Ackroo Announces Re-structuring of BDC loan

13 Agosto 2024 - 9:00AM

Ackroo Inc. (TSX-V: AKR; OTC: AKRFF) (the “Company”), a gift card,

loyalty marketing, payments and point-of-sale technology

consolidator and services provider, is pleased to report they have

re-structured their loan with BDC Capital (“BDC”). The current loan

consists of:

- $4,000,000 (of which Ackroo has

paid back $1,000,000 to date)

- Bears a floating interest rate of

BDC Capital’s base rate (which is currently 9.3%) plus a Variance

of 1.7% per year.

- Includes a 2.55% annual royalty on

clients acquired with the facility during the term of the loan,

excluding the first year.

- Includes a 0.5% bonus on sale or

change of control payment to be made to BDC Capital should the

Company sell the business during the term of the loan

- Includes a 1.5% processing fee of

the value of the facility (as the funds are tranched) plus $100 a

month financing management fee

- Final principal ballon payment of

$3,000,000 due on September 15th,2024.

Ackroo and BDC Capital have agreed to

re-structure the balloon payment by having Ackroo pay a minimum

$50,000 a month for 12 months commencing September 30th,2024 and

then a balloon payment of $2,450,000 due on August 31st, 2025.

During the term the Company may pay up to the full principal

balance owed without prepayment penalty of any kind. The company

will maintain all other terms and conditions of the current

loan.

“We are very appreciative of the partnership we

have with BDC Capital” said Steve Levely, CEO of Ackroo. “The

initial loan back in 2019 was at an integral time for the Company

as we wanted to continue to execute our roll-up strategy however,

we wanted to do so with very minimal dilution to shareholders

through equity issuances. Doing accretive deals was and is

important for Ackroo so using debt and our own working capital have

been important aspects of our strategy over the last 5 years. We

have been successful in doing so and are now in a position to not

only service the interest payments but also the principal loan

itself. We came to a monthly amount that Ackroo can comfortably

support while also continuing our capital allocation towards future

acquisitions and share buy backs. In all we are very happy with the

re-structuring and appreciate the on-going partnership BDC capital

extends.”

About BDC CapitalBDC Capital is

the investment arm of the Business Development Bank of Canada -

Canada’s only bank devoted exclusively to entrepreneurs. With

$3 billion under management, BDC Capital serves as a strategic

partner to the country’s most innovative firms. It offers a full

spectrum of risk capital, from seed investments to transition

capital, supporting Canadian entrepreneurs who wish to scale their

businesses into global champions. Visit bdc.ca/capital.

About Ackroo

As an industry consolidator, Ackroo acquires,

integrates and manages gift card, loyalty marketing, payment and

point-of-sale solutions used by merchants of all sizes. Ackroo’s

self-serve, data driven, cloud-based marketing platform helps

merchants in-store and online process and manage loyalty, gift card

and promotional transactions at the point of sale. Ackroo’s

acquisition of payment ISO’s affords Ackroo the ability to resell

payment processing solutions to their growing merchant base through

some of the world’s largest payment technology and service

providers. As a third revenue stream Ackroo has acquired certain

custom software products including hybrid management and

point-of-sale solutions that help manage and optimize the general

operations for niche industry’s including automotive dealers and

more. All solutions are focused on helping to consolidate, simplify

and improve the merchant marketing, payments and point-of sale

ecosystem for their clients. Ackroo is headquartered in Hamilton,

Ontario, Canada. For more information, visit: www.ackroo.com.

For further information, please contact:

Steve

LevelyChief Executive Officer | AckrooTel: 416-360-5619

x730Email: slevely@ackroo.com

The TSX Venture Exchange has neither approved

nor disapproved the contents of this press release. Neither TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward Looking StatementsThis

release contains forecasts and forward-looking statements that are

not guarantees of future performance and activities and are subject

to risks and uncertainties. The Company has based these

forward-looking statements on assumptions and assessments made by

its management in light of their experience and their perception of

historical trends, current conditions, expected future developments

and other factors they believe to be appropriate. Important factors

that could cause actual results, developments and business

decisions to differ materially from those anticipated in these

forward-looking statements include, but are not limited to: the

Company’s ability to raise enough capital to support the Company’s

go forward plans; the overall global economic environment; the

impact of competition and new technologies; general market,

political and economic conditions in the countries in which the

Company operates; projected capital expenditures and liquidity;

changes in the Company’s strategy; government regulations and

approvals; changes in customers’ budgeting priorities; plus other

factors that may arise. Any forward-looking statements in this

press release are made as of the date hereof, and the Company

undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

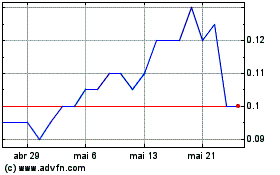

Ackroo (TSXV:AKR)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

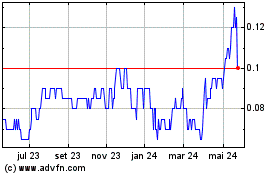

Ackroo (TSXV:AKR)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024