El Pollo Loco Holdings, Inc. (Nasdaq: LOCO) today announced

financial results for the 13-week period ended

June 26, 2024.

Highlights for the second quarter ended

June 26, 2024 compared to the second quarter ended

June 28, 2023 were as follows:

- Total revenue was

$122.2 million compared to $121.5 million.

- System-wide comparable

restaurant sales(1)

increased by 4.5%.

- Income from

operations was $12.3 million compared to $10.9

million.

- Restaurant

contribution(1) was

$19.1 million, or 18.6% of company-operated restaurant revenue,

compared to $17.6 million, or 16.9% of company-operated restaurant

revenue.

- Net income was

$7.6 million, or $0.25 per diluted share, compared to net

income of $7.1 million, or $0.20 per diluted share.

- Adjusted net

income(1) was

$7.8 million, or $0.26 per diluted share, compared to

$8.0 million, or $0.23 per diluted share.

- Adjusted

EBITDA(1) was $17.2

million, compared to $16.6 million.

--------------------

|

(1) |

|

System-wide comparable restaurant sales, restaurant contribution,

adjusted net income and Adjusted EBITDA are not presented in

accordance with accounting principles generally accepted in the

United States of America (“GAAP”) and are defined below under

“Definitions of Non-GAAP and other Key Financial Measures” below. A

reconciliation of these non-GAAP financial measures to the most

directly comparable GAAP financial measure is included in the

accompanying financial data. See also “Non-GAAP Financial Measures”

below. |

|

|

|

|

Liz Williams, Chief Executive Officer of El

Pollo Loco Holdings, Inc., stated, “I am proud of the solid

performance we delivered in Q2, as demonstrated by 4.5% system-wide

comparable restaurant sales growth and company operated store

margins of 18.6%, a 170 basis-point improvement. Our iconic

Fire-Grilled Chicken, renewed focus in everyday value, and our

consistent operations have clearly resonated with our guests and

delivered exceptional results for the quarter. We are pleased with

our results for the quarter, and believe that there is still

significant potential for this beloved brand.”

Second Quarter 2024 Financial Results

Company-operated restaurant revenue in the

second quarter of 2024 decreased to $102.3 million, compared to

$103.9 million in the second quarter of 2023, mainly due to a $5.4

million decrease in revenue primarily from

the 19 company-operated restaurants sold by the Company

to existing franchisees during or subsequent to the second quarter

of 2023. This company-operated restaurant revenue decrease was

partially offset by $0.7 million of additional sales from

restaurants opened during or after the second quarter of 2023, as

well as an increase in company-operated comparable restaurant

revenue of $3.1 million, or 3.2%. The company-operated comparable

restaurant sales increase consisted of a 8.8% increase in average

check size due to increases in menu prices, partially offset by a

5.2% decrease in transactions.

Franchise revenue in the second quarter of 2024

increased 15.1% to $11.7 million. This increase was primarily due

to a franchise comparable restaurant sales increase of 5.3%, four

franchise-operated restaurant openings and 19 company-operated

restaurants sold by us to our existing franchisees in each case,

during or subsequent to the second quarter of 2023.

Income from operations in the second quarter of

2024 was $12.3 million, compared to $10.9 million in the second

quarter of 2023. Restaurant contribution was $19.1 million, or

18.6% of company-operated restaurant revenue, compared to $17.6

million, or 16.9% of company-operated restaurant revenue in the

second quarter of 2023. The increase in restaurant contribution as

a percentage of company-operated restaurant revenue was largely due

to higher menu prices combined with better operating

efficiencies.

General and administrative expenses in the

second quarter of 2024 was $11.8 million, compared to $11.1 million

in the second quarter of 2023. The increase was due

primarily to a $0.6 million increase in labor related

costs, primarily related to an increase in estimated management

bonus expense.

Net income for the second quarter of 2024

was $7.6 million, or $0.25 per diluted share,

compared to net income of $7.1 million, or $0.20 per

diluted share, in the second quarter of 2023. Adjusted net income

was $7.8 million, or $0.26 per diluted share, during the

second quarter of 2024, compared to $8.0 million,

or $0.23 per diluted share, during the second quarter of

2023.

As of June 26, 2024, after pay downs

of $7.0 million on its five-year senior-secured revolving credit

facility (the “2022 Revolver”), the Company’s outstanding debt

balance was $87.0 million with $10.5 million in cash and cash

equivalents. Additionally, during the second quarter, the Company

repurchased 203,483 shares of its common stock under its

Share Repurchase Program, using open market purchases, for total

consideration of approximately $2.0 million. Following

completion of these repurchases, approximately $4.2 million of the

Company’s common stock remained available for repurchase under the

Share Repurchase Program at June 26, 2024. In addition, on May 29,

2024, the Company repurchased 1,534,303 shares for a total purchase

price of $15.0 million under the Stock Repurchase Agreement with FS

Equity Partners V, L.P. and FS Affiliates V, L.P.

Subsequent Events

Subsequent to the quarter-end, the Company paid

down an additional $4.0 million on its 2022 Revolver

resulting in outstanding borrowings as of $83.0 million as of

August 1, 2024.

2024 Outlook

The Company is providing the following expectations for the

remainder of 2024:

- The opening of two new company-owned

restaurants and four to five new franchised restaurants.

- Capital spending between $24.0 – $26.0 million.

- G&A expense between $45.0 and $47.0 million excluding

one-time charges.

- Adjusted income tax rate of 27.5 –

28.0%.

Definitions of Non-GAAP and other Key Financial

Measures

System-Wide Sales are neither

required by, nor presented in accordance with GAAP. System-wide

sales are the sum of company-operated restaurant revenue and sales

from franchised restaurants. The Company’s total revenue in the

consolidated statements of income is limited to company-operated

restaurant revenue and franchise revenue from the Company’s

franchisees. Accordingly, system-wide sales should not be

considered in isolation or as a substitute for our results as

reported under GAAP. Management believes that the presentation of

system-wide sales provides useful information to investors, because

it is a measure that is widely used in the restaurant industry,

including by our management, to evaluate brand scale and market

penetration. System-wide sales does not include the 10 licensed

stores in the Philippines.

Company-Operated Restaurant

Revenue consists of sales of food and beverages in

company-operated restaurants net of promotional allowances,

employee meals, and other discounts. Company-operated restaurant

revenue in any period is directly influenced by the number of

operating weeks in such period, the number of open restaurants, and

comparable restaurant sales. Seasonal factors and the timing of

holidays cause our revenue to fluctuate from quarter to quarter.

Our revenue per restaurant is typically lower in the first and

fourth quarters due to reduced January and December transactions

and higher in the second and third quarters. As a result of

seasonality, our quarterly and annual results of operations and key

performance indicators such as company-operated restaurant revenue

and comparable restaurant sales may fluctuate.

Comparable Restaurant Sales

reflect year-over-year sales changes for comparable

company-operated, franchised and system-wide restaurants. A

restaurant enters our comparable restaurant base the first full

week after it has operated for 15 months. Comparable restaurant

sales exclude restaurants closed during the applicable period. At

June 26, 2024, there were 482 comparable restaurants, 168

company-operated and 314 franchised. Comparable restaurant sales

indicate the performance of existing restaurants, since new

restaurants are excluded. Comparable restaurant sales growth can be

generated by an increase in the number of meals sold and/or by

increases in the average check amount, resulting from a shift in

menu mix and/or higher prices resulting from new products or price

increases. Because other companies may calculate this measure

differently than we do, comparable restaurant sales as presented

herein may not be comparable to similarly titled measures reported

by other companies. Management believes that comparable restaurant

sales is a valuable metric for investors to evaluate the

performance of our store base, excluding the impact of new stores

and closed stores.

Restaurant Contribution and

Restaurant Contribution Margin are neither

required by, nor presented in accordance with, GAAP. Restaurant

contribution is defined as company-operated restaurant revenue less

company restaurant expenses, which includes food and paper cost,

labor and related expenses, and occupancy and other operating

expenses, where applicable. Restaurant contribution therefore

excludes franchise revenue, franchise advertising fee revenue and

franchise expenses as well as certain other costs, such as general

and administrative expenses, franchise expenses, depreciation and

amortization, asset impairment and closed-store reserve, loss on

disposal of assets and other costs that are considered

corporate-level expenses and are not considered normal operating

costs of our restaurants. Accordingly, restaurant contribution is

not indicative of overall Company results and does not accrue

directly to the benefit of stockholders because of the exclusion of

certain corporate-level expenses. Restaurant contribution margin is

defined as restaurant contribution as a percentage of net

company-operated restaurant revenue. Restaurant contribution and

restaurant contribution margin are supplemental measures of

operating performance of our restaurants, and our calculations

thereof may not be comparable to those reported by other companies.

Restaurant contribution and restaurant contribution margin have

limitations as analytical tools, and you should not consider them

in isolation, or superior to, or as substitutes for the analysis of

our results as reported under GAAP. Management uses restaurant

contribution and restaurant contribution margin as key metrics to

evaluate the profitability of incremental sales at our restaurants,

to evaluate our restaurant performance across periods, and to

evaluate our restaurant financial performance compared with our

competitors. Management believes that restaurant contribution and

restaurant contribution margin are important tools for investors,

because they are widely-used metrics within the restaurant industry

to evaluate restaurant-level productivity, efficiency, and

performance. Management further believes restaurant level operating

margin is useful to investors to highlight trends in our core

business that may not otherwise be apparent to investors when

relying solely on GAAP financial measures.

EBITDA and Adjusted

EBITDA are neither required by, nor presented in

accordance with, GAAP. EBITDA represents net income (loss) before

interest expense, provision (benefit) for income taxes,

depreciation, and amortization, and Adjusted EBITDA represents net

income (loss) before interest expense, provision (benefit) for

income taxes, depreciation, amortization, and items that we do not

consider representative of our ongoing operating performance, as

identified in the reconciliation table included under “Unaudited

Reconciliation of Net Income to EBITDA and Adjusted EBITDA” in the

accompanying financial tables at the end of this release. EBITDA

and Adjusted EBITDA as presented in this release are supplemental

measures of our performance that are neither required by, nor

presented in accordance with, GAAP. EBITDA and Adjusted EBITDA are

not measurements of our financial performance under GAAP and should

not be considered as alternatives to net income, operating income,

or any other performance measures derived in accordance with GAAP,

or as alternatives to cash flow from operating activities as a

measure of our liquidity. In addition, in evaluating EBITDA and

Adjusted EBITDA, you should be aware that in the future we will

incur expenses or charges such as those added back to calculate

EBITDA and Adjusted EBITDA. Our presentation of EBITDA and Adjusted

EBITDA should not be construed as an inference that our future

results will be unaffected by unusual or nonrecurring items.

EBITDA and Adjusted EBITDA have limitations as

analytical tools, and you should not consider them in isolation, or

as substitutes for analysis of our results as reported under GAAP.

Some of these limitations are (i) they do not reflect our cash

expenditures, or future requirements for capital expenditures or

contractual commitments, (ii) they do not reflect changes in, or

cash requirements for, our working capital needs, (iii) they do not

reflect the significant interest expense, or the cash requirements

necessary to service interest or principal payments, on our debt,

(iv) although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized will often have to be

replaced in the future, and EBITDA and Adjusted EBITDA do not

reflect any cash requirements for such replacements, (v) they do

not adjust for all non-cash income or expense items that are

reflected in our statements of cash flows, (vi) they do not reflect

the impact of earnings or charges resulting from matters we

consider not to be indicative of our on-going operations, and (vii)

other companies in our industry may calculate these measures

differently than we do, limiting their usefulness as comparative

measures. We compensate for these limitations by providing specific

information regarding the GAAP amounts excluded from such non-GAAP

financial measures. We further compensate for the limitations in

our use of non-GAAP financial measures by presenting comparable

GAAP measures more prominently.

Management believes that EBITDA and Adjusted

EBITDA facilitate operating performance comparisons from period to

period by isolating the effects of some items that vary from period

to period without any correlation to core operating performance or

that vary widely among similar companies. These potential

differences may be caused by variations in capital structures

(affecting interest expense), tax positions (such as the impact on

periods or companies of changes in effective tax rates or NOLs) and

the age and book depreciation of facilities and equipment

(affecting relative depreciation expense). We also present EBITDA

and Adjusted EBITDA because (i) management believes that these

measures are frequently used by securities analysts, investors and

other interested parties to evaluate companies in our industry,

(ii) management believes that investors will find these measures

useful in assessing our ability to service or incur indebtedness,

and (iii) we use EBITDA and Adjusted EBITDA internally for a number

of benchmarks, including to compare our performance to that of our

competitors.

Adjusted Net Income is

neither required by, nor presented in accordance with, GAAP.

Adjusted net income represents net income adjusted for

(i) costs (or gains) related to loss (or gains) on disposal of

assets or assets held for sale and asset impairment and closed

store costs reserves, (ii) amortization expense and other

estimate adjustments (whether expense or income) incurred on the

Tax Receivable Agreement (“TRA”) completed at the time of our IPO,

(iii) legal costs associated with securities class action

litigation, (iv) extraordinary legal settlement costs,

(v) insurance proceeds received related to securities class

action legal expenses and (vi) provision for income taxes at a

normalized tax rate of 28.2% and 27.7% for the thirteen and

twenty-six weeks ended June 26, 2024, respectively, and

26.9% for both the thirteen and twenty-six weeks ended

June 28, 2023, which reflects our estimated long-term

effective tax rate, including both federal and state income taxes

(excluding the impact of the income tax receivable agreement,

valuation allowance and other discrete items) and applied after

giving effect to the foregoing adjustments. Because other companies

may calculate these measures differently than we do, adjusted net

income as presented herein may not be comparable to similarly

titled measures reported by other companies. Management believes

adjusted net income is an important supplement to GAAP measures

that enhances the overall understanding of our operating

performance and long-term profitability, and enables investors to

more effectively compare the Company’s performance to prior and

future periods.

Conference Call

The Company will host a conference call to

discuss financial results for the second quarter of 2024 today at

4:30 PM Eastern Time. Liz Williams, Chief Executive Officer, and

Ira Fils, Chief Financial Officer, will host the call.

The conference call can be accessed live over

the phone by dialing 201-493-6780. A replay will be available after

the call and can be accessed by dialing 412-317-6671; the passcode

is 13747643. The replay will be available until Thursday, August

15, 2024. The conference call will also be webcast live from the

Company’s corporate website at investor.elpolloloco.com under the

“Events & Presentations” page. An archive of the webcast

will be available at the same location on the corporate website

shortly after the call has concluded.

About El Pollo Loco

El Pollo Loco (Nasdaq: LOCO) is the nation's

leading fire-grilled chicken restaurant known for its craveable,

flavorful, and better-for-you offerings. Our menu features

innovative meals with Mexican flavors all made in our restaurants

daily using quality ingredients. At El Pollo Loco, inclusivity is

at the heart of our culture. Our community of over 4,000 employees

reflects our commitment to creating a workplace where everyone has

a seat at our table. Since 1980, El Pollo Loco has

successfully expanded its presence, operating more than 495

company-owned and franchised restaurants across seven U.S. states:

Arizona, California, Colorado, Nevada, Texas, Utah and

Louisiana. The Company has also extended its footprint

internationally, with ten licensed restaurant locations in the

Philippines. For more information or to place an order, visit

the Loco Rewards APP or ElPolloLoco.com. Follow us on

Instagram, TikTok, Facebook, or X.

Forward-Looking Statements

This press release contains forward-looking

statements that are subject to risks and uncertainties. All

statements other than statements of historical fact included in

this press release are forward-looking statements. Forward-looking

statements discuss our current expectations and projections

relating to our financial condition, results of operations, plans,

objectives, future performance and business. You can identify

forward-looking statements because they do not relate strictly to

historical or current facts. These statements may include words

such as “aim,” “anticipate,” “believe,” “estimate,” “expect,”

“forecast,” “outlook,” “potential,” “project,” “projection,”

“plan,” “intend,” “seek,” “may,” “could,” “would,” “will,”

“should,” “can,” “can have,” “likely,” the negatives thereof and

other words and terms of similar meaning in connection with any

discussion of the timing or nature of future operating or financial

performance or other events. They appear in a number of places

throughout this press release and include our 2024 outlook and

statements regarding the expected results of our initiatives and

our ability to capture opportunities and attract franchisees, as

well as our ongoing business intentions, beliefs or current

expectations concerning, among other things, our results of

operations, financial condition, liquidity, prospects, growth,

strategies and the industry in which we operate. All

forward-looking statements are subject to risks and uncertainties

that could cause actual results to differ materially from those

that we expected.

While we believe that our assumptions are

reasonable, we caution that it is very difficult to predict the

impact of known factors, and it is impossible for us to anticipate

all factors that could affect our actual results. All

forward-looking statements are expressly qualified in their

entirety by these cautionary statements. You should evaluate all

forward-looking statements made in this press release in the

context of the risks and uncertainties that could cause outcomes to

differ materially from our expectations. These factors include, but

are not limited to: global economic or other business conditions

that may affect the desire or ability of our customers to purchase

our products such as inflationary pressures, high unemployment

levels, increases in gas prices, and declines in median income

growth, consumer confidence and consumer discretionary spending;

our ability to open new restaurants in new and existing markets,

including difficulty in finding sites and in negotiating acceptable

leases; our ability to compete successfully with other

quick-service and fast casual restaurants; our vulnerability to

changes in political and economic conditions and consumer

preferences; our ability to attract, develop, assimilate, and

retain employees; our vulnerability to conditions in the greater

Los Angeles area and to natural disasters given the geographic

concentration and real estate intensive nature of our business; the

possibility that we may continue to incur significant impairment of

certain of our assets, in particular in our new markets; changes in

food and supply costs, especially for chicken, labor, construction

and utilities; social media and negative publicity, whether or not

valid, and our ability to respond to and effectively manage the

accelerated impact of social media; our ability to continue to

expand our digital business, delivery orders and catering; concerns

about food safety and quality and about food-borne illness;

dependence on frequent and timely deliveries of food and supplies;

our ability to service our level of indebtedness; uncertainty

related to the success of our marketing programs, new menu items,

advertising campaigns and restaurant designs and remodels; adverse

changes in the economic environment, including inflation and

increased labor and supply costs, which may affect our franchisees,

with adverse consequences to us; the impact of federal, state and

local labor law governing our relationships with our employees,

including minimum wage laws, minimum standards for fast food

workers or other similar laws; the impacts of the uncertainty

regarding pandemics, epidemics or infectious disease outbreaks

(such as the recent COVID-19 pandemic) on our company, our

employees, our customers, our partners, our industry and the

economy as a whole, as well as our franchisees’ ability to operate

their individual restaurants without disruption; our limited

control over our franchisees and potential deterioration of our

relations with existing or potential franchisees; potential

exposure to unexpected costs and losses from our self-insurance

programs; potential obligations under long-term and non-cancelable

leases, and our ability to renew leases at the end of their terms;

the possibility that Delaware law, our organizational documents,

our shareholder rights agreement, and our existing and future debt

agreements may impede or discourage a takeover; the impact of

shareholder activism on our expenses, business and stock price; the

impact of any failure of our information technology system or any

breach of our network security; the impact of any security breaches

on our ability to protect our customers’ payment method data or

personal information; our ability to enforce and maintain our

trademarks and protect our other proprietary intellectual property;

risks related to government regulation and litigation, including

employment and labor laws and other risks set forth in our filings

with the Securities and Exchange Commission from time to time,

including under Item 1A, Risk Factors in our annual report on

Form 10-K for the year ended December 27, 2023,

as such risk factors may be amended, supplemented or superseded

from time to time by other reports we file with the Securities and

Exchange Commission, all of which are or will be available online

at www.sec.gov.

We caution you that the important factors

referenced above may not contain all of the factors that are

important to you. In addition, we cannot assure you that we will

realize the results or developments we expect or anticipate or,

even if substantially realized, that they will result in the

consequences we anticipate or affect us or our operations in the

ways that we expect. The forward-looking statements included in

this press release are made only as of the date hereof. We

undertake no obligation to publicly update or revise any

forward-looking statement as a result of new information, future

events or otherwise, except as required by law. If we do update one

or more forward-looking statements, no inference should be made

that we will make additional updates with respect to those or other

forward-looking statements. We qualify all of our forward-looking

statements by these cautionary statements.

Non-GAAP Financial Measures

To supplement our consolidated financial

statements, which are prepared and presented in accordance with

GAAP, we use the following non-GAAP financial measures that are

supplemental measures of the operating performance of our business

and restaurants: System-wide sales, Restaurant contribution and

restaurant contribution margin, EBITDA and Adjusted EBITDA, and

Adjusted net income. Our calculations of these non-GAAP financial

measures may not be comparable to those reported by other

companies. These measures have limitations as analytical tools, and

are not intended to be considered in isolation or as substitutes

for, or superior to, financial measures prepared and presented in

accordance with GAAP. We use non-GAAP financial measures for

financial and operational decision-making and as a means to

evaluate period-to-period comparisons and to evaluate our

restaurants’ financial performance against our competitors’

performance. We believe these measures they provide useful

information about our operating results, enhance understanding of

past performance and future prospects, and allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision making. These non-GAAP financial

measures may also assist investors in evaluating our business and

performance relative to industry peers and provide greater

transparency with respect to the Company’s financial condition and

results of operation.

Additional information about these non-GAAP

financial measures (System-wide sales, Restaurant contribution and

restaurant contribution margin, EBITDA and Adjusted EBITDA, and

Adjusted net income) is provided under “Definitions of Non-GAAP and

other Key Financial Measures” above. For a reconciliations of each

of these non-GAAP financial measures to the most directly

comparable GAAP financial measure, see “Unaudited Reconciliation of

System-Wide Sales to Company-Operated Restaurant Revenue and Total

Revenue,” “Unaudited Reconciliation of Net Income to EBITDA and

Adjusted EBITDA,” “Unaudited Reconciliation of Net Income to

Adjusted Net Income” and “Unaudited Reconciliation of Income from

Operations to Restaurant Contribution” in the accompanying

financial tables at the end of this press release.

Investor Contact:

Jeff PriesterICRInvestors@elpolloloco.com

Media Contact:

Glenda Vaquerano The ID

AgencyEPLmedia@theidagency.com

| |

|

EL POLLO LOCO HOLDINGS, INC.UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF INCOME(in

thousands, except share data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

Twenty-Six Weeks Ended |

| |

|

June 26, 2024 |

|

June 28, 2023 |

|

June 26, 2024 |

|

June 28, 2023 |

| |

|

$ |

|

% |

|

$ |

|

% |

|

$ |

|

% |

|

$ |

|

% |

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company-operated restaurant revenue |

|

$ |

102,307 |

|

83.7 |

|

$ |

103,901 |

|

|

85.5 |

|

|

$ |

199,460 |

|

|

83.7 |

|

|

$ |

201,774 |

|

|

85.5 |

|

| Franchise revenue |

|

|

11,651 |

|

9.5 |

|

|

10,119 |

|

|

8.3 |

|

|

|

22,999 |

|

|

9.7 |

|

|

|

19,791 |

|

|

8.4 |

|

| Franchise advertising fee

revenue |

|

|

8,218 |

|

6.8 |

|

|

7,472 |

|

|

6.2 |

|

|

|

15,870 |

|

|

6.6 |

|

|

|

14,453 |

|

|

6.1 |

|

|

Total revenue |

|

|

122,176 |

|

100.0 |

|

|

121,492 |

|

|

100.0 |

|

|

|

238,329 |

|

|

100.0 |

|

|

|

236,018 |

|

|

100.0 |

|

| Cost of

operations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Food and paper cost(1) |

|

|

25,731 |

|

25.2 |

|

|

28,474 |

|

|

27.4 |

|

|

|

51,350 |

|

|

25.7 |

|

|

|

55,376 |

|

|

27.4 |

|

|

Labor and related expenses(1) |

|

|

32,868 |

|

32.1 |

|

|

32,277 |

|

|

31.1 |

|

|

|

63,448 |

|

|

31.8 |

|

|

|

63,818 |

|

|

31.6 |

|

|

Occupancy and other operating expenses(1) |

|

|

24,656 |

|

24.1 |

|

|

25,576 |

|

|

24.6 |

|

|

|

48,521 |

|

|

24.3 |

|

|

|

50,462 |

|

|

25.0 |

|

|

Gain on recovery of insurance proceeds, lost profits, net(1) |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

(151 |

) |

|

(0.1 |

) |

|

Company restaurant

expenses(1) |

|

|

83,255 |

|

81.4 |

|

|

86,327 |

|

|

83.1 |

|

|

|

163,319 |

|

|

81.8 |

|

|

|

169,505 |

|

|

83.9 |

|

| General and administrative

expenses |

|

|

11,787 |

|

9.6 |

|

|

11,108 |

|

|

9.1 |

|

|

|

23,712 |

|

|

9.9 |

|

|

|

22,307 |

|

|

9.5 |

|

| Franchise expenses |

|

|

10,871 |

|

8.9 |

|

|

9,492 |

|

|

7.8 |

|

|

|

21,473 |

|

|

9.0 |

|

|

|

18,524 |

|

|

7.8 |

|

| Depreciation and

amortization |

|

|

3,870 |

|

3.2 |

|

|

3,694 |

|

|

3.0 |

|

|

|

7,721 |

|

|

3.2 |

|

|

|

7,331 |

|

|

3.1 |

|

| Loss (gain) on disposal of

assets |

|

|

63 |

|

0.1 |

|

|

(80 |

) |

|

(0.1 |

) |

|

|

104 |

|

|

0.0 |

|

|

|

(50 |

) |

|

(0.0 |

) |

| Gain on recovery of insurance

proceeds, property, equipment and expenses |

|

|

— |

|

— |

|

|

— |

|

|

— |

|

|

|

(41 |

) |

|

(0.0 |

) |

|

|

(242 |

) |

|

(0.1 |

) |

| Loss (gain) on disposition of

restaurants |

|

|

7 |

|

0.0 |

|

|

25 |

|

|

0.0 |

|

|

|

7 |

|

|

0.0 |

|

|

|

(111 |

) |

|

(0.0 |

) |

| Impairment and closed-store

reserves |

|

|

5 |

|

0.0 |

|

|

38 |

|

|

0.0 |

|

|

|

37 |

|

|

0.0 |

|

|

|

115 |

|

|

0.0 |

|

|

Total expenses |

|

|

109,858 |

|

89.9 |

|

|

110,604 |

|

|

91.0 |

|

|

|

216,332 |

|

|

90.8 |

|

|

|

217,379 |

|

|

92.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from

operations |

|

|

12,318 |

|

10.1 |

|

|

10,888 |

|

|

9.0 |

|

|

|

21,997 |

|

|

9.2 |

|

|

|

18,639 |

|

|

7.9 |

|

| Interest expense, net |

|

|

1,527 |

|

1.2 |

|

|

976 |

|

|

0.8 |

|

|

|

3,091 |

|

|

1.3 |

|

|

|

1,980 |

|

|

0.8 |

|

| Income tax receivable agreement

income |

|

|

— |

|

— |

|

|

121 |

|

|

0.1 |

|

|

|

— |

|

|

— |

|

|

|

(1 |

) |

|

(0.0 |

) |

| Income before provision

for income taxes |

|

|

10,791 |

|

8.9 |

|

|

9,791 |

|

|

8.1 |

|

|

|

18,906 |

|

|

7.9 |

|

|

|

16,660 |

|

|

7.1 |

|

| Provision for income taxes |

|

|

3,158 |

|

2.6 |

|

|

2,735 |

|

|

2.3 |

|

|

|

5,361 |

|

|

2.1 |

|

|

|

4,686 |

|

|

2.0 |

|

| Net income |

|

$ |

7,633 |

|

6.3 |

|

$ |

7,056 |

|

|

5.8 |

|

|

$ |

13,545 |

|

|

5.7 |

|

|

$ |

11,974 |

|

|

5.1 |

|

| Net income per

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.25 |

|

|

|

$ |

0.20 |

|

|

|

|

$ |

0.44 |

|

|

|

|

$ |

0.33 |

|

|

|

| Diluted |

|

$ |

0.25 |

|

|

|

$ |

0.20 |

|

|

|

|

$ |

0.44 |

|

|

|

|

$ |

0.33 |

|

|

|

| Weighted average shares

used in computing net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

30,240,170 |

|

|

|

|

35,433,414 |

|

|

|

|

|

30,508,970 |

|

|

|

|

|

35,833,759 |

|

|

|

| Diluted |

|

|

30,378,048 |

|

|

|

|

35,534,104 |

|

|

|

|

|

30,661,830 |

|

|

|

|

|

36,018,288 |

|

|

|

______________________

|

(1) |

|

Percentages for line items relating to cost of operations and

company restaurant expenses are calculated with company-operated

restaurant revenue as the denominator. All other percentages

use total revenue. |

|

|

|

|

| |

|

EL POLLO LOCO HOLDINGS, INC.UNAUDITED

SELECTED CONDENSED CONSOLIDATED BALANCE SHEETS AND SELECTED

OPERATING DATA(dollar amounts in

thousands) |

|

|

|

|

|

|

|

|

|

|

| |

|

As of |

|

| |

|

June 26, 2024 |

|

|

December 27, 2023 |

|

| Selected Balance Sheet

Data: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

10,465 |

|

|

$ |

7,288 |

|

| Total assets |

|

|

593,846 |

|

|

|

592,301 |

|

| Total debt |

|

|

87,000 |

|

|

|

84,000 |

|

| Total liabilities |

|

|

345,268 |

|

|

|

341,605 |

|

| Total stockholders’ equity |

|

|

248,578 |

|

|

|

250,696 |

|

| |

|

Twenty-Six Weeks Ended |

|

| |

|

June 26, 2024 |

|

|

June 28, 2023 |

|

|

Selected Operating Data: |

|

|

|

|

|

|

|

|

| Company-operated restaurants at

end of period |

|

|

171 |

|

|

|

188 |

|

| Franchised restaurants at end of

period |

|

|

324 |

|

|

|

304 |

|

| Company-operated: |

|

|

|

|

|

|

|

|

|

Comparable restaurant sales growth |

|

|

3.4 |

% |

|

|

0.5 |

% |

|

Restaurants in the comparable base |

|

|

168 |

|

|

|

182 |

|

|

|

|

|

|

|

|

|

|

|

| |

|

EL POLLO LOCO HOLDINGS, INC.UNAUDITED

RESTAURANT COUNTS AT THE BEGINNING AND END OF EACH OF THE LAST

THREE FISCAL YEARS AND THE TWENTY-SIX WEEKS ENDED JUNE 26,

2024 |

| |

|

|

|

|

|

|

|

|

| |

|

Twenty-Six Weeks Ended |

|

Fiscal Year Ended |

| |

|

June 26, 2024 |

|

2023 |

|

2022 |

|

2021 |

| Company-operated

restaurant

activity(1): |

|

|

|

|

|

|

|

|

|

Beginning of period |

|

172 |

|

|

188 |

|

|

189 |

|

|

196 |

|

| Openings |

|

— |

|

|

2 |

|

|

4 |

|

|

2 |

|

| Restaurant sale to

franchisee |

|

(1 |

) |

|

(18 |

) |

|

(3 |

) |

|

(8 |

) |

| Closures |

|

— |

|

|

— |

|

|

(2 |

) |

|

(1 |

) |

| Restaurants at end of

period |

|

171 |

|

|

172 |

|

|

188 |

|

|

189 |

|

| Franchised restaurant

activity: |

|

|

|

|

|

|

|

|

| Beginning of period |

|

323 |

|

|

302 |

|

|

291 |

|

|

283 |

|

| Openings |

|

1 |

|

|

3 |

|

|

9 |

|

|

2 |

|

| Restaurant sale to

franchisee |

|

1 |

|

|

18 |

|

|

3 |

|

|

8 |

|

| Closures |

|

(1 |

) |

|

— |

|

|

(1 |

) |

|

(2 |

) |

| Restaurants at end of

period |

|

324 |

|

|

323 |

|

|

302 |

|

|

291 |

|

| System-wide restaurant

activity: |

|

|

|

|

|

|

|

|

| Beginning of period |

|

495 |

|

|

490 |

|

|

480 |

|

|

479 |

|

| Openings |

|

1 |

|

|

5 |

|

|

13 |

|

|

4 |

|

| Closures |

|

(1 |

) |

|

— |

|

|

(3 |

) |

|

(3 |

) |

| Restaurants at end of

period |

|

495 |

|

|

495 |

|

|

490 |

|

|

480 |

|

|

(1) |

|

Our restaurant count above includes 495 domestic restaurants and

excludes 10 licensed restaurants in the Philippines. |

|

|

|

|

| |

|

EL POLLO LOCO HOLDINGS, INC.UNAUDITED

RECONCILIATION OF SYSTEM-WIDE SALES TO COMPANY-OPERATED RESTAURANT

REVENUE AND TOTAL REVENUE(in

thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

Twenty-Six Weeks Ended |

|

(Dollar amounts in thousands) |

|

June 26, 2024 |

|

June 28, 2023 |

|

June 26, 2024 |

|

June 28, 2023 |

|

Company-operated restaurant revenue |

|

$ |

102,307 |

|

|

$ |

103,901 |

|

|

$ |

199,460 |

|

|

$ |

201,774 |

|

| Franchise revenue |

|

|

11,651 |

|

|

|

10,119 |

|

|

|

22,999 |

|

|

|

19,791 |

|

| Franchise advertising fee

revenue |

|

|

8,218 |

|

|

|

7,472 |

|

|

|

15,870 |

|

|

|

14,453 |

|

| Total

Revenue |

|

|

122,176 |

|

|

|

121,492 |

|

|

|

238,329 |

|

|

|

236,018 |

|

| Franchise revenue |

|

|

(11,651 |

) |

|

|

(10,119 |

) |

|

|

(22,999 |

) |

|

|

(19,791 |

) |

| Franchise advertising fee

revenue |

|

|

(8,218 |

) |

|

|

(7,472 |

) |

|

|

(15,870 |

) |

|

|

(14,453 |

) |

| Sales from franchised

restaurants |

|

|

183,300 |

|

|

|

166,452 |

|

|

|

354,036 |

|

|

|

322,066 |

|

| System-wide

sales(1) |

|

$ |

285,607 |

|

|

$ |

270,353 |

|

|

$ |

553,496 |

|

|

$ |

523,840 |

|

|

(1) |

|

System-wide sales does not include the 10 licensed stores in the

Philippines. |

|

|

|

|

| |

|

EL POLLO LOCO HOLDINGS, INC.UNAUDITED

RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED

EBITDA(in thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

Twenty-Six Weeks Ended |

| |

|

June 26, 2024 |

|

June 28, 2023 |

|

June 26, 2024 |

|

June 28, 2023 |

| Adjusted

EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income, as reported |

|

$ |

7,633 |

|

|

$ |

7,056 |

|

|

$ |

13,545 |

|

|

$ |

11,974 |

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

|

3,158 |

|

|

|

2,735 |

|

|

|

5,361 |

|

|

|

4,686 |

|

|

Interest expense, net of interest income |

|

|

1,527 |

|

|

|

976 |

|

|

|

3,091 |

|

|

|

1,980 |

|

|

Depreciation and amortization |

|

|

3,870 |

|

|

|

3,694 |

|

|

|

7,721 |

|

|

|

7,331 |

|

| EBITDA |

|

$ |

16,188 |

|

|

$ |

14,461 |

|

|

$ |

29,718 |

|

|

$ |

25,971 |

|

|

Stock-based compensation expense (a) |

|

|

897 |

|

|

|

817 |

|

|

|

1,817 |

|

|

|

1,588 |

|

|

Loss (gain) on disposal of assets (b) |

|

|

63 |

|

|

|

(80 |

) |

|

|

104 |

|

|

|

(50 |

) |

|

Impairment and closed-store reserves (c) |

|

|

5 |

|

|

|

38 |

|

|

|

37 |

|

|

|

115 |

|

|

Loss (gain) on disposition of restaurants (d) |

|

|

7 |

|

|

|

25 |

|

|

|

7 |

|

|

|

(111 |

) |

|

Income tax receivable agreement income (e) |

|

|

— |

|

|

|

121 |

|

|

|

— |

|

|

|

(1 |

) |

|

Special other expenses (f) |

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

429 |

|

|

Gain on recovery of insurance proceeds (g) |

|

|

— |

|

|

|

— |

|

|

|

(41 |

) |

|

|

(394 |

) |

|

Executive transition costs (h) |

|

|

— |

|

|

|

— |

|

|

|

643 |

|

|

|

— |

|

|

Restructuring charges (i) |

|

|

— |

|

|

|

1,055 |

|

|

|

551 |

|

|

|

1,055 |

|

|

Pre-opening costs (j) |

|

|

58 |

|

|

|

184 |

|

|

|

81 |

|

|

|

189 |

|

| Adjusted

EBITDA |

|

$ |

17,218 |

|

|

$ |

16,623 |

|

|

$ |

32,917 |

|

|

$ |

28,791 |

|

_________________________

|

(a) |

|

Includes non-cash, stock-based compensation. |

|

(b) |

|

Loss (gain) on disposal of assets includes the loss or gain on

disposal of assets related to retirements and replacement or

write-off of leasehold improvements or equipment. |

|

(c) |

|

Includes costs related to impairment of property and equipment and

ROU assets and closing restaurants. During the thirteen and

twenty-six weeks ended June 26, 2024, we did not record any

non-cash impairment charges. During the thirteen and twenty-six

weeks ended June 28, 2023, we recorded non-cash impairment

charges of less than $0.1 million, primarily related to the

carrying value of the ROU assets of one restaurant in

California. |

|

|

|

During both the thirteen and twenty-six weeks ended June

26, 2024 and June 28, 2023, we recognized less than $0.1

million of closed-store reserve expense related to the amortization

of ROU assets, property taxes and CAM payments for our closed

locations. |

|

(d) |

|

During the twenty-six weeks ended June 26, 2024, we

completed the sale of one restaurant within California to an

existing franchisee due to an expiring lease term on April 30,

2024. During the twenty-six weeks ended June 26, 2024 and June 28,

2023, we completed the sale of one restaurant within California to

an existing franchisee. These sales resulted in cash proceeds

of $0.1 million and $0.2 million, respectively, during the

twenty-six weeks ended June 26, 2024 and June 28,

2023, and a net loss on sale of restaurant of less than $0.1

million and a net gain on sale of restaurant of $0.1 million for

the twenty-six weeks ended June 26, 2024 and June 28, 2023,

respectively. |

|

(e) |

|

On July 30, 2014, we entered into the TRA. This agreement

calls for us to pay to our pre-IPO stockholders 85% of the savings

in cash that we realize in our taxes as a result of utilizing our

NOLs and other tax attributes attributable to preceding periods.

For the thirteen and twenty-six weeks ended June 26, 2024, we did

not record any income tax receivable agreement income or expense.

For the thirteen and twenty-six weeks ended

June 28, 2023, income tax receivable agreement income

consisted of the amortization of interest expense and changes in

estimates for actual tax returns filed, related to our total

expected TRA payments. |

|

(f) |

|

Consists of (1) nominal costs and recoveries related to the defense

of securities lawsuits, (2) $0.3 million in legal costs related to

the share distribution by Trimaran Group of substantially all of

the Company’s common stock held by Trimaran Group to its investors,

members and limited partners, which occurred on March 28, 2023, and

(3) for the twenty-six weeks ended June 28, 2023, $0.1 million in

costs related to a special dividend declaration which was paid on

November 9, 2022, to stockholders of record, including holders of

restricted stock. |

|

(g) |

|

During the fiscal 2022, one of our restaurants incurred damage

resulting from a fire. In fiscal 2023, we incurred costs directly

related to the fire of less than $0.1 million. We received $0.4

million in cash, net of the insurance deductible, from the

insurance company during fiscal 2023 for which we recognized gains

of $0.2 million, related to the reimbursement of property and

equipment and expenses incurred and $0.2 million related to the

reimbursement of lost profits. The gain on recovery of insurance

proceeds for the reimbursement of property and equipment and

expenses and the reimbursement of lost profits, net of the related

costs is included in the accompanying condensed consolidated

statements of income, for the twenty-six weeks ended June 28, 2023,

as a reduction of company restaurant expenses. |

|

(h) |

|

Includes costs associated with the transition of our former CEO,

such as severance, executive recruiting costs and stock-based

compensation costs. |

|

(i) |

|

On March 8, 2024, the Company made the decision to eliminate and

restructure certain positions in the organization, which resulted

in one-time costs of approximately $0.6 million. |

|

(j) |

|

Pre-opening costs are a component of general and administrative

expenses, and consist of costs directly associated with the opening

of new restaurants and incurred prior to opening, including

management labor costs, staff labor costs during training, food and

supplies used during training, marketing costs, and other related

pre-opening costs. These are generally incurred over the three to

five months prior to opening. Pre-opening costs also include

occupancy costs incurred between the date of possession and the

opening date for a restaurant. |

|

|

|

|

| |

|

EL POLLO LOCO HOLDINGS, INC.UNAUDITED

RECONCILIATION OF NET INCOME TO ADJUSTED NET

INCOME(dollar amounts in thousands, except share

data) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

Twenty-Six Weeks Ended |

| |

|

June 26, 2024 |

|

June 28, 2023 |

|

June 26, 2024 |

|

June 28, 2023 |

| Adjusted net

income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income, as reported |

|

$ |

7,633 |

|

|

$ |

7,056 |

|

|

$ |

13,545 |

|

|

$ |

11,974 |

|

|

Provision for taxes, as reported |

|

|

3,158 |

|

|

|

2,735 |

|

|

|

5,361 |

|

|

|

4,686 |

|

|

Income tax receivable agreement income |

|

|

— |

|

|

|

121 |

|

|

|

— |

|

|

|

(1 |

) |

|

Loss (gain) on disposal of assets |

|

|

63 |

|

|

|

(80 |

) |

|

|

104 |

|

|

|

(50 |

) |

|

Loss (gain) on disposition of restaurants |

|

|

7 |

|

|

|

25 |

|

|

|

7 |

|

|

|

(111 |

) |

|

Impairment and closed-store reserves |

|

|

5 |

|

|

|

38 |

|

|

|

37 |

|

|

|

115 |

|

|

Special other expenses |

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

|

429 |

|

|

Restructuring charges |

|

|

— |

|

|

|

1,055 |

|

|

|

551 |

|

|

|

1,055 |

|

|

Gain on recovery of insurance proceeds |

|

|

— |

|

|

|

— |

|

|

|

(41 |

) |

|

|

(394 |

) |

|

Executive transition costs |

|

|

— |

|

|

|

— |

|

|

|

643 |

|

|

|

— |

|

|

Provision for income taxes |

|

|

(3,061 |

) |

|

|

(2,946 |

) |

|

|

(5,597 |

) |

|

|

(4,762 |

) |

| Adjusted net

income |

|

$ |

7,805 |

|

|

$ |

8,006 |

|

|

$ |

14,610 |

|

|

$ |

12,941 |

|

| Adjusted weighted-average

share and per share data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income per

share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.26 |

|

|

$ |

0.23 |

|

|

$ |

0.48 |

|

|

$ |

0.36 |

|

|

Diluted |

|

$ |

0.26 |

|

|

$ |

0.23 |

|

|

$ |

0.48 |

|

|

$ |

0.36 |

|

| Weighted-average shares used in

computing adjusted net income per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

30,240,170 |

|

|

|

35,433,414 |

|

|

|

30,508,970 |

|

|

|

35,833,759 |

|

|

Diluted |

|

|

30,378,048 |

|

|

|

35,534,104 |

|

|

|

30,661,830 |

|

|

|

36,018,288 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

EL POLLO LOCO HOLDINGS, INC.UNAUDITED

RECONCILIATION OF INCOME FROM OPERATIONS TO RESTAURANT

CONTRIBUTION(dollar amounts in

thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Thirteen Weeks Ended |

|

Twenty-Six Weeks Ended |

|

| |

|

June 26, 2024 |

|

June 28, 2023 |

|

June 26, 2024 |

|

June 28, 2023 |

|

| Restaurant

contribution: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations |

|

$ |

12,318 |

|

|

$ |

10,888 |

|

|

$ |

21,997 |

|

|

$ |

18,639 |

|

|

|

Add (less): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative expenses |

|

|

11,787 |

|

|

|

11,108 |

|

|

|

23,712 |

|

|

|

22,307 |

|

|

|

Franchise expenses |

|

|

10,871 |

|

|

|

9,492 |

|

|

|

21,473 |

|

|

|

18,524 |

|

|

|

Depreciation and amortization |

|

|

3,870 |

|

|

|

3,694 |

|

|

|

7,721 |

|

|

|

7,331 |

|

|

|

Loss (gain) on disposal of assets |

|

|

63 |

|

|

|

(80 |

) |

|

|

104 |

|

|

|

(50 |

) |

|

|

Gain on recovery of insurance proceeds, property, equipment and

expenses |

|

|

— |

|

|

|

— |

|

|

|

(41 |

) |

|

|

(242 |

) |

|

|

Franchise revenue |

|

|

(11,651 |

) |

|

|

(10,119 |

) |

|

|

(22,999 |

) |

|

|

(19,791 |

) |

|

|

Franchise advertising fee revenue |

|

|

(8,218 |

) |

|

|

(7,472 |

) |

|

|

(15,870 |

) |

|

|

(14,453 |

) |

|

|

Impairment and closed-store reserves |

|

|

5 |

|

|

|

38 |

|

|

|

37 |

|

|

|

115 |

|

|

|

Loss (gain) on disposition of restaurants |

|

|

7 |

|

|

|

25 |

|

|

|

7 |

|

|

|

(111 |

) |

|

| Restaurant

contribution |

|

$ |

19,052 |

|

|

$ |

17,574 |

|

|

$ |

36,141 |

|

|

$ |

32,269 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Company-operated

restaurant revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total

revenue |

|

$ |

122,176 |

|

|

$ |

121,492 |

|

|

$ |

238,329 |

|

|

$ |

236,018 |

|

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Franchise revenue |

|

|

(11,651 |

) |

|

|

(10,119 |

) |

|

|

(22,999 |

) |

|

|

(19,791 |

) |

|

|

Franchise advertising fee revenue |

|

|

(8,218 |

) |

|

|

(7,472 |

) |

|

|

(15,870 |

) |

|

|

(14,453 |

) |

|

| Company-operated

restaurant revenue |

|

$ |

102,307 |

|

|

$ |

103,901 |

|

|

$ |

199,460 |

|

|

$ |

201,774 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restaurant contribution margin

(%) |

|

|

18.6 |

|

% |

|

16.9 |

|

% |

|

18.1 |

|

% |

|

16.0 |

|

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

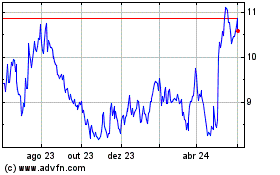

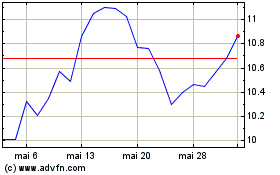

El Pollo Loco (NASDAQ:LOCO)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

El Pollo Loco (NASDAQ:LOCO)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024