings like the EpsilonCat Re token.

The EpsilonCat Re tokens were offered to United

States (“US”) accredited investors under Rule 506(c) of US

Securities and Exchange Commission (SEC) Regulation D and to non-US

investors pursuant to Regulation S of the US Securities Act 1933,

as amended.

Jay Madhu, President and CEO of Oxbridge Re,

commented: "Last year, SurancePlus incorporated digital innovations

and Web3 insights, democratizing access to reinsurance as an

alternative investment. We believe we were the first publicly

traded company to raise capital for catastrophe reinsurance risks

through the sale of tokenized reinsurance securities. Building on

that success, we are delighted to have partnered with Zoniqx and we

believe their state-of-the-art tokenization and digital asset

lifecycle management offerings will also further enhance our RWA

Tokenization and Web-3 capabilities. We have also closed our 2024

EpsilonCat Re offering and are targeting returns of approximately

42%’’.

Co-Founder and CBO of Zoniqx, Sanjeev Birari,

said: "This collaboration with Oxbridge Re and SurancePlus marks a

significant milestone in advancing RWA tokenization. By leveraging

our state-of-the-art TALM system and the DyCIST protocol, we are

showcasing the reliability and versatility of our asset-agnostic

technology in the reinsurance industry. Partnering with a listed

NASDAQ company like Oxbridge Re speaks volumes about the robustness

of our solutions. This partnership enhances transparency, security,

and efficiency in the tokenization of reinsurance securities,

validating our vision and unlocking new opportunities for

investors. We're thrilled to bridge traditional finance with

digital ecosystems, reshaping the future of digital asset

management and driving accessibility in financial markets."

About Zoniqx

Zoniqx, ("Zoh-nicks") formerly known as Tassets,

stands as a beacon in financial technology from Silicon Valley,

specializing in Tokenization Platform as a Service (TPaaS). It

adeptly transforms Real World Assets into Digital Assets. The

cornerstone of its offerings, the Tokenized Asset Lifecycle

Management (TALM) solution, embraces the DyCIST - Dynamic Compliant

Interoperable Security Token Protocol built on ERC-7518 standard,

ensuring utmost security and scalability. Central to Zoniqx's

ecosystem is SecureConnect, a groundbreaking platform that

seamlessly bridges asset tokenization with institutional liquidity,

amplifying market reach and ensuring compliance. This synergy

positions Zoniqx not just as a provider but as an innovator at the

forefront of digital asset transformation. Zoniqx offers an

interoperable, compliant infrastructure for the RWA tokenization

market, enabling global liquidity and DeFi integration through its

end-to-end ecosystem of SDKs and APIs. Zoniqx pioneers on-chain,

fully automated RWA deployment on public, private, and hybrid

chains. To explore how Zoniqx can assist your organization in

unlocking the potential of tokenized assets or to discuss potential

partnerships and collaborations, please visit their contact

page.

About Oxbridge Re Holdings Limited

Oxbridge Re Holdings Limited (NASDAQ: OXBR,

OXBRW) (“Oxbridge Re”) is headquartered in the Cayman Islands.

The company offers tokenized Real-World Assets (“RWAs”) as

tokenized reinsurance securities and reinsurance business solutions

to property and casualty insurers, through its wholly owned

subsidiaries SurancePlus Inc., Oxbridge Re NS, and Oxbridge

Reinsurance Limited.

Insurance businesses in the Gulf Coast region of

the United States purchase property and casualty reinsurance

through our licensed reinsurers Oxbridge Reinsurance Limited and

Oxbridge Re NS.

Our Web3-focused subsidiary, SurancePlus Inc.

(“SurancePlus”), has developed the first “on-chain” reinsurance RWA

of its kind to be sponsored by a subsidiary of a publicly traded

company. By digitizing interests in reinsurance contracts as

on-chain RWAs, SurancePlus has democratized the availability of

reinsurance as an alternative investment to both U.S. and non-U.S.

investors.

Company Contact:Oxbridge Re Holdings LimitedJay

Madhu, CEO+1 345-749-7570jmadhu@oxbridgere.com

Forward-Looking Statements

This press release may contain forward-looking

statements made pursuant to the Private Securities Litigation

Reform Act of 1995. Words such as “anticipate,” “estimate,”

“expect,” “intend,” “plan,” “project” and other similar words and

expressions are intended to signify forward-looking statements.

Forward-looking statements are not guarantees of future results and

conditions but rather are subject to various risks and

uncertainties. A detailed discussion of risks and uncertainties

that could cause actual results and events to differ materially

from such forward-looking statements is included in the section

entitled “Risk Factors” contained in our Form 10-K filed with the

Securities and Exchange Commission (“SEC”) on 26th March 2024. The

occurrence of any of these risks and uncertainties could have a

material adverse effect on the Company’s business, financial

condition and results of operations. Any forward-looking statements

made in this press release speak only as of the date of this press

release and, except as required by law, the Company undertakes no

obligation to update any forward-looking statement contained in

this press release, even if the Company’s expectations or any

related events, conditions or circumstances change.

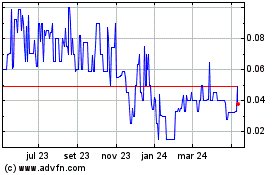

Oxbridge Re (NASDAQ:OXBRW)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

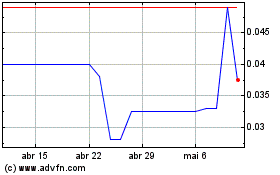

Oxbridge Re (NASDAQ:OXBRW)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025