Supremex Inc. (“Supremex” or the “Company”) (TSX: SXP), a

leading North American manufacturer and marketer of envelopes and a

growing provider of paper-based packaging solutions, today

announced its results for the second quarter ended June 30, 2024.

The Company will hold a conference call to discuss these results

today at 10:00 a.m. (Eastern Time).

Second Quarter Financial Highlights and

Recent Events

- Total revenue of $69.3 million, down 3.3% from $71.7 million in

the second quarter of 2023.

- Envelope segment revenue of $49.5 million, up 0.4% from $49.2

million in the prior year.

- Packaging and specialty products segment revenue of $19.9

million, down 11.4% from $22.4 million last year.

- Net earnings were $2.0 million, compared to $2.1 million last

year.

- Earnings per share of $0.08, stable from a year ago.

- Adjusted EBITDA1 of $9.0 million, or 13.0% of revenue, versus

$9.6 million, or 13.3% of revenue, a year ago.

- Acquisition on May 1, 2024, of the assets of Forest Envelope

Group (“Forest Envelope”), a regional leader in specialty envelope

manufacturing located in Bolingbrook, Illinois.

- On July 24, 2024, the Company announced optimization

initiatives designed to improve costs, overall efficiency,

productivity and achieving synergies within its Envelope segment

operations which are expected to result in annual cost savings in

excess of $2.0 million once all measures are implemented.

- On August 7, 2024, the Board of Directors declared a quarterly

dividend of $0.04 per common share, payable on September 20, 2024,

to shareholders of record at the close of business on September 5,

2024.

|

Financial Highlights (in thousands of dollars,

except for per share amounts and margins) |

Three-month periodsended

June 30 |

Six-month periodsended June

30 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Statement of Earnings |

|

Revenue |

69,337 |

|

71,666 |

|

142,605 |

|

160,088 |

|

|

Operating earnings |

3,905 |

|

4,471 |

|

9,668 |

|

18,842 |

|

|

Adjusted EBITDA(1) |

8,998 |

|

9,562 |

|

19,481 |

|

28,403 |

|

|

Adjusted EBITDA margin(1) |

13.0 |

% |

13.3 |

% |

13.7 |

% |

17.7 |

% |

|

Net earnings |

1,980 |

|

2,113 |

|

5,476 |

|

11,609 |

|

|

Basic and diluted net earnings per share |

0.08 |

|

0.08 |

|

0.22 |

|

0.45 |

|

|

Adjusted net earnings(1) |

2,105 |

|

2,270 |

|

5,619 |

|

12,050 |

|

|

Adjusted net earnings per share(1) |

0.08 |

|

0.09 |

|

0.22 |

|

0.47 |

|

|

Cash Flow |

|

Net cash flows related to operating activities |

10,222 |

|

10,006 |

|

15,318 |

|

17,547 |

|

|

Free cash flow(1) |

10,920 |

|

9,808 |

|

15,653 |

|

13,211 |

|

(1) Non-IFRS financial measures or ratios.

Non-IFRS financial measures do not have standardized meanings

prescribed by IFRS and therefore may not be comparable to similar

measures presented by other entities. Refer to the non-IFRS

financial measures section for definitions and reconciliations.

“Continued strong free cash flow generation

enabled Supremex to further reduce debt and repurchase shares

during the second quarter,” said Stewart Emerson, President and CEO

of Supremex. “Our envelope volume increased almost 10% from last

year driven by successful initiatives to expand our reach in the

vast U.S. market. In packaging, profitability improved

significantly from prior quarters reflecting measures to optimize

efficiency, however volume continues to lag. Although market

recovery and business development initiatives are taking longer

than anticipated, we are proactively managing our asset utilization

and cost structure to foster efficiency and productivity gains

across our network, as we continue to methodically execute our

business strategy to create lasting value for

shareholders.”

Summary of three-month period ended June

30, 2024

Revenue

Total revenue for the three-month period ended

June 30, 2024, was $69.3 million, representing a decrease of

$2.3 million, or 3.3%, from the equivalent quarter of

2023.

Envelope Segment

Revenue was $49.5 million, representing an

increase of 0.4%, from $49.2 million in the second quarter of 2023.

The variation is mainly attributable to a 9.8% increase in the

volume of units sold, reflecting the Company’s efforts to further

penetrate the U.S. market, and the contribution from the purchase

of the Forest Envelope assets. These factors were partially offset

by an average selling price decrease of 8.5% compared to last year.

The Envelope segment represented 71.3% of the Company’s revenue in

the quarter, versus 68.7% of revenue in the equivalent period of

last year.

Packaging & Specialty Products Segment

Revenue was $19.9 million, down 11.4% from $22.4

million in the second quarter of 2023. The decrease reflects lower

demand from certain sectors more closely correlated to economic

conditions, partially offset by higher demand for e-commerce

packaging solutions. The Packaging & Specialty Products segment

represented 28.7% of the Company’s revenue in the quarter, versus

31.3% of revenue in the equivalent period of last year.

EBITDA2 and Adjusted

EBITDA2

EBITDA was $8.8 million, compared to $9.4

million in the second quarter last year. Adjusted EBITDA was $9.1

million, versus $9.6 million in the second quarter of 2023. The

decrease reflects lower revenue and higher selling, general and

administrative expenses, partially offset by lower operating

expenses. The Adjusted EBITDA margin was 13.1% of revenue, versus

13.3% in the equivalent quarter of 2023.

Envelope Segment

Adjusted EBITDA was $8.0 million, down from $9.7

million in the second quarter of 2023. The decrease is

primarily attributable to lower average selling prices, mainly in

the U.S. market, partially offset by a higher volume of units sold.

On a percentage of segmented revenue, Adjusted EBITDA from the

Envelope segment was 16.2%, compared with 19.6% in the equivalent

period of 2023.

Packaging & Specialty Products Segment

Adjusted EBITDA was $2.8 million, versus $1.7

million in the second quarter of 2023. This increase mainly

reflects benefits from cost reduction measures implemented in late

2023 to improve profitability and efficiency and, to a lesser

extent, the reversal of a provision related to a previous

acquisition. On a percentage of segmented revenue, Adjusted EBITDA

from the Packaging & Specialty Products segment was 13.7%,

compared to 7.4% in the equivalent period of 2023.

Corporate and other non-allocated expenses

Corporate and other non-allocated expenses for

the second quarter of 2024 remained relatively stable at $1.7

million, versus $1.8 million a year ago.

Net Earnings, Adjusted Net

Earnings2, Net Earnings Per Share

and Adjusted Net Earnings Per Share2

Net earnings were $2.0 million or $0.08 per

share for the three-month period ended June 30, 2024, compared to

$2.1 million or $0.08 per share for the equivalent period last

year.

Adjusted net earnings were $2.1 million or $0.08

per share for the three-month period ended June 30, 2024, compared

to $2.3 million or $0.09 per share for the equivalent period in

2023.

Summary of six-month period ended June

30, 2024

Revenue

Total revenue for the six-month period ended

June 30, 2024, was $142.6 million, representing a decrease of

$17.5 million, or 10.9%, from the equivalent period of

2023.

Envelope Segment

Revenue was $102.9 million, representing a

decrease of $10.8 million, or 9.5%, from $113.7 million in the

six-month period ended June 30, 2023. The variation is attributable

to a 5.7% decrease in the volume of units sold compared to last

year, with a reduction in the first quarter partially offset by an

increase in the second quarter, and to an average selling price

decrease of 4.0%. These factors were partially offset by the

contribution from the Forest Envelope assets. Envelope represented

72.2% of the Company’s revenue in the period, versus 71.0% during

the equivalent period of last year.

Packaging & Specialty Products Segment

Revenue was $39.7 million, down $6.7 million, or

14.4%, from $46.4 million in the corresponding period of 2023. The

variation reflects lower demand from certain sectors more closely

correlated to economic conditions, partially offset by higher

demand for e-commerce packaging solutions. Packaging &

Specialty Products represented 27.8% of the Company’s revenue in

the first half of 2024, compared with 29.0% during the equivalent

period of last year.

EBITDA3 and Adjusted

EBITDA3

EBITDA was $19.3 million, down from $27.8

million in the first six months of 2023. Adjusted EBITDA was

$19.5 million, down from $28.4 million for the same period a

year ago. The decrease reflects lower revenue, partially offset by

lower operating expenses as well as lower selling, general and

administrative expenses. The Adjusted EBITDA margin reached 13.7%

in the first half of 2024, versus 17.7% in the first half of

2023.

Envelope Segment

Adjusted EBITDA was $18.9 million, down from

$26.9 million in the first half of 2023. The decrease was primarily

attributable to lower average selling prices, mainly in the U.S.

market. On a percentage of segmented revenue, Adjusted EBITDA from

the Envelope segment was 18.4%, compared to 23.7% in the equivalent

period of 2023.

Packaging & Speciality Products Segment

Adjusted EBITDA was $3.9 million, compared to

$5.5 million in the first half of 2023. This decrease mostly

reflects lower demand from certain sectors more closely correlated

to economic conditions which impacted the absorption of fixed

costs. This factor was partially offset by benefits from cost

reduction measures and, to a lesser extent, the reversal of a

provision related to a previous acquisition. On a percentage of

segmented revenue, Adjusted EBITDA from the Packaging &

Specialty Products segment was 9.9%, compared to 11.9% in the

equivalent period of 2023.

Corporate and other non-allocated expenses

Corporate and other non--allocated expenses were

$3.4 million compared to $4.0 million in the first half of 2023.

The decrease resulted mainly from a favourable adjustment related

to DSUs and PSUs and a foreign exchange gain.

Net Earnings, Adjusted Net

Earnings3, Net Earnings Per Share

and Adjusted Net Earnings Per Share3

Net earnings were $5.5 million or $0.22 per

share for the six-month period ended June 30, 2024, compared to

$11.6 million or $0.45 per share for the equivalent period last

year.

Adjusted net earnings amounted to $5.6 million

or $0.22 per share for the six-month period ended June 30, 2024,

compared to $12.1 million or $0.47 per share for the equivalent

period in 2023.

Liquidity and Capital

Resources

Cash Flow

Net cash flows from operating activities were

$10.2 million for the three-month period ended June 30, 2024,

compared to $10.0 million in the equivalent period of 2023. The

increase is mainly attributable to lower working capital

requirements this year compared to last year, partially offset by

lower profitability.

For the six-month period ended June 30, 2024,

net cash flows from operating activities reached $15.3 million,

compared to $17.5 million in the equivalent period of 2023. The

decrease essentially reflects lower profitability, partially offset

by lower working capital requirements this year compared to last

year.

Free cash flow4 amounted to $10.9 million in the

second quarter of 2024, compared to $9.8 million for the same

period last year. The increase is mainly attributable to net

disposals of property, plant and equipment this year, as opposed to

net additions last year, and to slightly higher cash flow from

operating activities.

For the six-month period ended June 30, 2024,

free cash flow reached $15.7 million, compared to $13.2 million for

the same period in 2023. The increase reflects net disposals of

property, plant and equipment this year, as opposed to net

additions last year, partially offset by lower cash flow from

operating activities.

Debt and Leverage

Total debt decreased to $51.8 million as at June

30, 2024, compared to $56.8 million as at December 31, 2023. The

variation is essentially attributable to debt repayment resulting

from free cash flow generation.

Normal Course Issuer Bid

(“NCIB”)

During the three and six-month periods ended

June 30, 2024, the Company repurchased 492,800 and 811,400 common

shares for cancellation under its NCIB program for total

considerations of $1.9 million and $3.3 million, respectively.

Subsequent to the end of the period, an additional 157,800 shares

were purchased for cancellation for total consideration of $0.6

million.

Dividend Declaration

On August 7, 2024, the Board of Directors

declared a quarterly dividend of $0.04 per common share, payable on

September 20, 2024, to shareholders of record at the close of

business on September 5, 2024. This dividend is designated as an

“eligible” dividend for the purpose of the Income Tax Act (Canada)

and any similar provincial legislation.

Subsequent Event

On July 24, 2024, the Company announced

optimization initiatives aimed at improving costs, overall

efficiency, productivity and achieving synergies within its

Envelope segment operations. First, the Company ceased production

at its very small facility in Niagara Falls, New York, and

maintained the premises as a distribution centre. Additionally,

Supremex will close its facility in Concord, Ontario, as its lease

expires in February 2025 and will transfer the most efficient

production equipment, primarily to its other Greater Toronto area

envelope plants in Mississauga and Etobicoke over the coming

months.

Related to these moves, Supremex will record

restructuring charges of approximately $2.7 million before taxes

for a period extending from the third quarter of 2024 through the

first quarter of 2025. These initiatives are expected to result in

annual cost savings in excess of $2.0 million once all measures are

implemented, primarily from the reduction of rent and other fixed

costs, and modest productivity improvements.

Outlook

Demand for the Company’s products is gradually

returning to historical patterns, although market recovery is

taking more time than anticipated as it remains somewhat impacted

by persisting high interest rates and inflation. As it continues to

expand in the vast and fragmented U.S. envelope market, Supremex

will be increasingly subject to competitive pressures, but the

Company will rely on its solid reputation and geographic reach to

stimulate sales while continuing to proactively control

expenses.

The Company remains focused on optimizing

operating efficiency, productivity and capacity utilization

throughout its network, as well as on capturing all sales and cost

synergies from recent business acquisitions. In this regard,

initiatives announced on July 24 for the Envelope segment are

expected to result in annual cost savings in excess of $2.0 million

once all measures are implemented, while initiatives announced in

October 2023 for the Packaging and specialty products segment are

expected to yield annual cost savings of approximately $1.5 million

once all measures are implemented.

With respect to capital deployment, the Company

will continue to look for strategic acquisitions, mainly in the

Packaging and specialty products segment, while sustaining capital

returns to shareholders.

August 8, 2024 – Second Quarter Results

Conference Call:

A conference call to discuss the Company’s

results for the second quarter ended June 30, 2024, will be held

Thursday, August 8, 2024, at 10:00 a.m. (Eastern Time). A live

broadcast of the Conference Call will be available on the Company’s

website, in the Investors section under Webcast. To participate

(professional investment community only) or to listen to the live

conference call, please dial the following numbers. We suggest that

participants call-in at least 5 minutes prior to the scheduled

start time:

|

• |

|

Confirmation number: |

|

10023550 |

|

• |

|

Local (Toronto) and

international participants, dial: |

|

647 484-8814 |

|

• |

|

North American participants,

dial toll-free: |

|

1 844 763-8274 |

A replay of the conference call will be

available on the Company’s website in the Investors section under

Webcast. To listen to a recording of the conference call, please

call toll-free 1 855-669-9658 or 604-674-8052 and enter the

code 0748. The recording will be available until Thursday, August

15, 2024.

Non-IFRS Financial Measures

Non-IFRS financial measures do not have any

standardized meaning prescribed by IFRS and therefore may not be

comparable to similar measures presented by other companies and

should not be viewed as alternatives to measures of financial

performance prepared in accordance with IFRS. Management considers

these metrics to be information which may assist investors in

evaluating the Company’s profitability and enable better

comparability of the results from one period to another.

These Non-IFRS Financial Measures are defined as

follows:

|

Non-IFRS Measure |

Definition |

|

EBITDA |

EBITDA represents earnings before net financing charges, income tax

expense, depreciation of property, plant and equipment and

right-of-use assets and amortization of intangible assets. The

Company uses EBITDA to assess its performance. Management believes

this non-IFRS measure provides users with an enhanced understanding

of its operating earnings. |

|

Adjusted EBITDA |

Adjusted EBITDA represents EBITDA adjusted to remove items of

significance that are not in the normal course of operations. These

items of significance include, when applicable, but are not limited

to, charges for impairment of assets, restructuring expenses, value

adjustment on inventory acquired and business acquisition costs.

The Company uses Adjusted EBITDA to assess its operating

performance, excluding items that are not in the normal course of

operations. Management believes this non-IFRS measure provides

users with enhanced understanding of the Company’s operating

earnings and increases the transparency and clarity of the

Company’s core results. It also allows users to better evaluate the

Company’s operating profitability when compared to previous

years. |

|

Adjusted EBITDA margin |

Adjusted EBITDA margin is a percentage corresponding to the ratio

of Adjusted EBITDA divided by revenue. The Company uses Adjusted

EBITDA margin for the purpose of evaluating business performance,

excluding items that are not in the normal course of operations.

Management believes this non-IFRS measure provides users with

enhanced understanding of the Company’s results and related

trends. |

|

Adjusted net earnings |

Adjusted net earnings represents net earnings excluding items of

significance listed above under Adjusted EBITDA, net of income

taxes. The Company uses Adjusted net earnings to assess its

business performance and profitability without the effect of items

that are not in the normal course of operations, net of income

taxes. Management believes this non-IFRS measure provides users

with an alternative assessment of the Company’s earnings without

the effect of items that are not in the normal course of operations

making it valuable to assess ongoing operations and trends in the

business performance. Management also believes this non-IFRS

measure provides users with enhanced understanding of the Company’s

results and provides better comparability between periods. |

|

Adjusted net earnings per share |

Adjusted net earnings per share represents Adjusted net earnings

divided by the weighted average number of common shares outstanding

for the relevant period. The Company uses Adjusted net earnings per

share for purposes of evaluating performance and profitability,

excluding items that are not in the normal course of operations of

the Company, net of income taxes, on a per share basis. |

|

Free cash flow |

This measure corresponds to net cash flows related to operating

activities according to the consolidated statements of cash flows

less additions (net of disposals) to property, plant and equipment

and intangible assets. Management considers Free cash flow to be a

good indicator of the Company’s financial strength and operating

performance because it shows the amount of funds available to

manage growth, repay debt and reinvest in the Company. Management

considers this measure useful to provide investors with a

perspective on its ability to generate liquidity, after making

capital investments required to support business operations and

long-term value creation. |

|

Net debt |

Net debt represents the Company’s total debt, net of deferred

financing costs and cash. The Company uses Net debt as an indicator

of its indebtedness level and financial leverage as it represents

the amount of debt that is not covered by available cash.

Management believes that investors could benefit from the use of

net debt to determine a company’s financial leverage. |

|

Net debt to Adjusted EBITDA ratio |

Net debt to Adjusted EBITDA ratio represents Net debt divided by

trailing 12-month (TTM) Adjusted EBITDA. This ratio is used by

management to monitor the Company’s financial leverage and

management believes certain investors use this ratio as a measure

of financial leverage. |

The following tables provide the reconciliation of Non-IFRS

Financial Measures:

|

Reconciliation of Net earnings to Adjusted EBITDA

(in thousands of dollars, except for margins) |

Three-month periodsended June 30 |

Six-month periodsended June

30 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Net earnings |

1,980 |

|

2,113 |

|

5,476 |

|

11,609 |

|

|

Income tax expense |

631 |

|

850 |

|

1,784 |

|

4,255 |

|

|

Net financing charges |

1,294 |

|

1,508 |

|

2,408 |

|

2,978 |

|

|

Depreciation of property, plant and equipment |

1,730 |

|

1,722 |

|

3,363 |

|

3,269 |

|

|

Depreciation of right-of-use assets |

1,478 |

|

1,380 |

|

2,832 |

|

2,726 |

|

|

Amortization of intangible assets |

1,716 |

|

1,777 |

|

3,425 |

|

2,970 |

|

|

EBITDA |

8,829 |

|

9,350 |

|

19,288 |

|

27,807 |

|

|

Acquisition costs related to business combinations |

111 |

|

72 |

|

111 |

|

263 |

|

|

Asset impairment |

75 |

|

— |

|

75 |

|

— |

|

|

Restructuring expenses |

37 |

|

129 |

|

61 |

|

255 |

|

|

Value adjustment on acquired inventory through a business

combination |

(54 |

) |

11 |

|

(54 |

) |

78 |

|

|

Adjusted EBITDA |

8,998 |

|

9,562 |

|

19,481 |

|

28,403 |

|

|

Adjusted EBITDA margin (%) |

13.0 |

% |

13.3 |

% |

13.7 |

% |

17.7 |

% |

|

Reconciliation of Net earnings to Adjusted net earnings and

of Net earnings per share to Adjusted net earnings per

share (in thousands of dollars, except for per share

amounts) |

Three-month periodsended June

30 |

Six-month periodsended June 30 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Net earnings |

1,980 |

|

2,113 |

|

5,476 |

|

11,609 |

|

|

Adjustments, net of income taxes |

|

|

|

|

|

|

|

Acquisition costs related to business combinations |

82 |

|

53 |

|

82 |

|

194 |

|

|

Asset impairment |

56 |

|

— |

|

56 |

|

— |

|

|

Restructuring expenses |

27 |

|

95 |

|

45 |

|

188 |

|

|

Value adjustment on acquired inventory through a business

combination |

(40 |

) |

9 |

|

(40 |

) |

59 |

|

|

Adjusted net earnings |

2,105 |

|

2,270 |

|

5,619 |

|

12,050 |

|

|

|

|

Net earnings per share |

0.08 |

|

0.08 |

|

0.22 |

|

0.45 |

|

|

Adjustments, net of income taxes, per share |

— |

|

0.01 |

|

— |

|

0.02 |

|

|

Adjusted net earnings per share |

0.08 |

|

0.09 |

|

0.22 |

|

0.47 |

|

|

Reconciliation of Cash flows related to operating

activities to Free cash flow (in thousands of

dollars) |

Three-month periodsended June 30 |

Six-month periodsended June 30 |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Cash flows related to operating activities |

10,222 |

|

10,006 |

|

15,318 |

|

17,547 |

|

|

Acquisitions (net of disposals) of property, plant and

equipment |

764 |

|

(164 |

) |

401 |

|

(4,297 |

) |

|

Acquisitions of intangible assets |

(66 |

) |

(34 |

) |

(66 |

) |

(39 |

) |

|

Free cash flow |

10,920 |

|

9,808 |

|

15,653 |

|

13,211 |

|

Forward-Looking Information

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

laws, including (but not limited to) statements about the EBITDA,

Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net earnings,

Adjusted net earnings per share, free cash flow5, capital

expenditures, dividend payments and future performance of Supremex

and similar statements or information concerning anticipated future

results, circumstances, performance or expectations.

Forward-looking information may include words such as anticipate,

assumption, believe, could, expect, goal, guidance, intend, may,

objective, outlook, plan, seek, should, strive, target and will.

Such information relates to future events or future performance and

reflects current assumptions, expectations and estimates of

management regarding growth, results of operations, performance,

business prospects and opportunities, Canadian economic environment

and ability to attract and retain customers. Such forward-looking

information reflects current assumptions, expectations and

estimates of management and is based on information currently

available to Supremex as at the date of this press release. Such

assumptions, expectations and estimates are discussed throughout

the MD&A for the year ended December 31, 2023, and in the

Company’s Annual Information Form dated March 28, 2024. Supremex

cautions that such assumptions may not materialize and that

economic conditions such as heightened inflation and central banks’

large interest rate hikes, economic downturns or recessions, may

render such assumptions, although believed reasonable at the time

they were made, subject to greater uncertainty.

Forward-looking information is subject to

certain risks and uncertainties and should not be read as a

guarantee of future performance or results and actual results may

differ materially from the conclusion, forecast or projection

stated in such forward-looking information. These risks and

uncertainties include but are not limited to the following: decline

in envelope consumption, growth and diversification strategy, key

personnel, labour shortage, contributions to employee benefits

plans, raw material price increases, cyber security and data

protection, operational disruption, dependence on and loss of

customer relationships, increase of competition, economic cycles,

exchange rate fluctuation, interest rate fluctuation, credit risks

with respect to trade receivables, availability of capital,

concerns about protection of the environment, potential risk of

litigation, no guarantee to pay dividends and other external risks

such as global health crisis and pandemic and inflation. Such risks

and uncertainties are discussed throughout the MD&A for the

year ended December 31, 2023, and in the Company’s Annual

Information Form dated March 28, 2024, in particular in “Risk

Factors”. Consequently, the Company cannot guarantee that any

forward-looking information will materialize. Readers should not

place any undue reliance on such forward-looking information unless

otherwise required by applicable securities legislation. The

Company expressly disclaims any intention and assumes no obligation

to update or revise any forward-looking information, whether as a

result of new information, future events or otherwise.

The Management Discussion and Analysis and

Financial Statements can be found on www.sedarplus.ca and on

Supremex’ website.

About Supremex

Supremex is a leading North American

manufacturer and marketer of envelopes and a growing provider of

paper-based packaging solutions. Supremex operates ten

manufacturing facilities across four provinces in Canada and five

manufacturing facilities in three states in the United States

employing approximately 900 people. Supremex’ extensive network

allows it to efficiently manufacture and distribute envelope and

packaging solutions designed to the specifications of major

national and multinational corporations, direct mailers, resellers,

government entities, SMEs and solutions providers.

For more information, please visit

www.supremex.com.

| Contact: |

| François

Bolduc, CPA |

|

Martin Goulet,

M.Sc., CFA |

| Chief Financial Officer |

|

MBC Capital Markets Advisors |

| investors@supremex.com |

|

mgoulet@maisonbrison.com |

| 514 595-0555, extension 2316 |

|

514 731-0000, extension 229 |

1 Non-IFRS financial measures or ratios.

Refer to the non-IFRS financial measures section for definitions

and reconciliations. 2 Non-IFRS financial measures or ratios. Refer

to the non-IFRS financial measures section for definitions and

reconciliations. 3 Non-IFRS financial measures or ratios. Refer to

the non-IFRS financial measures section for definitions and

reconciliations. 4 Non-IFRS financial measures or ratios. Refer to

the non-IFRS financial measures section for definitions and

reconciliations. 5 Non-IFRS financial measures or ratios.

Refer to the non-IFRS financial measures section for definitions

and reconciliations.

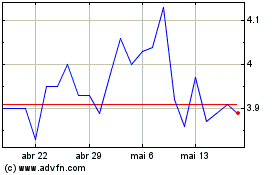

Supremex (TSX:SXP)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Supremex (TSX:SXP)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024