Ackroo Releases Q3 2024 Financial Results

23 Outubro 2024 - 9:00AM

Ackroo Inc. (TSX-V: AKR; OTC: AKRFF) (the “Company”), a gift card,

loyalty marketing, payments and point-of-sale technology

consolidator and services provider, has filed its financial results

for the period ended September 30, 2024. The results for the period

ended September 30th,2024 reflect a 1% increase in recurring

revenues and a 4% decrease in total revenues over the same period

in 2023. The Company delivered a 35% increase in EBITDA over the

same period in 2023 representing 34% of total revenues which now

has year to date adjusted EBITDA at $1,552,275, a 43% increase over

the same period in 2023. Ackroo used $175,000 of their earnings

towards share buy-backs and to pay down debt and continued to

optimize their product and operations. The Company plans to

continue their focus on earnings generation in order to continue to

improve their balance sheet, pay down debt, buy back shares and to

help fund future acquisitions.

The complete financial results for Ackroo, along

with management’s discussion and analysis for the quarter ended

September 30, 2024, are available under the profile for the Company

at www.sedar.com. Highlights include:

Q3 2024 vs. Q3 2023:

|

|

Q3 2023 TOTALS |

Q3 2023 TOTALS |

+/- % Change |

|

Total Revenue |

$1,551,696 |

$1,624,001 |

(-4%) |

|

Subscription Rev |

$1,411,166 |

$1,396,732 |

+ 1% |

|

Gross Margins |

$1,357,831 (88%) |

$1,477,437 (91%) |

(-3%) |

|

Adjusted EBITDA |

$530,937 |

$394,155 |

+ 35% |

|

EBITDA % of Rev |

34% |

24% |

+ 10% |

Nine Months Ended Sept 30, 2024 vs. Nine Months Ended

Sept 30, 2023:

|

|

YTD 2024 TOTALS |

YTD 2023 TOTALS |

+/- % Change |

|

Total Revenue |

$4,732,352 |

$5,060,328 |

(-6%) |

|

Subscription Rev |

$4,297,734 |

$4,418,596 |

(-3%) |

|

Gross Margins |

$4,155,526 (88%) |

$4,636,809 (92%) |

(-4%) |

|

Adjusted EBITDA |

$1,552,275 |

$1,087,419 |

+ 43% |

|

EBITDA % of Rev |

33% |

21% |

+ 12% |

“As we continue to explore strategic options for

the Company we have continued our tight focus on operational

efficiency and earnings generation to maximize cash generation,”

said Steve Levely, CEO of Ackroo. “We see cash generation as a key

focal point for the business so that we can pay down debt, buy back

shares and overall increase the business value of Ackroo. We once

again saw a decrease in one-time revenues from less card orders and

new setup fees however we maintained our recurring revenues and

increased our earnings substantially year over year delivering one

of our best ever EBITDA quarters. At a time when inflation and

interest rates are high we see our ability to continue to generate

more cash while optimizing our product and operations becomes an

important differentiator for Ackroo. On a year to date standpoint

we are generating a great 33% of EBITDA as a percentage of revenue

where as we head into our busiest quarter of the year we expect

that trend to continue.”

About Ackroo

As an industry consolidator, Ackroo acquires,

integrates and manages gift card, loyalty marketing, payment and

point-of-sale solutions used by merchants of all sizes. Ackroo’s

self-serve, data driven, cloud-based marketing platform helps

merchants in-store and online process and manage loyalty, gift card

and promotional transactions at the point of sale. Ackroo’s

acquisition of payment ISO’s affords Ackroo the ability to resell

payment processing solutions to their growing merchant base through

some of the world’s largest payment technology and service

providers. As a third revenue stream Ackroo has acquired certain

custom software products including hybrid management and

point-of-sale solutions that help manage and optimize the general

operations for niche industry’s including automotive dealers and

more. All solutions are focused on helping to consolidate, simplify

and improve the merchant marketing, payments and point-of sale

ecosystem for their clients. Ackroo is headquartered in Hamilton,

Ontario, Canada. For more information, visit: www.ackroo.com.

For further information, please contact:

Steve LevelyChief Executive

Officer | AckrooTel: 416-360-5619 x730Email: slevely@ackroo.com

The TSX Venture Exchange has neither approved

nor disapproved the contents of this press release. Neither TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward Looking StatementsThis

release contains forecasts and forward-looking statements that are

not guarantees of future performance and activities and are subject

to risks and uncertainties. The Company has based these

forward-looking statements on assumptions and assessments made by

its management in light of their experience and their perception of

historical trends, current conditions, expected future developments

and other factors they believe to be appropriate. Important factors

that could cause actual results, developments and business

decisions to differ materially from those anticipated in these

forward-looking statements include, but are not limited to: the

Company’s ability to raise enough capital to support the Company’s

go forward plans; the overall global economic environment; the

impact of competition and new technologies; general market,

political and economic conditions in the countries in which the

Company operates; projected capital expenditures and liquidity;

changes in the Company’s strategy; government regulations and

approvals; changes in customers’ budgeting priorities; plus other

factors that may arise. Any forward-looking statements in this

press release are made as of the date hereof, and the Company

undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

*“Adjusted EBITDA” is a non-International

Financial Reporting Standard (IFRS) measure, and does not have a

standardized meaning prescribed by IFRS. Adjusted EBITDA is

calculated as net income (loss) excluding interest, taxes,

depreciation and amortization, or EBITDA, as adjusted for

share-based compensation and related expenses and foreign exchange

gains and losses. A complete reconciliation of this amount to net

income (loss) for the corresponding period is available in

managements’ discussion and analysis.

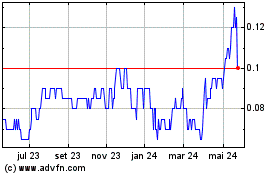

Ackroo (TSXV:AKR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

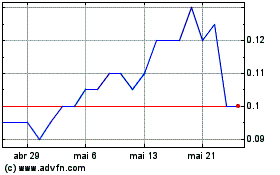

Ackroo (TSXV:AKR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025